Right to old age pension without length of service

According to the new reform, in order to retire in old age, you need to reach the established retirement age and have a certain amount of work experience and accumulate the required number of pension points.

For 2020, these figures are equal, for men 60.5 years. For a woman – 55.5 years. At the same time, they must have at least 10 years of work experience and accumulate 16.2 points.

In 2024, these values will be set at the level: men 65 years old, women 60 years old, work experience 15 years, number of pension points 30.

If an individual reaches the established age, but does not have the required number of years of work experience or pension points, then he can also receive an old-age pension, but without experience.

What if there is no work experience? Is the citizen entitled to a pension? Yes, and it's called social. It is paid when a person does not have the required amount of work experience.

There are several such cases - survivor's benefits, which are paid to dependents:

- if the insured person has died and does not have the required number of years of work experience;

- if a person has been assigned a disability group and, due to lack of ability to work, has no work experience;

- the person has never earned the established required work experience.

In old age, the state provides assistance and pays pensions even to those people who have no work experience. Its size is small, in 2019 it is 5,283.84 rubles. In addition, in each region a minimum subsistence level is established, and additional payments are made up to its value.

There are conditions for receiving this pension. A person should not work. He must live in Russia. For foreign citizens, the period of residence in Russia must be at least 15 years.

How to apply for an old-age social pension without work experience: step-by-step instructions

To apply for a social old-age pension without having any work experience, you must act in the following sequence:

- Wait until the deadline for submitting documents. It is no more than a month before the day from which the right to a pension begins. For example, if you are a woman and you turn 60 on February 21, you can apply to the Pension Fund after January 21. A man who turns 65 on April 15 can plan a visit for dates starting from March 16.

- Collect a package of necessary documents, which includes:

- application for a pension (you can take it and fill it out on site at the Pension Fund branch or the Multifunctional Center for State and Municipal Services (MFC) or download a form and sample form);

- passport;

When applying for a social old-age pension, the passport simultaneously identifies the applicant and confirms that he has reached retirement age

- confirmation of the legality of long-term residence in the Russian Federation (temporary residence permit or residence permit) if you are a foreigner or stateless person;

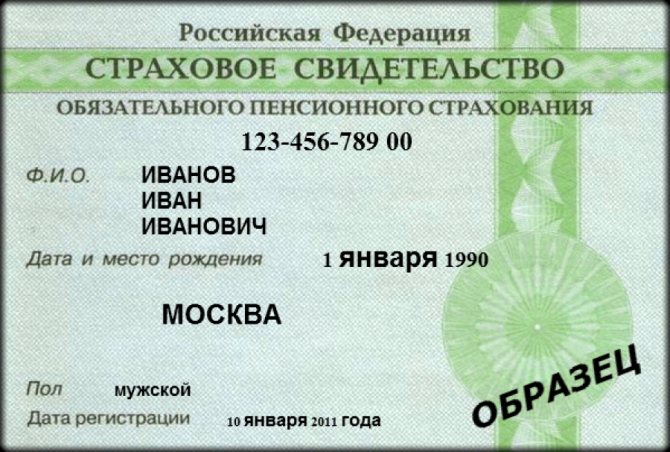

- certificate of compulsory pension insurance (SNILS);

The set of documents attached to the application for a pension must include SNILS

- certificate of assignment of TIN;

- marriage certificate, if available;

- if there are dependents, documents confirming their presence, for example, birth certificates of children;

- confirmation of membership in other categories entitled to a social pension (peoples of the Far North, disabled people, etc.), if applicable;

- confirmation of existing work experience, if there is no work experience at all, not applicable;

- notarized power of attorney, if documents will be submitted through a proxy.

- Select the method of submitting documents from the available options:

- personal visit to the Pension Fund branch at the place of registration of residence or the nearest Multifunctional Center for State and Municipal Services (MFC);

- submitting documents directly to the Pension Fund or through the MFC through an authorized representative;

- by mail;

- via the Internet on the government services portal or through your personal account on the PFR website, you can log in using the login and password to your account on the government portal class=»aligncenter» width=»1200″ height=»524″[/img]

Login to your personal citizen's office on the Pension Fund website - Submit documents using your chosen method.

- Wait for the decision of the Pension Fund. It must be accepted within ten days from the date of submission of documents.

