Funded pension: how it is formed

Savings are formed for persons with the following circumstances:

- If insurance premiums were paid separately for those born before 1967.

- With a date of birth between 1953-1966, men and women are counted equally. The main thing is that managers pay contributions for them during 2002-2004.

- Those to whom the state provides co-financing.

- With the formation of the savings part at the expense of maternal capital.

Such actions begin the formation of the cumulative part:

- At the first stage, they are determined with the management company, a non-state pension fund. They manage money.

- During the second, a statement is sent to the control body.

- 22% of salary is the standard for employee insurance contributions.

2014 is the time for the abolition of insurance premiums from managers. Now only voluntary investments are taken into account.

Who can take part in the program?

Participants in the state program are divided into three types:

- Russians who want to increase their pension savings;

- their employers, who can optionally join the program;

- state co-financing pension payments.

By 2020, participants in the state program were formed from among the country's citizens. Anyone could apply from October 2008 until the end of 2014. They also had to have time to make at least one voluntary insurance contribution (VA) towards the funded part of their pension salary by the end of January 2015.

According to the program, the participant can annually contribute any amount that goes towards the growth of his funded pension. According to Article 13 of Law No. 56-FZ, if the contribution amount is from 2 to 12 thousand rubles per year, the state doubles this amount. If a person is entitled to one of the types of insurance benefits for which he decides not to apply, the state increases his annual premiums four times. The maximum possible amount of state aid per year is 48 thousand rubles.

In addition to the state and the citizen, the latter’s employer can also become a participant. According to Article 8 of Law No. 56-FZ, having decided to take part in the fate of an employee, the employer must issue a corresponding order or introduce a special clause into the collective agreement. The amount of DSA in favor of the employee is calculated by the employer independently every month, because he pays the money from his own funds.

READ MORE: Insurance for Schengen Sberbank

Such contributions are made to a special account opened for the Federal Treasury in a department of the Central Bank, and are issued in separate payment orders. The employer is obliged to create an additional register of insured employees in whose favor he makes additional contributions. Within twenty days after the end of the quarter, all registers must be provided to the Pension Fund.

Ways to check pension savings

You can view your pension in the pension fund in the following ways.

- When visiting the fund office in person.

- Remotely, via the Internet or by phone.

Expert opinion

Elena Koshereva

Pension lawyer, ready to answer your questions.

Ask me a question

To do this, you will need to know your personal account number, and when visiting the fund in person, have a passport with you for personal identification.

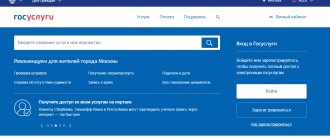

Since 2010 The online portal “Government Services” was put into operation, making it possible to remotely communicate with various government bodies and institutions. Since this site works only with organizations run by the state, through it you will only be able to view your pension in the Russian Pension Fund. It is no longer possible to find out the status of an account in a non-state fund through the State Services website.

To obtain an extract from the Pension Fund of Russia through State Services, you should follow these steps.

Types of individual plans, terms of provision

Participation in the program provides some benefits in the field of taxation and inheritance. Paragraph 5 of Article 219 of the Tax Code gives taxpayers who contribute DSA towards the funded part of their pension salary the right to receive a social tax deduction. To do this, you must provide the tax office with papers confirming the costs of paying contributions.

- passport;

- a completed declaration (in Form 3-NDFL), which reflects the payment of contributions;

- a certificate of the amount of DSA transferred from wages;

- copies of documents confirming self-deposit of funds;

- account details for transferring the deduction amount.

The tax authority checks the submitted papers within three months, after which, if a positive decision is made, the money due to him is transferred to the citizen. If a program participant deposited the maximum 12 thousand rubles into the account, he will be returned 1,560 rubles, that is, 13%.

In the event of the death of the investor, all savings accumulated by him are transferred to his heirs, whose names were indicated in the agreement concluded with the fund, or in the application submitted to the fund during the validity of the agreement. If the deceased did not leave a will and did not appoint successors, the money is divided among the closest relatives. You must apply for an inheritance within six months from the date of death of the relative who contributed the DWI.

