List of documents for registration of deductions

- Residence in the Russian Federation in those years to which the deduction is transferred is more than 183 days.

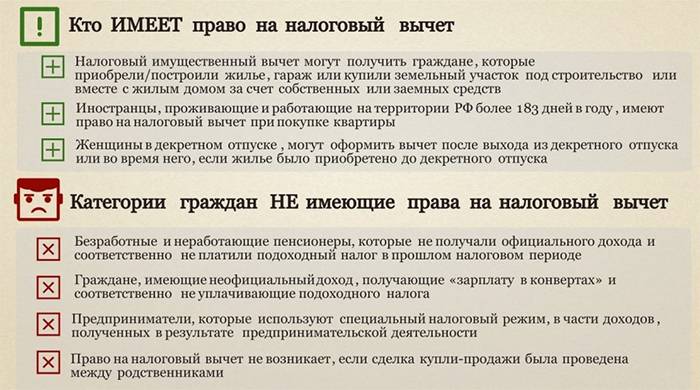

This condition is due to the fact that only a resident of the Russian Federation can receive a deduction, which is a citizen who stays on the territory of the Russian Federation for more than 183 days a year. - Availability of income subject to personal income tax at a rate of 13%.

The absence of income taxed at the specified rate deprives the pensioner of the right to receive a deduction.

- Buying a home with personal funds.

Purchasing residential real estate with government funds and benefits, as well as with employer funds, deprives a pensioner of the right to a deduction, since he did not incur any real costs for purchasing housing.

Note: purchasing housing under government assistance programs for certain socially vulnerable groups of citizens, which involve reducing or eliminating the down payment or reducing the mortgage rate, does not deprive the pensioner of the right to receive a property deduction.

- Purchasing housing not from related parties.

If the housing was purchased from close relatives, whom the Tax Code recognizes as spouses, children, parents, brothers and sisters, as well as guardians and trustees, the pensioner will be denied the benefit.

Please note that until 2012, the circle of interdependent persons was wider and included all close relatives with whom the citizen was in a marriage relationship, relationship of kinship and property.

Pensioners can receive the rest of the deduction only through the tax authority.

- 3-NDFL declarations filled out in reverse order.

- Application for personal income tax refund.

- Application for distribution of expenses (if claiming a deduction for marriage).

- Documents confirming the fact of acquisition of real estate.

- Documents confirming expenses.

More details about the list of documents submitted when applying for a property deduction can be found here.

Article No. 220 of the Tax Code of the Russian Federation contains information on how to return 13 percent of the purchase of an apartment to a pensioner. According to paragraph 10 of the document, senior citizens can receive a deduction for land, individual construction, real estate and mortgages.

Payments are made in accordance with the general procedure.

The maximum amount that is taken into account when determining the amount of deduction is 2 million rubles. The applicant can receive no more than 13% (260 thousand rubles) from it. When a married couple buys a home, this amount is divided by two. Husband and wife receive 130 thousand rubles each. every.

When purchasing an apartment with a mortgage, the amount increases to 3 million.

Example. Ivanov bought a house for 1.5 million rubles. for your own money. He will receive 195 thousand rubles. Petrov decorated the apartment for 2.5 million rubles. into a mortgage. He will receive a deduction of 325 thousand rubles, because the maximum amount for calculation is limited to 3 million. Sidorov bought housing for 2.7 million rubles with his own money. His deduction will be 260 thousand rubles.

In 2020, a citizen can return money for 2020, 2020, 2020, 2018. If a pensioner had no income during the specified periods, he will receive nothing.

Features of the 13 percent refund when purchasing an apartment:

- When transferring a deduction, the declaration is filled out in the reverse order: 2020, 2020, 2020.

- The Federal Tax Service accepts applications after the end of the calendar year in which the housing was purchased.

- The deduction is issued for the last 4 years.

Refund includes:

- Submitting a package of documents to the Federal Tax Service in person, in the taxpayer’s electronic account or by mail.

- Conducting a desk audit for 3 months.

- Transfer of money to the taxpayer's account. Funds will be received 30 days after the end of the procedure.

