- Without car parking (the vehicle title is used as collateral).

- Cash with parking.

In the second case, everything is extremely simple and clear.

You want to receive funds in the form of a loan. Your car will be taken away for this. But not forever, but only until you pay off the loan for it. The property (and the car is one of its varieties) will remain with the creditor all this time. And the peculiarity of PTS collateral is that such loans usually start at 6 percent, but not per annum, but per month. Those. Relatively speaking, the nominal rate on such a secured loan (with PTS) starts at 72 percent per annum. Not the cheapest pleasure.

If we are talking about putting a car into storage, then this is usually 3-5 percent per month. Naturally, the rate for PTS is higher. At least due to the fact that additional risks are imposed. Having a car parked in a parking lot, a creditor can only fear a lucky coincidence when some meteorite crashes into the parking lot or the car is simply stolen. The latter is easy to stop. But when the car remains with the borrower, the risks increase disproportionately:

- Damage.

- Accidents.

- Car disassembly and resale (yes, there are also scammers among borrowers), etc.

In general, car pawnshops perform worse than banks. In the sense that it’s worse for yourself. Because they do not check the borrower on all bases. Usually it takes an hour or two to take out such a loan. And that’s it, you are given cash in your hands.

And frankly speaking, the documentation requirements are minimal. The borrower needs registration documents and a passport. No guarantors are usually required. You usually don’t need to confirm your income either.

Let’s say right away that sooner or later these relaxations will disappear. When most pawn shops will simply disappear. Due to the fact that they will accumulate a critical mass of non-returns. Thus began the era of online MFOs. When a small loan was issued simply based on passport screenshots, and nothing was really checked. After particularly smart guys took advantage of this, MFOs simply closed in batches. Because the non-return rate was cosmic. And most of these clients were also fake. Lawsuits began, the client was relieved of his obligations under the contract, and the microfinance organizations suffered losses.

Most likely, the situation will be similar with car pawnshops. It's only a matter of time.

It is also interesting that at the time of publication, car pawn shops are also engaged in their own promotion. And there are very few independent materials about such a business. Which does not reveal all the pitfalls. And, believe us, there are a lot of them there. And most often it is the borrower who suffers, not the lender.

Trial

To clarify the positions of the parties, the judge may schedule a preliminary hearing, at which the parties to the trial can exchange arguments and evidence. It is important for the plaintiff to convince the court that the Pension Fund’s calculations are erroneous. This is not always easy to do, since the legislation is quite confusing and at the time of filing the application, the plaintiff may not take into account certain nuances. When resolving a case on its merits, it is necessary to refer to the current legislation. In his decision, the judge can refer not only to laws, but also to judicial acts - Resolutions of the Plenums of the Armed Forces of the Russian Federation and Determinations of the Constitutional Court of Russia.

Shortcomings in determining the amount of a pension may be based on various legislative nuances and depend on the circumstances of a particular case. If the decision was not made in favor of the plaintiff, then it can be appealed to higher authorities. It is important to comply with the procedural deadlines for appeal, and if they are missed, to prove the validity of the reasons for the untimely appeal to the appellate, cassation or supervisory authority.

Info

I do not agree with the calculation of my pension I do not agree with the calculation of my pension, I would like to double-check.

You can contact any lawyer in private messages. The service is paid.

I do not agree with the amount of the accrued pension, how can I go to the Pension Fund for clarification and what form should the certificate be in? Thank you.

Good afternoon If you do not agree with the amount of your pension, then you need to submit a free-form application addressed to the head of the Pension Fund of the Russian Federation at your place of registration. The application is submitted by you in two copies, one remains with you for the registration stamp, the second for the Pension Fund of Russia, the response period is 30 days.

Important

I also recommend that you immediately request a copy of your pension payment file and verify that this file takes into account your length of service at all places of work, benefits, etc. And if you disagree with the amount of your pension, go to court to protect your rights. We don’t agree with my grandmother’s accrued pension. We found out that it was much less than others her age.

Attention

Plus, 2000 were cut this month. How to find out whether the accrued pension is correct? Hello Alena! Write a complaint to the Pension Fund.

Please tell me what I should do if I do not agree with the accrued pensions. Where to go and how to justify your disagreement with the Pension Fund?

You need to contact the Pension Fund directly for clarification and a statement of your arguments; after receiving a response, if there are grounds, you can go to court.

