Information about the fund

- Full name of the organization (name of NPF): Joint Stock Company Non-state pension fund "UMMC-Perspective"

- Status in 2020: Active - Valid license

- License number: 378/2

In 2001, the non-state pension fund UMMC Perspective was registered, however, it began active work only in 2006. The services provided by the fund are standard: OPS and NPO programs, pension co-financing, corporate pension programs for legal entities. The fund is among the TOP 40 largest NPFs in Russia. The founders of the fund are a number of large enterprises of the Ural mining and metallurgical industry; accordingly, the main client base is made up of employees of enterprises living in Yekaterinburg.

On January 23, 2020, an entry was made into the Unified State Register of Legal Entities about the creation of the Non-State Pension Fund “UMMC-Perspective” as a result of the reorganization of the Joint Stock Company. the rights and obligations of NPF UMMC-Perspectiva (a non-profit organization) were transferred in full to JSC NPF "UMMC-Perspective".

Affiliated funds

There are no affiliated funds

Requisites

View details

License No. 378/2 dated November 23, 2004. issued by the Federal Financial Markets Service of Russia to carry out activities related to pension provision and pension insurance without limitation of validity period

OGRN: 1156600000182, INN 6686058813, KPP 665801001

Bank details for transferring pension contributions: account number 40701810200000000376 to LLC “RING OF THE URAL”, Ekaterinburg, BIK046577768, account number 30101810500000000768

Pension Fund

On these pages you are given the opportunity to see information that is known to a limited number of people. According to generally accepted rules, personal data of citizens must be kept secret from all curious people. Therefore, only those who have received special permission from the site owners, or in other words, “access” to the secret, can see such data.

To get permission to see your data, you need to prove that you have the right to do so.

To do this, first “registration” is carried out, and then “authorization” of the visitor to the personal account. When registering, you are asked to enter your name or personal number and contact information. It also specifically stipulates how you will confirm that you are you. In addition, you will need to indicate how you can be contacted: by email, via SMS or some other way.

Contacts

Official website of NPF UMMC-Perspective

https://www.npfond.ru/ Here anyone can use the pension calculator or ask a question to a fund expert. The official NPF resource is informative and functional, there is a mobile version and feedback.

Email mail

Address

Ekaterinburg, st. Boris Yeltsin, building 3/2, Demidov Business House, 5th floor, office 3.

Working hours: from 8-30 to 17-30. Saturday and Sunday are days off.

Hotline number

8-800-5000-852 (toll-free call) or 8 (343) 2850929

How to conclude an OPS agreement

A citizen has the right to independently manage the funded part of the pension, that is, transfer it to the management of any pension fund, including non-state ones, for further investment and income generation. Before the transfer, the funded part is at the disposal of the Pension Fund, which cooperates in terms of investment with the manager.

Rice. 4. Pension from UMMC-Perspective

If you want to choose PPF "UMMC-Perspective" as your insurer, you must:

- Fill out the questionnaire.

- Sign the OPS agreement.

- Submit to the Pension Fund yourself or by mail an application for transfer to a non-state fund and transfer of a pension.

Download the questionnaire.

Download the OPS agreement.

An agreement with UMMC-Perspective can be concluded directly in the office or through an authorized representative. Contacts of representatives can be found on the official website of NPF “UMMC-Perspective” in the “Geography” section.

If there is no branch of the organization in the city, contact the NPF:

- by phone 8-800-5000-852;

- via email;

- via skype: ugmk.perspektiva.

To complete the documents, you will need the original and copies of your passport and SNILS.

Reference! The contract comes into force after the insured person’s funds are received into the fund’s accounts.

Personal Area

For convenience, the fund’s clients are given access to their personal account, where they can view:

- with the results of the organization’s work based on the results of the latest reporting periods;

- upon request with data on the status of your personal account;

- upon request with a compulsory insurance information form.

To gain access to your personal account, you must log in. To authorize you must enter:

- Login – pension agreement number.

- Password – date of birth in the format DDMMYYYY without dots.

Note! When entering the contract number, you must replace the Cyrillic alphabet with Latin alphabet and remove the slash.

Example: contract number OPS2-23, when entering your login you need to change it to OPS2-23.

If more than 1 contract has been concluded, you must enter the numbers of each in the “Login” field.

How to terminate an OPS agreement

The insured person has the right to change the insurer no more than once a year. Therefore, it will be possible to terminate the contract with UMMC-Perspective only one year after its conclusion.

The algorithm of actions will depend on where the client wishes to transfer his savings:

- When transferring to a new NPF, you need to conclude a contract with it and notify the Russian Pension Fund about the transfer of finances. Some non-state funds notify the Pension Fund of the Russian Federation about new contracts independently.

