Information about the fund

- Full name of the organization (name of NPF): Joint Stock Company "National Non-State Pension Fund"

- Status in 2020: Active - Valid license

- License number: 288/2

The founding date of the National Non-State Pension Fund can be considered April 1997. Just a year later, the first few hundred people began to receive their pensions. Currently, the fund is one of the largest non-state pension funds in the Russian Federation, serving through corporate programs over 500 organizations related to the oil, construction, financial and many other sectors. The fund's clients include more than half a million people, among whom about 300 thousand are under the OPS program, and 200 thousand are under the NGO program. The volume of assets exceeds 23 billion rubles.

Affiliated funds

NPF Blagovest was merged on December 26, 2016.

This is evidenced by the “Agreement on the transfer of the obligation of a non-state pension fund to pay non-state pensions and property assigned to participants for life” dated December 26, 2016 No. 2016-4200/49, concluded between JSC National Non-State Pension Fund and JSC Non-State Pension Fund Blagovest represented by the State Corporation "Deposit Insurance Agency" (liquidator, DIA).

Requisites

View details

DETAILS FOR TRANSFER (FROM PFR AND NPF) PENSION SAVINGS:

• Recipient: JSC "National Non-State Pension Fund" • OGRN: 1147799010314 • INN: 7701100510 • KPP: 772001001 • BIC: 044525659 • account: 40701810900760010163 in PJSC "CREDIT BANK OF MOSCOW" ", Moscow • correspondence/account: 30101810745250000659

DETAILS OF THE HEAD OFFICE IN MOSCOW FOR TRANSFER OF CONTRIBUTIONS TO NON-STATE PENSION SECURITY:

• Recipient: JSC "National Non-State Pension Fund" • OGRN: 1147799010314 • INN: 7701100510 • KPP: 772001001 • BIC: 044525272 • account: 40701810700004000667 in PJSC Bank ZENIT, Moscow (for individuals) • account: 40701810500000000667 in PJSC Bank ZENIT Moscow (for legal entities) • cor/account: 30101810000000000272

DETAILS FOR PAYMENT FOR CURRENT AND ECONOMIC ACTIVITIES:

• Recipient: JSC "National Non-State Pension Fund" • OGRN: 1147799010314 • INN: 7701100510 • KPP: 772001001 • BIC: 044525272 • r/account: 40701810100002000667 in PJSC Bank ZENIT, Moscow • cor/account : 30101810000000000272

Reviews about NPF

And I entrusted the funded part of my pension to this organization, despite the dissuasions of friends and acquaintances. I want to say that I have never regretted what I did. I conducted an analysis and concluded that the fund occupies one of the leading places in terms of profitability of savings from pension contributions. In addition, I liked the documentation and the contract itself.

Svetlana, Saratov

After reading reviews on the Internet, I decided to write my own. The National Non-State Pension Fund is not the first in my experience. I changed 2 organizations, so I have something to compare with. Excellent attitude aimed at comfort for people; they offered to draw up a contract right at my place of work. In addition, the fund’s performance is excellent, 4 years have passed and I have no complaints or complaints. I recommend it to everyone.

Igor, Mr. Murmansk

Contacts

Official website National Non-State Pension Fund

https://www.nnpf.ru/

For existing clients there is access to a personal account; for everyone, the website contains a lot of background information and official documents with statistics and reporting.

Email mail

Address

MOSCOW

111123, Moscow, st. Plekhanova, house 4

Hotline number

8 800 555-999-1 (hotline) 8 (reception)

Rating of non-state pension funds based on reviews in the blogosphere for the third quarter of 2020

Rating of NPFs of Russia

Hard times have come for NPFs. The economic situation in the country forced the government to extend the freeze on pension savings until the end of 2020, so NPFs will lose more than 300 billion rubles. The government's decision will affect the financial stability of non-state pension funds and their popularity among the population.

At the moment, only NPFs that have been inspected by the Central Bank and for which the regulator has issued a positive conclusion on the NPF’s compliance with the requirements for participation in the system of guaranteeing the rights of insured persons can work with the savings of Russians in accordance with Law No. 422-FZ adopted in 2013 “On Guaranteeing Rights” insured persons in the compulsory pension insurance system."

Citizens should not worry; they can control the status of their savings account in the NPF by requesting information from the NPF or in their personal account, if such a function is available on the NPF website. The Pension Fund of Russia has already implemented the personal account function. Citizens who have entrusted their funded pension to the Pension Fund can find out in their personal account about the status of their savings account, as well as the accumulated pension points.

