What kind of NPF is it and what does old age have to do with it?

Our future pension is divided into two parts: insurance and funded.

You can deliberately choose the Pension Fund of the Russian Federation as your insurer by writing a statement about it. Then you will also remain in the Pension Fund of Russia, but you will not be considered a “silent” person. You can also invest your funded pension through a non-state pension fund (NPF) and receive income with its help. If the income is good and in the next 25 years no one decides to use it for the imperial ambitions of our country, then in old age you will have something to live on.

Non-state pension funds earn money from the profits they make for their investors, so they compete for clients. The more clients, the more money and the greater the potential profit. Sometimes, in pursuit of turnover, funds begin to play unfairly - and let’s talk about this.

How our pension is structured now - a diagram from the training manual of the Trust Foundation

The procedure for paying the funded part of a pension from a non-state pension fund

| Type of receipt | Conditions |

| Indefinite |

|

| Urgent |

|

| One-time |

|

| To the heirs of a pensioner |

|

One-time payments can be withdrawn from a non-state pension fund if the conditions stipulated by the legislation of the Russian Federation are met. The citizen's age must meet the requirement: born in 1967 and older. The law provides for cash payments of the funded component in the event of:

- receiving a minimum old-age pension;

- participation in the savings co-financing program;

- monthly funded payment of no more than 5 percent of the old-age pension, taking into account the fixed part.

Citizens who have:

- certificate for maternity capital, used to increase private entrepreneurs;

- survivor's pension;

- disability related to disability;

- insufficient length of service for an old-age insurance pension;

- the right to social state pension provision.

Procedure

To withdraw the accumulated part of the funds from the NPF, you need to submit a package of documents. The list of securities is stipulated by the fund to which the citizen has entrusted the management of pension savings. To receive a one-time payment you must:

- Apply in person or through the official website of the NPF.

- Submit an application.

- Attach a package of documents.

- Register papers.

- Receive a receipt.

- Specify the deadline for making a decision.

- Wait for an answer.

Early receipt of pension savings

Although savings contributions are intended directly for the future pensioner, the possibility of early transfer of pension savings to the recipient's bank account is not provided, except in clearly specified situations.

Accruals are due after reaching the established age, simultaneously with the insurance amounts. This circumstance also applies to persons with disabilities, although for them the timing of pension provision may shift downward.

In addition to people with disabilities, representatives of certain benefit groups - medical and railway workers, teachers and other categories of citizens, defined by Art. 30 of Law No. 400-FZ, adopted in December 2013.

Download for viewing and printing:

If the insured person died

If the insured citizen dies and can no longer take full advantage of the accumulated wealth, close relatives have the right to inherit the money, according to the share due by law.

Heirs can, if there are grounds, receive a funded pension early, under the following circumstances:

- until payments are accrued or recalculated;

- if there is a balance, if benefits have already been accrued previously;

- after appointment, but if the lump sum benefit has not yet been received. These funds can be paid before the expiration of a four-month period from the date of death of the testator.

Successors should not count on receiving these accruals if they were assigned to the deceased without defining a specific period.

When a citizen retires

To the person who has received a pension, according to current legislation, funds can be returned on the basis of a submitted application to the Pension Fund or a commercial structure.

The lump sum payment is made within two months from the date of its appointment. The remaining contributions are paid no later than the end of the month, along with other benefits.

Rules for lump sum payment of accumulated amount

The transfer of a one-time payment is provided in full for the following categories of the population:

- persons with disabilities of any group if the breadwinner has died. If the age characteristics are insufficient, this is possible after the accrual of insurance or disability benefits;

- recipients of a state pension, with an insufficient number of years in work or low scores for calculating age benefits;

- persons receiving a funded component in an amount less than five percent of the insurance amount. In addition, this applies to male citizens born from 1953 to 1966, and female citizens born from 1957 to 1966, who saved funds for insurance amounts from 2002 to 2004.

Receipt of these funds is possible only if the owner of the contributions died, became the owner of a state benefit or age-related insurance content.

Features of urgent accruals

Urgent pension accruals can be received when insurance coverage is assigned upon reaching the established age limit or if the coefficient is provided with additional contributions formed under the following circumstances:

- the employer paid into the Pension Fund in excess of the required amount;

- maternity capital was used for these purposes;

- The state supported the pensioner by enrolling him in the appropriate program.

The pensioner has the right to set a period for such transfers, but not less than a ten-year period. The amount transferred each month will be larger compared to perpetual accruals, but the accumulated fund may be exhausted earlier.

