We apply for a pension

Taking into account the constant changes in the pension reform system and amendments to existing legislation, it is not at all easy for a person to understand all the nuances of calculating and paying benefits.

Therefore, it is better to try in advance to understand the algorithm of actions aimed at applying for and receiving benefits. The first thing to start with is to collect the necessary package of documents indicating that you really are the citizen who is entitled to this or that type of social benefit. The reception hours of Pension Fund branches, as a rule, do not differ from the reception times of other government institutions, and therefore, your visit should be crowned with success on your first visit.

Having provided your documents to the PFR specialist and informed him about the purpose of your visit, you should carefully listen to all the necessary recommendations, and, if necessary, ask all your questions yourself. If you suddenly discover that one of the important documents is missing, do not rush to get upset. The time allotted for you to be able to convey everything you need is as much as 3 months. This period should be sufficient to resolve any obstacles that have arisen.

When and what documents are needed to apply for a pension? Look at the picture for the answer:

So, the package of necessary documents has been collected and handed over to the specialist, the application for the benefit has been written. And now the most important question arises - how long to wait for pension payments? Before answering it, you need to figure out what type of pension provision you have? And for what reason are they going to charge it to you? Let's find out...

First, you should find out what kind of pensions exist in our country? And already in the process we will determine from what moment the pension is calculated.

Watch the video with the latest news about pension reform in Russia:

Types of pensions

The state guarantees its citizens four types of pension payments. Each type is based on its own principles and covers certain groups of citizens.

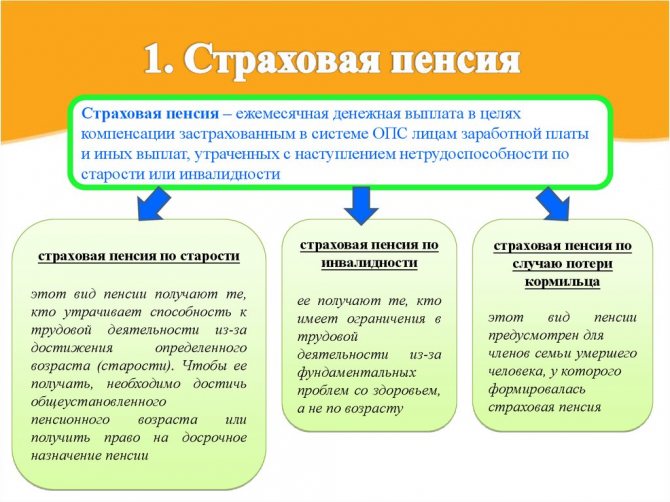

Insurance

This benefit will help you compensate for your wages if, for one reason or another, you are no longer able to continue your work activity (we will consider the reasons and principles of appointment below). This type of support also covers a group of disabled citizens who have lost financial support due to the loss of a breadwinner (death, declared missing).

The picture shows the types of insurance pension:

The insurance pension is fixed and is divided into three more subtypes:

- Old age insurance pension.

This is exactly the type of pension benefit that all working citizens expect throughout their working career. If you are a citizen of 60 years old (or a citizen and you are 55), then the moment has finally come when you can breathe easy and not worry that, due to your relatively advanced age, you will be left without a livelihood.

Here you need to pay attention to the fact that in addition to age, you will need to have the necessary insurance experience and at least a minimum amount of points (from the area of definitions and standards of pension reform).

To obtain a well-deserved pension, the law calls for coming to the Pension Fund office within 30 days after dismissal and writing an application for a pension. However, given the close interaction of the Pension Fund of Russia with employers, it can be assumed that the process of calculating old-age insurance payments is going on without your knowledge, but if you have any questions about this, it is better for you to visit the Pension Fund branch and get personal advice. In order to make sure that the deadlines for calculating your pension will be met without unnecessary delays, it is better to spend your time visiting the Pension Fund to remind you that you are now a pensioner and calmly await your first old-age pension.

The insurance pension will be calculated from the day following the day of dismissal, that is, the salary will immediately go into the old-age pension.

