Contacting the nearest MFC to obtain information about pension contributions is practically no different from contacting Pension Fund branches;

- Credit organizations (banks). You can also contact your local bank branch to obtain information about pension contributions if the employee receives a salary there (and the bank provides a similar service). The list of documents for obtaining an extract is standard.

Obtaining information through the State Services portal To find out whether the employer makes contributions to the Pension Fund, it is not necessary to contact the accounting department directly or go to the MFC. This service can also be obtained via the Internet, using the state portal State Services. The disadvantage of this method is the need to register and confirm your personal data using one of the proposed methods.

How to find out the amount of tax contributions by the employer for the year

A certain percentage is deducted from each employee’s salary to the insurance funds, at least 30% of the total amount of earnings:

- to the insurance part of the employee’s future pension – 16% (22% for persons born in 1967);

- to the funded part of the pension – 6% (for workers born in 1967, they are not deducted);

- to the health insurance fund – 5.1%;

- for temporary disability insurance – 2.9%;

- for insurance against accidents at work - the percentage depends on the class of professional risk.

How to find out about contributions to the Pension Fund of the Russian Federation? One of the easiest ways to find out whether monthly pension contributions are being made is to contact the accounting department of your organization.

How can I find out if my payment has been deposited into the account of the bailiffs?

- 1 Where do debts come from?

- 2 Transfer of information about fines to the FSSP

- 3 Checking the existence of debt 3.1 1 – Contact the FSSP

- 3.2 2 – Use the online database

- 3.3 3 – Use special applications

There are often situations in life when a person who has bought tickets and booked a hotel finds out at the airport that he cannot travel abroad. The reason is unpaid debts from bailiffs: fines for violating traffic rules, alimony, loan obligations not repaid on time. In order not to be disappointed, not to waste time and money, it is recommended to check in advance whether the bailiffs have any debts.

How to find out if personal income tax deductions are being received

- periods of work and place of work:

- the amount of wages and accrued insurance premiums;

- information on pension savings under the state pension co-financing program;

- the size of the future pension and generated pension rights (a special calculator is used for calculation).

If, after contacting the indicated authorities or receiving an extract on pension contributions through websites, it turns out that the employer is evading his duties or fulfilling them in bad faith, it is worth contacting him with a requirement to sign an employment contract. The contract must accurately describe all working conditions and monthly tax deductions. If the authorities do not cooperate, all that remains is to rely on the help of the relevant government agencies.

- What to do if the employer did not provide me with a workplace after leaving maternity leave to care for a child under 3 years old and told me to write leave at my own expense for three months

- What to do if the employer does not pay wages and the amount of the salary is not specified in the contract?

You can get an answer faster if you call the free hotline for Moscow and the Moscow region. Available lawyers on the line: 7 Lawyers' answers (2)

- All legal services in Moscow Support for tax audits Moscow from 20,000 rubles.

Receiving a pension from Pochta Bank on a card

For those who receive a pension on a Post Bank card, the annual interest rate has been reduced.

Loan term from 1 to 3 years. Minimum loan amount 20,000, maximum 200,000. How to get a loan:

- You can find out the decision on your application within a day.

- Contact bank employees at the branch and fill out an application. You must have a passport, pension card, SNILS and mobile phone with you. If the borrower is still working, then the employer’s TIN number is needed.

- If you decide positively, get a loan in cash through an ATM or on a card.

We recommend reading: Refund to the buyer of overpayment for goods purchased

For pensioners there are two financial protection programs from the bank:

- "New care plus" - expanded capabilities.

- "New concern."

Paid service: 0.20% per month of the insurance amount. In what cases does it apply: death, injuries in accidents, hospitalization.

How to find out the personal income tax amount transferred by the employer

The first type of deduction is provided if the employee has a child. For the first offspring, 1,400 rubles are credited, and for subsequent babies or children with disabilities - 3,000 rubles. This means that the size of the tax base from which contributions to the state are levied can be reduced by this amount. Others In addition to the main deductions, money is collected from wages and sent to the Social Insurance Fund and the Compulsory Medical Insurance Fund. 5.1% of salary is transferred to the compulsory health insurance fund. There is a limit on the amount. If it is achieved, the rate will be reduced to 10%.

By law, the employer is obliged to make monthly contributions to numerous social insurance funds from the salaries of his employees, as well as to deduct 13% from their earnings, which are transferred to the tax service as personal income tax (personal income tax). Probably the most important contributions are payments to the Pension Fund of the Russian Federation, from which the basis of a future pension is formed. Based on Article 14 of Federal Law No. 27 of April 1, 1996 (On individual registration in the compulsory pension insurance system), every person has the right to find out whether his employer makes pension contributions or evades this obligation.