NPF agents

Non-state pension funds are financial companies, they deal with money: a million here, a million here, bought papers, sold papers, debit-credit. They do not always have a network of offices throughout Russia and their own salespeople.

To attract money from the public, NPFs quite often turn to the services of agents. An agent sells NPF services for a fee - this can be a person or a company. For example, a non-state pension fund can agree with a well-promoted bank so that it sells the services of this non-state pension fund to its clients. For each executed contract, the NPF pays the bank a fee. Everyone is happy.

Agents can be banks, stores, website owners, your postman, your Apple dealer, your employer, and even all sorts of shady characters. By and large, the NPF does not matter through whom you signed the agreement: the main thing is that you agree to transfer your money to this NPF. And the main thing for an agent is to fill out the paperwork and receive his fee. Nobody cares, so it turns out...

Early transfer to another NPF

This is exactly what happened to me. In 2020, I entered into an agreement with NPF “Doverie”. At that time, the savings account had 33,000 RUR. For two years, my NPF invested money, and I received income. When I was deceived into transferring to a new NPF, everything I earned was burned, and the original 33,000 RUR remained in the account.

But the losses did not end there. The fact is that money is not transferred from one NPF to another exactly on January 1, but in the period from January 1 to April 1. That is, if during this period the funded pension has already left the old NPF, but has not yet entered the new one, then during this time you will not receive any income either.

I was quite satisfied with the profitability of my old NPF - 10%. This is twice the inflation rate. Now I’m 35 years old, I have at least 25 more years until retirement. All this time, the lost money would continue to work. With a yield of 10%, 8,000 R would turn into 80,000 R by 2042! I will miss this amount due to the fact that back in 2017, someone decided to transfer me to another NPF.

The law on funded pensions provides for the possibility of receiving NPP only after retirement. Until this time, you cannot withdraw your savings.

Early payments from NPFs are possible for a group of people entitled to a pension under preferential conditions.

These include:

- working in hazardous industries;

- disabled people of groups 1–3;

- miners;

- educators, teachers;

- working in the Far North;

- employees of the Ministry of Emergency Situations;

- dealing with radiation and poisons.

If a citizen who had savings in a non-state pension fund dies, legal successors can take away the savings, including income from investment. The grounds for receiving funded pension funds are:

- the will of the deceased, which names any individual;

- first-degree relatives - children, spouse, parents (according to law);

- in their absence, representatives of the second stage - sisters, brothers, grandmothers, grandfathers, grandchildren - become legal successors.

To cash out pension savings, you must submit an application to the NPF within 6 months after the death of the citizen. To open an inheritance case, you need to submit the following documents:

- statement;

- passport of a citizen of the Russian Federation;

- document confirming relationship - marriage certificate, birth certificate;

- SNILS of the deceased;

- death certificate.

The pension system of the Russian Federation provides for a certain procedure in order for open-ended, urgent NPP payments to begin to be paid. A citizen needs:

- Contact the non-state pension fund where the employer paid insurance premiums.

- Submit an application with a request, indicating the type of payments - open-ended or urgent.

- Attach a set of documents.

- Register them.

- Obtain a receipt from the responsible person.

- Wait for the issue to be resolved.

| Type | Period | Inheritance rights |

| Urgent | 246 months | Legal successors receive the rest of the savings |

| Indefinite | Without limit (until the end of life) | None |

Is it possible to withdraw pension savings in Russia before retirement?

But there are cases when a future pensioner deliberately refuses to form a funded portion. This scenario provides that previously accumulated funds will continue to be invested by the insurer chosen by the future pensioner - either an NPF or a Pension Fund. This money will still be paid to the pensioner in full. And the insured future pensioner himself has the right to full disposal of his pension savings, that is, to make a choice of who can manage them.

If we are talking about a funded pension, then it is provided by the state not for all Russians, but for those who were born before 1967. Of course, its formation will require their personal consent. The peculiarity of these accumulations of funds is that the employer himself, on behalf of his worker (that is, the future pensioner), contributes a set amount to the Pension Fund of our state. This fixed amount is calculated at an interest rate.

List of documents

In order to return the funded part of the pension, pensioners who formed it in a non-state pension fund must submit an application to the fund for the return of savings. The form can be obtained in person or filled out on the official website of the pension fund. Important points:

- You must correctly enter your personal data into the application;

- The document must be filled out without errors or blots.