I receive a pension from the penal system, I do not agree with the calculation of the pension, tell me how to prove that the pension was calculated incorrectly. Disagreements with the PF UFSIN regarding length of service.

Good evening! To prove that the pension calculation was incorrect, you must bring your calculation to the court and justify it.

Accordingly, you understand that it is necessary to file a claim in court. If you need help in compiling it, write.

Accordingly, it is necessary to make the calculation correctly, with the involvement of an expert who will be accepted in court.

Complaint against the Pension Fund: sample, rules and features

First of all, we recommend that you file a complaint with the head of the Pension Fund Office: as a general rule, your complaint must be answered within 30 days. If this does not happen or the measures taken by the head of the department seem insufficient to you, you have several options: file a complaint with a higher office of the Pension Fund, the prosecutor's office or the court.

Pension legislation in Russia is so confusing and changes frequently (perhaps even too often) that problems with the Pension Fund arise not only among ordinary citizens who are far from jurisprudence, but even among professional lawyers.

If I don’t agree with the accrued pension, where should I go?

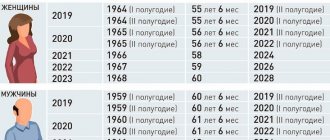

In 2024, the minimum duration of insurance coverage will be 15 years.

This length of service must be at the time the citizen reaches retirement age. The insurance period includes all periods of a citizen’s work for which the employer paid social and pension contributions. The periods of caring for each child under 1.5 years of age are also counted, but the total amount of such experience should not be more than 6 years.

The main problem of disputes with the Pension Fund Administration is precisely the incorrect calculation of the insurance period.

Specialists do not take into account all certificates, due to their improper execution or incorrect information about the organization. Incorrect coefficients may be used when calculating the minimum pension and allowances for long service and for working under hazardous working conditions. When calculating pension coefficients, allowances for caring for each child are taken into account. A pensioner is entitled to:

- — 1.8 – for 1 year for the first child;

- – 3.6 – for 1 year for the 2nd child;

- – 5.4 – for 1 year of caring for the 3rd child.

You can appeal the payment amount on various grounds. The Pension Fund may not correctly indicate the coefficients, as well as calculate the required payments for caring for a disabled child. When resolving a dispute related to the calculation of supplements and payments, the argument should be based on federal legislation that provides for the procedure for calculating additional payments to pensions. To calculate its size, you should also take into account the amount of wages in relation to the average wage in Russia. The final calculations are carried out by the Pension Fund. All calculations can be displayed in the form of help or email.

Who is entitled to the Luzhkov pension supplement in 2020

- be a recipient of a pension;

- lack of work (temporary or permanent);

- confirmed residence in Moscow for at least 10 years;

- low income.

Attention! The Luzhkov bonus is not available to working pensioners.

In addition to the basic amount of his pension, every pensioner has the right to apply for and receive various bonuses. We’ll tell you more about them, especially about the one that was called the “Luzhkov pension supplement.”

Appeal procedure

You must submit your application directly to the Pension Fund. The citizen must state in detail the reason for the appeal.

I contacted the pension fund at my place of residence and they said they might have messed up the Russian Pension Fund.

Therefore, calculating the amount of a pension has become very complicated and errors cannot be ruled out. Errors can arise for various reasons: due to the incompetence of a pension fund specialist, with errors (inaccuracies) in the documents submitted when applying for a pension. In addition, the pensioner himself can make mistakes, for example, by forgetting to indicate whether he has the right to any additional payments or that he has someone as a dependent.

How to check the correctness of determining the size of a pension If a pensioner has doubts about the correctness of calculating the size of his pension, he can initiate a check of the calculation of the pension and, based on the results of this check, he will be convinced of the correctness or incorrectness of the calculation.

You need to prove that the Pension Fund of the Russian Federation incorrectly calculated the labor pension, otherwise the court will refuse your claim.

The right to file a lawsuit and demand that the decision of the pension fund be declared invalid and the obligation to recalculate, as well as to collect from the Pension Fund the amounts not paid to you - Art. 131-132 Code of Civil Procedure of the Russian Federation. After filing a claim, you acquire the status of a plaintiff with all rights under the Code of Civil Procedure of the Russian Federation.

The court can assist you in collecting evidence under Article 57 of the Code of Civil Procedure of the Russian Federation - for this purpose, a petition is submitted at the court hearing orally or a written petition is given.