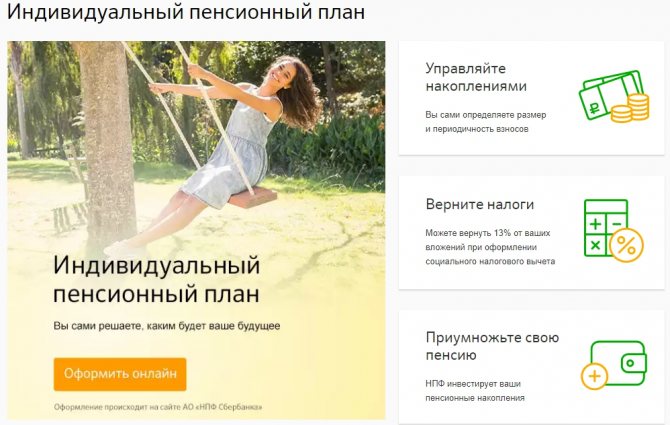

The Sberbank pension program includes 3 types of additional income generation:

- universal;

- guaranteed;

- complex.

The parameters look like this:

- Initial investment – minimum 1500 rubles, periodic – from 500 rubles.

- Arbitrary frequency of payment of contributions.

- The pension is paid for 5 or more years.

- Savings are inherited and are not subject to division during divorce proceedings and cannot be collected by 3 parties.

- Possibility of returning up to RUB 15,600. per year when registering START.

- In case of early withdrawal of savings, you can receive 80% of the amount during the first two years, after 2 years - in the amount of 100% of the contributions paid and half of the amount of investment income, or after 5 years, then the return will be made in full.

The essence of a guaranteed plan is that the client makes contributions, the size and schedule of which depend on the amount of desired pension payments.

Similar to the previous strategy, an individual receives a non-state pension in accordance with a signed co-financing agreement. The conditions for early return of accumulated funds also coincide.

The size of the initial and regular contributions are identical. Periodic replenishments occur in accordance with the current contract. The period of pension payments is from 10 years.

A comprehensive individual plan consists of transferring pension savings to a non-state pension fund of Sberbank and registering an IPP. As a result, the user receives a funded and non-state pension. In other respects, the strategy is similar to the first option.

Only a universal pension plan can be applied for online. Other types are available for opening at the Sber NPF office or bank branch. With the exception of the complex option (SNILS is required), you can open an IPP using a Russian passport.

Funds are transferred to the client's card account monthly. If the amount of payments is lower than those established by the Pension Fund, then the pension can be paid once every 3 or 6 months.

Payment of contributions can be made in several ways:

- via Sberbank Online;

- by bank card on the fund portal;

- using an ATM, terminal;

- through the corporate account of the employing organization indicating the name of the recipient, BIC, correspondent account, RS, INN, KPP.

The advantages of a non-state pension in the largest bank in Russia are as follows:

- Additional supplement to standard pension payments. This is especially true if the employee’s income is more than 45 thousand rubles. (no deductions are made for an amount exceeding this threshold), the employment is unofficial or the individual is self-employed (individual entrepreneurs, freelancers, lawyers in private practice, etc.).

- Registration of one document (with the exception of a comprehensive individual plan).

READ MORE: Increasing the length of service of police officers to 25

In addition to the advantages, the program has several disadvantages:

- low interest rate;

- insufficient understanding by clients of the procedure for calculating pension accruals and subsequent payments after reaching the appropriate age.

If we compare NPFs of Sberbank, Lukoil, VTB, Magnit, the first one loses in terms of interest accrued on depositors’ contributions. Despite this, many Russians tend to trust Sber, based on the reliability of the bank, the quality of the services provided, and the convenient location of service offices.

The pension plan offered by Sberbank makes it easy to generate additional income. It has a number of advantages:

- You determine the frequency and amount of contributions yourself.

- The Sberbank non-state pension fund increases your savings every year thanks to investment income.

- By applying for a social tax deduction within the framework of current legislation, you can return 13% of your investment.

Is it worth applying for an individual pension plan of Sberbank and what conditions to choose?

