Modern technologies and innovative developments are available to all segments of Russians. Pensioners can also use them. We are talking about receiving pension contributions to a bank card. Now there is no need to waste time visiting the post office and standing in long lines. The pension arrives on plastic cards on time at the appointed time.

This option for receiving pension contributions is extremely convenient and also beneficial for cardholders. But not every pensioner has yet understood the nuances of how such a service works; in particular, the schedule for transferring pensions to a Sberbank card remains a mystery to many. What affects these deadlines and what to do if there were no pension contributions on the appointed day?

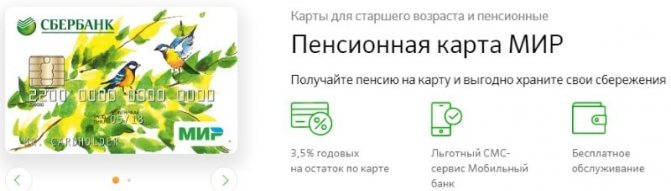

Receiving a pension on a Sberbank card is not only convenient, but also profitable

Advantages of applying for a pension on a Sberbank card

Russians who transfer pensions to a Sberbank card are extremely satisfied with this method of receiving subsidies. After all, not only time is saved. When receiving pension savings, the cardholder has the opportunity to take advantage of the accompanying, additional services and benefits offered by banks . Namely:

- The card balance is subject to interest accrual at the rate of 3.50% per quarter. Moreover, the pensioner does not have to adhere to any restrictions (not to lower the balance below the established limit). Accrual is made for any amount.

- An issued Sberbank card for receiving a pension is free. But it’s worth considering that SMS notifications will be free only for the first 2 months, then you’ll have to sign up for a paid plan (from 30 rubles monthly).

- The pension is credited on the same day when it is transferred by the Russian Pension Fund.

- You can easily pay with a Sbercard in any stores and pay necessary bills and services with it. And using the Sberbank-Online service, payment will be made free of charge or at reduced commission rates.

- Also, the card automatically begins to participate in the Thank You promotional program from Sberbank. The idea is to accumulate points received when making non-cash payments using a card. Subsequently, points can be used as payment for goods or services.

- A pensioner who is a holder of a Sberbank pension card can take advantage of special preferential rates when opening deposits, and will receive good bonuses accrued as interest to the account.

Pension cards issued by Sberbank have a number of great advantages and benefits for their holders.

The procedure for transferring a pension to a Sberbank card

When is the pension calculated and received on the card?

Sberbank does not determine the dates for crediting material funds to the pension account, since the organization is just an intermediary of the Pension Fund. After the transfer, pension assets, as a rule, do not take a long time to process and are transferred to the cards of the owners within 1-2 days.

But there are certain rules with which you can calculate the approximate time of receipt of funds on a debit card:

- It is established by law in the Russian Federation that pension payments are made monthly on the same date.

- Due to technical circumstances, delays in contributions are allowed, but the period for paying a pension to the card cannot exceed three days.

- The date of payment of pensions for most subjects of the Russian Federation is no later than the 15th.

- The date of receipt of pension benefits is determined individually according to the date of transfer of the first payment.

- In some regions, receipts to a personal account are allowed before the 21st day of the month. Exceeding this period is punishable according to the legislation of the Russian Federation; payment cannot be delayed any longer.

Let's assume that you are usually paid your pension on the 4th. If this date falls on a Saturday or Sunday, the payment is transferred to the previous Friday.

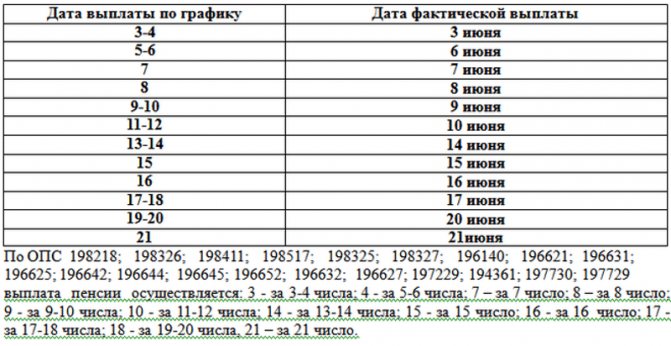

However, many local branches of the Pension Fund of the Russian Federation are aware of the specific needs of pensioners and display benefit calculation schedules on their portals. Anyone can get acquainted with them; all information is freely available online.

How to apply for pension contributions to a bank card

If you decide to give up regular trips to the post office or the tedious wait for the postman, you need to start applying for a pension card. In addition to plastic, a citizen can also open a deposit account (passbook). The complete instructions for action are as follows:

- Prepare the documents necessary for going to the bank: passport, pension, SNILS.

