State pension in England

The old age benefit system in the English territories consists of two parts:

- Basic pension;

- And an additional part.

All elderly people who have reached a certain age can count on a basic pension. Additional payments are due for length of service.

To receive the minimum payment in the UK, you only need to work for 11 years.

The maximum pension is calculated after 44 years of work experience. When a person reaches 80 years of age, the state gives him a gradually increasing pension supplement.

The full basic pension payment is close to £110 per week. Pensions are indexed depending on wage growth in the country.

Some large companies have their own pension insurance programs. If a person participates in them, then an additional pension is paid to him from this money.

In addition, the country has many private pension programs, and the British are happy to independently make additional savings for their old age.

The British receive pension payments based on their length of service and their age. It is from these indicators that basic and additional pension payments are calculated.

You can even apply for payments online. Then its additional part will be calculated and credited automatically.

Special pension schemes

Since 2012, employers have offered their subordinates to participate in special pension schemes. This innovation initially came to large companies, and by 2020 it is planned that all organizations will work in the same way. The bottom line is that if you are an employee and are involved in a special scheme, then you will need to pay contributions on a regular basis. All taxes will be deducted from you by your employer and invested in this scheme. Contributions are made until you reach retirement age.

The following employees can take advantage of this opportunity:

- People who have not yet reached retirement age.

- Persons over 22 years of age.

- Citizens who work in England under a contract.

- Those who earn more than the minimum amount.

Features of the pension system

By 2020, England underwent a reform of the pension system, during which the retirement age increased. A new type of contribution “New State Pension” has also appeared.

To receive the “New State Pension” you need:

- 10 years of work experience in the UK;

- 10 years of experience in receiving social insurance benefits for unemployment;

- voluntarily paid pension contributions.

If a citizen of England has worked for 35 years, he can count on the highest pension.

There are a number of benefits:

- The purchase of medicines and travel on public transport are provided free of charge.

- Discount on utility bills.

- Banks provide favorable conditions with high interest rates for maintaining savings accounts.

Attention! Persons born before April 6, 1945 are required to obtain 44 years of work experience. For the rest, the age of work experience is 30 years.

Working pension

Working citizens carefully choose their employer, because... the quality of cooperation directly affects pension contributions.

Work security in old age is added to the state one, and does not replace it. The employee contributes a percentage of his total income to accumulate a working pension. The employer then adds his percentage to the accumulated pension after a certain number of years. The amount that will be charged as a surcharge is agreed upon in advance. It depends on the company, the employer and the length of the employee’s work.

The entire amount is in an investment account, which, if everything goes well, is constantly increasing. Pension income is not taxed, so the pensioner receives the entire amount in hand.

You can count on a working pension:

- persons receiving at least £490 monthly;

- citizens earning at least £113 weekly;

- persons earning at least £452 in 4 weeks.

Anyone who earns less falls out of the workers' pension system.

Also, an employee counting on deductions must:

- be over 22 years old;

- be under the established retirement age;

- earn more than the specified minimum thresholds.

Pensioners have the right to withdraw their savings partially or all at once. The security can be divided over a specified number of years. If a citizen withdraws the entire amount, he is required to pay income tax on 75% of the deductions.

Important! Last salary security was previously popular. A citizen worked all his life at one enterprise, which until the end of his days paid him a certain amount. Now such payments have practically disappeared, because... they are disadvantageous for companies.

The pension you save for at work

In addition to the state pension in Britain, there is a pension that the employee provides for himself together with the employer.

There are two types of such pension. The first - with certain payments (defined benefit), the second - with certain contributions (defined contribution).

The first type is rare and is more often offered to public sector employees. “When you retire, you are paid a certain percentage of your salary for each year you work. The advantage of this plan is that it is indexed to inflation and is not affected by market fluctuations,” says investment expert Victoria Humble.

The second type is more common. An employee contributes a certain percentage of his salary to a special retirement account. The employer adds the same or slightly less amount. The pension pot is formed from these savings.

The size of the pension pot in this option depends on market fluctuations, but pension investments have a horizon of several decades, and therefore the risk in this case is considered justified.

