Briefly about NPF "Promagrofond"

NPF "Promagrofond" is a non-profit organization of non-state pension provision and compulsory pension insurance.

In 2016, NPF Promagrofond was merged with NPF Gazfond, which previously also included NPF Heritage (Norilsk Nickel) and NPF Kit-Finance. All clients of Promagrofond came under the management of the Gazfond pension fund.

NPF GAZFOND received the status of the largest and most reliable pension fund. At the end of 2020, the fund’s own funds increased to 451 billion rubles, the size of pension reserves amounted to 372 billion rubles.

In January 2020, the Expert RA agency confirmed the fund's A++ rating, which means “Exceptionally high (highest) level of reliability.”

The reorganization does not require the re-conclusion of contracts on compulsory pension insurance and non-state pension provision.

Clients of NPF Promagrofond have the opportunity to use their personal account at their previous address, using their existing login and password. No re-registration required.

NPF Promagrofond - profitability rating and customer reviews

Reading time: 4 minutes(s) NPF Promagrofond

Information about the fund:

Status in 2020: Reorganized (merged with another NPF) In 2020, Promagrfond was reorganized and merged with NPF Gazfond.

Reorganization and merger: with whom did Promagrofond merge?

In 2016, NPF Promagrofond was merged with NPF Gazfond, which previously included NPF Heritage (formerly known as the Norilsk Nickel fund) and NPF Kit-Finance.

All Promagrofond clients are transferred under the management of the Gazfond pension fund. In 1994, the non-state pension fund Promagrofond was created, which currently provides pension and insurance services. It is considered one of the largest funds in the Russian Federation with the number of clients exceeding 1.6 million people. As already written above, the services of this organization focus on non-state pension programs and compulsory pension insurance. The fund survived all crises (1998 and 2008, for example) without consequences for its clients, confirming its reliability.

Full name of the organization: Promagrofond CJSC NPF

Data for 2013: Another indicator of the reliability of NPF Promagrofond, and a very significant one, is the A++ rating assigned by the Expert RA agency, which means the highest level of quality of services and reliability of deposits. In terms of the volume of pension savings, Promagrofond is in 9th place in the ranking of TOP-10 NPFs in Russia (2013).

Reliability rating in 2017

Expert RA: withdrawn National Rating Agency (NRA): not participating

The RAEX rating agency (Expert RA) withdrew without confirmation the reliability rating of NPF Promagrofond CJSC due to reorganization in the form of merger with NPF Gazfond Pension Savings OJSC. Previously, the fund had a rating of A++ “Exceptionally high (highest) level of reliability” with a stable outlook.

Statistics of NPF Promagrofond

Statistics on NPO (non-state pension provision) as of July 1, 2013

- Total reserves: 645 million rubles

- Total amount of payments: 34,854 thousand rubles

- Total number of participants: 8,003 people

Statistics on compulsory pension insurance (compulsory pension insurance) as of July 1, 2013

- Total amount of savings: 43,025,372 thousand rubles

- Number of insured clients: 1,557,013 people

- Profitability (for 2012): 3.55%

Despite the very low rates of return in recent years, over the long-term period from 2005 to 2012, every thousand rubles of savings turned into 2,002 rubles, under the leadership of the managers of the Promagrofond NPF.

Profitability and reliability

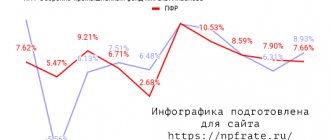

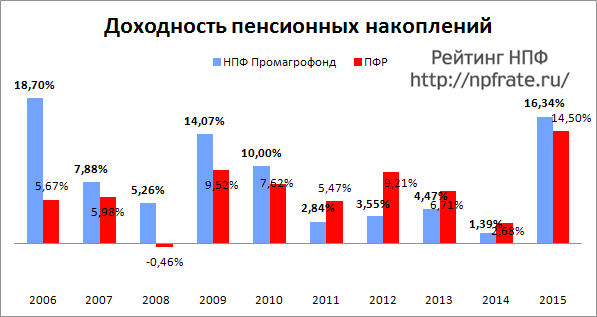

In recent years, there has been a downward trend in investment returns, but in 2009 and 2010 the returns were 14.07% and 10%, respectively. Promagrofond also survived the 2008 crisis with a yield of 5.26%, while VEB, the official manager of the Pension Fund, issued negative returns.