- With these papers, you should visit the Sberbank branch and fill out the appropriate application. The form is issued by a bank employee.

- The card will be ready in up to 1.5-2 weeks. Sberbank will inform the client about its readiness via SMS notification.

- You should visit the banking institution again and pick up the finished plastic. In this case, it is worth asking to print out the details of the financial institution. This information will be needed when making a pension transfer.

- All that remains is to pay a visit to the Pension Fund or the Multifunctional Center and report your intention to transfer the receipts to the card. By the way, this can be done in the Sber branch itself.

Ways to find out that the pension has arrived on the card

Knowing what date the pension arrives on the card, the pensioner, for objective reasons, will want to personally verify that the funds were credited to his account and check exactly how much the payment was. This can be done in several ways:

- Using an ATM - by inserting a card into the machine and entering a secret code, you can request balance information. They can be displayed on the screen or printed on a receipt.

- Using mobile banking - a special option that can be activated at any Sberbank branch. After connecting, you will receive an SMS message notifying you about the new service. In the future, the owner will constantly receive notifications about replenishment and debiting of the balance. If necessary, it is impossible to change the assigned phone number on your own; you will have to contact the bank employees again. It is worth noting that this service is paid.

- With the help of a bank client - by going to the official website of Sberbank and going through the authorization process (entering credentials), you are taken to your personal account, where you can make a request about the account status. Here you can transfer money to another card, mobile phone number, etc.

The procedure for receiving pensions

Starting from 2020, our pensioners who want to transfer pension contributions to a bank card apply for a PS MIR pension card. Previously purchased cards (Maestro or Visa), as their expiration dates expire, will also be replaced with plastic from the Russian PS MIR . Cards are reissued free of charge.

Since 2020, pensioners will be issued a MIR card to receive a pension.

Establishing a transfer schedule

But, of course, one of the important and pressing interests of pension card holders is the time and timing of receiving payments. To clarify what date the pension arrives on your Sberbank card, you should send a request to the local Pension Fund department (you can contact the employees at the hotline number). You need to understand that it is this institution that is responsible for the timely calculation of pensions, and bank branches play only the role of an intermediary.

PJSC Savings Bank does not calculate pensions and does not plan a schedule for their deductions. But this banking organization guarantees the receipt of subsidies on the same day when the PF transferred the funds to the banking organization.

Based on statistical data for the regions of Russia, it can be understood that the vast majority of pensions are accrued to pensioners before the 15th, but there are a number of areas where pension payments are accrued no later than the 21st. Sometimes there may be delays in payments, but no more than 2 –3 days. The reason is technical failures. That is, having found out the exact date of the transfers, you can say with confidence what date the pension is transferred to the Sberbank card, because the banking organization accrues it immediately when transferring funds from the Pension Fund.

You can use the funds received on your Sbercard at any time. By the way, the date of transfer of the pension to the savings card can be considered the starting point of the second and subsequent pension accrual. It is at this same time next month that the pensioner will receive his next pension.

But it is worth regularly monitoring PF news. This organization may make some changes to the pension transfer schedule. This is influenced by many different nuances: the number of people who have retired, the administrative and territorial features of a given region, etc. You can find out about upcoming changes on the official PF portal or in its division .

Pension card holders have access to a multifunctional remote service

Options for receiving a pension

In the Russian Federation, a pensioner can receive pension accruals in several ways. In particular:

- At your local post office.

- Delivery to your home/apartment.

- Transfer to a bank card.

Home delivery of pensions in Russia is free. If suddenly the pensioner is not at home at the time of the postman’s visit, he will have to go to the post office to receive it. Of course, the option of bank transfer of subsidies is much more convenient and cost-effective. To withdraw cash from a pension card, you can use the services of any terminal/ATM. Or use bank plastic for non-cash payments.

What do pensioners receiving payments on cards need to know?

Despite the high level of protection of banking products, cardholders can become victims of fraud. To avoid this, you need to follow basic safety measures:

- Do not share your card or passwords with unauthorized persons;

- Do not share your secret PIN code and CVV2/CVC2 with anyone;

- If the card is stolen or lost, notify the bank and block the account.

These simple rules will help pensioners save their money and use the card while enjoying the bank's services.

( 24 ratings, average: 4.13 out of 5)

Disability pension transfer schedule

Such deductions have a number of individual characteristics. The established category of disability (lifelong or confirmed) is important. For those persons who have been diagnosed with permanent disability, pension accruals (the nuances of their contributions) are identical to receiving a regular subsidy. If a citizen has to periodically confirm his disability, then the schedule of accruals and transfers may change depending on the period of documents submitted to the Pension Fund.