To return 13 percent for the purchase of housing, send to the Federal Tax Service:

- completed application form;

- copy of passport;

- declaration;

- an extract from the Unified State Register of Real Estate, a purchase and sale agreement and other documents for the apartment;

- certificate 2-NDFL;

- pensioner's ID;

- military ID;

- original certificate of expenses.

Through the employer

Citizens who work in retirement can receive 13 percent of the purchase of a house on a general basis. To do this, you need to take a tax notice from the Federal Tax Service and submit it to the accounting department.

The employer will stop withholding personal income tax from the salary amount by the end of the year.

Action plan:

- Write an application in any form to receive notification.

- Prepare a package of documents that confirms your right to a refund.

- Provide the papers to the Federal Tax Service at your place of residence or registration.

- Pick up your notice after 30 days.

- Give it to your employer.

- Prepare documents, an official agreement with the bank, a certificate of interest payment.

- Submit the application papers to the Federal Tax Service.

- Select the tax refund method - the Federal Tax Service or the employer. In the first case, provide your bank account details.

- The package of documents is reviewed for 3 months. After a positive decision is made, the money will be credited to your account within 30 days. The total waiting period is 4 months.

There is a general rule that applies to all taxpayers, including pensioners: the right to deduction arises from the year of receipt of the certificate of ownership, when purchasing real estate under a sale and purchase agreement, or the transfer and acceptance certificate when purchasing under a share participation agreement in construction .

In the year following the year in which the right to deduction was obtained, the pensioner-owner can exercise his right by submitting a 3-NDFL declaration to the tax authority. Two situations may arise:

- property deduction for a working pensioner;

- property deduction for a non-working pensioner.

A pensioner who continues to work has the right to submit a 3-NDFL declaration for a tax deduction when purchasing real estate in the year following the year in which such a right was obtained.

As we found out, the right to deduction arises in the year:

- obtaining a certificate of ownership (if the property was purchased under a sales contract);

- signing the transfer and acceptance certificate (in case of an agreement of shared participation in construction)

Let's look at a few examples that will help you decide on your case:

- Purchasing real estate after retirement. The certificate of ownership of the apartment was received in 2020. The owner retired in 2014 but continues to work. The deduction is issued in 2016 for 2020 and the transfer of the deduction to 2014, 2013, 2012. If, having issued a transfer to the previous 3 years, the pensioner did not receive the entire deduction in full, that is, the balance of the property deduction has formed, then you can continue to receive it, transferring it to future years as long as there is income. According to paragraph 28, paragraph 2, paragraph 1 of Art. 220 Tax Code of the Russian Federation;

- Purchasing real estate before retirement. The certificate of ownership of the apartment was received in 2020. The owner retired in mid-2020. The deduction is issued in 2020 for 2015, in 2020 for 2020 and the transfer of the balance of the tax deduction to 2020, 2014, 2013. But since the deduction has already been received for 2020, the transfer is possible only for 2014, 2013 . According to Letter of the Ministry of Finance of the Russian Federation dated August 28, 2014 No. 03-04-05/43076.

The transfer of the balance of the property deduction to previous years must be applied for during the year following the one in which the balance was formed (during 2020, a declaration for 2020 is submitted, for which the balance appears, and the transfer is immediately completed). If you miss the moment and apply to transfer the deduction, for example, to 2020, then you can apply for the deduction already two years in advance - 2014, 2013. According to Letter of the Ministry of Finance of Russia dated May 30, 2014 No. 03-04-RZ/26111.

Non-working pensioners have the right to a deduction if they worked for 3 years before the year the balance of the property deduction was formed. The absence of income taxed at a tax rate of 13% for taxpayers receiving pensions, if they have the right to receive a property tax deduction, indicates the presence of a balance of property deduction, which can be carried forward to previous tax periods, but not more than three. According to the Letter of the Ministry of Finance Russia dated April 28, 2012 No. 03-04-05/7-577.

We also draw your attention: The transfer of the balance of the property deduction to previous years must be applied for during the year following the one in which the balance was formed.