Previously, this money had to be used to buy an insurance policy that guaranteed lifelong pension payments. Now this norm has been abolished, and pensioners can manage this money as they wish.

The main condition is to pay taxes. Pension savings, like other income, are subject to a progressive tax scale.

Private pension

A person can personally contribute a certain amount of income to a pension fund every month. The fund transfers funds to an investment account, which helps increase the final payout.

Once the payer reaches retirement age, he can withdraw all his money or divide the amount into monthly payments.

Fund accounts can be used by all UK citizens with at least 2 years of work experience. When withdrawing 25% from accounts, no income tax is paid.

According to the last salary and a certain deposit

Another type of pension, which is quite rare at the moment, is the final salary pension. You receive it if you worked at an enterprise that offers employees participation in a pension scheme of this type. The size of the pension is determined depending on the length of service and salary in the last year of work at this enterprise.

In the 1960-70s, most large organizations offered their employees this type of pension: people worked in one place all their lives, accumulated experience and, when they retired, knew exactly how much the company would pay them for the rest of their lives.

Today, final salary pensions are rare. It is unprofitable for companies due to the increase in life expectancy and, accordingly, a significant increase in the size of the company’s liabilities, which is forced to pay its pensioners a guaranteed pension over an increasingly longer period of time. Many enterprises that practiced this type of pension 30 years ago have now either closed it or rarely offer it to anyone.

The National Health Service and some public services still operate under this scheme.

The defined contribution pension, which most enterprises now offer their employees, operates completely differently. This type of pension is also called a money purchase scheme, that is, a pension purchased for money. Having started working for a company and joining its pension plan, during the working years the employee, as well as his employer, transfer a certain percentage of the employee’s salary to the pension fund.

If an employee decides to change jobs, he ceases to be an active member of the old company's pension scheme, and a new plan is opened for him in the new company. The future pension is not determined and will depend on the total amount of all pension plans available to the employee.

Obtaining the necessary experience

To be able to receive a pension, the candidate will need to confirm his work experience. To do this, it is advisable to study the scheme for calculating length of service, identifying the key indicators that influence it. Work experience is called Qualifying Years in English and it includes: All years of the employee’s work as an employee. The candidate's salary is at least £155/week.

Be sure to read it! Mortgage for pensioners: can a pensioner take out a mortgage in 2020

All years of work as self-employed, subject to National Insurance Contributions. The period for which Child Benefit was provided. Even if there is no work for this period. Other factors. In order to check a citizen's pension status, you will need to make a request to HMRC, which will contain information about the future pension.

If the length of service is not enough even for its minimum values, it is advisable to use VNIC by paying the required amount to the fund. In this way, you can pay off insurance premiums in no more than 6 years, which allows you to receive a pension even if you have insufficient work experience.

How it works?

Since 2020, the state pension has been divided into “old” (basic State Pension) and “new” (new State Pension). The old payment system was quite complex and was divided into two levels, which were abolished and combined into one, making it more understandable.