The court may also invite a specialist to check the calculation of the Pension Fund. Article 35. Rights and obligations of persons participating in the case

1. Persons participating in the case have the right to familiarize themselves with the case materials, make extracts from them, make copies, file challenges, present evidence and participate in their study, ask questions to other persons, participants in the case, witnesses, experts and specialists;

file petitions, including requests for evidence;

give explanations to the court orally and in writing; present your arguments on all issues arising during the trial, object to the requests and arguments of other persons participating in the case; appeal court decisions and use other procedural rights provided by the legislation on civil proceedings. Persons participating in the case must conscientiously use all their procedural rights.

I don’t agree (and neither does my husband) with the calculation of his pension amount. Since 2004, there was a high salary, but it was not taken into account. How to check the accuracy of pension calculations?

Submit an application to the Pension Fund office. To calculate the pension, earnings are taken either for any 5 consecutive years before 2001, or for 24 months - 2000-2001.

I do not agree with the pension accrued to me.

Bring documents to the consultation.

The refusal of permission to leave the Russian Federation due to the fact that the applicant is aware of information constituting a state secret is disputed in the relevant supreme court of the republic, regional, regional court, court of a federal city, court of an autonomous region, court of an autonomous district at the place of acceptance decisions to leave the request to leave without satisfaction. 3. An application by a serviceman challenging a decision, action (inaction) of a military command body or commander (chief) of a military unit is submitted to a military court. 4. The court has the right to suspend the effect of the contested decision until the court decision enters into legal force.

I do not agree with the amount of the old age pension. Work experience: 26 years, of which 7 years in logging. They assigned a minimum wage of 7300. What should I do?

clarify in the Pension Fund which periods are included, which are possibly excluded, what earnings are taken into account, first write a corresponding application to the pension authority

A pension has been accrued that I do not agree with, how can I check the accuracy of the accruals?

contact any lawyer with documents.

If I do not agree with the accrued pension, what should I do, where should I apply and what documents do I need for this?

Hello. Apply for recalculation to the Pension Fund.

If I do not agree with the pension accrued to me, what rights do I have?

Good afternoon. The statement of claim is filed in court according to the rules of Art. 131, 132 of the Civil Procedure Code of the Russian Federation. A court decision that has entered into force is mandatory for execution in accordance with Article 13 of the Civil Procedure Code of the Russian Federation.

Protection of violated rights is carried out by the court (Article 11 of the Civil Code of the Russian Federation), and by virtue of clause 1 of Article 254 of the Civil Procedure Code of the Russian Federation, a citizen has the right to challenge in court any decision, action (inaction) of a government body or official. Go to court.

You have the right to go to court based on the following. In accordance with Art.

It should be indicated what exactly the violations of the pension rights of citizens are. The applicant should provide detailed calculations and compare them with calculations from the Pension Fund. The appeal can be submitted in person or through a legal representative.

If a legal representative comes to the Pension Fund with an application, he must provide a notarized power of attorney. According to the Federal Law “On the Procedure for Considering Citizens’ Appeals,” the period for consideration of a citizen’s application or complaint cannot be more than 30 days.

In exceptional cases, if it is necessary to request additional documents, the period may be extended by another 30 days. A decision on a citizen’s issue must be motivated. If the Pension Fund believes that the calculations were carried out correctly, then it has the right to issue a reasoned refusal.

It is possible to recommend providing other documents - confirming the pensioner’s work experience, preferential accrual of pension points and calculation of length of service.

Luzhkov pension supplements in 2020: who pays and who is entitled to

If a citizen has lived less than 10 years in the capital, but his income level is below the capital’s minimum, then he will also receive an additional payment. Its size will indeed be insignificant. The increase will only be up to the PM level in the region. This is much less than Luzhkov's payment.

This is interesting: Benefits for Labor Veterans on Taxes in the Republic of Adygea

The Luzhkov supplement is targeted, that is, it is provided to those people who need it. This status for such a benefit is determined taking into account the compliance of the citizen’s income level with Moscow indicators. If it is below the established indicator, then an additional payment will be established.

