Concept

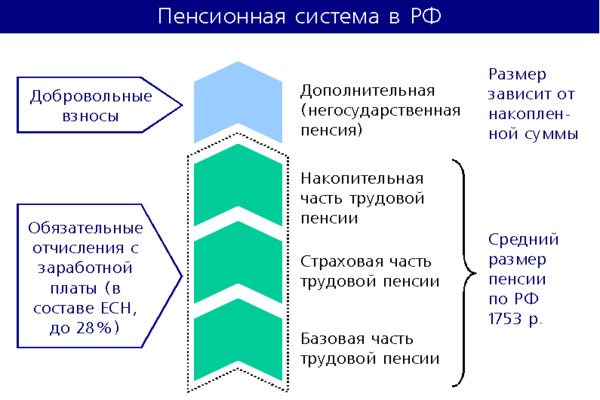

The legal framework provides a complete definition of the described preference. The old-age insurance pension is a monthly deduction from the budget of the Pension Fund of Russia (PFR) to recipients. Such payments are characterized as conditionally accumulative. Their purpose is to compensate citizens for income lost due to loss of ability to work.

Financing of insurance pensions is carried out on the basis of the principle of distribution of joint income of the Pension Fund.

What is the difference from labor

In previous years, the relevant legislation designated the pension as a labor pension. After the reform, this term was replaced by insurance payments. The difference lies in the principle of taking into account the contribution of a citizen, which gives the right to assign maintenance in old age.

- Previously, the total work experience was calculated. Its size influenced the amount of the pension payment.

- Now the periods are taken into account:

- insurance period - the time when contributions were made to the Pension Fund for the worker;

- included in the list of exceptions, namely:

- child care;

- care for disabled people of group 1; and citizens who have crossed the 80-year-old threshold;

- conscript service;

- some others.

Non-insurance periods are taken into account in the calculation of accruals only for citizens who were employed before or immediately after them.

Starting from 2020, pension eligibility is taken into account in points or coefficients. These indicators are converted into rubles based on the government-approved price of one point.

The legislative framework

The concept of “insurance part” has come into use relatively recently, since 2015. Pension provision is regulated by Federal Law 400 “On Insurance Pensions” , as well as by the following documents:

- Federal Law-167 , containing the rules of pension insurance;

- FZ-166 , which explains pension standards in Russia;

- Regional documents explaining the current amounts of insurance pensions.

An insurance pension can be obtained by both citizens of the Russian Federation and those who do not have citizenship, subject to certain conditions (for foreigners this, in addition to the basic conditions, is permanent residence in the Russian Federation or the presence of international treaties with the resident country).

What is the insurance part of a pension in simple words?

These issues are regulated by separate provisions of Federal Law No. 400, adopted in 2020. There are three main groups of payments for pensioners, which can be assigned subject to certain conditions. We are talking about the following state capabilities:

Every citizen of the Russian Federation wants to live in the state at a decent material level even after reaching retirement age. To ensure a dignified old age, many citizens begin to take care of their own pensions long before they reach the established age. It is for this reason that many people try to find a job that will not only provide a decent income, but will also provide for their future life in the form of a pension benefit.

This is interesting: Can bailiffs seize furniture in an apartment and what kind?

Conditions of receipt

- Disability due to age (old age) . According to general standards, in the first half of 2020 this age is 60.5 years for men and 55.5 years for women.

Those who will celebrate 55 years (women) and 60 years (men) in 2020. Women whose 55th birthday will fall in 2020 will retire only after 1.5 years, their retirement age will be 56.5 and 61. 5 years respectively.

- Sufficient work experience . The higher it is, the larger the pension will be. However, it should not be below the minimum established by law.

In 2020 it is 11 years. For those born in 1965, it must be at least 12 years old.

- Enough pension points have been accumulated . The concept of an individual pension coefficient was introduced to facilitate the formation of monthly allowances.

The IPC depends on length of service, the size of transfers from the employer and directly affects the size of the pension.

In 2020, the minimum IPC for men and women is 18.6. For those who belong to the next stage of raising the retirement age, the value will be set to 21 (in 2021).