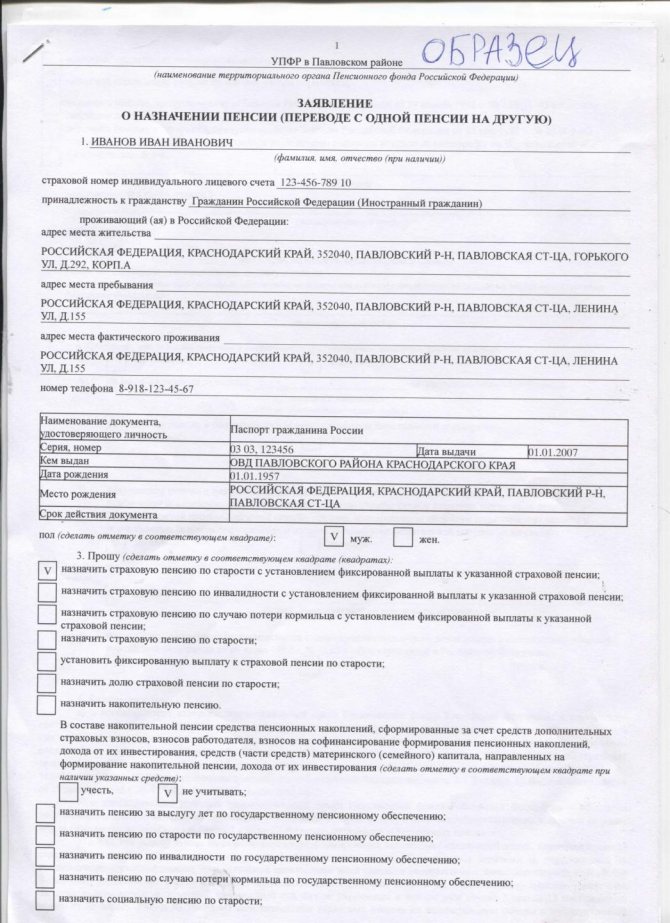

How to fill out an application for a social pension

An application for a social pension can be filled out on a computer or by hand - in legible handwriting, without corrections or erasures.

It needs to reflect the following data:

- The exact name of the PFR branch to which it is addressed. You can find them out on the Pension Fund website or check directly with the branch or MFC.

- Full name of the applicant as it is written in the passport.

- Passport data: series, number, date of issue, name of the issuing authority as written in the passport, department code.

- Details of the temporary residence permit or residence permit, if applicable: series, number, by whom, when and for what period the document was issued.

- Registration address of place of residence.

- Address of place of stay or actual residence, if applicable.

- SNILS number.

- Contact information: postal address, email address, if available, telephone number.

- Information about the presence and number of dependents or their absence.

- Information about existing official work activity, if applicable.

- Personal data of the authorized person, if applicable.

- List of attached documents.

Sample of filling out an application for old age pension. When filling out an application for an old-age social pension, check the appropriate box

A sample will help you fill out the application correctly.

When filling out the application, please note that you must tick the box strictly opposite the type of pension to which you are entitled. If you do not have enough service to receive an insurance pension or do not have enough points, you are entitled to a social old-age pension, and the box corresponding to it must be ticked.

If the application is submitted online, documents are attached to it in the form of scanned or photocopies. It is better to clarify the need for notarization when submitting documents by mail or through a proxy at the Pension Fund of Russia or MFC branch. When visiting the Pension Fund in person, just in case, it is advisable to have with you not only the original documents, but also their simple photocopies.

Types of pensions in the absence of work experience:

Insurance

According to current legislation, upon reaching a specified number of years, a person becomes entitled to receive an insurance pension.

It is paid based on the employee’s insurance record and the number of accumulated pension points. The size of each such pension is calculated individually for each person based on the indicators available to him.

Persons with at least one day of work experience also receive an insurance pension, calculated based on available data. However, they can choose between insurance and social if the amount of the latter is greater than the security calculated by the Pension Fund.

Social

But they will receive a social pension. This pension is paid by the state if a person does not have the necessary criteria for receiving an insurance pension.

Calculation of old-age pension without work experience

It is necessary to know the general conditions that are established at the legislative level, as well as the existing features.

Pension law

The main legislative act on the issue of obtaining pensions without work experience is considered to be Federal Law No. 166. In particular, Federal Law No. 166 clearly explains:

- what age must the recipient be to receive not only an insurance, but also a social pension;

- minimum payment amount;

- the right to use an increasing coefficient;

- a list of citizens who are entitled to receive such payments.

In the process of studying this bill, many may have certain questions. To help citizens understand the conditions for receiving such a pension, we will consider all the available nuances.

What age is required to receive

The age that allows you to qualify for pension payments without work experience can be divided into several categories:

- common;

- special.

