What age is now considered pre-retirement: why is it important to know?

Officially unemployed citizens who had no more than two years left before their old-age pension could apply for it without waiting for retirement age. This benefit, enshrined in Article 32 of the Law on Employment of April 19, 1991 No. 1032-1, was the only preference for pre-retirement Russians until January 1, 2020. It covered (and still covers) a rather narrow circle of citizens who lost their jobs as a result of downsizing or liquidation of an enterprise.

However, due to the increase in the retirement age, pre-retirees have become a vulnerable social group, and more benefits are now provided for them. Therefore, the question of what year pre-retirement age is considered ceases to be idle, and it should be dealt with.

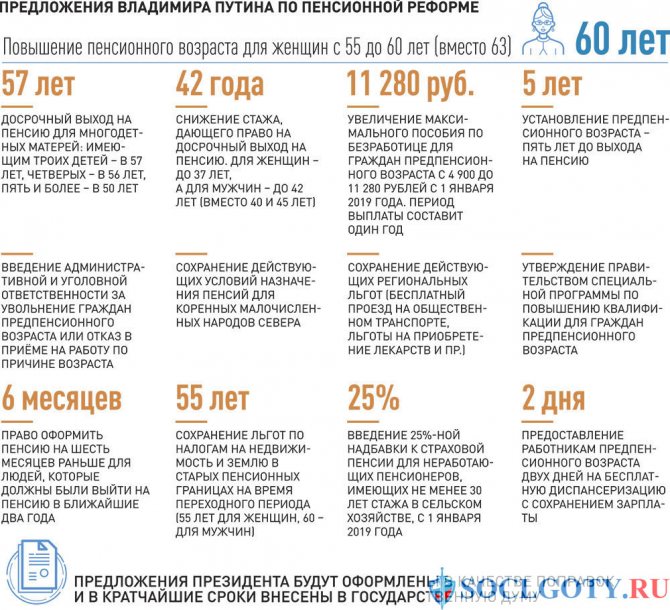

Thus, the following types of social support are guaranteed for pre-retirees:

- annual two-day release from work to undergo medical examination (these “time off” are paid by the employer) – clause 2 of Art. 185.1 Labor Code;

- increased unemployment benefits (maximum - 11,280 rubles - Russian Government Decree No. 1375 of November 15, 2018) and a longer period for paying this benefit (Article 34.2 of the Law “On Employment of the Population of the Russian Federation”),

- benefits on real estate and land taxes (Law No. 378 of October 30, 2018).

For employers, you need to know what age is considered pre-retirement and you cannot fire employees who have reached it, since this act is criminally punishable under certain circumstances. Responsible persons face punishment if the dismissal of a pre-retirement employee or refusal to hire him is found by the court to be unfounded (Article 144.1 of the Criminal Code). Violators will either have to pay a substantial fine - up to 200 thousand rubles, or atone for their guilt with compulsory work - up to 360 hours.

Criminal liability for dismissal of future pensioners

One of the reasons why the pension reform was negatively perceived by the population was the concern of older citizens about possible dismissal from work . Therefore, the President proposed to introduce criminal liability for employers for the unjustified dismissal of persons of pre-retirement age, as well as for refusal to hire due to old age. This law was signed by the President of the Russian Federation on October 3, 2020, and came into force on October 19 .

According to the new article 144.1 of the Criminal Code of the Russian Federation, employers who unreasonably fired and refused to hire pre-retirement workers face punishment in the form of :

- fine up to 200 thousand rubles. or in the amount of wages (or other income of the employer) for 18 months;

- or compulsory work for up to 360 hours.

It is possible that, in addition to criminal punishment, incentive measures could be taken for employers aimed at retaining employees of pre-retirement age in their jobs. One of these measures could be a reduction in the rate of insurance contributions to the Pension Fund for older workers.

What is the pre-retirement age according to the new law?