Let's look at specific examples:

- The owner retired before the year of receiving the certificate of ownership of the purchased property. The certificate was received in 2014. The owner retired in 2013. In 2015, the deduction is transferred to 2013, 2012, 2011.

- The owner retired long before the year of receiving the certificate of ownership of the purchased property. The certificate was received in 2013. The owner retired in 2008. In 2014, the deduction was transferred to 2012, 2011, 2010. As we can see, the owner did not work during these years, and, therefore, cannot use his right to deduction. If the property was purchased during marriage, the working or recently retired spouse may receive the deduction.

- Purchasing real estate in the year of retirement. The certificate of ownership of the apartment was received in 2014. The owner retired in mid-2014. The deduction is issued in 2020 for 2014 and the balance of the tax deduction is transferred to 2013, 2012, 2011.

Article: Distribution of deductions in favor of a working or recently retired spouse.

Unfortunately, in practice there are often cases when the tax authority denies the right to a deduction to pensioners. It is illegal.

Based on paragraph 5 of paragraph 1 of Article 32 of the Tax Code of the Russian Federation, tax authorities are required to be guided by written explanations of the Ministry of Finance of the Russian Federation on the application of the legislation of the Russian Federation on taxes and fees.

The corresponding clarifications on the procedure for providing property tax deductions to persons who are pensioners have been agreed upon with the Ministry of Finance of the Russian Federation and sent to the territorial tax authorities by letter of the Federal Tax Service of Russia dated July 19, 2013 No. ED-4-3/ [email protected]

The procedure for receiving a deduction by a pensioner does not differ from the general one. The only thing you need to remember is the possibility of transferring the balance of the property deduction to the past 3 years, which is unacceptable for those who are not pensioners. An additional document presented to the tax office is a pension certificate.

List of documents for registration of deductions

When concluding a transaction to register housing as joint property, you need to add to the standard package of documents:

- agreement between husband and wife on the distribution of shares;

- pensioner certificates;

- marriage certificate.

The refund for the purchase of an apartment does not depend on the status of the title owner. The tax benefit applies to husband and wife. Both spouses receive the same amount of deduction from personal income tax.

The money is credited to the personal accounts of each applicant.

The procedure for obtaining a tax deduction is no different from the standard procedure. The refund mechanism is carried out either through the employer or through the tax authority in accordance with current legislation.

To apply, a pensioner will need to provide:

- declaration of income transactions in form 3NDFL;

- certificate of taxes paid;

- application of the established form;

- receipt for the purchase of finishing materials, if construction makes sense;

- title documents for the property.

After this, no action is required from the citizen. It is enough to wait for a decision on the application. Within 3 months, the submitted documentation will be checked for authenticity and reliability. If everything is in order, then the person receives a notification stating the decision.

Next, you need to visit the territorial tax number at your place of residence or registration. Here you need to provide details for transferring funds. It is worth remembering that you must have a current account at a branch of any Russian banking institution.

In particular:

- It is worth remembering that a non-working citizen can receive funds for the previous three years that preceded the acquisition of real estate;

- when purchasing a property where the owner is only a shareholder, the payment is made in proportion to the share;

- a citizen of retirement age, like anyone else, can receive payment both from the employer and through the tax authority upon application. If a citizen works part-time in several places of employment, the tax authority independently determines the order of priority for the employer.

Look,

conditions for granting a disability pension to military personnel

.

Table of increasing the retirement age in Russia. Find it at the link.

There is another opportunity to purchase a tax deduction. If a citizen does not work, but is in a registered marriage, whose spouse has an official income, the latter can return the payment for the acquisition of the spouse. This right is retained even when registered in shared ownership or without it.

Current legislation allows registration in connection with the concept of jointly acquired property. But there is an additional condition here. All those who acquire such a right should not have received it until 2014. Or the possibility of a return remains in accordance with the remainder of the deduction.

To register with the tax authority, you will need to provide certain documents.

