The personal account of an insured citizen on the Pension Fund website was created to ensure comfortable use of government services. The insured person can receive the necessary services without leaving home, namely:

- Assignment of pension;

- Delivery method;

- Payments from maternity capital funds.

Citizens planning to retire can find out in the office about the status of their individual account and pension insurance contributions.

The service for pre-registration of citizens for an appointment through the Personal Account provides the possibility of providing a convenient time for the user to contact the local PFR authority. A person can send an online request to the Pension Fund on an issue of interest through the service. You can use these services on the Pension Fund portal even without authorization in your Personal Account.

To which citizens is it available?

All individuals who have received SNILS have the opportunity to use services in the PFR Personal Account. The document number is needed for registration and authorization on the site. Primary identification is carried out through the State Services portal. After this, the citizen goes to his Personal Account and can use all the services provided by the system.

Employers, private entrepreneurs and ordinary citizens will receive useful information here. People have a lot of questions. They can be divided into several categories. The most popular of them will be highlighted below.

Your options

The electronic platform gives the user the opportunity to familiarize themselves with the information located there. A person can receive the following information:

- The number of points scored during the tax period;

- Working hours in specific locations, which may affect the calculation of accruals in the future;

- Duration of total work experience;

- Information on social benefits and the amount of maternity capital accumulation;

Your personal account offers a large number of tabs and links. They allow the user to obtain useful information in thematic blocks. This is especially important for those who visit the site for information about pension rights.

Users significantly reduce their waiting time in queues. Sitting at home, you can order a letter electronically through the website es.pfrf.ru and receive a paper response from a specialist. The service provides services for ordering reference documents. If sending by mail is not possible, the time and place of receipt in person is indicated.

How to change a non-state pension fund

Not all non-state pension funds (NPFs) that work with our funded part of the pension show good profitability. Before December 1, 2020, you can have time to transfer from one NPF to another or transfer to it from the Pension Fund of Russia (PFR). We tell you how to do this, what has changed this year and who can change NPF without losses.

Once every five years, Russians can change one NPF to another without loss of income or transfer from a Pension Fund to a Non-State Pension Fund. This year, the transfer of pension savings takes place according to new rules. An application to change the fund must be submitted no later than December 1. Previously, this could be done before the end of the year.

Also, starting this year, a so-called “cooling period” is in effect. The person is given one more month (until December 31) so that he can refuse to change his pension insurance provider if he suddenly changes his mind about doing so.

The remaining changes are rather technical.

“You will definitely be asked to sign a notice stating that you agree with the loss of investment income if such losses threaten you,” says Sergei Okolesnov, CEO of the consulting company.

“Moreover, these losses can be very high.” For example, if you are “silent” and your funded pension has always been in the Pension Fund, then this year when you choose a non-state pension fund you will lose investment income for 4 years. The amount of the loss must be shown on the notice.

The only category of citizens who do not lose anything are those who in 2014 (5 years ago) wrote an application to transfer to the NPF, and now decided to leave it, says Sergei Okolesnov.

Important: if you wrote a transfer application in 2014, then it will come into force in 2020, and the five-year countdown begins from this year.

How to change fund

There are several ways to switch from one pension insurer to another:

- on the State Services portal;

- coming in person to the pension fund

- to the MFC (if you transfer savings from a non-state pension fund to the Pension Fund).

According to Sergei Okolesnov, this can only be done on the State Services portal if you have a qualified electronic digital signature. You can obtain it from accredited certification centers. You need a passport and SNILS.

There, on the State Services portal, you can find out the size of your savings and the amount of investment income.

To change NPF you need to fill out an application. You can download the template to fill out here.

How to choose a non-state pension fund

The money of Russians in pension funds is insured by the state. When a license is revoked, all savings are transferred to the Russian Pension Fund, but only the contributions themselves without investment income.

Therefore, when choosing a non-state pension fund, you should pay attention to its reliability. Rating agencies can help with this. For example, there is a reliability rating on the Expert RA website.

Experts note that the fund’s proximity to large financial groups can also indicate the stability and sustainability of the fund.

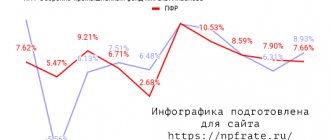

Of course, when choosing a non-state pension fund, you should focus on the profitability of previous periods and convenience (for example, the presence of a personal account, the friendliness of operators, etc.). Just remember that past investment returns do not guarantee the same returns in the future. This is how much the largest funds earned over the past three years, according to the Bank of Russia.

