Organization "NPF Electric Power Industry" appeared in 1994. In 2010, the institution expanded. It included three more pension organizations. Additionally, there is an insurance institution “Energogarant”. Today the company is one of the five largest associations. A pensioner can control the accumulation of funds using his personal account. However, you will first need to go through the registration procedure. We will talk further about the conditions under which access to the system is provided, the possible amount of profitability, as well as the advantages and disadvantages.

Creating an account in the Electric Power Industry Pension Fund system and logging in

The registration procedure is completed as quickly as possible. All you have to do is find her email address, go to the site and get an account.

To log in, an individual must provide the following information:

- passport information;

- SNILS number;

- date of birth.

When a resident of Moscow or another city is already a client of the electric power industry pension fund, in order to enter the site, you will need to provide a login or password. In practice, not all individuals remember personal data. In this case, the information can be restored by clicking on the column of the same name under the login form.

The non-state pension fund for the electric power industry provides citizens with a whole list of opportunities that they can take advantage of via the Internet.

Thus, in 2020, a person will receive the right to perform the following actions through the official website of the NPF:

- remotely find out the size of the funded part of the pension;

- correct personal information and confirm data provided for the electric power industry pension fund;

- calculate old age benefits;

- apply for a pension;

- enter into an agreement with the institution;

- request a copy of the documentation.

If you have any problems or need to ask a question to the pension fund, the hotline can help. Calls are accepted by number. Employees are ready to help citizens from 8:00 to 22:00. The applicant is provided with answers to all questions of interest. The official website of NPF “Electroenergy” also contains other data. So, here are reports for various periods of time. Additionally, news and history are published.

Practical advice: By visiting the official website of the institution on the Internet, a person will be able to familiarize himself with corporate programs and offers created for individuals. A separate section provides contacts and addresses of branches. It is acceptable to send a message to the Electric Power Industry Non-State Pension Fund via feedback. There are special forms available on the website for this purpose.

Legal relations

Citizens of the Russian Federation had the opportunity to transfer part of their savings from the Pension Fund to Non-State Pension Funds until the end of 2020.

At the moment, the investor has the right to change the pension fund once a year. And in some cases, depending on the terms of insurance, this is allowed to be done only once every five years. If any controversial or current issues arise, you can contact the NPF Electric Power Industry hotline specialists.

Note! Employees do not provide personal information over the phone.

Pension transfer

The procedure for transferring accumulated funds in the country is carried out by:

- employer of a citizen;

- the account owner himself.

An agreement must be concluded. The state provides several options for holding the event. To do this you need to contact:

- to a branch of the organization;

- in person at the Pension Fund;

- to branches of banking institutions that are partners of the fund.

Another person to whom a power of attorney has been issued also has the right to deal with the issue. It must be certified by a notary.

How to view your savings

There are two options, using which you can find out about the size of your savings.

This can be done by contacting the fund’s branch directly or through the website of the NPF Electric Power Industry by logging into your personal account. To register, you need to enter your personal and passport data.

In your profile section you can find the following information:

- information about your own account;

- request a sample application;

- review copies of the agreement.

You are also allowed to use the pension savings calculation program.

Termination of cooperation

To terminate contractual obligations between the parties, you must fill out a written application. It should indicate:

- full postal address;

- bank account details;

- information about another NPF.

All deposits are transferred along with savings within three months.

Attention! Termination of cooperation between a citizen of retirement age and an organization entails losses for the former.

Profit will be accrued only for a short period and upon return of all savings a tax of 13% will be withheld.

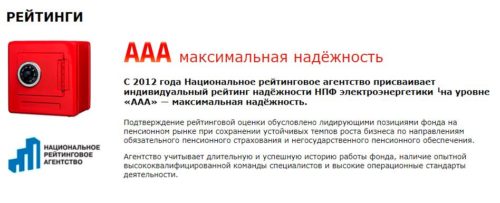

Reliability rating of the Electric Power Industry Pension Fund

The AAA mark was first awarded to the company in 2012. It has not changed for a long period of time. At the end of 2017, the company was placed on the waiting list. The fact is that the investment portfolio could not bring high results. Therefore, adjustments were required.

A waiting list is a special mark that is assigned to banks and pension funds that are undergoing significant changes. It is neither positive nor negative. Future prospects are taken into account. The mark is adjusted when it becomes clear how the changes will affect the functioning of the pension institution. Today the forecast has changed from uncertain to stable. This means that the NPF of the electric power industry is able to fulfill its obligations in full.

