About the fund

Two companies were involved in trust management of funds in the interests of the fund. By the end of 2014, the volume of pension savings in this structure reached 2.7 million rubles, reserves - 22.85 million, and property was estimated at 3.12 million.

Almost 80 thousand people were insured under OPS, and more than 8.5 thousand people became participants in non-state programs.

The fund had a good position in the North-West region, but the Pension Fund of Russia placed the main emphasis in its activities on the Far East. This is due to the active implementation of many investment projects here.

Buy an MTPL policy through RESO-GARANTIA

RESO-GARANTIYA is one of the major Russian insurers, has a high reliability rating and experience in auto insurance. Before you buy an MTPL policy through RESO-GARANTIA, you need to take into account that the price will depend on the following factors:

- driver age;

- driving experience;

- machine power;

- region of registration of the owner of the car.

Expert opinion

Maria Skoraya

Insurance expert

OSAGO calculator

You can find out your individual cost quickly using an insurance calculator. Afterwards it will take a couple of minutes to obtain compulsory motor liability insurance.

To buy a policy, click on “Buy” and in the window that opens, select the registration method. You can fill out the application form yourself or leave your phone number so that the operator will call you back and enter all the data. Next, follow all payment instructions. The paper version of the policy will be delivered by courier.

All data is entered into the database within a couple of hours.

Liquidation of NPF

However, in the summer of 2020, the Central Bank of the Russian Federation decided to cancel the license of the NPF Savings. The reasons given were violations of current requirements for the disposal of savings, as well as failure to comply with the regulator’s instructions.

This fund, as well as 6 other non-state pension funds, belonged to the group of Anatoly Motylev. All of them were deprived of licenses giving the right to engage in the relevant type of activity.

Important! The savings of the fund’s clients were completely preserved and were returned to the Pension Fund. Insured citizens continue to form a savings portion in accordance with the right to choose the type of pension provision.

At the same time, if there is a shortage in the accounts, the state in such cases compensates only for that part of the payments that was made by employers. The investment share is not returned.

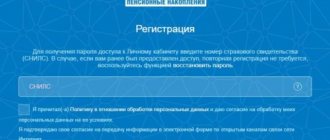

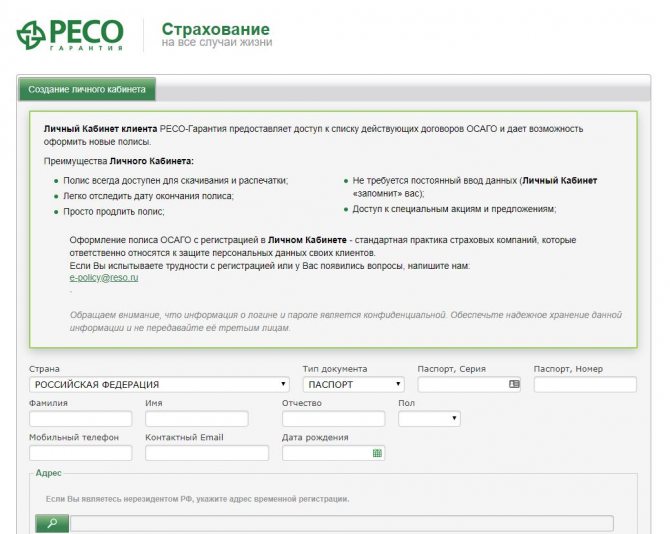

Possibility of registration in LC

To register, you will need to visit the official website of the organization. Then you need to choose the appropriate registration method: for individuals or legal entities.

Customers must then fill out a form with their personal details. In this case, you will need to provide only reliable registration data. It is mandatory to give consent to the processing and storage of personal information. After this, you need to check the specified data in the RSA. In the shortest possible time, the system will check the data that was specified.

If there are no errors, a password and login for logging into your account will be sent to your mobile phone or email address.

After the registration event, you can reset your password if necessary. To do this, you will need to provide your passport details. The system will verify the user's registration. After this, you can receive a notification with a new password that you can use to log in.

The registration event is carried out in the shortest possible time.

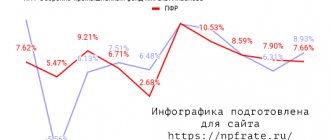

Profitability ratings and reliability

The Fund did not participate in the rating assessments of the NRA and RA Expert. Nevertheless, on the official website of the NPF “Sberegatelny” it was possible to familiarize yourself with the profitability indicators. In 2020, the indicator for OPS was 8.5%, for NGOs – 24.12%. A year earlier, the figures were 9.71% and 0.43%, respectively.

