The joint stock company “Non-State Pension Fund of Sberbank”, created on March 17, 1995, is one of the first NRFs in Russia and today is the largest pension fund.

Its founder and sole owner and shareholder is PJSC Sberbank of Russia. Sberbank has the largest branch network in the country, covering 8,500 branches, where you can draw up an agreement on compulsory pension insurance (OPI). The total number of clients of Sberbank NPF JSC is 8.3 million people. Financial assets – almost 500 billion rubles.

How are future pensions formed?

Sberbank NPF allows individuals to make regular contributions, ensuring themselves a calm, comfortable old age. Each user of the Pension Fund is provided with a personal account on the website https://lk.npfsb.ru/, where he can monitor non-state pension savings, create an IPP and calculate his future pension.

All Russian employers transfer 22 percent of their employees' wages to the pension fund. Until 2014, only 16% of these funds were the insurance portion. The employee had the right to direct 6% of the amount at his own discretion to “non-pension funds,” as NPF pensioners themselves called it. These funds constitute a funded pension. Since 2014, the funded pension has been frozen, and individuals are entitled only to that part of the funded pension that was formed before 2014. But the situation can change at any moment.

Non-state pension funds, in turn, make this money work: they invest in various serious projects so that the account amount constantly increases and does not suffer from inflation. Thus, the profitability of Sberbank NPF in 2020 was 9.5%. NPF Sberbank invests funds only in proven and reliable projects, which guarantees the safety of savings. This organization has the highest rating.

Before a user gains access to the personal account of Sberbank NPF, he must conclude an agreement offline at any of the local branches of Sberbank. And get data to access your account.

How is Sberbank’s non-state pension fund related to pension co-financing?

In Russia, a special pension co-financing program has been in place since 2008. Its essence is that a citizen can increase the amount of his future pension by making additional contributions, in addition to compulsory pension insurance.

The state, in turn, also pledged to double the amounts contributed by the future pensioner. Contributions, at the request of a citizen, could be sent to government administration (to the accounts of Vnesheconombank), private investment organizations and non-state pension funds.

Sberbank NPF actively took part in this program, allowing many of its clients to increase the size of their pension savings at the expense of the state.

Attention! There are no new participants accepted into the program at this time. Applications for participation could be submitted until December 31, 2014.

Registration and login to your personal account

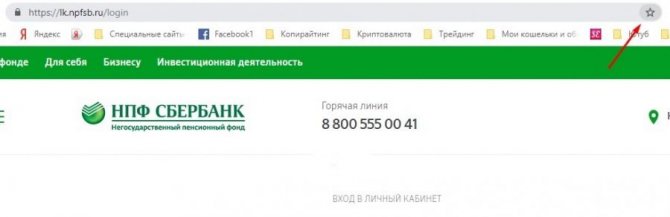

This is what the login page looks like. If the user has gained access to his personal account, he can click on the Login button. A user who has an account with Sberbank can click “login through Sberbank”.

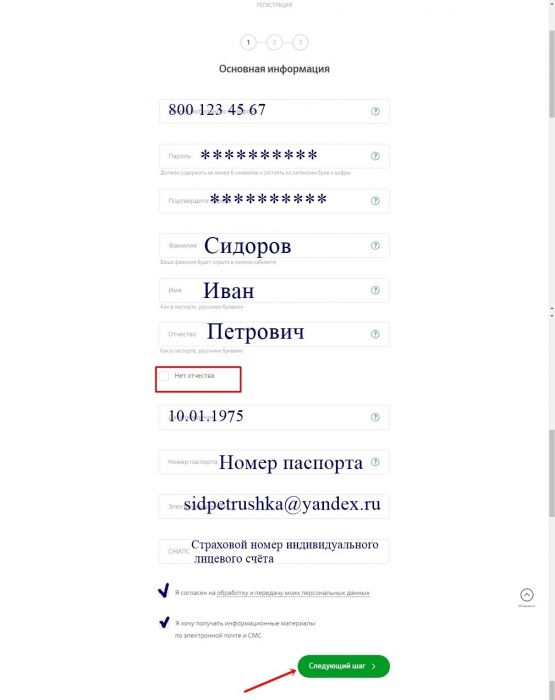

To register, you must click on the “Register” button. A page with fields for registration will open.

Fill out all the fields sequentially, as shown in the picture. The phone number is entered without a plus or an eight. The system itself will substitute what is needed.