The concept of pre-retirement age is defined in Article 5 of the Law “On Employment” No. 1032-1 (as amended on December 11, 2018). It says that this is the five-year period preceding the age of retirement. It does not matter whether it arrives ahead of schedule or at the usual time.

That is, at what age a person is considered to be of pre-retirement age is not tied to a specific number of years lived, but to the age when a person becomes entitled to an old-age pension. The five years preceding it are the pre-retirement period.

According to Article 8 of the Law “On Insurance Pensions” (No. 400-FZ dated December 28, 2013), the retirement age for Russian men, as a general rule, is 65 years, for women – 60 years. And then their pre-retirement age should be 60 and 55 years, respectively. However, due to the fact that the transition to the age values giving the right to a pension will be gradual, the pre-retirement period will not immediately increase by five years. It will increase following the retirement age, maintaining a five-year interval.

Conditions for retirement in 2020

At the second stage of the transition period of changes, women 56 years old and men 61 years old can count on rest after work. To smooth out the consequences of the reform, the government has provided a number of concessions.

Citizens can take advantage of a special benefit by ending their working career 6 months earlier.

Taking this into account, the minimum age for receiving payments is 55.5 and 60.5 years for women and men born in the 2nd half of 1964 and 1959. respectively.

Citizens will become eligible for a pension in the first half of 2020. Only those who did not take advantage of the opportunity to do so earlier will be able to obtain this status in the 2nd half of the year. Due to the gradual increase in age, next time on a general basis, citizens will only be able to become pensioners from July 2021.

Seniority

If a minimum of 10 years of experience was required to retire in 2020, then already in the first half of 2020 this figure increased to 11. Gradually, by 2024, the norm will be increased to 15.

The minimum length of service requirements are the same for women and men.

Changes in length of service requirements

| Year | Minimum number of years |

| 2020 | 11 |

| 2021 | 12 |

| 2022 | 13 |

| 2024 and beyond | 15 |

Pension points management

Individual pension coefficients (IPC) accrued to each employee can be checked on government service portals. The minimum indicator in 2020 is 18.6 points (but not more than 9.57 in 12 months).

On the PFR Internet portal you can calculate how much IPC will be accrued to a citizen this year. To do this, you need to use the calculator in the “Future Pensioners” section. You will need to enter your monthly income before personal income tax.

The number of collected IPCs depends on the official salary of the employee. The higher it is, the more insurance premiums the employer pays for the employee.

By the end of the reform in 2028, the IPC requirements will be raised to 30 points.

Changes in IPC requirements

| Year | Minimum required quantity |

| 2020 | 18,6 |

| 2021 | 21 |

| 2022 | 23,4 |

| 2024 | 28,2 |

| 2026 | 30 |

What else affects the timing of retirement?

The retirement period of a citizen of the Russian Federation can be influenced by:

- presence of 3 or more children (for mothers);

- work in hazardous enterprises, in the Far North (or equivalent territories), in the fields of pedagogy, medicine or culture;

- long work experience.

If the number of years or points is not enough, then you can use non-insurance periods (care for a pensioner or child). To do this, you must contact your local branch of the Fund and submit an application.

Another option to “get” the missing years is to pay insurance premiums for the period that is not enough to obtain status.

Missing pension points can be accrued for service in the army, living with military spouses, child care, etc. Raising children is counted until they reach 1.5 years of age.

The “cost” of each such year in the IPC is:

- service in the Armed Forces, living with a military spouse, caring for a disabled person - 1.8 points;

- for the 1st child - 1.8 points;

- for the 2nd - 3.6 points;

- for the 3rd and 4th - 5.4 points.

Participants in the savings system, recipients of urgent or one-time payments can count on them from the age of 55 for women and from 60 for men. To receive cash allowance in 2020, you must have 18.6 IPC points. The experience requirement is 11 years.

Having more than three children affects the mother's retirement age.

