About the fund

The non-state pension fund "Neftegarant" began operating in 2006. The first goal of the establishment was additional pension provision for employees of Rosneft and its enterprises.

Non-state pension provision and pension insurance are priority services provided by the fund to both individuals and employees of enterprises in various industries.

The Neftegarant pension fund has left the control of Rosneft.

Far Eastern Bank, owned by the group, has become the main owner of the non-state pension fund (NPF) Neftegarant, the bank said in a statement. The bank clarifies that 70% of the voting shares of the NPF with a par value of 350 million rubles. became his property in January. Prior to this, the bank did not own shares in the fund.

On October 2, the Central Bank registered an additional issue of shares of NPF Neftegarant, which were purchased by the Far Eastern Bank, explains a representative of the Region Group of Companies. As a result of the additional issue, the fund's capital was increased by 994 million rubles, he points out. Before this, the capital of NPF Neftegarant amounted to 970.8 million rubles. (Central Bank data as of September 30).

RBC is awaiting Rosneft's comment.

The Far Eastern Bank belongs to, which in turn is owned (a subsidiary of the Investment Company Region, follows from the bank’s ownership pattern). According to the Interfax-CEA ranking, the bank ranks 128th in terms of assets among Russian banks.

Pension business "Region"

The joint-stock company NPF Neftegarant ranks 19th in terms of pension savings and manages 6.6 billion rubles. from 65 thousand clients. The fund was formed in 2014 as a result of the reorganization of the NPF of the same name, which was divided into two companies: a joint-stock company and a non-profit pension fund, as indicated on the NPF website. Neftegarant, operating as a non-profit organization (NPO), is the owner of the remaining 30% of the shares of the NPF through a subsidiary, it follows from Spark data. According to information on the website, the NPO was established by the oil company “to provide additional non-state pension coverage for employees.” Now it ranks 4th in terms of pension reserves and places 46.7 billion rubles. reserves from 145 thousand Russians, follows from the Central Bank data.

In the fourth quarter of 2020, the investment company became the owner of 9.9% of NPF Soglasie-OPS, the main owner of which is the Rossium concern of Roman Avdeev. This fund is in the top 10 in terms of pension savings. According to the Central Bank, at the end of nine months of 2020, the fund worked with 75.3 billion rubles. savings.

In addition, the Region group already owns a small NPF Tradition, which works only with pension reserves (RUB 124.8 million, according to the Central Bank).

Region has no plans to merge funds, says a company representative. A representative from Region refused to comment on the deal to acquire a stake in NPF Soglasie-OPS. The Group of Companies has no plans to purchase other pension assets, he emphasized.

The group also includes management companies (MCs), through which NPF Soglasie-OPS and Neftegarant invest pension funds. Region Trust Management Company works with both funds, and Region Asset Management cooperates only with NPF Soglasie. According to the law, management companies do not have the right to manage the funds of a fund affiliated with them, so Region will have to change the structure of investing pension savings. “The issue of affiliation will be resolved in full accordance with the requirements of current legislation,” says a representative of the Civil Code.

Rosneft, apparently, is engaged in restructuring pension assets, says Pavel Mitrofanov, managing director for corporate ratings at Expert RA. In 2014, when funds working with pension savings were being corporatized, Rosneft divided the pension business, leaving one NPF with the opportunity to operate as an NPO, he recalls. Before the beginning of 2019, when all funds (including funds working with reserves) will have to become joint-stock companies, Rosneft may be planning to merge the two NPFs again so as not to duplicate operational processes, the expert suggests. Region is considered close to Rosneft in terms of deal structuring. In addition, now all banks are clearing their balance sheets and leaving the most liquid and marketable assets on it. All these factors indicate that we may still see a change in the ownership structure of this NPF,” the analyst concludes.

