Hello! Today we’ll talk about non-state pension funds. The question of how to ensure a decent old age will sooner or later affect each of us. Few people have illusions that the state will solve this problem. How to plan your future correctly and which pension fund to choose will be discussed in this article.

Definition of NPF

A non-state pension fund is a structure that is under close government control. Deposits made into this structure are insured. This means that in the event of a non-state pension fund leaving the market, all assets are automatically transferred to the state Pension Fund.

What you need to know

Non-state pension funds do not just store the money of their clients, but invest it in state corporations, shares and other securities, thereby increasing the funds that have already been accumulated by investors.

What is NPF?

This section is a little boring, but I can’t skip it - what follows will be much more interesting.

A non-state pension fund is a non-profit organization whose work is to provide pensions to its clients who have previously concluded a pension insurance agreement; secondly, this is the activity of NPFs as an insurer in accordance with the Federal Law “On Compulsory Pension Insurance in the Russian Federation” (dated December 15, 2001, No. 167-FZ) and the Federal Law of May 7, 1998 N 75-FZ “On non-state pension funds."

Non-state pension funds operate as insurers for professional pension insurance, relying on the law and agreements on the creation of professional pension systems.

The activities of non-state pension funds are similar to the activities of the pension fund of the Russian Federation, both of them accumulate funds from citizens' pension savings, invest, keep records of them and prescribe payment of the funded part of the labor pension.

To transfer your funded part of your pension to a non-state pension fund you need:

No later than December 31 of the current year, send an application for transfer from the Pension Fund of the Russian Federation to a non-state pension fund that provides compulsory pension insurance in one of the following ways:

– personally to the territorial body of the Pension Fund of the Russian Federation;

– personally to the organization with which the Pension Fund of the Russian Federation has concluded an agreement on mutual certification of signatures;

– in another way (by mail or courier), while identification and verification of the authenticity of the signature of the insured person is carried out by a notary or in the manner established by clause 3 of Article 185 of the Civil Code of the Russian Federation.

You can view the current list of non-state pension funds on the official website of the Pension Fund.

Below is the section on how to choose the most suitable/profitable NPF.

Selecting a non-state pension fund

Experts have developed a number of characteristics by which you can choose a non-state pension fund that is suitable for you (and therefore highly reliable):

- Year of fund formation : Ideally, the NPF should be created before 1998, this will be confirmation that it suffered two difficult periods and survived;

- Founders : the greatest trust is in funds that were created by large enterprises, serious banks, and so on. All information about the founders can be obtained from the Unified State Register of Legal Entities;

- NPF income : how successful the fund is financially can be found out by visiting its official website, or from the reporting of the Bank of Russia, which is in the public domain. It is worth mentioning that the figures in the reports may differ from the actual ones. If the figures on the official website are clearly inflated compared to the reported ones, this is already a reason not to contact such a non-state pension fund;

- What place is the fund in the NPF ranking ? This indicator can be considered the most important. Thanks to the rating, you can find out how reliable the fund is;

- What are the reviews about the fund : you need to study customer reviews left on third-party resources (this is more objective);

- How convenient is the NPF website and services : it is worth paying attention to whether the NPF has additional offices in your city, whether there is a 24-hour helpline, whether it is possible to create a personal account on the website;

- Is information about the license, address, and is there access to reporting available on the fund’s website?.

Non-state pension funds

May 18, 2017

Contents

:

- How to switch to NPF

- NPF profitability rating

- NPF Reliability Rating

- Non-state pension funds. Reviews

- Adviсe

The first non-state pension funds were created back in 1993. But only in the last 5-6 years did citizens learn about their existence, since the state obliged citizens to move from state “hands” to private ones. Therefore, the article provides information about the most reliable NPFs and discusses in detail instructions for moving from one NPF to another.

How to switch to NPF

So, you have decided that you no longer want to stay in the State Pension Fund and have found a better offer in the Non-State Pension Fund.

To transfer to a private pension fund, you must complete the following steps:

- contact the NPF with an application to transfer savings;

- conclude an agreement on compulsory pension insurance.

The application is reviewed within 30 days. The transition date is set to one day - March 31.