There was also a pension calculator that made it possible to calculate the approximate level of payments taking into account a number of parameters. On the site one could find information about the founders, the proposed conditions and locations of branches.

License revocation

Over the past couple of years, many organizations specializing in the financial sector have undergone major changes.

Requirements for personal capital have increased, constant inspections and deprivation of licenses were aimed at purging the ranks of financial companies, as a result of which amateurs were eliminated, and only the strongest organizations continued to work in the market. Alas, many banks and funds could not withstand such stringent checks, during which many companies were forced to cease to exist. These include NPF Reso-Garantiya (formerly Sberfond Solntse). In 2020, the company lost its license for pension insurance and provision.

Now the Non-State Pension Fund is run by temporary management, all funds must be transferred as quickly as possible to the State Pension Fund of Russia. Former participants of the NPF Reso Garantiya will now receive payments from the state PF.

More detailed information can be found on the official page of the company. Enter pfrf.ru in the address bar to find out how pensions will be calculated further. Or call the phone number (4932) 31-24-47

.

Features of the fund's activities

The organization's investment policy provided for the investment of savings in financial instruments with a fixed return. It was planned to invest 80% of the funds in securities, as well as deposits and bonds, and up to 20% in shares. According to the fund, the funds were distributed as follows:

- Accounts receivable – 56.9%;

- Corporate bonds – 18.3%%

- Unplaced and remaining funds in accounts – 10.8%;

- Funds on bank deposits – 10.5%;

- Cash – 3.1%.

The personal account of the official website of NPF “Sberegatelny” is unavailable after the organization’s license was revoked and its liquidation.

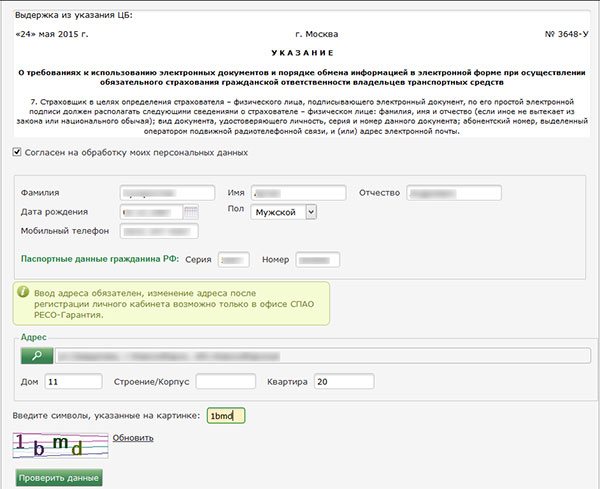

How to register in your RESO personal account?

To use the capabilities of your Personal Account, a citizen, first of all, needs to register on the insurance website.

Step 1

On the account creation page you will need to click on the “For individuals” link.

Step 2

In the form provided, you must enter information about the vehicle and its owner:

- passport details of the vehicle owner;

- technical passport (PTS);

- driver's license (document number, length of service, date of issue, etc.);

- vehicle diagnostic card.

Step 3

After checking the entered information, it is recommended to double-check the data for typos.

Step 4

Confirm the agreement for the processing of personal data.

Step 5

Check the information using the appropriate button.

Step 6

Enter contact information (e-mail, phone number).

Step 7

The account login and password will be sent to the previously specified coordinates.

Subscribe to news

A letter to confirm your subscription has been sent to the e-mail you specified.

09 September 2020 10:21

In August 2020, the Bank of Russia canceled the licenses of seven non-state pension funds (NPFs):

- JSC NPF "Sun. Life. Pension" (formerly "Renaissance Life and Pensions");

- JSC NPF "Adekta-Pension";

- NPO NPF "Uraloboronzavodsky";

- JSC NPF “Protection of the Future”;

- JSC NPF "Solnechnoe Vremya" (former NPF "Pension Fund "Industrial Construction Bank");

- JSC NPF "Savings Fund Solnechny Beach" (formerly CJSC NPF "SberFond RESO");

- JSC NPF "Sberegatelny".

Applications for the forced liquidation of these funds have been sent to the arbitration court.

