Adoption of the law on non-state pension funds

The history of the emergence of non-state pension funds is connected with the Decree of the President of the Russian Federation “On non-state pension funds”, adopted during the reforms in the economy. Within two years, about 350 such organizations were established. To license their activities, the NPF Inspectorate was created, which was later abolished.

Since 2008, the number of funds began to decline due to mergers and self-liquidations. In 2020, there are 94 non-state pension funds.

At the end of 2013, a law was adopted according to which by 2026 all non-state pension funds with mandatory pension insurance in practice should be corporatized. Other funds must undergo this procedure before the new year.

Before completion of corporatization, the pension savings of fund participants are transferred to the Pension Fund of the Russian Federation. For management companies investing pension savings, it is mandatory to join the insurance program after verification by the Central Bank. This program is necessary to guarantee the safety of depositors' funds.

Functions of non-state pension funds according to the law

The activities of NPFs are carried out in two main areas - non-state pension provision and compulsory pension insurance. There is also another type of activity of these organizations - professional pension insurance.

Federal law provides for the following functions of such organizations:

- conclusion of pension agreements and compulsory pension agreements;

- collection and storage of contributions and savings;

- maintaining accounts of NGOs (non-state pension provision);

- creation of pension reserves with the subsequent placement of their funds;

- investing savings to make a profit;

- appointment and payment of non-state pensions;

- appointment and execution of savings, urgent and one-time payments;

- formation of a payment reserve.

NPFs have the right to maintain pension accounts personally or through other organizations on the basis of relevant agreements. Statutory activities are ensured in a certain way. The organization's own funds are used to pay expenses.

Exception : expenses for placing reserve funds and investing pension savings.

Depositors, participants and insured persons are required to be provided with information on the status of their accounts annually. It is provided upon request within 10 days.

Required reserves of NPFs

Federal Law No. 75 provides that NPFs are obliged to ensure the sustainability of the fulfillment of obligations regarding their participants.

For these purposes, an insurance reserve is created. Its records are kept separately. The Bank of Russia establishes the specifics of the formation and use of the insurance reserve, and also regulates its standard size. Violation of these requirements results in administrative liability in accordance with the Code of Administrative Offenses.

For similar purposes, a reserve is created for general safety insurance. Its formation is ensured by:

- annual deductions for compulsory pension insurance from investment income;

- pension savings funds that were not received by legal successors;

- income from investment of fund funds under compulsory pension insurance.

If there is no income from investments or is insufficient, then the reserve is formed at the expense of the NPF’s own funds.

Important! Reserve funds are used to transfer pension savings to legal successors, as well as for guarantee replenishment.

Who controls the activities of the funds

Law No. 75 Federal Law of May 7, 1998 provides that the sole executive body of the fund does not have the right to delegate powers to an individual entrepreneur.

The activities of NPFs are monitored daily by a specialized depository. Control over the activities of funds is also carried out by the following bodies:

- Pension Fund of the Russian Federation;

- Bank of Russia;

- Federal Tax Service;

- Accounts Chamber;

- independent auditor;

- independent actuary.

Such multi-stage control is necessary to protect the rights and status of funds of NPF participants. Management and control bodies must have a certain composition and structure. This point is regulated by the fund’s charter and the legislation of the Russian Federation.

On the reorganization and liquidation of the fund

Reorganization of a non-state pension fund can be carried out in several forms: by accession, merger, division or separation. Other forms of reorganization are not permitted.

The question of the need for reorganization issues is raised at the general meeting of shareholders. After the corresponding decision is made, a notification is submitted to the Bank of Russia (the maximum period for filing such a document is three days). The notice must contain the following information:

- on the procedure for reorganization processes and the timing of their implementation;

- about the expected outcome of the processes.

Interested parties in this case are shareholders and creditors. The refusal of the Bank of Russia to carry out the reorganization procedure, if any, can be appealed.

The situation with liquidation is a little different. All accumulated funds must be transferred to the Pension Fund. The requirements of investors and company participants must be fully satisfied, but not at the expense of pension-type savings. A special liquidation commission must be created, the functions of which become a priority. The activities of the fund will cease after the removal of the relevant information from the state register of legal entities.