There are no refusals in such situations, since private organizations are interested in new “investors.”

Do not forget that you can submit an application to transfer to another NPF only once a year.

If two applications were submitted this year, the Pension Fund of the Russian Federation makes a decision on transfer to the last organization.

It is best to contact the supervisory authority in person, since when transmitting documents by mail, courier or using electronic services, it is necessary to have copies certified in advance by a notary. The price tag for some documents varies from 200 to 1,000 rubles. This way you will save money, and you will always have time.

NPF profitability rating

In the early 2000s, there were a huge number of private funds and each offered a unique program with high interest rates. In recent years, the owners of non-state pension funds have realized that dispersing the population’s savings does not lead to profit and have decided to merge into large concerns. Thus, one organization could absorb from 3 to 10 small private foundations. This decision turned out to be beneficial for all participants in the transaction: private funds receive more clients and funds, and clients, in turn, receive really high interest rates, which leads to an increase in the size of their future pension.

The six most profitable Non-State Pension Funds:

| Name of the Non-State Pension Fund | Profitability level (%) |

| CJSC NPF "Promagrofond" | 13,58% |

| OJSC NPF "GAZFOND Pension Savings" | 13,16% |

| JSC NPF First Industrial Alliance | 12,22% |

| JSC NPF Gefest | 11,95% |

| JSC NPF Volga-Capital | 11,31% |

| OJSC "NPF RGS" | 11,17% |

All organizations have offices in every region and major city.

NPF Reliability Rating

There are three options for NPF reliability:

- A++ - means that the fund has exceptionally high reliability;

- A+ - very high reliability;

- A - high reliability.

The ten most reliable non-state pension funds, according to a study by the independent rating agency Expert RA, were:

- JSC NPF NEFTEGARANT;

- CJSC NPF "Promagrofond";

- NPF VTB Pension Fund;

- NPF "Volga-Capital";

- OJSC NPF "GAZFOND Pension Savings";

- NPF "Sberbank";

- JSC NPF Soglasie;

- NPF "BLAGOSOSTOYANIE";

- NPF "Atomfond";

- NPF "Diamond Autumn".

You can also independently assess the reliability of NPFs using the following criteria:

- Date of creation of the organization. The older the fund, the better.

- Who is the founder of the company? As a rule, those funds that are based on enterprises are considered reliable. For example, thermal power engineering, mining, banks with state participation.

- Presence of a trade union organization. Of course, not all enterprises have it, but its presence will be a plus.

- Fund return. The interest rates offered must be realistic. Consider several NPF options and compare their profitability. If in doubt, it is better to refuse this offer.

- Rating in an independent study from the Expert RA agency. The company has gained trust in the research services market as an honest and incorruptible organization.

- Availability of information about the fund. Data on activities, financial statements, audits, etc. should be available on the company’s website.

- Company reputation. It is better to get information from third-party sources, because... Reviews can be purchased on the funds' website.

- Take a look at the website of the Central Bank of the Russian Federation. This is the main source of obtaining reliable information about existing non-state pension funds.

Non-state pension funds. Reviews

The World Wide Web is filled with various comments on this topic. Based on the information received, 90% of citizens are distrustful of NPFs. And even if these are well-known banks or oil producing companies, many are sure that in old age there will be nothing left of their savings, or the organization will go bankrupt. Although this point is regulated by the state, in the event of bankruptcy of a non-state pension fund, citizens are paid compensation in full.

Of course, this is a difficult moment - whether to trust your hard-earned money to strangers or not. It's up to you to decide.

Adviсe

- Track all information about movements and accruals on the NPF website.

- If agents from NPFs come to your home, refuse such services. Perhaps they are scammers.

- Be sure to compare the profitability of different NPFs and their reliability. If you are not satisfied with the conditions, move to another organization, because in old age you want to receive a decent pension, and it depends only on you.

Pros of NPF

Many people express distrust of non-state pension funds. This is explained, first of all, by a lack of information, which influences the formation of incorrect conclusions.

To partially dispel doubts, let’s analyze all the positive features of these structures.

