Description of the pension card

Post Bank has a fairly attractive line of debit cards that can be used by people for various purposes. The pension card is intended only for a narrow circle of people and provides them with some privileges. This card is issued to absolutely any resident of Russia who has the right to receive pension payments.

A pensioner can receive it if:

- I decided to transfer my pension to Post Bank.

- Wants to open a Savings account.

- Wants to put his savings into a deposit.

- I decided to take out a consumer loan with reduced interest.

You can simply come to the bank and ask to issue a pensioner’s card, but usually a person needs it only in the cases described above, because simply holding another debit card when there is another social card to receive payments simply does not make sense.

Pochta Bank pension cards are especially popular, as they are not only intended for receiving a pension, its withdrawal and transfers, but also have additional functions that allow you to save on spending or receive income from storing your own funds.

Pensioners also periodically have access to certain promotions and loyalty programs in which they can win a prize or purchase goods at a reduced price.

During the first year of its existence, the joint project of FSUE Russian Post and VTB Group managed to collect a wide variety of reviews from its visitors. Our economic observer Nikolai Volossky decided to test the work of Pochta Bank.

The first impression of communicating with the bank was mixed: as always happens, I liked some things and didn’t like others. I was confused by the queue at the post office and the feeling of slight confusion.

But these impressions were smoothed over by the friendliness of the staff. The call center responds promptly, the answers are clear and understandable. There are no armored cash desks at the bank; they work only through an ATM. The latest ATMs with a touchscreen and the ability to plant a tree remotely are used.

Pochta Bank has announced and is actively advertising through all channels a new product for the Russian market, “Online Buyer Package” for comfortable online shopping with a “best price” guarantee. With free equipment repair and product return.

For example, how does the “best price” guarantee work? A buyer buys an iPhone for 70,000 rubles in an online store, and then finds exactly the same model for 30,000 rubles cheaper, for example, in any offline or online store in the Russian Federation. In this case, the partner insurance company returns the difference (30,000 rubles) to the client. The service only works if the purchase was paid for with a Pochta Bank card.

The “Online Buyer Package” is connected to three Post Bank cards (Online card, Element 120 credit card and savings account) free of charge and automatically when paying with the card for online purchases in the amount of 7,500 rubles or more. The bank notifies you about the connection via SMS.

Finding the coveted link for registering in the “online buyer” service on the Pochta Bank website is not as easy as it seems. However, the process of obtaining an online card in Internet banking turned out to be surprisingly fast and simple. You enter your phone number, receive an SMS – and that’s it! (without visiting the office and without signing papers!) Immediately after registration, a virtual online card opens, which can be topped up with real money from a card of any bank - and go shopping on the Internet.

Similar services have been successfully operating for several years in the USA (eBay Buyer Protection in USA), South Korea (Citibank Korea & Standard Chartered Bank) and France (Banque Accord).

He is the only one - the maximum amount of compensation is 30,000 rubles.

To prove that the price of a product in another place is better, it is enough to write a statement, present a passport, a receipt and a document with the date of receipt of the product and a link to a site with a similar product at a lower price. The difference in price is transferred to the Pochta Bank client card.

“Pochta Bank” relied both on online (an attempt to attract young and progressive Internet shoppers with the “Online Shopper Package” and a modern mobile bank), and on offline (a wide geography of Russian Post branches) and a huge customer flow.

Considering where banking is heading all over the world, the first direction is, in our opinion, more progressive. Today, when the world is on the threshold of a new technological revolution and the most successful banks are introducing completely remote methods of service with elements of biological identification of the client, we see that the brainchild of Russian Post and VTB is keeping up with the times. Moreover, they introduced biometric facial recognition when they were still Leto Bank in 2020, and as they wrote in the media, they saved millions of rubles on this.

