According to available statistics, a significant number of our fellow citizens are beginning to think about how they will live in retirement while still at a young age. The recent reform of the pension system has allowed our compatriots to transfer the funded part of their future pension to non-state funds.

Currently, there are many similar organizations on the domestic market, but despite this, the lion’s share of our fellow citizens prefer NPFs from the described banking structure. There are many reasons for choosing NFP from Sberbank, among which it is worth noting:

- Our compatriots trust Sberbank, as it is the largest banking structure in the domestic market, which provides confidence in the safety of the funds transferred to it. The assets of the described banking structure make it possible not only to secure the savings of future retirees, but also to ensure their stable growth, even in difficult times for the domestic economy.

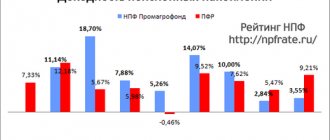

- NPF from the described banking structure is able to guarantee a higher level of profit than most competitors present on the market. The higher profitability that clients of the described banking structure can count on is ensured by the fact that Sberbank has a team of highly qualified professionals who, thanks to their vast experience, are able to competently select investment instruments to form a balanced portfolio.

After transferring the funded part of your pension to the NPF of the banking structure in question, you may periodically have a desire to check exactly how much money is currently in your pension account. Clients of the described banking structure have access to several methods for checking the balance of a pension account, we will talk about each of them separately.

How to find out the amount of savings in Sberbank NPF. Basic methods

The rules of the described banking structure allow you to check the current balance of your pension account at any time. In order to find out how much money has accumulated in your retirement account, you can use one of the following methods:

- The first method involves visiting the branch of the banking structure where you signed the pension insurance agreement. When visiting a branch, you need to contact one of the employees of the banking structure, who will provide you with information about the amount of funds in your account.

- The second method, which allows you to quickly obtain information about the amount of money in a pension account, is accessible only to those clients of the described banking structure who have registered in the online service. You can get information about the amount of money in your pension account in your personal account of the online service.

Practice shows that almost all people of pre-retirement age prefer to visit a branch of a banking structure to obtain information about the balance of their pension account. This is due to the fact that this method is considered by many of our compatriots to be simpler and more understandable. To obtain the information you are interested in, you must present your SNILS and passport to the banking employee.

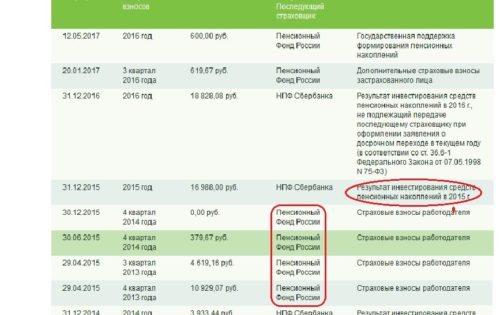

When visiting a branch of a banking structure, you can request details of the transaction on the NPF account. To obtain this information, you must submit a specialized request. You should also know that according to the rules of the described banking structure, up to one month is allotted to create a report on transactions performed with a pension account.

As soon as the employees of the banking structure generate a report for you on the transactions performed on the account, you will be contacted so that you can visit the branch of the banking structure and pick it up.

The described method of obtaining information about the account balance in a non-state pension fund has a rather serious drawback, which is that you will have to spend a fairly large amount of your own time visiting a branch of a banking structure. This method is especially inconvenient for those clients who live far from a branch of a banking structure. Due to the reasons described above, more and more NPF clients are using the remote method to check the current amount of money in their pension account.

Methods for issuing and receiving the funded part of the pension

Sberbank offers several options to check your savings:

- remotely through the Sberbank Online service;

- through ATMs and bank offices;

- visiting a branch of NPF Sberbank;

- in the personal account (PA) of NPF SB;

Let's consider the listed methods in more detail.

To use this method, you must be connected to Internet banking. Information about the status of your pension account can be obtained in the “Pension Fund” section.

You need to submit an application. The algorithm is like this:

- In the menu of the above section, select “Other”.

- Click on the “Pension programs” tab.

- Click on the “Get Statement” command.

- Complete the process by clicking on the virtual “Submit” button.

When the status of the application changes, that is, an o appears next to the request, you can click on the button to view the extract from the Pension Fund.