It has an expanded position for each contingent of persons:

- application of the established form;

- passport details;

- declaration in form 3NDFL;

- certificate 2NDFL;

- all documents for the apartment, including a certificate of state registration, acceptance and transfer or purchase and sale agreement;

- all documentation confirming payment for the purchase - bank statement and receipt if necessary;

- if this is a property purchased through mortgage lending, then they additionally provide a loan agreement and a certificate of the paid price of the product;

- if the owner is married, you must provide a marriage certificate and an application for the distribution of the deduction.

List of documents for obtaining a property deduction List of documents for filing a 3-NDFL declaration

When purchasing a home, the new owner is entitled to a refund of overpaid taxes - a property deduction. In order to use it, two conditions must be met:

- The right to deduction was not used or the amount was less than the limit.

- Housing is not purchased from a close relative or employer.

- Availability of income (wages) on which personal income tax is paid. You can return no more in a year than was paid into the budget.

This service is applicable not only to the present, but also to the future income of an individual until the limit is exhausted. If a working pensioner does not have any problems with the return of overpaid tax, except for the return period for small incomes, then the situation with a non-working pensioner is somewhat different, because the pension is not subject to taxation.

The Government of the Russian Federation, understanding the complexity of the situation, enshrined in paragraph 10 of Article 220 of the Tax Code of the Russian Federation one exception - citizens of retirement age can exercise their right to a deduction for the three years preceding the purchase of housing. If the amount of income tax for the period does not cover the maximum amount that a pensioner can receive by law, or he spent the last three years on a well-deserved vacation and did not pay personal income tax, then taxable income will be required to return the rest of the benefit.

Don’t forget about the pensioner’s close relatives, namely his wife or husband. If a citizen is officially married and his other half works or has taxable income, then compensation can be received for him.

The tax deduction amount is 2 million rubles, respectively, the maximum amount of compensation will be 2 million x 13% = 260 thousand rubles. When using a mortgage, the tax base can be reduced by up to three million rubles, but only one property per life. Applies to interest only.

What is important for a pensioner to remember: you can submit documents to the tax office at any time during the year when it is convenient for you. It doesn't matter when this is done: at the beginning of the year or at the end.

But, as already written above, you should not put off resolving this issue, since every year the possible amount of tax refund will decrease. This happens because it is possible to return personal income tax for a pensioner for the previous 3 years after purchasing real estate. But these years are counted from the current date. Therefore, each new year “eats up” the possible amount of return for the previous one.

It is important to understand that transferring the balance back 3 years is possible if the pensioner applies for a property deduction immediately after the end of the year when he had this right. If he puts off going to the tax office, he simply loses a year and the money that he could have returned.

This, first of all, applies to those pensioners who have completed their working career and do not receive additional income.

If a pensioner purchased housing and then retired, then the previous 3 years must be counted from the year of dismissal.

If the pensioner no longer worked and then bought real estate, then the year from which the 3 previous years are considered is the year of purchase of the home.

Consider the situations above, and if one of them applies to you, claim the remaining funds as quickly as possible to get the largest possible income tax refund from the government.

Documents for personal income tax reimbursement are submitted to the tax office at the place of registration. For all categories of citizens there is a standard list of documents:

- statement;

- passport;

- declaration 3-NDFL;

- certificate 2-NDFL (contains information about the source, amount of income and taxes paid);

- documents for the apartment (certificate of state registration of ownership, act of acceptance and transfer of the property and purchase and sale agreement);

- documents confirming payment for the purchase (bank statements, seller’s receipt, etc.);

- for property purchased with a mortgage, a loan agreement and a certificate from the bank about the interest actually paid are additionally provided;

- if the owner is married, then a marriage certificate and, if necessary, an application for the distribution of the deduction between the spouses are required.

2011 and earlier

Social benefits for pensioners

Social tax deductions can be issued:

- if tuition was paid (your own or your immediate family);

- when using paid healthcare services or purchasing medications;

- when transferring funds to charity;

- if funds are contributed for the purpose of voluntary pension insurance.

It is advisable to consider the specifics of processing social deductions using the example of reimbursements for treatment, since this is the option that is usually of interest to pensioners.

