Home / MATERNAL CAPITAL

Back

Published: September 24, 2019

Reading time: 2 min

0

2289

for holders of maternity capital certificates ( MC ) to take into account situations when funds issued by the state have to be returned. This is often capital already invested in the mortgage. Upon termination of the contract, the amount spent must be returned to the pension fund, since the goals specified in the contract were not achieved. We’ll talk about the reasons and methods for carrying out the procedure today.

- 1 Is it possible to return maternity capital to the Pension Fund?

- 2 What difficulties may arise when returning maternity capital to the pension fund

- 3 Options for returning funds from the state program

- 4 Is it possible to use maternity capital again?

- 5 Responsibility for refusal to return

Non-standard situation: how to return maternity capital to the Pension Fund

Due to the absence of a normal procedure for the return of maternity capital in the law, you have to act at your own peril and risk. We selected all the options proposed in this article taking into account existing judicial practice. In a controversial situation, we recommend that you further study the judicial practice in your region and consult with a lawyer. Also, be sure to contact your Pension Fund branch and clarify the procedure for your actions there. Perhaps the Pension Fund has already encountered a similar situation and knows how to act.

How to use maternity capital to pay off a mortgage

Is it possible to pay off a mortgage with maternity capital? Maternity capital is one of the forms of state support for families raising two or more children. The most common use of these funds is to improve housing conditions. Many families buy an apartment or house with a mortgage. In this article we will figure out how to use maternity capital to pay off a mortgage.

The potential borrower must provide the bank with a certificate along with the main package of documents. After this, a standard review of the application takes place and, if the decision is positive, a loan agreement is concluded. Next, the borrower needs to submit documents to the Pension Fund to transfer funds (after registering the purchase and sale agreement with Rosreestr). Also, maternity capital can be used in the form of a down payment only when there have been no payments from it yet.

Mortgage with maternal capital and divorce: how to divide, problems and their solutions

Good afternoon My husband and I (this is my second marriage) bought an apartment using mat. capital. We got a loan for two people, but the husband is the main borrower because... I'm still on maternity leave and haven't returned to work. Because The loan was issued for two, then the apartment was issued for two. The notary issued two obligations for my husband and me. The husband has two children from his first marriage, according to the obligation, as it is written there, he must “register the property as the common property of me, my spouse and children (including the first, second, third and subsequent children) with the size of the shares determined by agreement.” Does this mean that he must allocate shares to his children from his first marriage? After all, they have nothing to do with it. It was for our joint child that we received a swear word. capital. This is my second child, I have a daughter from my first marriage. I haven’t submitted my documents to the Pension Fund yet. Maybe the obligation needs to be redone?

We recommend reading: Capital young family 2020

Can mat capital be transferred ahead of schedule?

All this will take extra time.

To speed up the procedure for obtaining maternal capital as much as possible, experts recommend studying its nuances in advance. This will allow you to avoid errors, the elimination of which takes additional time. Recently, the news “New about maternity capital” was published on the official website of the Pension Fund of Russia, we recommend that you read it.

We’ll talk more about the amount of time during which the allocated money is transferred, the specifics of repaying a mortgage to maternal capital, and the specifics of the procedure.

A mortgage allows you to quickly purchase an apartment that is for sale.

Can PFR Mat Capital transfer money earlier than 40 days?

However, it will be possible to allocate capital for some purposes no earlier than the child turns 3 years old.

When will maternity capital be transferred after approval? The timing of this stage varies depending on a number of nuances, which will be discussed below. Attention! It takes no more than 5 days to consider an application for the issuance of money.

After which, the applicant is sent a notification with consent to extradition, or an official refusal describing the legal grounds.

Maternal capital

Therefore, it is up to the whole family to decide how to spend these funds.

And as the same law interprets, funds or part of the funds of maternity capital can be used to obtain education for both the natural child and the adopted child, including the first, second, third and subsequent children.

— If a family has twins or triplets, does the size of the MSC double or triple? — The recipient of maternity capital is not a child, but an adult, usually a mother.

When can you use maternity capital?

This can be done in the following areas:

- .

- without attracting loans or borrowings;

- or his maintenance in kindergarten;

However, in the following two areas it is possible to realize maternity capital, in connection with the birth or adoption of which this certificate was issued:

- payment of a down payment or principal and interest taken out for the purchase or construction of housing, including a mortgage;

- purchase of goods intended for .

An application with the appropriate package of documents for the sale of family capital is considered by Pension Fund employees within a period not exceeding 1 month.

After a positive decision is made, the money is credited to the account specified in the application, depending on the direction of use of the maternity capital, within another 10 working days.