Chapter X. STATE REGULATION OF ACTIVITIES IN THE FIELD OF NON-STATE PENSION SECURITY, COMPULSORY PENSION INSURANCE AND PROFESSIONAL PENSION INSURANCE. SUPERVISION AND CONTROL OF THE SPECIFIED ACTIVITIES

9) issues to the persons specified in paragraph 2 of this article, within its competence, orders to eliminate identified violations of the requirements of this Federal Law, as well as the legislation of the Russian Federation on compulsory pension insurance; 1. If violations of the requirements of federal laws or regulatory legal acts of the Russian Federation adopted in accordance with them are detected, in accordance with which the fund operates on the basis of a license, the authorized federal body has the right, by its order, to prohibit the fund from carrying out all or part of the operations, to apply other measures of responsibility, established by federal laws, and in cases provided for by this Federal Law, revoke his license and appoint a temporary administration to the fund. 8. The composition of the temporary administration includes the head of the temporary administration, his deputy (if necessary) and members of the temporary administration. An official of an authorized federal body is appointed as the head (deputy head) of the temporary administration. on the amount of income from the placement of pension reserves allocated for the formation of the fund’s insurance reserve; Adopted by the State Duma on April 8, 1998, an agreement on compulsory pension insurance is an agreement between the fund and the insured person in favor of the insured person or his legal successors, according to which the fund is obliged, upon the onset of pension grounds, to assign and pay to the insured person the funded part of the labor pension or pay it to legal successors. The legal successors of the insured person include the persons specified in paragraph 12 of Article 16 of the Federal Law of December 17, 2001 N 173-FZ “On Labor Pensions in the Russian Federation”; investment portfolio of a management company - assets formed from pension savings received by the management company in trust from one fund;

Participation in NPF

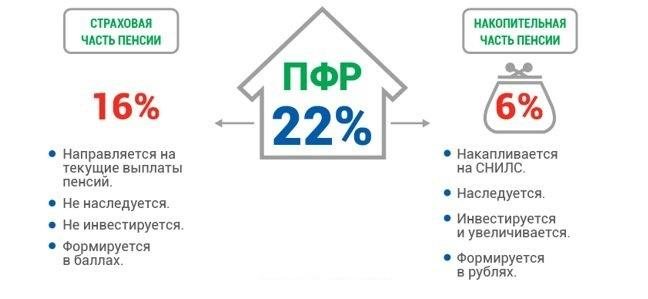

The pension has insurance and savings parts. They are formed from employer contributions (22%) and amount to 16% and 6% of the wage fund, respectively. The funded part is formed only for those citizens who have chosen the appropriate security.

The Law on Non-State Pension Provision assumes that any citizen has the right to transfer the funded portion to a non-state pension fund.

These rights do not apply to the insurance part, since it is currently used to pay existing pensioners.

Savings transferred to NPFs generate income. This is ensured by investing funds. If we compare the average profitability under state and non-state provision, then the indicators will be higher in the second case.

Please note: a mandatory condition for cooperation with a non-state pension fund is the conclusion of an agreement on mandatory pension insurance.

Transfer from the Pension Fund to the Non-State Pension Fund: procedure, methods

The transition to a non-state pension fund is carried out according to certain rules. Amendments have been made to the law, according to which an application for transfer must be submitted to the Pension Fund.

This can be done in person or by mail. In the second case, the application must be notarized.

Description of Federal Law 75

Federal Law “On Non-State Pension Funds” No. 75 FZ was adopted on May 7, 1998. The law regulates legal and socio-economic relations that manifest themselves during the formation of non-state pension funds, the implementation of their direct activities and abolition.

According to the Federal Law on Non-State Pension Funds of the Russian Federation, state registration of each new non-state pension fund occurs in accordance with the Federal Law “On State Registration of Legal Entities and Individual Entrepreneurs” N 129-FZ , adopted on August 8, 2001. The verdict on registration, abolition or reorganization of a non-state pension fund is made by the Bank of Russia.

The Fund is licensed indefinitely by the Bank of Russia Federal Law 75 (Article 7.1 Federal Law 75). However, in case of repeated violations of federal laws and regulations of the Bank, the license may be revoked. The Bank of Russia has the right to refuse licensing to an applicant if he does not meet the standards specified in Part 10 of Art. 7.1 of Law 75 on non-state pension funds.