At an ATM

You can use both a terminal and an ATM. You can use this method only if you have a Sberbank payment instrument. You should insert the plastic into the card reader and, by pressing PIN, go to the section to find the necessary information. The direction of action will be indicated by the interface of the selected device.

At the bank office

Information about the size of the savings portion at the time of application is required to be provided by Sberbank employees upon the client’s request.

By visiting one of the Sberbank offices, you can:

- get answers to questions from the operator;

- use one of the computers of a financial institution.

In the halls of large branches there are consultants who are ready to help clients.

Close relatives and spouses can obtain information about the deceased’s savings

Spouses and close relatives can obtain information about the deceased’s financial savings. To do this, you need to fill out an application with the pension fund within six months, attaching the necessary documents to it (SNILS of the deceased, death certificate, if necessary, and others, for example, in the case of inheritance - documents confirming kinship).

- Fixed-term pension - the payment period is chosen by the client, but it cannot be less than ten years.

- One time, that is, once in full. Can be obtained if one of the conditions is met: ● receipt of disability; ● loss of a breadwinner; ● payments in the amount of less than 5% of the difference from the insurance portion.

- In the form of unlimited payments.

How to find out your retirement account balance using an online service

The online service of the banking structure in question is a fairly universal platform that provides the ability to conveniently manage available deposits and accounts. NPF clients can use the online platform to manage their pension account, provided that they have created their own account in this service.

It is important to mention that in order to check the balance of your pension account, you will need not only to open an account in the online service, but also to write a special statement containing your permission to exchange information between Sberbank and the NPF.

Once you create your own account and complete a special application, you will be able to check your retirement account balance using an online platform. To view the data you are interested in, you need to complete the following steps:

- You must visit the online service account using the code received during registration.

- On the main page of the service you need to select the “Pension programs” option.

- In the window dedicated to pension programs, you need to select the option to receive a statement of your pension account.

- Next, you will be able to see a special form, the completion of which is required to receive an extract. In this form you must enter your personal data and select the “Submit” option. Then the screen will display information that your application has been sent to the banking structure.

In the online service, you can monitor exactly what stage the application you have generated is being processed. Once processing is complete, you will be able to access a detailed report of the transactions made in your retirement account. Unfortunately, if you need a statement stamped by the banking structure and with the force of an official document, you can only get it by visiting a branch.

How to register?

For the convenience of clients, the official website offers the opportunity to register and create a personal account.

Registration of a personal account is carried out in several stages:

- At the first stage, you need to enter your email address (future login), create a password, write your full name and select a security question for data recovery.

- In the second step, you need to provide the system with a mobile phone number without the number eight, date of birth, Russian passport number (last six digits) and eleven-digit SNILS number. In addition, you must consent to the processing of your personal data. After completing the second stage, a registration confirmation request will be sent to the specified email address.

Confirmation will make it possible to log into your personal account using your email address and password.

How to login?

You can log in not only from a personal computer, but also from mobile devices - tablet or smartphone. The site is adapted for these devices. An application is also currently being developed that can be downloaded and used on a smartphone.

Citizens who have entered into agreements with the fund can go to the account and use a number of online services:

- find out the exact amount of your pension capital under the concluded OPS, IPP or CPP agreement;

- pay the next installment or activate automatic payment;

- send applications to the fund and track their progress;

- receive fund notifications about all innovations and changes.

Using an account at Sberbank NPF

Sberbank NPF has provided its clients with the opportunity to create their own account, which can be used to manage a pension account. You can create such an account on the website of the NPF of the described banking structure. You are required to select the “Personal Account” option and go through the registration process, which is quite simple.

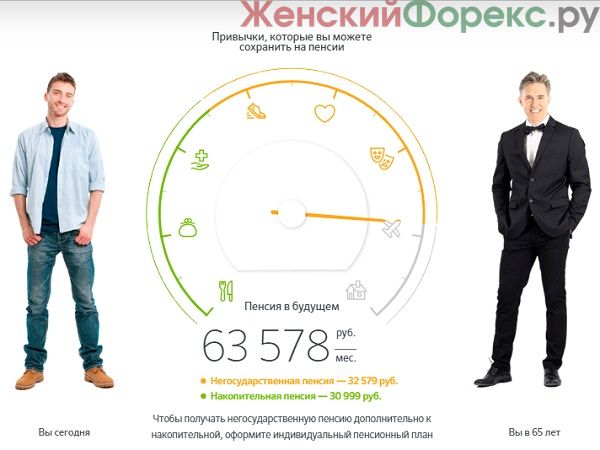

In this account, you can not only check the current balance of your account, but also calculate the amount of pension payments that you can count on in the future.