The password must consist of English letters and numbers. The number of characters must be at least six.

Last name, first name and patronymic are written in Russian letters, as in a passport. If you do not have a middle name, then check the box next to the “no middle name” line. On the screen it is highlighted with a red frame.

Important: for security purposes, the user’s last name is not shown in the personal account. It is hidden from prying eyes.

Please provide your passport number. Enter your email address. If you still haven’t managed to create your email, do it in one of the Russian email services: mail.ru or yandex.ru.

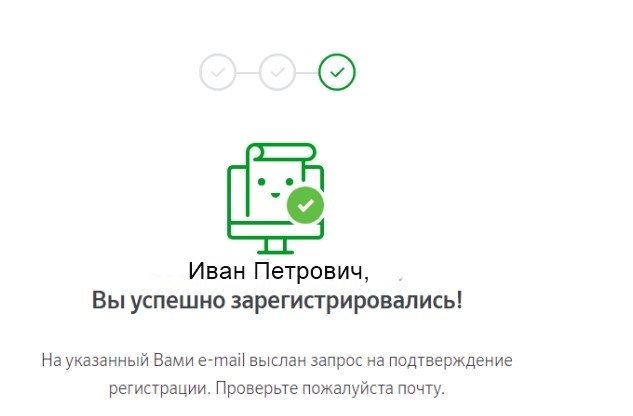

Under your email, please indicate your individual personal account insurance number (SNILS). This number is contained in the insurance certificate of compulsory pension insurance and is available to every pensioner. Check the boxes to indicate your consent to the processing and transfer of your data and express your desire to receive information from the site by email. Check again to see if you have made a mistake somewhere and move on to the next step. The following page will open:

Go to your mailbox. There will be a letter from Sberbank NPF with an activation link. Click the link.

JSC NPF Sberbank “www.npfsb.ru” – login to your personal account

After the registration process has been completed, authorization will be required to use all the proposed functionality. You can log in using different methods - from the main page of the resource or directly at the address. In the first case, the following sequence of actions is carried out:

- In the browser you are using, you need to find the portal and go to the system access section;

- A service profile is selected - individuals and legal entities, that is, representatives of companies;

- Passport and pension certificate details are entered;

- On the login page you need to indicate your login, that is, the mailbox specified during registration and the password you created;

- After checking the data, you need to activate the login button.

If the user forgets the password, he will be able to use a special system for retrieving it. For this purpose, you just need to click on Forgot your password and then strictly follow the requirements and points of the system.

Once you succeed in registering on www.npfsb.ru, the system will send an email with password recovery. You need to open it and follow the link that will be presented in it. The system takes the user to a special page where it is possible to change the previously set password to a new one. You need to remember it and then carry out the authorization process on the pension account with it.

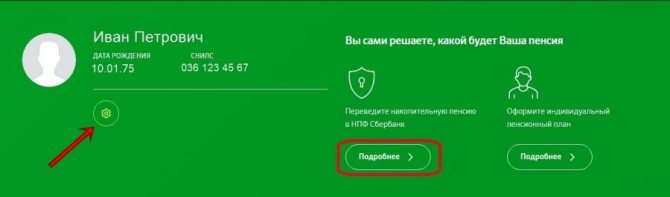

Personal Area

Log in to your personal account using your username and password.

The gear icon always indicates settings. By clicking it, you will open the profile page where you can make some changes or additions:

- Upload a photo;

- Change password;

- change the address in accordance with your actual place of residence;

- choose how and what information you want to receive.

You can log into your account through the official website https://www.npfsberbanka.ru/ and click on the “Personal Account” link or immediately go to the link https://lk.npfsb.ru/login.

Bookmark the site in your browser. This will make the login process much easier.

www.npfsb.ru register in your personal account of Sberbank NPF

To register a personal section on this portal and control the funded part of your pension, you will need to perform the following steps:

- You go to the site and click on the profile tab.

- A small questionnaire will be opened, in which you will need to enter data such as a mailbox, personal initials, password and the answer to one of the security questions.

- The system will quickly move you to the secondary stage of the registration process. Here you need to enter information from your passport, personal mobile number, as well as SNILS.

- A check mark is placed regarding consent to the processing of the entered data.

- If you wish, you can check the box to agree that the system will send SMS messages.

- Enter the special code from the attached picture.