Specific Condition Parameters

These three rules are mandatory and sufficient to receive permanent old-age benefits. Indicators are currently subject to change.

| Woman's year of birth | Age | Released | Minimum IPC size (points) | Experience |

| 1964 1st half year | 55,5 | 2019 2nd half of the year | 16,2 | 10 |

| 1964 2nd half year | 55,5 | 2020 1st half of the year | 18,6 | 11 |

| 1965 1st half year | 56,5 | 2021 2nd half | 21 | 12 |

| 1965 2nd half year | 56,5 | 2022 1st half year | 23,4 | 13 |

| 1966 | 58 | 2024 | 28,2 | 15 |

| 1967 | 59 | 2026 | 30 | 15 |

| 1968 | 60 | 2028 | 30 | 15 |

| Man's year of birth | Age | Released | Minimum IPC size (points) | Experience |

| 1959 1st half year | 60,5 | 2019 2nd half of the year | 16,2 | 10 |

| 1959 2nd half year | 60,5 | 2020 1st half of the year | 18,6 | 11 |

| 1960 1st half year | 61,5 | 2021 2nd half | 21 | 12 |

| 1960 2nd half | 61,5 | 2022 1st half year | 23,4 | 13 |

| 1961 | 63 | 2024 | 28,2 | 15 |

| 1962 | 64 | 2026 | 30 | 15 |

| 1963 | 65 | 2028 | 30 | 15 |

Attention: the law establishes a list of conditions under which preferential pensions are possible up to the established age threshold. There are also cases where the retirement age is higher than the general one. In particular, among civil servants.

- The length of service should ideally be 15 years. However, such a requirement will only be established by 2024. For 2020, it is 11 years, as the process of gradual transition to new conditions of insurance coverage is underway.

- The same applies to the indicator of individual coefficients (points). By 2025, a citizen who has accumulated 30 points will be able to apply for an insurance pension.

Until 2020, pensions were awarded to citizens whose work experience exceeded 5 years.

Who is entitled to a preferential pension?

The legislation defines two large groups of citizens who can qualify for early social payments from the Pension Fund. They are divided according to the following criteria:

- working conditions;

- belonging to certain social categories.

Information on specific preferential conditions is contained in the current legislation:

- Thus, the first group usually includes people who worked for a certain time in harmful conditions, in hazardous industries, in the Far North. Professions are listed in special lists. However, preferential conditions will be taken into account when the worker can prove the transfer of increased amounts to the Pension Fund budget. It must be carried out by the enterprise.

- Benefit recipients based on social characteristics include:

- mothers of many children (five or more children);

- parents raising disabled children;

- disabled people injured during hostilities;

- and others.

You can use the right to early assignment of old-age maintenance if you have:

- insurance period determined by law;

- belonging to one of the preferential categories;

- minimum score: 18.6 in 2020.

Age to receive state old age pension

For those citizens who were most severely affected by the tragedy at the Chernobyl nuclear power plant, the retirement age has been reduced by 5 to 10 years.

| Liquidators of the Chernobyl accident in 1986-1987; | ||

| Citizens evacuated from the exclusion zone; | ||

| Citizens who became disabled as a result of the Chernobyl disaster. | 50 years | 45 years |

| Liquidators of the Chernobyl accident in 1988-1990; | ||

| Citizens who became ill due to radiation at the Chernobyl nuclear power plant; | ||

| Citizens working at the Chernobyl Nuclear Power Plant and in the exclusion zone | 55 years | 50 years |

For citizens who lived or worked in contaminated areas at any time during the period from the Chernobyl accident to June 30, 1986, the generally established retirement period is reduced in accordance with the table below.

| Citizens resettled from the resettlement zone | |

| Citizens permanently residing in the resettlement zone before their relocation to other areas | |

| Citizens employed at work in the resettlement zone (not residing in this zone) | 3 years and an additional six months for each full year of residence or work in the resettlement zone, but not more than 7 years in total |

| Citizens permanently residing in the residence zone with the right to resettle | |

| Citizens who voluntarily left for a new place of residence from the zone of residence with the right to resettle | 2 years and an additional 1 year for every 3 years of residence or work in the specified zone, but not more than 5 years in total |

| Citizens permanently residing in a residential area with preferential socio-economic status | 1 year and an additional 1 year for every 4 years of residence or work in the specified zone, but not more than 3 years in total |

| Citizens who became disabled as a result of other (non-Chernobyl) radiation or man-made disasters | The conditions for assigning a pension are regulated by separate regulations |

Types of pensions for state pension provision

State pensions are benefits accrued from the budget of the Russian Federation. For such payments, the person’s length of service or whether a person has insurance premiums is usually not taken into account.