Sberbank offers one of three types of individual pension plans:

- Universal,

- Guaranteed,

- Complex.

Access to the “Personal Account” is provided under the following conditions: 1) the agreement on compulsory pension insurance (non-state pension agreement) has entered into force; 2) a pension account for the accumulative part of the labor pension has been opened in accordance with the Insurance Rules and/or a pension account for non-state pension provision has been opened in accordance with the Pension Rules; 3) availability of Consent to automated processing of personal data. Individual pension plan personal account:

lk npfsb ru

The size of the non-state pension that the client will receive in the future depends on savings. Sberbank’s individual universal plan provides for the following conditions:

- The minimum down payment is 1.5 thousand rubles.

- The minimum amount of periodic contributions is 500 rubles.

- An arbitrary schedule is drawn up according to which contributions will be made.

- The pension payment period is from 5 years.

- Inheritance of pension savings to the legal successor of the program participant is provided.

- Savings cannot be divided in case of divorce or collected by third parties.

In case of early return of savings within the framework of the universal pension plan, the following scheme works:

- After 2 years of participation in the program, the client receives the entire amount of paid fees and 50% of investment income;

- After 5 years – the entire volume of paid contributions and accrued investment income.

A Sberbank client has the right to a refund of income tax paid, which currently amounts to 13% of the total amount of contributions. The maximum refund amount per year is 15.6 thousand rubles.

To apply for a universal plan, the applicant will only need a passport of a citizen of the Russian Federation. You can become a participant in the program in a convenient way for the client:

- By contacting the nearest Sberbank branch;

- By visiting the NPF office of a credit institution;

- By filling out an application form on the bank's website.

Hotline of NPF PJSC Sberbank: 8 800 555 00 41

By phone you can ask all your questions and decide whether this offer is worth it.

According to the terms of the guaranteed plan, the amount of the desired pension is specified in the contract. Based on the expected amount, the amount of contributions is calculated, and a schedule of regular payments is drawn up.

The following conditions apply for this type of plan:

- The amount of the down payment is equal to the payment that the client will make regularly.

- The amount of periodic contributions is fixed and reflected in the contract.

- The schedule according to which payments will be made is drawn up in advance and stipulated in the contract.

- The minimum pension payment period is 10 years.

- The accumulated pension is inherited by legal successors, but cannot be divided in the event of divorce or seized by third parties.

In case of early termination of the contract, the client receives:

- After 2 years – the entire amount of contributions and 50% of the investment income received;

- After 5 years – the entire volume of payments and investment income.

The guaranteed plan also provides an income tax refund option. Its size is 13% of the amount of savings and cannot exceed 15.6 thousand rubles per year.

To take part in the Sberbank project, the applicant must contact the NPF office of the credit institution. To register a plan, it is enough to have only a passport of a citizen of the Russian Federation with you.

Find out the size of your funded pension online

Previously, employees of the Pension Fund of the Russian Federation were responsible for transmitting information about accounts. Now the situation is completely different. Citizens take the initiative, otherwise information cannot be obtained. You need to choose one of the existing methods. The service is free.

Information is obtained in the following ways:

- Communication with tellers in the following banks: VTB, Bank of Moscow, Gazprombank, Uralsib, Sberbank.

- Personal appeal to the Pension Fund.

- Via the Internet, but to the SNILS number.

The method is characterized by high speed of obtaining information and simplicity. The main advantage is saving time, which is not spent waiting in queues. Open access is maintained at any time.

The Pension Fund website and the Public Services portal are the most convenient options. Pre-registration and confirmation of action are required. Any information is available after registering your Personal Account.

The system records the amount of savings and contributions for the entire period of performance of duties.

In the search results, the information is displayed as a table.

Pension co-financing program

The project is based on the principle of a citizen transferring additional insurance contributions (hereinafter - DSV) to form the funded part of the insurance benefit and directly proportional to its increase at public expense. The program works like this:

- The insured person transfers DSV to the Pension Fund of Russia (hereinafter referred to as the Pension Fund) to the account of the funded part of his old-age insurance benefit.

- The state doubles this amount, and if certain conditions are met, quadruples it.