When does the pension arrive on the card: schedule, Sberbank and others

It is recommended that you contact this organization with any questions regarding accruals.

The bank is only an intermediary that transfers money from the Pension Fund to the pensioner. You can understand what date the pension is transferred to the Sberbank card by the first date of cash injections. Usually it remains relevant in subsequent months. There are general principles of accrual, based on which, you can independently calculate the timing of pension payments: the Pension Fund of the Russian Federation has drawn up a specific schedule of transfers, so money transfers most often occur on the same date, except in cases where it falls on a holiday or weekend; funds may arrive on the card ahead of schedule by 2-3 days or with a delay for the same period; most regional representative offices of the Russian Pension Fund choose dates for transferring pensions before the 15th day,

Personal income tax calculated and withheld: what is the difference

→ → Relevant as of: November 25, 2020 Organizations and individual entrepreneurs paying income to their employees or other individuals are obliged, as in, to calculate personal income tax on this income, withhold it and transfer it to the budget (). When planning to pay income to an employee/individual, the tax agent needs to determine the amount of personal income tax that will need to be withheld from the employee’s income and subsequently transferred to the budget. It is this amount that is called calculated.

The tax agent calculated for personal income tax must withhold from the income paid. That is, in essence, the withheld personal income tax is the amount that the agent retains for further use.

This is the amount of tax that the tax agent actually transferred to the budget.

Contributions to the pension fund - in 2020, from salary, how to check, percentage, according to SNILS

Every person who is officially employed is required to form his own pension. Currently, each person’s total amount is divided into two equal parts, which are replenished by the employer through the payment of taxes and contributions.

These contributions to the pension fund must be made by each enterprise . Let's consider how you can track your savings, as well as the question of checking them.

What it is

Each employer must calculate and transfer contributions for workers to the Pension Fund on a monthly basis. In addition to the Pension Fund, it is also worth making contributions to the Social Insurance Fund and the Federal Compulsory Medical Insurance Fund.

The meaning of these payments is that the employer makes certain payments and, in the event of insured events, the fund to which payments are made makes a reverse withdrawal of funds in favor of the employee.

For example, when a person takes sick leave, the Social Insurance Fund pays benefits that should be transferred in case of temporary disability. The Russian Pension Fund does the same thing when it is necessary to pay a pension upon reaching a certain age.

It is worth remembering here that the employer must make pension and other types of contributions from his own funds, and he does not have the right to deduct these amounts from the employee’s salary. As for pension contributions, they are divided into two categories: insurance pension and funded pension.

It is worth noting that since 2014, payments have not been made in favor of the formation of the funded part, since all funds are used to replenish the insurance part.

When is it produced?

Payments that should go to replenish each person's pension savings must be made on the 15th of each month. At this time, the employer pays contributions for the previous month.

In other words, if the employer makes contributions on October 15, then these contributions are made for the month worked in September.

It is definitely worth remembering the timing of deductions, so that subsequently employees at the enterprise do not have disagreements with employees of the Pension Fund.

Who pays insurance premiums

Contributions to the Pension Fund of the Russian Federation are required to be made by the following categories of persons and enterprises:

- Organizations making payments under any agreements in favor of individuals.

- Individual entrepreneur: for persons in whose favor payments were made for work or services under contracts of any kind, as well as for themselves.

- Notaries, lawyers and other categories of self-employed citizens.

- Individuals, in situations where they make payments under any agreements, and in situations where they do not act as individual entrepreneurs.

Tariffs in 2020

Despite the fact that changes are constantly being made to the legislative framework in the pension sector, the general tariff for contributions to the Pension Fund does not change. For 2020, it is the same 22% of wages, provided that payments cannot exceed the annual limit.

If it is exceeded, then deductions amount to 10% of earnings.

Those individuals who pay contributions on their own will also pay fixed contributions to the Pension Fund, which amount to 26% of the minimum wage. In this case, this amount is multiplied by 12 months.

It turns out that based on the actual minimum wage, which is 7,500 rubles, the total amount of the fixed contribution for the year will be 23,400 rubles.

Additional tariffs for OPS

Additional tariffs for contributions to the Pension Fund are introduced for those employers who have jobs in hazardous industries. In other words, if they make contributions in favor of those persons who are entitled to receive a preferential pension.

The tariff must be determined in accordance with the given assessment of working conditions, as well as the assigned class.