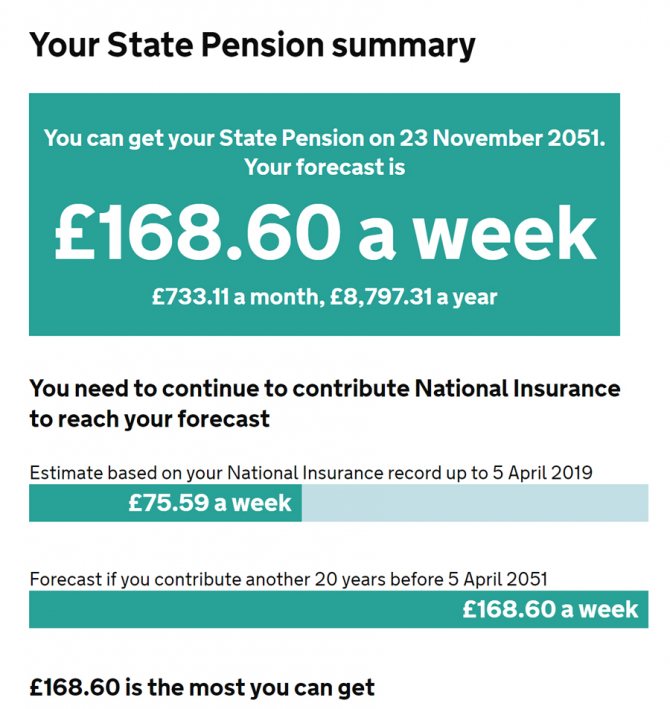

The maximum state pension is £168.60 per week, which is just over £8,750 per year. However, it is important to check online what kind of pension you can count on and when you should expect it.

Experience is accrued to anyone who has made contributions to the National Insurance Fund (National Insurance Contributions) - from salary, from business income through Self-Assessment or voluntarily, as well as to those who received National Insurance credits as part of certain government benefits. Thus, qualifying years include the years when a person received child benefit for children under 12 years of age, unemployment benefit, financial assistance and employment benefits, or sick care benefits.

If you did not have time to accumulate the required number of years, it does not matter - you can increase your length of service by voluntarily paying National Insurance Contributions for the missing years. Please note that you can cover up to six years in this way.

Old age pension

The starting age required to receive benefits differs between men and women. Representatives of the stronger sex are provided with payments starting from the age of 65, and the weaker - from 60.

Among the features of the pension system, it should be noted that there is no prohibition on working for retired persons. This allows you to receive benefits and increase your income through temporary or permanent employment. It is important to take into account that for persons born before April 6, 1945, there is a special requirement - work experience.

He must be at least 44 years old, and for those born after April 5, 1945 - 30 years old. At the same time, the government plans to increase the retirement age in the near future. This is due to a significant increase in the standard of living and, accordingly, its duration.

For women wishing to receive a pension, there are slightly different requirements. Currently, all female citizens are eligible to receive benefits at age 60.

The exception is persons born before April 6, 1950, who must have at least 39 years of work experience. Those born after April 5 of the same year are entitled to receive payments only after 44 years of work.

British citizens have the opportunity to retire earlier by receiving an additional pension. In this case, a person can claim it after turning 55 years old. Before reaching this age, pension payments can be assigned only if there are health problems.

When do Britons retire?

The retirement age in Britain began to be raised in 2010, and this affected women. They raised the retirement age from 60 to 65 years, which is what it already was for men. But the British authorities will not stop there. By 2020, the retirement age for everyone will rise to 66 years, and by 2028 to 67 years.

Retirement age in England

From November 2020, the retirement age in the UK will be the same for men and women. Everyone will retire at 65. Before this period, men retired at 65, and women took a well-deserved break from work at 60.

In a few years, the English government plans to raise the retirement age to 67 years. The minimum age for receiving old-age benefits may be 55 years, but it is available for certain categories of citizens, for example, for the disabled or people of special professions.

The increase in the retirement age limit is associated with an increase in people's life expectancy. So men in the UK live on average to 79 years, and women to 83 years. Compared to other countries, this figure is considered quite high, which makes it possible to justifiably delay the retirement of the British.

England is a developed, progressive and legal country. Most likely, it is precisely the above advantages of this state that allow the English government to provide a good pension to all social strata of the population. The size of pension payments can be used to judge the general level of development of the state. Everything is fine with pensions in England, which means that the country’s economy is in a stable state.

Exit age for men

The retirement age in England for men begins at 65 years . During this period, most English men receive the respected title of pensioner. At the same time, English legislation does not prohibit receiving pension payments and simultaneously continuing to work for the benefit of the country.

To receive the full amount of the basic pension, men who were born before April 6, 1945 must have 44 years of work experience. The working period of male persons born after April 5, 1945 is 30 years.

The age of men retiring in England is planned to be increased to 66 years (in Italy this age has already been adopted) in October 2020. This is due to an increase in the standard of living and, accordingly, an increase in its duration.

Exit age for women

Women in England become pensioners several years earlier than men, namely at the age of 60 . The retirement age for English women is likely to increase to 65 in November 2019 .