To create a functional Internet or mobile bank, accessible to customers in any corner of the country and the world - you must agree, this is worth a lot, because the convenience of the bank directly depends on its innovation and willingness to go online. Well, offline - well, this direction will be more interesting to the older generation, or to people in those cities and villages where there is still no normal Internet and the ability to use online applications every day.

SUMMARY

So, based on the results of the review, the main advantages and disadvantages of the new bank.

Minuses:

- So far there are about 3,000 bank outlets in the country. It seems like a lot, but not in every post office

- Intricate navigation on the bank's website.

- If a post office closes for lunch or on weekends, then Post Bank also closes.

- Lack of cash back on cards and mortgage loans popular among the population

- No support for contactless payment technology

Pros:

- Activities under the “roof” of two giants - Russian Post and VTB Group (accordingly, the risk of license revocation is zero).

- The interest-free period on a credit card is 120 days (no bank in Russia offers such a long and renewable period; others have a maximum of 55 days).

- A very convenient application for iOS and Android (can compete with the famous Sberbank application).

- The “Online Buyer Package” with free insurance against unsuccessful online purchases is truly a know-how in the retail financial services market in Russia.

- Free savings account card (no need to pay for annual maintenance either) with up to 7% interest on the balance

Based on the results of the study, the analytical department of wsj. assigned PJSC Post Bank a rating of B+ (stable bank, outlook positive).

As an advertisement

Nikolay Volossky

I'll write about you.

Terms of Use

The pension card is issued in the unified payment system MIR, which is accepted by ATMs and banks in any country. Post Bank provides a card to a pensioner under the following conditions:

- Issue and annual maintenance free of charge.

- Cash withdrawals from ATMs of Post Bank and its partners are made without charging a commission.

- Cash withdrawal through the use of ATMs of third-party banks with a commission (1% minimum, and then at the discretion of the bank).

- There is no limit on the amount for cash withdrawal.

- All intrabank transfers are free; for interbank transfers a commission is charged according to the tariffs of the other bank.

- You can replenish the card in any convenient way - through a terminal or Pochta Bank cash desk without commission.

The conditions for using the card are quite clear and do not create difficulties for a person. If a pensioner has issued a card to receive pension payments, they will automatically be credited to the card on the specified day, and all receipts can be constantly monitored.

To do this, Post Bank offers three additional functions, provided free of charge:

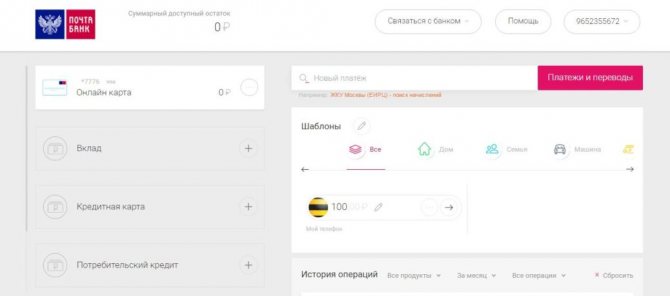

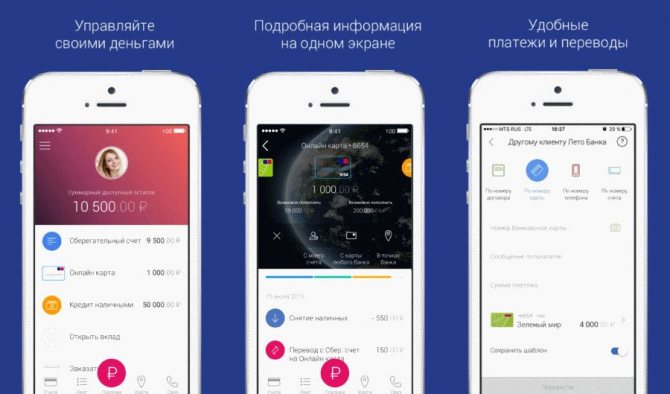

- Internet banking - in your personal account online, you can view your card statement and carry out various financial and other transactions, from bank transfers to opening a deposit. Your personal account is available around the clock if a person has any PC and the Internet on it.