An important condition for receiving a deduction for treatment is that the medical institution must have a state license. Moreover, the deduction is provided only for those services that are contained in the legally established list. All of them are divided into two categories: conventional and expensive treatment.

| Options for deduction | Conventional treatment | Expensive treatment |

| Composition of dental services | Treatment, orthopedics, etc., except for expensive services | Implantation and prosthetics |

| Maximum deduction amount | 120,000 rubles | Limited to the amount of personal income tax paid last year |

| Maximum compensation | 15,600 rubles | 13% of personal income tax paid last year |

According to the law, social deductions include the following types of expenses of citizens:

- to receive services: educational;

- medical;

More on the topic: Russian Pension Fund in the Samara Region, hotline phone number, branch address

We discussed medicine above. A retired worker can apply for a social tax preference in the same manner. Non-working pension recipients are entitled to such a benefit only if they had taxable income in the reporting period (from rent or from the sale of real estate).

Hint: social preference is provided on a general basis.

A standard tax benefit is a reduction in the tax base at the place of duty on the grounds established by law. For example, if the applicant is raising a minor child. This is provided to pension recipients on a general basis.

For information: working pension recipients can apply for a standard relaxation.

How is a tax deduction carried out for working pensioners when buying an apartment?

Women and men of retirement age can take advantage of the right to transfer deductions. This benefit applies to all categories of pensioners, including military personnel. Former employees of law enforcement agencies will not receive back paid taxes if housing was purchased with state budget money.

Today, any pensioner has the right to a deduction and its transfer for the purchase of an apartment. Moreover, this does not depend on whether the elderly person works or not.

- The period for applying for a deduction when transferring a balance is limited to 3 years.

You can transfer the balance only within 3 years from the date of its formation (retirement or purchase of an apartment).

Every year the number of years for transfer will be reduced by a year.

Klimov V.V. I bought an apartment in 2020 and retired that same year. If Klimov applies for a deduction in 2020, he will be able to receive it for 2020 and for the previous 3 years: 2016-2014. If he applies for a deduction in 2020, then he will be able to reimburse expenses only for 2020, 2020 and 2020. If in 2020, then only for 2017 and 2020.

- Working pensioners can carry over the balance of the deduction in the same way as non-working pensioners.

If a citizen retired or purchased housing after 2014, he, like non-working pensioners, can transfer the balance of the deduction to the previous three years. Moreover, if the deduction is not received in full during these 4 years, he will be able to receive the rest in subsequent years, subject to the availability of income.

Gromov K.I. retired in 2020 but continues to work. In 2020, he bought an apartment. With the deduction, he will be able to apply in 2018 and declare it for 4 years: 2017-2014. If he does not receive the entire deduction for 4 years, he will be able to claim the balance in 2020 and subsequent periods if he continues to work.

- When transferring deductions, declarations must be completed in reverse order.

Stroev V.V. I bought an apartment in 2020 and retired that same year. In 2020, he can claim a deduction for 2020, 2020, 2020 and 2014. First, he will need to fill out the declaration for 2017, then transfer the remainder of the deduction to the declaration for 2020, then fill out the reports for 2020 and, last but not least, for 2014.

- If the deduction has already been received in the years for which the transfer is made, then it will not be possible to receive it again.

There are two options for applying for benefits: through the employer or the tax office. Of course, there are still options for filing a declaration through the State Services portal or the tax website, but you will still need a visit to the inspectorate and the procedure will require an electronic digital signature, which not everyone has (after writing instructions on this topic, a link will be added here).

However, a visit to the Federal Tax Service will also be required if an application is submitted to a tax agent. After checking the documents, the inspector will issue a notice of the right to deduction within a month, which, together with the application, is submitted to the employer’s accounting department. In the future, the tax base will decrease until the deduction limit is completely exhausted, and personal income tax will no longer be withheld from your salary.

In case of a visit directly to the tax service, you will need to wait until the end of the year and, in addition to the main list of papers, fill out a 3-NDFL declaration and take a 2-NDFL certificate. The overpaid tax for the past year will be returned in full to the current account within up to four months (up to three months will be required for a desk audit and a month for the transfer of funds), in case of a positive decision.

