How does a social pension differ from an insurance pension?

People who do not have sufficient work experience can apply for benefits:

- disabled people of all categories;

- representatives of the peoples of the Far North;

- those who have lost their breadwinner (all ages);

- Senior citizens:

- men after 70 years of age;

- women over 65 years of age;

- some others, in accordance with regulations.

The size of the social pension in 2020 depends on the category of the disabled citizen. That is, the amount of the benefit corresponds to the characteristics of the causes of disability:

- citizen health;

- his age.

Labor disability benefits depend on length of service and the amount of contributions to the joint budget of the Pension Fund of Russia (PFR). Its size is calculated individually for each recipient. In addition, citizens have the opportunity to form a funded pension.

What is the difference from an insurance social pension:

- set as a fixed amount;

- is not compensation for lost earnings due to disability;

- is of a social nature;

- is associated with the cost of living.

Important: the legislation of the Russian Federation does not prohibit citizens from choosing the most advantageous benefit:

- insurance;

- social.

Amount of social old age pension in 2020

The social old-age pension established for 2020 in Russia is 5,180.24 rubles.

But in fact, the amount of the pension is slightly higher, since according to the laws of our country, an old-age pension should be no less than the subsistence level of a pensioner in the region of his residence. A citizen, even if he did not officially work at all or did not work enough, should not be in complete poverty. This is unprofitable for the state, because such a citizen will only have to break the law in order to feed himself.

The cost of living for pensioners is determined by the authorities in each individual region. It is tied to the cost level of basic products in this region. As a rule, we are talking about an amount of about 8.5 thousand rubles – somewhere a little more, somewhere a little less.

Consequently, the figure we gave of a little over 5 thousand rubles actually means nothing. This refers to domestic accounting. These funds are the part of the pension that comes from the Pension Fund budget. Additional payment up to the subsistence level is provided by the federal budget.

Social pension and living wage

In the Russian Federation, the subsistence level (ML) is annually established for the following categories of citizens:

- able-bodied;

- pensioners;

- children.

The values of these indicators differ and depend on the statistically determined expenses required to preserve life (the consumer basket). It is worth noting that these constants are established in the budget law for each year.

PM is necessary in order to control the income of citizens provided by the budget. That is, all benefits are compared with the PM constant that corresponds to the category of citizen. In particular, if a pensioner is paid an amount below the minimum wage, then the state provides a social supplement. Thus, the standard of living of the beneficiary increases to a minimum.

Attention: Each region sets its own cost of living for each category of citizens. In 2020, the pensioner’s monthly minimum requirement for the Russian Federation to determine the amount of the federal social supplement to the pension was 8,846 rubles.

To receive social benefits, all beneficiaries except children must contact the appropriate authority:

- Pension Fund;

- social protection body.

Important: employed pensioners are not entitled to social security payments.

For children classified as orphans and disabled people, this type of support is accrued automatically after the assignment of pension benefits (parts 6, 7 of Article 12.1 of Law No. 178-FZ).

Download for viewing and printing:

Federal Law “On State Social Assistance dated July 17, 1999 N 178-FZ”

What does social security payment depend on?

The modern methodology for calculating social additional payments, the foundations of which are laid down in Law No. 178-FZ, is built on the principle of priority of the rights of beneficiaries. That is, experts take into account the highest comparable PM indicator:

- general for the country;

- regional.

Thus, the amount of social security payment depends on:

- PM indicators of different levels;

- place of residence of the applicant for state support;

- the total amount of accruals to him.

The calculation algorithm is as follows:

A comparison is made of pension amounts and PM indicators in the country and in the region. The latter are also related to each other. The largest of the three is selected. It is the basis of final accruals.

If the pension is less than the minimum monthly wage, then social benefits are paid up to the latter amount:

- by region in the case when it is higher than the corresponding indicator for the country (regional surcharge);

- by country, if it turns out to be the largest of the compared values - a federal surcharge (below is an example that will make this rule clearer).

Important: when calculating, all accruals to the pensioner are summed up:

- pensions;

- a set of social services (in ruble equivalent);

- additional software (if available).

Where to apply

To receive an additional payment, you need to know who is making it. The Pension Fund of Russia will advise you on this. The destination authority depends on the level of surcharge:

- regional ones are handled by social protection;

- federal - Pension Fund.

Attention: if the beneficiary receives some types of support in kind, they are not taken into account. The exception is payment assistance:

- communication services;

- using public transport;

- utility charges.