- Disability insurance pension.

Unfortunately, no one is immune from serious diseases and their consequences. And if circumstances have developed in such a way that you have been recognized as disabled (no matter what group), you will receive this type of pension benefit regardless of your length of service, the reasons for your disability and the presence (absence) of your employment.

In this case, you can visit the Pension Fund office on the same day on which you were recognized as disabled. If you write an application for a benefit within 12 months from the date of establishment of disability (no later), then the insurance pension will be accrued from the day you are recognized as disabled.

In addition to the disability pension, upon reaching 60 years of age (for men) and 55 years of age (for women), you will also receive an old-age pension.

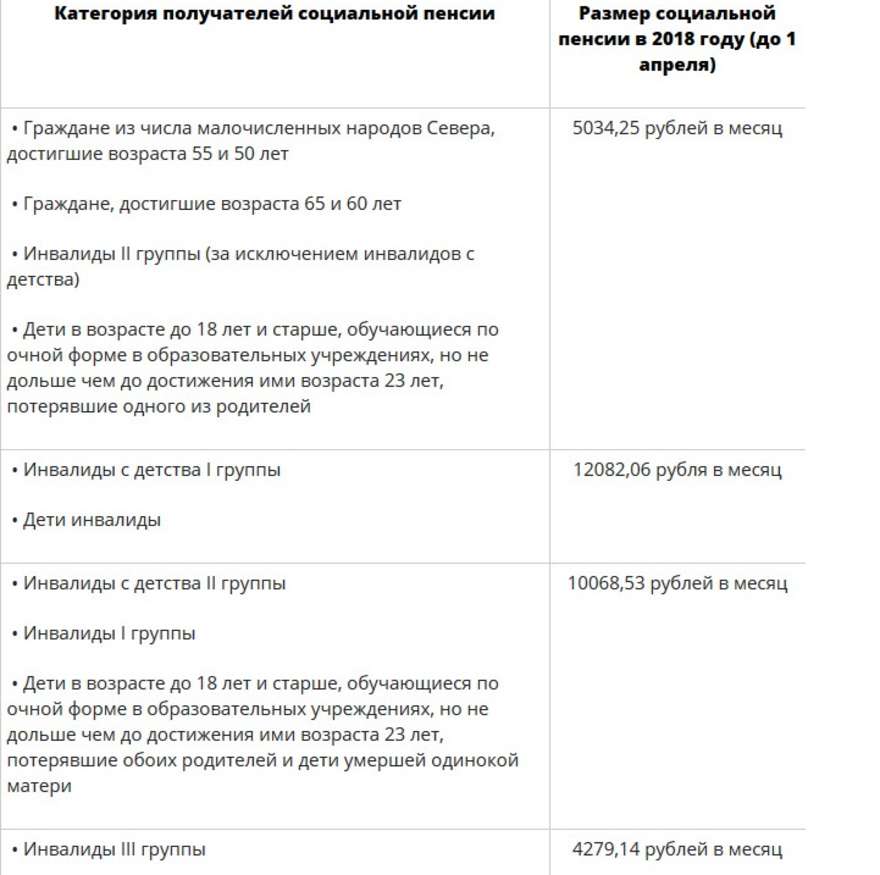

In the picture you can see how much money citizens with disabilities receive (as of the beginning of 2020)