The list of documents depends on the type of deduction and the best option would be to find your case and look at the documents in our article. If you still have questions, you can contact a lawyer using the pop-up form or get legal advice by phone.

Tax payment for such citizens raises quite a few different questions. After all, this segment of the population is considered the most vulnerable. And in most cases, all expense transactions fall on the shoulders of the working contingent. Therefore, working people can get a refund.

Many retirees are trying to invest in real estate. That is why they are interested in the question of the possibility of a tax refund. But not everyone knows about this possibility at all. Since 2001, legislation has stipulated the issue of purchasing tax payments for specific categories of citizens.

That is, you can return funds for any residential property. This right is provided by the state in the form of a 13% return. The amount to be refunded is called the property tax payment. The maximum refund amount is 13% of 2,000,000 rubles.

The difficulty here arises mainly due to the fact that pensioners receive a pension that is not subject to any tax at all. Therefore, it is not considered to be a profitable operation.

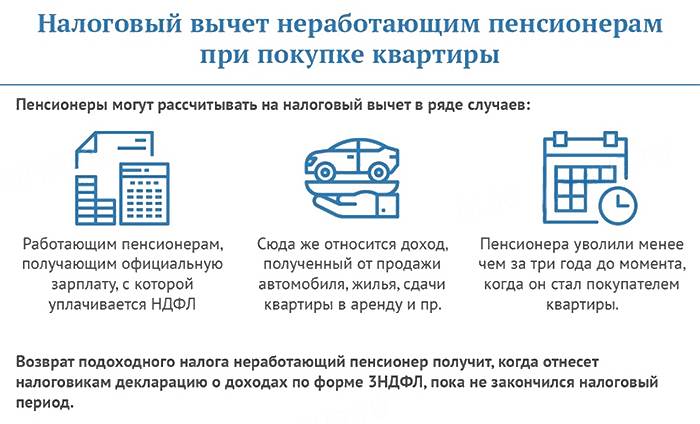

The form of income can be:

- sale of property;

- renting out an apartment or car;

- non-state pension provision;

- additional wages or other income from which the tax base is paid.

This type of registration can be applied to any income transaction. In some cases, there are restrictions that relate to the maximum payment amount on an annual basis. That is, it cannot exceed the amount of tax that is paid for the same period of time.

Until 2014, working pensioners did not have the right to transfer the property deduction. Changes to the Tax Code that came into force on January 1, 2014, abolished this condition.

Now, any category of pensioners - both those with additional income and those who receive only a pension - are allowed to transfer the tax deduction for housing to the previous three years. Grounds: clause 10 of Art. 220 of the Tax Code of the Russian Federation, Federal Law dated July 23, 2013 N 212-FZ, Letter of the Federal Tax Service of the Russian Federation dated April 28, 2014 No. BS-4-11/ [email protected] , Letters of the Ministry of Finance of the Russian Federation dated May 15, 2020 No. 03-04-05/27966, 17 April 2014 No. 03-04-07/17776.

In 2020, you retired but continued to work. We bought a house in 2018. In 2020, you are eligible to file property deductions for 2020, 2020, 2020 and 2020. If the personal income tax paid by you during these years does not cover the tax deduction due to you, you will receive the rest in the future. To do this, in 2020 you will submit a declaration for 2020, in 2021 - for 2020, and so on, until the deduction is completely exhausted.

If you are a working pensioner, have our specialist fill out the 3-NDFL declaration. We will carefully and competently prepare the document and send it to your tax office

If you have not yet purchased a home, we recommend our partner’s site-guide “Realtor Secrets”: Apartment-without-agent.ru. With the help of the site’s materials, you will be able to independently navigate the issues of buying and selling real estate, control your realtor and ask him the right questions.

This right is provided through personal income tax (or income tax) paid to the state - 13% of wages. The amount that is subject to refund is called a property tax deduction, and the buyer can compensate a maximum of 13% of the 2 million rubles spent on the property.

