In June, the Government of the Russian Federation approved the concept of the upcoming pension reform, within the framework of which it is planned to increase the retirement age. A more detailed analysis of the bills is already nearing completion. Starting in July 2020, the Duma has been discussing all the intricacies of the new reform, and already on September 26, after the first stages of voting, it is possible to clearly outline the innovations that await Russian pensioners.

The new pension bill, which will come into force at the beginning of 2019, will invariably affect every resident of Russia. Despite the arguments provided by the creators of the bill, the reforms proposed in it are already causing a storm of popular protest. What will the pension system of the Russian Federation be like after reform, what exactly does the proposed pension bill mean for ordinary people and benefit recipients, and what can older people expect from January 1, 2020? Let's figure it out.

The main essence of the bill

The conversation about raising the retirement age has been going on for a long time, and the bill, which sets out in detail how and who needs to move the threshold for retirement from 2020, did not come as a surprise to most. In an effort to level the bar with the standards already existing in Europe, the Cabinet of Ministers of the Russian Federation proposes to take the following steps:

- Raise the retirement age.

- Increase length of service for employees of the Ministry of Internal Affairs.

- Gradually increase the amount of social benefits.

The main argument of the authors of the bill is the inevitable process of aging of the nation. An approximate table of the percentage of the working-age population and pensioners for 2020 and 2030 will look like:

| 2018 | 2030 | |

| Working population | 56% | 54,3% |

| Pensioners | 25,5% | 28,3% |

Obviously, given the reduction in insurance payments received from working Russians and the increase in the number of people of retirement age, the financial pressure on the budget will increase significantly.

A solution has been found - to raise the retirement age for men and women by 5 years, which for most people will mean the need to work until 65 and 60 years old, respectively.

Who will be affected by the new pension law proposed by the Cabinet of Ministers starting in 2020? in fact, its effect will be felt by almost all Russians who claim:

- old age insurance pension;

- well-deserved rest after length of service;

- retirement on preferential lists (residents of the north, doctors, teachers...);

- persons who have not accumulated the required work experience;

- relatives of fallen servicemen.

Why does it say “almost everything”? As always happens, there are exceptions to the general rule. The bill clarifies the list of categories to which the innovation will not apply - these are:

- persons who had already received a pension before the start of the reform;

- people receiving a disability pension;

- employees of various enterprises working in difficult and unhealthy conditions;

- persons who have a special status as victims of man-made disasters.

Without a doubt, many are interested in the question of whether the retirement age for government employees will be raised. Yes, the reform will also affect them, but for this category the reform process will begin a year later (from 2020).

New law on pensions from January 2020: briefly about everything

Retirement age - upcoming changes

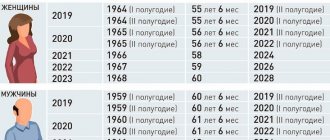

Federal Law No. 350-FZ, approved by the President on October 3 of this year, includes a whole range of changes relating not only to old-age insurance pensions, but also to social and early pensions of Russian citizens. The transition from the current age limits to the new ones will be gradual and smooth. Every year, starting in January 2020, one year of “working time” will be added to the retirement age.

New procedure for assigning an insurance pension

For the bulk of the population applying for a labor (insurance) pension, the modified version of the age limit is as follows: the male population will be able to receive the status of a non-working pensioner at 65 years old, instead of the current 60; Women will be able to leave work at 60 instead of 55.

Russians who are almost approaching retirement age and, according to the current law, should have stopped working in the next couple of years, will receive compensation measures. The preferential procedure gives the right to go on vacation 6 months earlier than the already adjusted age limits. The first to be affected by the adopted adjustments will be men born in 1959. and women born in 1964

Right to early retirement

The adopted bill with amendments recommended by V.V. Putin

, clearly defines the categories of pension recipients who will not be affected by the introduced innovations. The document also stipulates certain categories of employees, as well as persons who, for medical reasons or social status, receive the right to retire earlier than the generally accepted period.

The age limits for retirement remain the same for the following citizens

: Russians who have already retired; workers engaged in work with difficult and harmful conditions, if the employer regularly made contributions to the treasury (miners, employees of hot shops); those employed in mining operations, in mines; professional rescuers; women working in heavy work (textile industry, logging); victims of the Chernobyl accident; test pilots.

Legislators also revised the procedure for assigning early benefits. According to the new law, the following will be able to leave their place of work before the generally accepted age from January 1, 2020: citizens with long work experience (42 and 37 years); mothers of many children with more than three children; mother or father (guardian) of a disabled child (the previous norms remain); disabled people of war, group 1, vision and other preferential categories.

A detailed list of preferential categories and the intricacies of calculating the retirement age, and there are quite a few of them, can be found on the Pension Fund website.