The main condition is the fact of falling into a specific category:

- Astronauts.

- Civil servants.

- Unemployed citizens.

- Test pilots.

- Military personnel.

- Participants of the Second World War.

- Victims of radiation.

- People who survived the siege of Leningrad.

Social

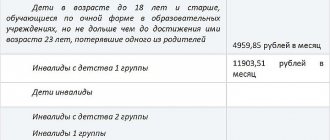

For disabled persons who do not have the right to receive insurance-type subsidies, social charges are established. The basis for assigning such payments may be payment due to age, the presence of a disability, or the loss of a parent by a child.

Social benefits for old age are assigned to people who have reached a specific age (60 and 65 years), who have not reached the required length of service or the required individual coefficient.

At the same time, certain categories of people have the right to receive early payments. Thus, for the small peoples of the North, accrual of social benefits based on age begins to arrive at 50 and 55 years.

The necessary factors for assigning such payments are permanent residence in Russia, as well as the status of a disabled person.

By old age

Age benefits are established for persons who have become victims of radiation. However, the grounds for the emergence of the right to receive a pension, as well as its amount, depend on many conditions:

- on the status of the recipient;

- type of work performed;

- territory and period of stay in the contaminated place.

These payments are financed from the federal budget. The benefit amount for this category is 250% of standard social subsidies.

For length of service

Benefits accrued based on length of service are provided for:

- Cosmonauts (special experience required: 1) 20 years for women; 2) 25 men).

- Civil servants (after 15 years of experience).

- Test pilots (special experience required: 1) women 20 years old; 2)men 25)

- Military personnel.

By disability

The amount of disability benefits also depends on the person’s status. These include:

- WWII veterans;

- people who survived the siege of Leningrad.

- military personnel who were injured, injured or suffered illness during their service;

- cosmonauts who became disabled during space flights.

- people who lost their ability to work after the Chernobyl disaster.

These subsidies are paid regardless of the fact of work, and the security is calculated based on a percentage of the total amount of social benefits.

For the loss of a breadwinner

Security under the SPC is established after the death of:

- military, as a result of service;

- a breadwinner affected by radiation accidents;

- astronaut

In this case, disabled family members of the deceased, children or spouses, parents can apply for benefits. The size of the payment is determined based on the status of the recipient.

What should those who did not manage to accumulate points and experience by retirement age do?

Citizens who have lived to the age of incapacity apply to the Pension Fund with an application for a pension. If all conditions are met, the insurance part of the pension will be assigned 10 days after the application and will be credited to the account monthly along with other payments due to the pensioner.

But the insurance part of the pension may be denied if no length of service or IPC has been accumulated. In this case, the old-age pensioner can:

- Accumulate the missing points by working for a while. For people of pre-retirement and retirement age, the IPC and length of service are calculated according to different rules than for working-age citizens: they can accumulate a little faster.

- “Buy” the right to receive an insurance pension by depositing a certain amount into your pension account (equivalent to a contribution from the employer).

- Wait 5 years and apply for a social pension.

All three points are controversial, difficult for some pensioners to implement, and, perhaps, in the future the rules for calculating insurance pensions will be changed.

Types of insurance pensions and conditions for their assignment

An insurance pension is the most popular pension payment, intended for monthly financial support of its recipient in connection with reaching retirement age, the loss of a citizen’s ability to work, or the loss of income of the breadwinner (due to his death). Federal Law dated December 28, 2013 N 400-FZ (as amended on December 29, 2015) “On Insurance Pensions” establishes three types of insurance benefits :

- on the occasion of old age;

- on disability;

- by loss of a breadwinner.

Each payment has its own characteristics and is assigned to its recipient subject to the conditions specified by law.

Old age insurance pension

The right to an old-age pension arises when a citizen reaches the generally established age:

- for women - 60 years;

- for men - 65 years.

From 2020 to 2022 there is a transition period when the retirement age will be lower (read more in the article).

The old age (age) insurance pension is assigned by law if the following values are required in 2020:

- insurance experience of at least 11 years , the duration requirement of which increases by 1 year every year until reaching 15 years;

- The IPC (individual pension coefficient) is not less than 18.6 , the requirement for which also increases annually by 2.4 until it reaches 30 .