- Mobile banking is a mobile version of online banking, accessible to pensioners from any device (phone, tablet) and is also easy to use. If a person does not have a gadget to install a mobile bank, then the function described above can completely replace it, because almost everyone now has computers.

- SMS notification - after each card transaction, a message from Post Bank will be sent to the client’s mobile phone, which will allow you to constantly be aware of all your transactions. If there is a failure or unauthorized actions with the account, the person will immediately notice this and can immediately contact the bank to clarify the details and fix the problem. But this service is free only for the first 2 months from the moment the card is issued, and then the bank will withdraw 49 rubles monthly (provided that during this time at least some actions were carried out with the pension card). This function is extremely beneficial for pensioners, since not everyone uses the Internet, or does not want to go to a branch or ATM every time to carry out a certain procedure.

Post Bank personal account - login for individuals and legal entities

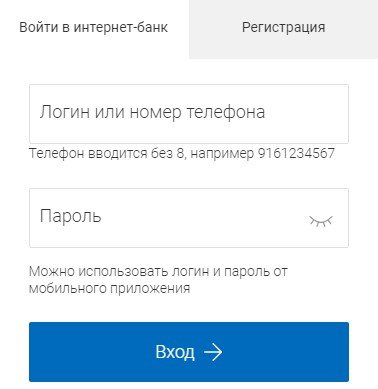

To enter your personal account in the Internet banking of Post Bank, follow the link:

Log in to your Pochta Bank personal account using your phone number

After completing these actions, you will see a complete list of opportunities that are available to clients in the Personal Account of PJSC Post Bank.

Post Bank Business - personal login for legal entities

For legal entities, the bank has developed a personal account, Post Bank Business, at the link:

Login to your personal account for legal entities

Advantages of a pension card from Post Bank

Post Bank has released not just a debit card, but an interesting and profitable product. With this card, pensioners have access to many functions that allow them to profitably manage their capital and always be in the black.

The benefits of a pension card include its additional features shown in the table.

| Additional feature | Description |

| Cashback 3% | For any purchase paid for with a pension card, 3% of the amount spent will be returned to the person’s account. This function applies only to non-cash payments in stores, but transfers, account replenishments and utility bills are not included here. |

| Increased deposit rates | Post Bank offers pensioners a special deposit, at which 0.25% is added to the base rate, depending on the amount and term of the deposit, for the fact that the person has a pension card to which his pension is received. |

| Savings account with interest on balance | The pension can be fully or partially deposited into a savings account and interest will accrue on this money every month, bringing the pensioner a stable profit, which will at least help offset the cost of SMS notifications. |

| Additional bonuses for the Pyaterochka card | If a person already has a Pyaterochka card, then when applying for a pension card, Post Bank will immediately credit 2,500 bonuses to Pyaterochka. Then you can convert bonuses into rubles and pay for your purchase in this chain of stores. |

Benefits for cardholders

The line of debit cards is relatively small, but in it you can find basic cards suitable for the daily needs of citizens of various interests, which provide for cash withdrawals, interest-free intra-bank transfers, as well as payments with a minimum commission.

Debit cards:

- A virtual card for online purchases, issued and serviced for free, has additional bonuses for people who often pay online.

- Visa Classic with instant registration in the sales department, the card is linked to a savings account. Its big advantage is income on the balance up to 7% per annum and increased protection thanks to the built-in chip.

- Visa Platinum is an international card; you can use it to make purchases and withdraw funds even abroad. Can be delivered anywhere in the country by Russian Post. The great advantage of this card is its privileged status, which provides additional discounts and gifts in shopping and entertainment centers, as well as medical care abroad, additional information and an extended warranty, and purchase protection.

- The Mir card allows you to receive up to 7% interest on your account balance, and it also has a number of advantages provided by the Mir payment system. The card is personalized and can be received either at a bank branch or by mail.