Participation in the program is carried out on a voluntary basis upon the personal application of the applicant. Conditions:

- Before December 31, 2014, it was necessary to submit an application to join the program.

- Make your first payment before 01/31/2015.

- Pay DSA in accordance with the rules of the state co-financing program for at least 1 year. For example, citizen Ivanova transferred 12,000 rubles for 2020. She is 54 and plans to retire in 2020. After registering for an old-age insurance benefit, in addition to it, she will receive her DSV (12,000 rubles) and state co-financing in the amount of 12,000 rubles, because she has fulfilled the minimum requirements of the program.

- A person receiving any other type of software and submitting a statement of intent to participate in the project will increase his accumulative pension capital, but his voluntary insurance contributions will not be doubled;

- State-co-financed payments can be received after applying for old-age insurance benefits.

Amount of contributions

The minimum amount of insurance contributions that a future recipient of benefits must transfer to the Pension Fund or Non-State Pension Fund is 2,000 rubles per year, the maximum is 12,000 rubles. The state doubles it and transfers it to an individual pension account. Amounts transferred to the Pension Fund or Non-State Pension Fund to the account of future DSVs that are below or above the limits provided for by the program are not co-financed. Examples:

- Citizen Petrova transferred 17,000 rubles. for the past year to the account of the insurance part of your pension. The state will make an additional payment of 12,000 rubles. The following will be credited to Petrova’s account: RUB 17,000. (from personal savings) + 12,000 rub. (state co-financing according to the upper threshold of DSA provided for by the program) = 29,000 rub.

- Citizen Vasiliev contributed 2,500 rubles to the account of his future insurance pension. The state will double this amount. Vasiliev will receive: 2,500 rubles. + 5,000 rub. = 7,500 rub.

- A citizen of Nikolaev transferred 1,800 rubles. to the account of a future insurance pension and then refused to participate in the program. When she retires, she will receive only her 1,800 rubles.

The state co-financing program provides 2 options for increasing the daily allowance. Nuances:

- contributions of a program participant who contributed from 2 thousand to 12 thousand rubles for 1 year are doubled;

- a fourfold increase in own funds transferred to the future benefit account in the same range (RUB 2,000–12,000) is provided for persons who have reached retirement age but have not received an insurance or any other pension.

Duration of the program

The Russian government developed a program for co-financing insurance pension benefits in 2008. It was designed for 5 years. You could submit an application to join the program from 10/01/2008 to 12/31/2014, and make the first payment until 01/31/2015. At the moment, registration for participation in the project is not available, but due to its popularity, its renewal is not excluded . In 2013, the program was extended for another 5 years and will continue to operate for participating participants for 10 years - until 2025.

Extract from the Pension Fund of Russia through Gosuslugi

Many people are interested in the question of how to check whether their pension was calculated correctly. This is due to the complexity and complexity of the procedure for calculating payments due, especially after the introduction of the point system. You can check the accuracy of the accruals using the State Services portal. This is done as follows:

- After logging into the site, select the “Pensions and Benefits” section.

- In the tab that opens, select the pension calculator.

- In the electronic form that appears, fill out all sections, ensuring that the information entered is correct.

- Next, the calculator independently makes all the necessary calculations and issues the due amount of pension payments.

On the State Services website you can not only find out your SNILS pension online, but also order an account statement. To do this, after logging into the site, select the “Notification by personal account” action. The system issues an official document containing the following information:

- FULL NAME. user.

- SNILS number.

- The size of the savings amount.

- List of organizations that transferred contributions for this citizen.

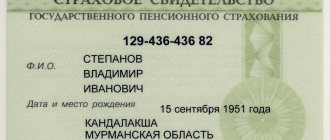

Remote receipt of information via SNILS

SNILS or individual personal account insurance number is a small card with several numbers on the surface. This document contains information related to the pension rights of a particular citizen. Information is given to anyone who has the appropriate card.

In the case of remote servicing, you must select the official page of the Pension Fund or the State Services website.

The procedure looks like this:

- The visitor opens the site and registers.

- Next comes filling out the questionnaire, one of the sections of which is dedicated to SNILS.

