Information about the fund

- Full name of the organization (name of NPF): Joint Stock Company “Non-state pension fund “Defense-Industrial Fund named after. V.V. Livanov"

- Status in 2020: Active - Valid license

- License number: 347/2

NPF Defense-Industrial Fund named after.

V.V. Livanova was founded in 2000 and provides social security to citizens of the Russian Federation under OPS and NGO programs. The value of the fund’s own assets exceeds 5.3 billion rubles of savings, and the number of clients reaches the 100 thousand mark. The fund is part of the DIA system, i.e. pension funds are insured by the state. Interesting fact from the official website: Just 2 years after its opening, the fund paid pensions to more than 5 thousand people. Now more than 10 thousand people receive an additional non-state pension.

Affiliated funds

No affiliated funds

Requisites

View details

INN of the non-state pension fund 7718003106 KPP of the non-state pension fund 771801001 Name of the payee (abbreviated) JSC NPF OPF Bank account number of the payee 40701810700030000098 Bank of the payee VTB Bank (PJSC) Location of the payee's bank Moscow Cash account of the payee's bank 30101810700000000187 BIC of the payee's bank 044525187 INN/KPP of the payee's bank 7702070139/783501001

Small non-state pension funds are becoming burdensome for owners

Small non-state pension funds (NPFs) are looking for buyers en masse. High unit costs reduce the attractiveness of their business. The largest banking and financial groups interested in attracting new clients for compulsory pension insurance can become consolidation centers. However, they are not ready to pay the price requested by the current owners of NPFs against the backdrop of declining investment returns and increasing payments from the funds.

Medium-sized Orenburg NPF "Doverie"

(assets at the middle of the year amounted to 8 billion rubles) is looking for a buyer, sources told Kommersant.

Among the contenders they name VTB Pension Fund (acquired NPF Magnit last year) and Gazfond Pension Savings (Gazfond PN; acquired NPF Almaznaya Osen). According to Kommersant's information, funds comparable to Doverie's include Gephaestus

(4.3 billion rubles),

Stroykompleks

(4.7 billion rubles), and

UMMC-Perspective

(15 billion rubles). ).

As two Kommersant interlocutors note, the owners of the Defense Industrial Fund are also considering exiting the asset.

V.V. Livanova (8.3 billion rubles). “Right now we are not going to sell NPFs, but in the next few years, given the uncertainty in the market, we can return to this issue,” says Olga Lapina, president of the fund.

VTB confirmed that they were studying the possibility of buying NPF Doverie, but the offer did not suit the price. One of Kommersant’s sources says that Gazfond PN stopped the negotiations for a similar reason. According to him, “the offer was at the level of 10–11% of assets.” Considering the high operating costs of maintaining the fund, there is no point in buying it at a high price, Kommersant’s interlocutor believes. General Director of VTB Pension Fund Larisa Gorchakovskaya in an interview with Kommersant spoke about possible purchases of funds at a valuation of “about 8% of assets” in the absence of “limiting covenants” (see Kommersant on July 31). The price of recent transactions to purchase NPFs was about 10% of assets (see Kommersant on January 9 and February 27).

In addition to Gazfond PN and VTB Pension Fund, consolidation centers could become Sberbank NPF (previously acquired NPF VNIIEF-Garant), the group (the latest purchase was NPF Federation), NPF Otkritie. Promsvyazbank is also thinking about creating its own pension business (see Kommersant on February 25).

But so far all negotiations have been suspended, including due to the pandemic.

“Right now no one is ready to make investment decisions. You shouldn’t expect any deals on the pension market in the next three months,” notes one of Kommersant’s interlocutors. The pension funds Gazfond PN, Doverie, Gefest and Stroykompleks did not respond to Kommersant’s request.

But in the future, M&A transactions in the segment will continue. Regulatory requirements for “mid-market funds” are the same as for large funds, and this implies significant expenses, explains Sergei Okolesnov, CEO of the consulting company. “The optimal ratio of NPF expenses to its assets is less than 1%, which is typical for funds from the top ten. For small NPFs it reaches 5%,” notes Alexey Morozov, head of the committee for the development of small and regional funds of the Association of NPFs. According to Kommersant's estimates, for funds put up for sale, this figure is 1.7–3.7%. According to Mr. Okolesnov, in such conditions it is “very difficult for small funds to survive”: they need to either grow, and this requires significant investment from the shareholder, or be sold.

“In the current conditions of frozen transition campaigns, large players, of course, have an interest in acquiring a medium-sized NPF,” notes Managing Director of Expert RA Pavel Mitrofanov.