The difficulty in obtaining a tax deduction for pensioners when buying an apartment is due to the fact that their main cash income - pensions - is not subject to personal income tax. Therefore, this source of income can not even be considered, but there are others...

https://www.youtube.com/watch?v=3T_sVCSPYOg

Suppose, in addition to the state pension, the pensioner has additional income. It could be:

- sale of property;

- renting an apartment or car;

- additional non-state pension;

- additional salary or any cash receipts on which income tax is paid.

In this case, a property deduction is applicable against this income. There is a limitation associated with the maximum amount of deduction for the year - it cannot exceed the amount of tax paid to the state for the same period.

Let's consider what options are possible for a pensioner who has no additional income other than a state pension.

Until 2012, he could not receive a property deduction. After changes are made to the Tax Code, a pensioner has the right to transfer the deduction to those years when he was still working, but no more than three years ago.

The deadline for submitting documents is not limited by law. But as you can see, you should not delay the procedure if you plan to transfer the amount to previous years in order to have time to return the property tax paid to the pensioner.

So, when purchasing in 2020 and submitting documents in 2020, transfer is possible to 2020–2016. If you submit documents in 2021, you can only transfer to 2020 and 2020. Well, don’t forget to add here the year the apartment was purchased: 2020.

A tax deduction for working pensioners when purchasing an apartment can be issued without problems, since they receive an official salary subject to personal income tax. In this case, the pensioner is treated like any other working owner.

How to get a property deduction for pensioners?

If a citizen bought or built housing before retirement or in the year of retirement, the moment of formation of the remainder will be considered the year of retirement.

If a citizen retired and bought an apartment a year or more later, the moment the balance was formed will be considered the year the apartment was purchased.

Let's consider all the options in more detail.

If a citizen bought a home and retired in the same year, he must wait until the end of the year and then contact the Federal Tax Service at his place of permanent residence to receive a deduction.

He will be able to immediately claim a deduction for 4 years:

- the year in which the property was purchased (the year the balance was formed).

- for 3 years preceding the year of formation of the balance (year of purchase of the apartment).

Paramonov P.D. I bought an apartment in January 2020 and retired in November of the same year. In 2020, he will be able to receive a deduction for 4 years at once: 2020 (the year of purchase of the apartment and retirement) and 2016, 2020 and 2014 (the years to which the balance of the benefit is transferred).

He can claim the deduction in the same year in which he retired.

Tkachev A.L. I bought an apartment in 2020 and retired in 2020. In the same year, Tkachev applied to the Federal Tax Service for a deduction. He can claim the benefit for 2020 (the year of retirement) and for the 3 previous years: 2020, 2020, 2020.

To receive the deduction, he must wait until the end of the year.

In May 2020, Yakhontov O.A. retired. In 2020, he purchased a one-room apartment. He will be able to apply for the deduction no earlier than January 2020. The year of formation of the balance will be 2020, but since he was no longer working during this period, he will be able to simultaneously claim benefits only for part of 2017 (when he was still working) and for 2020 and 2020.

If more than 4 years have passed from the moment of retirement to the moment of purchasing a home, unfortunately, it will not be possible to receive a deduction, since the pensioner did not have any income.

Kirov B.D. He retired in 2013 and bought an apartment in 2020. In 2020, he will be able to claim a deduction for 2020 (the year the balance was formed) and 2016-2014. But since Kirov did not have any income during the indicated periods, he will not be able to receive a deduction.

- If there is additional income, for example, when renting out property on which the pensioner pays personal income tax, he can receive a deduction for the period in which the tax was paid.

Trofimov K.A. He has been retired since 2012. Since 2013, he has been renting out his two apartments and paying personal income tax on the income received. In 2020 he is buying another apartment. In 2020, he will be able to receive a deduction for 2017-2014 in relation to the personal income tax that he paid to the budget for renting out apartments.

- If the apartment was purchased during a marriage where one spouse has taxable income, the deduction can be distributed in his favor.

The Sakharov couple bought an apartment in 2020 for 1,900,000 rubles. My wife has been retired since 2013. If the spouses write a statement in which they indicate that the husband incurred expenses in the amount of 1,900,000 rubles, and the wife did not incur expenses, her husband will be able to receive a deduction in full.

