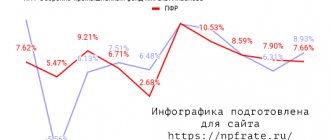

Place of NPF Raiffeisen in the industry

NPF Raiffeisen demonstrates growing profitability and good financial results.

Thus, at the end of 2014, according to the Central Bank of the Russian Federation, it occupied 1st place among all NPFs in Russia in terms of the size of the average account and 16th in terms of the volume of pension savings - 15 billion rubles, was among the top twenty in terms of the volume of pension reserves - 4, 6 billion rubles

Fund indicators:

- 20 billion rubles – NPF’s own property;

- number of insured – 128.7 thousand people;

- the number of participants in the NGO program is 45,021 people.

All data as of 12/31/14.

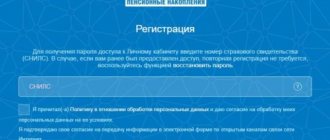

Pension in the bank

One way to increase your pension is to place funds under the control of non-state pension funds. Most often, such funds are organized by commercial banks. Sravni.ru found out whether it is worth giving your pension to bank pension funds and how to do it.

Since 2002, compulsory pension insurance has been introduced in Russia. For Russians born in 1967 and younger, pension savings are managed by the Pension Fund of Russia (PFR), which places them in Vnesheconombank. These savings are formed through contributions from employers. For the unemployed, the funded part of the pension is not accrued.

Most citizens, of course, do not think about retirement. The funds remain under the management of the state fund. This is due to the fact that some people do not particularly expect to live in the future on retirement, others simply do not have time to think about their old age, and still others do not even know that their funds can be invested in other funds.

Since 2004, non-state pension funds (NPFs) have begun to gain popularity. These funds also accumulate pension savings and citizens manage them in order to obtain maximum income.

Today there are more than 150 funds operating in Russia. In addition to all other NPFs, there are so-called open or universal funds. They are the ones who actively build their work on serving individuals. As a rule, the opening of non-state pension funds are subsidiaries of large financial organizations, most often commercial banks.

If we compare the funds of large investment companies and banks, there are no fundamental differences in the funds. True, bank NPFs can place funds in several funds of management companies and thereby reduce both risks and profitability of investments.

Today, many large banks have subsidiary non-state pension funds. They all propose to conclude an agreement on compulsory pension provision and transfer their pension savings under their control. Today, BNP Paribas, Raiffeisenbank, Nomos-Bank, Bank of Moscow, and Gazprombank demonstrate relatively high profitability. The average return on successful funds, as of May 2012, is 5% per annum. At the same time, a number of pension funds also incur losses from their investment activities - last year they amounted to about 10%.

As noted by the chief economist of Finam Management, Alexander Osin, the comparative profitability of funds changes constantly and depends on the activity of demand for “risk” and “quality” in the global economy. Fund funds are allocated through exchange and over-the-counter markets for the purchase and sale of assets.

“From the point of view of investment risks, funds placed with Vnesheconombank are most profitable,” believes Alexander Osin. – From the point of view of insurance against inflation, non-state pension funds and private management companies are more profitable. There is no ideal option for an investor in the current system of financial coordinates. You can optimize investments, focusing on investments in large non-state pension funds and management companies in inflation-protected infrastructure bond funds. However, Vnesheconombank is also increasing the share of such assets in its portfolio.”

When you reach retirement age, you can set up your own individual retirement plan. For example, at Raiffeisenbank NPF you can choose a lifetime pension, a pension with a specified period of succession, a fixed-term pension or a pension until the funds in the account are exhausted.

How much will your monthly pension be if you transfer your savings to a non-state pension fund? For a 30-year-old man who will retire at 60, who already has the funded and insurance part of his pension in his account with the Pension Fund, the pension will be about 13 thousand rubles. At the same time, he must earn at least 30 thousand rubles per month. Moreover, his salary should grow at a rate of 5% per year. And the profitability of NPFs must be at least 6% . If the NPF profitability is about 10% , the pension will be more than 20 thousand rubles.

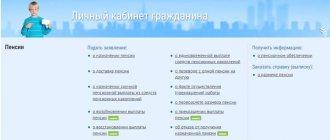

In order to transfer pension savings to a non-state pension fund, you must: 1. Contact the desired NPF with a passport and pension insurance certificate (often the place of application may be a bank branch). 2. Sign an agreement on compulsory pension insurance with the fund in three copies: the first one remains with you, the second one with the NPF, the third one is sent to the Pension Fund of Russia. 3. Sign an application for the transfer of your funded part of your labor pension from the Pension Fund of the Russian Federation to the NPF.