For some categories of citizens, if certain requirements are met, it is possible to obtain the right to insurance benefits ahead of schedule , i.e. before they reach retirement age.

This category includes persons insured in the compulsory pension insurance system and who:

- worked in hazardous working conditions, as well as difficult and hazardous to health;

- worked or lived in the Far North and (or) places equivalent to it;

- have a certain social status.

The list of professions and persons entitled to early retirement, as well as the conditions for its appointment, are determined by the law of December 28, 2013 N 400-FZ “On Insurance Pensions” in Articles 30, 31 and 32.

Disability insurance pension

Disability pension benefits are assigned to citizens who, based on the results of a medical and social examination, have been assigned 1, 2 or 3 disability groups. At the same time, the law defines some nuances:

- the establishment of a disability insurance pension is not influenced by the cause of disability, the duration of the insurance period (it is enough to have at least 1 working day), or whether the recipient has a job at the time the pension is assigned;

- If a disabled person has no insurance coverage at the time of pension, a social pension benefit is established for him. Such disabled people include children or citizens who have never officially worked.

The pension is paid for the entire period for which the disability is established, or until the recipient reaches retirement age (60/65 years if the required length of service is available, 65/70 years if there is no experience).

When assigning an old-age pension to a disabled person (upon reaching the appropriate age), its amount should not be less than the benefit that he received for disability.

Survivor's insurance pension

Survivor's insurance benefits are established and paid to his relatives to provide them with financial assistance. The following are entitled to such payment:

- family members of the deceased who are unable to work and provide for themselves financially due to age or due to loss of health, or because of full-time study (under the age of 23) and who are dependent on him;

- one of the parents, spouse or other adult family member, if he does not work due to caring for the children of the deceased under the age of 14, including his brothers, sisters and grandchildren if they do not have able-bodied parents;

- disabled parents or spouse of the deceased who are not dependent on him, if they lose their source of financial resources. At the same time, the assignment of a pension does not depend on how much time has passed since the death of the breadwinner.

The survivor's benefit is assigned for the period until the recipient becomes able to work or, in some cases, is established indefinitely.

Families in which the breadwinner is legally recognized as missing are considered a family that has lost its breadwinner due to death.

Insurance payment is issued provided that:

- the breadwinner had at least one day of insurance coverage;

- his death is not a consequence of illegal criminal actions of his disabled relatives.

Procedure for receiving an insurance pension

If a citizen meets all the conditions discussed above, he has every right to apply to the local branch of the Pension Fund of the Russian Federation with a request to assign him an insurance pension. The PFR branch must correspond to the citizen’s registered address. It is also legal to contact the MFC.

The subject must collect in advance the documents required to receive pension benefits, in particular:

- identification;

- documents that would record the person’s length of service. Often, for this purpose, they provide a work book and copies of all employment agreements on the terms of the civil process agreement, if any;

- statement of income for the last 5 years of continuous employment, if such activity was carried out before 2002;

- other securities that may affect the amount of the pension amount.

An application should also be attached to this package of documents. It is compiled according to a standard algorithm. In particular, the paper must contain the following information :

- name of the authority where the package of papers is sent;

- information about the applicant. Full name, residential address, and contact information (telephone or email) are required;

- in the center of the sheet the name of the document is indicated - “Application for a pension”;

- in the main text, the subject must reflect his request for an old-age insurance pension, as well as indicate the grounds (reaching retirement age with reference to his passport);

- Below you should indicate when the last payment was made. That is, it is necessary to enter the wording: “Money allowance is provided until...”;

- such a statement requires an indication of the existence of parallel income of the subject (whether the citizen is employed or already has pension benefits from any government agency);

- family composition, if the subject applies for a bonus due to the presence of disabled family members, or an unemployed spouse and minor dependents;

- it should be noted that the subject undertakes to notify the Pension Fund of the Russian Federation within 5 days from the moment when any of the subject’s dependents finds a job;

- a list of applications, which should include all the documents described above;

- signature and date.