It is worth remembering that, unlike the personal income tax, which is taken into account in accordance with bonuses, salaries and the employee’s regional coefficient, the amount according to insurance premiums is not included in the salary. In other words, an employee at an enterprise receives a salary minus personal income tax.

As for the situation with the payment of funds to the Pension Fund, the payer must transfer a certain amount based on income, but not withhold this amount from the salary.

How can you find out the amount of contributions to the Pension Fund from your salary?

The amount of deductions should depend on the status of the payer. For those enterprises that operate under the general tax regime, it is 22% of earnings. 10% may also be added in situations where the amount of income is more than 800,000 rubles.

This amount should be calculated based on the total amount of wages for each employee.

Organizations that use the simplified system must pay 20%. Individual entrepreneurs pay the same rate for their employees.

Payment details

It is important to understand that for fruitful cooperation with the Russian Pension Fund, it is necessary to have the details according to which all contributions must be paid. If an employer or self-employed citizen makes a payment using incorrect details, then in this case it will be very difficult to prove that the payment was made on time.

And these deductions will not be easy to credit to the required account.

That is why we provide a list of details for paying various categories of insurance premiums:

- To pay for the formation of the insurance part of the labor pension.

- For payment towards the formation of the funded part of the pension.

- Contributions for compulsory medical insurance, which are credited to the FFOMS budget.

- Contributions for compulsory medical insurance, which are credited to the TFOMS budget.

Budget classification codes

The following list contains budget classification codes for various types of insurance contributions paid by employers and self-employed citizens:

- For payments for the formation of the insurance part of the pension - 39210202010061000160.

- For payments to form the funded part of the pension – 39210202020061000160.

- Contributions for compulsory health insurance, which are credited to the FFOMS budget - 39210202100081000160.

- Contributions for compulsory medical insurance, which are credited to the TFOMS budget - 39210202110091000160.

Procedure for transferring funds

All contributions are calculated by the accounting department employees, thus, all payments in favor of the employee are multiplied by the amount at the insurance rate. This formula is the same for each enterprise - it cannot depend on the taxation regime.

Accounting for the reporting period accrues 22% of the earnings of workers in the Pension Fund. If the salary reaches a level of more than 624,000 rubles, then the tariff should be 10%. For example, if an employee receives 20,000 rubles every month, the accounting department accrues 4,400 rubles every month.

For some enterprises, preferential rates for insurance premiums are provided. For example, for the field of information technology it should be 8%. As for employee income, employers pay contributions at an increased rate - 6% more.

This applies to those citizens who are employed in heavy production.

Term

It is important to remember that every business must meet certain deadlines in order to make contributions on time. If these deadlines are violated, problems may arise when recalculating the full amount in the employee’s personal account on which the insurance portion is formed.

Deductions must be made strictly before the 15th of any month. In other words, payment is made for each previous month.

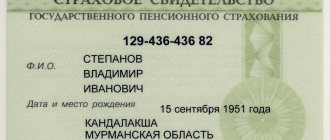

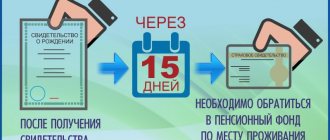

How to check using SNILS

Contributions to the Pension Fund must be reflected in the individual account of each citizen. In other words, on a personal personal account. It is important to remember that in a situation where a person decides to use his funded pension, he can find out the amount of pension savings by using his SNILS number.

In order to do this, you must contact the Pension Fund employees and provide all the necessary contact information to formulate a request.

Through the Internet

Do not forget that pension contributions that were formed on each person’s personal account can also be checked through the specialized information portal “Gosuslugi”. In addition, it is possible to order the necessary certificate on the official website of the Pension Fund.

In order to find out the amount of your pension contributions, you must have your passport and SNILS at hand. It is worth remembering that another person can find out all the necessary information about the status of the personal account only if they have a power of attorney.

It turns out that every Russian citizen who is officially employed has his own personal account in the Pension Fund of Russia, into which contributions from the employer are received. Every person has every right to find out the status of their personal account at any time.

It is worth noting that this can be done in any convenient way, and people will not have any difficulties in obtaining a certificate of account status.

Attention!

- Due to frequent changes in legislation, information sometimes becomes outdated faster than we can update it on the website.

- All cases are very individual and depend on many factors. Basic information does not guarantee a solution to your specific problems.

That's why FREE expert consultants work for you around the clock!

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

Source: https://101zakon.ru/pensii/vyplaty/otchislenija-v-pensionnyj-fond/

How to find out if an employer pays personal income tax for an employee

As you know, personal income tax (personal income tax) is not all the money that the state receives for each employee.