Profitability of the top 10 non-state pension funds by asset size

| Pension Fund | Asset size, thousand ₽ | 9 months of 2020 | 2018 | 2017 |

| NPF "Surgutneftegas"NPF "Otkritie" | 41 905 439574 087 805 | 13,17%12,46% | 5,32%-10,8% | 8,74%- |

| NPF "Neftegarant" | 211 487 614 | 11,64% | 5,12% | — |

| "NPF Sberbank" | 647 260 665 | 10,28% | 4,64% | 8,7% |

| NPF "Bolshoi" | 51 593 542 | 10,28% | 2,21% | 7,16% |

| NPF Transneft | 106 374 956 | 9,95% | 3,72% | 8,39% |

| NPF "Safmar" | 271 038 762 | 9,64% | -11,05% | 2,98% |

| NPF VTB Pension Fund | 245 713 709 | 8,94% | 5,53% | 9,02% |

| NPF "GAZFOND pension savings" | 578 541 817 | 8,61% | 6,37% | 9,53% |

| NPF "Future" | 258 236 282 | 6,22% | -15,28% | -2,01% |

*Profitability of investing pension savings minus remuneration to management companies, specialized depository and fund

NPF Blagosostoyanie and NPF Neftegarant were not included in the list because the funds deal only with pension reserves and not savings.

Ekaterina Alikina, illustration by Lamia Al Dari

Source: https://www.Sravni.ru/text/2019/11/28/kak-pomenjat-negosudarstvennyj-pensionnyj-fond/

Citizens living abroad

The pension fund also thought about this category of citizens. Site visitors living outside the Russian Federation also have access to all information about the assignment of pensions and social benefits. They can find out on the portal about the current status of the document and order the necessary certificate of the established form.

In recent years, dramatic changes have been observed in the provision of services to citizens in the Pension Fund of Russia. There were much fewer queues and associated scandals between clients. There were often conflicts with employees when the client had to visit the PFL authorities several times to resolve just one issue.

This still happens now. This is only due to the low computer literacy of our citizens. Most of them are people of retirement and pre-retirement age.

Work to improve remote service to citizens through personal accounts in the Pension Fund of the Russian Federation continues. The range of issues that can be resolved without visiting the territorial bodies of the pension fund is expanding.

Application for transfer to the Pension Fund from the Non-State Pension Fund through public services

Is it possible to change NPF through State Services

? Yes, it is possible to fill out an application and change NPF through State Services, however, for this the user must:

- pre-register on the portal and confirm your account;

- and also, have an electronic signature for this, which can be obtained at the Portal User Service Centers. An electronic signature is needed to certify an application for transfer to a non-state pension fund through State Services.

It is worth noting that changing NPFs through State Services is absolutely free.

How to transfer to the Pension Fund of the Russian Federation from a non-state pension fund?

We'll show you how pension savings are formed in the picture:

Executive bodies provide the opportunity to all citizens who wish to transfer their funds from NPFs to the Pension Fund and inform through legislation on how to transfer pensions to the State Pension Fund.

The rules for transferring to the Pension Fund provide several options:

- Plan a visit to the Pension Fund of Russia branch and submit an application for transfer from a non-state company to the Pension Fund of Russia. The application form can be obtained either at the fund’s branch or downloaded from the official website at: pfrf.ru. In addition to the application, you must have:

- identification;

- SNILS.

The picture shows a sample application for transfer to the Pension Fund of the Russian Federation from a non-state pension fund:

You can transfer savings without losing interest on investments once every 5 years. In case of filing an application for early transfer to the State Pension Fund, funds are transferred no later than March 31 of the following year. Savings will be transferred with loss of capitalization.

- It is also possible to make the transition by notifying a non-state pension company of the desire to leave the NPF and transfer their savings to the Pension Fund. In this case, NPF employees will help you terminate the agreement and draw up a new application, and also advise you on the amount of savings in your personal account, taking into account investment income.

- It is possible to submit an application to transfer to a pension fund not only in pension funds. This service is also provided in companies cooperating with the Pension Fund of Russia (Sberbank, VTB, Alfa Bank, Rosselkhozbank, etc.).

In addition to these methods, insured citizens can use State Services to transfer from a non-state pension fund to a state one.

How often can you change NPF?

The legislator provides the right for future pensioners to switch from one NPF to another. There are only 2 ways:

- Urgent, i.e. An application for transfer of funds can be submitted once every 5 years. Consequently, investment income is completely preserved;

- Early, i.e. the applicant has the opportunity to transfer to another NPF once a year. However, previously received investment income is not paid out. And therefore the volume of savings does not increase, and in some situations it may even decrease.