Going to court

There is no universal way to successfully challenge the amount of a pension from the state. Judicial practice on such issues, unfortunately, is not on the side of the pensioner. The applicants file a statement of claim, believing that the meager amount of the pension, which does not reach the subsistence level, is an abuse of power on the part of the Pension Fund. In practice, most of the calculations are carried out correctly, and the low pension provision is due to the generally small amounts of such payments in the country.

Before going to court, you should exhaust other ways to protect your rights. An application for recalculation of the pension amount can be submitted according to the rules established by the Federal Law “On Labor Pensions”. It should indicate the reason why the applicant does not agree with the amount of periodic payments. If the decision on the application is not in favor of the applicant, then it is necessary to file an administrative claim with the Pension Fund Office.

They also demanded that I prove that I was really in my place of residence (Kamchatka, Far North region)! — I was looking, for example, for kiosk rental agreements, etc. (There is no market, no agreements, of course, since no one imagined that such papers would have to be stored for 15 years! Thanks in advance!

Good evening. If you do not agree with the amount of your pension and the periods included in the length of service, you need to go to court to restore your pension rights. You will need to prove the fact of conducting activities in the Far North. Make inquiries to the government. bodies with which entrepreneurs conducted business.

I do not agree with the pension accrued to me (for the first time). Where can I go? I live in the city of Simferopol.

I do not agree with the pension accrued to me (for the first time). Where can I go? I live in the city of Simferopol. to the pension fund at your place of residence.

Where should I go if I don’t agree with the pension accrued to me (for the first time) in Crimea, because we don’t take into account salaries for 2000-2014.

PFR branch for the Republic of Crimea Address: 295011, Republic of Crimea, Simferopol, st. Karaimskaya, 52 Hotline phone: +7(978) 018-74-35; Additional telephone numbers: reception, fax, or to the district court, depending on your area of residence.

I do not agree with the calculation of the pension. I am 53 years old, I have been retired for 3 years. I receive a pension of 6486.60 rubles + for 3 grams. inv. 924.84 rub. Is it possible to increase your pension?

Just because you don't agree - no. If there are grounds for recalculation, yes.

My name is Tamara Petrovna, born in 1951.

It is not uncommon for citizens who have received their first pension payment to have doubts about the fairness of its size. And of course, in this case, the pensioner wants to make sure that no error occurred when calculating the pension. Which, in his opinion, led to the accrual of such a small pension to him. You will learn where to turn if you are in doubt about the correct calculation of the amount of your pension from this article.

Today, citizens who have worked in the Soviet, post-Soviet and Russian periods of the existence of our state are eligible for old-age insurance pensions. In each of these periods, changes to pension laws occurred. But according to the existing rule, the pension rights of a citizen earned by him in each of these periods are preserved and taken into account according to the pension laws that were in force in those time periods.

Therefore, calculating the size of the pension has become very complicated and errors cannot be ruled out. Errors can arise for various reasons: due to the incompetence of a pension fund specialist, errors (inaccuracies) in the documents submitted when applying for a pension. In addition, the pensioner himself can make mistakes, for example, by forgetting to indicate whether he has the right to any additional payments or that he has someone as a dependent.

If a pensioner has doubts about the correctness of the calculation of the amount of his pension, he can initiate a check of the pension calculation and, based on the results of this check, he will be convinced of the correctness or incorrectness of the calculation.

This is very easy to do, just take your documents and go to the territorial branch of the Pension Fund of the Russian Federation closest to your place of residence.

The application is submitted, at your choice, to the court at the location of the plaintiff or defendant.

The form and content of the statement of claim are determined by Art. 125 CAS RF. The claim must be made in writing. It must indicate the date of signatures by the administrative plaintiff, as well as the date the claim was submitted to the court. The document itself must indicate:

- — the name of the court to which the plaintiff files the application;

- - information about the plaintiff - his full name, place of permanent residence or temporary stay;

- — information about the representative of the plaintiff and whether he has a higher legal education;

- — name of the defendant;

- - information on compliance with the pre-trial procedure for resolving a dispute - you can indicate - registered letters with statements that were sent to the Pension Fund;

- — information about what exactly are the violations of a citizen’s pension rights by the state and directly by the PF;

- — information about payment of the state duty or the existence of grounds for a discount or complete exemption from payment of the duty.

An administrative claim can be filed electronically via the Internet. Then the document must be certified by a qualified electronic signature of the applicant or his legal representative.

Required documents

Sample claim to court

Download document

The administrative claim must be accompanied by:

- — notification of delivery of a copy of the claim and attached documents to the parties to the proceeding.