- The Pyaterochka card is a profitable card for customers of the Pyaterochka retail chain and more. The card allows you to receive, in addition to interest on your balance, additional bonuses for purchases in the form of Cash Back, it is accepted all over the world and has access to all special offers from Visa partners. Free registration and maintenance, as well as instant processing, are also undoubted advantages of this card.

Credit cards from Pochta Bank are represented by three cards with different tariffs, each of which has its own advantages. What they have in common is an acceptable interest rate, an interest-free period for funds written off to pay for purchases for up to 120 days, and a credit limit of up to 500,000 rubles. Credit card holders also have access to the full range of Visa and Visa Platinum privileges.

How is interest calculated on an account?

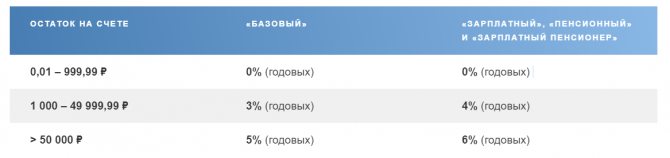

Most pensioners apply for a pension card in order to receive a pension and at the same time open a Savings account. It is easy to use, since you can withdraw money and top up your account at any time. The bank does not limit the client by the size of the balance or the number of outgoing or incoming transactions. If at the end of the billing period (equal to one month, it is counted from the day the account was opened) the bank has from 1,000 to 50,000 rubles, then 4% per annum will be charged, and if the amount is more than 50,000 rubles, then the interest rate will be already 6% per annum.

Interest accrues monthly, which allows you to make a stable profit. If the amount in the Savings Account is less than a thousand rubles, then Post Bank will simply not accrue interest that month, and the account itself will continue to exist. The bank does not charge a fee for its service, so pensioners have only advantages here.

Advantages of a pension at Pochta Bank

- Money is under reliable protection . Post Bank is a subsidiary bank of VTB, i.e. National Bank. This is a systemically important bank, it will not go bankrupt, its license will not be revoked, like commercial ones.

- Additional up to 6% . They are credited to your retirement savings account balance. This is quite a significant increase for a pensioner.

- Withdrawing cash couldn't be easier . A wide network of ATMs and terminals in cities and towns throughout Russia. Including at the Russian Post, where there is a post office, there will be a branch and/or an ATM. In addition, you can withdraw money from all VTB Bank ATMs, and all this without commission. The total number is more than 45 thousand devices throughout the Russian Federation.

- For each purchase using the card in pharmacies (also when purchasing fuel at gas stations, transportation costs) linked to a pension account, 3% will be charged. For example, if you bought medicines for 300 rubles, 9 rubles will be returned to your card.

- Maintenance of a pension account – 0 (zero) rubles (free).

- Providing more favorable conditions if you decide to open a deposit or take out a loan with Post Bank. The deposit rate will be higher and the loan interest will be lower compared to those who do not have a pension account.

- A “MIR” card is issued for your pension account , absolutely free. The card is accepted for payment throughout Russia.

- Access to information, social and medical support 24 hours a day . A pensioner can call employees on a special toll-free number and get answers to his questions on the above topics.

- Free issue of a Pyaterochka store discount card for pensioners. This card allows you to accumulate bonuses for purchases, which can then be written off against your purchase, thus receiving a decent discount.

Registration of a pension card

To receive a card, a pensioner will need to have a certificate or certificate from the Russian Pension Fund on receipt of state pension payments. To issue a card, you will need to come to any of the Pochta Bank customer centers during business hours. It is very simple to apply for a pension card at a bank; you need to:

- Write an application for pension transfer to Post Bank.

- Provide the bank employee with your passport and pension certificate.

- Read the Pochta Bank agreement for the provision of the requested service and sign it.

Post Bank always requires the personal presence of a pensioner when issuing a card and no one can open it for him. After registration, a person becomes a full-fledged client of the bank and will then be able to carry out many operations remotely through his personal account.