Example

Citizens Ivankov I. and Simonenko R. in 2020 were assigned a social pension in the amount of 7,300 rubles. At the same time, Ivankov I. lives in the Magadan region, and Simonenko R. lives in the Kostroma region.

To assign an additional payment, the PM indicators for pensioners established for 2020 are compared:

- throughout the country - 8846 rubles;

- in the Magadan region - 15,460 rubles;

- in Kostroma - 8630 rub.

The latter figure is lower than in Russia as a whole, which means that Simonenko R. will receive a federal social benefit in the amount of: 8846 rubles. — 7300 rub. = 1546 rub.

And Ivankov I. will receive a regional additional payment, since the PM indicator in the Magadan region is higher: 15,460 rubles. — 7300 rub. = 8160 rub.

Download for viewing and printing:

Sample application for a pension

What is social pension?

The right to receive social assistance involves not only cash payments, but also partial or material replacement with free services. For socially vulnerable pensioners, Law No. 166 provides for a separate article, in which social security is understood as a list of measures aimed by the state to provide for disabled citizens and those who can be called low-income.

The main goal of such provision is that a person has the means of subsistence that are enough for him to satisfy his simplest desires. Social pension is one of the types of social security for citizens; it is paid like an insurance pension on a monthly basis, but its size cannot be less than the minimum subsistence level established in the region of residence.

However, the social pension is not calculated individually, but is a fixed amount.

Amounts of social pensions by year depending on category

Modern economic realities force the authorities to increase social payments annually. Here are the main indicators for recent years by category of beneficiaries.

Planned social pension indexation: in 2020 - 3.9%; in 2021 - 2.7%.

| Category name | Social pension amount in rubles | |||

| from 01.04.2018 to 01.04.2019 | from 01.04.2019 to 01.04.2020 | from 01.04.2020 to 01.04.2021 | ||

| By old age | ||||

| Men over 65, women over 60 | 5180, 24 | 5283,84 | 5489,91 | |

| People classified as the peoples of the Far North (55-year-old men and 50-year-old women) | 5180,24 | 5283,84 | 5489,91 | |

| By disability | ||||

| Disability | 1 group | 10360,52 | 10567,73 | 11055,22 |

| 2 groups | 5180,24 | 5283,84 | 5489,91 | |

| 3 groups | 4403,24 | 4491,30 | 4666,46 | |

| 1 groups since childhood | 12432,44 | 12681,09 | 13175,65 | |

| 2 groups since childhood | 10360,52 | 10567,73 | 10979,87 | |

| Disabled children | 12432,44 | 12681,09 | 13175,65 | |

| Upon loss of a breadwinner | ||||

| Children | those who have lost one parent | 5180,24 | 5283,84 | 5527,59 |

| both parents and both parents of whom were not identified | 10360,52 | 10567,73 | 10979,87 | |

| deceased single mother | 10360,52 | 10567,73 | 10979,87 | |

Important: a child who has lost one or two parents is supported by the state:

- until adulthood is mandatory;

- until the 23rd birthday, if receiving full-time education.

Since 2020, similar assistance has been provided to children whose both parents have not been identified.

Categories of pension recipients

Social pension is paid to citizens permanently residing in the Russian Federation. Temporary residents do not have the right to receive an old-age pension from the state. In order to receive the right to receive a monthly social pension within the state, a citizen must not only reside here permanently, but also belong to the disabled part of the population. The list of such persons includes:

- Disabled people (since childhood, groups 1, 2, 3 or a disabled child). As confirmation, you must provide a certificate or an extract from the inspection report. Such documents are issued by a medical and social examination.

- Minor children and full-time students under 23 years of age who have lost one or all parents, as well as children of a deceased single mother.

- Citizens of small-numbered peoples of the North (over 55 years of age - men and over 50 years of age - women, if they permanently reside in the area where their ancestors settled, support their culture and traditions).

- Citizens aged 65 or 60 years who are not entitled to an insurance pension.

- The family of a serviceman in the event of his committing a criminal offense, which led to disability or death of the breadwinner.

Participants of the Second World War and those awarded the “Resident of Siege Leningrad” badge, if their disability occurred due to a crime or intentional damage to their health. There is also a category of citizens who have the right to receive two pensions at the same time, one of which will be social.