Men and women of what year of birth are considered pre-retirement age: table

The table below will help you figure out when and who will reach retirement age. The retirement age according to the new standards is indicated in accordance with Appendix No. 6 to Law No. 400-FZ.

| Years | 2019 (2 p/y) | 2020 (1 p/y) | 2021 (2 p/y) | 2022 (1 p/y) | 2024 | 2026 | 2028 |

| New retirement age for women | 55,5 | 55,5 | 56,5 | 56.5 years | 58 years old | 59 years old | 60 years |

| What age is considered pre-retirement for women (number of completed years) | 51 — 55 | 51 — 55 | 52 — 56 | 52 — 56 | 53 — 57 | 54 — 58 | 55 — 59 |

| What year of birth is considered pre-retirement age for women? | 1964–1968 | 1965-1969 | 1965 — 1969 | 1966 — 1970 | 1967 — 1971 | 1968-1972 | 1969-1973 |

| New retirement age for men | 60,5 | 60,5 | 61,5 | 61,5 | 63 | 64 years old | 65 years old |

| What age is considered pre-retirement for men (number of completed years) | 56 — 60 | 56 — 60 | 57 — 61 | 57 — 61 | 58 — 62 | 59 — 63 | 60-64 |

| What year of birth is considered pre-retirement age for men? | 1959-1963 | 1960-1964 | 1960 — 1964 | 1961-1965 | 1962 — 1966 | 1963-1967 | 1964-1968 |

If a citizen has grounds to apply for an early pension (Article 32 of Law No. 400-FZ), his pre-retirement age also begins five years before the moment when it will be assigned to him.

Deadlines for release

In 2020, the standards were changed, while all general conditions for applying for benefits remained the same:

- Being at a certain age. The values of 55 and 60 years from the previous period are no longer relevant. From January 1, 2020, a new stage of reforms for their growth was introduced. This parameter will be finalized by 2023.

- Availability of insurance experience. There is an annual increase of 1 year in the figure. In 2024, the final standard will be fixed - 15 years.

- Availability of an established tariff for pension points. The final requirement that the Government is aiming for is 30 points. We are approaching them through an annual increase of 2.4 points.

The topic may be difficult to understand, as it is accompanied by a number of nuances. A lawyer can explain them by providing free online answers to popular and individual questions.

By age and year of birth

Intermediate requirements between outdated and updated standards are stated in relation to applicants for wives. born 1964-1967 Men born in 1959-1962 will also feel the progressive effect of the reform. The values will increase from 55.5/59 to 60.5/64 years, respectively. The final parameters will be formed for women. Categories: born 1968, male. kind - born 1963 and younger. For them, the required threshold will be 60/65 years.

| Year of release under the new law | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |

| Numbers (number of years) | AND | 55.5 | 56.5 | 58 | 56 | 60 | 60 |

| M | 60.5 | 61.5 | 63 | 64 | 65 | 65 | |

Taking into account the insurance period

The indicators will be changed by the female population category of 1964-1965 and the male population category of 1959-1960. birth. For them, the standard varies between 10-13 years. The final requirements will be felt by women born in 1966, men – by 1960. and younger. This will be 15 years of experience.

| Parameters for the annual increase in minimum length of service | ||||||

| Year | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

| Indicators | 10 | 11 | 12 | 13 | 14 | 15 |

Points and odds

Since January 2020, planned reform ideas have been introduced. The parameters of experience and coefficient increased by 1 year and 2.4 points. To go on vacation in this period, it will be enough: 10 years and 16.2 points, instead of 9 and 13.8 as it was in 2020. Every year, as planned, one year of work experience and 2.4 points are added to the current standard. By 2025, the transition stage will be completed and the standard will be fixed at 30 points and 15 years of experience.