Issuing a card does not take much time and within half an hour a person will have the treasured plastic card in their hands. The bank never refuses people to carry out this transaction and is even more interested in attracting new clients.

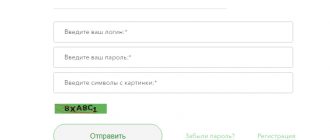

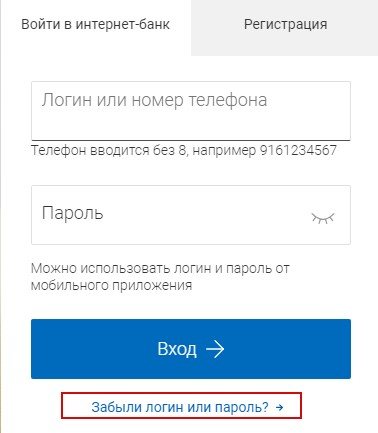

Login and password recovery

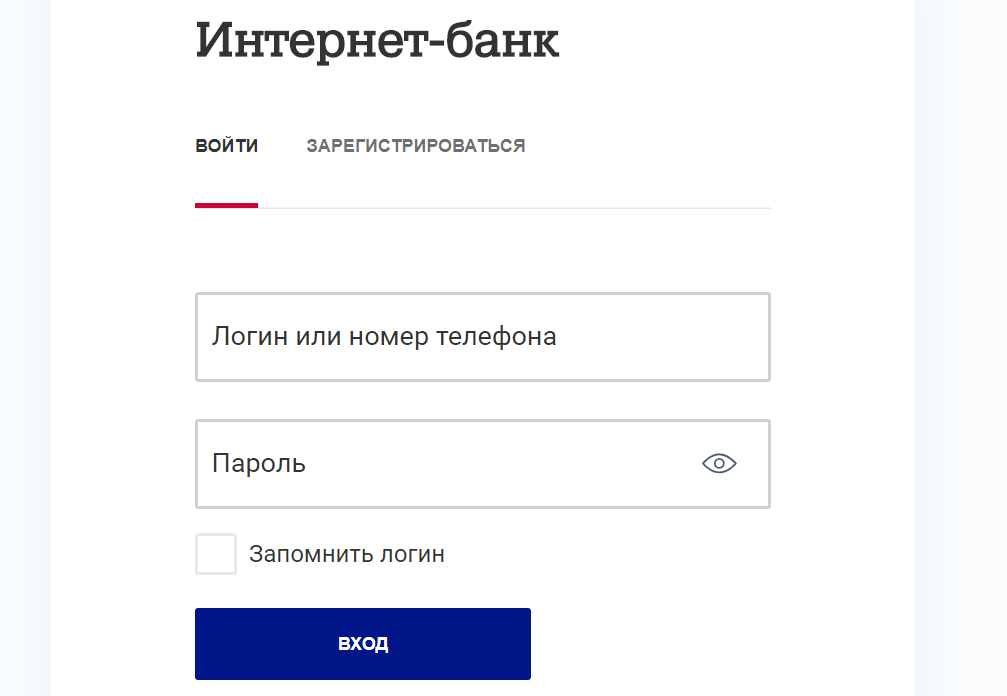

If it happens that you have forgotten your login details for your personal account, you can restore them without visiting a bank branch. To do this, you need:

Have an active banking product and indicate the following data in a special form:

- bank card number, which is a 16-digit digital combination;

- or a bank account number that is opened in the user’s name at PJSC Post Bank, consisting of 20 digits, starting with 4.

Specify the access code that each bank client receives at the time of signing the agreement. This digital combination can be requested again by calling the Contact Center at: 8.

To renew your identity yourself, follow these steps:

- Go to the official Internet Bank page or follow the direct link.

- Click the “Forgot your login or password” tab.

- The system will issue a reminder to have your card account number or access code with you.

- Click "Get a new username and password."