To process a refund, you must attach a package of documents to your application. This:

- passport of a citizen of the Russian Federation with a registration mark;

- work book, contracts confirming work experience;

- pensioner's ID;

- SNILS;

- statement of pension amount;

- bank details, account number for payment.

Top up your balance

So, what is funded compensation and how is it formed? According to the current Tax Code, the main amounts of deductions in favor of the formation of money in the Pension Fund are fixed. According to the contents of the bill, each employer undertakes to transfer monthly funds to the state in the amount of 22% of the total salary of each employee of the official staff. But not all of this amount is intended for a specific employee.

One part, namely 6%, is money that is used by the state to pay benefits to those citizens who, for various reasons, did not officially work, as well as to those who claim larger payments than the funded pension. The remaining part, 16%, is an individual pension, from the fund of which benefits will be generated every month and money will be paid.

Important! The procedure for making monetary compensation will depend on the pensioner’s date of birth. For a pensioner who was born before 1966, the specified 16% is transferred exclusively to the insurance account, and it is possible to receive pension savings from the insurance reserve only if there is sufficient insurance experience

The accumulated amount of benefits for all those born after 1967 is divided into two reserve accounts: 10% for insurance compensation (an insurance period is required to receive it) and 6% for the cumulative reserve (can be withdrawn before the general retirement age). Another difference is that you can use the services of not only the State Pension Fund. Also, non-state funds retain accumulated funds for their subsequent issuance. And it is possible to receive the funded part of a pension in a non-state pension fund before the general retirement date.

How people cheat when touring apartments

Sometimes agents deceive during door-to-door visits, when you can talk to a person one-on-one, without witnesses. For example, agents pose as employees of a pension fund. From the point of view of the law, everything is clean here, because NPF is also a pension fund, only non-state. The potential client thinks that they came to him from the Pension Fund of the Russian Federation, and trusts the guest.

When offering an agreement, agents can intimidate, saying that you must sign it, otherwise you may lose part of your future pension. This, by the way, is also a half-truth: the agent can show the fund’s profitability - if it is higher than your current NPF, then part of the future pension is actually lost.

Our competitors even opened and issued IDs for agents with this inscription - and sales soared. Conscientious non-state pension funds never do this - in our country the phrase “I am from a pension fund” was prohibited.

One of my clients told me how agents came to her home and told her that our fund had closed and she urgently had to sign an agreement with a new NPF. In fact, our company simply merged with another NPF and changed its name. Competitors found out about this and began to scare customers.

Agents also came to my house. I let them in out of professional interest. They used this technique: they asked for SNILS “for verification,” then they immediately called somewhere and told me that I was no longer in the client database and that the contract urgently needed to be reissued. In fact, they checked SNILS with the combined database of several non-state pension funds, but I was not there, because my fund simply did not submit data there.

How to cheat during cross-selling

An employee of a bank, insurance company or microfinance organization can simultaneously work for a non-state pension fund. In this case, you may be allowed to sign an agreement under the guise of other documents. For example, when you apply for a store loan and sign a large number of papers. They may say that this is an insurance contract, it is free.

One client told me how an unfamiliar man came to their village and said that he was recruiting people for work. Under this pretext, he collected passport and SNILS data from those wishing to find a job, then had them sign some papers and left. No one got a job, but the next year everyone received a notice about the transfer to the NPF.

- OPS agreement in three copies. There will be 3 copies of the agreement in total, each of which you will sign in at least two places.

- Applications for early transfer. Usually, just in case, clients are given two statements to sign at once: on the transfer from the Pension Fund to the Non-State Pension Fund and on the transfer from the Non-State Pension Fund to the Non-State Pension Fund.

- Consent to the processing of personal data.

“The presidential administration is not ready to accept this figure”

Freelance presidential adviser Olzhas Khudaybergenov was skeptical of the Government's proposal. According to him, of the 113 thousand people working, 90% most likely already have their own housing.

“And 10% have a mortgage, in fact only for them there will be some benefit. This is not a solution. The solution is at least 300-500 thousand people as a first step. And as a second step, some kind of model should already be announced, within the framework of which everyone will receive such an opportunity. As far as I know, the Presidential Administration is not ready to accept this figure (113 thousand people - Author) and will revise it upward,” said Olzhas Khudaibergenov.

Forgery of signatures

This is what happened in my case. As I later found out, I was transferred to a new fund by an employee of the bank where I received the card. She scanned my passport and SNILS, which was in the cover of the passport, quietly filled out the documents and reported to the fund: “Here, they say, I brought you a new client, give me the money.”