The main functions of NPFs established in the current federal law are to work with the pension savings of investors, timely payments to participants, and monitor the safety of fund savings. If part of the assets is lost, shareholders are obliged to compensate investors for the missing amount.

The charter of a non-state pension fund is determined by its creator. Mandatory items are:

- The name in full and abbreviated form with the presence of the concept “Non-State Pension Fund” and the abbreviation “NPF”;

- Definition of the exclusive activities of a joint stock community;

- Determining the maximum of your own income from investing pension funds and reserve placements;

- Directive to create a board of trustees from among investors, fund participants and authorized representatives of insured persons.

Requirements for officials, accounting employees and controllers of non-state pension funds are regulated by Article 6.2 . The current text defines the criteria for competence and suitability. In particular, an applicant for the position of an official should not have outstanding convictions for intentional criminal acts, or be employed in similar positions in a financial organization declared bankrupt, if no more than three years have passed since the bankruptcy. The departmental controller, chief accountant, and member of the supervisory board of directors are elected from among the members of the joint-stock company. An individual from the partner list of a non-state pension fund cannot hold the listed positions.

The current Federal Law gives non-state pension funds the powers to gain access to confidential information of investors and partners (Article 15). Information confidentiality must be maintained. Disclosure of personal information of depositors to third parties is punishable by law in accordance with the Constitution of the Russian Federation, excluding cases provided for by the law in question. NPF has the right to process personal data of individuals without their direct consent.

Investors have the right to demand absolute compliance with obligations under the pension agreement. These include timely pension payments, including premature ones (upon prior request).

The reorganization of the non-state pension fund takes place on the basis of a decision made at the general meeting of shareholders. The decision to change the functions of a joint stock company obliges its management to inform the Bank of Russia about what is happening. Within 30 working days from the date of notification to the Bank, creditors are notified of the reorganization. The notification about the beginning of the procedure for reorganizing a non-state pension fund must indicate the estimated timing of its implementation, the conditions of the reorganization and information about the possible addresses of additional funds created as a result of the reform. At the end of the procedure, a record of the reorganization of the joint-stock company is entered into the state register.

Read the Federal Law “On Free Legal Aid in the Russian Federation”

The decision to terminate the activities of the fund is made in accordance with the current federal law and the Constitution of the Russian Federation. Within 30 days from the date of adoption of liquidation measures, pension savings are sent to the Pension Fund of the Russian Federation in the manner prescribed by the Bank. The exploitation of NFP reserves is carried out as part of payments or redirection to other pension insurance funds and redemption amounts to investors and participants. If there is a shortage of cash assets in the pension reserve, the missing amount can be added from joint guarantee savings.

The Bank of Russia has the right to submit to the Arbitration Court of the Russian Federation an application for the forced termination of the activities of a non-state pension fund . If a corresponding decision is made in court, the joint-stock company is declared insolvent in accordance with the provisions of Federal Law of October 26, 2002 N 127-FZ “On Insolvency (Bankruptcy)”. The decision of the Arbitration Court is made within a month from the date of filing the petition by the Bank of Russia.

Like other laws of the Russian Federation, Federal Law 75 on non-state pension funds undergoes periodic changes. This is due to the rapidly changing socio-economic situation in the state. The last significant amendments to 75-FZ were made on July 3, 2016.

Latest changes regarding the activities of non-state PFs

The latest amendments to the Federal Law “On Non-State Pension Funds” No. 75 FZ were made on July 3, 2016 and came into force on January 1, 2020.

The changes affected several articles of this law at once. Clause 9 of Art. 7.1 in the new edition states that the license of a non-state pension fund drawn up on the form of the Bank of Russia must indicate information about possible restrictions on the implementation of activities for compulsory pension insurance and non-state pension provision.

Amendments were made to paragraph 12 The Bank of Russia is authorized to reissue licensing in the event of changes in the name of the NPF or a change in the actual address of the fund.

Article 7.1, in accordance with the act of July 2, 216, is supplemented by clause 18. The text of this part of this article clarifies that the NFP is authorized to carry out the direct activities specified in the license document. All possible amendments are discussed and agreed upon with the Bank of Russia.