- The last stage is to go to the Pension Fund tab with the information of interest.

If you encounter any difficulties while visiting the portal, there is a 24-hour support line. It is indicated at the top of the page.

Pension savings: investing

Formation by citizens is the main advantage of savings. And he chooses when and how to invest. The disadvantage is the lack of indexation by the government.

The insurance pension is formed automatically if the citizen has not made any decision regarding his money before 2020. Such citizens were called “silent people”.

There are several directions where money can go:

- NPF.

- Private Management Companies.

- Vnesheconombank.

Once a year, a citizen is informed free of charge about the results of the actions taken. To do this, contact the same fund where the accounts are serviced. A mandatory step is to draw up applications in the prescribed form. NPFs publish reports on their work in the media. Information is also constantly posted on websites.

How to calculate a funded pension?

The size of the funded pension is determined by the amounts saved by the person at the time of application. The citizen selects the transfers to be taken into account:

- Insurance premiums, additional.

- Contributions from the employer.

- Money from which the state co-finances the pension.

- Maternal capital.

- Investment results.

- NP – pension amount.

- PN – pension savings of a person.

- T – payment period. In 2020 it was equal to 240 months.

In 2020, six months were added to this period, now it is 248 months. The decision is based on the fact that life expectancy in the country is longer. When calculating, the minimum period is 120 or 148 months.

Payments are made using four different methods:

- Indefinite or lifetime scheme.

- Urgent.

- One-time.

- Transfer to successors when the insured dies.

The appeal is sent to the organization responsible for the formation of savings.

Procedure for paying pension contributions

There are two options for making contributions to the pension co-financing program:

- Through the accounting department,

- through the bank.

In the first option, the application is submitted to the accounting department. It states the amount of the contribution or as a percentage of the salary. If you decide to cancel the deposit, you need to write a notification about this to the accounting department. The employer may become a third party. Then he will make a voluntary contribution to increase his future pension. Its size can be any.

Payments are made through the bank based on a payment receipt. It is obtained from the territorial pension fund or on the official website. Depending on availability, contributions can be made in equal payments or as a one-time payment. Don't forget to take a copy of the payment document. It will be useful for filing tax deductions.

Payment procedure

State co-financing of pensions has several features. If you have withdrawn money from it, you are not allowed to take part in it again. Payments are made from January 1, 2012 to those persons who have already reached the age of receiving state support and were in the program before this time. In all other situations, you can receive a payment only after reaching retirement age. The state makes additional payments from January to the last day of spring, so it is best to apply in April.

| Until the end of life | Indefinite order |

| Within 10 years | Urgent order |

| at one time | Provided that the pension under the plan is less than 5% of your Social Security. |

Inheritance according to the program has been developed. It is possible:

- if the subject died before the pension was assigned,

- if urgent order is specified.

Persons registering an inheritance must contact the Pension Fund within 6 months from the date of death. After this period the right will be lost. It can only be restored through the courts.

Last news

According to the new law, anyone can make contributions to the funded part in 2020. But co-financing will only be available to those who:

- does not receive a pension

- is not a retired judge receiving a monthly life allowance.

- This rule does not apply to military personnel, employees of the Ministry of Internal Affairs, and firefighters.

The rules for co-financing pensions for working pensioners have been changed since 2015. Participants cannot be subjects who have retired but continue to work.

In conclusion, there are some disadvantages to this program. You can only receive money if you stop working when you reach a certain age. Inflation also has a negative impact on the amount, reducing the actual payment. Military pensioners cannot participate in the program.

{amp}gt;

Pension contributions are made by the client in the amounts specified in the agreement concluded under the individual plan. To make payments, a program participant can choose any convenient method:

- Use the official Internet portal of the Fund and a bank card;

- Make a payment using the Sberbank mobile application or service. Online";

- Deposit the required amount through an ATM or Sberbank terminal;

- Contact a bank branch or office;

- Transfer funds through the accounting department of your company, submitting a corresponding application there.

Details for receiving pension contributions can be found on the bank’s official website.