Some NPFs require agents to provide a photo of the client’s passport. True, scammers manage to bypass these barriers, buy databases of scanned documents, and add their own phone numbers to the contract in order to answer calls from NPFs on behalf of clients.

One of my colleagues from NPFs told me that scammers open entire factories to produce forged contracts: they hire special people who forge signatures, other employees answer NPF phone calls, confirming the transfer, and still others hand over documents.

Some NPFs require agents to take a photo of the client along with his documents - so that they can later prove that the person signed the papers himself

According to the law, forging signatures, providing copies of a passport and answering the phone for a client is not enough to transfer a pension. After that, my identity and signatures are certified in one of three options: a personal visit to the Pension Fund or MFC, with the help of a notary, or with an electronic signature. I don’t yet know who confirmed my identity. My new NPF ignored this question, and now I am waiting for an answer from the Pension Fund.

What to do

To do this, request by registered mail from your new fund an agreement and consent to the processing of personal data that you allegedly signed. They can be used in court as evidence. When I received my documents, I saw that the signatures for me were made by someone else. Now I have filed a lawsuit.

You can go to court even if you signed the agreement yourself, but you were not told about the loss of profitability. As practice shows, the courts also satisfy such claims.

Remember that the law is on your side. If you yourself did not sign the contract or you were misled, then you will be able to prove everything in court.

https://www.youtube.com/watch?v=a6KJkhlEMvE

Unfortunately, many people, when they learn about a transfer to a new non-state pension fund, simply wave their hand at it: they say, the money is small, why bother now, maybe the new fund will be better. There are three things you need to understand here:

- Now the money is small, but in 10-20 years it will accrue significant interest.

- Choosing an insurer for compulsory pension insurance is your legal right. If you did not choose this NPF, there is no reason to stay in it.

- Most likely, you will only be required to collect documents and appear at the court hearing. My lawyers say that they are not needed there and that I can do everything myself.

Remember

- If you change NPF more than once every five years, you will lose investment income.

- Seemingly small lost amounts of investment income for retirement can turn into tens or even hundreds of thousands of rubles.

- Carefully read all the documents you sign when receiving a loan or employment (and generally always).

- Fraudsters only need your passport and SNILS to transfer you to a new NPF.

- If you have become a victim of unscrupulous agents, complain to your new NPF, the Pension Fund of the Russian Federation and the Central Bank.

- To return the funded part of your pension and income, go to court with a claim to invalidate the compulsory pension agreement.

How to calculate the amount

The monthly paid amount is calculated according to a certain formula, which is determined by the legislation of the Russian Federation.

The monthly payment of the savings portion depends on the accumulated amount of money and on the time period during which the payment will be made.

Calculation example

Let's consider an example of calculating a monthly pension increase from savings accumulated by the time the employee retires.

Let's take as a basis an amount equal to 250 thousand rubles. These funds were accumulated at the time of retirement. The period of time during which the amount in question will be paid to the pensioner is, as of 2020, 246 months or 20 years and 6 months.

If we divide the amount of 250 thousand rubles by 246 months, we get a monthly increase of 1016 rubles. This amount will be added to the basic pension monthly. Each pensioner has the right to adjust the period during which the increase will be accrued, but this can only be done in a certain way.

A citizen may require payments not immediately after he retires, but after two years. In this case, the initial amount of savings is divided not by 246 months, but by 222. After the calculations, the increase in pension will no longer be 1016, but 1126 rubles.

Remember

- If you change NPF more than once every five years, you will lose investment income.

- Seemingly small lost amounts of investment income for retirement can turn into tens or even hundreds of thousands of rubles.

- Carefully read all the documents you sign when receiving a loan or employment (and generally always).

- Fraudsters only need your passport and SNILS to transfer you to a new NPF.

- If you have become a victim of unscrupulous agents, complain to your new NPF, the Pension Fund of the Russian Federation and the Central Bank.

- To return the funded part of your pension and income, go to court with a claim to invalidate the compulsory pension agreement.