Reporting documentation must be provided in electronic form, sealed with an electronic signature (Article 32.1, Part 3) .

Art. 7.2 was supplemented by part 2.1 . According to its regulations, the Bank of Russia is authorized to cancel the licensing of a non-state pension fund for refusal to comply with the requirement for membership in an SRO (N 223-FZ “On Self-Regulatory Organizations in the Financial Market”). Appeared in the updated article. 14, paragraph 6 also obliges NPFs to join an SRO in the financial market.

Investing savings and placing reserve funds according to the law

The law regulates that the movements of invested savings and placed reserve funds must be transparent and open to information.

NPF is guided by certain principles:

- guarantee the safety of these funds;

- ensure the receipt of income, investments in various assets, their liquidity;

- determine an investment strategy based on unbiased criteria;

- take into account the reliability of securities;

- professionally manage the investment process.

Funds can place reserve funds independently or through management companies, but the latter do not receive ownership rights.

Investment objects are provided by the Bank of Russia. Cooperation with management companies is carried out under a trust management agreement.

Investment objects

Pension savings assets must meet certain criteria established by the Bank of Russia.

Pension savings funds can be invested in relation to the following objects:

- government securities of the Russian Federation and its constituent entities;

- bonds and shares (if created in the form of an OJSC) of Russian issuers;

- units of mutual funds;

- mortgage securities;

- funds in accounts and deposits of credit institutions (rubles, foreign currency);

- securities of an international financial organization, if they are allowed to be publicly circulated and placed in the Russian Federation;

- bonds of foreign issuers, if a Russian legal entity receives income from their placement.

The Bank of Russia also has the right to introduce additional restrictions regarding investment.

Federal Law No. 167-FZ of June 27, 2020

RUSSIAN FEDERATION FEDERAL LAW

On amendments to certain legislative acts of the Russian Federation regarding combating the theft of funds

Adopted by the State Duma on June 5, 2020

Approved by the Federation Council on June 20, 2020

Article 1

Introduce into Article 26 of the Federal Law “On Banks and Banking Activities” (as amended by the Federal Law of February 3, 1996 No. 17-FZ) (Vedomosti of the Congress of People's Deputies of the RSFSR and the Supreme Council of the RSFSR, 1990, No. 27, Art. 357; Collection of Legislation Russian Federation, 1996, No. 6, Art. 492; 2001, No. 33, Art. 3424; 2003, No. 27, Art. 2700; No. 52, Art. 5033; 2004, No. 27, Art. 2711; 2005, No. 1 , Art. 45; 2007, No. 31, Art. 4011; No. 41, Art. 4845; 2009, No. 23, Art. 2776; No. 30, Art. 3739; 2010, No. 31, Art. 4193; No. 47, Art. 6028; 2011, No. 7, Art. 905; No. 27, Art. 3873; No. 48, Art. 6730; No. 50, Art. 7351; 2012, No. 27, Art. 3588; No. 50, Art. 6954; No. 53, Art. 7605; 2013, No. 11, Art. 1076; No. 19, Art. 2329; No. 26, Art. 3207; No. 27, Art. 3438; No. 30, Art. 4084; No. 51, Art. 6699; 2014, No. 26, Art. 3395; No. 52, Art. 7543; 2020, No. 27, Art. 3950; No. 29, Art. 4357; 2020, No. 18, Art. 2661) the following changes:

1) add a new part forty-one as follows: “Information about cases and (or) attempts to transfer funds without the client’s consent (including information about transactions, accounts and deposits in respect of which cases and (or) attempts were recorded making money transfers without the client’s consent) is submitted in cases provided for by the Federal Law “On the National Payment System”, by credit institutions, payment system operators, and payment infrastructure service operators to the Bank of Russia. The Bank of Russia has the right to provide information received in accordance with this part to credit institutions, payment system operators, payment infrastructure service operators in cases provided for by the Federal Law “On the National Payment System.”;

2) parts forty-one - forty-four shall be considered parts forty-two - forty-five, respectively.

