Information about the fund

- Full name of the organization (name of NPF): NON-STATE PENSION FUND “RENAISSANCE LIFE AND PENSIONS”

- Status in 2020: Active - Valid license

- License number: 383/2

An industry-free pension fund that has no restrictions when managing entrusted finances. The company positions itself as one of the largest non-state pension funds with successful performance indicators for 15 years.

The fund was founded in 2002.

The shareholders of the Fund are: LLC “Velby Holding” and JSC IC “Renaissance Health”.

Affiliated funds

No affiliated funds

Requisites

View details

ORGN1187700021948 INN/KPP9725000621 / 772501001

Programs from Renaissance

The insurance company has been operating for 14 years. During this time, she gained the trust of citizens and earned a good reputation. The company offers a large selection of insurance policies. Among them there are NSW programs, each of them has its own characteristics:

| Program | Cumulative period | Annual payment | Annual percentage |

| Family deposit | From 5 years | Calculated individually | The first three years - 10%, the remaining 2 years - 4% |

| Harmony of life | From 10 years | No restrictions under the main agreement | Depends on the size of the payments. The amount is subject to indexation |

| Future | From 10 years | The client can determine himself | Depends on the amount of insurance premiums. The client can index the amount |

| Children | From 5 years | Determined on an individual basis | Directly depends on the insurance period and the amount of payments |

| Heritage | From 5 to 20 years | 100,000 rubles | 0.224 |

Family deposit

Any person between the ages of 18 and 65 can become a participant in this program. It involves depositing funds over a period of 5 years. In this case, the amount of the mandatory contribution is calculated on an individual basis. Its formation is influenced by gender, age, profession and state of health of a person. If an insured event occurs, the client’s relatives or persons specified in the contract receive funds to cover losses.

Insured events include the following:

- death - payment 100%;

- Fatal accidents - 200%;

- air and railway accidents - 200%.

This product guarantees financial protection to any family. If the insured event does not occur, the funds are returned with additional income.

Harmony of life

The primary advantage of the policy is that it combines two types of insurance - cumulative and risk. This allows you to accumulate a fairly large amount during the term of the contract, as well as protect yourself and your family from risks for the same period. An insured event is death for various reasons.

The client can significantly expand the terms of the contract. So, it can enable the following extensions:

- accident insurance;

- diagnosing serious diseases;

- benefits for breast and ovarian cancer;

- payments upon receipt of disability;

- protection of client deposits;

- termination of payments in case of an insured event;

- investment

It is worth noting that contributions can be made not only in rubles. Additional currencies are the dollar and euro.

Future

To be confident in the future, you need to plan your budget. However, not every person can do this competently. The Future program allows you to plan your own budget for several months or even years in advance.

The principle of the program is as follows: by making contributions, the client forms cash savings that are equal to the insured amount. At the end of the contract, he receives this money and can spend it at his discretion. The insurance policy opens up the following opportunities for the client:

- take part in the additional income of the insurance company, which was received during the investment of deposits;

- independently determine the amount of the insured amount;

- deposit funds in any convenient form;

- change the terms of the contract after a year;

- index the amount to avoid the impact of inflation.

In addition, the insurer provides assistance in diagnosing life-threatening diseases and treating female oncology. The main insurance risks are the survival of the insured person until the end of the contract, as well as his death, regardless of the cause. In the latter case, funds are paid to his relatives.

Children

Every caring parent wants his child to not need for anything. The “Children” insurance program is an investment in the future and an effective financial instrument that will prepare a reliable financial foundation. It will help your child confidently enter adulthood. According to the terms of the contract, by the specified date, the children of the insured person are paid the accumulated amount, which can be spent as desired. For example, to pay for university studies or buy a personal car. Payment of the insured amount to the child is guaranteed even in the event of the client’s death. The policy also includes the following options:

- accident insurance;

- protection of client's cash contributions;

- investment, which allows you to increase the savings amount.