Women born before 6 April 1950 must have worked for England for at least 39 years to begin receiving the full basic state pension. Those born after April 5, 1950 must work for 44 years.

The earliest age for the British to start receiving earnings is considered to be 55 years old , provided that the person does not have health problems that force him to retire earlier.

Timing and statistics

You can only receive a state pension after reaching retirement age.

The government regularly reviews this age and, as a rule, increases it - this is influenced by statistics on the average life expectancy of British residents.

In 1948, when the state pension was first introduced, a 65-year-old British resident could count on it for 13 and a half years - about 23% of his adult life. However, already in 2017, statistics showed that this period had increased to almost 23 years, which amounted to 33.6% of “adult” life.

It is precisely because of such forecasts that the established retirement age is being postponed - the longer the average adult population of the country lives, the longer they have to work, or wait for a pension from the state. According to the latest information, the retirement age will increase to 68 years between 2037 and 2039.

Fun fact: You can continue working even after you reach retirement age, and there's a big bonus: your National Insurance contribution will no longer be deducted from your salary.

An example of calculating a pension for a person born in 1983 who has worked for about ten full years

What happens to your spouse/partner's pension after they die? All spouses or civil partners who reach pension age after 6 April 2020 have the option to inherit the pension automatically. To check how this will work for you, go to www.gov.uk/state-pension-through-partner

– when your spouse/partner has reached retirement age,

– when you got married or became civil partners.

However, according to the rules, you will not be able to claim your spouse's pension savings if, after his death, you decide to enter into a new marriage and you yourself have not reached retirement age at that time.

If your spouse reaches retirement age after 6 April 2016, but your marriage took place before that date, you will be able to additionally inherit half of their Protected Payment (the amount that accumulates above the maximum pension rate).

You may be able to claim Bereavement Support Payment if your spouse/partner dies before you reach retirement age.

Key conditions include: you must be under pension age and live in the UK, your spouse/partner had paid NI contributions for at least 25 weeks before their death, or died due to an accident at work. In this case, you will receive a lump sum of £2,000 or £3,500 (if you are entitled to Child Benefit), followed by up to 18 monthly payments of £100 or £350 respectively.

Full details and terms of such payments are available at www.gov.uk/bereavement-support-payment

British pension benefits

The highest pension for 35 years of work experience is almost 650 pounds monthly or 52,000 rubles. For England these are not such large amounts.

A citizen with 10 years of work experience receives 170 pounds of contributions from the state monthly or 14,000 rubles.

Individual entrepreneurs do not receive contributions from their working pension. They must independently transfer part of the amount to the fund.

The British pension system does not provide for a wealthy old age; it is believed that an elderly person must independently take care of his quality of life in old age. The state only provides the minimum that will allow you to eat and pay bills.

How is pension calculated?

Providing for an Englishman consists of 3 points:

- government contributions;

- work deductions;

- personal savings.

Be sure to read it! Dismissal by transfer to another organization in 2020: sample application, entry in the work book, article in the Labor Code of the Russian Federation

The largest state pension is received by those who have worked for 35 years. Those who have worked for 10 years or more also receive payments, but the amount will be less.

Personal savings usually amount to 5-7% of the monthly salary. Some citizens can afford to save large sums.

If a citizen does not work but lives in England, he receives social benefits. The fact of residence within the country must be confirmed by relevant documents.

War veterans, disabled people and widowers receive additional contributions. Wounded veterans receive the most bonuses. There are additional benefits for all senior citizens, such as free medicines and travel.

Minimum and maximum level

The smallest government provision is £44.40 weekly. To obtain it, you must have ten years of work experience in the UK. This is the minimum threshold, which can be increased by receiving financial assistance.

The government financial benefit is £142 per week, which already covers bills and food. All UK citizens over 66 years of age are eligible to receive financial assistance if their contributions are less than £160 per week.

The maximum state pension is £165 weekly.

Pension supplements

For older Englishmen, there is a Pension Credit, which is paid by compensating for the difference in minimum and actual payments. Anyone who has citizenship or a residence permit within the country can apply for Pension Credit, no matter how long the person has worked in England.