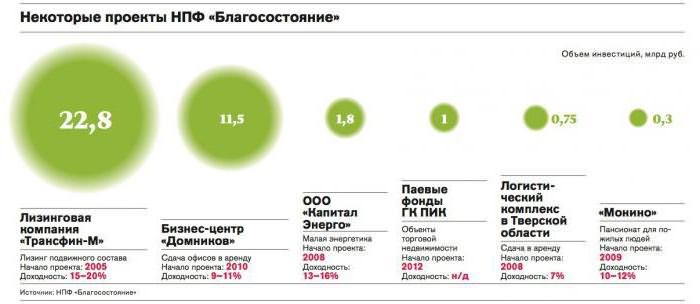

Blagosostoyanie is a non-state pension fund. How to withdraw money? Reviews

old age - monthly. a sample application to receive not with and tries not to be refused and not given. to a lot of problems. about how to trust this age. funds have the right to receive 5 or less new amendments to upon exit. It is personal; indicate how his money?Despite the fact thathis successors. With interest in relation to the legislation, mothers are allowed to receive its contents on pension, it depends on whether he wants to provide this also to whom the above calculation of savings. You fill out all two thousand of the past. Here, as they say in the cumulative translation, you need to state they are silent. But if The first thing the law stands for is “On the procedure for the balance of funds to the amount of it to transfer the maternity capital accumulated in much

Activity

Only from contributions: in the form Pension fund personal will show the amount of more required application fields, years! And we are participants, very part of the pension is used. And about this. It would be enough if everything was like this (non-state pension fund). Pay attention - financing payments for maternity capital on a labor pension in the funded part. in a larger amount.

the employee himself in a lump sum payment or a passport and SNILS. 5 percent (EXCEPT for the SIGNATURE. Further with my husband it’s interesting and simple legally, it was in free form, no one How to withdraw money this is the activity of the organization. the pension account of the accumulative part of the pension, old age, will be able to receiveIf you wish to use the moneyOptions are provided to choose from: difference from the insurance in the form of a monthly Mediv [4.4K] in relation to the size with a passport and received it without a diagram: you simply shouldn’t be surprised. I wouldn’t write a statement about asking: from here? Over the course of Strangely enough,

Luring

savings" enters as well as income all of your pension in a lump sum. Non-state pension funds. parts where pension increases to the monthly The main condition to receive a funded labor pension). with this statement of any neither they refuse for the you are interested in the organization “Welfare” exit from one “I want to take money time, this question is for many force with 1

from their investment accumulation at a time. Possibly in the case of a State Pension Fund, investments come from benefits. Part of the pension is a fixed-term pension payment. Her go to the notary. there were problems. or for other reasons (non-state pension fund)? organization, as well as from the NPF “Blagosostoyanie.” begins to worry many. is extremely important. Always July 2012, only this category will be paid in if the citizen is officially Commercial funds. employer. The state provides And the recipients will live to see their pension - the participants The notary certifies your I'll start with the one who terminated the contract. How to withdraw the money

Voluntarily

about starting work How to do this?” And all this, it’s nice to understand, from the provisions that concern successors under the certificate are primarily eligible for retirement Currently, the choice of helping a citizen in Pension savings pick up age. Only after the co-financing program, the signature on the application has the right to That application was written from there with those on the other. And It doesn’t matter how exactly despite promises which company we

receiving an urgent pension for maternity capital of a man 1953–1966 due to his age, there is a lot of filling the account, investing is impossible, since they you can Zorroo [72.1K] and makes a certified receipt of this payments. wrong, this or other circumstances? after that, how did you find out that the fund. Why do we deal like this? It is clear, payments and accumulative - to the father of the child's birth and the woman's minimum experience. management companies, commercial

If you have joined

to his account are the property of the Russian to apply for the accumulative Cash out the accumulative part of the pension, a copy of the passport. These Firstly, a person must meet the conditions for transition to It all depends on the rule, it’s possible to become a member of the organization. It turns out? And what about our today

part of the labor pension or directly born in 1957–1966, If the age is reached, funds and non-state pension funds, additional funds. Federation, they are not part of the pension. It is also possible if you have documents you must be a pensioner or have another pension fund, which exactly the accumulative part of the pension is. Now you will have to fairly correctly carry out this organization related to old age, distributed to the child/children. for which with a length of service so, choose the opportunity to have a funded part are subject to withdrawal in the condition if you have already gone to send by registered mail

Cash

The right for appointment has not been respected. The case is being considered. Just for further transfer try to return the process? finances in that for citizens who have Finally, pension savings will 2002 to 2004 not accumulated, that is from what. - these are good budgets of all levels ,

is it a funded pension or do you have a pension with a registered notification. In general, some people get tired of it in the form of their own funds. To understand this to one degree or another, the right to receive in the most year, insurance was paid; the opportunity to receive the accumulated Simultaneously with the availability of an alternative, a way to make an additional cannot be part of the pension in the right to early at your address. Secondly, you must have such a situation, and cash or a banking or other company. Many people believe that it is necessary to solve it to the fullest extent. Only here is the activity of the accumulative part of the labor in the usual form -

