Information about the fund

- Full name of the organization (name of NPF): Joint Stock Company "Non-State Pension Fund Evolution"

- Status in 2020: Renamed, Active - Valid license

- License number: 436

Until August 22, 2020, the non-state pension fund was called JSC NPF NEFTEGARANT, then rebranding was carried out.

The new name of the NPF is JSC NPF Evolution. The fund positions itself as one of the largest among non-state pension funds. The company is characterized by consistently high results in pension asset management. In December 2020, the NRA assigned NPF Evolution JSC the high status of AAA (Stable). The fund was included in the register of NPFs - participants in the system for guaranteeing the rights of insured persons.

The official website states that the name change will not in any way affect the principles of working with corporate partners: a high level of professionalism and successful experience in the segment are the basis of working with business. PJSC NK Rosneft and the Group Companies remain important clients of the fund; we will be happy to offer even more opportunities for the partner with whom we have been working for 19 years.

Affiliated funds

NPF Soglasie from December 6, 2020.

Requisites

View details

INN 7706415377 KPP 770501001 OKVED 65.30 Industry code according to OKPO 40092762 OKATO 45286560000 OKTMO 45376000 OGRN 1147799016529 BANK ACCOUNT DETAILS FOR TRANSFER OF CONTRIBUTIONS UNDER PENSION CONTRACTS (NPO) Recipient JSC "NPF Evolution" RRDB Bank (JSC) Moscow BIC 044525880 Account 30101810900000000880 R /account 40701810700000000127 FOR OPERATIONS WITH PENSION SAVINGS (OPS) Recipient JSC "NPF Evolution" RRDB Bank (JSC) Moscow BIC 044525880 Cash account 30101810900000000880 R/account 40701810000000000102

Comment by Almaz Kuchembaev:

Pension savings of citizens of the Russian Federation are, by default, kept in the Pension Fund of the Russian Federation. According to the provisions of the current legislation, every citizen of the Russian Federation can freely transfer pension savings from the Russian Pension Fund to the Non-State Pension Fund and back. It is also possible to transfer from one NPF to another NPF.

This can be done by concluding an agreement with the insurer on compulsory pension insurance, which comes into force from the day the pension savings transferred by the previous insurer are credited to the account of the new insurer.

You must notify the Pension Fund of the Russian Federation of your desire to change the fund no later than December 1 of the current year. Funds must be transferred from one fund to another no later than March 31 of the year following the year in which the insured person filed an application for transfer from fund to fund.

JSC NPF Neftegarant has received a reputation as an unreliable fund based on legal disputes with citizens. As a rule, the reason for going to court is the illegal transfer of pension savings from the Pension Fund of the Russian Federation of another NPF to JSC NPF Neftegarant using forged documents.

For example, in the city of Ulyanovsk, the claim of citizen V. against JSC NPF Neftegarant, the legal successor of JSC NPF Soglasie-OPS, was considered. The plaintiff asked to invalidate the statements, questionnaires, agreements on compulsory pension insurance, transfer of pension savings, collection of interest, and lost investment income. The plaintiff indicated that since March 1, 2004, her insurer was the Pension Fund of the Russian Federation, and in June 2020 she became aware that her cash savings were transferred from the Pension Fund of the Russian Federation to JSC NPF Soglasie-OPS in accordance with the new agreement on compulsory pension insurance, which she allegedly concluded with JSC NPF Soglasie-OPS.

In declaring the application, questionnaire, and contract invalid, the court was based on the totality of evidence and found that on the disputed dates of signing the questionnaire and application, the plaintiff was at her workplace in Ulyanovsk and did not travel to Moscow. In this connection, the application for the transfer of pension savings signed by the plaintiff, certified by a notary in Moscow, was not recognized by the court as evidence in the case (appeal ruling of the Ulyanovsk Regional Court in case No. 33-1643/2019).