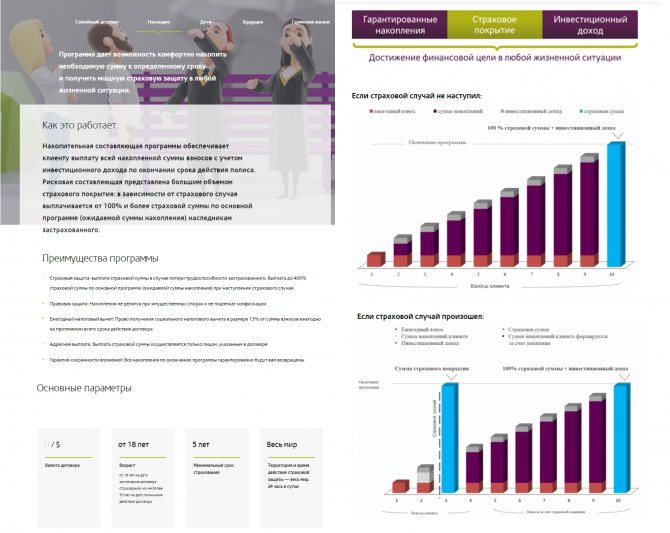

Heritage

Life is unpredictable and an emergency can happen at any moment, requiring a large amount of money to resolve. The Heritage insurance program allows you to accumulate an impressive amount of money by a certain date. This policy has many advantages. Among them it is worth noting the following:

- the insurance amount is paid in the amount of 100% in case of loss of ability to work and in the amount of up to 400% in case of death or accident;

- accumulated funds cannot be confiscated;

- Every year the client can receive a tax deduction in the amount of 13% of the deposit amount;

- funds are paid only to those persons specified in the agreement;

- The insurer guarantees the client the safety of his investments.

The insured event of the Heritage program includes death, accident, and road traffic accident. In the latter case, the client's family receives 300%.

Thus, endowment life insurance is an excellent option for those who want to insure their life and receive income over time. Among other things, the NJ allows for long-term budget planning.

Contacts

Official website of NPF Renaissance Life and Pensions

https://renpensions.com/ The site itself is modern: there is a mobile version and an easy-to-download desktop version. There is no pension calculator, but all other necessary information is available to anyone: documents, reporting, answers to questions, list of branches.

Email mail

Address

115114, Russia, Moscow, Derbenevskaya embankment, 7, building 22, entrance B, 3rd floor

Hotline number

For calls from Moscow and other countries +7

For calls from other regions of Russia 8

Fax +7

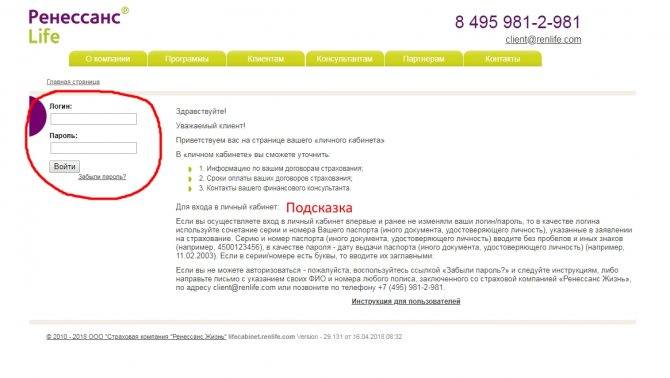

Registration and login to your personal account

Before activating a personal account online, the client must contact the nearest branch of the company to obtain insurance. To select the nearest branch to visit, you can use a detailed online map.

Where to get login and password

A client who has not previously logged into the account and has not changed the secret login data can use the passport data as a login and password. You can also indicate the details of any other document that proves your identity and was used to issue the policy. When entering your login, you do not need to use any punctuation marks or spaces. The information is entered into the line as a single unit. When entering a password, the use of characters is allowed.

As a login, you must enter the series or passport number (another document is possible). The date of issue of the client's identification document should be entered as the password. If the document contains letters, they must be entered into the form in capital form.

If you can't log in

When you enter reliable data, following the rules, authorization in your account occurs very quickly. After which the client, if desired, will be able to immediately change the login information using the settings section.

If difficulties arise when trying to log in, indicating data with which the system worked correctly until that moment, you must fill out a mini login form by clicking on the “Forgot your password” link. If this method of restoring access to your account does not work, you should write a letter to the email address, indicating your full name and insurance contract number. Clients can also contact the 24-hour support service for any questions regarding their personal account:

| SK Renaissance Life support phone number | +7-495-981-2981 |

Statistics of NPF Renaissance Life and Pensions: rating of reliability and profitability

According to the Central Bank of the Russian Federation from the reporting “Main performance indicators of non-state pension funds” as of the date: 01/01/2020

Fund assets (thousand rubles): 20435837.16

Statistics on NPO (non-state pension provision) as of 01/01/2020

- Total volume of pension reserves (thousand rubles): 19684119.82

- Total number of participants (people): 41612

- Participants receiving a pension (persons): 185

- Total amount of pensions paid under NPO (thousand rubles): 14881.89

Statistics on compulsory pension insurance (compulsory pension insurance) as of 01/01/2020