The entire procedure for completing and signing documents usually takes no more than 10 minutes. The money will be transferred to the selected pension fund after January 1 of the following year. The fund can be selected annually. The funded part of the pension placed in any fund is insured by the state.

Features of termination of an insurance contract

The agreement with the company may be terminated upon the occurrence of events that are an exception to insurance coverage, the expiration of the contract, or the termination of transfers to pay for insurance. On the company's part, the contract is terminated if it detects the provision of inaccurate data when opening the program.

Video files

Insurance programs from IC "Raiffeisen Life" and "Raiffeisen Bank Aval"

Concluding agreements to cover financial risks for a client carries a certain burden on the budget. On the part of the insurer, expenses arise during the payment period. For this reason, organizations such as Raiffeisen Life, an insurance company, are allowed to enter the market if they have significant assets. To offset the significant costs, the service provider creates various programs. With their help, you can select the necessary types of risks to cover, as well as optimize the amount of insurance premiums.

Among the programs from Raiffeisen LIFE is life and health insurance - a savings tariff.

As part of interaction with the company, the client is provided with the following benefits:

- creation of a promising fund from premiums. Subsequently, the accumulative part of the funds in Raiffeisen can be used to implement the plans of the policyholder;

- this money can be used as a reserve for emergency needs;

- The personal life insurance fund, by order of the holder, is spent for its intended purpose - to cover the costs of treatment and restoration of lost health.

According to the bank's terms, the program is in many ways similar to depositories. Significant differences are that the insurance company provides coverage for the entire term of the contract.

Also, in the event of loss of ability to work, the client receives compensation regardless of the completeness of receipts in the savings fund.

Related article: Features of insurance in

For individuals

Raiffeisenbank's experience and stable financial position ensures significant coverage of core market services. Individuals are offered traditional, popular and innovative programs that will appeal to even the most sophisticated applicants. The demand for the company's products can be called popular, since the products are affordable and of consistent quality. In addition, most services can be purchased on the insurer’s website.

OSAGO online from Raiffeisen Life will allow you to forget about queues and additional service packages, often imposed by unscrupulous market participants.

In addition to motor vehicle liability insurance, the following programs are offered to individuals:

- accumulative tariffs;

- protection of borrowers for consumer and mortgage loans;

- ensuring risks of loss of health. The program is similar to the standard conditions of VHI - voluntary health insurance. The list of risks is agreed upon at the stage of concluding the contract. Standard and premium programs are available to individuals;

- financial protection of the family budget in the event of an insured event.

The advantages of insurance at Raiffeisen are open terms of cooperation and a guarantee of payments upon the occurrence of circumstances specified in the contract. Among the disadvantages for clients is the lack of government participation and limited presence in the regions. In addition, there are a large number of dubious reviews about the company on the Internet.

Legal entities

The spectrum includes corporate insurance.

Clients from among legal entities are offered the following types of insurance:

- concluding contracts for employees against industrial accidents or illness. A popular type of insurance that supports the status of companies that take care of their employees. With such motivation, it is more difficult for staff to refuse proposals from the administration;

- organization of voluntary health insurance in companies. Under such policies, employees can receive high-quality medical services, for example, diagnostics, dental treatment and others;

- personnel life insurance.

Insurance conditions

The parameters of the financial risk security agreement depend on the program chosen by the client. You can choose the optimal tariff, which depends on the age and gender of the applicant. There is also a standard plan; it does not take into account health status and area of employment.

The coverage of risks also depends on the chosen program; for example, the following offer applies for mortgage protection from Raiffeisen Bank:

- providing compensation for damage upon the death of the borrower;

- covering expenses in case of disability of the first or second group;

- additional security (agreed with the client) in case of hospitalization or loss of job.

Related article: Reviews and descriptions of insurance

The fourth section of the contract with the company specifies exceptions to insurance coverage. Particular attention should be paid to the content of this clause, since upon the occurrence of the events specified there, the agreement with Raiffeisen becomes void.

Raiffeisen Online - personal account

The list of services provided by this bank’s online service includes all the options users need for remote financial management. Anyone who has an active card can register in the system and gain access to advanced features. Registration is a mandatory procedure.

How to login and register?