The period for applying for a certificate for maternal family capital is not limited.

Is it possible to use financial capital ahead of schedule?

The disposal of funds (part of the funds) of maternal (family) capital is carried out by persons specified in parts 1 and 3 of Article 3 of this Federal Law, who have received a certificate, by submitting an application for disposal of funds of maternal (family) capital (hereinafter referred to as the application for disposal), in which indicates the direction of use of maternal (family) capital in accordance with this Federal Law. 2. In cases where a child (children) has the right to additional measures of state support on the grounds provided for in parts 4 and 5 of Article 3 of this Federal Law, the disposal of maternal (family) capital funds is carried out by the adoptive parents, guardians (trustees) or adoptive parents of the child (children) with the preliminary or the child (children) themselves upon reaching the age of majority or acquiring full legal capacity before reaching the age of majority.

When is mat capital transferred after approval?

1 tbsp. 8 of Law No. 256-FZ dated December 29, 2006 is assigned to the Pension Fund for consideration of an application for the disposal of maternity capital funds and making a decision on it (to satisfy or refuse to satisfy);

- If a positive decision is made, money from the Pension Fund will be transferred to the details specified in the application within a period not exceeding 10 working days, which in general is two calendar weeks, or half a month (previously this period was also up to one calendar month).

In 2020, these changes are being made to the Rules for the use of maternity capital in all areas provided for by law - i.e.

Important Employees of the Pension Fund of the Russian Federation for 30 calendar days:

- check the authenticity of documents and applications;

- make a decision on the direction of maternal capital funds; in case of a negative decision, they draw up a written justified refusal.

- make requests to various authorities to confirm the accuracy of the specified information;

The terms for transferring maternity capital funds have been reduced

The issuance of certificates of state registration of rights has been stopped.

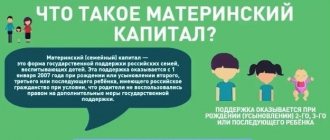

Let us remind you that maternity capital funds can be used in four areas: improving housing conditions, paying for educational services for children, forming a mother’s future pension, and paying for goods and services for social adaptation and integration of disabled children into society. The amount of maternity capital in 2020 is 453 thousand.

rubles To enter the maternity capital program, Russians have two more years: to obtain the right to maternity capital, it is necessary that the child who qualifies for the certificate be born or adopted before December 31, 2020.

At the same time, as before, the receipt of the certificate and the disposal of its funds are not limited by time. REFERENCE. Over ten years, almost 42 thousand Mari families became certificate holders. Using MSC funds, 30,226 families (72.3% of families who received a certificate) improved their living conditions.

Deadlines for registration and receipt of maternity capital in 2020

Therefore, copyright holders are not limited by any time frame. A response will be received within 1 month from the date of filing the application. You are either given a certificate or refused to issue it with appropriate motivation.

Attention! In October 2020, it was decided to reduce this period by half, that is, to 15 days. But the period for disposing of maternal capital is somewhat different.

An application for disposition may be submitted no earlier than three years from the date of birth of the child.

If the right to receive maternity capital arose in connection with the adoption of a child, then three years must pass from the date of adoption.

If a child without parental care, who has the right to such a measure of state support, wants to dispose of maternity capital, then he needs to wait until he comes of age or reaches full legal capacity. Attention! Exception: down payment or repayment

The deadline for transferring maternity capital funds in 2020 has been shortened

Funds are provided only for certain purposes, the list of which is limited to five points:

Important!

Return of maternity capital

Please tell me, is it possible to return maternity capital? The situation is this: a one-room apartment was purchased using maternity capital. It is registered, as expected, for all family members (parents have 1/10 shares, two children have 4/10 shares). The whole family is registered and lives in a private house (house 150 sq.m.). The ownership of the house is registered only in the father's name. No one is registered or living in the apartment. Is it possible to allocate shares in the ownership of the house to the children, sell the apartment and return the maternity capital to the pension fund, and subsequently use it for the education of the children?

Transfer of maternity capital money: conditions and terms

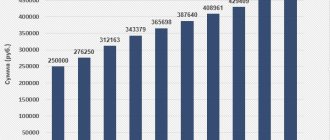

The picture describes in detail what you can spend maternity capital on and what its size is:

Maternity capital is one of the ways of state support for young parents with two (if the second child was born between 2007 and 2021) and more children (if the family did not previously apply for financial assistance). The project began its work in 2007 and continues to this day.

For now, the deadline for birth (adoption) is 2021. However, the State Duma and the Government have made amendments and proposals so many times that it is likely that the program will be extended in the future.