- A person can influence his own pension payments . This can be called the main advantage of NPF. Everyone determines their own capabilities and regulates the contributions they make to the fund;

- All savings are protected from negative legislative and pension reforms . Now there is no certainty that in six months or 10 years there will not be any negative changes regarding pensions. And thanks to the NPF, you can plan the amount of payments due;

- State control over the activities of non-state pension funds . All non-state pension funds comply with the requirements of the legislation of the country in which they operate, have all permits and are fully accountable to the state for their activities;

- Tax benefits . For accurate and up-to-date information, you should contact Russian tax legislation or the representative office of the selected NPF;

- Transparency of all activities . Typically all investors have access to their retirement accounts. All information can also be obtained from the fund administrator;

- Investing in assets with a high degree of reliability . All capital is invested only in those instruments that are defined by law, this reduces the risk of losing funds;

- Savings can be passed on by inheritance . In the event of the death of the investor, all savings will be received not by the state, but by his heirs;

- Funds can be transferred from one fund to another, or again to the state one . This possibility is provided for by law.

Now we have analyzed the positive aspects of NPFs, but we should not forget that there is always a second side to the coin.

Non-state pension fund National

NPF "National" is a non-state pension fund. The only type of activity that this organization is engaged in is the formation of pension savings and their insurance. The organization ensures the safety of investments and their increase, and also pays funds to clients in accordance with the concluded agreement.

About the National Fund

The year “National” was created and received a license was 1997. A year later, 520 former employees were paid non-state pensions. In the first three years of operation, the foundation became one of the largest organizations of its kind in the Russian Federation.

Since 2004, National has been engaged in compulsory pension insurance. By 2008, a network of Branches was created throughout Tatarstan; about 20 thousand people received non-state pensions. The 2008 crisis did not prevent the fund from bringing investment reserves to the previous level and receiving a return of 34% per annum, ranking second in this indicator.

In 2014, the organization was reorganized into a closed joint stock company. By the end of 2017, over 5 billion rubles were paid to pensioners.

NPF website

The official website of the non-state pension fund "National" www.nnpf.ru contains a lot of useful information. Here you can find:

- Official financial statements;

- Auditors' reports;

- List of programs with a detailed description of the conditions;

- Data on the structure and divisions of the fund;

- Information about shareholders;

- News of the organization.

A special section presents graphs and tables on the results of investing pension reserves and the distribution of the savings portfolio.

According to the official website of NPF National, pension savings are invested in:

- Stock;

- State securities;

- Bonds of state corporations and entities;

- Cash.

The resource also contains information about the sectoral distribution of investments, where the first place is occupied by the public sector, and the second by the oil and gas industry.

Here you can also learn about the structure of issuers in pension savings. The leader is also the state, followed by Rosneft and Rostelecom. The same indicators are presented for pension reserves.

Currently, approximately 50 thousand people receive a non-state pension from the fund. Interest income is accrued annually to a special account and capitalization is carried out. The format and timing of payment of such a pension can be chosen at your discretion.

Good to know! The client can terminate the contract with the NPF; it can be terminated at the client’s request at any time and receive the redemption amount.

Using the calculator on the website, you can determine the optimal pension program and calculate future payments. To do this you need to specify:

- Age;

- Year of application for a non-state pension;

- Decision on payment of additional and regular contributions;

- Period of payment and amount of contributions;

- Type of pension: lifelong or fixed-term.

The indicators are calculated taking into account the fund's profitability and other characteristics of its activities.

Advantages of cooperation with the fund

Cooperation with the First National Pension Fund in the field of compulsory insurance has a number of advantages:

- Funded pension contributions are invested;

- Thanks to the income from such investments, savings are formed;

- The funds received are paid in the form of a pension to the insured person;

- The state acts as an insurer of savings.

As for personal plans, they help accumulate funds for use after reaching retirement age. In fact, this means receiving a non-state pension. The system operates on the principle of voluntary contributions.

Helpful information! The amount of non-state pension payments does not depend on salary, length of service, or state pension payments.

It is formed by paying contributions, as well as from income from their investment investments.