If a pensioner receives less than £160 weekly or RUB 13,000, and less than £243 or RUB 20,000 for a couple, they are eligible to receive payments.

Relying only on the state pension within the UK is quite risky. Therefore, citizens from a young age, when applying for a job, think about a working pension, choosing favorable conditions. Also, almost every Englishman has personal contributions to the fund.

In European countries

The countries of the European Union are famous for their high standard of living for retirees. Local residents live longer and earn more as a result of a developed economic system.

The EU has the highest wage replacement rate with pensions, that is, the percentage of previous wages that pensioners can count on after retiring.

According to the International Labor Organization (ILO) convention, it cannot be lower than 40%. For example, in Spain it is 80%. In Russia, for comparison, it is only 29.8%.

Among non-EU countries, Switzerland has the highest pensions - a minimum of 1100 francs or 1800 US dollars per month. The replacement rate is at least 50%, which means that upon retirement, citizens can afford almost the same quality of life.

| A country | Retirement age | Average pension size, in dollars | Life expectancy, years | |

| For women | For men | |||

| Austria | 60 | 65 | 1500 | 81.4 |

| Belgium | 65 | 65 | 1200 | 81.5 |

| Bulgaria | 61.2 | 64.1 | 577 | 71.4 |

| Great Britain | 65.5 | 65.5 | 700 | 81.2 |

| Hungary | 63.5 | 63.5 | 400 | 73.1 |

| Germany | 65.7 | 65.7 | 850 | 81.2 |

| Greece | 67 | 67 | 700 | 82.1 |

| Denmark | 65 | 65 | 2800 | 80.8 |

| Ireland | 66 | 66 | 1000 | 82 |

| Spain | 65.5 | 65.5 | 1190 | 83.4 |

| Italy | 67 | 67 | 580 | 83.4 |

| Cyprus | 65 | 65 | 740 | 80.8 |

| Latvia | 63.9 | 63.9 | 300 | 70.1 |

| Lithuania | 62.4 | 63.8 | 408 | 74.7 |

| Luxembourg | 65 | 65 | 3000 | 82.1 |

| Malta | 62 | 62 | 1500 | 82.4 |

| Netherlands | 66.4 | 66.4 | 800 | 82.1 |

| Poland | 60 | 65 | 538 | 78.5 |

| Portugal | 68 | 68 | 500 | 81.9 |

| Romania | 60.11 | 65 | 446 | 72.5 |

| Slovakia | 65.4 | 65.5 | 502 | 77.4 |

| Slovenia | 59.8 | 60 | 500 | 81.2 |

| Finland | 63 | 63 | 1781 | 81.7 |

| France | 62 | 62 | 700 | 82.5 |

| Croatia | 62 | 65 | 300 | 78.3 |

| Czech | 62.8 | 63.4 | 680 | 79.2 |

| Sweden | 61 | 61 | 1100 | 82.7 |

| Estonia | 63.5 | 63.5 | 656 | 78.6 |

Benefits for pensioners in England

For older people, the government has provided many forms of benefits, of which it is worth highlighting:

- free travel on public transport;

- benefits for utilities. For example, significant discounts on heating in the winter months;

- favorable conditions in banks: high interest rates on savings accounts, etc.

Despite the variety of pension forms and the seeming instability of the pension system itself, older people in England are among the most protected in the world. Plus, they have the right and opportunity to choose in favor of one or another type of pension payments. In conclusion to all of the above, we can conclude that English pensioners are a protected segment of the population.

Data history () by year

Data Period Date

| 66 | 2020 | 28.06.2020 |

| 65.5 | 2019 | 17.01.2019 |

| 65 | 2018 | 07.03.2018 |

| 65 | 2017 | 11.08.2017 |

| 65 | 2016 | 31.12.2016 |

| 65 | 2015 | 31.12.2015 |

| 65 | 2014 | 31.12.2014 |

| 65 | 2013 | 31.12.2013 |

What should thirty-year-olds do so as not to become too poor in retirement?

- There is no need to ignore pension funds. “Invest in a pension system because it is tax-efficient. Because the employer gives a certain contribution on his part.”