Advantages and disadvantages

The combination of user opinions and official data determines the positive and negative aspects of cooperation with NPF Electric Power Industry:

| pros | Minuses |

| High AAA reliability ratings | Delay in payments |

| Long service life | Imposing contractual relations for energy industry workers |

| Average level of profitability | Impossibility of concluding a contract with persons over 44 years of age |

| Large number of investors | |

| Availability of information about the activities of the fund, personal account |

NPF Electric Power Industry is recognized as one of the most stable in terms of development among non-state pension funds in Russia.

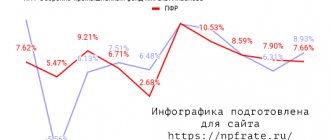

Pension fund profitability

Today, NPF Electric Power Industry cooperates with 600 organizations throughout the country. The institution has corporate programs created for each company. The composition of the personnel and financial capabilities are taken into account. The amount of the pension depends on the chosen program and frequency of contributions. So, if a woman has the right to maternity capital, it can be used to form an old-age payment. The application must be submitted in person during a visit to the organization.

| Year | Profitability of the Electric Power Industry Pension Fund |

| 2014 | 9,04% |

| 2015 | 8,46% |

| 2016 | 8,94% |

| 2017 | 4,3% |

Service

What do they say about service? Here, too, it is difficult to find a common opinion. The quality of customer service varies. Much depends on the city in which the collaboration takes place. Every place has its own employees, everyone behaves differently.

The good news is that you can not only personally contact the Non-State Pension Fund for the Electricity Industry. “Personal account” is an opportunity that attracts many. This is a way to work with the Pension Fund online.

This function works, as many have noted, with some glitches. But not too critical. If desired, you can easily consult a consultant directly via the Internet. Also, “Personal Account” allows you to easily manage your account and order statements from it.

During a personal visit to offices, visitors, as a rule, also try to provide due attention. And it pleases. Nevertheless, the Non-State Pension Fund of the Electricity Industry receives mixed reviews for customer service.

On the one hand, attention is paid to everyone. And they answer questions that visitors ask. On the other hand, the speed of service leaves much to be desired. Sometimes consultants do not answer questions, but only confuse clients. Fortunately, there are not many such complaints. There are no significant complaints about service, but NPFs have shortcomings in this area.

Official website of NPF Electric Energy

The non-state fund has simplified relationships with clients by creating its own website. Now at www.npfe.ru you can find a resource that will allow clients to manage their financial future.

Thanks to the dynamic development and successful implementation of technologies, NPF was able to gather a client base of 1.3 million clients. The organization manages 136 billion rubles of pension funds, and the number of pensioners with concluded contracts is 116 thousand.

On the main page of the official website there is a menu with main sections from offers to individuals and companies to online services. The latter work on the basis of a personal account, registration in which only requires a passport and SNILS.

Important! Your personal account is available to all clients of JSC NPF Electric Power Industry on the website.

The development of new services continues, but in the meantime the following are available to clients:

- filing an application for pension payments;

- requests for necessary copies of documents;

- updating and confirming personal data;

- conclusion of a pension agreement.

Registration does not take much time, and the unlocked benefits of an expanded profile allow you to successfully interact with the fund from any convenient location. You can obtain such a profile if you have a valid phone number in your organization's database.

Any question regarding pension savings can be asked by calling the toll-free hotline 8-800-200-44-04. You can also make a preliminary appointment for a subsequent visit to the office using this number.

NPF personal account

Advice from lawyers:

1. According to NPF Sberbank, I entered into an agreement with them in 2020 on February 14, this is indicated in my personal account, but in the state account. services, I ordered a statement from the Pension Fund, it states that on March 4, 2020, I am their insurer, tell me where my savings went for this year, thanks in advance.

1.1. See the extract from the Sberbank NPF website. All deadlines are indicated there: transfer of funds from the Pension Fund, investment results. The extract from the Russian Pension Fund indicates the non-state pension fund to which your funds were transferred.

Did the answer help you?YesNo

Consultation on your issue

8

Calls from landlines and mobiles are free throughout Russia

2. The funded part of the pension in a non-state pension fund. In the personal account of the Pension Fund of Russia the accumulative amount is indicated as 198,000 rubles, and in the personal account of the Non-State Pension Fund - 320,000. So what is the accumulated amount, from which one should I calculate when calculating whether I can receive the entire amount at a time or not? And why such different amounts?

2.1. Focus on the amount that is in the NPF if you have entered into an agreement with them. On the Pension Fund website and in your personal account, complete information is not always displayed. Read the terms of payment in your agreement with the NPF.