There are two ways:

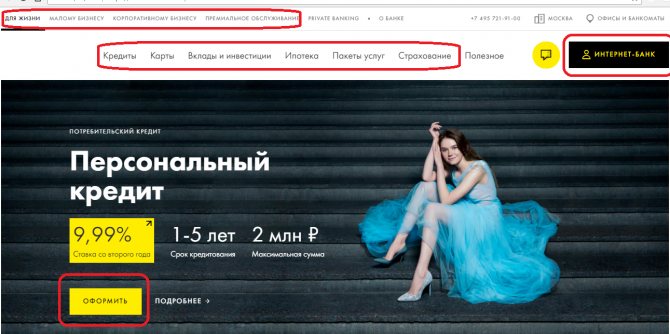

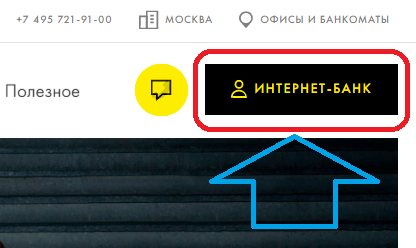

- Open the main page of the official website of Raiffeisenbank. In the window that turns over, you need to activate the button to log in to the Internet bank. Link to main page – raiffeisen.ru.

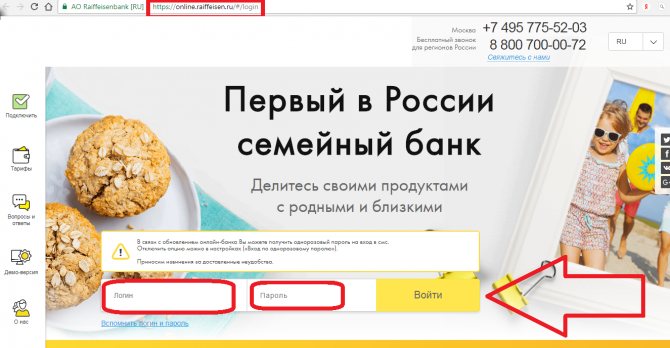

- Launch your browser. Enter the following combination of characters into the address bar - online.raiffeisen.ru. The window that opens is the entrance to your Raiffeisen Online personal account.

Further actions depend on whether you are registered or this is your first login.

Registration and login to your personal account Raiffeisen Bank Online

Access to the system is achieved through a correctly entered login and password. In the same window there is a link that allows you to restore these combinations of symbols if you go through all the steps provided, according to the prompts.

In order to register, there are several options:

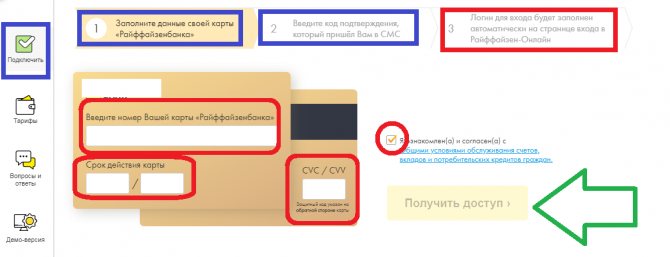

- You need to go to the official website of Raiffeisenbank. In a special form you must enter the numbers from the card number of this bank (must be active). In response to this action, the user will receive a text message on the smartphone with a code set of 4 digits, which must also be entered in the appropriate field. This is the login. After this, a password will be sent to the same phone number (linked to the card).

- You need to visit one of the bank branches. To register in the system you will need a passport. The procedure will take no more than 3-4 minutes.

- You can also activate this service at an ATM. After loading the card, click “Connect”, and a sequence of password characters will be sent to the phone number assigned to the card. The login is written on the check.

It is recommended to change the access code to a new character set immediately after activation to ensure maximum security.

Features of your Raiffeisen Online personal account

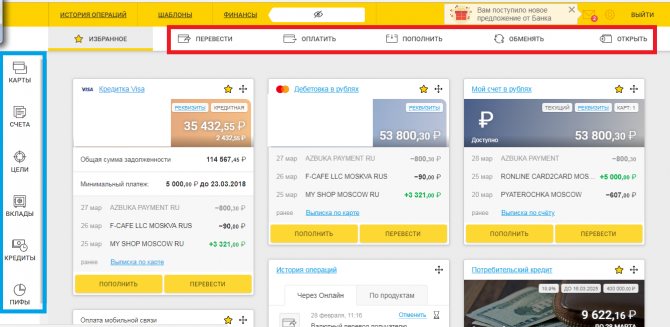

The functionality is constantly updated with new features in accordance with the wishes of users. Today, everyone who registers can:

- track the current status of accounts;

- control expenses on accounts and cards;

- make transactions affecting accounts, cards, electronic wallets, payment systems;

- receive a bank statement about previous transactions;

- exchange currency;

- connect as many of your cards and accounts as you like;

- gain access to information about ongoing promotions and discounts in the bank’s partner stores;