To check the accrual, the pensioner should contact the Pension Fund Office at the place of registration with an application addressed to the manager with a request to double-check the correctness of the pension accrual from the moment of receipt of it, with all allowances and recalculations. After applying, the pensioner’s application will be reviewed, employees will double-check the accuracy of the calculation and report the results.

Social factor

Then, in the “Send to Branch” field, select your PFR branch at your place of residence, then fill in all other fields. You must attach scanned or photographed copies of documents (files) to your request. Select the option to receive a response: to the postal address of your place of residence or to your email address (you can choose both options). Enter the text indicated in the picture in the empty field to the right of the picture.

A pension fund department specialist will conduct a full check of the calculation of your pension based on the documents available in your pension file.

Why did they stop paying me Luzhkov’s pension supplement?

The bonus is paid on the basis of this law and provided that your pension does not exceed 14,500 rubles per month, this is the so-called city social standard. Maybe your pension has increased to this amount? Or you were working. The bonus is paid only to those who are not working.

The city social standard is a social standard for the material support of non-working pensioners who receive a pension in the city of Moscow and are registered in the city of Moscow at their place of residence, the value of which is established by the Moscow Government.

I do not agree with the pension calculation

Pravoved.RU 460 lawyers are now on the site

- Social Security

- Pensions and benefits

The work experience was about 25 years and the pension accrued was less than the minimum 6100. Salary certificates for 5 years were provided. But this had no effect. Where should I go? Collapse Victoria Dymova Support employee Pravoved.ru Similar questions have already been considered, try looking here:

- How to write an application to the Pension Fund if I do not agree with the amount of the assigned pension?

- Can I sell my house if my sisters don't agree?

Lawyers' answers (2)

- All legal services in Moscow Division of jointly acquired property Moscow from 15,000 rubles.

Contact any operator to submit a written request to the head of the department with a request to check the calculation of your pension.

Don't forget to bring the following documents: - your personal passport; - pensioner's ID; - SNILS card.

If you cannot personally contact the pension fund office, then you can send your application by mail, additionally enclosing notarized copies of the above documents in the envelope.

An application to check the calculation of your pension can be sent to your PFR branch without leaving your home - through the official website of the PFR (https://www.pfrf.ru/eservices/send_appeal/resident/). Having opened this page, read the rules for receiving and considering online requests, then in the “Recipient” field (at the bottom of the page), by clicking on the black icon on the right - ▼, select your regional branch. Then, in the “Send to Branch” field, select your Pension Fund branch at your place of residence, then fill out all other fields.

You must attach scanned or photographed copies of documents (files) to your application. Select the option to receive a response: to the postal address of your place of residence or to your email address (you can select both options). Enter the text indicated in the picture in the empty field to the right of the picture.

Check the box next to the picture “I consent to the processing of my data.” Then click the “Submit” button.

Do not hesitate to contact the Pension Fund, you have every right to check the correctness of the accrued amount of your pension; if you have any doubts, it is better to remove them as early as possible.

A pension fund department specialist will conduct a full check of the calculation of your pension based on the documents available in your pension file. Options will certainly be considered to increase the size of your pension.

The cause of the error may be incorrect filling out of the work book and certificate of employment.

Read about whether it is possible to close an individual entrepreneur with tax and pension fund debts at the following link:

Algorithm for checking:

- submitting an application to the head of the Pension Fund to verify accruals;

- if a refusal is received, an application is written to the prosecutor to check the work of the pension fund employees;

- If the prosecutor's office does not resolve the issue, the pensioner goes to court.

If a pensioner was paid an underestimated amount due to his fault, then the recalculation of its amount is made from the 1st day of the next month. Pension recalculation is carried out only upon application. If an error is detected, recalculation is done automatically.

Sample application to court

Where to complain?

If a pensioner is not sure about the correct calculation of the old-age pension, he must contact the head of the pension fund with a statement. It indicates a request for information about the amount of settlements made. Fund employees are required to respond in writing.

Documents for applying to the pension fund:

- identification;

- pensioner's ID;

- SNILS.

If, after receiving the extract, the pensioner still has questions, he or she files a complaint with the regional office of the pension fund. It should resolve the issue of incorrect accrual. There he has the right to challenge his position. Situations where an employer gives incorrect information should be carefully examined. A person has the right to challenge the amount of a pension if he believes that he is right.