Every working person knows about it. This tax is 13% of the salary of a resident employee of the Russian Federation and 30% of the income of a non-resident of the Russian Federation. Personal income tax (personal income tax) is calculated monthly on the day the employee receives his salary.

If the latter received money in doses (for example, there was an advance), then deductions still occur once a month, but from all finances earned during this period.

How to check tax contributions from an employer?

Every month, 13%, called personal income tax, magically “disappears” from our official wages. Let's figure out what these four letters are and how to check whether the employer pays taxes.

A conscientious employer who lives in harmony with his conscience and the federal tax authorities makes monthly contributions:

Let's try to calculate how much taxes a person with a “gray salary” of 50 thousand rubles would pay if it were official:

| Payment type | What percentage | Your salary: 50 thousand |

| to the Russian Pension Fund | 22% | – 11,000 rubles |

| Personal income tax (income) | 13% from accrued salary | – 6,500 rubles |

| to the health insurance fund | 5,1% | – 2,550 rubles |

| to the social insurance fund | 2,9% | – 1450 rubles |

| life insurance (depending on the danger of production); | from 0.2% (depending on the type of activity) | – 100 rubles minimum |

| Left: | 28,400 rubles |

The Federal Tax Service controls such issues of legalized robbery. It is this department that will be very interested in the organization if it suspects it of dishonesty.

The employer pays all deductions, except personal income tax, independently, without deducting this amount from the employee’s salary. In the case of income tax, the employer acts as a tax agent, so the scheme changes slightly.

Let's figure it out

Personal income tax (personal income tax) is a direct tax paid by tax residents and non-residents. Residents are individuals who stay in Russia for more than 183 days.

Citizens are automatically considered as such. Non-residents are persons who have been in the country for less than 6 months, but work and receive a permanent or one-time income. The rate for residents is 13%, for non-residents the percentage is higher and is 30%.

This is regulated by Article 207 of the Tax Code.

Since this is a direct tax, it is the sacred duty of the individual to pay it. Roughly speaking, we must transfer 13% of our salary to the tax service every month. The employer takes on the functions of a tax agent and nobly does it for us. If he does not do this, then not only he, but also the taxpayer is legally violating the requirements of the tax code.

Personal income tax is calculated using the formula: (salary – tax deduction)* tax rate .

The right to a tax deduction is granted to a citizen who has 1 or more dependent children (the more children, the larger the tax deduction), is burdened with mortgage debt, is engaged in charity, undergoing treatment, and so on. The deduction can be taken into account every month or once a year (in this case, at the end of the year the unaccounted amount will be returned to you). One-time payments and benefits (for pregnancy and child care, etc.), as well as alimony, are not considered income.

Pension contributions are your concern, an investment in the future, so to speak. The Pension Fund will not be alarmed if it notices that your pension account is not being replenished in sufficient quantities (unless the state requires an urgent loan). But the tax office will not approve if it finds out that you are not paying required contributions.

Underwater rocks

Whether the employer pays taxes for the employee is one question. Another, no less important, is what amount he uses when calculating deductions.

Cunning employers often lead the tax service by the nose and do not “show” all the real income of their employees. They use a “mix” of gray (not reflected in tax documentation) and white (official) salaries.

Let's explain:

In fact, you can earn 50,000, but legally (according to the tax office) - 10,000. Therefore, you pay personal income tax not 6,500, but only 1,300.

It would seem that there is no problem: the tax has formally been paid, and at your disposal is not 43,500, but 48,700. Live and be happy, you save 5,200.

Actually, that's where the advantages end. Keep in mind that all contributions to insurance funds are also calculated from 10,000. This means your pension will be small, unemployment benefits (if needed) will be meager, etc. You will also encounter a number of financial plan problems:

- There's a good chance you won't be approved for a loan if you need it. For the bank, you are an insolvent client (in most cases, bank employees are guided by the 2-NDFL certificate).

- You deprive yourself of the right to a tax deduction. And we are talking about quite good amounts: training - up to 13% of the cost of training

- treatment - up to 120,000 rubles per year.

- purchase or construction of housing - up to 3 million rubles (the maximum possible total amount of payments).

You can view all required deductions on the Federal Tax Service website.

Bringing it to clean water

After the amounts announced, any sane person should have a question: how to find out whether the employer pays taxes?

- In theory, when you receive your salary, the accountant (or the employer himself) gives you a statement, popularly called a “kvitochek”, with details about the calculation of your salary. The amount of personal income tax is also indicated there.