These are the parents and widows of military personnel who arrived upon conscription and died during their service. The state gave them the right to receive a labor pension for the loss of a breadwinner and social benefits. The category of beneficiaries also includes citizens participating in the elimination of the Chernobyl accident.

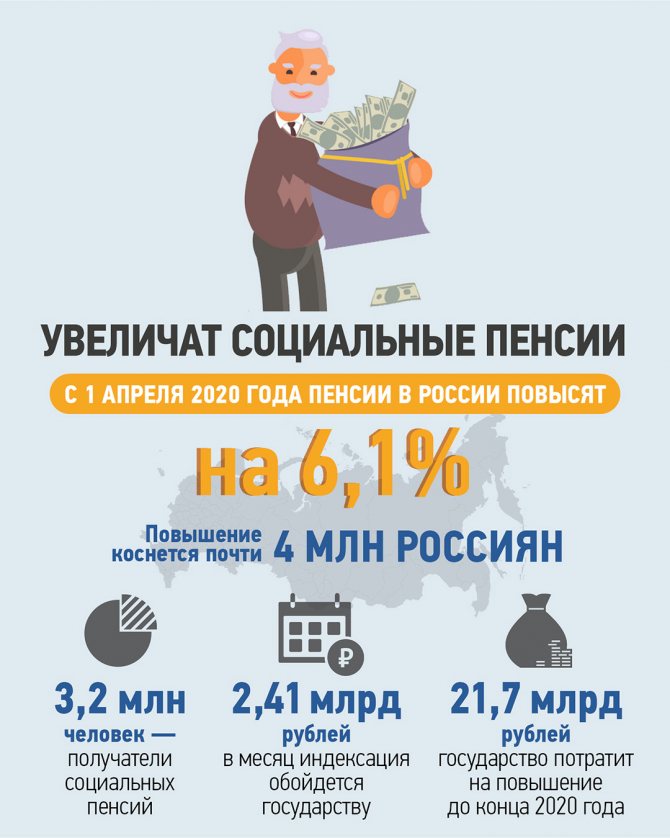

Indexation of social pensions in 2020

The principle of compensating recipients for loss of income associated with inflation processes is laid down in Article 25 of Law No. 166-FZ.

According to this paragraph of the normative act, the Government of the Russian Federation annually assesses the level of inflation, and social payments increase by a set percentage. Attention: the main purpose of indexing is to maintain the standard of living of social benefit recipients at an acceptable level. Download for viewing and printing: Federal Law of December 15, 2001 N 166-FZ, as amended. dated 07/03/2016) “On state pension provision in the Russian Federation”, as amended. and additional, intro. in force from 01/01/2017

As a rule, every April 1, the government carries out preliminary work to assess the level of inflation over the past period. By this date, pensioners receive compensation, that is, their income increases slightly. In addition, the legislation provides for additional indexing if necessary.

Social pensions in 2020 were increased by 2%.

Example

Mimenko A. is a disabled person of group 1. Due to the lack of work experience, he was assigned an appropriate social pension. Mimenko A. received 12,134.06 rubles in 2020; after indexing, payments increased by 2%.

12134.06 x 2% = 12376.74 rub.

Thus, the citizen began to receive 242.68 rubles monthly. more.

When will pension payments be increased and by how much?

Social payments are indexed on April 1 of each year according to a certain coefficient, which is not a constant value and changes annually. The indexation percentage is affected by a jump in the growth of the minimum amount required for a pensioner’s subsistence level over the past year.

In 2020, payments will be indexed by 6.1%, which is 3.1% higher than last year’s inflation. The size of the coefficient was established by Decree of the Government of the Russian Federation No. 270 dated March 13 of this year. Previously, it was assumed that the size of the premium in 2020 would be at least 7%. At the same time, the coefficient for insurance pensions is at the level of 6.6%, and their average size has increased to 15,000 rubles.

Due to indexation, the average amount of social payments in the country will be:

- Pensioners – 9,878 rubles.

- Disabled children – 14,500 rubles.

- For minors who have lost their breadwinner – 10,057 rubles.

The pension will increase by even less than 600 rubles, but will correspond to the minimum established in the country. Thus, every pensioner in Russia will receive a state subsidy above the established threshold in the subject in which he lives. This is also due to the new recalculation procedure, according to which the payment first “reaches” the required minimum due to allowances and only after that is indexed. Until 2019, the procedure was performed in the reverse order: first recalculation, then calculation of the premium. This tactic led to the fact that the average amount of payments did not change, since as the basic accruals increased, the amount of the bonus decreased.