Profitability indicators of NPF Promagrofond in 2005-2012

Data on the profitability of Promagrofond CJSC NPF as of January 1, 2017, including information for the previous 10 years in comparison with the profitability of the Pension Fund of the Russian Federation:

Profitability of NPF Promagrofond for 2014-2015 and previous years

The profitability rating for 2016 is currently unknown, due to the reorganization and merger of Promagrofond with the Heritage fund (NPF Kit Finance and Gazfond also included).

The investment strategy of NPF Promagrofond is completely open to clients. At the moment, the policy for distributing savings for investment is as follows: - up to 80%, household bonds. companies - up to 40%, shares of strategic enterprises. industries - up to 80%, deposits - up to 20%, mortgage securities - up to 40%, securities of constituent entities of the Russian Federation - up to 100% of assets, government. securities - up to 40%, municipal bonds

Current information with exact figures is available in documents on the official website of NPF Promagrofond.

Official website and contacts

At https://www.promagrofond.ru/ you can find the office. Promagrofund website, which, in addition to a large amount of information about the fund and its investments, provides several services for its clients. For current ones - a personal account, for future ones - pension calculation calculators.

Address and telephone

The company's central office is located at the address: 115114, Moscow, 1st Kozhevnichesky lane, 8. The department is open from 9 to 18 Mon-Fri (break from 13 to 14). You can also call by general telephone

NPF Promagrofond on the Yandex map:

As of 2013, the non-state pension fund Promagrofond has branches and offices in 113 cities of the Russian Federation and the network is constantly expanding.

NPF Promagrofond - scammers?

Recently, there have been rumors on the Internet that Promagrofond are scammers and it is unsafe to keep your pension savings with them. We dare to assure you that this statement is only half true. The fund itself represents a reliable organization that you can trust with your future pension. At least, the fund discloses profitability regularly, unlike the Russian Standard, reviews of which leave the fund wanting to be more attentive to its clients (including potential ones).

A completely different matter is employees, so-called pension agents, who sometimes fraudulently enter into contracts under various pretexts. And all because pension agents are paid precisely for the contracts concluded and their number (sometimes, regardless of the amount of savings that the client contributes). Let's hope that Promagrofond will finally begin to improve the qualifications of its employees and more carefully select HR people.

Customer Reviews

Anyone can leave their feedback about NPF Promagrofond on this page - this applies to both clients and employees of the organization. Let the public know the real situation! For example, on the page of the Big Pension Fund, one of the visitors is outraged by the incompetence of pension agents.

Did this article help you? We would be grateful for your rating:

0 1

Functionality of the Promagrofond personal account

In the “Personal Account”, NPF clients have the opportunity to track transactions on their pension accounts opened with the Fund.

The service is designed for the convenience of users so that all actions performed are intuitive.

The service allows you to:

- Use a simple interface with tooltips when performing various actions and operations.

- Gain access to personal information and, if necessary, correct it.

- View transaction history. The story is available for download in several formats.

- Write and send electronic applications to the Foundation.

- Create a chart of the state of pension savings.

- Use a filter by period and type of transaction.

- Consult the available reference book for answers to the most common questions.

Rules for using the website of NPF Promagrofond

NPF "Promagrofond" has an official website on the Internet. On the website, current and prospective clients of the fund have the opportunity to familiarize themselves with all the information they are interested in.

By studying the pages of the site, you can find a lot of information not only about the fund itself and its investment activities.

Registered users can track their pension savings through their personal account (login is available to both individuals and companies) on the website.

A calculator for calculating pension payments is provided for potential clients. For citizens of the Russian Federation, it is possible to submit an online application for concluding an agreement on a mandatory public security agreement.

To do this, you will need to enter SNILS, passport data, postal address and contact information. A copy of the agreement will be received by email for signature and further sending to the fund.

Then you must contact the Pension Fund branch at your place of residence and write an application for the transfer of pension savings to the NPF Gazfond.

For entrepreneurs, there is an opportunity on the website to submit an application to join the corporate pension program, which guarantees financial support for company employees in the future.

How to write an application

Registered users are served through a personal account in the form of applications. The official website of the foundation contains examples of statements.

As a result of filling out all the fields, the application, along with possible scans of documents, is sent to the fund’s email address.

The client will receive a letter with the decision by email or by registered mail.