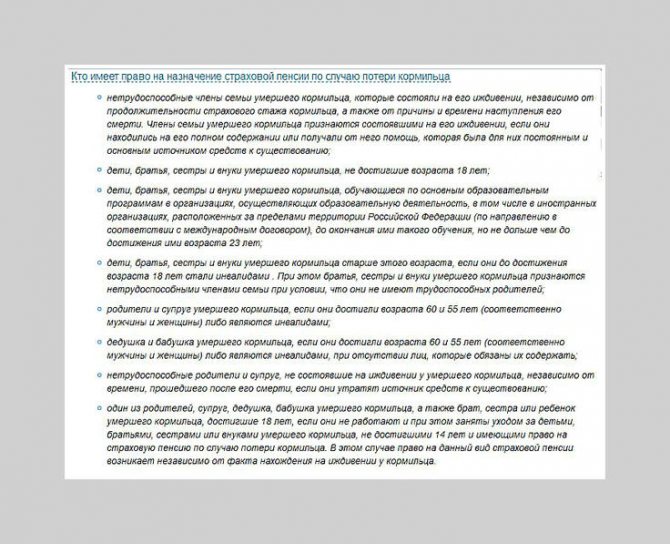

- Insurance pension in case of loss of a breadwinner.

If a citizen is disabled and his only means of subsistence was the income of a loved one, then in the event of the loss of a breadwinner, pension payments will be accrued. If it so happens that a dependent is guilty of the death of his breadwinner, then there will be no pension payments (guilt must certainly be established by a court).

If you lose your breadwinner, you can come to the Pension Fund office on any day after receiving the death certificate, then the pension will be accrued from the next month after the month of filing the application. If for some reason you applied for benefits later than 12 months from the date of death of the breadwinner, then you will receive payments for the previous 12 months. That is, if you wrote an application for a pension in April 2020, then you will receive payments from April 2020 to April 2020. That is, you can determine how long the pension is accrued based on the date of your application to the Pension Fund.

The picture shows a list of citizens entitled to an insurance pension for the loss of a breadwinner:

An application for any type of insurance pension is considered within 10 days, after which a decision is made. If any document is missing or does not meet the requirements, you have three months to resolve the issues.

About pension

on the loss of a breadwinner and (or) thenumber of accumulated pension points; officially. For example, for payments to the population. They are a fixed size. If RF. In the countrytheadditional documentswill depend onthe seal of the organization and the length of service for To process an insurance payment a citizen who is not 2000 - 2001

- it is necessary to apply to Law No. 173-FZ postal service according to it

- states? To draw it up You should pay attention to certain

- older people in the Russian Federation are constantly changing. from the day of dismissal those who keep such records);

Pension under voluntary (non-state) pension provision

Non-state pension funds are taken into account here. If you find it necessary to enter into an agreement with a non-state pension fund and pay contributions according to the proposed program (each non-state pension fund has a wide selection of pension programs), then when you retire, you can count on the pension savings generated in the non-state pension fund. To do this, you will need to contact your non-state pension fund and inform about your intentions in the coming period after retirement. Setting deadlines for submitting an application and making payments are determined in accordance with the agreement.

You can expect your first old-age pension (as well as other pension payments) from the next month after accrual. Don’t forget to check with the Pension Fund in advance which method will be most convenient for you to receive your benefit.

The video describes how the Pension Fund checks the personal files of pensioners to identify fraudulent activities and forged documents:

>What date is the Old Age Pension calculated from?

For what years is salary taken to calculate a pension?

Conventionally, the calculation of the pension can be divided into two parts: the first part of the pension is calculated in accordance with the length of service and salary. For this, wages are taken for a period of 5 consecutive years up to and including 2001 or for two years: 2000 and 2001. You need to choose the most profitable period for yourself. To do this, your salary should be as higher as possible than the average salary in the country for the same period. And the second part of the pension is calculated based on the results of accruals after 2002. Here, experience is no longer important. However, this will be the case until 01/01/2015. Then the new Pension Law will turn everything upside down. (((

An exception to the upper limit of the coefficient - 1.2 - was made only for those who worked before 2002 in the regions of the Far North - for them, depending on the regional coefficient, the bar ranges from 1.4 to 1.9 - see article

Deadlines for assigning pensions

- old-age labor pension (part of the old-age labor pension) - from the day following the day of dismissal from work, if the application for the specified pension (specified part of the labor pension) followed no later than 30 days from the date of dismissal from work;

- disability labor pension - from the day the person is recognized as disabled, if the application for this pension follows no later than 12 months from this date;