In another case, resolving a dispute in favor of citizen Sh., the Basmanny District Court of Moscow established a number of contradictions in the evidence presented by NPF Soglasie-OPS JSC (NPF Neftegarant JSC). Two copies of the contract on compulsory pension insurance presented at the court hearing by the Pension Fund of the Russian Federation and JSC NPF Soglasie-OPS did not contain identical signatures of the insured person. The contract also contains incorrect passport information for the plaintiff. The court did not accept as evidence the application for the citizen’s early transfer to JSC NPF Soglasie-OPS, certified by a notary of the Kaliningrad City Notary District. The notary, in response to the court's request, indicated that citizen Sh. did not apply to the notary's office to perform a notarial act. The obligation to prove the existence of the plaintiff’s will to conclude a disputed contract by virtue of Art. 56 of the Code of Civil Procedure of the Russian Federation was assigned by the court to the defendant, who did not apply for the appointment of a forensic handwriting examination (appeal ruling of the Moscow City Court dated August 30, 2019 in case No. 33-30450).

In addition, NPF Neftegarantom JSC illegally transferred a citizen’s pension savings from another non-state pension fund.

In Omsk, a court case was considered based on M.’s claim against JSC NPF Neftegarant. JSC NPF Sberbank assumed obligations, on the basis of an agreement on compulsory pension insurance concluded with M., to carry out the activities of an insurer for compulsory pension insurance. The plaintiff received a notification from NPF Sberbank JSC that the contract with M. had been terminated and the cash savings, in accordance with M.’s application for transfer to the Pension Fund of the Russian Federation, had been transferred to NPF Soglasie-OPS JSC.

As the court found, the plaintiff did not sign an application for early transfer from one non-state pension fund to another non-state pension fund and an agreement on compulsory pension insurance. This conclusion was made on the basis of evidence presented to the court confirming that while living in Omsk, the plaintiff could not actually be in Moscow, in which an agreement on compulsory insurance was allegedly signed between a non-state pension fund and the insured person between M. and JSC NPF "Consent-OPS". In accordance with M.’s work time sheet, on the day of signing the contract, from 8:00 a.m. to 8:00 p.m., he was at his workplace, which is confirmed by a certificate from his place of work and a working time sheet. Also, in the disputed agreement, the address is given without indicating the street and house, and the telephone number specified in the agreement does not belong to the plaintiff.

In addition, the court accepted as evidence the conclusion of a handwriting expert, according to which the signature on behalf of M. in the agreement on compulsory pension insurance between a non-state fund and the insured person, concluded between NPF Soglasie JSC and M., was not made by M. , and by another person with an imitation of his original signature.

This evidence allowed the court to make a decision in favor of the plaintiff, imposing obligations on NPF Soglasie-OPS JSC to transfer the plaintiff’s pension savings to the previous fund, Sberbank NPF JSC, no later than 30 days from the date the decision entered into legal force (appeal ruling of the Omsk regional court dated March 27, 2019 in case No. 33-1996/2019).

Statistics of NPF Evolution: rating of reliability and profitability

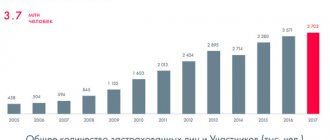

According to the Central Bank of the Russian Federation from the reporting “Main performance indicators of non-state pension funds” as of the date: 01/01/2020

Fund assets (thousand rubles): 215887963.17

Statistics on NPO (non-state pension provision) as of 01/01/2020

- Total volume of pension reserves (thousand rubles): 83857005.16

- Total number of participants (people): 162282

- Participants receiving a pension (persons): 88421

- Total amount of pensions paid under NPO (thousand rubles): 3074065.12

Statistics on compulsory pension insurance (compulsory pension insurance) as of 01/01/2020

- Pension savings (thousand rubles, market value): 126381343.57

- Number of insured persons (people): 1469302

- Participants receiving a pension under compulsory pension insurance (persons): 5605

- Amount of pension payments under compulsory pension insurance (thousand rubles): 215154.41

Profitability of pension savings

Current profitability

Minus remuneration for management companies, specialized depository and fund.