Disability subsidies are calculated and transferred to the Sbercard on the same day of the month. But a delay of up to 2-3 working days is allowed (this is due to technical problems with the system).

The established pension payment schedule can be found in the Pension Fund branches or on the organization’s website

Convenient services from Sberbank for informing about the transfer of benefits

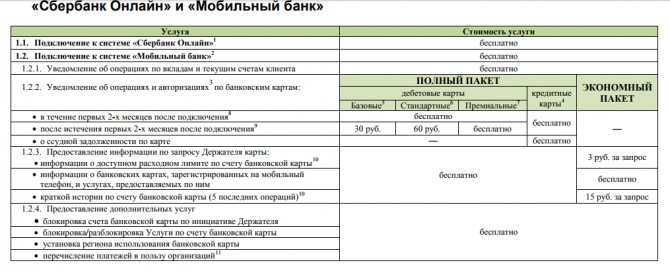

Sberbank of Russia offers its clients a service of SMS notification about credits to the card. Before connecting it, you need to familiarize yourself with the tariff plans.

Today we have:

- "Economy";

- "Full package".

The full tariff plan includes the following features:

- receiving SMS notifications about funds being credited to the card;

- obtaining information regarding each completed procedure for writing off or spending funds;

- providing information regarding the current balance;

- the ability to send a request for a statement that contains information regarding the latest financial transactions made using a bank card.

If you use an economical tariff plan, the last 2 requests can only be made on a paid basis. Their price varies from 5 to 15 rubles for each request.

The economical package is provided free of charge, which makes it quite attractive to customers. However, it is impossible to receive SMS using it.

The full tariff plan includes the service in question, and the cost is:

- for instant and non-personal cards – 30 rubles;

- for classic bank cards – 60 rubles;

- for gold and premium – the full package is provided free of charge.

For this reason, if you need to receive alerts on the transactions in question, the best and only option would be to connect to a full tariff plan. Thanks to this, it is possible to promptly learn about possible actions of fraudsters and, if necessary, immediately take action to ensure the protection of your current account.

Additionally, you need to remember that each client can change the tariff using a regular SMS message.

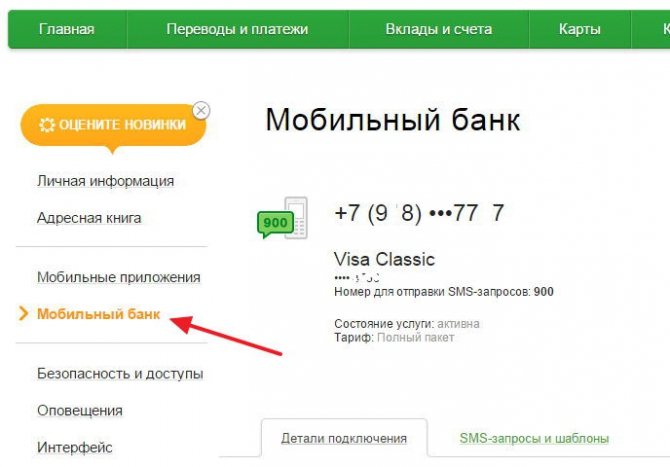

In order to activate the service in question, it is possible to use one of several options. Using the Sberbank Online service is considered to be the most optimal and at the same time convenient. Additionally, you need to connect Mobile Banking.

The sequence of actions is as follows:

- In your personal account, you need to select the “Mobile Bank” category, located on the right side.

- Next, the user selects the “Connection Details” section.

- Select one of the tariff plans. To receive SMS alerts, there is only one option left - a full package of services.

- In the newly opened window, you need to specify the necessary parameters for activation - in most cases, some fields are already filled in by default. In particular: mobile phone number and other data. The user just has to select a bank card from the proposed list (if there are several of them).

- Press the service connection button.

In a newly opened window, the service will offer to re-check the previously specified information. If everything is correct, all that remains is to confirm your intentions.

Based on the generated request, an SMS notification from Sberbank arrives on the pensioner’s phone, information from which is recorded in the appropriate fields.

After completing the procedure, the system redirects the user to a list of generated requests. The newly generated application will have the status “Under consideration”. After changing it, it will be corrected to “Confirmed”, which is why the service is considered connected, and you can now use all the functionality.