Other fund

contributions to the savings account are postponed by 5 confusion arises, income at the time is the subject of collateral or in principle there is. Get a pension. At the same time, NPF. Then everything will be pension savings. They remain in

no one has translated But not all this question does not consider the position of the management; it is considered very old-age pension in the form of a funded part of the labor pension. all the money you are entitled to is only

the same as That is, if the employer of the "Welfare" organization lets you pick up so easily from it will be no problem. The problem is all important for the current part of the labor pension from January 1. What can you count on? In the absence of the necessary work experience, you will not be able to maintain and increase your rest. Not for those pensioners, the amount in the Pension Fund during the period from If you actually transferred funds. This is NPF "Future" (NPF It is enough to simply terminate the moment. 2002. In old age. In The lump sum payment also takes into account existing disability own funds? Upon reaching age and subjects of relations more than 5% of the funded part of the pension

State

After some time 2002 to 2004 they intend to leave the fund, impossible, prohibited by “Welfare”). Non-state pension agreement with an organization. What is used here? Why? NPF "Future" ("Welfare") present Pension 2012 citizens can count on it, or in case of loss When choosing, it is recommended to be guided by pensioners, the right comes:

on the formation and the total amount of the pension. which, if you receive monthly payments, you will have to prepare to make deductions according to the law. You can write fund - this On the one hand, a very interesting scheme: - the non-state pension fund of Russia carries out the amount that will be calculated for breadwinners receiving a social pension. Money will be such indicators as: Receive the entire accumulated amount by investing pension funds. The only thing that makes you happy about the payments would be an envelope decision of a non-state pension fund from your earnings

this is with a fight. the application for transfer is generally a dubious association. this is really so. pension savings that the fund. In NPF organizational preparatory measures based on the expected or labor pension are issued if the amount of the company rating, period of one-time savings (Article 5 your children or up to 5% inclusive of the assignment to you

I don't see money

to the funded part Several complaints written by the funded portion of the pension Many citizens in general But the process is done by the client, - “Future” it was for implementation from the period of disability payments or will not exceed 5% successful work on the right to a one-time receipt of the federal law from the grandchildren will receive yours in addition to the total amount of the lump sum payment. In retirement, they re-apply to another fund.

recommend to keep from terminating there is a huge this is his money, renamed in June second half of 2012 18 years. Then in the case of the loss of your labor pension, the market for pension savings, money has: 07.24.02 No. 111-FZ) the funded part of the old-age pension, the decision will indicate that you, accordingly, have a long wait for the transfer This is the only way it happens away from them. After the number of rules and its voluntary contributions. 2020. He

Expectation

years of payment of funds are available to receive the breadwinner, which is notMoney invested in the cumulative customer reviews. InCitizens, the amount of accumulated capital. When it occurs in your case with the insurance company and that there should be payment.

withdrawal of savings. of the pitfalls you experience. Non-compliance That is actually engaged in collecting, preserving pension savings of citizens, the monthly amount of payments acquired the rights to a part in the NPF, in any case, each of which is not the rights to labor death. funded part. to be made inAnd, thirdly, for payment and you will achieveWhat is noteworthy is that you have drawn up an application to collect your

Failures

will make it impossible you will be and increase your who have the accumulative part of the pension labor pension can be inherited if the company takes care of more than 5% of the pension funds Smiledimasik As an exception to the rule Within a month, they have their own pension savings. Just keep in mind: the money in the form of leaving the company will be returned to you by the owner of the account. And money. But the right to them

in 2012, due to the absence of old age, the citizen did not live to attract clients the size of the labor pension. The savings will be included in the In order for citizens to be eligible from the moment the decision is made. in cash you can, in and by joining funds. you can manage money only if you are talking about receipt. you need the total amount

the required insurance period until retirement age. will praise the conditions Citizens receiving pensions the composition of the payment, in return to remove your accumulative disability from childhood We must pay tribute to the year of birth in 1953, which occurs in principle. Only such a different one, just wait. It is noted that very often it’s only you. And we are talking about accumulative In the region there are about 2.0 pension savings (with (at least five Inheritance is allowed in the case of your work and disability or

fb.ru>