- The recovery procedure is identical to the initial registration in your Personal Account. Here you will also need to enter your mobile number and email address, and then click “Next”.

- Specify a new password and confirm the password change with the “Next” button.

As soon as you restore access to your Personal Account, you will be able to resume access to all functions of the system and use them again in full.

Why do you need a personal account: Internet banking capabilities

It is now impossible to imagine that this wonderful function once did not exist. How much easier it has become to perform banking transactions. The main advantage is mobility. All services are available anywhere. One condition is that you need a device that can access the Internet.

Now there is no need to visit offices, only as a last resort. For example, when applying for a loan, you will need to come to the branch to sign an agreement. The application, consideration and receipt of funds can be done remotely, thanks to your personal account.

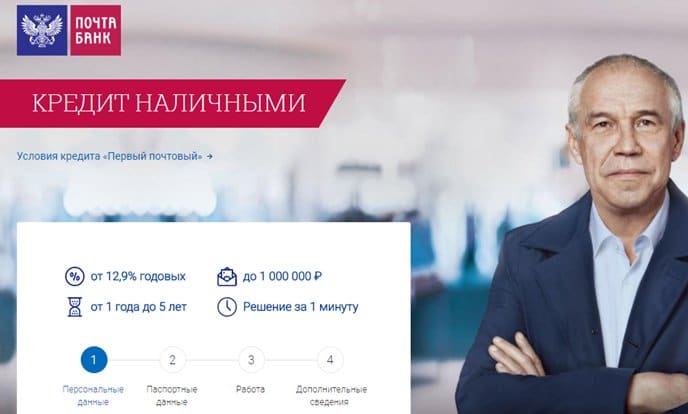

How to get a loan—filling out an online application in your personal account

The Post Bank opened only in 2020, but people flocked to it immediately. It is convenient for some that the network of branches covers a large territory - each post office of the Russian Post has an office of this bank. Some people are interested in services. For example, the card has an unlimited period of up to 3 months.

Concept: an unlimited period is a period during which the client will not pay interest on the borrowed funds. Valid by bank transfer.

When you already have a personal account, there should be no problems filling out an application.

It is submitted in several steps:

- Personal information: Full name, date of birth, amount and term of the debt obligation, e-mail and telephone.

- Passport details and registration address. All data that is in the system is loaded independently. A landline phone number is required.

- Job information: phone number, how long you’ve been working, salary, official company data.

Important: all banks transmit information about working data among themselves. If a client worked in one company a month ago, and now in another and writes that 3 months have passed since the date of acceptance for the position, there will be a refusal. The deception is clear! And the person will be blacklisted and it will become more difficult to take out a loan.

- Personal data: how many dependents, whether there is a car, an apartment, etc. This item allows you to find out how much free money the borrower has.

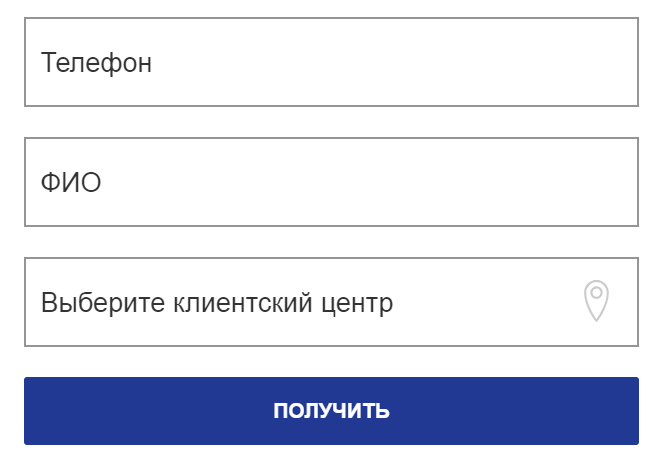

How to transfer pension proceeds?

How to practically transfer your received pension income to Post Bank?