Recently, the analysis of social networks and blogs has become popular among sociologists. When questions arise, the vast majority of Russians tend to look for answers online, and, as surveys show, trust in the statements of social network participants and bloggers is much greater than in media publications and official communications from companies.

The Center for the Study of Pension Reform has compiled a rating of non-state pension funds included in the guaranteed insurance system based on the opinion of the blogosphere, which makes it possible to assess the level of public confidence in the activities of various non-state pension funds.

Methodology

The rating was compiled based on an analysis of almost 4,000 messages in the blogosphere and social networks containing mentions of NPFs. Messages from July 1 to September 30, 2020 were taken into account. In addition to blogging platforms, the analysis also took into account messages from the popular social networks VKontakte and Facebook. The ranking of NPF places in the rating was based on the calculation of the conflict potential index, reflecting the ratio of positive, negative and neutral messages in the structure of the information field.

The rating included only non-state pension funds included in the register of participants in the system for guaranteeing the rights of insured persons of the Deposit Insurance Agency.

| Item No. | NPF | Positive feedback | Negative reviews | Neutral reviews | Total reviews | NPF market share, % | Profitability, % | Conflict index |

| 1 | NPF Sberbank | 35 | 7 | 188 | 230 | 6,61 | 12,7 | 0,12 |

| 2 | NPF Heritage | 3 | 0 | 32 | 35 | 4,36 | 19,26 | 0,08 |

| 3 | NPF GAZFOND | 11 | 2 | 95 | 108 | 5,61 | 13,7 | 0,08 |

| 4 | KITFinance NPF | 9 | 1 | 107 | 117 | 5,75 | 15,63 | 0,06 |

| 5 | NPF LUKOIL-GARANT | 7 | 1 | 95 | 103 | 13,27 | 8,88 | 0,05 |

| 6 | NPF Soglasie | 7 | 0 | 124 | 131 | 0,29 | 9,36 | 0,05 |

| 7 | NPF Electric Power Industry | 2 | 0 | 40 | 42 | 6,45 | 7,86 | 0,04 |

| 8 | NPF Trust | 12 | 1 | 239 | 252 | 1,08 | 27,8 | 0,04 |

| 9 | NPF StalFond | 22 | 3 | 472 | 497 | 3,19 | 4,86 | 0,03 |

| 10 | National Non-State Pension Fund | 4 | 0 | 133 | 137 | 1,14 | 13,31 | 0,02 |

| 11 | NPF VTB | 16 | 6 | 404 | 426 | 6,09 | 12,79 | 0,02 |

| 12 | NPF European Pension Fund | 5 | 1 | 170 | 176 | 1,38 | 23,29 | 0,02 |

| 13 | NPF Russian Standard | 1 | 0 | 48 | 49 | 0,29 | 19,62 | 0,02 |

| 14 | NPF GMK-Perspective | 1 | 0 | 50 | 51 | no data | 17 | 0,01 |

| 15 | NPF FUTURE | 8 | 2 | 307 | 317 | no data | 6,07 | 0,01 |

| 16 | NPF URALSIB | 1 | 0 | 55 | 56 | 0,34 | 9,25 | 0,01 |

| 17 | NPF BIG | 3 | 1 | 505 | 509 | 2,4 | 11,98 | 0,003 |

| 18 | NPF Vladimir | 0 | 0 | 59 | 59 | 0,25 | 13,28 | 0 |

| 19 | NPF RGS | 0 | 0 | 56 | 56 | 5,73 | 9,6 | 0 |

| 20 | NPF NEFTEGARANT | 0 | 0 | 41 | 41 | no data | 12,44 | 0 |

* The rating included 20 non-state pension funds that received the maximum number of reviews. The remaining non-state pension funds included in the guarantee system were not considered due to low mention in the blogosphere.

The most popular topic of blog posts was the problem of adding non-state pension funds to the pension savings insurance register. The content of the messages shows that the population strives to secure their savings as much as possible in the future.

In second place is the question of the profitability of savings in various non-state pension funds, and the emphasis is shifted towards the reliability of the fund. Citizens understand that it is better to choose a fund with slightly lower risks and average returns than to take risks by investing their savings “at a high interest rate” in a fund that risks the savings of its clients. The main thesis of these messages is the search for a golden mean between profitability and reliability. Thus, NPF Sberbank, Heritage, Gazfond, KITFinance and Lukoil shared the 5 leading positions, respectively. Despite the average profitability indicators, these NPFs have established themselves in the blogosphere as stable and reliable funds with a good market share; they have the largest number of positive reviews and a small number of negative reviews.