How can you find out how much money is in your NPF account?

There are several ways to find out how much money is allowed in a savings account.

- For conservative-minded citizens accustomed to the traditional type of service, a personal visit to a branch of the Sberbank Non-State Pension Fund is provided.

- Persons who prefer modern operational services online will benefit from using a personal account on the official website of the fund.

- If necessary, you can find out the amount of accumulated funds through the terminal.

Next, you should consider each of the methods in detail.

Personal visit

The easiest way to check the status of a personal account in an organization is to visit the nearest territorial branch of the NPF. You need to have your passport and Pension Insurance Certificate with you. One visit to the office is enough to get complete information about the status of your account.

But you can get full details only by writing a corresponding application.

The statement is generated and sent within a month to e-mail, the applicant’s regular mailbox or to a bank branch (optional).

The disadvantage of this method is the presence of queues. Although the electronic system that issues priority coupons makes it possible to regulate the order of customer service as much as possible.

You need to wait until the code indicated on the coupon is displayed on the display and approach the specialist at the window.

At the NPF branch you can also view the account balance with the funded part of the pension through a terminal or ATM. A consultant is always ready to help with this. It is easy to follow the actions and explanations of a specialist in order to independently find out about the status of your personal account in the future using high-tech devices.

How to watch online?

The Sberbank Online service provides clients with the opportunity to remotely manage accounts and cards, make transfers, open deposits and much more. To view details of your pension contribution account, you must also access it.

Any client of a financial institution can register with Sberbank Online using their bank card number. But in order to provide information regarding non-state pension funds, a special application for registration in the information exchange system with the Pension Fund of the Russian Federation should be drawn up at the bank office.

After this, the “Pension Fund” tab will be displayed in your personal account. All you have to do is sit down at the computer, make a few clicks and all the information will appear before your eyes. The procedure is as follows:

- Log in to the Sberbank-Online system and in the “Other” tab (located on the right) click on the “Pension programs” section;

- in the window that pops up, click “Get extract”;

- after opening the “Application for an extract” page with the user’s passport data displayed, press the “Submit” button;

- after getting to the action confirmation page, click on the “Confirm” button (if the client changes his mind about receiving the statement, he must click on “Cancel”);

- wait for the message “The application has been successfully sent to the bank!” to appear on the monitor;

- return to the main page and in the list of recent transactions in the “Pension Fund” tab, view information about the request, as well as its status;

- When the application is completed, a link “View statement” will appear next to the status.

That's all. All you have to do is click on this link and find out all the information about the amounts and dates of their accrual to your personal account in detail. In the future, the client has the opportunity to view previous statements , submit applications for a month, a week or a specifically selected period.

Important! Of course, it is much faster and more convenient to find out the amount of the funded part of your pension without leaving home, online.

But if you need documentary evidence that money has been credited to your personal account, you can’t do without visiting Sberbank Non-State Pension Fund.

Thanks to the Sberbank-Online service, it is possible not only to inquire about the account balance and the order of receipts, but also to find out, using a calculation, how much money still needs to be deposited, so that the pension amount has reached the desired amount.

How to check the amount through the government services portal?

Another way to find out how much money has accumulated in the account for the funded part of the pension is to use the government services portal. This service provides a wide range of opportunities, but specifically, to check the funded part of your pension you will need:

- register on the portal indicating passport information and SNILS and TIN data;

- send a request to receive an activation code to a cell phone or email, thanks to which the service identifies the user’s identity;

- fill out the form and gain access to your personal account;

- activate the “Electronic Services” section and in the menu that opens, click on the “Pension Fund” section;

- receive information about the account status - it will be displayed on the monitor within a few seconds.

Reference! In order to use the “State Services” service in the future, you only need to enter your SNILS number when entering.

Watch the video on the subtitle topic:

The formation of pension savings must be approached responsibly. An unsuitable management organization can turn even good savings into a loss. Citizens who decide to transfer funds to Sberbank NPF for a future pension must carefully consider the pros and cons of registration, calculate the profitability, and also know about the possibilities of withdrawing NPP.