The user does not have any problems filling out the necessary information in his personal account on lk.npfsb.ru. Next to each line you can find a small question mark. These are certain clues that you need to rely on. If the registration process is successfully completed, the system will immediately notify you about this.

What are the possibilities?

How to register with Sberbank online from your phone

Using a personal account eliminates the need for the client to visit a local Sberbank office, since all transactions are performed online:

- The client receives SMS messages about the accrual of the amount to the funded part of the pension.

- He can log into the personal account of Sberbank NPF at any time to see the amount of accumulated funds.

- Without leaving home, he makes payments to increase his pension;

- Checks the accrual history;

- Checks the status of contracts and applications.

- Creates a template that systematically transfers a standard contribution amount from the card to the NFP account.

Sberbank has developed a mobile application for NFP. The application is downloaded to your smartphone or tablet and is thus always with you.

what is Sberbank NPF

Sberbank NPF is a so-called non-state pension fund, the personal account of which has a multifunctional structure that allows you to get acquainted in detail with current pension programs that comply with current legislation - managing personal savings is easy and simple.

...more details about registering a personal account of a non-state pension fund are described on this page: registration in the personal account of a non-state pension fund of Sberbank...

back to contents

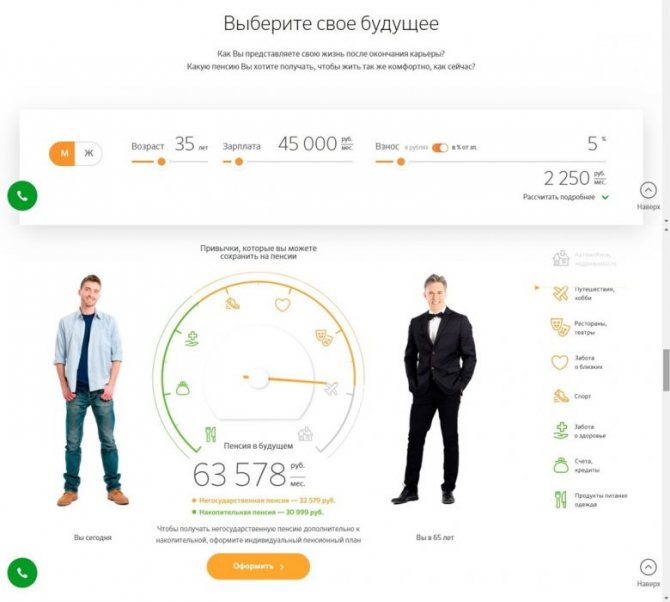

IPP

In the personal account, the user can develop an IPP - one of the pension programs of Sberbank NPF. To do this, in your personal account, click on the “Sign up an individual pension plan” button.

This will allow you to calculate and plan your future pension. There is less and less hope for state support. In the future, the pensioner’s maintenance will consist of those contributions made by the employer and those that the employee himself will have time to accumulate for the IPP.

Sberbank recommends starting to take care of your future at an early age. While your salary is small, it is enough to transfer 2–3% to the IPP. As yields rise, this rate can be increased.

An individual pension plan can be approximately calculated using the calculator in your personal account.

Use the sliders to set your age, salary and percentage, which can be increased from 2% to half the salary. Click “Checkout”.

Attention. On the calculation page, the system warns that the specified calculation is not the final offer to conclude a transaction. The calculations provide that wages will grow in accordance with the inflation rate, which was predicted by the Ministry of Economic Development until 2030. The calculations also take into account the suspension of 6% contributions for the period 2014–2021.

With this warning, Sberbank insures itself against all kinds of political disasters and economic crises. The economic situation may change, but in any case, savings will serve as a buffer, a safety cushion that will protect the pensioner from poverty in the future.

Transfer of funded pension to NPF

The non-state (additional) pension is formed from independent contributions of the depositor and investment income of the Sberbank Non-State Pension Fund.

To issue it, you need:

- Fill out the “Application for payment of a non-state pension under an NGO agreement.” You can find the form in your Personal Account, in the “Application” section.

- Take it to the bank. You must have your passport, pension agreement number and bank details for enrollment.

When retiring ahead of schedule, attach a certificate from the Pension Fund or a copy of your pension certificate to your application.

If, during the validity period of the contract, your personal data has changed, please attach copies of documents confirming the changes.

Sberbank employees need to attach a copy of their work record book to confirm their work experience at the bank.