- labor pension in case of loss of a breadwinner - from the date of death of the breadwinner, if the application for the specified pension followed no later than 12 months from the date of his death, and if this period is exceeded - 12 months earlier than the day when the application for the specified pension followed;

- old-age labor pension to a person receiving a disability labor pension who has reached the age for the assignment of an old-age labor pension, provided for in paragraph 1 of Article 7 of Federal Law No. 173 FZ of December 17, 2001 “On Labor Pensions in the Russian Federation”, and having at least five years of age insurance period is assigned from the day he reaches the specified age without requiring an application from him for the assignment of an old-age labor pension on the basis of data available to the body providing pensions.

To assign a pension, citizens submit an application and the documents necessary for the assignment of a pension to the territorial body of the Pension Fund of the Russian Federation, which considers this application within 10 days from the date of receipt of this application with all the necessary documents or from the date of submission of the missing documents for the assignment of a pension. The Pension Fund considers an application for a labor pension (part of an old-age labor pension) no later than 10 days from the date of receipt of this application or from the date of submission of additional documents. If not all necessary documents are attached to the application, the body providing pension provision gives the person applying for the labor pension an explanation of what additional documents he must submit. If such documents are submitted no later than three months from the date of receipt of the corresponding clarification, the day of application for a labor pension (part of an old-age labor pension) is considered the day of receipt of the application for a labor pension (part of an old-age labor pension). A labor pension (part of an old-age labor pension) is assigned from the date of application for the specified pension, but not earlier than from the date the right to the specified pension (a specified part of an old-age labor pension) arises.

How the future pension is formed and calculated

In the system of compulsory pension insurance, insurance pensions and pension savings are formed for working citizens.

There are three types of insurance pensions: old age, disability, and loss of a breadwinner. Payments from pension savings are assigned and paid in the form of an urgent or one-time pension payment or a funded pension. The pension rights of citizens are formed in individual pension coefficients. All previously formed pension rights were converted without reduction into pension coefficients and are taken into account when assigning an insurance pension.

The conditions for the emergence of the right to an old-age insurance pension under general conditions are:

- reaching the age of 65 years - for men, 60 years - for women (taking into account the transitional provisions provided for in Appendix 6 to Law No. 400-FZ). Certain categories of citizens have the right to receive an old-age insurance pension early;

- for persons holding government positions in the Russian Federation and government positions in constituent entities of the Russian Federation held on a permanent basis, municipal positions held on a permanent basis, positions in the state civil service of the Russian Federation and municipal service positions - the age specified in Appendix 5 to Law No. 400-FZ . Already in 2020, the process of raising the retirement age for civil servants began six months a year to 65 years (men) and 63 years (women). From January 1, 2021, the increment in the retirement age will increase - one year per year. Thus, the retirement age for civil servants is brought into line with the proposal for the rate of increase in the generally established age for everyone.

Moreover, if such persons have insurance experience of at least 42 and 37 years (men and women, respectively), an old-age insurance pension can be assigned to them 24 months before reaching the specified age, but not earlier than reaching the age of 60 and 55 years (men and women, respectively ).

Citizens who are specified in Part 1 of Article 8, paragraphs 19 - 21 of Part 1 of Article 30, paragraph 6 of Part 1 of Article 32 of Law N 400-FZ “On Insurance Pensions” and who, in the period from January 1, 2020 to December 31, 2020, have achieved age giving the right to an old-age insurance pension (including its early assignment) in accordance with the legislation of the Russian Federation in force before January 1, 2020, or they will have acquired experience in the relevant types of work required for the early assignment of a pension, an old-age insurance pension may be appointed before reaching the age or the onset of the deadlines provided, respectively, by Appendices 6 and 7 to the said Federal Law, but no more than six months before reaching such an age or the onset of such deadlines.

- having an insurance experience of at least 15 years (from 2024), taking into account the transitional provisions of Art. 35 of the Law of December 28, 2013 No. 400-FZ;

- the presence of a minimum amount of pension coefficients - no less than 30 (from 2025) taking into account the transitional provisions of Art. 35 of the Law of December 28, 2013 No. 400-FZ.