In this regard, the benefits of maintaining savings in one NPF for a period of at least 5 years become obvious. Then the pension capital will become more and more.

Note! Don't go overboard with the number of statements:

- if, within the period specified by law, several applications for the transfer of funds to the Pension Fund of the Russian Federation are submitted, then the decision will be made on the most recent one;

- If several applications are submitted on the same day, the Pension Fund of the Russian Federation will refuse to satisfy all of them.

Instructions for transferring to a non-state pension fund through government services

To change a pension fund through the State Services portal, it is not enough to have a confirmed account. An enhanced qualified electronic signature will also be required. An electronic signature is required to certify the user’s application when sent from government agencies, since the NPF is not one of the federal institutions.

After logging into your personal account, the user will need to do the following:

- Enter the Pension Fund in the search bar and click “Find”;

- Among the presented list;

- Then select the required service;

- On the next page you can get acquainted with detailed information about the service, then click the “Get service” button;

- Next, the user will see a form with an application. Filling out the form will not be difficult, as it is short and does not have complex questions. However, difficulties may arise with indicating the current pension fund, because it is necessary to indicate its name, and there is no possibility of choosing ready-made options.

When the user fills out an application to transfer to a non-state pension fund, the portal will require that the procedure be certified with an electronic signature. To begin with, the system will require you to install the special “Cryptocomponent” software, then you need to insert the removable disk with the electronic signature into the USB connector, after the software identifies the flash drive, just click “Finish” and the application will be sent.

An application to change the Pension Fund is approved by default. The main condition is the correct indication of the new and old pension funds so that interaction is carried out between them. You can see if the NPF has changed in a few days using a notification about the status of your personal account.

https://www..com/watch?v=ynughlRiQ9Y

Where can I form a funded pension?

Persons who have decided in favor of forming pension savings can use the following options for their placement:

- In the Pension Fund of the Russian Federation with the choice of a management company (MC) . In this case, the management company can be any - private, with which the Pension Fund of the Russian Federation has entered into an agreement, or state-owned (Vnesheconombank).

- In a non-state pension fund (NPF).

If the savings are in the management company, then the assignment and payment of the funded pension will be made by the Pension Fund of the Russian Federation, in the case of placing funds in a non-state pension fund - by the selected NPF.

The formation of a funded pension occurs through compulsory insurance contributions transferred by the employer for its employees to compulsory pension insurance (compulsory pension insurance), voluntary contributions , and through the investment of these funds. Insurance contributions are transferred by the employer in the amount of 22% of the employee’s salary , of which:

- 6% goes to a funded pension;

- 16% — for insurance pension (10%) and solidarity tariff (6%).

It is worth remembering that from 2020, pension savings from insurance contributions to compulsory pension insurance can be formed by persons born in 1967 and younger who, before December 31, 2015, decided in favor of a funded pension. The same opportunity remains for citizens who have recently started working, and for whom no more than 5 years have passed since the start of deductions of insurance premiums.

The procedure for forming a pension in a non-state pension fund or management company

Unfortunately, since 2014, by decision of the Government, the formation of funded pensions from insurance contributions has been “frozen” . As a result, all contributions are transferred only to the insurance pension. The moratorium has been extended into 2019 and will also remain in effect in 2020. As a result, only the voluntary component remains for the formation of pension savings.

The procedure for forming a funded pension differs from the formation of insurance pension provision:

- Unlike an insurance pension, the funded version does not accrue pension points. Incoming funds are placed in the citizen’s individual account in the management company or non-state pension fund of his choice.

- Pension savings are not indexed ; their profitability depends on their investment in the financial market. However, there are risks, since this process can have both positive and negative results. In any case, there are state guarantees : in the event of losses or cancellation of a license from a non-state pension fund, the insured person retains savings in the amount of paid insurance premiums, but excluding investment income.

In the event of the death of the insured person, his savings are inherited and can be paid to his relatives or to the person whom the insured person indicated in the agreement with the NPF (UK) or in the application.

How to transfer to the Non-State Pension Fund through State Services

It is not necessary to stick to one non-state pension fund. During the period of working life, at his own request, a Russian citizen has the right to change pension funds as many times as he sees fit. Each time the service is provided free of charge.

When the user fills out an application to transfer to a non-state pension fund, the portal will require that the procedure be certified with an electronic signature. To begin with, the system will require you to install the special “Cryptocomponent” software, then you need to insert the removable disk with the electronic signature into the USB connector, after the software identifies the flash drive, just click “Finish” and the application will be sent.

Source: https://uchebnyj.okd1.ru/zakon/zayavlenie-o-perehode-v-pfr-iz-npf-cherez-gosuslugi/