New procedure for the retirement of teachers, doctors and a number of creative professions

The changes did not affect the length of service of teachers and health workers. Depending on the field of activity, citizens of these professions need to work, as before, from 25 to 30 years. However, the retirement age will be increased by 5 years. The establishment of a new age limit will also take place using a transition period.

Pension benefits for “northerners”

Workers in the Far North will also retire in a new way starting next year. Legislators explained the opportunity to adjust the retirement age for this category of Russians by improving living conditions and increasing average life expectancy. From January 1, 2020, in 12-month increments in several stages, the age of future pensioners in the Far North will be raised by 5 years.

New category of beneficiaries – pre-retirees

An expression from the people as a result of the pension reform has turned into a legal term. Pre-retirement age (PPA) - citizens will have this status for five years preceding the assignment of an old-age labor pension.

They are provided with a set of benefits and privileges: the opportunity, at the expense of the state, to acquire a new profession or improve their qualifications; receive unemployment benefits doubled (compared to the current benefit amount); relaxations in tax payments; benefits for travel, housing and communal services, provision of medicines; the right to free medical examination during two days of vacation plus the main one, paid at the expense of the employer. In addition, they will be protected by law from unjustified dismissal and refusal to hire.

Pension payments will increase

The principle of pension indexation has been updated. Previously, the amount of retirement benefit was increased annually once by the amount of inflation. Starting from the new year, the supplement will be noticeably larger, but the frequency remains the same - once every 12 months. The amount by which the pension will increase will be calculated by multiplying the basic pension by the indexation percentage, individually for each pensioner. Thus, some will have a larger increase, while others will have a smaller one.

The new legislation plans to increase payments until 2024. With an average pension of 14,414 rubles, the additional payment in 2019 will be about 1 thousand rubles. Indexation of pensions will affect only non-working pensioners

.

Minimum length of service for pension calculation

Starting from 2020, the pension reform in Russia involves an annual increase in the length of service required to calculate a pension. If before this period it was possible to retire after working for 5 years, then in 2020 the minimum work experience should be 10 years.

Principles for calculating pensions

The insurance benefit is calculated based on the number of pension points (IPC). The calculation procedure is specified in Federal Law No. 400-FZ “On Insurance Pensions”. It also says that a complete transition to the new conditions for entering a well-deserved retirement must take place within 10 years, that is, until 2025.

Starting from 2020, every year the IPC increases in increments of 2.4 points, which corresponds to 1 year. If in 2020, upon reaching retirement age, the account does not have the minimum 16.2 points, then the accrual of the pension will be delayed. The person is given another 5 years, during which he will be able to earn the missing working period. Otherwise, social benefits will be assigned. Important! When calculating, it is not the total length of service that is taken into account, but the insurance period. In the north, men must work for at least 25 years, and women 20, while the “northern” must work for at least 15 calendar years (a year in such regions is equal to 9 months)

Accruals for various categories

There are always exceptions to the general rule. For example, the pension reform for civil servants started in 2020, and a gradual increase in six-month increments began on January 1, 2020. The length of service for civil servants in 2020 will be 16.5 years. In this case, it is the length of service that is very important: the pension is paid in the amount of 45 to 75% of average monthly earnings, and if the minimum is exceeded, then another plus 3% for each year on top. As for the military and security forces, in 2020 everything will remain the same for them. The length of service will remain at 20 years. On average, military personnel retire at the age of 40-45. With mixed experience, you must work in the armed forces for at least 12 years.

The minimum length of service for calculating benefits for disabled people is only 1 day; otherwise, the person is assigned a social benefit. Moreover, if disability occurred before January 1, 2011, then the person himself has the right to choose what type of benefit to receive: social or labor.

For group III disabled people, benefits are calculated based on length of service earned before 2002. If disability was established before this time, then an IPC of 0.3 is taken.

The survivor's insurance pension is assigned regardless of the years worked. It is paid to minor children (or children studying on a budget until they reach 23 years of age) and elderly parents of the deceased.

Persons who have performed certain types of work are also entitled to early appointments. For them, the concept of “length of service” is established: Workers of mines and mines. Employees of fishing companies working on ships. Teachers and health workers. Emergency responders.

What is included in the insurance period

Along with the working period, other cases are also taken into account for calculating insurance benefits:

- service in the armed forces;

— the length of time military wives lived in areas where there were no opportunities for employment;

— period of temporary incapacity for work (receiving unemployment benefits);

- time to care for a child up to 1.5 years (or 2 or more children, but for a period of no more than 6 years);

— the period of serving a sentence in places of deprivation of liberty in the case of unjustified criminal prosecution;

- time spent by an able-bodied person caring for a disabled child, group I disabled person or person over 80 years of age;

- period of work abroad in consular offices and permanent missions of the Russian Federation abroad.