The leader in the number of mentions in the blogosphere was NPF Bolshoi, which received 509 messages in the 3rd quarter of 2020. The fund has a good return rate of 11.98%, which is comparable to the inflation rate in the country. Despite the largest number of mentions, NPF takes 6th place in the ranking for the reason that the bulk of mentions are neutral.

The largest number of positive comments - 35 - out of a total of 188, was received by Sberbank Non-State Pension Fund; in addition to the maximum number of positive reviews, it also received the maximum number of negative comments. Mostly negative comments are associated with an overly intrusive offer to transfer your savings from the Pension Fund. At the same time, NPF clients are satisfied with the convenience of working with the fund and the accessibility of its offices.

The bottom lines of the ranking are occupied by non-state pension funds with a fairly high level of profitability, sometimes exceeding inflation, but occupying a small market share and little mentioned in bloggers’ posts. These funds are part of the guarantee system and are actively engaged in their development, but have not yet received the proper response on the network. Such funds include NPF Vlvdimir, RGS, Neftegarant.

© BBF.RU

Statistics National non-state pension fund: rating of reliability and profitability

According to the Central Bank of the Russian Federation from the reporting “Main performance indicators of non-state pension funds” as of the date: 01/01/2020

Fund assets (thousand rubles): 39695793.67

Statistics on NPO (non-state pension provision) as of 01/01/2020

- Total volume of pension reserves (thousand rubles): 15526804.65

- Total number of participants (people): 110666

- Participants receiving a pension (persons): 53835

- Total amount of pensions paid under NPO (thousand rubles): 850634.00

Statistics on compulsory pension insurance (compulsory pension insurance) as of 01/01/2020

- Pension savings (thousand rubles, market value): 20468494.35

- Number of insured persons (people): 284157

- Participants receiving a pension under compulsory pension insurance (persons): 7792

- Amount of pension payments under compulsory pension insurance (thousand rubles): 127263.70

Profitability of pension savings

Current profitability

Minus remuneration for management companies, specialized depository and fund.

- Profitability of placing funds from pension reserves (NPO): 10.50%

- Return on investment of pension savings (OPS): 10.83%

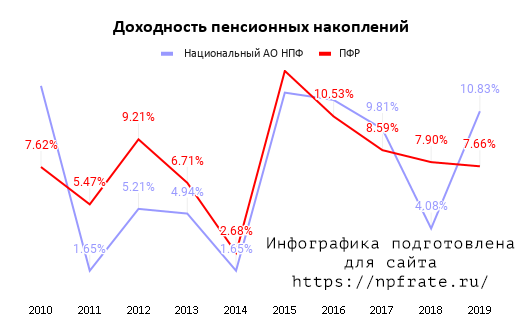

Profitability chart

Data on the profitability of the National Non-State Pension Fund in 2020 (as of 01/01/2020), including information for the previous 10 years in comparison with the profitability of the Pension Fund (VEB):

Yield comparison table

| Year | National JSC Non-State Pension Fund | Pension Fund |

| 2010 | 12.29% | 7.62% |

| 2011 | 1.65% | 5.47% |

| 2012 | 5.21% | 9.21% |

| 2013 | 4.94% | 6.71% |

| 2014 | 1.7% | 2.68% |

| 2015 | 11.90% | 13.15% |

| 2016 | 11.48% | 10.53% |

| 2017 | 9.81% | 8.59% |

| 2018 | 4.08% | 7.90% |

| 2019 | 10.83% | 7.66% |

NPF national

There are quite a lot of non-state pension funds. An example of such an organization is JSC NPF “National” . The company has chosen the protection of pension savings of citizens and the formation of amounts as its core activity.

The non-state pension fund "National" ensures the safety of investments and allows you to increase them. Additionally, clients can count on receiving income. It is calculated in accordance with the provisions of the concluded agreement.

We will talk further about the organization, its official website, the benefits of cooperation, reliability rating and other features.

A little about the institution

The company entered the market in 1997. During the same period of time, the non-state pension fund “National” was able to obtain a license. Initially, NPF was engaged in paying pensions to Tatneft employees in Kazan.