Did the answer help you?YesNo

3. In August 2020, I was transferred to the Otkritie NPF without my consent; I was previously a member of the RGS NPF. I went into my personal account and saw that they charged me RUR 494. Are the actions of NPF Otkritie legal and can I transfer my funded part of my pension to another pension fund without significant losses?

3.1. good day, Elena! NPF RGS was merged with NPF LUKOIL-GARANT, which was renamed NPF OTKRITIE. This means that the change of fund occurred not due to the transfer of your funds in connection with the new agreement on compulsory pension insurance, but due to the reorganization of the NPF RGS. The loss of 494 rubles needs to be dealt with; I believe that the reason is different (it is possible that a negative result of investing your funds will be reflected on your account, which is not legal, since NPFs are obliged to comply with the principle of safety of the funds of insured persons). You can transfer funds to another NPF if you enter into a new agreement with the new NPF and fill out a regular application for transfer from a NPF to another NPF (NOT early), in this case you will be transferred without loss of investment income after 5 years, from the year of filing such an application . I don’t recommend that you change NPFs now, since there will be further changes to pension legislation soon, so it’s not clear what will happen in 5 years, but you need to deal with the loss of 494 rubles. Contact us if you need help in filing a claim with JSC NPF OTKRITIE.

Did the answer help you?YesNo

4. How can you terminate the agreement with NPF “Blagosostoyaniye” and return contributions to your personal account. Can this be done without visiting the office, through the bank’s personal account? And also, contributions are made for personal and corporate, what is the difference, and which of them do I have the right to return?

4.1. The agreement can be terminated only by concluding an agreement with another non-state pension account (submitting an application for the transfer of pension savings to this new NPF) or by submitting an application for the transfer of pension savings to the Pension Fund of the Russian Federation. Pension savings will be transferred to a new insurer (NPF or Pension Fund). It is impossible to receive them in your hands before the pension period arrives.

Did the answer help you?YesNo

5. In 4 months I will retire(07/15/1959). At the same time, my employer company entered into an agreement with NPF Otkritie (NPF Electric Power Industry) and as a result, today I see two accounts in my personal account: Funded pension and Non-state pension with specific amounts. How and when can I use these amounts? My name is Andrey Borisovich. Thank you.

5.1. Men have the right to apply for a funded pension at the age of 60. As for a non-state pension, one of the grounds for its assignment is reaching retirement age. However, specific grounds are specified in the Agreement on non-state pension provision concluded between your employer and the NPF, as well as in the Pension Rules, which are an integral part of this Agreement. The employer and NPF are also obliged to inform you about the conditions for assigning a non-state pension.

Did the answer help you?YesNo

6. Since 2008, I have been a client of NPF Elektroenergetika. In August 2018, it was renamed into NPF Lukoil-Garant, in December 2020 it was renamed into NPF Otkritie. Your personal account shows savings of 935 rubles. Where's the money?

6.1. You need to request an extract from your pension account in writing from NPF Otkrytie; perhaps the information is reflected incorrectly in your personal account.

Did the answer help you?YesNo

7. I am 46 years old. In 2013, I registered the funded part of my pension at the Non-State Pension Fund “Future”. Until 2020, the organization where I work transferred part of the pension fees to the NPF. Then, as far as I understand, the government decided to freeze such deductions. Now in the personal account of the NPF, I saw a good amount that is in the accounts there. Is it possible to withdraw money from a non-state pension fund before retirement age?

7.1. Good afternoon Elena, there is no retirement age, but not earlier than 55 years. The funded pension is assigned to insured persons entitled to an old-age insurance pension (Clause 1, Article 6, Federal Law No. 424-FZ of December 28, 2013.

Did the answer help you?YesNo

7.2. Submit a written application to the authority and wait for an answer, and then decide to go to court or wait until you get older.

Did the answer help you?YesNo

8. I work in a kindergarten. Several times we were transferred from one NPF to another. In my PF personal account, I found out that I belong to Lukoil Garant. How to register there if their personal account is closed? Thanks a lot.

8.1. Good afternoon From January 1, 2019, JSC NPF LUKOIL-GARANT was renamed JSC NPF OTKRITIE. Foundation website: https://open-npf.ru call the Foundation and clarify the procedure for logging into your personal account.

Did the answer help you?YesNo

9. NPF “Doverie” posted information in my personal account that the transfer of savings to a new insurer will be carried out before the end of 2020. At the moment, there is no information that the savings have been transferred. What should I do?