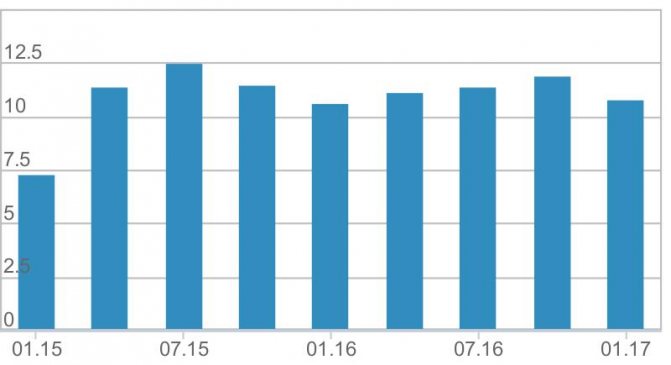

Profitability

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

8 (800) 700 95 53

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

In 2006, the organization's profitability reached its highest level - 20.10%. In 2008, the minimum level of return of the fund was registered - 0%, during this period Neftegarant went into negative territory. Over a seven-year period (2006 – 2012), the total return rose to 61.98% and continued to grow rapidly.

Profitability of NPF "Neftegarant" for 2020:

What programs exist

There are two programs for individuals:

- non-state pension provision;

- compulsory pension insurance.

A distinctive feature of the non-state pension program is the opportunity to provide a pension not only for yourself, but also for your family members, if this is provided for by the terms of the contract.

When applying to the fund, the investor himself chooses the terms of the agreement. It includes items such as:

- amount of pension contributions;

- frequency of receipt of funds;

- term of pension payment (for life or for several years);

- conditions for transferring funds by inheritance.

After agreeing on all the details, the investor chooses a pension scheme. The rules of the fund provide for two types of schemes - with a lifetime payment and “urgent”, payments under it are made for a specific period.

The fund also provides individuals with compulsory pension insurance services.

Legal entities

The program for legal entities offers corporate pension benefits. Enterprises that create a corporate pension system for their employees are still a rarity in Russian realities.

Some believe that such a step is just a tribute to fashion. However, the joint experience of NPF Neftegarant and investor enterprises has proven the effectiveness and reliability of such cooperation.

Thanks to the rules for assigning corporate pensions, the company receives additional opportunities for personnel management:

- the problem of “turnover” of workers helps to eliminate the requirement for a certain work experience;

- a system of coefficients for timely retirement facilitates lowering the age limit of employees and promoting them up the career ladder;

- the use of a parity plan, with the joint participation of the employer and employee, increases the level of responsibility of the latter for his pension provision. In addition, this scheme reduces the cost of the program for the company.

The corporate pension program is developed individually by the fund’s employees, depending on the employer’s requirements, the size of contributions and the company’s internal policy.

Customer support

There are several ways to contact a non-state pension fund; use them depending on what problem you need to solve:

- All relevant information about the pension programs provided, NPF news and answers to frequently asked questions are provided on the official website of the fund neftegarant.ru.

- If you need to urgently solve problems and get a quick answer to your questions, you can contact the company's employees via the hotline 8-800-700-65-54

, as well as by number

8-499-576-65-54

. - If you need to send requests or copies of documents to the fund, you can use the address 117997, Moscow, Sofiyskaya embankment. 26/1.

- Access to the personal account of NPF Neftegarant is provided via the link lk.neftegarant.ru/login.php. or by clicking the appropriate link on the official website of the fund.

Reforms encourage the country's citizens to take care of the future. NPF Neftegarant will help you provide for yourself after leaving work for a well-deserved rest. Consideration should be given to how to move closer to European standards, where substantial pension payments are considered the norm to ensure citizens have an optimal standard of living.

An employee must independently take care of a decent existence in his mature years, so one should strive to improve his financial situation long before old age. The sooner a citizen begins to think about a decent life, the greater his chances of securing a future.

Important! A citizen needs to take care of himself in order to ensure his existence in the future!

Transfer of contributions

Under the terms of the concluded agreement, the investor is obliged to transfer contributions to the fund in the amount and terms specified in the agreement.

However, even if payments are terminated by the investor, the agreement with the fund remains in force and the previously credited funds participate in the investment programs used by the fund.

Thus, the accrual of investment income does not stop, and the investor can resume transferring contributions if possible.

Other rules apply for employees, on the basis of which pension contributions must be credited monthly.