This institution is the organizer of the fund. In the first year after the launch, 520 non-state pensions were provided to former employees of the above institution. Within 3 years of operation, the company has acquired a nationwide scale.

It was recognized as one of the largest organizations.

In 2014, the list of services of the non-state pension fund “National” expanded significantly. NPF began to engage in compulsory pension insurance. In 2008, a network of branches was built throughout Tatarstan.

During this period of time, about 20 thousand people received a non-state pension from NPF National. In 2008, a crisis broke out in the Russian Federation.

However, this did not prevent the fund from subsequently withdrawing investment reserves to the previous level.

The non-state pension fund “National” managed to achieve a return of 34% per annum. This allowed the institution to take second place in this indicator. In 2014, the non-state pension fund “National” was awaiting reorganization. As a result, the company began to operate in the form of a closed joint stock company. By the end of 2020, pensioners were able to receive over 5 billion rubles from the organization.

Official website of the institution on the Internet

The non-state pension fund "National" keeps up with the times. The official website nnpf.ru contains a large amount of information.

After familiarizing yourself with the site, the client will be able to obtain the following information about the joint-stock company NPF “National”:

- data on the work of the institution, generated in the form of reporting;

- Latest news and shareholder information;

- a list of available pension programs with a detailed description of the conditions;

- information about the structure and divisions of the fund.

For clarity, graphs and tables are used. They are presented in a special section of the site. The tables and graphs reflect information about the specifics of investing and distribution of the savings portfolio.

NPF “National” invests in several directions at once:

- deposits in shares and government securities;

- investments in bonds of entities and state corporations;

- cash.

After familiarizing yourself with the resource, a person will be able to find out information about the sectoral distribution of investments. The main one is the public sphere. The company then invests in the oil and gas industry.

Additionally, you will be able to learn about the structure of the so-called issuers of pension savings. The state continues to be the leader. It is followed by Rostelecom and Rosneft. Additionally, there is information regarding pension reserves.

Currently, about 50 thousand people receive pensions from the National Pension Fund.

Please note: Investments accrue profits annually. Additionally, capitalization is carried out. The client has the right to independently choose the format for subsequent receipt of the pension and the timing of its payments. Termination of the contract is acceptable. The client's desire is enough. The manipulation can be performed at any time. The person is provided with a ransom amount.

There is a calculator on the website. This is an optimized pension program that allows you to quickly determine the approximate size of your future pension.

In order for the system to be able to determine the value of the indicator, you will need to provide the following data:

- client age;

- features of making contributions;

- the year in which the application for a non-state pension will occur;

- types of pensions;

- the need for additional contributions.

The calculation of indicators is carried out taking into account the profitability of the pension fund and other factors that influence the conduct of activities.

Benefits of interacting with an organization

If the client chooses the non-state pension fund “National”, this will entail a number of advantages.

The list of positive features includes:

- the fund invests contributions;

- savings are formed based on the income received;

- funds are provided in the form of a pension to the insured citizen;

- The state is the insurer of the funds.

Payments are made voluntarily. Pensions do not depend on wages, length of service and state pension payments. Formation is made through contributions and income from investment.

Reliability and profitability of the institution

The NPF was assessed by the Expert rating agency. The fund was assigned an A++ rating. The forecast is stable. A similar state of affairs has been observed since 2012. The company regularly confirms the assigned rating. The national rating agency did not evaluate NPFs.

The profitability of the pension fund is also high. In 2009, the figure was 33%. In the crisis year of 2008, the profitability value was 0%. In 2011, there was high volatility in the securities market. This brought the figure above 0.59%.

Currently, the profitability of the institution has decreased slightly. The Central Bank fixed the profitability of NPF “National” at about 12.3% per annum. The size of the pension fund's assets is about 35 billion rubles. At the same time, the number of savings is 16.9 billion, and reserves are 14.6 billion rubles.

Over 400 thousand clients cooperate with the fund.

Communication with the company and savings management

NPF offices are present throughout the Russian Federation. You can find information on the official website. Additionally, there is a hotline telephone number. Calls are accepted by number.

For the convenience of clients, a personal account has been created. To register and log in, you will need to enter 9 digits in SNILS. No checksum is entered. The use of the account is carried out after completing the registration procedure.

During it, you need to indicate your full name, date of birth, SNILS number and information about the contract. After this, the person will be able to receive the password. Information is strictly prohibited from being provided to third parties.

This may result in unauthorized access to personal data.

Source: https://pf-rf.ru/npf/npf-natsionalnyj/