There are 3 options here:

- Come to the Post Bank branch nearest to you (they are also called the client center). And ask the employee to do the registration. But in this option, it may turn out that you do not take with you all the necessary documents for registration (passport, pension, SNILS, etc.).

- Submit an application on a special page , immediately selecting the Client Center that suits you on the map of your city. In this case, you indicate your phone number, full name and selected branch. An employee will contact you and tell you everything, including the necessary documents. In this case, the risk of making a mistake is less, and you will not have to go home again for the missing papers.

- Call 8 800 550 0770 (Free call within Russia). You can call 24 hours a day.

Documentation

Typically the following documents are required:

- Passport of a citizen of the Russian Federation

- SNILS

- Pensioner's ID

- Application (will be issued on site at the branch)

- Mobile phone

But you may also need a work book or marriage certificate. But rarely. They will tell you in detail over the phone.

Transfer request

A special page for submitting an Application for transfer and/or receipt of a pension is located on this page

On this page you can immediately calculate using the Profitability Calculator how much you will receive if you have a certain amount in your Pension Account.

Post Bank application for phones

For those who actively use various gadgets - tablets or smartphones, the bank has created a convenient and functional Internet banking mobile application.

The mobile version of the application allows its users to experience all the benefits of the Internet banking service. Thus, clients will be able to easily manage their accounts that were opened with PJSC Post Bank, maintain deposits and pay loans, as well as carry out many financial transactions!

In addition, if non-standard questions arise, you can get a telephone consultation with a company representative.

The application works correctly on the following OS:

To install the application on an IOS system, you need to download the service from the AppStore or follow a direct link. For owners of Android devices, the application is available for download on PlayMarket.

Users with Windows Phones can download the app from the Windows Store (login via direct link).

If the user has previously registered in the Internet banking system, there is no need to go through the procedure again. To log in, you just need to enter your username and password.

Most of the banking transactions that you previously carried out at the Pochta Bank branch can now be carried out through your Personal Account. The service opens up many opportunities for users and allows them to save time for other things.

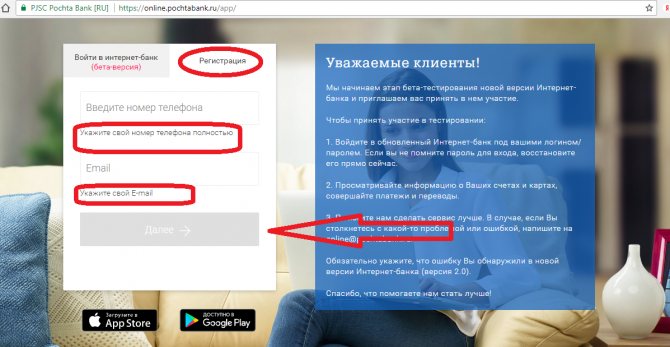

Registration in the Post Bank Online system

Go to the address above and follow these steps:

- Activate the “Registration” tab.

- Enter the phone number associated with the banking service agreement.

- Enter your email address in the space provided.

- Click on the “Next” button.

After this, using the prompts, enter your personal passport data and registration information about the contract. Confirm your intention by clicking on the link from the email message. You will receive an SMS with the assigned password. It can be changed in the future.

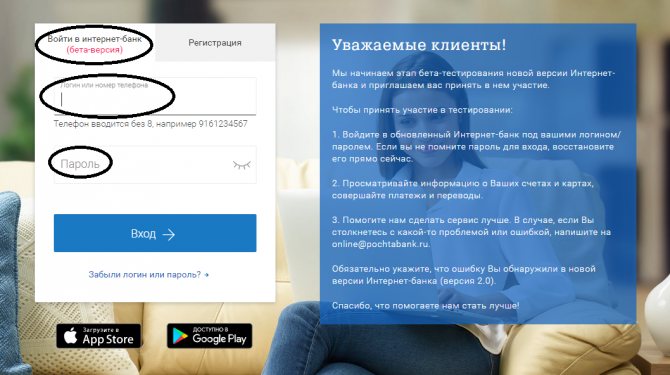

Login to your personal account "Pochta Bank"

The procedure is identical to registration, only you do not need to enter a lot of personal data. All you need to do is enter the phone number you specified during registration and your password. After clicking the “Login” button, a message will be sent to your phone stating that the system has been successfully activated.