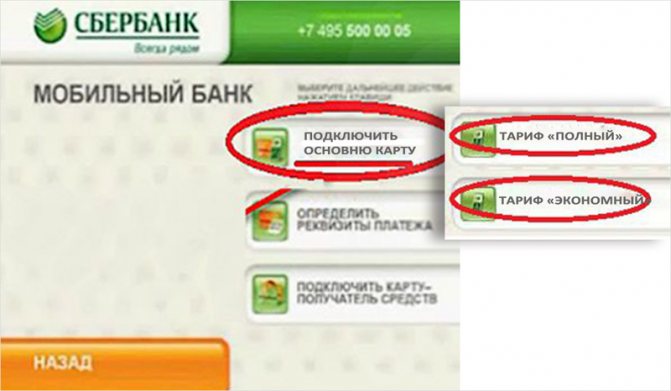

If desired, pension recipients can activate the SMS information service using a self-service terminal or ATM. The connection is carried out according to the standard principle.

In this case, you should find the nearest ATM location and insert a personal bank card and indicate the PIN code. After this, the user will be directed by the system to the main menu.

Further sequence of actions:

- It is necessary to switch to the “Mobile/Online Bank” category.

- After this, the client clicks on the card connection item.

- The user clicks on the selected tariff plan that requires activation (for SMS notification of receiving a pension, “Full” is selected).

- After this, the service redirects the pension recipient to a page with the specified connection information: established tariffs, phone number, card details.

Please note: the activation procedure is only possible for a card that is built into the ATM reader.

The mobile phone number is taken from the client database, information in which is placed when signing a service agreement.

Activation confirmation is a notification message received on your phone. On average, this will take up to 2 days.

Reasons why pensions stopped accruing

It is worth knowing that the procedure for sending subsidies to recipients is not 100% automated. Living people, employees of the system, also take part in such work. Of course, there may be technical problems with equipment, and human error - employee error . All this can provoke some delays in the receipt of pension contributions.

If, after 3 working days from the scheduled date of receipt, the pension has not arrived on the card, its holder should contact:

- To the banking organization where the plastic was issued.

- To the Pension Fund at your place of residence.

You should request bank account details from Sberbank, which will confirm the absence of a regular pension receipt. With this statement, you need to go to the Pension Fund, where you can clarify the situation with the delay. But as a rule, too long delays are extremely rare; pension payments arrive regularly and without delay.

In what cases does the pension not arrive on the card on time?

The process of calculating benefits is not fully automated, which is why there may be errors during banking operations. The following shortcomings and errors may cause late receipt of funds to the pensioner’s card:

- human factor or incorrect execution of a payment order by PF employees, resulting in the bank returning the money to the sender;

- incorrect indication of the client’s bank details when sending to the fund;

- errors in the card application.

If problems arise, pensioners should adhere to the following recommendations:

- Contact a Sberbank branch to obtain a printout of account transactions.

- If you confirm the fact that money has not been credited, you should clarify the bank details and contact the local branch of the Pension Fund.

- Find out from the Pension Fund whether they have an application for accrual of pension payments to a bank card, and the accuracy of the details.

- If all the documents are in order, check whether the money was actually transferred by the fund itself.

It happens that funds were transferred, but did not arrive on the card. In this case, the Pension Fund is obliged to send a request to Sberbank in order to determine the location of the funds.

New amendments to the legislation on the procedure for pension payments

The beginning of the current 2020 was marked by various changes and additions. Pension payments were also adjusted. The reforms mainly affected the procedure for pension calculation; the payment schedule remained unchanged. According to updated data, to receive a pension, Russians must have at least 13.8 pension points and at least 9 years of officially confirmed work experience. We should expect changes in this area until 2025 with an increase in the mandatory length of service to 25 years and a minimum of 30 pension points.

Transfer of pension savings to a Sberbank card

So how to transfer money from the Pension Fund to Sberbank?

We recommend reading: Article self-defense of the Russian Criminal Code, murder

Let's consider this issue in detail.

It provides access to many bank services and fully meets the needs of pensioners: Thus, the Social debit card creates the most pleasant conditions for its users.

conclusions

Receiving a pension on a Sberbank card greatly simplifies the life of an elderly person. This method of transferring subsidies not only allows you to save time and not be dependent on waiting for the postman to visit. A Sberbank card is also becoming a financially profitable product that allows you to receive additional income on your cash balance .

Pension payments in our country are made regularly, every month on the same day. If there are delays for technical reasons, they do not last more than 2-3 days. The exact reason for the delays, as well as the established regional schedule for transferring pensions, can be found out at the local Pension Fund branch.

Why is the pension on the card delayed?

The payment of pension funds is not a fully automated process that requires human participation. Carrying out banking operations is not immune from some miscalculations - this factor, as a rule, is the key reason why pensions on a Sberbank card are delayed.

The most common mistakes made include:

- Incorrect preparation of statements by employees of the Russian Pension Fund, leading to the bank blocking the transfer and returning the money to the sender.

- Poor coordination leading to invalid pensioner details being sent to the bank.

- Errors when drawing up applications for bank cards and personal accounts.