Fund reliability – rating

RA “Expert” assesses the reliability of NPF “National” as exceptionally high. This is evidenced by the maximum rating of “A++” with a stable outlook. The fund has demonstrated this level since 2012, regularly confirming it. This NPF does not participate in assessing reliability according to the criteria of the National Rating Agency.

In 2009, the fund demonstrated a profitability rate of 32.99%, and in the crisis year of 2008 it turned out to be zero. Against the background of high volatility of the securities market in 2011, the yield did not exceed 0.59%.

Profitability indicators

This year, the Central Bank recorded the profitability of NPF "National" in the field of compulsory pension insurance - 12.56%, in terms of non-state pension provision - 12.24%.

At the moment, the assets of NPF “National” amount to 35 billion rubles, the accumulation of pension funds reached 16.9 billion rubles, and reserves – 14.6 billion rubles. More than 400 thousand people form a funded or non-state pension in the fund.

Contact Information

Today, offices and representative offices of the National Pension Fund operate throughout Russia; every citizen has the opportunity to contact the nearest branch. Office addresses and telephone numbers can be found on the website. There is a hotline at 8-800-555-999-1, which you can contact with any questions you may have.

Access to your personal account

There is a personal pension account for clients of JSC NPF National at lpc.nnpf.ru/auth. To register and subsequently log in, you must specify 9 SNILS digits without a checksum. Using the account is possible after completing the registration procedure and providing consent to the processing of personal information.

During registration, you must enter your full name, date of birth, SNILS number with a control digit and contract number. After this, the user is provided with a password.

Important! Do not share your personal account password with unauthorized persons, as this may lead to unauthorized access to your personal data.

Customer Reviews

Feedback from the fund's clients is most often positive. This is not surprising, because the organization is one of the leaders in its market segment. People point out the opportunity to protect themselves from unscrupulous agents by providing a photocopy of their passport and SNILS to the NPF.

An important factor is the presence of six founders from different sectors of the economy, each of whom is well known. As is known, the presence of one dominant founder has a negative impact on the work of the organization.

Often people even refuse service at another NPF in favor of National, and subsequently do not regret it.

(19 3,58 of 5) Loading...

Source: https://ru-NPF.ru/natsionalnyy/

Disadvantages of NPF

- Money is deposited now, but payments will not be made until many years later . Given the instability of the economy, the prospects are rather vague;

- Capital gains are very small . Often no more than 1%, which in reality does not even cover actual inflation, that is, participation in such a fund is simply unprofitable;

- Savings can only be made in rubles (if we are talking about Russia) . But a large number of people do not particularly trust the national currency, preferring to keep their savings in dollars and euros, or even divide them into 3 parts;

- You can withdraw money before the expiration date only in extreme cases . These include: death of the investor, disability, change of residence (moving to another country);

- No one can guarantee a high percentage of profitability.

- Legislation may change in a negative direction in relation to non-state pension funds . As mentioned above, planning anything for a long period of time is difficult. And in difficult times, the government may make various decisions that can hurt NPF clients.

If you are planning to transfer savings to a non-state pension fund, it is better to pay attention to the considered positive and negative aspects.

Security of NPFs - is it risky to trust them with money?

It makes sense that many residents are wary of risky investments and investments, especially when it comes to their future retirement. Therefore, answering the question about the safety of NPFs - yes, they are reliable and safe investments and should be made.

The non-state pension fund undertakes to invest money exclusively in reliable assets, such as:

- Bank deposits

- Bonds. Most often in government domestic loan bonds (OFZ)

- Shares of reliable companies (mostly blue chips: Sberbank, Gazprom, Lukoil, Rosneft, Severstal)

- Bank metals

- Real estate

Therefore, your money is always in the most reliable places.

In addition to this list, a non-state pension fund can simply invest money in a management company (UIF) that has the appropriate license.

All money in the NPF is insured, so in the event of its bankruptcy or liquidation, the investor will receive the entire amount back to the Russian pension fund. Excluding accrued interest.

Advantages of transferring the funded part of a pension to a non-state pension fund

- Opportunity to earn income above inflation

- All investments are insured. This is an important point, so you don’t have to be afraid of losing your money.