From the moment the license is revoked, compulsory pension insurance contracts with the funds are considered terminated, and the clients of these NPFs are transferred to the Pension Fund of the Russian Federation (PFR). The funds received from the Bank of Russia are transferred by the Pension Fund to the trust management of the state manager, to the “extended” portfolio.

If non-state pension funds that have lost their license are unable to compensate for all amounts of pension savings that were due to citizens, the Central Bank of Russia, in accordance with the law, will reimburse the Pension Fund for the nominal amount of insurance contributions. Investment income is not compensated in this case.

Funds as of the date of cancellation of the fund’s license will be transferred to the Pension Fund no later than October 30, 2020.

During the 2014 campaign, the territorial bodies of the Pension Fund of the Ivanovo Region received 26 applications to choose one of seven non-state pension funds with a revoked license as an insurer:

- RENAISSANCE LIFE AND PENSIONS –12;

- SAVINGS –3;

- SBERFOND RESO – 11.

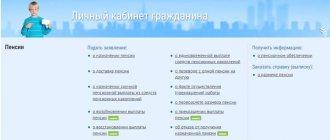

Clients of these funds can find out where pension savings are currently being formed in the territorial bodies of the Pension Fund, on the Pension Fund website in the “Personal Account of the Insured Person” or on the government services portal.

Consultations by calling the hotline of the Pension Fund Branch (4932) 31-24-47.

Providing services in the non-state Pension Fund Gazfond (NPF)

In addition, at the end of the term, the citizen receives a slightly larger pension from the NPF. By investing in the fund, a citizen agrees that his money will go into investment, which will allow him to earn a little money on dividends.

According to the latest data, the Gazfond's profitability is 11.6%, which is comparatively less than, for example, in 2020, where the same figure was 13.7%. But as everyone knows, profits are big when money is invested in the right direction.

09 Jun 2020 uristlaw 223

Share this post

- Related Posts

- Is it possible to build a house on a dacha plot using maternal capital?

- How to Pay Utilities If You're in Another Place

- When can you Privatize an Apartment under a Social Tenancy Agreement 2020

- 10 Years of Service What Gives

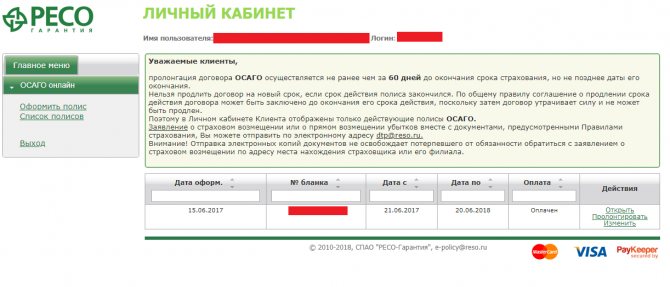

Authorization features

To log into your account you will need to provide basic information.

First of all, the login is indicated. This is the telephone number to which the insurance company account is linked.

You should also provide a password, which is a set of characters. This password is used to confirm your identity. In this case, the password will be sent to your mobile phone number or email address.

You need to understand that if necessary, data can be restored in the shortest possible time.

Briefly about

RESO-Garantiya has been providing insurance services on the Russian market for more than 25 years. The name of the company stands for “Russian-European Insurance Company”, which is explained by close ties with several large European companies. The parent company RGI Holdings BV is located in Holland. Effective management, an extensive list of products offered, as well as a competent client policy, allowed RESO to become a systemically important player in the Russian insurance market.

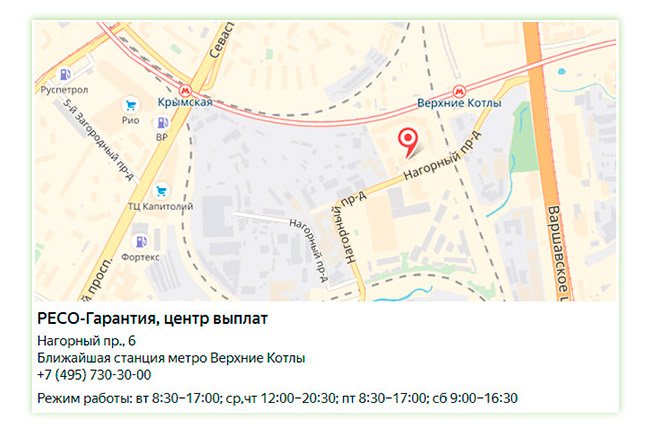

Activities primarily take place in branches and sales offices. The number of divisions exceeds 800, thanks to which almost all Russians have access to the company’s services. The central building is located in Moscow. There are a number of representative offices of RESO-Garantiya in the countries of the Middle East, Asia and Europe. In total, the insurer employs more than 20 thousand employees and agents, whose services are highly paid due to their significant demand.