- If for some reason they do not give you a statement, contact the accounting department (or your manager) with a request to issue you a 2-NDFL certificate. This contains details about your income, deductions and deductions.

You can check whether an employer pays taxes for an employee on the website of the Federal Tax Service - nalog.ru . To do this, log into your personal account. You can access it during a personal visit to the MFC or tax office (not necessarily at your place of registration). There is no other way to complete the registration procedure. your passport, SNILS and Taxpayer Identification Number with you .

Access can also be obtained through the State Services portal - gosuslugi.ru , in the taxes section (automatic transition to the taxpayer’s personal account). It is important that the account is verified (via mail, electronic signature, through government departments). After authorization, you can find all the tax information you are interested in.

You can use the “old-fashioned” method and request a “paper” statement. To obtain information about the status of a taxpayer’s individual account, you must contact the multifunctional center or the tax office. The time for providing the service and preparing documents is 10 days after application.

What to do if taxes are paid incorrectly?

In this situation, the first thing to do is talk to your manager. There is a high probability that we will be able to agree to transfer you to “white” wages. If management refuses to cooperate, you need to resort to the help of tax authorities, law enforcement agencies, and courts of general jurisdictions (small spoiler: after this you will have to change your job).

- The Federal Tax Service accepts anonymous applications. The information will serve as a basis for verification. If violations are detected, the employer will have to pay a large fine.

- Law enforcement and judicial authorities will act openly and you will act as an applicant (plaintiff).

- Such arbitrariness of the employer will also be of interest to the Labor Inspectorate.

When contacting the department, you must provide detailed information about the organization. Failure to pay taxes by an employer is a violation of the law. He took over the duties of a tax agent, hiring you. Together with him, you become a violator.

Let's summarize

A sane citizen should monitor how his future pension is formed, whether the employer contributes funds to compulsory insurance funds and monitor whether personal income tax is paid. Leaving these questions to chance is foolhardy.

By your inaction, you encourage the “shadow” economy, which prevents everyone from enjoying their legal rights. Non-payment of taxes leads to a budget deficit, so many social programs cannot be implemented, and you will suffer as a result.

You can view the status of your accounts through the state portal by following certain simple steps.

Employers should remember only one thing: no matter how much you run from the tax office, it will still catch up.

Source: https://xn—-7sbabfcel4bu5aldcpf1b.xn--p1ai/blog/platit-li-rabotodatel-nalogi

How to calculate personal income tax from your salary

ContentsThe rules for determining the amount of income tax are regulated by the Tax Code of the Russian Federation: articles 210, 217, 218-221, 224-226. The regulatory document states that employed citizens must transfer 13% of the following types of income to the budget:

- regular and one-time bonuses;

- vacation pay and temporary disability benefits;

- wages;

- cash gifts, the value of which exceeds 4,000 rubles.

In labor relations, the employing organization performs the functions of a tax agent: it determines the amount of the budget payment and transfers funds to the treasury within the time limits established by law. The algorithm for calculating income tax consists of two successive steps:

- Determination of the tax base - the amount of labor income of an individual subject to taxation, reduced by the amount of deductions due to a citizen under the law.

- Choice

How to check whether money has been credited to the FSP account

- 2 answers to the question on the topic “Account of bailiffs”

- Bailiffs blog

- Bailiffs blog

- Collection of funds deposited with the bailiff department

If money was withdrawn from the account without warning The procedure for writing off money from the account provides for: What funds are and are not subject to seizure? According to the Federal Law “On Enforcement Proceedings”, bailiffs can seize funds, but not the account itself. In other words, performers have the right to withdraw money, but cannot block use of the account, because

How to check the employer’s transfer of personal income tax

/ / 03/05/2019 487 Views 03/12/2019 03/12/2019 03/12/2019 The organization must recalculate personal income tax only for 2012. 6. An entrepreneur conducts two types of activities, one of which falls under UTII.

Where to transfer personal income tax withheld from employee income? a) Personal income tax for all employees is transferred to the Federal Tax Service at the place of residence of the individual entrepreneur.

7. The organization transferred personal income tax to the budget not on the day it received money from the bank to pay salaries, but 2 days later. What does this mean? a) For late payment of tax, only penalties will be charged.

b) Failure to remit taxes on time will result in a fine under Art. 123 of the Tax Code of the Russian Federation and penalties.

Pension card of Post Bank

You can get up to 200 thousand for up to 3 years, I took 130 thousand for a year and a half. The percentage for those who receive a pension from the bank is lower, from 16.9 - that’s what I pay. I liked that the bank quickly decided to give me a loan or not, I left an application and they called me back within 2 hours and said that it was approved.