Article 2

Introduce into the Federal Law of July 10, 2002 No. 86-FZ “On the Central Bank of the Russian Federation (Bank of Russia)” (Collected Legislation of the Russian Federation, 2002, No. 28, Art. 2790; 2003, No. 2, Art. 157; No. 52 , Art. 5032; 2004, No. 31, Art. 3233; 2006, No. 19, Art. 2061; 2007, No. 1, Art. 9, 10; 2008, No. 42, Art. 4699; No. 52, Art. 6231; 2009, No. 1, Art. 25; No. 48, Art. 5731; 2011, No. 27, Art. 3873; No. 43, Art. 5973; 2012, No. 53, Art. 7607; 2013, No. 27, Art. 3438, 3476; No. 30, Art. 4084; No. 51, Art. 6695, 6699; No. 52, Art. 6975; 2014, No. 26, Art. 3395; No. 30, Art. 4219; No. 45, Art. 6154; No. 52 , Art. 7543; 2020, No. 29, Art. 4348, 4357; 2020, No. 1, Art. 23, 50; No. 27, Art. 4225, 4295; 2020, No. 14, Art. 1997; No. 18, Art. 2661, 2669; No. 27, Art. 3950; No. 31, Art. 4830; 2020, No. 1, Art. 66; No. 11, Art. 1588; No. 18, Art. 2557) the following changes:

1) add Article 574 with the following content:

“Article 574. The Bank of Russia, in agreement with the federal executive body authorized in the field of security, and the federal executive body authorized in the field of countering technical intelligence and technical protection of information, establishes mandatory requirements for credit organizations to ensure the protection of information when carrying out banking activities in order to counteract the implementation of money transfers without the client’s consent, with the exception of the requirements for ensuring the protection of information established by federal laws and regulations adopted in accordance with them.”;

2) add Article 764″1 with the following content: “Article 764″1. The Bank of Russia, in agreement with the federal executive body authorized in the field of security, and the federal executive body authorized in the field of countering technical intelligence and technical protection of information, establishes mandatory requirements for non-bank financial organizations to ensure the protection of information when carrying out activities in the field of financial markets, provided for in part one of Article 761 of this Federal Law, in order to combat illegal financial transactions, with the exception of the requirements for ensuring the protection of information established by federal laws and regulations adopted in accordance with them.”

Article 3

Introduce into the Federal Law of June 27, 2011 No. 161-FZ “National Payment System” (Collection of Legislation

Russian Federation, 2011, No. 27, art.

1) Part 10 of Article 7 after the words “Transfer of electronic funds” shall be supplemented with the words “except for the cases provided for in Part 91 of Article 9 of this Federal Law”;

2) Article 8 is supplemented with parts 51 - 53 as follows:

"51. The money transfer operator, if he identifies an operation that corresponds to the signs of a money transfer without the client’s consent, is obliged, before debiting funds from the client’s bank account, for a period of no more than two working days, to suspend the execution of the order to carry out the operation that corresponds to the signs of a money transfer. without the client's consent. Signs of transferring funds without the client’s consent are established by the Bank of Russia and posted on its official website on the Internet. The money transfer operator, within the framework of the risk management system it implements, determines in the documents regulating risk management procedures procedures for identifying transactions that correspond to the characteristics of money transfers without the client’s consent, based on an analysis of the nature, parameters and volume of transactions performed by its clients (activities carried out by clients) .

52. The money transfer operator, after performing the actions provided for in Part 51 of this article, is obliged, in the manner established by the agreement concluded with the client:

1) provide the client with information:

a) about his commission of actions provided for in part 51 of this article;

b) on recommendations for reducing the risks of repeated transfers of funds without the client’s consent;

2) immediately request confirmation from the client to resume execution of the order.

53. Upon receipt from the client of the confirmation specified in paragraph 2 of part 52 of this article, the money transfer operator is obliged to immediately resume execution of the order. If the client does not receive the confirmation specified in paragraph 2 of part 52 of this article, the money transfer operator resumes execution of the order after two working days after the day he performed the actions provided for in part 51 of this article.”;

3) Article 9:

a) add part 91 with the following content:

"91. In cases where the money transfer operator identifies transactions that correspond to the signs of a money transfer without the client’s consent, the money transfer operator suspends the client’s use of the electronic means of payment and carries out, in relation to reducing the balance of the payer’s electronic money, the actions provided for in parts 51-53 of Article 8 of this Federal Law. Upon receipt from the client of confirmation of the resumption of execution of the order specified in clause 2 of part 52 of article 8 of this Federal Law, the money transfer operator is obliged to immediately resume the client’s use of the electronic means of payment. If the client does not receive confirmation of the resumption of execution of the order specified in paragraph 2 of part 52 of article 8 of this Federal Law, the money transfer operator resumes the client’s use of the electronic means of payment after two working days after the day he performed the actions provided for in part 51 of article 8 of this Federal Law law."; b) add parts 111 - II5 with the following content: “II1. Upon receipt from a client - a legal entity of the notification specified in part 11 of this article, after debiting funds from the client's bank account, the money transfer operator servicing the payer is obliged to immediately send a notice of suspension to the money transfer operator servicing the recipient of funds crediting funds to the bank account of the recipient of funds or increasing the balance of electronic funds of the recipient of funds (hereinafter referred to as notice of suspension) in the form and in the manner established by the regulatory act of the Bank of Russia.

112. If a money transfer operator serving the payer receives a notice of suspension before funds are credited to the recipient’s bank account or the balance of the recipient’s electronic funds increases, the money transfer operator serving the payer is obliged to suspend for a period up to five working days from the date of receipt of such notification, crediting funds to the bank account of the recipient of funds in the amount of the funds transfer or increasing the balance of electronic funds of the recipient of funds by the amount of the transfer of electronic funds and immediately notify the recipient of funds in the manner established by the agreement concluded with the recipient funds, on the suspension of crediting funds or increasing the balance of electronic funds and the need to submit documents within the specified period confirming the validity of receipt of transferred funds or electronic funds.

eleven . If, within five working days from the day the funds transfer operator serving the recipient of funds performs the actions provided for in Part II2 of this article, the recipient of funds submits documents confirming the validity of receiving the transferred funds or electronic funds, the funds transfer operator, servicing the recipient of funds is obliged to transfer funds to the bank account of the recipient of funds or increase the balance of electronic funds of the recipient of funds.

II4. If, within five working days from the day the money transfer operator serving the recipient of funds performs the actions provided for in Part II2 of this article, the recipient of funds fails to provide documents confirming the validity of receiving the transferred funds or electronic funds, the money transfer operator, servicing the recipient of funds is obliged to return funds or electronic funds to the money transfer operator serving the payer no later than two business days after the expiration of the specified five-day period. The money transfer operator serving the payer is obliged to credit funds to the payer's bank account or increase the balance of the payer's electronic funds by the amount of their return made by the money transfer operator serving the recipient of the funds no later than two days from the date of their receipt.

115. If the money transfer operator serving the payer receives a notice of suspension after the transfer of funds to the bank account of the recipient of funds or an increase in the balance of the electronic money of the recipient of funds, the money transfer operator serving the recipient of funds is obliged to send to the operator by transfer of funds servicing the payer, a notification about the impossibility of suspending the transfer of funds to the bank account of the recipient of funds or suspending the increase in the balance of electronic funds of the recipient of funds in the form and in the manner established by the regulatory act of the Bank of Russia. The money transfer operator is not liable to the client for losses resulting from the proper fulfillment of the requirements provided for in parts 112 - 114 of this article.”;

4) Article 27 shall be supplemented with parts 4-7 as follows: “4. Funds transfer operators, payment system operators, and payment infrastructure service operators are required to implement measures to counteract money transfers without the client’s consent in the manner established by the Bank of Russia.

5. In order to ensure the protection of information when making money transfers, the Bank of Russia creates and maintains a database of cases and attempts to make money transfers without the client’s consent.

6. Funds transfer operators, payment system operators, payment infrastructure service operators are required to send to the Bank of Russia information about all cases and (or) attempts to transfer funds without the client’s consent in the form and in the manner established by the Bank of Russia.

7. Funds transfer operators, payment system operators, payment infrastructure service operators have the right to receive from the Bank of Russia, in the form and in the manner established by it, information contained in the database on cases and attempts to transfer funds without the client’s consent.” .

Article 4

This Federal Law comes into force ninety days after the day of its official publication.

V.Putin

Moscow, Kremlin June 27, 2020 No. 167-FZ