The Reso Pension Fund was deprived of its license, what to do?

Cancellation of a NPF license establishes a number of responsibilities for the fund. The primary task is to notify the NPF of its depositors, participants and insured persons, as well as their legal successors, about the cancellation of its license (Clause 13, Article 7.2 of the Federal Law of 05/07/1998 No. 75-FZ (as amended on 06/29/2020) " On non-state pension funds"). Moreover, the law sets a period during which it is necessary to carry out these actions. It is three months from the date of the licensing authority’s decision to revoke the license of a non-state pension fund.

If the proceeds from the sale by the Deposit Insurance Agency (DIA) of NPF assets exceed the size of the guaranteed face value, then the excess funds will also go to the Pension Fund for the restoration of lost investment income by the insured person.

01 Sep 2020 uristland 124

Share this post

- Related Posts

- Registration for 5 years Is it permanent or temporary

- What Payments Will There Be to Pensioners in 2020?

- Find out the owner by cadastral number online for free

- What Documents Are Needed to Issue a Child Birth Certificate?

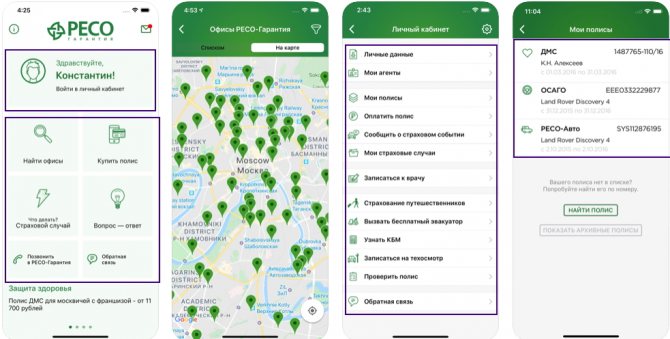

RESO Mobile - mobile application from RESO-Garantiya

Modern users can control their own insurance anytime and anywhere through "RESO Mobile". The application is distributed on Android and iOS platforms. The functionality of the utility is much broader than that of a classic personal account, since RESO-Garantiya focuses on the mobility of its services. Among the options it is worth noting the following:

- search for the nearest RESO offices;

- familiarization with lists of agents, policies, insurance cases;

- payment for existing insurance;

- registration for technical inspection of the insured vehicle;

- making an appointment with a doctor with health insurance;

- take out a travel insurance policy;

- get acquainted with the insurance program and study the list of medical institutions;

- call a doctor at home and, if necessary, call an ambulance;

- notify the insurance company about the insured event;

- view the insurance claims processing statue;

- call a tow truck (Moscow only) and make an appointment for car repairs (Moscow, St. Petersburg)

- study the instructions in the event of an insured event;

- call the insurance company, it is also possible to contact a personal insurance consultant;

- evaluate the end of insurance programs and extend them.

RESO Mobile is a young application, so it is not without errors. Constant updates eliminate shortcomings, so the quality of service is constantly improving.

List of NPFs deprived of their license in 2020

Two funds that were prohibited from attracting new client funds were resources called Savings and Sunny Beach. To clarify, the Central Bank prohibited them from concluding new agreements and transferring funds to management organizations. Organizations can correct the situation only by changing the policy regarding the investment of pension deposits.

Interesting read: Deed of gift for an apartment after the death of the donor

Regarding non-governmental organizations that ceased operations due to the fact that, at the request of the client, they did not transfer funds to the new company, here the Pension Fund of the Russian Federation reflects these same clients as remaining in the old funds. Therefore, these clients are guaranteed a transfer of the nominal amount of funds to the Pension Fund, that is, the procedure is the same as in the case if the person did not try to leave the NPF under the leadership of Motylev. To decide where to transfer your savings, you need to know the non-state pension funds included in the list of organizations that guarantee the safety of funds.