- Everyone independently decides in which fund to store their contributions and can transfer them from there at any time

- How to calculate capitalization of interest on a deposit;

- Interest on deposit - example of calculation;

- Pension deposit in Post Bank;

How to transfer to a non-state pension fund

Let's consider all stages of the transition procedure.

Briefly: you need to have a passport and a certificate of state pension insurance (SNILS).

- Contact the NPF that has been selected;

- Provide the fund consultant with the documents listed above;

- Fill out the application form;

- After the application is received, the Pension Fund itself will transfer the savings to the NPF.

Important information : you can make not only a transfer from the Pension Fund of the Russian Federation and a non-state fund, but also back, as well as from a non-state pension fund to another non-state pension fund.

Non-state pension funds (NPFs) are starting to pay citizens more and more money

Friends!

Interesting news from the Kommersant publishing house.

Non-state pension funds (NPFs) are beginning to pay more and more money to citizens. This year, for the first time in the history of the funded component of compulsory pension insurance (OPI), the amount of payments may exceed 20 billion rubles. However, real lifelong or fixed-term pensions make up only 5% of total payments, the rest of the money is paid in a lump sum or to the legal successors of deceased citizens. The increase in payments, as well as the significant fees charged by NPFs for management, will lead to stagnation of the total volume of pension savings until 2022, experts believe.

Payments to clients of private funds under OPS this year will exceed 20 billion rubles!

This is the forecast of Kommersant, made on the basis of NPF reports, data from the Central Bank, as well as an analysis of the Pensopathology project. Last year, such payments amounted to 18.7 billion rubles, which is 25% more than a year earlier. Over five years, according to statistics collected by the regulator, payments to clients of private funds increased almost 3.5 times, while their average annual growth (CAGR) was 27%. In the first half of the year, NPFs have already paid out about 9.5 billion rubles to insured persons and their legal successors, according to Kommersant’s assessment based on the reports of private funds (Khanty-Mansiysk NPF, Orenburg fund “Doverie”, “Federation” and “Rostec” do not publish detailed annexes to interim reporting).

NPF payments are divided into four components.

A monthly lifelong (funded) pension is paid to citizens who have reached the pension grounds (basic - 55 years for women and 60 years for men), who have accumulated enough funds in their account with the insurer for monthly payments to exceed 5% of all monthly pension payments (funded and insurance). parts). If not, then the client is paid a lump sum of all funds collected in the account.

A fixed-term (term chosen by the client, but not less than ten years) pension is paid to those citizens who, within the framework of the compulsory pension system, made voluntary contributions to the co-financing program and chose this type of payment. Finally, if a citizen did not live to reach the pension grounds and lifelong payments were not started, the pension savings and the balance of funds for the unpaid fixed-term pensions of the deceased citizen are paid to the legal successor.

Mass payments of pension savings will begin in 2022, when pension grounds for the funded component of compulsory pension insurance will arise for women born in 1967. However, this has already occurred among people born in 1953–1957 and younger, for whom, since 2002, a funded component of an insurance contribution of 2% of wages has been formed (“two percenters”; discontinued in 2005), as well as for those who pension grounds have come into effect ahead of schedule, for example, if you have the required length of service in certain types of work (“early pay”).

The vast majority of pensions by private funds are paid in a lump sum - last year, about 72% of payments in monetary terms, or 13.4 billion rubles. paid pension savings. Payments to legal successors last year accounted for 23% of all payments to NPFs (RUB 4.3 billion). Lifetime pension payments are only about 4%, and term pensions are just over 1%.

“Taking into account the growth of payments, the actual suspension of transition campaigns, as well as the reduction in investment profitability due to the fall in the Central Bank key rate, we can predict that by 2022 - the time of the start of mass payments of savings to pensioners - the total payments of NPFs will amount to about 1% of the funds they have accumulated for OPS,” says Evgeniy Biezbardis, head of the Pensopathology project.

In 2014, payments under OPS by private funds were about 0.5%, and until 2020, NPFs managed to maintain this ratio due to the massive attraction of new clients from the Pension Fund. However, with its slowdown and significant increase in payments, the share in 2019 almost reached 0.7%.