- Pay attention to what fees pension funds have. Let's say there are two pension funds that have a similar strategy and it generates the same income. But they have different commissions - one has half a percent, and the other one and a half. If you invest the same amount in them, the fund with the lower fee will earn you an extra 10% over 10 years.

- Now many Britons are investing their pension savings in buying an apartment or house. Then they can rent it out, pass it on to their children, or resell it. However, the profitability of such a scheme greatly depends on the location, region and situation on the real estate market.

- The most important advice is to start thinking about your retirement savings yourself as early as possible and look for different investment options. “When you reach 50 or 60 years old, it turns out that there is more money in the retirement account than you initially thought,” the expert explains, provided that the employee saved for retirement from a young age.

Data history () by year

Data Period Date

| 66 | 2020 | 28.06.2020 |

| 65.5 | 2019 | 17.01.2019 |

| 65 | 2018 | 07.03.2018 |

| 63.5 | 2017 | 11.08.2017 |

| 63 | 2016 | 31.12.2016 |

| 62.5 | 2015 | 31.12.2015 |

| 62 | 2014 | 31.12.2014 |

| 61.5 | 2013 | 31.12.2013 |

Foreign pensioners in the United Kingdom

Elderly foreigners, under certain conditions, can count on a special social benefit in the UK - Pension Credit. Older people have the right to receive such financial assistance even without a single day of work experience in the United Kingdom. You just need to have a residence permit, as well as proof of actual residence in the country.

Pension Credit will increase a claimant/couple's weekly income to £155.65 per week for a single person or £243.25 for a couple.

Stateless immigrants have two options:

- when you reach old age, simply apply for the minimum Pension Credit benefit;

- earn enough experience to receive a state pension. In the UK it is 10 years.

The question may arise what foreigners who come to the country and work on a temporary or permanent basis receive. It all depends on the specific case.

If a foreigner has moved to the UK for permanent residence, works, pays taxes and transfers a certain amount each month into the National Insurance account, he is subject to all the rules regarding receiving a pension that apply to local residents.

In addition, by drawing up an employment contract, you can become a participant in the pension scheme of your employer. Another option is to open a personal pension plan with a private provider.

It may happen that a citizen of another country is planning to move to Foggy Albion at pre-retirement age, which is why he will not have time to obtain the length of service required for a state pension in the UK. Then he needs to make sure that it will be accrued in his home country.

If a foreigner lived in one of the EU states, he will be paid a pension in the amount to which he is entitled in accordance with the legislation of that country.

Useful resources

www.yourpension.gov.uk

“I’m over 20,” “I’m over 30,” “I’m over 40,” “I’m over 50,” “I’m over 60,” or “I’ve reached retirement age.” Each of them will provide information that is useful specifically for this age group, will tell you how many more years you need to work to receive a state pension, as well as how to save up a working or private pension and what savings accounts will be useful at this stage of life.

www.gov.uk/check-state-pension

A state online service that will help you find out how much state pension you can expect (State Pension forecast), when your retirement age will come, and how you can increase the amount of your pension benefit. You will need to register or log in with your Government Gateway ID or GOV.UK Verify account. All the numbers and forecast are shown here in a very accessible way.

citizensadvice.org.uk/debt-and-money/pensions/types-of-pension/state-pension/

Another useful resource that helps you sort out the facts about the state pension - there are special links created here for the sections: year of birth and gender, which help determine the onset of retirement age.

www.moneyadviceservice.org.uk

Money Advice is a free independent organization and their website has useful information on all types of pensions and has a pension calculator to help you determine the size of your pension, not just state pensions but also work and private pensions.

www.pensionsadvisoryservice.org.uk

Information about different types of pensions, convenient planning schemes, as well as sections on possible problems with pensions. If you get lost in the pension welter, there is a phone or web chat helpline.

The article was prepared based on information from official sources

Types of pension contributions in Germany

There are two types: public and private. Each citizen decides for himself which one to give preference to. Most Germans use both if income allows.