The above conditions are included in the length of service only if the able-bodied person worked before or after them. Otherwise, a person can only count on social benefits in old age. If the insurance and non-insurance periods coincide, then the pensioner has the right to choose which period suits him best.

Source: 2018god.net

Putin's speech

It is worth noting that not only the people, but also the president did not like the initially proposed reform format. In an effort to soften the transition to the new system for people, Vladimir Putin made his proposals, voicing them live on August 29, 2020.

The President argued the need for such an unpopular step and explained in what format he sees the implementation of the reform, which will start on January 1, 2020. Among the main changes that the President proposed to make to the bill, it is worth noting:

- Reducing the retirement age for women. If the bill initially proposed an increase to 63 years of age, then in the final version the figure will drop to 60.

- Introduction of the concept of “pre-retirement age” (5 years before retirement).

- Providing benefits for real estate and land not upon retirement, but upon reaching the ages of 55 and 60 years, respectively.

- Reducing the mandatory retirement period. Now, for early retirement, women will need to work 37 years, and men – 42 years.

- Maintaining benefits for Chernobyl victims, employees of chemical production and hot shops, as well as northerners.

- Special unemployment benefit (RUB 11,280) for people of pre-retirement age.

- Introducing administrative and even criminal liability for employers who refuse to hire or fire an employee of pre-retirement age.

- 25% supplement to the insurance pension for residents of villages and villages.

The Duma voted for the innovations proposed by Vladimir Putin on September 26, 2020. The presidential amendments were adopted unanimously (“for” - 385 votes, abstentions and no votes against).

Federal Law No. 400-FZ (ed.

1) pensions, including the amount of the due old-age insurance pension, taking into account the fixed payment to the insurance pension, increases in the fixed payment to the insurance pension established in accordance with Federal Law of December 28, 2013 N 400-FZ “On Insurance Pensions” ( Collection of Legislation of the Russian Federation, 2013, N 52, Art. 6965; 2014, N 2 (amendment); 2020, N 27, Art. 3964; N 2020, N 1, Art. 5; N 22, Art. 3091; N 27 , Art. 4183; N 52, Art. 7477, 7486) (hereinafter referred to as Federal Law of December 28, 2013 N 400-FZ), and a funded pension established in accordance with Federal Law of December 28, 2013 N 424- Federal Law “On Cumulative Pension” (Collected Legislation of the Russian Federation, 2013, No. 52, Art. 6989; 2020, No. 22, Art. 3091), in the event of a citizen’s refusal to receive these pensions;

1. Establish that citizens of the Russian Federation who held positions in the apparatus of the Executive Committee of the Union of Belarus and Russia and in the Secretariat of the Parliamentary Assembly of the Union of Belarus and Russia (hereinafter referred to as officials), if on the day of dismissal from the apparatus of the Executive Committee of the Union of Belarus and Russia and from Secretariat of the Parliamentary Assembly of the Union of Belarus and Russia (hereinafter referred to as the apparatus of the Union bodies) with a civil service experience of at least that provided for in the annex to the Federal Law of December 15, 2001 N 166-FZ “On State Pension Provision in the Russian Federation” are entitled to a monthly supplement to the insurance old age (disability) pension assigned in accordance with Federal Law dated December 28, 2013 N 400-FZ “On Insurance Pensions”, or a pension assigned ahead of schedule in accordance with the Law of the Russian Federation dated April 19, 1991 N 1032- 1 “On employment of the population in the Russian Federation” (hereinafter referred to as the monthly supplement to pension), upon dismissal from the apparatus of the Union bodies in the case of:

What awaits ordinary citizens?

According to the norms dictated by the text of the updated and revised draft law on pensions, as of January 1, 2020, we will enter the so-called transition period, which will last until 2028.

Every year, starting in 2020, the age limit will increase by 1 year. As a result, we get the following table of retirement by year of birth for both sexes:

Thus, after the completion of the reform process, men and women in Russia will retire at 65 and 60 years old, respectively.

You can find a detailed calculation of retirement for different categories of citizens of the Russian Federation in the article “Table of retirement age from 2020 in Russia.”

Federal Law 400 - Federal Law on Insurance Pensions

We should also talk about the legal regulation of the pension sector. No. 400-FZ is far from the only regulatory act regulating pension-type payments. It is also worth highlighting No. 156-FZ “On Social Insurance”, Federal Law “On Personalized Accounting in the Insurance System”, as well as some other laws. All presented regulations, in accordance with Article 2 No. 400-FZ, are designed to consolidate the existing pension system and modernize it.