The standard application contains the name of the NPF, full name of the client, date of birth, SNILS, gender, citizenship, passport data, place of actual residence (if it does not match the registration address), email, contact information, type of pension received.

This is followed by a request for the assignment of pension savings and bank details for transferring funds.

Interest rates for contributions

Deposits can be made by citizens of the Russian Federation who receive a pension from the NPF Gazfond, as well as holders of Gazprombank bank cards, which were issued in accordance with agreements with Gazfond on the issue of pension cards.

Gazfond clients have the opportunity to open a pension contribution and receive interest at the end of the period.

The interest rate is up to 6.2% per annum for citizens of the capital. The deposit is subject to insurance and can be opened for a period of six months to one and a half years.

Registration in the account

To register in your personal account, you must conclude a pension insurance agreement with the Fund and wait until it comes into force.

It should be taken into account that after the reorganization, contracts are concluded with NPF Gazfond.

Registration in the personal account of NPF "Promagrofond" occurs in remote access mode. To register, you must prepare scans of the following documents:

- passport (page 2 and 3),

- SNILS.

Scans can be replaced with photo copies. It is important that their quality is high: all symbols and photos on the passport must be clearly visible.

Registration begins with the “Registration” button on the official website. And sequentially, step by step, entering the required information:

- SNILS number.

- Mobile phone.

- Email.

- Mailing address.

- Personal data.

The last step involves uploading scanned copies of documents as separate files.

Within 10 working days, a notification will be sent to your email and phone indicating a temporary password.

Reliability

For example, the so-called trust level. This is something like an indicator characterizing customer trust, reliability and sustainability of the corporation. Sometimes the indicators may not agree with the usual rating.

But NPF Promagrofond has a relatively high level of trust - it varies between A+ and A++. We can say that there are no higher indicators at the moment. It is precisely thanks to this component that many potential clients are looking at our current non-state pension fund. Only then do you have to pay attention to at least one more important indicator. And for some investors it is decisive.

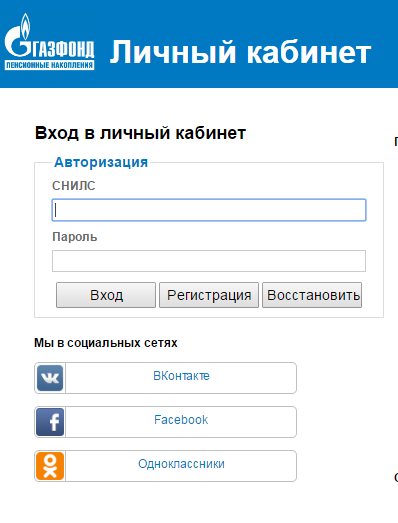

Authorization in your personal account

The authorization mechanism in the account includes the following steps:

- Opening the main page of the official website of the foundation.

- Click on the active button “Login to your personal account” in the upper right corner.

- Enter your login and password into the provided forms. Login is your SNILS number.

- During initial authorization, you will be asked to change the received temporary password to a permanent one.

Official site

Since September 2020, Promagrofond has not carried out procedures for concluding contracts.

All previously registered clients must be authorized to their personal account from the official page of JSC NPF GAZFOND Pension Savings. All obligations to Promagrofond investors are fully fulfilled by Gazfond. Gazfond offers its clients:

- seven pension savings schemes;

- service contracts;

- individual pension programs:

- individual and corporate insurance programs.

Attention!

For investors who transferred to the Gazfond from other funds after the reorganization, a memo on the rules of work under the new conditions has been prepared. https://gazfond-pn.ru/private/npo/customer_service/promagrofond.php. You can find out all the information about the status of your account through registration, through the State Services portal in your personal account on the official page of the Gazfond. (For clients of KITFinance NPF and Promagrofond, the previous electronic account remains operational), which must be confirmed through a new password, which the client receives after filling out the authorization form.

The following options are available in your personal account.

- View your retirement savings.

- Tracking the history of financial transactions.

- Changing data.

- Submitting an application to the fund, for example, to terminate the contract.

- Receiving personal advice.

The non-state pension fund Gazfond provides support to its clients online, via email, and by telephone. The hotline number is open 24 hours a day, calls within the Russian Federation are free. On all issues related to the procedure for deductions, the inability to access your personal account using the details, managers carry out individual work.