State

Pension insurance is compulsory and is part of the social system. Every working citizen is obliged to make contributions to the Deutsche Rentenversicherung. The tariff is approved by the Cabinet of Ministers. In 2018-2019 - 18.6% of the salary, in 2016-2017 - 18.7%, and in 2007-2011. the maximum value was set at 19.9%. Moreover, 50% of this amount is paid by the employee from his salary, and 50% is transferred by the employer. Last year it was decided that until 2025, contributions to the Pension Fund will not exceed 20%.

If you receive amounts equal to the average salary in the country, 1 point will be awarded for this year. For others, they will proportionally decrease or increase, but not infinitely. The score has a limit, which is calculated as the ratio of the maximum to the average salary. It is installed differently for the Western and Eastern parts of Germany.

Private

For citizens with a high level of income or those not officially employed (there are very few of them), this is one of the popular types of savings. Businessmen and self-employed people most often choose private funds, concluding an agreement with them and determining the amount of contributions. They work for themselves - the state needs to pay the full tariff.

Managers of such funds invest the money they receive and bring additional income to clients. Transfers are sent to a special bank account from which funds can be withdrawn at any time. Most people do not touch it, but leave the accumulated amounts until they stop working in order to receive a significant increase in their pension.

Other labor market and unemployment indicators in the UK

| Indicator | Period | Fact. meaning | Prev. meaning |

| Unemployment rate | Aug. 2019 | 3.9 % | |

| Wage | Aug. 2019 | 2798.54 USD/month | |

| Change in the number of applications for unemployment benefits | Sep. 2019 | 21.1 thousand | |

| Number of vacancies | Aug. 2019 | 813 thousand | |

| Economic activity level | Jul. 2019 | 79 % | |

| Real cost of living | 2018 | 1102.991 USD/month. | 1047.533 |

| A country | Period | Fact. meaning | Prev. meaning |

| Austria | 2018 | 65 | 65 |

| Ireland | 2020 | 66 | 66 |

| Luxembourg | 2018 | 65 | 65 |

| Spain | 2020 | 65.83 | 65.67 |

| Iceland | 2018 | 67 | 67 |

| Norway | 2020 | 62 | 62 |

| Belarus | 2018 | 61 | 60.5 |

| Belgium | 2018 | 65 | 65 |

| Bulgaria | 2018 | 64.08 | 64 |

| Croatia | 2018 | 65 | 65 |

| Cyprus | 2018 | 65 | 65 |

| Czech | 2018 | 63.33 | 63.17 |

| Denmark | 2018 | 65 | 65 |

| Estonia | 2018 | 63.5 | 63.25 |

| Eurozone | 2018 | 64.36 | 64.27 |

| European Union | 2018 | 64.28 | 64.21 |

| Finland | 2018 | 63 | 63 |

| France | 2020 | 62 | 62 |

| Germany | 2020 | 65.75 | 65.67 |

| Greece | 2019 | 67 | 67 |

| Hungary | 2019 | 64 | 63.5 |

| Italy | 2020 | 67 | 67 |

| Latvia | 2018 | 63.25 | 63 |

| Lithuania | 2018 | 63.67 | 63.5 |

| Malta | 2018 | 62 | 62 |

| Moldova | 2018 | 63 | 62.5 |

| Netherlands | 2020 | 66.67 | 66.33 |

| Poland | 2020 | 65 | 65 |

| Portugal | 2020 | 66.42 | 66.42 |

| Romania | 2018 | 65 | 65 |

| Russia | 2019 | 60.5 | 60 |

| Serbia | 2018 | 65 | 65 |

| Slovakia | 2018 | 62.42 | 62.17 |

| Slovenia | 2018 | 60 | 59.67 |

| Sweden | 2020 | 62 | 61 |

| Switzerland | 2020 | 65 | 65 |

| Türkiye | 2020 | 60 | 60 |

| Ukraine | 2018 | 60 | 60 |

| Great Britain | 2020 | 66 | 65.5 |

| Liechtenstein | 2018 | 64 | 64 |

| Albania | 2018 | 65 | 65 |

READ Federal Law on Refugees in Russia