The generally accepted age applies to all residents of the Russian Federation without exception and is:

| For men's category | 65 years old |

| For women | 60 years |

At the same time, it is necessary to understand that the right to registration at a younger age belongs to residents of the North and amounts to:

| For women | 50 years |

| For men | 55 years |

Residents of the North must necessarily live in difficult climatic conditions until they reach retirement age.

In what cases is the minimum size assigned?

To be able to apply for a pension without having any work experience, you must meet certain conditions, namely:

- compulsory residence in the Russian Federation continuously for the last 15 years;

- mandatory presence of Russian citizenship;

- reaching the established age by the legislation of the Russian Federation.

If at least one of the above conditions is not met, the PF representatives will certainly refuse to receive pension payments.

Amount of monthly benefit (how much is the amount)

The amount of pension benefits without the required work experience directly depends on many factors.

For example, in the case where a potential applicant does not have the required work experience, he will be accrued a minimum benefit in the amount of 5 thousand 034 rubles.

At the same time, some important factors are taken into account:

| Indexing | Which is carried out by the Government of the Russian Federation every year. At the beginning of each calendar year, or more precisely, in the month of April, the amount of pension payments is subject to indexation |

| Place of residence | There are regions in Russia in which pensions and other types of payments are accrued with mandatory consideration of an increased coefficient |

The amount of government assistance could exceed the level of inflation, as well as the minimum subsistence level.

For example, the pension benefit in 2020 was indexed taking into account a coefficient of 1.03. Based on the results of the recalculation, the average pension figures are about 8.5 thousand rubles. The same amount is in St. Petersburg.

In this situation we are talking about those pensioners and citizens who live beyond the Arctic Circle. If you move to warmer climes, the size of payments is significantly reduced.

Old-age pensions without work experience in Russia increase when a pensioner reaches 80 years of age. An old-age pension without work experience in Moscow is determined according to general rules.

The difference between insurance and social pensions

Let's take a closer look at the differences between social and insurance pensions:

- Insurance is assigned for the number of years actually worked by a person. Social – as a measure of support in the absence of work experience.

- The size of the insurance pension is usually higher than the social pension. Since it is calculated based on contributions made by the employer, and not from the minimum wage established by the state.

- Both pensions are subject to indexation annually, but the percentage of recalculation is for the insurance pension. In 2020, for the insurance pension it was 7.05%, for the social pension 2.4%. At the same time, the indexation of the insurance pension is carried out in February, and the social pension in April.

- You can receive an insurance pension when a person reaches the age established by law. In 2020, for men it is 60.5 years old, for women it is 55.5 years old. After completion of the reform, these indicators will be 65 years and 60 years, respectively. The right to a social pension appears to a person five years after the established age, if he has no work experience in 2020, only at 65.5 years for men and 60.5 years for women.

- The insurance pension is paid to the citizen until his death, the social pension - if the conditions are violated, it may be suspended.

Insurance and social pensions: concepts

First, let's look at what types of pensions there are.

An insurance or regular pension is paid under two conditions: crossing the retirement age limit and length of service sufficient to receive it. The amount of payments depends on the amount of work experience and a number of modifiers. As of 2020, at least 10 accrued years are required for retirement, but, under the terms of the pension reform, the period is constantly growing, and by 2024 the limit will stop at 15 years.

Social benefits are provided upon reaching retirement age plus five years on top if the accumulated experience was not enough. The pension is paid from the federal budget and is the same throughout the country (although regions have the right to establish additional bonuses and benefits). In this case, length of service is not taken into account, and any unemployed person who has reached the required age can receive social benefits.

Types of pensions available to citizens of the Russian Federation

In 2020, the size of the social pension will be 5,300.14 rubles for both elderly people and vulnerable categories of citizens in case of loss of a breadwinner. Disabled people will receive from 4,500 to 12,700 rubles depending on the group. Statistically, the average social pension in the country will be about 9,200 rubles, and the payments themselves were increased in April by 2.4 percent.

Low-income pensioners with incomes below the subsistence level receive additional assistance. Additional payments are due to unemployed citizens whose pension is below the regional minimum. The additional payment does not apply to working pensioners: they are indexed taking into account additional insurance contributions.

The calculation procedure looks like this:

- The amount of additional payment is fixed from the basic pension to the subsistence level.

- The amount of the increase is calculated taking into account annual indexation.

- Indexed funds are added to the pension increased to the subsistence level.

For example, a pensioner receives 7,000 rubles monthly, and the cost of living in the region is 8,500 rubles. In this case, the size of the increase during indexation in 2020 will be 7000 * 7.05% = 493.5 rubles, and the additional payment to the minimum will be 8500 - 7000 = 1500 rubles. The final pension will exceed the minimum amount and amount to 8993.5 rubles.