“Based on the growth of financial markets this year, and also assuming a stable situation next year, it can be assumed that due to increasing payments, as well as due to fees charged by non-state pension funds, the volume of pension savings accumulated by funds will stagnate until 2022,” — says the founder of the “My Pension” project Sergei Okolesnov.

Source

https://www.kommersant.ru/doc/4449331?utm_source=smi2_agr

Read more >>>

Rating of TOP 10 reliable NPFs in Russia

Let's talk about the most reliable non-state pension funds in our country according to the Expert RA agency. The data was compiled as of October of this year.

| Name | Position in the ranking | Reliability level (RA Expert) |

| JSC "European Pension Fund" | 1 | A++ (maximum level) |

| NPF "Defense-Industrial Fund" | 2 | A (normal reliability) |

| "Ural Financial House" | 3 | The level is not determined, showed high profitability |

| "Education and Science" | 4 | Normal reliability |

| JSC Education | 5 | Level not defined |

| NPF Surgutneftegaz | 6 | Maximum level |

| NPF St. Petersburg | 7 | Not defined, showed high profitability |

| NPF Magnit | 8 | Not defined, showed high profitability |

| NPF Bolshoi | 9 | Maximum level |

| NPF Povolzhsky | 10 | Not defined, showed high profitability |

This table examined the top ten funds that are among the best. The total number of such funds is 50.

In this part it is worth taking a closer look at the NPF of Sberbank of Russia. This pension fund is attracting increased attention and interest from potential investors.

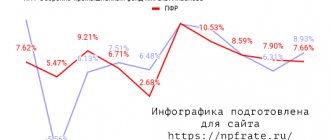

What is the yield of the most reliable non-state pension funds by year?

Having decided to transfer pension savings from a state fund to a private one, you need to check its reliability. A non-state pension fund must undergo an accreditation procedure and have a license. It is useful to study its performance over the past years and ratings. Based on certain criteria, experts determine the level of reliability of a non-state pension fund and place it in the appropriate position.

The highest trust rating is given as A+++. Placing your own pension savings in any A-rated funds is less risky than in others. The level of profitability depends on the assets in which organizations invest their policyholders' funds.

Among the leaders, who are determined by profitability and reliability, the following non-state pension funds can be distinguished:

- European Pension Fund. Created in 1994. Has an A++ rating in 2016, yield is 12.43%. A year earlier, the figure was 14.37%;

- Defense Industrial Fund. Formed in 2006. Rating at level A with a return in 2020 of 11.9%, a year earlier 0.04% higher;

- UFD (Ural Financial House), created in 1996, showed the return on pension savings at 10.9%, compared with the same figure last year at 11.38%;

- Surgutneftegaz, operating since 1995, has an average yield of 10.5% in 2020 and an A++ rating. In 2020, the profitability, like that of all non-state pension funds, was higher - 14.11%;

- Magnet. Formed as part of a large holding in 2009. Profitability for two years in a row at 10.3%;

- Uralsib. Created in 2004. Has a yield of 13.43% and an AA- rating in 2020. A year earlier it showed almost the same level of 13.15%.

The assessment of the funds is based on the results of the ratings of the well-known agency “Expert RA”.

NPF of Sberbank of Russia

This fund was created more than 20 years ago, in 1995. Its only founder is PJSC Sberbank. The fund also offers not one, but several pension programs:

- Individual pension insurance programs (development of individual pension plans);

- OPS (compulsory pension insurance);

- Pension programs for legal entities.

The geography of this NPF is very wide and covers a vast territory from the European part of Russia to Kamchatka. It has many branches and departments. Sberbank NPF is also a member of the National Association of NPFs.

The fund has many awards and has been awarded the highest level of reliability (A++) by the national rating agency.

All these indicators allow us to say that this NPF is stable, it operated during economic crisis periods and continues to operate, the fund’s activities are transparent (which is confirmed by the availability of information on the official website), and its structure is generally stable.

Why do people switch to NPFs?