If they cannot help in this instance, then you should contact a lawyer to resolve the issue in court. Our lawyer on the website will help you draw up a claim correctly and answer your questions.

The Pension Fund of Russia believes that it has calculated my pension as of 01/02/2017 and it is exactly the amount that was announced to me in the certificate. But the points for 2020 in the answer are recorded in the same amount as they were in the personal account as of 10/01/2016, i.e. It seems that the employer in the 4th quarter. he didn’t transfer anything for me, although just yesterday evening data for the 4th quarter in the amount of 2 points appeared in the personal account. So what now, will these points go to nothing or will they still be added in August? Tell me, advise me what to do next.....

- Answer

- Don't like it anymore

I am 100% sure that the 4th quarter of 2016 is not taken into account in your assigned pension. Probably will be taken into account in August 2020. You retired in Q1 2017 and continued to work as a working retiree.

Pension increases in Moscow

- statement;

- passport;

- pension certificate or certificate;

- document confirming residence in Moscow;

- employment history;

- certificate from the ITU bureau (for people with disabilities);

- a document confirming social benefits (for example, a certificate of loss of a breadwinner).

The processing time for documentation is 2 weeks. If the decision is positive, the increase is assigned from the first day of the next month. In case of a negative decision, the pensioner receives a notification explaining the reasons for the refusal. An elderly person has the right to appeal the refusal of the Pension Fund.

How to challenge the amount of a pension

I heard this figure in his answer to a question, and he mentioned the word “social”.

Most likely he doesn’t know that we have different pensions: social and labor in old age….

A prudent person is one who is not sad about what he does not have, but, on the contrary, is glad about what he has. Reply with quotation

- 12/15/2011, 10:44 pm #4 Re: They didn’t provide a full calculation of my pension Galya, somehow you confused me.

For example, what am I entitled to? Work experience -46 years By year 61 years Disabled person of the 3rd group? I get 7250! Reply with quotation - 12/15/2011, 10:50 pm #5 Re: They didn’t provide a full calculation of my pension. At 61 I’m already in old age. Disability is somehow taken into account in it. I can not say exactly. When disability is granted before retirement age, for example, at 56 years old for a man, a social pension is assigned.

To check the accrual, the pensioner should contact the Pension Fund of Russia (PFR) at the place of registration with an application addressed to the manager with a request to double-check the correctness of the accrual.

An elderly person thinks about what means he will live on in old age. The amount the government pays depends on many factors. The main condition is the presence of official earnings from which the money is calculated.

If the amount of payments does not suit the citizen, he can challenge them.

Drawing up a complaint to the Pension Fund of Russia

There is no unified complaint form, so a person can draw it up at his own discretion. But at the same time, we should not forget about the general provisions that business documentation should include. It is important to remember that a certain structure is provided for the application. Also, the text of the document should not contain any expressive expressions, that is, it should be limited exclusively to business vocabulary. As for the specific content of the complaint, it, of course, depends on the reason for the appeal, but in any case it should include the following information:

- the name of the higher authority to which the complaint is filed;

- personal data of the applicant, including registration address and telephone number;

- the reason for appealing the actions of the Pension Fund;

- waiting for the applicant after consideration of the complaint;

- list of additional documentation;

- time and signature.

To be able to file a complaint against the Pension Fund, you must also present the following documents:

- the complaint itself to the Pension Fund, which was drawn up by the applicant;

- identification document;

- SNISL.

How to check the correctness of pension calculation?

To understand if the amount due is calculated correctly, an elderly person applies to the Pension Fund of Russia (PFR). The pensioner writes a statement, on the basis of which the head of the Pension Fund rechecks the amount of accruals.

The application is considered within 5 days from the date of its submission. After review, Pension Fund employees inform the pensioner about the results.

If they do not suit him, he can challenge them.

A citizen can send an application by mail, adding a copy of his identity card and a certificate of pension insurance.

You can check the status of your personal account:

- in banking organizations with which the fund has entered into an agreement - Sberbank, Uralsib Bank, Gazprombank, Bank of Moscow;

- on the website of municipal and state authorities. The citizen registers, enters his personal account, clicks the Pension Fund icon and checks the account data;

- in Pension Fund branches at your place of residence. The pensioner must provide identification and a pension card.