However, according to him, in the context of falling yields, as well as increasing natural outflows from pension funds as a result of payments, the base for remuneration is shrinking, which puts pressure on the price of funds. Now a buyer's market has developed, the expert explains, small funds need to sell, and large players, as a result of these factors, do not want to pay much and will insist on lowering the price.

Polina Trifonova, Ilya Usov

Contacts

Official website of the NPF Defense-Industrial Fund named after. V.V. Livanova

https://www.npfopf.ru/

On the website you can find a pension calculator for calculating your future pension, documents with performance indicators, the latest news and contact information.

Email mail

Address

Legal address:

107076, Moscow, st. Stromynka, 18, room 5 B

Actual address:

125167, Moscow, Aviatsionny per., 5, k.4A Branches: 625000, Tyumen region, Tyumen, st. Dzerzhinsky, 15 (5th floor), office 512 tel., 8-963-061-04-41, e-mail: [email protected] 680014, Khabarovsk region, Khabarovsk, st. Dzerzhinskogo, 65, office No. 904. tel: (4212) 408664, 408665, 8(909) 825 8878 e-mail: [email protected] 681000, Khabarovsk region, Komsomolsk-on-Amur, st. Sovetskaya, 1, office No. 210, tel., e-mail: [email protected] Separate divisions: 681000, Khabarovsk Territory, Komsomolsk-on-Amur, Mira Avenue, building 29, office No. 22, tel. 4 217 549 250, e-mail: [email protected] 432072, Ulyanovsk region, Ulyanovsk, Antonova Ave., building 1, room 313, tel., e-mail

Hotline number

Unified information service: 8-800-505-87-53 (calls within Russia are free)

Tel: (499) 747-7435, (499) 747-7436 Fax: (499) 747-7436

JSC - NPF - OPF

JSC NPF OPF was registered on December 9, 2014 by the registrar DEPARTMENT OF THE FEDERAL TAX SERVICE FOR MOSCOW. Head of the organization: President Lapina Olga Vasilievna. The legal address of JSC NPF OPF is 107014, Moscow, Stromynka street, 18 5b.

This is interesting: Benefits in the Perm Region for Dental Prosthetics for Labor Veterans

The main activity is “Activities of non-state pension funds”. Organizations JOINT STOCK COMPANY “NON-STATE PENSION FUND “DEFENSE-INDUSTRIAL FUND IM. V.V. LIVANOVA" was assigned TIN 7718003106, OGRN 1147799019125, OKPO 53358167.

Statistics of NPF Defense-Industrial Fund named after. V.V. Livanova: rating of reliability and profitability

According to the Central Bank of the Russian Federation from the reporting “Main performance indicators of non-state pension funds” as of the date: 01/01/2020

Fund assets (thousand rubles): 8128541.39

Statistics on NPO (non-state pension provision) as of 01/01/2020

- Total volume of pension reserves (thousand rubles): 2341689.61

- Total number of participants (people): 12255

- Participants receiving a pension (persons): 9064

- Total amount of pensions paid under NPO (thousand rubles): 157690.24

Statistics on compulsory pension insurance (compulsory pension insurance) as of 01/01/2020

- Pension savings (thousand rubles, market value): 5453227.90

- Number of insured persons (people): 55794

- Participants receiving a pension under compulsory pension insurance (persons): 1052

- Amount of pension payments under compulsory pension insurance (thousand rubles): 27909.22

Profitability of pension savings

Current profitability

Minus remuneration for management companies, specialized depository and fund.

- Profitability of placing funds from pension reserves (NPO): 5.26%

- Return on investment of pension savings (OPS): 8.93%

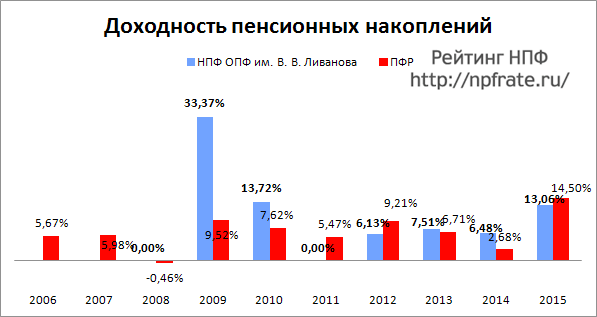

Profitability chart

Data on the profitability of the NPF Military-Industrial Fund named after. V.V. Livanov in 2020 (as of 01/01/2020), including information for the previous 10 years in comparison with the profitability of the Pension Fund of Russia (VEB):

Yield comparison table

| Year | NPF Defense-Industrial Fund named after. V.V. Livanova | Pension Fund |

| 2010 | 13.72% | 7.62% |

| 2011 | -5.56% | 5.47% |

| 2012 | 6.13% | 9.21% |

| 2013 | 7.51% | 6.71% |

| 2014 | 6.5% | 2.68% |

| 2015 | 13.06% | 13.15% |

| 2016 | 12.31% | 10.53% |

| 2017 | 8.62% | 8.59% |

| 2018 | 6.31% | 7.90% |

| 2019 | 8.93% | 7.66% |

NPF Defense Industrial Fund reviews

Information about the fund:

NPF Defense-Industrial Fund named after.