NPF Sberbank programs

Currently, NPF Sberbank is ready to offer its clients two large programs:

- clients could transfer the funded part of the pension to the fund, these funds are invested in various conservative instruments to obtain maximum profit - subsequently, the insurance part of the pension is formed from these contributions, which is paid together with the state pension;

- the client, together with the fund manager, draws up a program for investing in a future pension.

For 2017-2019, the Government again “froze” the funded part of the pension, so the employer will not make transfers to the fund’s account. Consequently, for clients of Sberbank NPF, the only option to guarantee an increase in their future pension is to participate in a program for the formation of a non-state pension.

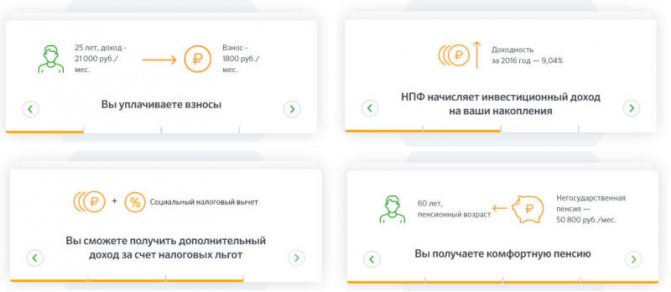

The essence of the program is as follows:

- the client makes periodic deductions to his personal account;

- NPF Sberbank invests these contributions in accordance with the chosen program and increases their amount;

- When a client retires, he fills out an application to NPF Sberbank to receive a non-state pension.

At the moment, the funded part transferred by the employer is frozen. In fact, this means that the client of the fund will receive two pensions: from the state and accumulated independently.

Additional advantages:

- return of investments is possible: after 2 years - made contributions and 50% of accumulated income, after 5 years - all contributions and all investment income;

- you can apply for a social deduction in the amount of 13% of the amount transferred to your personal account (maximum - 15.6 thousand rubles per year);

- you can designate heirs, and in the event of your death, the savings will be transferred to them.

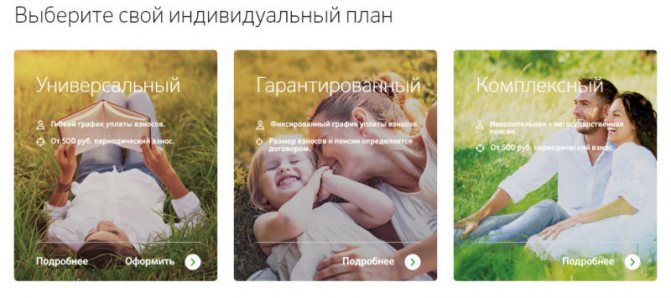

Sberbank offers three options for an individual pension plan:

- Universal – the client replenishes the account with an arbitrary amount at any frequency. The initial payment is 1,500 rubles, subsequent payments – from 500 rubles. The payment period for future pensions is from 5 years.

- Guaranteed – within the framework of the plan, a fixed payment schedule is drawn up based on the desired amount of the future pension. The amount of the contribution and subsequent replenishments vary depending on the terms of the agreement. The minimum pension payment period is 10 years.

- Comprehensive - the contract establishes a minimum replenishment amount of 500 rubles (initial payment - from 1000 rubles), at the same time, the client can make any payments to the account according to an arbitrary schedule. The pension payment period is 5 years or more.

A Sberbank NPF client can combine both programs - increasing the funded part of the pension and forming his own pension to maximize future payments.

Choose the individual pension plan that suits you best, developed by the specialists of NPF Sberbank

Sberbank Pension Fund - reviews

Transferring money to funds, both government and commercial, often raises concerns among citizens. Dissatisfaction is associated both with the current technical aspects of transferring funds to non-state pension funds, registering an individual savings program, and with the fear of ending up without your savings at all. Some fund clients complain about difficulties with cashing out their accumulated savings. Investment conditions change from year to year, so the fund client needs to regularly monitor the size and growth rate of accruals. If desired, the client can change NPF, but not more often than once every 5 years.

At the same time, there are many satisfied clients who have decided to form their pension savings in the Sberbank fund. The transparency of the system allows you to see complete information on your savings. The fund’s high percentage of returns, as well as several savings accumulation programs, add additional attractiveness to the fund. Participation in the co-financing program allows you to transfer money from your bank card directly to the Sberbank pension fund account.