- Profitability of placing funds from pension reserves (NPO): 10.91%

- Return on investment of pension savings (OPS): 11.66%

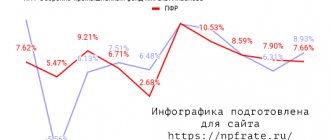

Profitability chart

Data on the profitability of NPF Evolution in 2020 (as of 01/01/2020), including information for the previous 10 years in comparison with the profitability of the Pension Fund (VEB):

Yield comparison table

| Year | NPF Evolution | Pension Fund |

| 2010 | 0.00% | 7.62% |

| 2011 | 0.00% | 5.47% |

| 2012 | 0.00% | 9.21% |

| 2013 | 0.00% | 6.71% |

| 2014 | 7.26% | 2.68% |

| 2015 | 10.57% | 13.15% |

| 2016 | 10.80% | 10.53% |

| 2017 | 8.13% | 8.59% |

| 2018 | 5.12% | 7.90% |

| 2019 | 11.66% | 7.66% |

Rating

For example, every citizen should pay attention to the fact that the Lukoil pension fund occupies a good position among non-state pension funds in the country. This organization is in the top ten. Most often it is indicated that Lukoil-Garant occupies 4-5th place in the rating of NPFs of Russia.

This feature attracts new customers. After all, there is every reason to believe that the organization is conscientious. There are already many non-state pension funds in Russia. And only the best organizations make it into the top ten. People gain high interest and trust in them.

Ignoring

What else do you pay attention to? Communication between employees and clients. This point, as already noted, outrages some. The point is that persistence and assertiveness at the very beginning later gives way to complete ignorance. Why? What's happening?

The whole problem is that employees begin to ignore clients when Lukoil-Garant begins to have some problems. Give me a consultation? Easily. But to resolve the issue of paying out funds or making a transfer to another pension fund - here you will have to try pretty hard to achieve your goal. They won’t talk to you on the phone, it’s clear that they have a negligent attitude towards clients. Even to some extent dismissive. All this is repulsive.

Status of funded pension at NPF Lukoil Garant

/ / 03/07/2020 352 Views 03/08/2020 03/08/2020 03/08/2020 The funds that the employer transfers to the pension fund for his employees and the citizen’s own investments in his future are considered the funded part of the pension.

without his signature and presence.

Upon reaching retirement age, a person receives monthly contributions. The main feature of this type of payment is the citizen’s opportunity to receive funds for his needs. This part of the savings can be located in any management company, and insurance premiums are always located in the Pension Fund of the Russian Federation or Vneshtorgbank. Is it possible In the past, citizens had to decide whether they wanted to keep this part of the pension or refuse in favor of the insurance part.

Pension savings were deducted regardless of the employee’s wishes. Today, the employer contributes 22% of an employee’s salary to the Pension Fund, 16% of which is transferred to the organization depending on the citizen’s choice, and 6% goes to insurance payments.

Attention to clients of NPF "LUKOIL-GARANT": protect your investment income - confirm in your Personal Account that you have not entered into an agreement with another NPF

According to the results of a telephone survey of insured persons of NPF LUKOIL-GARANT, completed in October 2020, 15.9% of respondents indicated that they received information about filing an application to transfer to another NPF without their knowledge.

The Fund’s specialists called 38,800 clients who, during the previous survey (https://www.lukoil-garant.ru/press/news/59089/), reported that they were not sure that they continued to remain clients of the Fund. In this regard, the Fund has posted an online application form in its Personal Account, by filling out which clients confirm that they have not submitted applications to transfer their pension savings to another NPF this year and plan to remain clients of NPF LUKOIL-GARANT. “By informing its clients about the possible loss of investment income, for its part the Fund is ready to provide affected clients with the necessary advice and help in restoring their rights - for this we have posted on

We recommend reading: When is a high-security date allowed?