- When transferring savings to the Pension Fund of Russia, it is enough to submit a corresponding application to it.

In any case, upon early transfer, the insured person loses a significant part of the investment income.

Features of NGO agreements

NGO agreements are concluded on a voluntary basis. Therefore, the terms of the contract can be negotiated with the client individually. There is a standard NGO agreement, but you can additionally agree on:

- terms and frequency of contributions;

- amount of contributions;

- period of non-state pension payments – from 3 to 20 years;

- appoint successors.

Upon termination of the NPO agreement, the client receives all funds accumulated through contributions and the full amount of investment income.

Corporate programs

For corporate clients, NPO "UMMC-Perspective" offers several employee pension programs, which are based on the principles:

- personal pension accounts – opened by individuals, the company can additionally replenish the employee’s personal account;

- parity pension program - personalized financing is provided by both the company and the employee;

- joint pension accounts – contributions are made to the account of a group of persons, the employee receives a fixed additional pension after retirement.

Fig.5. Principles of basic corporate pension programs. Source: official website

The terms of corporate programs are negotiated with the legal entity individually.

Did you like the article?

NoAverageYes

Save and share information on social networks:

Now many citizens and companies prefer non-state pension funds for additional security when entering a well-deserved retirement. Many of these organizations deserve close attention.

Statistics of NPF UMMC-Perspective: rating of reliability and profitability

According to the Central Bank of the Russian Federation from the reporting “Main performance indicators of non-state pension funds” as of the date: 01/01/2020

Fund assets (thousand rubles): 13935736.77

Statistics on NPO (non-state pension provision) as of 01/01/2020

- Total volume of pension reserves (thousand rubles): 2233166.63

- Total number of participants (people): 64769

- Participants receiving a pension (persons): 3196

- Total amount of pensions paid under NPO (thousand rubles): 56520.03

Statistics on compulsory pension insurance (compulsory pension insurance) as of 01/01/2020

- Pension savings (thousand rubles, market value): 10659655.24

- Number of insured persons (people): 92240

- Participants receiving a pension under compulsory pension insurance (persons): 3254

- Amount of pension payments under compulsory pension insurance (thousand rubles): 74608.95

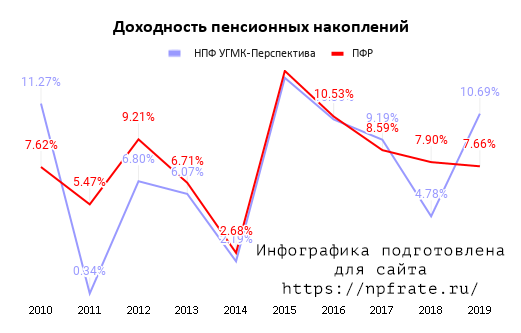

Profitability of pension savings

Current profitability

Minus remuneration for management companies, specialized depository and fund.

- Profitability of placing funds from pension reserves (NPO): 10.45%

- Return on investment of pension savings (OPS): 10.69%

Profitability chart

Data on the profitability of NPF UMMC-Perspective in 2020 (as of 01/01/2020), including information for the previous 10 years in comparison with the profitability of the Pension Fund (VEB):

Yield comparison table

| Year | NPF UMMC-Perspective | Pension Fund |

| 2010 | 11.27% | 7.62% |

| 2011 | 0.34% | 5.47% |

| 2012 | 6.80% | 9.21% |

| 2013 | 6.07% | 6.71% |

| 2014 | 2.19% | 2.68% |

| 2015 | 12.75% | 13.15% |

| 2016 | 10.36% | 10.53% |

| 2017 | 9.19% | 8.59% |

| 2018 | 4.78% | 7.90% |

| 2019 | 10.69% | 7.66% |

Disclosure of key indicators

Profitability indicators, the number of clients of the organization and the amount of funds in dynamics show a detailed picture of the state of the fund, as well as its reliability and prospects.

Profitability

UMMC-Perspective pursues a conservative policy regarding the accumulation of funds, which makes it possible to neutralize risks and increase income.