V.V. Livanova was founded in 2000 and provides social security to citizens of the Russian Federation under OPS and NGO programs. The value of the fund’s own assets exceeds 5.3 billion rubles of savings, and the number of clients reaches the 100 thousand mark. The fund is part of the DIA system, i.e. pension funds are insured by the state. Full name of the organization: Defense-Industrial Fund named after. V.V. Livanova JSC NPF

In 2014, the number of participants under non-state pension agreements: 10,806 people; number of participants receiving non-state pension: 8979 people.

Chairman of the Board of Directors - Tatyana Olegovna Filippova. President - Lapina Olga Vasilievna.

Reliability rating in 2017

Expert RA: A+ National Rating Agency (NRA): AA-

The rating agency RAEX (Expert RA) has upgraded the reliability rating of NPF OPF to level A+ “Very high level of reliability”, the rating outlook is “stable”, which means a high probability of maintaining the rating at the same level in the medium term. Previously, the fund had a reliability rating of A level “High level of reliability.”

The National Rating Agency assigned a reliability rating to NPF OPF JSC at the level of “AA-” on the national scale with a stable outlook. This is the first time a reliability rating has been assigned to the Company.

Statistics of NPF Defense-Industrial Fund named after. V.V. Livanova

Statistics on NPO (non-state pension provision) as of 06/30/2016

- Total volume of pension reserves, thousand rubles: 1,862,653

- Total amount of pensions paid under the program: —

- Total number of participants, people: 22,403

- Participants receiving a pension, people: -

Statistics on compulsory pension insurance (compulsory pension insurance) as of 06/30/2016

- Total savings (book value): 4,977,433

- Participants insured, people: 69,573

- Participants receiving a pension under compulsory pension insurance, people: -

- Amount of pension payments under compulsory pension insurance, thousand rubles: —

Accumulated return on pension savings of the OPF fund for 2006-2013. amounted to 136.15%. Average profitability taken into account for 2006-2015. amounted to 11.52% per annum.

Profitability

Profitability data of the Defense Industrial Fund named after. V.V. Livanova JSC NPF as of January 1, 2017, including information for the previous 10 years in comparison with the profitability of the Pension Fund of the Russian Federation:

Official website and contacts

Official website of the NPF Defense-Industrial Fund named after. V.V. Livanova is available at https://npfopf.ru

On the website you can find a pension calculator for calculating your future pension, documents with performance indicators, the latest news and contact information.

Personal account: find out your savings

The OPF Pension Fund provides all its clients with free access to their personal account: https://npfopf.ru/?issue_ >

Address

The central office is located in Moscow at the address: 125167, Moscow, Aviation lane, 5, room 4A Telephone: (499) 747-7435, (499) 747-7436

NPF Defense-Industrial Fund named after. V.V. Livanova on the Yandex map:

Hotline number

24-hour customer service phone number: 8 (800) 505 87 53 (calls within Russia are free)

Customer Reviews

If you are already a client of the Defense Industrial Fund. V.V. Livanova - leave your feedback using the comment form below, tell us about your impressions of interacting with the fund - what you liked, what you didn’t and what needs to be corrected. Also ask questions about the work of the fund, you will receive answers to them from the organization’s employees.

Office addresses: branches and representative offices

Listed below are the addresses of branches of the non-state pension fund NPF Military-Industrial Fund named after. V.V. Livanov in the regions of the Russian Federation:

Severodvinsk Address: 164500, Arkhangelsk region, Severodvinsk, Lomonosova str., 100 (temporarily closed)

Pension funds for military-industrial complex workers and more

The insurance premium rate for compulsory pension insurance in 2014 remains at 22%. The maximum annual earnings from which insurance contributions to the compulsory pension insurance system are paid in 2014 will be 624,000 rubles plus 10% above this amount for policyholders making payments and other benefits to individuals.

This is interesting: Will there be a pension supplement in October?

The program of state co-financing of pensions is still closed: its participants are only citizens who joined the program before October 1, 2013 and made the first contribution before the end of 2013. And only those who made a personal contribution during 2013 in the amount of at least 2,000 rubles will receive state co-financing in the first and second quarters of 2014 - from 2,000 to 12,000 rubles, depending on the size of the contribution.