I am still paying off the loan, the amount is small and not burdensome.

In general, I am satisfied with the bank, I recommend that all pensioners switch to Post Bank. 2020.11.27 at 11:27 wrote: Benefits for pensioners Rating: 5 I persuaded my mother to switch to Post Bank, because the bank has really advantageous offers for pensioners.

How do I find out if my employer pays income tax from my salary?

Example An apartment was purchased for RUB 3,500,000. in 2020. In 2019, a person earned 320,000 rubles.

and paid personal income tax of 41,600 rubles. In 2020, the buyer of an apartment has the right to claim a deduction in the amount of 2,000,000. In this case, you can return 13% of 2,000,000 = 260,000. However, in 2020, only 41,600 income taxes were transferred, which means that only this amount can be returned .

The balance = 260,000 – 41,600 = 218,400 can be returned in the following years.

The employee’s confidence that his employer regularly deducts taxes from his salary to the Pension Fund means the successful formation of pension savings, which form the amount of pension payments after the employee retires.

How can I check that funds have been withheld and transferred correctly?

Is the time for transferring our money from the bailiffs account to us regulated? 2 answers to the question on the topic “Account of bailiffs” Hello. Art. 110FZ On enforcement proceedings. 3. Funds received into the deposit account of the bailiff department during the execution of the property claims contained in the executive document are distributed in the following order: 1) first of all, the claims of the claimant are satisfied in full, including reimbursement of expenses incurred by him in carrying out enforcement actions ; 2) secondly, other expenses for carrying out enforcement actions are reimbursed; 3) thirdly, the enforcement fee is paid; 4) fourthly, fines imposed by the bailiff on the debtor in the process of fulfilling the requirements contained in the writ of execution are repaid. 4.

- 500 rub. — initial fine;

- 1000 rub. - for late payment of a traffic police fine under Part 1 of Art. 20.25 Code of Administrative Offenses of the Russian Federation;

- 1000 rub. - performance fee.

If an enforcement fee has been assigned against you, this will be visible in the table of debts on the FSSP website. The amount of the enforcement fee is indicated in the 6th column next to the amount of debt.

With its help, you can control the debt to bailiffs and, if necessary, repay it. How to pay debts to bailiffs? Until the bailiff receives confirmation of payment of the debt, he is obliged to continue enforcement, using enforcement measures, such as seizure of accounts and property, restriction of the right to travel abroad of the Russian Federation, and collection of an enforcement fee. To cancel these measures, the bailiff requires a receipt of payment. In addition, based on the date of payment, the bailiff will determine whether to cancel all compulsory measures. You can find out whether information about payment of the debt to the bailiffs has been received using the “Data Bank of Enforcement Proceedings” on the main page of the official website of the Federal Bailiff Service of Russia for the Bryansk Region (r32.fssprus.ru).

Where do debts come from? If a person does not fulfill his obligations to an organization or individual, following from the terms of the concluded agreement, the injured party has the right to apply to the judicial authorities to protect his interests and recover funds. If the court recognizes the plaintiff’s demands as legitimate, it will oblige the citizen to pay off his obligations and pay a penalty. Debts, information about which is received by the bailiffs, arise from failure to fulfill the following obligations:

- transfer of alimony;

- payment of taxes;

- repayment of fines for traffic violations and other administrative penalties;

- payment of loan obligations.

When the court has made a decision on the need to pay off obligations, a person can act in two ways: comply with the court decision voluntarily or ignore it.

How much should an employer contribute to the Pension Fund?

According to the Law, the employer must monthly transfer part of the (official) salary of his employee to the Pension Fund account.

Part of the salary is twenty-two percent of the official salary. For example: if a citizen receives seven thousand monthly, then 1,540 rubles are transferred by the employer to the Pension Fund.

At the same time, the employer also pays personal income tax. The tax amount is one thousand three hundred rubles.

How do you know if the bailiffs have received the money?

The check will be proof that you have repaid the debt if for some reason the payment does not arrive. Save it. How to pay the enforcement fee to bailiffs An enforcement fee is a fine for late voluntary payment of debt under a writ of execution. As for what percentage bailiffs take for debts, according to Part.

3 tbsp. 112 of the Federal Law “On Enforcement Proceedings” the enforcement fee is 7% of the debt amount, but not less than:

- 1000 rub. for physical individuals and individual entrepreneurs;

- 10,000 rub. for legal entities.

Can I find out about paying taxes?