An extract on the status of your personal account can be obtained once a year.

Application for recalculation

If you notice an error, what should you do?

If a citizen believes that he is being incorrectly charged the required amount, he must check and challenge.

I do not agree with the accrued old-age pension, can I recalculate my pension for the other four and a half years based on the collected salary certificates of work experience of more than 40 years?

Yes, you can write an application to the Pension Fund

I DO NOT agree with the calculation of the old-age pension in March 2015, 1.7, I have 8.5 years of experience in an area equivalent to the Far North, total experience is 32 years,

- you had to challenge this appointment within 3 months. But you can apply to the court to recalculate your pension taking into account your work at the RKS.

I do not agree with the calculation of the pension. How to calculate correctly? The coefficient in the salary certificate is 0.83

Contact the pension fund with a statement of disagreement; they are obliged to explain everything to you.

I was assigned an early retirement pension, but I do not agree with the timing of the appointment or with the accrual since the certificate of my salary is incorrect, reduce it by 3 times.

Hello.

If you don’t agree, go to court

Hello! You need to contact the Pension Fund for a personal consultation

I do not agree with the calculation of the pension.

You will have to file an application with the court to challenge the action or decision of the Pension Fund of Russia in accordance with Art. 254 of the Code of Civil Procedure of the Russian Federation: “An application may be submitted by a citizen to the court at the place of his residence or at the location of the state authority, local government body, official, state or municipal employee, the decision, action (inaction) of which is disputed.” You have 3 months. from the day they learned about the violation of their rights. State duty 300 rub. The application is considered by the court within ten days. Art. 56 of the Code of Civil Procedure of the Russian Federation states: “Each party must prove the circumstances to which it refers as the basis for its claims and objections, unless otherwise provided by federal law.” Ask the court to order an examination of the correctness of the calculation of your pension (its size).

It is not uncommon for citizens who have received their first pension payment to have doubts about the fairness of its size. And of course, in this case, the pensioner wants to make sure that no error occurred when calculating the pension. Which, in his opinion, led to the accrual of such a small pension to him. You will learn from this article where to turn if you have doubts about the correctness of calculating the amount of your pension. Today, citizens who have worked in the Soviet, post-Soviet and Russian periods of our state’s existence are eligible for old-age insurance pensions. In each of these periods, changes to pension laws occurred. But according to the existing rule, the pension rights of a citizen earned by him in each of these periods are preserved and taken into account according to the pension laws that were in force in those time periods.

Where to complain

What to do if the pension delay exceeds one week

If the delay in payments has already exceeded one week, then it’s time to find out on your own what the reason is and why the money is not coming. To do this, you need to follow the following procedure:

- Contact a banking institution and obtain a document stating that the pension has indeed not been received. This could be a statement from the account to which the card is linked and to which the pension should be received. Usually there are no problems with obtaining such a document.

- If possible, you need to stock up on a certificate for the Pension Fund, which will indicate that the funds were not received at the specified time.

- After this, with the available documents, you can safely go to the nearest Pension Fund branch and present your claim there. It can be in writing, it can be orally. Fund employees must not only eliminate all problems with the transfer as soon as possible, but also explain in detail what exactly was the reason for the delay in pension funds.

In some cases, the pension does not arrive due to the fact that the citizen himself did not provide a complete package of documents to the Pension Fund or banking organization. In this case, he must be provided with a list of required documents and certificates that should be provided as soon as possible. This is what will determine whether the citizen will receive his benefits on time next month or not.

Once again, please note that you should contact the Pension Fund or bank no earlier than after 5-7 days of delay. Unfortunately, in our country, technical problems with translations are the norm. Therefore, do not panic ahead of time.

In this video you will learn about how the transition to World cards will occur:

Noticed a mistake? Select it and press Ctrl+Enter to let us know.

Conflicts between pensioners and Pension Fund employees are far from uncommon, so you need to know where to complain about the Pension Fund. The work of Pension Fund employees is clearly regulated by pension legislation, however, elderly people often face an outright violation of their rights. To be fair, it should be said that sometimes complaints may be unfounded, however, in any case, a higher authority will help to effectively solve the problem. This article will discuss how to write and to whom to submit a statement of violation of pension legislation.

What to do if you do not agree with the accrued pension?