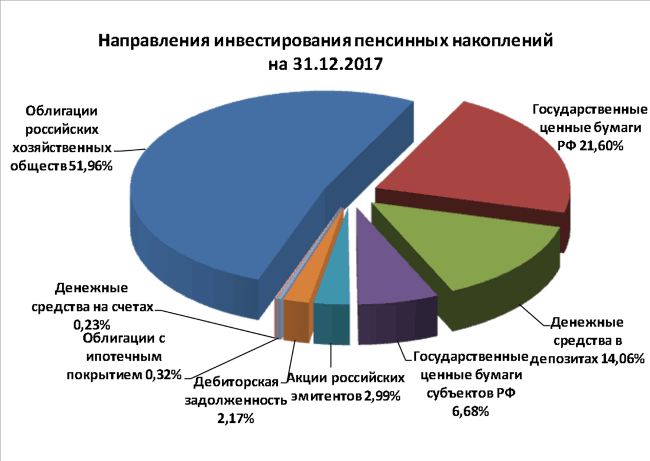

Rice. 2. Directions of investment according to OPS. Source: official website

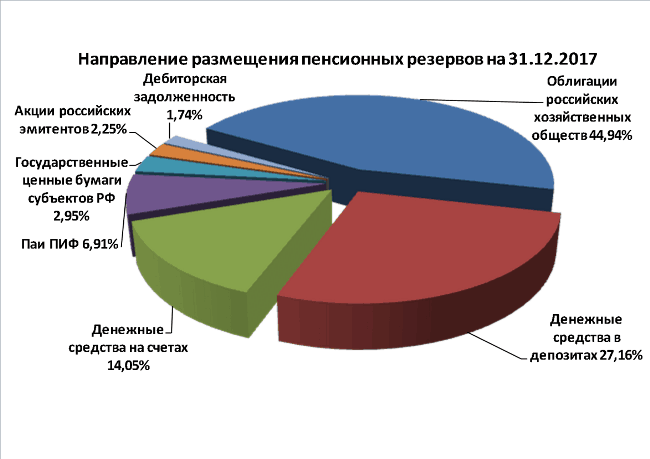

Rice. 3. Directions of investment in NGOs. Source: official website

Table 2. Return on savings and reserves in 2014–2018 Source: npf.investfunds.ru, cbr.ru

| Year | Profitability, % | |

| OPS | NPC | |

| 2014 | 2,19 | 4,92 |

| 2015 | 12,75 | 10,2 |

| 2016 | 10,36 | 11,68 |

| 2017 | 9,19 | 7,47 |

| 2018, March | 12,52 | 10,23 |

Chart 1. Profitability dynamics in 2014-2018 Source:: npf.investfunds.ru, cbr.ru

Reference! At the end of 2020, the Central Bank assigned the UMMC-Perspektiva Pension Fund 7th place in the overall list in terms of profitability.

The leaders in the ranking in terms of profitability in the first quarter of 2020 were the NPF Gazfond Pension Savings, the Vladimir Fund and the National Non-State Pension Fund.

Number of clients

The fund works with individuals in two directions, concluding contracts for compulsory and voluntary pension provision.

Table 3. Number of insured persons of the fund in 2014–2018. Source: npf.investfunds.ru, cbr.ru

| Year | Number of clients by OPS, people. |

| 2010 | 58 914 |

| 2011 | 60 983 |

| 2012 | 65 561 |

| 2013 | 65 471 |

| 2014 | 65 179 |

| 2015 | 58 965 |

| 2016 | 70 635 |

| 2017 | 74 517 |

| 2018, March | 82 066 |

Chart 2. Growth dynamics of the fund's insured persons, 2010–2018. Source: npf.investfunds.ru, cbr.ru

Reference! The NPF also serves 89,631 participants, of which 3,137 people, as of the end of 2017, received an additional pension.

Volume of pension savings

Table 4. The amount of pension savings of the fund in 2005–2017. Source: npf.investfunds.ru, cbr.ru

| Year | Amount of savings, million rubles. |

| 2010 | 1 532 |

| 2011 | 2 727 |

| 2012 | 3 726 |

| 2013 | 4 686 |

| 2014 | 4 751 |

| 2015 | 5 389 |

| 2016 | 7 175 |

| 2017 | 7 956 |

| 2018, March | 8 414 |

Graph 3. Dynamics of increase in savings in 2010–2017 Source: npf.investfunds.ru, cbr.ru

Reference! The volume of pension reserves at the end of the first quarter of 2020 reached RUB 2,018 million.

Awards and ratings

In October 2020, NPF "UMMC-Perspective" confirmed the reliability rating ruA+ (very high level of reliability and quality of services) of the expert agency "ExpertRA" and withdrew it.

In the RAEX rankings at the end of 2020, the fund ranks:

- 26th place in terms of capital;

- 28th place in pension reserves;

- 23rd place in savings.

Table 5. Place in the NRA ranking as of March 31, 2018. Source: npf.investfunds.ru, ra-national.ru

| Name | Place in the ranking | Market share, % |

| Amount of own property | 25 | 0,29 |

| Number of insured persons | 19 | 0,22 |

| Number of participants | 16 | 1,05 |

| Volume of pension savings | 18 | 0,33 |

| Volume of pension reserves | 29 | 0,17 |