The insurance period for the old-age pension, as well as the number of pension points, is calculated by the fund’s employees. The procedure for reviewing the package of papers takes place within 10 days from the date of the subject’s application. In case of a positive decision, the first pension amount will be paid in the month following the month of the end of the subject’s allowance. Practice demonstrates that there are also situations when a person may be refused. However, in such circumstances, the fund employee must explain to the citizen the reason for the refusal. This often happens if the package of documents was incomplete.

Pension amounts in 2020

The amount of the pension benefit depends on the size of the insurance pension and the fixed payment to it. The insurance pension payment is calculated using the formula:

SP = IPK x SPK,

Where:

- SP - the amount of the insurance pension;

- IPC - individual pension coefficient;

- SPK is the cost of one coefficient on the day the benefit is assigned.

The cost of the IPC is established by law; from January 1, 2020, it is equal to 93 rubles . The size of the IPC is influenced by:

- the amount of insurance contributions that were transferred to the pension fund for the employee during his working life;

- the duration of the insurance period and the periods that are included in it (non-insurance);

- application of an increasing coefficient if the registration of an old-age pension benefit (including early) was postponed for a year or more after the entitlement to it became available (but not earlier than January 1, 2015), and the value of the coefficient depends on the duration of the deferment.

The coefficient for increasing the IPC can also be applied when assigning an insurance pension for the loss of a breadwinner, if, when he (the breadwinner) became entitled to an old-age insurance pension (including early), he postponed its registration or refused to receive it.

The size of the insurance pension benefit, provided that its recipient does not work, increases annually due to indexation.

Structure of insurance pension accruals by age

The insurance pension consists of two parts, calculated separately. It includes the following components:

- basic;

- premium.

The latter depends on the coefficients accumulated over the years of work. And the basic or fixed component (BC) is the same for all citizens. It is part of the state-guaranteed pension.

In addition, for certain categories of citizens, an increase in the fixed component has been established. These include:

- disabled people of group 1;

- elderly citizens who have crossed the 80-year-old threshold;

- people who worked or lived in the regions of the Far North or equivalent (multiples of the established coefficients for these territories);

- agricultural workers.

To encourage later applications for old-age pensions, increasing coefficients have been introduced. They apply to both components of payments.

Amount of fixed (basic) payment

A fixed payment is established for the insurance pension simultaneously with its assignment. Its size is determined by law dated October 3, 2018 No. 350-FZ, and after indexation from January 1, 2020 it is 5,686.25 rubles . Law No. 400-FZ establishes the following points:

- when applying for a disability insurance benefit for disabled people of group 3 and a survivor's pension, a fixed payment is assigned in the amount of 50% of the amount established by law;

- when establishing an old-age pension after delaying its registration or refusal to receive it, depending on the period that has passed from the moment the right to a pension became available (but not earlier than January 1, 2015) to the day of its appointment, an increasing factor is applied to the fixed payment;

- the payment is indexed annually;

- By decision of the Government of the Russian Federation, the size of the payment may additionally increase annually depending on the growth of Pension Fund income.

Art. 17 of the Law of December 28, 2013 N 400-FZ (as amended on December 29, 2015) “On Insurance Pensions” provides for certain categories of recipients the payment of a fixed amount in an increased amount .

Indexation in 2020

On January 1, 2020, the indexation of insurance pension payments by decision of the Government was carried out by a percentage higher than the inflation rate for 2020 - by 6.6% .

In addition, a number of decisions concerning working pension recipients have been extended:

- Working pensioners have not had their insurance pensions indexed and will not be indexed now;

- indexation of payments will resume when the pensioner resigns, and he will begin to receive a pension benefit taking into account all missed indexations;

- If desired, the benefit recipient can get a job again, and there will be no reduction in the recalculated pension payment.

While limiting working pensioners in the indexation of pension payments, the legislator retained the annual recalculation of their pensions, made in August based on the amount of insurance contributions transferred for them by the employer.

Pension provision for citizens - differences between funded, insurance, social pensions

- has a cash equivalent;

- Frequency of receipt: once a month ;

- produced at the expense of the federal budget;

- the circle of persons is specified by federal law.

This is interesting: Correction of a Cadastral Error of a Previously Registered Land Plot Art. 43.P.2

Note! The social type of monetary allowance is guaranteed by the Constitution of the Russian Federation, Article 39 . The question of who receives an insurance pension and who receives a social pension worries citizens of pre-retirement age. Social benefits are paid to disabled residents. The category includes disabled people, children under the age of 18, indigenous peoples of the North - 50-55 years old , people who have lost their breadwinner, under the age of 23 , undergoing full-time education.