9.1. Good afternoon NPF Trust is in the process of joining NPF SAMAR. All information about the procedure and deadlines should be on the website. You can write a letter asking for the necessary information, and I also recommend requesting an extract from your account in order to properly monitor the work of the fund. If you have any questions, write in a message.

Did the answer help you?YesNo

10. In 2011 I joined the NPF, I have absolutely no memory of this fact. In 2014, I got another job, where I signed an application to another fund. Is it possible to belong to 2 funds at the same time? None of them asked to write a statement of refusal or transfer. And on the government services website I have the first fund listed in my personal account. What to do about it? And can I write an application to the 1st fund to withdraw and withdraw my savings?

10.1. Dear Olga, you can be a member of 2 funds at the same time. You can write an application to the 1st fund to withdraw and withdraw your savings.

Did the answer help you?YesNo

10.2. Good afternoon Insurance contributions for the formation of a funded pension can only be taken into account by ONE insurer

(PFR or NPF). At the same time, to transfer to a non-state pension fund, you need to conclude an agreement on compulsory pension insurance and fill out an application to the Pension Fund for transfer to a non-state pension fund (early transfer), and to transfer from a non-state pension fund to the Pension Fund, you only need to fill out an application for such a transfer (regular or early transfer). You cannot withdraw funds from pension savings; you can only transfer these funds from one insurer to another, and also, after assigning you an old-age insurance pension, fill out an application for assigning you a funded pension.

Did the answer help you?YesNo

11. I did not enter into an agreement with NPF Future, but off. website of the Russian Pension Fund, in my personal account it is indicated that I am a client of the NPF Future. How can I get a copy of the agreement with NPF Future? Thanks for the answer!

11.1. Send a letter with a request to send you a copy of the agreement to the legal address of NPF Future.

Did the answer help you?YesNo

12. I have my pension savings in NPF. On the website, NPF, my pension savings are displayed in my personal account. The last savings were in 2020, and I still work in the same organization to this day. Please tell me, it turns out that in 2017-2018 the organization did not pay contributions to the pension fund? And what to do with it? Thank you very much in advance for your answer.

12.1. Hello. Pension savings have been “frozen” by the Government for which YOU VOTED IN THE ELECTIONS. Request an extract from the individual personal account of the Pension Fund through the State Services Portal, and in 5 minutes you will find out whether your employer paid insurance contributions for you.

Did the answer help you?YesNo

12.2. First, make a request to the Pension Fund. Federal Law No. 167 (Article 15) states that an employee has the right to demand information about accruals, and in their absence, apply to a judicial authority.

Did the answer help you?YesNo

13. I went into the personal account of a non-state pension fund, where I found out that my agreement with this fund was closed and the funds were transferred to another NPF! I didn’t write an application for transfer to another NPF, I didn’t sign any contracts! How to understand the situation? Who did it, how and how to fix it? Thank you.

13.1. Hello! If funds were transferred to this non-state pension fund unlawfully, without your consent, you can submit an application (complaint) to the NPF. Specialists will explain your rights to manage your pension savings, including transferring your pension funds back to the Pension Fund or Non-State Pension Fund of your choice.

Did the answer help you?YesNo

Consultation on your issue

8

Calls from landlines and mobiles are free throughout Russia

14. Pension documents were submitted to the Pension Fund of the Russian Federation and accepted. They told me to call in 10 days. Today I went to the State website. services, in my personal account I requested information about the status of my individual personal account. All information matches. But! 4. Your insurer since 06/02/2016 is: FUTURE NPF Nothing has been transferred anywhere. What to do? Retirement is just around the corner.

14.1. It is possible that some comrades wandering around the entrances came to you and asked for your SNILS number. You gave. Or one of your people living in the house. Or at work, for example. We need to find out.

Did the answer help you?YesNo

14.2. — Hello, check with the pension fund. We cannot know this. Good luck to you and all the best, with respect, lawyer Legostaeva A.V.: sm_ax:

Did the answer help you?YesNo

14.3. You have the right to contact the Pension Fund of the Russian Federation through the government services portal about the transfer of funds from the NPF to the Pension Fund of the Russian Federation and indicate separately in the application that you have become aware of the transfer of funds to the NPF through the government services website. This will not affect your right to receive a pension, but the funded part of the pension can be paid to you either from the NPF or through the Pension Fund of the Russian Federation after the transfer.

Did the answer help you?YesNo

15. In my personal account on public services it is written that some of my data in Rosreestr has been changed. NPF received my digital signature for government services. Could this be some kind of scam?

15.1. Fraud is also possible. Since only you have the right to use your electronic digital signature. Good luck to you and all the best.