| Annual Point Increase Options | ||||||

| Year | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

| Indicators | 16.2 | 18.6 | 21 | 23.4 | 28.2 | 30 |

For workers of the Far North

According to the old legislative forms, the possibility of early retirement was guaranteed. The parameters were 5 years less than the standard and became 50 and 55 years. From 2020, the new age for workers in the Far North has been increased to 55 and 60 years. These are the requirements of this stage of reform.

| New requirements | |

| Year | f/m, age |

| 2019 | 50.5 and 55.5 |

| 2021 | 51.5 and 56.5 |

| 1924 | 53 and 58 |

| 1926 | 54 and 59 |

| 1928 | 55 and 60 |

The situation in the field of education, medicine

According to the new reform, it was planned to increase the threshold by 5 years for all categories of citizens. As a result, teachers, doctors and other beneficiaries would be able to go on vacation, having not 25 years as now, but 30 years of experience. But the Constitutional Court declared such a requirement illegal.

There has been no growth for representatives of these industries, as the requirements do not comply with the provisions of the Constitution. But there are still restrictions, a delay has been introduced.

Example!

The teacher has worked 25 years in the field, giving him the right to benefits in 2028. But due to reform restrictions, he will be paid only after five years, in 2033.

Main provisions of the bill

If now in Russia, upon reaching the age of 60, men, and women 55, receive the right to maintenance in the established amount from the state, then soon everything may change. Amendments to the law will introduce a new rule: Russians will retire upon reaching the ages of 65 and 63 (men and women, respectively). However, legislators promise to carry out the reform not at once - a fairly long transition period is envisaged (16 years for women and 10 for men).

Law on increasing the retirement age from 2020 - which years of birth are included?

The general schedule for retirement after raising the retirement age in comparison with the provisions still in force is as follows. This clearly shows how the retirement age will change.

| Year of birth | Year of retirement | Retirement age | ||||

| Men | Women | In accordance with the provisions of the bill | According to the rules still in force | Men | Women | |

| 1959 | 1964 | 2020 | 2019 | 61 | 56 | |

| 1960 | 1965 | 2022 | 2020 | 62 | 57 | |

| 1961 | 1966 | 2024 | 2021 | 63 | 58 | |

| 1962 | 1967 | 2026 | 2022 | 64 | 59 | |

| 1963 | 1968 | 2028 | 2023 | 65 | 60 | |

| 1969 | 2030 | 2024 | 61 | |||

| 1970 | 2032 | 2025 | 62 | |||

| 1971 | 2034 | 2026 | 63 | |||

For a clearer picture, we will provide a separate retirement schedule by year starting from 2020 for men in Russia in accordance with the bill.

| Year of birth | Retirement age (in years) | Released |

| 1959 | 61 | 2020 |

| 1960 | 62 | 2022 |

| 1961 | 63 | 2024 |

| 1962 | 64 | 2026 |

| 1963 | 65 | 2028 |

And also a retirement schedule by year from 2020 for women in the Russian Federation.

| Year of birth | Retirement age (in years) | Released |

| 1964 | 56 | 2020 |

| 1965 | 57 | 2022 |

| 1966 | 58 | 2024 |

| 1967 | 59 | 2026 |

| 1968 | 60 | 2028 |

| 1969 | 61 | 2030 |

| 1970 | 62 | 2032 |

| 1971 | 63 | 2034 |

The schedule for retirement after raising the retirement age is given in the bill and the explanatory note to it; it is part of this legislative initiative. However, changes may be made to it; this is not the final version. A new pension schedule after the retirement of Russians in 2028 and 2024, respectively, will not be established; it is provided only for a transition period, then all citizens will retire upon reaching 65 and 63 years of age.

Pension points in 2020 – how are they calculated and how much do they cost in rubles?

What will happen to beneficiaries?

The retirement age will also be raised for northerners, who currently have an advantage over other categories of workers. However, the preferential difference of 5 years for northerners will remain, since the legislator recognizes working conditions in the Far North as quite difficult for this.