One-time receipt

The money is paid once, within a month after the application, in full. The main thing is to consider the application and make a positive decision on it. Receiving such amounts is open to persons of certain categories:

- With savings of 5% or less in relation to social payments.

- Those who claim benefits due to disability or loss of a breadwinner. State support is taken into account. This is relevant for those who have little experience or have accumulated less than 30 points.

- Legal successors of persons. The money is transferred to them after the death of the citizen who was originally the owner of the funds.

If the payment has already been received, then re-applying is permissible at least five years later.

When can I receive co-financing money?

Money cannot be withdrawn from the account at will - it forms the funded part of the pension salary. Receipt of this type of payment depends solely on the age of the person. According to the new rules introduced by Law No. 350-FZ, it is no longer necessary to wait until retirement age is reached, which in 2019 will begin to increase annually by 1 year until it increases by five years by 2024. Men pensioners can receive money at 60 years old, women - at 55.

Having reached the above age, you need to contact the employees of the organization where the savings are kept. You need to take with you:

- passport;

- SNILS;

- pensioner's certificate;

- details of the bank account to which payments will be received.

The cumulative part of the pension can be received both for the rest of your life (in the form of a monthly increase in pension) and for a period of at least 10 years. It is possible to receive the accumulated funds in the form of a one-time payment. However, this is allowed only to those who have no more than 5% of the insurance portion of their pension salary remaining (or accumulated) in their account.

A funded pension, like other pension options, is issued only upon the occurrence of an insured event. For funded provision, the most common reason for receiving funds is reaching retirement age.

You can earn a pension ahead of schedule only in cases prescribed by law. For example, when working in the Far North or in harmful conditions. Early payments are also provided:

- for women with 3 children or more;

- some categories of disabled people;

- unemployed people of pre-retirement age, etc.

A complete list of reasons for taking a well-deserved retirement ahead of schedule is indicated in Art. 30-32 of the Federal Law “On Insurance Pensions” dated December 28, 2013 No. 400-FZ.

There are no exceptions for co-financing savings. Citizens can return funds only upon receipt of the right to a pension. In most women it appears at 55 years old, in men - at 60 years old.

Features of the Unified Portal of State Services for obtaining information

New users create their account using the following sequence of actions:

- Open the registration site.

- Receiving a password involves choosing a method of personal identification. An option with universal electronic cards is acceptable, but this will require an electronic key.

- The form is filled out with personal information to confirm your identity. The answer will arrive after 20-30 days if sent by mail.

- When the registration code arrives, it is entered into a special window on the website. Registration is completed.

After that, you need a tab for electronic services, in the section dedicated to the Pension Fund of the Russian Federation. After selecting the appropriate item, a list will appear. From there you need to go to the tab informing about the status of pension accounts. A few minutes later, an extract appears describing the position of citizens in the system. They also control how the review proceeds.

About additional safety rules

Pension insurance is mandatory for every citizen. At the time of the first contact with Pension Fund employees, a green card is issued - this is SNILS. The document remains in the possession of the visitor throughout his life.

An insurance certificate makes it easier to obtain information regarding several parameters:

- Seniority.

- Contributions.

- The fund that is responsible for the formation of pensions.

Even when the plastic is lost, or the owner changes personal data, the SNILS card number does not change.

The SNILS number should not be revealed to strangers. Otherwise, there is a high probability of committing fraudulent actions with future savings. For example, all savings can be transferred to a non-state pension fund. In this case, the insured person will not receive any notifications. If it becomes known that such actions have been committed, a police report is immediately filed.

Particular care must be taken when choosing a non-state pension fund. Before concluding a contract, it is worth analyzing the following indicators:

- Time on market.

- Profitability.

- Size of customer base.

How to apply for a tax deduction

A participant in an individual pension plan can take advantage of the social tax deduction provided for by law. The amount of contributions from which you can receive a deduction is 120 thousand rubles per year.

To receive a tax deduction, you will need the following documents:

- Free-form application for tax refund;

- Tax return;

- A copy of the agreement with a non-state PF;

- Copies of passport and TIN;

- Copies of receipts or other payment documents that confirm payment of contributions.