Retirement occurs when a person reaches a certain age in life. Deadlines may vary depending on the person’s work activity. Residents of the country can receive 3 options for pension accruals - social, funded, insurance. Each payment has differences that a person of pre-retirement age needs to know about.

How is old-age insurance determined?

When appropriate legal conditions arise, the applicant should write an application at the nearest Pension Fund branch. You can do this:

- personally;

- by post;

- through a representative;

- on the official website of the Pension Fund (via the Internet);

- in a multifunctional center (if there is one in the city).

The general rules for processing applications are as follows:

- Pension payments are assigned from the date of application, but not earlier than the right to them;

- an exception is the case of application within a month from the date of dismissal (the date of calculation of the insurance pension is considered to be the day following the termination of employment);

- Pension Fund specialists are given ten working days to process documents:

- exceptions are cases when additional documents are required;

- three months are allotted for such work without changing the date of assignment of the pension;

- A justified refusal is sent to the applicant’s address within five days;

- the letter must indicate the terms and conditions for appealing it.

An insurance pension is assigned in connection with reaching the working age limit for an indefinite period, that is, the decision does not contain data on the end of transfers.

List of required documents

There are a number of documents that are required. So, it is recommended to have originals and copies of the following documents with you:

- the applicant’s passport or residence permit for foreigners (they limit the period for assigning pension accruals);

- certificates of compulsory pension insurance (SNILS);

- work book, certificate of work at enterprises, if the data is not included in an official document;

- data on income for 60 consecutive months in the work book until December 31, 2001.

Important: the amount of the final payment will be calculated based on the income certificate. Therefore, the applicant is allowed to independently choose the most profitable period.

However, periods of high income must meet the following conditions:

- cover a full 60 months, with the exception of periods when the citizen did not work officially;

- follow each other in the work book (excluding any is not allowed).

In some cases, a salary certificate will not be required. Thus, if there is an amount of insurance premiums for 2000-2001 on a citizen’s personal account of 44,000 or more, the maximum ratio of wages to the required indicator is established.

Often, other paperwork is required to assign a payment. The PFR specialist informs the applicant about this. Information stored in government agencies is obtained by the latter independently.

Example of calculating the minimum old-age pension

To determine what the smallest amount of insurance payment is, you can use the above data (for 2020):

- basic payment 5334.19 rubles;

- the cost of one point is 87.24 rubles;

- the number of minimum required coefficients is 16.2.

Substituting everything into the formula, we get:

16.2×87.24 rub. + 5334.19 rub. = 6747.5 rub.

Important: the amount received is significantly below the subsistence level. Such insurance pensions are subject to federal supplements, which increase their size.

Where do you receive old age pensions?

The method of listing the content is determined by the applicant during the writing of the application. Typically, the following enumerations are used:

- through the post office;

- to a bank account.

The application must contain accurate and reliable information about the relevant details of the recipient.

The method of transferring money can be changed by the recipient on his own initiative. To do this, you should write an application at the Pension Fund office.

How to get an old-age social pension

The application and a complete package of documents must be submitted to the Pension Fund office at the place of your permanent or temporary registration. If there is no registration, the documents are submitted to the Pension Fund branch operating at the place of your actual residence in Russia.

Serving method of your choice:

- personally;

- through a proxy;

- sending by Russian Post;

- through your personal account on the Pension Fund website.

The old-age social pension is assigned for an unlimited period (indefinitely) from the 1st day of the month in which you contact the Pension Fund of the Russian Federation, but not before you become entitled to it.

The exception is citizens who previously received a disability pension, but due to reaching age were transferred to receive a social pension. For these people, the pension payment date will remain unchanged

State pension

State pension

– monthly state cash payment to citizens in order to compensate them for earnings (income) lost due to termination of federal public service upon reaching length of service upon retirement due to old age (disability); or for the purpose of compensating lost earnings for citizens from among the cosmonauts or from among the flight test personnel in connection with retirement for long service; or for the purpose of compensation for damage caused to the health of citizens during military service, as a result of radiation or man-made disasters, in the event of disability or loss of a breadwinner, upon reaching the legal age; or disabled citizens in order to provide them with a means of subsistence.