The transition period schedule in this case is as follows.

| Year of birth | Year of retirement | Retirement age (in years) | ||

| Men | Women | Men | Women | |

| 1964 | 1969 | 2020 | 56 | 51 |

| 1965 | 1970 | 2022 | 57 | 52 |

| 1966 | 1971 | 2024 | 58 | 53 |

| 1967 | 1972 | 2026 | 59 | 54 |

| 1968 | 1973 | 2028 | 60 | 55 |

| 1974 | 2030 | 56 | ||

| 1975 | 2032 | 57 | ||

| 1976 | 2034 | 58 | ||

According to the new law, the retirement age will also be raised for teachers, medical and creative workers (more precisely, an eight-year delay in granting pensions will be established), although the need to develop special experience will remain. The transition period schedule is shown below.

| Year of retirement of teachers, medical and creative workers | Pension deadline |

| 2019 | One year after the right to pension provision arises |

| 2020 | In two years |

| 2021 | In three years |

| 2022 | Four years later |

| 2023 | In five years |

| 2024 | Six years later |

| 2025 | Seven years later |

| 2026 and beyond | Eight years later |

For civil servants, from January 1, 2020, an increase in the growth rate of the retirement age step will be introduced - one year per year.

For citizens eligible to receive a social pension, the retirement age will also be raised to 68 for women and 70 for men.

“13th pension”: what is the fate of the law on increasing the level of pension provision?

Transition period schedule for these citizens.

| Year of birth | Year of retirement | Retirement age (in years) | ||

| Men | Women | Men | Women | |

| 1954 | 1959 | 2020 | 66 | 61 |

| 1955 | 1960 | 2022 | 67 | 62 |

| 1956 | 1961 | 2024 | 68 | 63 |

| 1957 | 1962 | 2026 | 69 | 64 |

| 1958 | 1963 | 2028 | 70 | 65 |

| 1964 | 2030 | 66 | ||

| 1965 | 2032 | 67 | ||

| 1966 | 2034 | 68 | ||

Retirement age of certain categories of citizens

Some Russians can apply for a well-deserved retirement according to other rules. Such benefits are provided to representatives of certain professions with extensive work experience or residents of the Northern regions. Let's look at the most common options.

Doctors and teachers

Doctors and employees of educational institutions retire based on their length of service. The right to retire early was retained after the reform, however, now medical workers and teachers received a so-called deferment, the amount of which will be 5 years by 2023. In fact , this means increasing the minimum length of service required for early retirement.

Read also: Freezing the funded part of the pension

By 2025, the insurance period for citizens employed in medicine and education should be:

- For doctors working in rural areas – 30 years.

- For medical workers working in cities – 35 years.

- Teachers will be able to apply for a pension if they have 30 years of work experience.

The extension of the standard will also be carried out in stages.

| Period of developing special experience | Deferment before applying to the Pension Fund | Actual retirement date (years) |

| 2019 | 6 months | 2019 and 2020 |

| 2020 | 18 months | 2021 and 2022 |

| 2021 | 36 months | 2024 |

| 2022 | 48 months | 2026 |

| 2023 | 60 months | 2028 |

Residents of the Far North

Benefits have also been established for those citizens who carried out their labor activities in the northern regions of the country. Today they have the right to receive pension payments five years earlier than the deadline established by law . This rule is still in effect, however, the countdown begins based on the new standards.

Residents of the Far North who are engaged in traditional trades, including whalers, reindeer herders, etc., will be able to apply for a pension at 45 and 50 years old, respectively. The changes brought about by “age” will not affect them.

Civil servants

Citizens working in government institutions were affected by the 2020 pension reform earlier than others, and the retirement age for this category of citizens was increased already in 2020. The threshold value increases by six months annually, and by 2021 it will be compatible with generally accepted legislative norms.

The growth of the standard will continue until 2028 for men under 65 years of age and until 2034 for women under 63 years of age.