On average, the federal surcharge will be 400 rubles per month. More than 4 million pensioners use the bonus annually, which costs the budget 20 billion rubles. Retrieving and indexing is done automatically, no applications are required. The remaining funds are paid by the regions to the minimum. The amount can range from 6,900 rubles (Belgorod region) to 16,500 rubles (Chukchi Autonomous Okrug). .

Table 1. The value of the annual indexation coefficient for the next five years

| Year of indexation | Amount of increase in payments, in % |

| 2019 | 7,05 |

| 2020 | 6,6 |

| 2021 | 6,3 |

| 2022 | 5,9 |

| 2023 | 5,2 |

| 2024 | 5,5 |

Differences between pension categories

Since the insurance pension is formed from the citizen’s many years of savings, it is noticeably larger than the “free” social pension. The following differences can be distinguished:

- By default, the insurance pension allows you to stop working five years earlier. In case of early exit (for example, for residents of the Far North), the gap could be a decade, and for dangerous professions (military, Ministry of Emergency Situations, police) even greater.

- The average payment for an insurance pension in 2020 exceeds 14 thousand rubles, while the social pension is at the level of nine thousand. In practice, social benefits will be barely enough to make ends meet, and any work will seriously reduce their amount.

- Every working pensioner must pay contributions to the Pension Fund for recalculation of payments. The difference is that for a citizen with an insurance pension, these funds will be taken into account during the annual re-indexation, and with a social pension, the money will go towards future insurance, without in any way affecting the amount of monthly payments.

- Social benefits may be suspended or canceled for a number of reasons. The insurance pension is guaranteed by the state and is always paid, regardless of the situation in the country or the circumstances of the pensioner’s life.

Retirement age without work experience in 2020

A person also has the right to receive a social pension upon reaching the age established by law. However, there is no transition period for it. Therefore, in 2020, you can apply for an old-age pension in the absence of work experience, if the man is 65 years old and the woman is 60 years old.

This rule does not apply to pensioners belonging to small-numbered peoples of the north.

A pensioner can apply for a pension in 2020 if he turns 60.5 or 55.5 years old. However, it will only be paid when the recipient turns 65.5 years old and 60.5 years old, respectively.

An important condition for its appointment is that the pensioner does not have a permanent place of work. As well as residence in the country.

Early retirement benefits for mothers of many children are available only if they have the required work experience. You will not be able to retire early from your social pension.

What will be the old age pension without work experience?

The average size of the old-age social pension in 2020 was 8,600 rubles. This year, taking into account indexation, its size will increase slightly.

What is required?

To be eligible to receive a social pension benefit, in addition to reaching the legal age, you need 5 years of work or insurance experience, which is summed up from the periods listed above.

Social pension

If a citizen is granted a social old-age pension, he will receive a fixed cash benefit every month for the rest of his life, indexed every year.

But, it should be remembered that, unlike an insurance pension, social payments may be suspended or even terminated if the conditions for its provision are not met.

For military wives

Wives of military personnel have the right to receive a social pension on a general basis. But don’t rush into its design.

If you have the opportunity to document that for 5 years you lived in a military unit where there was no opportunity to get a job, plus 1.5 years or more you were on maternity leave, it only takes six months of official work experience to assign more profitable insurance pension.

Read on our website about pensions for displaced people. Information about granting pensions to municipal employees for length of service is here.

How is a pension calculated after age 80? Find out here.

Terms of accrual and provision

The amount of a pension without work experience according to the work book is determined by the pension fund at the time a citizen applies for a benefit.

Documentation

- Application for accrual of pension.

- Russian citizen's passport or documents confirming long-term permanent residence on its territory.

- Documents confirming belonging to the peoples of the North (if any).

- Documents confirming the right to receive survivor benefits (if any).

Size in 2020-2017

In 2020, the size of the social pension was 8,600 rubles.

In 2020, pension indexation is planned by 2.6%. As a result, it will be approximately 8,800 rubles.

Pensioners in the Moscow region received social benefits in the amount of 8,950 rubles in 2020. This year it is planned to increase to 9,161 rubles.

In Moscow, the minimum pension for 2020 was 9,850 rubles; after the increase, pensioners will receive a little more than 10 thousand rubles.

News and changes in 2020

In 2020, the social pension is expected to be indexed in April. The planned level of pension recalculation should be 7% with an inflation rate of 3%.

It is planned that in 2020 there will be an increase in the number of federal subjects that will provide regional additional payments to the social pension. There are currently 16 entities participating in this program, and 15 more are expected to join in 2020.

The opportunity to apply for a social pension will be available to persons who turn 66.5 years old for men and 56.5 years old for women in 2020.