Did the answer help you?YesNo

16. I am a member of the NPF. I switched a few years ago. So I went to the website of this NPF and went to my personal account. And there, in savings, insurance premiums are 20,000 rubles and then you don’t have a non-state pension. How to understand this? Can I transfer this money back to the Russian Pension Fund?

16.1. Good afternoon It is understood that there are no additional voluntary contributions. Yes, you can transfer to the Pension Fund at any time; to do this, go to the Pension Fund and submit the appropriate application. Thank you for applying, we wish you good luck!

Did the answer help you?YesNo

17. At the beginning of 2020, I filed an application with the state. The Pension Fund about the transfer to the Sberbank Non-State Pension Fund, they gave me a receipt. A little earlier, in 2014, I entered into an agreement with Sberbank Non-State Pension Fund. After some time, I logged into my personal account and it turned out that I would be transferred to the NPF only in 2021. Why so long? Where will my pension contributions go?

17.1. After some time, I logged into my personal account and it turned out that I would be transferred to the NPF only in 2021. Why so long? Where will my pension contributions go? - Check with the Pension Fund of the Russian Federation at your place of residence for this point.

Did the answer help you?YesNo

18. I am a client of the non-state pension fund of Sberbank. However, I received unverified information that my contract with Sberbank was canceled and they offered me to move to NPF Future. On the spur of the moment, I agreed and signed all the papers. Now I found information in the Personal Account of Sberbank NPF that I am still their client. How can I terminate the agreement with NPF Future and remain in Sberbank NPF without losing funds?

18.1. Call the hotline number indicated in the contract with PB “Future” and explain the situation, try to revoke the contract if not enough time has passed. Transfer of funds from one fund to another is carried out within about a month. Usually they will accommodate you if they consider the reason to be valid - no one will force you into an agreement against your will. Or, at the end of the year, apply to transfer your pension savings back - the possibility of changing the fund is provided.

Did the answer help you?YesNo

19. According to the 3-NDFL declaration, income to the NPF was indicated. Now the tax office needs a receipt for the payment of contributions to the NPF, but I did not physically make contributions, so there is no receipt or other payment document. I entered into an agreement with the NPF and signed the Application. Then in my personal account I saw that the amount came to the NPF from the previous insurer of the Pension Fund of Russia. From whom and what document should I take for the tax office to confirm the amount received by the NPF?

19.1. You need to take an extract from the pension fund.

Did the answer help you?YesNo

20. I transferred the savings portion to the Kitfinance Non-State Pension Fund. I checked in my personal account, there are 2000 rubles. I took early retirement in 2020 (50 years old), and continue to work. I would like to know why the savings portion is so small, for what reason and where to go? Since 2004, the salary has not been lower than 10,000. Thanks in advance.

20.1. Hello! Your savings part was formed over a short period of time. Contact the Pension Fund for clarification about savings and transfers from the employer.

Did the answer help you?YesNo

Please, can I transfer my funded part of my pension to a non-government pension fund in 2016?

My name is Alexander. I tried to register in the personal account of NPF Trustia where I entered my phone series and passport number,

NPF Kit-Finance at the employment company offered to transfer the funded part of the pension from the steel fund to Kit-Finance.

I have been registered for two years and am still working for an individual entrepreneur. There is a labor record, as well as an employment contract.

I entered into an agreement with NPF Renaissance Life and Pensions and I can’t log into my personal account, it says that my SNI is not registered.

Until 2013, my pension savings were in the NPF Lukoil-Garant, and since 31.

NPF Electric Power Industry - profitability rating and customer reviews

The work of NPF Electric Energy began two decades ago - in 1994. Today, according to the rating of non-state pension funds, it is among the top five pension funds not only in terms of financial performance indicators, but also in the total number of clients, as well as the level of service. As of March 2013, 950,000 people—that’s exactly how many clients—entrusted this fund with insuring their pensions, and over 530,000 signed up for non-state pension agreements. The total volume of pension payments exceeds $9 billion.

I didn’t like the fund, as they wrote above, there are different answers to the same question, but the Pension Fund has a third answer. I wanted to switch to another fund (a year ago), but they refused because... received a refusal to pay a lump sum because the pension (based on length of service) is small.

10 Jun 2020 lawurist7 299

Share this post

- Related Posts

- Law on Observing Peace and Quietness of Citizens

- Penza pension supplements for labor veterans

- What are the benefits for labor veterans of the Russian Federation who live in Bashkortostan?

- Can Bailiffs Seize the Property of the Debtor's Relatives?