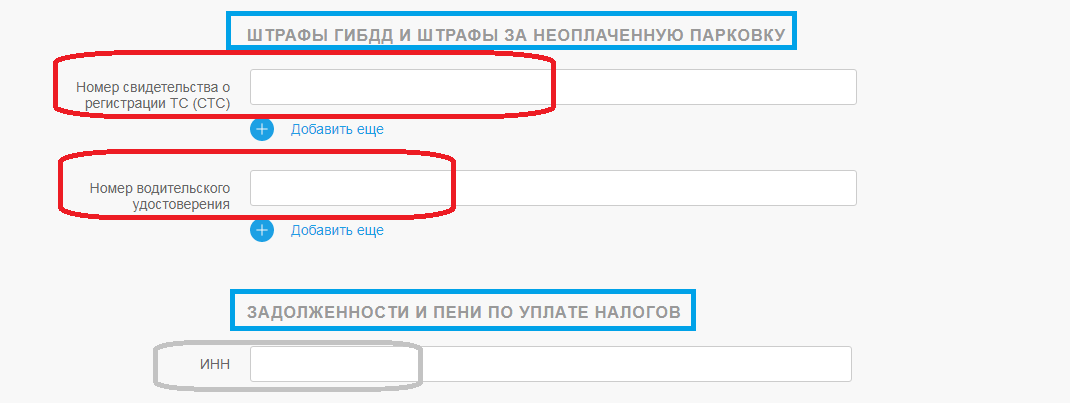

- pay fines, taxes, utility bills, etc. without fees;

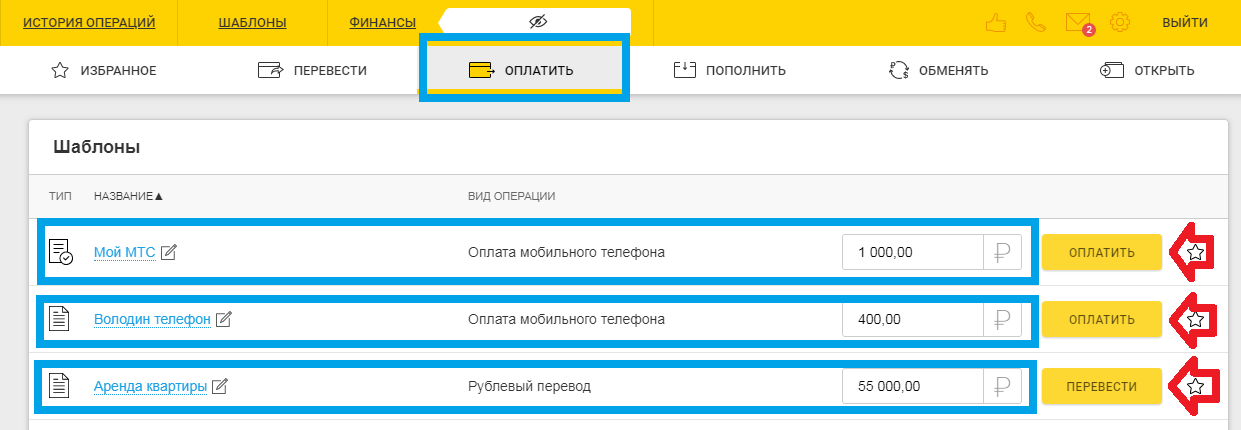

- create templates for regular payments;

- receive information about debts and upcoming mandatory payments (loans, taxes, fines);

- apply for loans;

- repay loans;

- open and manage deposits;

- issue new cards.

This concerns actions with finances. But there are a number of options that complement the user’s comfort.

Additional functions of the Raiffeisenbank Online personal account

To ensure that every client feels cared for by the bank administration, the online service provides the opportunity in their personal account to:

- Join loyalty programs. Earn points, collect them, spend them.

- Find out where the nearest branch or ATM is located. There is a corresponding section that contains a map. You will need to enter your location, and it will display all service points in the specified city (district). One click, and a window with the address and work schedule will open before your eyes.

- Receive support consultation. There are several methods for this, and you need to choose the most convenient one. This could be a direct or return phone call, email or online correspondence.

- Have access to the most objective information. The latest news, offers and information about innovations in the work of the bank and online service are published in your Raiffeisenbank Online personal account.

Most functions are also available on the official website of Raiffeisenbank. But in your personal account you can manage cards.

Credit card management

In your Raiffeisen Online personal account you can:

- order the issuance of new cards;

- block lost ones;

- unblock credit cards;

- set withdrawal limits;

- regulate the maximum amount for payment for purchases;

- limit card expenses by period (day or month).

All this is aimed at providing maximum comfort to bank clients, as well as the security of their funds.