Until 2012, these rules applied to everyone, including pensioners. From 01/01/2012, after the entry into force of Federal Law No. 330-FZ of November 21, 2011, Part 2 of Art. 220 of the Tax Code of the Russian Federation, and preferential conditions have been introduced for pensioners. Now pensioners can receive a property deduction for the previous three years, regardless of when they received the right to own their home. This means that the pensioner’s deduction will include those years when he was still working.

“For taxpayers receiving pensions in accordance with the legislation of the Russian Federation, property tax deductions provided for in subparagraphs 3 and 4 of paragraph 1 of this article may be transferred to previous tax periods, but not more than three, immediately preceding the tax period in which the carried forward balance was formed property tax deductions."

In fact, a retiree can receive a deduction for four years, including the year in which the non-carryover balance was incurred. Below we will tell you in more detail and show examples.

In order to answer the question of whether a pensioner can receive a deduction, it is necessary to consider a specific case. Contact the tax experts of the online service NDFLka.ru and get full advice on your issue

Citizens who have a regular income can take advantage of this right. To do this, you need to write an application addressed to the employer or contact the Federal Tax Service at your place of residence.

Next year, a citizen will be able to use the right to receive a deduction or transfer it again.

Why an officially unemployed pensioner cannot receive a tax deduction

The procedure for filing a tax deduction is regulated by Article 220 of the Tax Code. This contains the basic rules for receiving a refund of part of the funds from the budget when purchasing an apartment. They are uniform for the entire territory of the country and are established at the federal level.

According to the Tax Code, in order to obtain the right to apply for a property deduction, a number of conditions must be met:

- a pensioner must be a tax resident of the Russian Federation and buy an apartment in Russia;

- he must spend his own funds (not state support funds) to purchase it;

- the apartment should not be purchased from interdependent persons (close relatives);

- at the time of registration of a tax deduction for an apartment, ownership rights must be registered or a transfer deed must be signed with the developer when purchasing real estate in a new building under an equity participation agreement;

- he did not exercise the right to a property deduction until 2014 (at that time the property deduction was provided to each taxpayer once);

- he did not exhaust the required tax limit of 2 million rubles. (if the deduction for an apartment was issued after 2014, then to obtain the right to deduction it is necessary that the previously purchased property was cheaper than 2 million rubles).

According to the general rules, non-working pensioners are deprived of the right to apply for a property deduction. This is due to the fact that it is provided exclusively to personal income tax payers who receive income subject to this tax. Pension payments are exempt from personal income tax, so non-working pensioners have nothing to return from the budget and they do not have the right to apply for a deduction.

In addition to unemployed pensioners, unemployed citizens, entrepreneurs on special regimes, women on maternity leave, etc. are deprived of the right to deduction.

Property deductions are due to a pensioner according to the standard scheme only in one case: if he is officially employed, and the employer regularly withholds and transfers personal income tax from his earnings.

Moreover, all pensioners, regardless of whether they are employed or not, have one tax preference. They have the right to transfer the property deduction to previous tax periods, namely the previous 4 years. For example, when applying to the inspectorate in 2018, a pensioner is entitled to a deduction for 2014, 2020, 2020, 2017. A pensioner should apply for a deduction only in the year following the purchase of real estate. For example, a deduction for an apartment purchased in 2020 can be applied for in 2019.

Based on the above rules, if a person has been retired for more than 5 years, then the right to a deduction is finally lost.

The possibility of postponing tax periods for pensioners was assigned to them by Federal Law No. 330-FZ of November 1, 2011, which came into force in 2012. Before 2012, there were no transfer options for pensioners.

For example, in 2020, citizen Ivanov retired. In 2017, he bought an apartment as a pensioner. He has the right to apply for a tax deduction in 2020 and transfer it to the period of time when he was still working and was a personal income tax payer: 2014-2016.

When postponing the tax period, it is worth considering that declarations must be submitted in reverse order: first for 2020, then for 2020, etc.

There are two more options for applying for a deduction for a pensioner:

- accounting for alternative income;

- registration of deductions for a working spouse.