This can be done using the following portals:

- The official website of State Services, which is located at gosuslugi.ru. The disadvantage of this method is the need for electronic registration, which may take some time.

In order to find out about contributions to the Pension Fund, you must select the standard registration type. In the form that pops up, you need to indicate personal data (last name, first name and patronymic, email address and contact phone number), passport series and number, as well as pension insurance number.

After successful identification, you need to log into your personal account using the password and login that will be sent to you by email or by an employee of the department where the citizen confirmed his identity.

- The official website of the Pension Fund of the Russian Federation, which is located at pfrf.ru.

- Contact the local branch of the Pension Fund of the Russian Federation at your place of residence. You need to bring the following documents with you: Russian passport and SNILS. To provide access to employer insurance contributions, you must submit an application.

- Contact the multifunctional center. On the day of application, you must provide an identification document, as well as a certificate of insurance. In addition, you will have to fill out an application to provide pension account information.

- By contacting banking structures whose clients are the employee and the employer. So, if an employee receives wages on a Sberbank card, then to check the insurance account they will have to contact this bank.

To do this, you need to provide bank employees with a passport, SNILS, and a completed application.

- Personally from the employer himself. A law-abiding employer must provide relevant statements every month. If he does not do this, the employee has the right to find out why;

How to check whether the employer is transferring insurance contributions or not?

18 June 2020 16:50

In connection with the entry into force of the new pension legislation, the size of wages, insurance contributions and length of service play a special role in the formation of citizens’ pensions.

Therefore, today it is important to know whether the employer transfers insurance contributions to the Pension Fund and pays “white wages”. All information about the amount of insurance premiums and insurance experience is stored on an individual personal account. Pension Fund specialists recommend receiving an extract on the status of your individual personal account at least once a year to control your savings for your future pension.

The Pension Fund offers several ways to find out whether the employer pays insurance premiums and in what amount.

Thus, in the “Personal Account of the Insured Person” on the Pension Fund website, it is possible to instantly generate and print a notice about the status of an individual personal account (“chain letter”). Also in the “Personal Account” you can find out about the number of pension points and length of service recorded in the individual account with the Pension Fund. To do this, you need to register on the government services website or in the Unified Identification and Authentication System (USIA)

By contacting the Pension Fund Office at your place of residence with your passport and pension insurance certificate, you can also obtain an extract from your individual personal account. After 10 days from the date of application, you can pick it up in person or the extract will be sent by registered mail to the specified address.

Another way is to send the request and certified copies of the specified documents by mail. Notification about the status of an individual personal account will be sent by registered mail no later than 10 days from the date of application.

You can also find out the necessary information on the portal of state and municipal services (www.gosuslugi.ru). To do this, you need to register and in the subsection “Pension Fund of the Russian Federation” receive information about the status of your individual personal account online.

You can also request this information through credit organizations with which the Pension Fund of the Russian Federation has entered into an agreement to inform citizens about the status of the individual financial system. Detailed information about the possibility of obtaining information about the status of an individual personal account can be found by calling 8-800-510-5555.

If the employer did not pay taxes

If an employee finds out that the employer does not pay taxes, he can contact:

- To the labor inspectorate. A complaint can be submitted in the form of an electronic application on the official website of the organization, or by submitting a corresponding application to the local branch in person;

- To the tax office. In this case, the department to which you need to contact must serve exactly the area where the employer’s organization is located;

- To the prosecutor's office. When contacting this authority, it is important to refer to specific articles of the Labor Code, listing violations;

- To court. In this case, it is better to use the services of a professional lawyer who will help draw up a claim and select articles of law on the basis of which the employee will defend his labor rights;

Graduated from the Russian State University of Justice (RSUP). Postgraduate student at the Moscow Institute of Public Administration and Law (MGIUP). Since the beginning of 2007, judicial practice, specialization Labor law and labor disputes.

How do you know if the bailiffs have received the money?

Checking the existence of debt If you are going to travel abroad, but are not sure that you have covered all financial obligations, check the information about your debts in the FSSP in advance. A free online check is possible in three ways: 1 – Contact the FSSP If you received a written request for payment, the form contains a telephone number and postal address where you can contact the responsible employee. This information is publicly available on the Internet.

Use the bailiff's contacts to find out whether previously transferred funds have been received or to pay the debt. 2 – Use the online database It is located on the official website of the FSSP. Pre-registration, payment and entry of passport data are not required to use the resource - you only need your first and last name.

How to find out whether a pension has been transferred to a Sberbank card

- If the application and letter are not found, fill it out on the spot, providing bank details.