The ability to transfer pension savings to commercial or non-state pension funds became possible in Russia relatively recently. If you withdraw them from the state fund, then the minimum period is 5 years.

Early return to a government structure is possible upon application. The main reasons for signing an agreement with NPFs are:

- desire to save a pension. Some citizens fear that the government agency may spend all its funds on payments to current pensioners;

- the need to increase your own pension. The State Fund offers only 2% indexation of the funded part. By investing in various assets, a non-state pension fund can increase this level to 14–20%;

- increasing profitability in general in order to use part of the pension early. Those interested in the world of finance understand that it is more profitable to invest the funded part of a pension in other assets than to subsequently receive a bonus. Especially if you are not sure of survival.

Those who transferred funds to NPFs are reassured by the opportunity to transfer them back to a government organization ahead of schedule. This makes it easier to make risky decisions. It must be remembered that the NPF will retain the profit received if the contract is terminated early. Unless otherwise stated therein.

Activities related to non-state pension provision[ | ]

Organization of interaction between a citizen and NPF[ | ]

The investor transfers contributions to the NPF on the basis of a pension agreement. When concluding this agreement, he needs to choose a pension scheme - a certain specification of the agreement that largely determines its conditions.

The Fund takes into account received pension contributions on the depositor's joint or personal account and forms pension reserves. He invests these reserves (usually through) in highly reliable assets. The income received from the investment results is distributed among the accounts and increases the future pension of the participants. However, it should be remembered that part of the income (no more than 15%) is used to remunerate the manager (NPF or NPF and management company), to replenish the insurance reserve and to pay the costs of servicing the fund.

When a participant retires, the NPF (and in some cases, in accordance with the agreement, the investor), based on the accumulated amount, determines the amount of the non-state pension and the procedure for receiving it.

Pension reserves[ | ]

Main article: Pension reserves

Pension reserves are the personal pension money of the investor within the framework of an individual or corporate NGO agreement, that is, the independent formation by the investor personally or through the employer who has entered into the agreement of his non-state pension. As part of their activities on non-state pension provision (NPO), non-state pension funds form pension reserves. In accordance with current legislation, non-state pension funds can place their pension reserves independently or through management companies. NPFs have the right to independently place funds in state and municipal securities, securities of constituent entities of the Russian Federation, on a bank deposit or in real estate. To invest in other assets, the fund must attract a management company. For these reasons, the annual return on pension reserves under NPO agreements is higher, in some years many times higher, than on pension savings, that is, on state compulsory pension insurance (OPS).

Relations between NPFs and management companies are built on the basis of trust management agreements and other agreements, depending on the scheme of work of NPFs in the financial market. Management companies are required to have a license for all types of activities for which they carry out transactions with pension funds.

The placement of pension reserves of NPFs must meet the following requirements:

- the cost of pension reserves placed in one facility cannot exceed 15% of the total value of pension reserves;

- the total value of pension reserves placed in securities that do not have recognized quotations must not exceed 20% of the value of pension reserves;

- the total value of pension reserves placed in securities issued by the founders and investors of the fund should not exceed 30% of the value of pension reserves, except for cases when these securities are included in the RTS Quotation List of the first level;

- the total value of pension reserves placed in federal government securities should not exceed 50% of the value of pension reserves, except in cases of their acquisition as a result of novation;

- the total value of pension reserves placed in government securities of constituent entities of the Russian Federation and municipal securities must not exceed 50% of the value of pension reserves;

- the total value of pension reserves placed in shares and bonds of enterprises and organizations should not exceed 70% of the value of the placed pension reserves;

- the total value of pension reserves placed in bank deposits and real estate should not exceed 80% of the value of the placed pension reserves.

There are deviations from the requirement for mandatory diversification of NPF investments. For example:

- if the total value of the fund's placed pension reserves does not exceed 1.5 million rubles, percentage restrictions on the placement of pension reserves in federal government securities and (or) bank deposits of banks are not imposed.

- if shares of mutual investment funds are purchased, the rules and investment declaration of which provide for compliance with the rules and requirements for non-state pension funds, percentage restrictions on the value of pension reserves placed in the shares of these mutual investment funds are not imposed.