- Pension savings (thousand rubles, market value): 0

- Number of insured persons (people): 0

- Participants receiving a pension under compulsory pension insurance (persons): 0

- Amount of pension payments under compulsory pension insurance (thousand rubles): 0

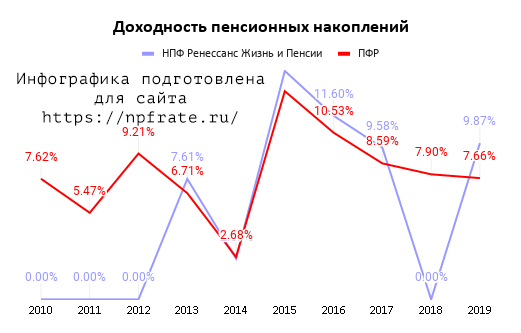

Profitability of pension savings

Current profitability

Minus remuneration for management companies, specialized depository and fund.

- Profitability of placing funds from pension reserves (NPO): 9.63%

- Return on investment of pension savings (OPS): 9.87%

Profitability chart

Data on the profitability of NPF Renaissance Life and Pensions in 2020 (as of 01/01/2020), including information for the previous 10 years in comparison with the profitability of the Pension Fund (VEB):

Yield comparison table

| Year | NPF Renaissance Life and Pensions | Pension Fund |

| 2010 | 0.00% | 7.62% |

| 2011 | 0.00% | 5.47% |

| 2012 | 0.00% | 9.21% |

| 2013 | 7.61% | 6.71% |

| 2014 | 2.57% | 2.68% |

| 2015 | 14.43% | 13.15% |

| 2016 | 11.60% | 10.53% |

| 2017 | 9.58% | 8.59% |

| 2018 | 0.00% | 7.90% |

| 2019 | 9.87% | 7.66% |

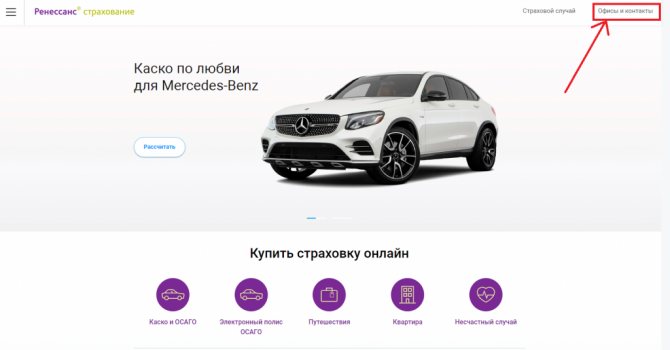

Office and addresses

Offices in every city in Russia can be found on the official website by clicking the button in the upper right corner of the site . You can find the nearest office in Moscow, St. Petersburg, Balashikha, Vladimir, Volokolamsk, Voskresensk, Vsevolozhsk, Vybka, Gatchina, Gorelovo, Dmitrov, Domodedovo, Yegoryevsk, Yekaterinburg, Zhezeznodorozhny, Zvenigorod, Izhevsk, Istvre, Kazan, Kaliningrad, Kashira, Kirishi, Klin, Kolomna, Krasnodar, Lomonosov, Lyubertsy, Mytishaya, Nozhny Novgorod, Novosibirsk, Noginsk, Ozery, Omsk, Orekhovo-Zuevo, Pavlovsky Posad, Perm, Peterhof, Petrozavodsk, Podolsk, Ramensky, Rostov-on-Don, Samara, Saransk, Saratov, Sergeev Posad, Serpukhov, Tver, Togliatti, Tosno, Tula, Chelyabinsk, Chekhov, Shatura, Shakhovskaya, Shchelkovo and Yaroslavl

Contact Renaissance Insurance by 24/7 toll-free number 8 (800) 333-8-800. Get an excellent level of service related to life and property insurance services at the best price. The company’s specialists will be happy and understanding to answer all questions and advise in any situation related to the company’s services.

Reincarnation

It's difficult to decide. After all, Renaissance is a non-state pension fund, which has undergone quite a lot of changes throughout its existence. The thing is that he went through a merger with several pension funds several times.

The last name of the organization is “Renaissance - Sun. Life. Pension". It is under this name that the non-state fund mentioned can be found. Therefore, it is surprising that about “Renaissance” and “Sun. Life. Pension” leaving the same reviews is not necessary. This is the same organization.

Frequent changes of names, as well as combination with other non-state funds, makes many people think about the integrity and sustainability of the company. But what should you pay attention to in order to determine as accurately as possible whether it is worth investing in the fund or not?