Currently, indexation is “frozen,” but the country’s leadership plans to resume it in 2020.

Maternal money can be spent on clearly defined purposes. According to statistics, 72.3% of certificate holders spend them on purchasing a house, apartment, other real estate in the primary and secondary markets and otherwise improving living conditions. You can use the certificate upon reaching the second (third, etc.)

) a three-year-old child. An important exception is the desire of parents to use part or all of the funds from the mother’s certificate to pay for a housing loan (loan).

In this case, it will be possible to use maternity capital funds immediately after the birth (adoption) of a child, with the birth of which the law connects the onset of the right to maternity capital.

Watch the video with the latest news about matkapital:

Requirements for a purchase and sale transaction when using maternal capital funds

- The property must be located on Russian territory;

- Housing ownership is registered for the entire family (including children, including

minors); - The purchase and sale agreement (possibly a mortgage agreement) must be reached and executed in writing before the application for disposal itself is submitted to the Pension Fund;

- The buyer of the property under the contract is either the certificate holder himself or another family member (with the consent of the holder);

- The buyer and seller are not closely related (otherwise the transaction will be considered fraudulent with all the ensuing consequences).

When will the money be transferred?

The deadline for transferring maternity capital money when purchasing a house or other housing is determined by law and is subject to strict execution.

In accordance with the Rules approved by Decree of the Government of the Russian Federation N 862 (as amended on May 31, 2018).

), is one calendar month (for the Russian Pension Fund to make a decision to satisfy the application for spending maternity capital funds) and ten working days (for the transfer of funds).

To calculate approximately how long it takes for maternity capital to be transferred to the seller’s account, you need to add to the announced deadline the time for preparing a package of documents for submission to the Pension Fund of the Russian Federation. It is individual, but the main documents will be:

- Passport (or passport + power of attorney - for a representative);

- Passport of the spouse of the person holding the certificate + marriage certificate (if the spouse is a party to a transaction or obligation during the purchase or construction of residential real estate, or he himself carries out work on the construction (reconstruction) of residential premises).

- Sales and Purchase Agreement (duly registered);

- Extract from the Unified State Register of Real Estate (which replaced certificates of real estate rights);

- Certificate from the seller about the amount underpaid under the contract;

- An obligation drawn up and executed by a notary about the allocation of shares to all family members within six months from the date of the transaction (completion of construction, removal of encumbrance).

After submission, the package of documents is checked by the Pension Fund for authenticity and reliability. To do this, requests are made to various authorities to clarify information. Based on the information received, a decision is made to transfer funds or to refuse this operation.

Attention! The applicant will learn about the decision within 5 days via SMS or by receiving a notification to his email address. Also, in case of refusal, you should wait for a letter explaining its grounds. After this, the amount of maternity capital will be transferred to the seller.

Of course, the seller will have a question: “How long should I wait for the money to be transferred?” The period for transferring maternity capital when purchasing a home is strictly determined by the legislator and is 10 working days.

The duration of this period cannot be accelerated or “slowed down” due to any circumstances that may arise. The money is transferred to the seller’s bank account, i.e. the certificate holder (buyer) will not be able to cash them.

This point is fundamental and the state is closely monitoring it.

An excellent opportunity to have children and purchase housing: repaying the mortgage with maternity capital

- valid certificate;

- the home is located on the territory of the Russian Federation;

- the loan agreement must contain the phrase “mortgage agreement” - the Pension Fund of the Russian Federation will not provide a subsidy for a consumer loan;

- the subsidy has not yet been spent;

- a loyal bank (not all of them agree to work with maternity capital, and the number of those who agree has now decreased);

- good credit history;

- having an official job;

- lack of other housing.

Mortgage and maternity capital: is there a hole in the law?

Today, in the law on maternity capital, there is not only the “hole in the law” described above. There are several schemes for illegal de-cash of maternity capital. One of them is, for example, the so-called fictitious purchase of housing from relatives or friends, when the transaction is not completed in practice - the money is returned to the owner of the certificate, and the previous owner remains to live in the sold premises. Although all the requirements of the law seem to be met, the housing is registered as the property of the children. While there is such a possibility, it is not a fact that this loophole will not be closed if the number of such cases increases.

We recommend reading: How a realtor can sell an apartment

How to divide a mortgaged apartment during a divorce from maternity capital

Please note: As noted in the review of judicial practice of the Supreme Court dated June 22, 2020 (paragraph 13), shares of housing purchased with the help of MK can be recognized as equal only based on the amount of payment of state support funds, and not the entire cost of housing as a whole. If the cost of housing significantly exceeds the amount of maternity capital, then an equal distribution of shares may not be established even by a court decision. And the cost of housing, as a rule, always exceeds the MK amount, since the target payment under the state support program is 453,026 rubles as of June 1, 2020, which is clearly not enough to buy an apartment or house not only in a large city, but also in the province. For the Supreme Court's explanation, see the document below.