Article 7 establishes the rules for financial support for insurance-type pensions. Thus, the bill under consideration may be amended to increase costs for the payment of insurance-type pensions. Such changes are permissible only once a year as part of drawing up a budget for the new year or for the planning period.

We recommend reading: Is it possible to put a child in the front seat in a child seat? Traffic regulations 2020

What awaits beneficiaries?

One of the presidential initiatives was to preserve all types of benefits provided to the population of Russia before the start of reform. Moreover, if previously it was possible to count on benefits only after retirement, then from 2020 many benefits will be provided when a person reaches pre-retirement age.

The last 5 years before retirement will be considered pre-retirement.

For mothers with many children, early retirement is expected, depending on the number of children raised in the family. Thus, women who raised 3 children will be able to retire 3 years earlier (at 57 years old), 4 children - not 4 years earlier (at 56 years old), and those who raised 5 or more children - at 50 years old.

Among the pleasant innovations also offered:

- 25% bonus for rural residents with work experience of 30 years or more;

- the right to early retirement if you have length of service (men – 42 years, women – 37 years).

Also, for pensioners, all regional benefits relating to:

- purchasing medicines;

- housing and communal services payments;

- major housing repairs;

- travel on public transport.

Regional features of retirement in 2019

Subjects of the Russian Federation establish their own characteristics of retirement. Let's touch on some of them:

| Region | Peculiarities | Legal basis |

| Moscow | To adapt to the reform, Moscow residents are provided with additional support measures, including free travel, dental services, spa treatment, etc. | Moscow Law “On additional measures...” dated 09.26.2018 No. 19 |

| Republic of Bashkortostan | The right to study at the People's University of the Third Age is secured | Decree of the Government of the Republic of Belarus “On financial support...” dated March 20, 2019 No. 160 |

| The Republic of Buryatia | Increasing the amount of surcharges at the municipal level | For example, an order Mayor of Ulan-Ude "About increasing the size..." dated March 25, 2019 No. 18-r |

| Kemerovo region | Indexation of payments for length of service | Resolution of the Governor of the Kemerovo Region "About indexing..." dated 04/16/2019 No. 24-pg |

| Kurgan region | Adoption of the regional state program “Older Generation” | Decree of the Government of the Kurgan Region "About the state program..." dated 12/14/2018 No. 429 |

| Lipetsk region | Development of training programs for persons wishing to resume working activities | Order of the Department of Labor and Employment of the Lipetsk Region “On Amendments...” dated 12/26/2018 No. 462 |

| Samara Region | Calculation of income of persons who were supposed to retire, but did not, which is taken into account in other payments | Decree of the Government of the Samara Region "About approval..." dated 12/28/2018 No. 860 |

What awaits the employees of the Ministry of Internal Affairs?

The new bill, which is planned to be considered in mid-July 2020, states that starting from 2020, pensions for employees of the Ministry of Internal Affairs will be accrued with a total length of service of 25 years, provided that at least 12.5 years of them are in service.

To receive a second (social) pension, you will need at least 15 more years of civil service in addition to those included in the calculation of length of service. Thus, the Government will sharply reduce the number of very young pensioners and those who, by the time they reach retirement age, will actually be able to claim double payments.

Law “On Labor Pensions in the Russian Federation” 2020

It is very important to know which provisions of the law on pensions are no longer in force after changes are made to the legislation. For example, after the Federal Law “On Insurance Pensions” came into force, the provisions of this act are valid only to the extent that does not contradict this innovation.

Sooner or later, any working citizen thinks about this topic, because according to the law (and in essence) such a pension is compensation for wages that were not received due to old age, occupational illness, disability or loss of a breadwinner. The Law “On Labor Pensions” also establishes the specifics of paying pensions to employees whose working conditions differ from usual ones, often being more difficult.

Early retirement pension and social options

The categories of early workers raise some questions. T.. those who retire earlier than everyone else and are considered young pensioners. The changes will affect them too. Everything will look like this:

| Category of people | Current retirement age (women - men) | Retirement age under the new law | Notes |

| People working in the Far North and territories equivalent to it | 50-55 years | 58-60 years | |

| Teachers, doctors, creative workers | Retirement depends on length of service - 15-30 years are required | The required level of experience increases by 8 years | They take into account the age of the employee at which he completed the proposed length of service, after which they have the right to retire, but taking into account the provisions on the transition period |

| Civil servants (so-called public sector employees) | The retirement age will be set in accordance with the generally established provisions of the bill; The age increase period will begin for such categories in 2020 | ||

| Social pensioners (i.e. those who have not accumulated enough experience) | 60 – 65 years | 68 – 70 years | The increase will be introduced gradually |