It is important to remember that the transition period for using the MIR payment system ends in June 2020. Therefore, from July 1, 2020, it will be possible to receive social pensions only on cards of the MIR payment system.

How to apply for an old-age pension without work experience?

Required documents

To apply for a social pension, you do not need a large number of documents.

The following forms must be collected and provided:

- Application for a social pension;

- A document to confirm the identity of a citizen (passport, residence permit, etc.);

- Documents to confirm other circumstances (for example, a certificate stating that the citizen belongs to the small nations of the North).

Contacting the Pension Fund

A citizen can apply for a pension at any time when he becomes entitled to it. You must contact the Pension Fund branch at the citizen’s place of residence, at the place of his actual location, using the MFC or the postal service

The law establishes that a citizen can submit documents for a pension in several ways:

- In person to the Pension Fund branch;

- Through a representative under a notarized power of attorney;

- Through the employer;

- By filling out an application on the State Services website;

- By filling out an application in your PFR personal account.

After reviewing the documents, the pension will be assigned from the 1st day of the month in which the citizen applied for it. But not before the citizen had a real right to a pension.

Is there an old-age pension without work experience?

The current procedure for assigning old-age pensions is regulated, first of all, by the new edition of Federal Law dated December 28, 2013 No. 400-FZ “On Insurance Pensions,” which came into force in January 2015.

The main innovations relate specifically to the old-age insurance pension, one of the conditions for the appointment of which is sufficient insurance experience. There are three such conditions:

- reaching retirement age - in 2020 it is still 55 years for women and 60 for men, its gradual increase has so far affected only civil servants;

- having a minimum insurance period - in 2020 this is nine years, but this criterion increases by one year every year and should reach 16 years by 2025;

- the presence of accumulated points of the individual pension coefficient (IPC) is not lower than the minimum - in 2020 it is 13.8 points, but this barrier is increasing every year and will reach 30 by 2025. The IPC depends on the citizen’s income from which contributions were made to the Pension Fund (PFR) ) and is tied to the minimum wage (minimum wage). For income at the level of one minimum wage per month for one year (recalculation of the IPC is done every year in the fourth quarter), 1 point is awarded, and then the higher the earnings, the more points.

If an applicant for a pension does not satisfy at least one of these conditions, he will not receive an insurance pension. So even sufficient experience does not guarantee the assignment of an insurance pension.

For example, if a man who turns 60 in 2020 has exactly nine years of experience, but all these years he officially received a salary at the minimum level (whether he really had such income or the lion’s share of it was paid in cash in an envelope, it doesn’t matter ), he was only able to accumulate nine SIP points. And this is not enough. But if he worked for 14 years under these conditions, he will receive an insurance pension.

To receive an old-age insurance pension, you now need not only length of service, but also a sufficient number of points

If the length of service is insufficient or does not exist at all, there is no point in going to the Pension Fund office to receive an old-age insurance pension. But this does not mean that he is not entitled to any pension. It is required, but of a different type and with its own conditions of purpose.

The concept of work experience today only covers work and other activities useful to society by a future pensioner in the period before January 1, 2002. For later periods, the term insurance period is used. However, in everyday life, the entire length of service that is taken into account to assess the right to an old-age insurance pension is often called labor in the old fashioned way. When assigning an insurance pension, the key role is played by the insurance period - the total period after January 1, 2002, during which contributions were made to the Pension Fund for the future pensioner. But if he also has earlier work experience, this is also taken into account. For example, if he started working in 1997 and worked continuously until 2020 inclusive, all periods will be counted - from 1997 to 2001, and from 2002 to 2020 - a total of 5 + 15 = 20 years.

In 2020, there are three types of pensions in Russia:

- insurance, which is assigned on the conditions mentioned above;

- social;

- state

The state pension is awarded to special categories of citizens: victims of radiation accidents and man-made disasters and liquidators of their consequences, veterans of the Great Patriotic War, municipal employees, and career military personnel. Therefore, there is no point in dwelling on it in detail.

But the social aspect is worth paying attention to. It is actually a benefit from the state to those who, for one reason or another, have lost their ability to work and cannot take care of themselves.

The social pension is awarded to the following categories of citizens:

- disabled people of all three groups;

- disabled children;

- orphans and families who have lost their breadwinner;

- representatives of indigenous peoples of the North and citizens equated to them;

- children whose parents are unknown (introduced on January 1, 2018);

- people who have reached retirement age but are not entitled to an insurance pension.

However, in relation to the last category (and these are exactly those we are talking about), the lower retirement age limit is higher than for the appointment of insurance.