I do not agree with the accrued old-age pension, can I recalculate my pension for the other four? that the pension was not accrued correctlyread answers (2) Topic: Retire Retired 3 months ago, total experience 23 years worked 13 years at a factory, based on 5 years before 1994read answers (1) Topic: Size I don’t agree with the amount accrued pension, I want someone to explain to me how it was calculated. read the answers (3) Topic: Amount I do not agree with the amount of the accrued pension.

How to challenge an old-age pension?

In order to challenge an assigned old-age pension, you must write an application to the court. It indicates the reason for disagreement with the amount received. The pensioner independently recalculates the pension received from the one he is entitled to.

Earnings are the main component in calculating a pension.

The role of experience in calculations is insignificant.

The appeal states:

- FULL NAME;

- full registration address;

- statement of the problem.

To challenge an assigned pension you must:

- see for what period the earnings were taken and its size;

- The pension case is being checked.

Is it possible to increase the size of the pension?

Ways to increase your pension:

- The pension amount is calculated based on official salary data. It is important to ensure yourself the highest “white” salary throughout the entire working period;

- study the process of charging money. It is important to know all changes in legislation;

- choose the correct accrual process.

It is important to study all the pros and cons.

The provided options enable a person to increase the size of the future payment amount. Options are available to citizens who want to make a difference. The lazy can just wait and hope.

A citizen can increase the amount of payments if he works at retirement age. He can refuse all types of pensions and save.

Advantages:

- a noticeable increase in the size of the pension;

- openness of the method to a wide audience.

Cons: looking for other sources of income.

Working citizens of retirement age receive increased amounts.

If you do not agree with the amount of your pension, you have the right to contact the Pension Fund in writing with a request to provide information about the procedure for calculating your pension and about your disagreement. Or you can contact the prosecutor's office, they will conduct an investigation.

I do not agree with the amount of the accrued pension. Where can I contact.

Hello! Apply for recalculation to the head of the Pension Fund in the region. If you receive a written refusal to recalculate, contact the court.

In case of disagreement with the decision of the body providing pensions, the citizen has the right to appeal it to a higher authority (in relation to the body that made the relevant decision) and (or) go to court with the relevant demands.

Dear Natasha! Let me explain to you that decisions of the Pension Fund can be appealed both out of court and in court. However, it is not necessary to follow the pre-trial appeal procedure. Thus, it is allowed: to appeal the decision out of court, and then, in case of a negative result, go to court; simultaneously appeal the decision out of court and in court; without appealing the decision out of court, file an application in court. The pre-trial procedure for appealing the decision of the Pension Fund is specified in Articles 53-55 of Law No. 212-FZ. The complaint is submitted in writing or in the form of an electronic document to a higher official or a higher authority. A complaint can be filed within 3 months from the day the person learned or should have known about the violation of his rights. In support of the complaint, I recommend attaching copies of the necessary documents. Useful link: https://www.pfrf.ru/info/smev/dosudeb/

I don’t agree with the amount of the accrued pension, I want them to explain to me how it was calculated.

Hello, apply for a payment to the Pension Fund at your place of residence if something does not suit you. Write a complaint to the prosecutor's office of the same district, they will check the legality of accruing your pension and will give you a written answer.

Good afternoon.

The procedure for drawing up and filing a complaint against the Pension Fund

If the reason for appealing the work of the Pension Fund is a violation of pension legislation by an employee of a specific branch of the Pension Fund, then first you need to complain to the head of the branch’s client service. However, the problem is that the administration does not always express a desire to respond to the appeal of an ordinary pensioner. If management does not want to resolve the conflict, then you need to contact the Pension Fund office with a written statement. If possible, you can immediately contact the branch manager directly, bypassing the customer service. To do this, you must first find out the reception hours for pensioners and make an appointment.

If you were unable to achieve protection of your rights at the main branch of the Pension Fund of Russia, then you need to write a complaint to the prosecutor’s office. There is usually an employee here who specializes in labor law and constantly works with such conflicts. The application can be made in writing and sent by mail. You can also come to a personal meeting with the prosecutor. At this stage, it is necessary to collect all the documents confirming the accrual of the pension, and also explain what the problem actually is, and whether there have been attempts to eliminate it. In addition, it is recommended to add receipts or receipts that would confirm the fact that the pension was calculated at the wrong coefficient.

Interesting to read: Who Pays for Maternity Leave If a Woman Doesn’t Work