State pension benefits have five types:

— state pension for length of service — assigned to military personnel, cosmonauts and flight test personnel, and federal government employees.

— state old-age pension — assigned to citizens who suffered as a result of radiation or man-made disasters.

— state disability pension — assigned to military personnel; citizens affected by radiation or man-made disasters; participants of the Great Patriotic War; citizens awarded the badge “Resident of besieged Leningrad”; to astronauts.

- state pension in case of loss of a breadwinner - is assigned to disabled members of the families of fallen (deceased) military personnel; citizens injured as a result of radiation or man-made disasters, astronauts.

- social pension - assigned to disabled citizens permanently residing in the Russian Federation due to old age, disability, or loss of a breadwinner in the absence of the required insurance period and the minimum amount of pension points (taking into account the transitional provisions of pension legislation).

Early retirement

According to information published by the state Pension Fund, there are conditions that allow you to apply for an old-age pension prematurely.

This is a kind of concession for length of service or a certain length of service gained in jobs with difficult, dangerous, harmful working conditions and for persons with a preferential social situation.

Early retirement is also affected by the pension coefficient, which is a numerical code of 6.6 with an annual increase in the period until 2025 by 2.4 points to the level of number 30.

You can exercise your right to early pension provision no earlier than:

- 12 months in 2020;

- 24 months in 2020;

- 36 in 2021;

- 48 in 2022;

- 60 calendar months from the date a citizen becomes entitled to old-age pension payments in 2023 and subsequent years.

The preferential social group includes persons with health limitations, women with many children, or citizens who are guardians of a person with serious health problems. Also, early pension is provided to people as compensation when working in regions classified as “northern” according to the List of Regions of the Far North or when carrying out labor activities in similar areas.

Size

The amount of the state old-age pension is determined depending on many factors . Persons who were exposed to radiation or became disabled due to a man-made accident are entitled to monthly payments in the amount of 250 percent of the social pension.

Important! Russians who live or work in places with high levels of radiation receive 200 percent of their social pension every month.

If a citizen is the breadwinner of disabled relatives, the pension is calculated taking into account the changed amount of social payments. In this case, the minimum established social pension is increased by 1,441 rubles for each disabled family member (no more than 3 people).

For people who live in the northern regions, regional coefficients are taken into account when assigning and determining the amount of pension benefits. They are established for each subject of the Russian Federation and depend on local conditions.

Calculation

Since 2010, the amount of old-age pension payments from the state is calculated taking into account the social pension. Let's look at an example of how the size of the state old-age pension is determined.

Oleg is a Russian who was evacuated from the exclusion zone and resettled from the resettlement zone. He supports a child who has not reached the age of majority and has a disability of the 2nd category.

Oleg, who suffered from the Chernobyl accident and is supporting a disabled child, can receive state old-age pension payments, the amount of which is equal to the amount of 2562 (a fixed indicator of the insurance part of the labor pension for persons who are not anyone’s breadwinners) and 1441 (an allowance for one dependent) , multiplied by 200 percent. Consequently, Oleg can receive 8,006 rubles every month.

Is it possible to work and receive a pension?

Pension legislation allows recipients of insurance pension payments to carry out labor activities.

An exception is the receipt of a survivor's pension, since it is paid provided that the recipient is disabled or does not work due to caring for children under 14 years of age.

In order to reduce pension costs, there was an attempt to legislatively limit working pensioners from receiving pension payments depending on the size of their income, but this project has not yet been adopted, and the right to earn additional funds to the pension remains unchanged.

Fixed payment to the insurance pension

A fixed payment is a mandatory component of an insurance pension. It is summed up with the result obtained after calculating pension points.

If the subject was unable to comply with all the conditions necessary to ensure insurance pension benefits, then he will be assigned only the amount of a fixed payment without additional pension points.

The amount of the basic payment under consideration is also not the same, and may vary depending on the presence of a number of factors. So, for example, in 2019 the lower limit of the fixed payment is 5334.19 rubles. Practice shows that such an amount is assigned extremely rarely. For example, citizens who are over 80 years old receive a pension in the amount of 10,668 rubles, and those pensioners who have a dependent can count on an insurance pension in the amount of 7,112 rubles.

The fixed payment is indexed annually.