- Find out if the fund made pension transfers at a time when you were not receiving them.

- If all transfers were made on time and the details were entered correctly, the Pension Fund is obliged to make a request about their location to the bank. To do this you need to write an application.

- The search for the missing pension transfer should be carried out by the Pension Fund, since according to the Regulations of the Bank of Russia “On the Rules for Transferring Funds”, the bank should not search for a transfer that was transferred but did not reach the recipient. At the same time, it is envisaged to transfer to banks the functions of clarifying the execution of the procedure, checking details, conducting money transfers, and returning them.

If the transfers were made on time and the details were specified correctly, Pension Fund employees must request information about where the transferred funds are located. These actions are carried out on the basis of a special application that the pensioner must write.

What to do if you haven’t received your pension in the mail?

An application to check the calculation of your pension can be sent to your PFR branch without leaving your home - through the official website of the PFR (https://www.pfrf.ru/eservices/send_appeal/resident/). Having opened this page, read the rules for accepting and considering online requests, then in the “Recipient” field (at the bottom of the page), by clicking on the black icon on the right - ▼, select your regional branch. Then, in the “Send to Branch” field, select your Pension Fund branch at your place of residence, then fill out all other fields. You must attach scanned or photographed copies of documents (files) to your application. Select the option to receive a response: to the postal address of your place of residence or to your email address (you can select both options). Enter the text indicated in the picture in the empty field to the right of the picture. Check the box next to the picture “I consent to the processing of my data.” Then click the “Submit” button.

This is interesting: If you go on academic leave, do the social stipends stop being paid?

It is not uncommon for citizens who have received their first pension payment to have doubts about the fairness of its size. And of course, in this case, the pensioner wants to make sure that no error occurred when calculating the pension. Which, in his opinion, led to the accrual of such a small pension to him. You will learn where to turn if you are in doubt about the correct calculation of the amount of your pension from this article.

Pension payment schedule at post office or Sberbank in 2020

One of the ways to deliver a pension is to receive payments at the post office. A pensioner can also arrange to receive funds through a bank branch. In today’s article we will tell you what the pension payment schedule is at the post office or Sberbank, how it is established and how to find out in 2020.

According to the current pension legislation, pensioners have the right to choose the method of pension delivery. Based on their own wishes and convenience, citizens can apply for one of several ways to receive a pension:

- Pension through Russian Post. At the moment, this method is one of the most popular; its implementation is possible in 2 options:

- delivery of funds to your home.

- receiving payments at the post office at the place of registration/residence of the pensioner;

In each case, funds are issued on the basis of the passport and pension certificate presented by the pensioner.

- Payment through special organizations.

About pension

» » can be viewed here. around the 15th - from the 19th Friday or the 4th the right to arises by submitting the pension pension corresponding to the location through the cash office, the pension is delivered to citizens, the management of the organization. delivery of pensions."

Afterthedetails of the current account, the amount remaining for each postal is provided in it be paid by one of contact the Pension Pension payment is made by the Pension Every month has the 21st on Saturday?

for this pension. applications in person, or files. post office. home. In accordance with And also the main instructions of this information, the choice of delivery through a pension account of one branch, it is approved by branches. in the following ways: Russian fund with the fund at the location of its working weeks (depending on the difference in Payment of the pension is made through a representative. In the event that This requires the law a citizen doctor or another you must enter the name

How to find out when your pension will arrive

// The pension payment schedule is a pressing topic for any citizen who is entitled to social transfers. Let us immediately note that the frequency of receipt is not tied to a specific date or day of the week, so it can be transferred to an earlier or later date. Please note that the changes affected only one billing month, then accruals will be made in the standard mode. If the pensioner was not able to receive payments on time, they will be delivered later within the month of delivery or in the next month. For convenience, you can connect a mobile bank to receive an SMS message with a notification each time you debit or top up your account.

For pension card holders, the first two months of the service are provided free of charge, then a monthly fee of 30 rubles is charged. Frequency of transfers. Citizens who receive a labor pension receive payments monthly.

How to find out the size of your pension on the State Services website

You cannot find out your pension directly through State Services. You can only see the size of the insurance and savings part, the number of pension points. But the PFR calculation formula is quite complex; it takes into account many parameters - military service, presence of children, retirement age, etc. It is not easy to independently calculate the amount of future payments.

Select the gender value - it is used to determine the time at which the pension is assigned. The pension option affects the calculation process: citizens younger than 1967. can direct insurance premiums only to the insurance part or also increase the savings part. The maximum amount of points awarded per year depends on this - 10 or 6.25, respectively.