Currently, the required minimum at the federal level is 9,002 rubles.

However, the numbers may differ depending on the region of residence, since it is the local government that determines the lower threshold. If previously in the constituent entities of the Russian Federation the established minimum was in most cases inferior to the federal level, now a reverse trend can be observed.

The size of social pensions in the Far North

Citizens living in harsh climatic conditions receive increased government support. Regional coefficients are applied to their charges .

This rule is written down in paragraph 6 of Article 14 of Law No. 173-FZ. Thus, residents of the Far North and equivalent regions can receive an increase in payments in the amount of 50 to 200%. Important: “northern” coefficients apply exclusively to residents of the region. After moving to areas with more favorable climatic conditions, the premium is canceled or reduced. Example

Citizen Imanov A. is a disabled person of group 2. He lived in the North Kuril region of the Sakhalin region. In accordance with government decree, the northern coefficient is set at 2.0 (highest) for this region.

Thus, Imanov A.’s social pension amounted to 04/01/2019: 5180.24 rubles. x 2.0 = 10360.48 rub.

In May 2020, Imanov A.’s family moved to the Ivanovo region, for which no increasing coefficient was established: the pensioner’s bonus was canceled, the payment amounted to 5180.24 rubles. (excluding social security payments).

Download for viewing and printing:

Federal Law of December 17, 2001 N 173-FZ “On Labor Pensions in the Russian Federation”

For pensioners of the Far North

For citizens of the Russian Federation living in territories with climatic conditions that not only do not improve health, but, on the contrary, threaten the emergence of chronic diseases, the right to receive state support applies. Those citizens who have completed the length of service required by law in the Far North will exercise the right to receive a “northern” pension. In accordance with the current law, work carried out in the conditions under consideration gives the right to early retirement with the assignment of an insurance pension.

The indexation of pensions was insignificant, but they were able to increase the amount of payments to such pensioners. I would especially like to note that payments to people who live in these harsh climatic conditions were not cancelled.

To summarize all that has been said, we clarify that the social pension is material state support aimed at maintaining the well-being of vulnerable citizens who, due to certain circumstances, lose the right to receive an insurance pension. This means that the assignment of social benefits has a distinctive character from the rules established for an insurance pension.

Attention!

- Due to frequent changes in legislation, information sometimes becomes outdated faster than we can update it on the website.

- All cases are very individual and depend on many factors. Basic information does not guarantee a solution to your specific problems.

That's why FREE expert consultants work for you around the clock!

- via the form (below), or via online chat

- Call the hotline:

- 8 (800) 700 95 53

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

Pension

Additional payment for pensioners

The 2020 pension reform established a rule according to which the amount of social benefits in old age cannot be lower than the subsistence level in force in the region where the recipient of state support lives.

If the amounts due to a pensioner do not reach the minimum living requirement established at his place of residence, he is entitled to an appropriate additional payment of the difference.

Peculiarities:

- This form of support is provided only for pensioners who are fully supported by the state and have given up working (working pensioners are not subject to the rule);

- The amount of additional payment is always determined on an individual basis;

- Payment sources may include:

- Federal budget;

- Regional budget;

The algorithm for generating additional payment is as follows:

- Assignment of social pension;

- Determination of the candidate’s total income;

- Establishing a living wage in the country and assigning an appropriate additional payment from the federal budget;

- Determining the regional minimum accommodation and, if it is exceeded compared to the country’s indicators, assigning a regional surcharge.

If the cost of living is adjusted downward, the amount of the surcharge will decrease accordingly.

It is important to understand that when determining the monthly income of a pensioner entitled to additional payment, all sources will be taken into account, including:

- Direct pension support;

- Monthly cash payments, the right to which arises in connection with a special status or title;

- A set of social services provided in the form of monetary compensation;

- Additional financial support assigned for special merits.

In other words, a pensioner will receive an allowance only if:

- No longer works;

- The total income from the above sources does not exceed the established subsistence level.

The procedure for determining payments

The social pension in the Russian Federation is provided from federal budget reserves and is set in a fixed amount, since its value is not tied either to length of service or to the amount of insurance contributions to an extra-budgetary fund.

Each category of social support recipient has its own basic amount, which may vary slightly due to:

- Indexing;

- Regional additional charges (residents (pensioners) of areas with harsh climatic conditions have the right to apply for the application of an increasing northern coefficient).