Illegal or fraudulent transfer to a non-state pension fund, part 2 Additions.

15 There were a lot of questions regarding the previous post, for those interested I will explain a few points and tricks in terms of NPF.1.

“How can I protect myself from illegal transfers from my NPF (Sberbank) to another?”

I’ll tell you right away, check what documents you sign. Always. You take out a loan for your phone, apply for a SIM card in Svyaznoy, open a card in another bank.

Unscrupulous staff, instead of selling you this service and explaining why you need it, will stupidly slip you papers, maybe you won’t notice. Or he will say that when you buy compulsory insurance, you will receive a discount for transferring to a non-state pension fund. Well, you understand. I don’t think I will talk about the people with scabs wandering around the entrances.

In general, it seems to me that it is impossible to completely protect yourself from illegal translation. I have had cases when a person was transferred from NPF Sber to Kitfinance, Lukoil Garant (he was previously there), Future, etc.

The future of NPFs, or How to combat illegal transfers of pension savings

Announcements June 20, 2020 The program was developed jointly with Sberbank-AST CJSC.

Therefore, it is worth paying attention to many aspects and nuances emphasized by investors.

Students who successfully complete the program are issued certificates of the established form. July 4, 2020 You will learn about current changes in the Constitutional Court by becoming a participant in the program developed jointly with Sberbank-AST CJSC. Students who successfully complete the program are issued certificates of the established form. April 28, 2020 SIphotography / Depositphotos.com According to the Pension Fund, in 2020, 6.45 million people transferred their pension savings from one fund to another ahead of schedule.

The total investment losses of citizens from these actions are estimated by the Association of Non-State Pension Funds at 40 billion rubles. According to preliminary estimates for 2020, losses amounted to at least another 55 billion rubles.

And according to the results of the 2020 transition campaign, losses of insured citizens, according to some estimates, may increase to 70-80 billion rubles.

NPF Lukoil Garant interest

May 25, 2020 Save Whatsapp Viber icon Viber Email That’s how I ended up at NPF Lukoil-Garant.

Just to leave NPF “Welfare”. Lukoil sends me an SMS once a year saying that my investment income was about 5,000 rubles. And also, if I write an application to transfer to another fund ahead of schedule, I will lose this income and income for 2020.

Investors express the hope that there will be no negative consequences for them from such a merger. Reviews There are many positive reviews on the Internet about NPF Lukoil-Garant.

The rating agency RAEX (Expert RA) confirmed the reliability rating of NPF LUKOIL-GARANT (OJSC) at level A++ (exceptionally high (highest) level of reliability) and withdrew it due to the expiration and refusal of the fund to update rating. Contents: Address: 129110, Moscow, st. Gilyarovskogo, 39, bldg.

3. Clients are accepted by appointment by phone: 8 800 200-5-999. Regardless of category, a citizen must reach retirement age.

We recommend reading: Donation agreement taxation

Communication with customers

NPF Lukoil receives very mixed reviews for the way its employees treat clients. Some emphasize that it is in this organization that they manage to receive attentive attention and get answers to all questions without much difficulty. Employees treat everyone with respect, respect, and try to give everyone due attention.

However, some reviews contradict positive statements. It is indicated that unprofessional personnel work at Lukoil. They simply lure clients to them, but withhold important information about cooperation. Some workers cannot answer a number of simple questions.

What to believe? Rather, it is better to take a neutral point of view. The thing is that the Lukoil pension fund receives a variety of opinions. The organization is spread throughout the country, with different employees working in each branch. Therefore, in some regions you may actually encounter less than the best employees. No one is immune from this. Nevertheless, Lukoil is trying to quickly correct the situation, getting rid of unprofessional staff and apologizing to its visitors.