To transfer funds, you can use the current account of NPF “Neftegarant” or contact the accounting department at your place of work, providing a statement of a certain sample.

Personal account features

The Neftegarant personal account allows investors to:

- have quick access to an electronic copy of the agreement concluded with the Neftegarant pension fund;

- control the status of the account and monitor the growth of savings invested in the fund;

- correct and update personal information in the non-profit pension fund system;

- confirm changed personal data by sending scanned documents electronically;

- remotely electronically exchange documents with the fund.

Another convenient tool, the functionality of which you can use through your personal account of a non-profit pension fund, is an electronic pension calculator. The service will allow you to calculate the size of payments and the growth rate of your savings in the Neftegarant account.

Tax deduction

The current tax legislation provides benefits to those persons who pay contributions under a pension insurance agreement. On this basis, an individual can apply for a social tax deduction.

If the amount contributed for the year does not exceed 120 thousand rubles, such contributions are not subject to personal income tax.

You can apply for a tax deduction no earlier than 3 years from the start of deductions of pension contributions to the tax inspectorate. If contributions are deducted through the accounting department at the place of duty, you should contact it with an application to withhold the deduction.

Payment of pension

Payment of pensions is made based on the occurrence of pension grounds established by the legislation of the Russian Federation. When applying to the fund, a non-state pension is assigned on the terms of a previously concluded agreement.

To receive payments to the NPF, the following documents are provided:

- application for a pension;

- photocopy of passport;

- a certificate from the state pension fund about the right to receive a pension or a copy of the pension certificate;

- current account number or other details for payments provided for in the agreement;

- completed application form;

- signed consent to the processing of personal data of an individual.

How to terminate an agreement with the non-state pension fund Neftegarant

An individual has the right to terminate the contract with the fund by submitting a written application. In this case, the redemption amount will be paid in full.

If the investor has entered into an agreement under a scheme with a lifetime payment of a pension, he can terminate it only before the appointment of a non-state pension.

If a scheme has been chosen that provides payments for a limited period, the contract can be terminated at any time.

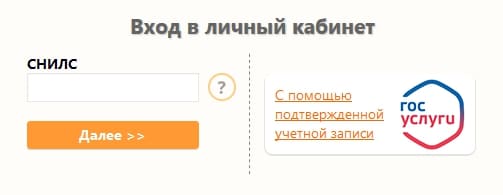

"Neftegarant": login and registration in your personal account

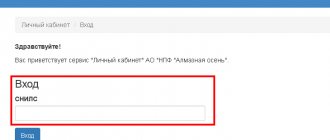

You can log in to your personal account from any page of the portal. The login form is located at the top. Authorization occurs after choosing a method of identity verification:

- Entering SNILS number and password;

- Using an ESIA account.

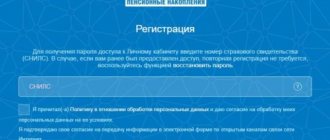

Any clients of the pension fund who have entered into an agreement and indicated SNILS can use the account. The first authorization is possible only after the first pension accrual.

Registration is not required. When you first log in, the Neftegarant service will require your passport number and its series as a password. The client is then prompted to set a personal password on the settings page. It is very important to come up with a reliable combination of symbols so that confidential information does not become the property of fraudsters.

If, when concluding an agreement with Neftegarant, a citizen did not provide SNILS to the employees, the possibility of a personal account will remain inactive. To gain access, you will need to send a high-quality scanned copy of your identity card and SNILS to the organization’s email address. In this case, it is important to indicate the subject of the letter “Access to your personal account for *full name*”. Employees will check the information and will soon open access to the personal account. If you can’t log in, you need to check your keyboard layout. The user is probably typing in Cyrillic. If the advice does not help, you must submit an application to the company to restore access.

We recommend: Personal account of NPF Kit Finance: login, registration, official website

Advantages and disadvantages

Today, many people are distrustful of non-state pension funds. This happens primarily due to a lack of information, so it is worth considering all the pros and cons of such pension provision.