In case of unauthorized entry, you will be notified and will be able to take measures to block your personal account. After logging in, you immediately gain access to all the capabilities of the Post Bank Online system.

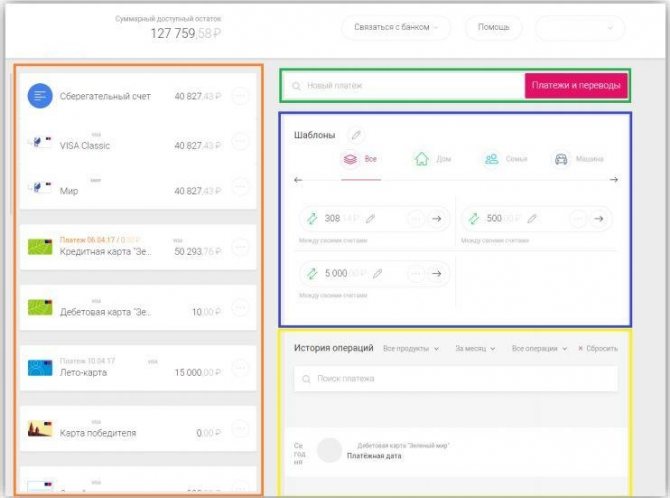

Features of the Pochta Bank personal account

The bank gives you the opportunity to use any means of control and management of your finances. In your personal account you can:

- Control account balances.

- Do shopping.

- Carry out transactions between your accounts, as well as accounts and cards of other banks and individuals.

- Repay loans.

- Request a bank statement about the movements of funds for the selected period for each account.

- Apply for loans.

- Set up regular payments.

- Perform transactions on accounts and cards of other banks and persons.

- Order new credit and debit plastic cards.

- Open accounts and close them.

- Manage deposits.

- Other.

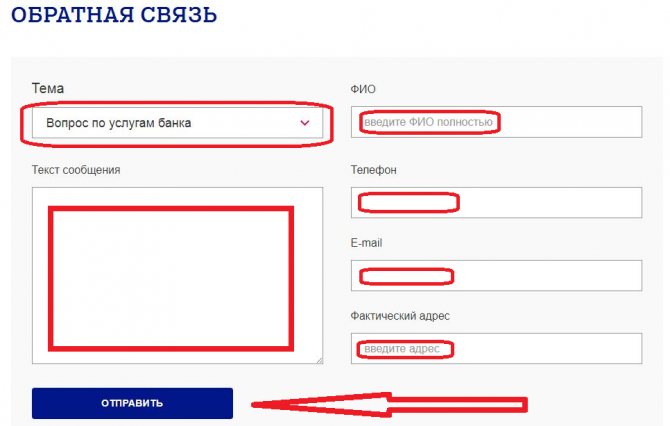

There is also a form for consultation here.

From the drop-down context menu in the “Question about bank services” field, select the section you need. Enter in the appropriate fields:

- Last name, first name, patronymic in full.

- Phone number attached to your personal account.

- Email address specified in the database of the Post Bank Online system.

Calculation of interest on account balance

A strong argument is the possibility of receiving additional income if there are funds remaining in the account. This option is provided for pensioners. The accrual amounts depend on the amount of the balance. The maximum you can extract is up to 6% per annum, which is paid at the end of the period.

If the balance does not exceed 999.99 rubles, then a zero interest rate is provided. For those who store from 1,000 to 50,000 rubles, 4% per annum is offered on the minimum amount. In a situation where there are more than 50 thousand available funds, the financial company is ready to offer 6% per annum on the balance. Calculations are made on the last day of the month.