Terms of payment of maternity capital when buying an apartment: how long does it take for the money to be transferred?

In any case of using a certificate, the issue of the speed of crediting funds to the home seller or the party providing educational services is important.

Let's look at why this is important below.

Now, starting from March 3, 2017, based on Resolution No. 253, we can say that the total period for receiving maternity capital has been reduced by half a month.

The overall picture for parents is changing, because if we talk about a loan, then in two weeks considerable interest is accrued on the loan amount, so it is important to pay part of the loan amount with maternity capital in the shortest possible time.

The total payment period has been reduced to 10 working days; it cannot be shortened further; it is important not to extend it, since there are cases when a positive decision is not made on your decision due to some reasons.

Regardless of which organization parents purchase housing from, it is important to prepare documents for the transaction as quickly as possible.

In order to quickly receive payments you need:

- Contact PF.

- Provide correct payment details.

Reducing the time limit for paying maternity capital is aimed solely at the speed of the purchase and sale transaction. These subtleties must be clarified at the stage of preliminary preparation for the registration of a transaction for the purchase of housing.

What deadlines for transferring maternity capital are relevant, see the video

Questions for a lawyer

I have a maternity certificate, I want to use it to buy a home, my second child is already 3 years old. I found an apartment to buy, but it is not being sold by the owner, but by a proxy. He (the authorized representative) offers to conclude a purchase and sale agreement with the following condition - the money is transferred not to the seller, but to his (the authorized representative) account, and he showed me a power of attorney from the seller, there is a clause that he can sell the home on his own terms and get money for it. I am afraid that the pension fund for some reason may refuse to transfer the money, and I will be left with an unpaid contract. Yes, in this case, the purchase and sale agreement includes a clause regarding the payment of a fine or penalty if the money is not transferred.

Social support from the state: payments from the Pension Fund

This definition refers to a measure of social assistance expressed in financial support to those units of society where, after the beginning of 2020, the second and subsequent offspring were born (or adopted).

- this parent’s right to capital has been terminated

- the father who submitted the application is legally a stepfather (that is, he did not adopt the children);

- restriction of a parent's parental rights - valid until the restriction is lifted;

- payment has already been received;

- the child is removed from this family by court order;

How is a mortgage divided with maternity capital during a divorce?

- as part of the divorce proceedings in court, to raise the issue of dividing the mortgage loan between the former spouses due to divorce, it will be necessary to draw up a new payment schedule based on a mutual decision to repay obligations;

- contact the banking organization where the mortgage was issued with an application to provide two loan products to both spouses in order to repay the mortgage, in a total amount equal to the balance of the debt: as a result, the mortgage loan will be repaid, and both spouses will be equally responsible in the event of failure to fulfill obligations;

- continue the procedure for repaying the mortgage debt by agreement of both parties, without raising the issue of dividing the housing.

What will happen to maternity capital during bankruptcy?

Personal bankruptcy is a situation that cannot be predicted. Literally every person, and at any moment, may have a worsening financial situation, which will make it impossible to fulfill loan obligations. And the legal way out is to recognize the citizen’s insolvency.

But what will happen to maternity capital funds in bankruptcy?

The Federal Law “On Enforcement Proceedings” strictly determines that maternity capital is not subject to foreclosure. In the event of a parent's bankruptcy, maternity capital will not be withdrawn to pay off debts.

But there is one nuance - maternity capital is completely safe if it is not sold. When funds are spent on improving living conditions, there is a risk of parting with them.

Do they always take away an apartment from a bankrupt? The answer is no, the only housing is protected from foreclosure. Only the following can be sold:

- collateral real estate;

- property not related to the debtor's only residence.

In other words, if you spent maternity capital on major repairs or reconstruction of housing, the purchase of an apartment in which you live, or repaid a loan issued for construction or expansion of space, you don’t have to worry. The court will not take the housing; the debtor can sell it on his own, but the money received must be used to pay off debts.

But if the property on which the certificate was spent is pledged to the bank or is not one of the only ones, then in the event of bankruptcy it will be sold at auction, and the subsidy will not be returned to the Pension Fund.

Since most citizens use maternity capital to pay off a mortgage or as a down payment, they are at risk in the event of bankruptcy. Why? Let's take a closer look.