The advantages of NPF include:

- the opportunity to independently determine the amount of future pension payments. This is an undeniable advantage and it is provided only in non-state pension funds. Every investor can take into account personal capabilities and choose the right amount for a comfortable life;

- the admissibility of receiving payments from several sources. An individual can receive a state pension and payments from a non-state pension fund. In addition, no one will forbid applying to two or more pension funds, based on the individual payment capabilities of the investor;

- lack of possible changes in state pension reform. Considering the trends of recent years, one cannot be sure of the stability and reliability of government payments;

- control over the activities of non-state pension funds is carried out by the state;

- the opportunity to inherit your pension savings.

Disadvantages of NPF:

- low return on investment. In non-state pension funds, capital gains are very small compared to other investment options for receiving passive income;

- It is very difficult to receive your capital from the fund ahead of schedule; as a rule, this is only done in the event of death, moving to another country for permanent residence, becoming disabled and other difficult circumstances;

- savings are stored and increased only in rubles; there is no way to convert them into foreign currency.

Whether to become a contributor to a non-state pension fund is up to everyone to decide for themselves. Based on the information received, you can weigh all the pros and cons and make a final decision.

Personal account Garant - the largest cable operator in Pervouralsk

Garant LLC is the largest cable operator in the city of Pervouralsk, Sverdlovsk region.

The company traces its history back to 1965, having recently modernized the head-end station of analogue television and cable networks, and built a digital television station.

The company is constantly improving its work, introducing new technologies, and expanding its activities. Today Garant has licenses to provide various telecommunications services, which can be used by any resident of the city of Pervouralsk.

You can get all the necessary information about the company’s activities and the services it provides on the official website. There, among other things, a personal account is available for subscribers.

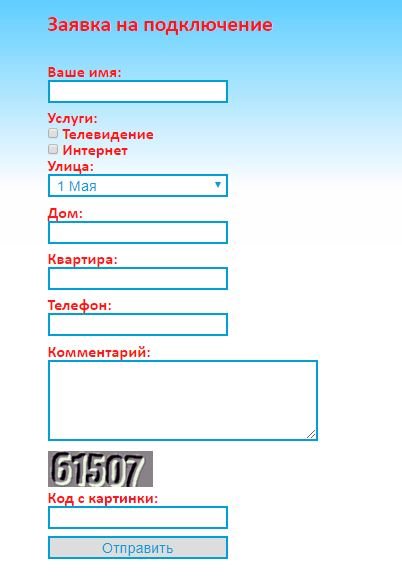

Official website Garant

If you are not yet a client of the company, connect, a request for which can be left directly on the website. To do this, use the “Connect!” button. and fill out the fields provided.

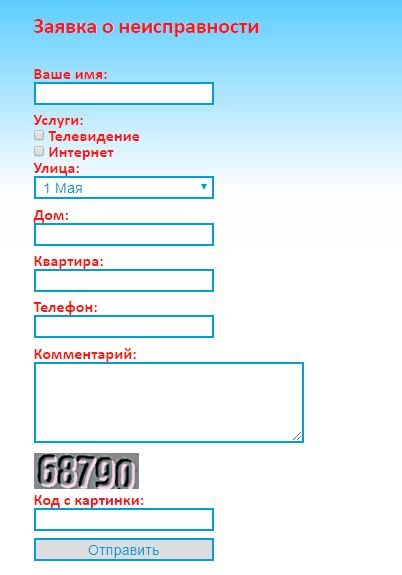

So, you will need to enter your name, select a service (television or Internet, or both), indicate the street, house and apartment number. Also in the application for connection you will need to provide the phone number and code from the proposed picture. If necessary, you can leave a comment in the appropriate field. After filling out the application, you must submit it by clicking on the appropriate tab.

Application for connection

For those who are already clients of the company, the website addresses not only the Garant personal account, but also the main menu tab “Customers”, where you can find a number of useful documents: regulations, regulations on tariffs, contracts, etc. Here you can familiarize yourself with payment methods, as well as carry out the corresponding procedure in real time.

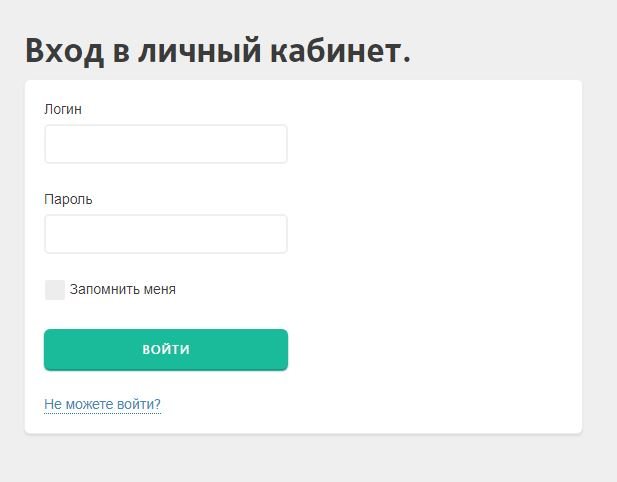

To enter your personal account, you must use the appropriate tab in the menu presented on the left side of the web page. In this case, you will need to provide a login and password. If necessary, you can o. After entering the required data, click on the “Login” button.

Login to your personal account

If you cannot log in to your account, make sure that you have entered your login and password correctly, taking into account uppercase and lowercase letters. If you do not have access at all, you should contact your administrator. If you yourself are an administrator, you should contact the owner of your personal account.

If you cannot solve the problem yourself, contact the technical support service at the phone number indicated on the login page. The telephone number of the customer service department is also provided here.

Phone numbers Guarantor

To restore the lost details necessary to enter your account, you should contact the Garant office.

Your personal account will allow you to view connected services, be aware of the current balance, and make other transactions, including payment for using services.

To transfer funds for Garant services, you can simply log into your account and use the “Online payment” section. You can also complete this procedure in real time using the “Online payment” tab, available in the “Clients” section. In this case, you will need to indicate the agreement number, email address and amount, and then click on the “Pay” button. Payment is made through SBERBANK PJSC using bank cards of such payment systems as Mir, Visa, MasterCard.

Online payment

If you do not remember your contract number, you can use the opportunity to determine it directly on the website. In this case, you will be asked to indicate the street, house and apartment number.

You can also fill out a malfunction request on the web resource. In this case, you will need to indicate your name, select a service and street, enter the house and apartment number. You will also need to provide your phone number and enter the code from the provided picture. If necessary, please leave a comment.

Fault report

Those who want to learn more about the company itself, as well as its work schedule, details, licenses and certificates, and receive other useful information, should refer to the first tab of the main menu of the web resource.

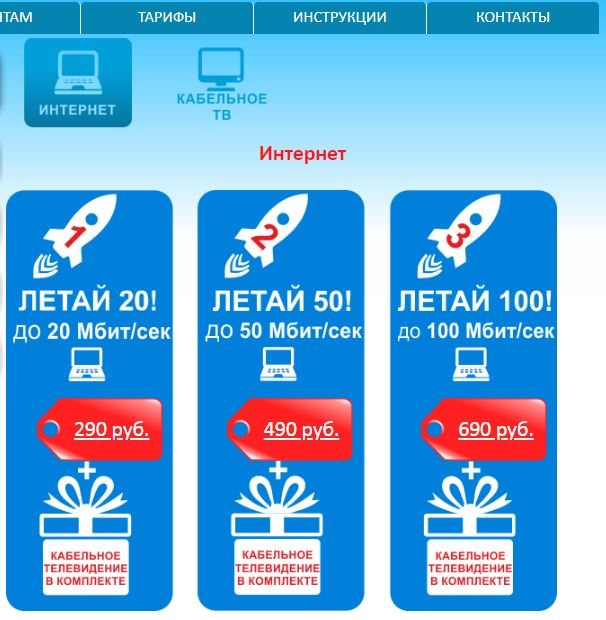

On the Garant company website you can also familiarize yourself with the tariffs presented in a separate tab of the main menu. Here you can find out about tariffs for Internet and cable TV, as well as additional services.

Internet tariffs

If you are interested in issues of electronic education, then you may also find useful a service such as cabinet.ruobr.ru Personal account of the electronic school of the Kemerovo region.

Personal account Guarantor - oauth.profintel.ru