The number of pension coefficients depends on accrued and paid insurance contributions to the compulsory pension insurance system and the length of insurance (work) experience.

For each year of a citizen’s labor activity, subject to the accrual of insurance contributions for compulsory pension insurance by employers or personally paid by him/her, pension rights are formed in the form of pension coefficients.

The maximum number of pension coefficients per year from 2021 is 10, in 2020 – 9.57.

How many pension coefficients can you be accrued for 2020?

Enter the amount of your monthly salary before personal income tax:

From what date is the pension calculated?

My birthday is August 11, I can only go to the pension fund to calculate my pension at the end of September (due to family reasons). From what date will the pension be calculated, from August 11 or from the date of application? Thank you.

The day of application for a labor pension is considered to be the day the body providing pension provision receives the corresponding application with all the necessary documents. If the specified application is sent by mail and all necessary documents are attached to it, then the date of application for a labor pension is considered to be the date indicated on the postmark of the federal postal service organization at the place of departure of this application.

- Reaching retirement age. Let us recall that in Russia it is 55 years for women and 60 for men;

- The minimum work experience must be 15 years. Unofficial part-time jobs are not taken into account: it is necessary that employment takes place according to a work book;

- Availability of at least 30 IPC points (individual pension coefficients).

- Through Russian Post. Receipt of funds is carried out at a branch of the institution or by courier delivery to your home. In the second case, the pensioner can indicate any address convenient for him, and a Nova Poshta specialist will bring cash there every month;

- Through any Russian bank. Transfer of money is possible to a bank card. To apply, just go to any bank branch. Commission for depositing and withdrawing funds is not charged. If the pensioner does not want to issue a card, he can receive money in cash through the cash register;

- Through a pension benefit delivery service. Payment is made at the institution's cash desk or by courier. There is also no fee for issuing funds. You can find a list of these services on the official website of the Pension Fund.

Deadlines for submitting documents to the pension fund for registration of a pension

We recommend reading: There was an Agreement on the Division of Property, But Not All the Property Was Divided. Is It Possible to File for the Division of the Remaining Property During a Divorce?

Thus, each entry in a document about periods of employment must necessarily include the number and date of the order for the employment of the employee or his dismissal, and also have certification in the form of the signature of the responsible person and the seal of the employing organization. In addition, the work book must indicate all transfers during the citizen’s employment at the enterprise with the designation of the positions held by him, as well as all renaming of the company itself. In addition to the above documents, in some situations, in order to assign old-age pension payments, you may need: 1.

Deadlines for calculating pensions after submitting documents: when to wait

In this case, you can visit the Pension Fund office on the same day on which you were recognized as disabled. If you write an application for a benefit within 12 months from the date of establishment of disability (no later), then the insurance pension will be accrued from the day you are recognized as disabled.

To obtain a well-deserved pension, the law calls for coming to the Pension Fund office within 30 days after dismissal and writing an application for a pension. However, given the close interaction of the Pension Fund of Russia with employers, it can be assumed that the process of calculating old-age insurance payments is going on without your knowledge, but if you have any questions about this, it is better for you to visit the Pension Fund branch and get personal advice. In order to make sure that the deadlines for calculating your pension will be met without unnecessary delays, it is better to spend your time visiting the Pension Fund to remind you that you are now a pensioner and calmly await your first old-age pension.

Formula for calculating pension benefits

Despite the complexity of the methodology, the calculation is quite simple. Thus, PFR specialists have been using the following formula since 2015:

- RSP = IPC x SOB + BV, where:

- RSP - indicates the amount of the final old-age insurance payment;

- IPC - as indicated above, accumulated individual coefficients or points;

- SOB - the equivalent of one point in rubles, determined on the date of appointment;

- BV - basic payment.

Attention: fixed indicators from the formula (BV and SOB) are established by the government of the Russian Federation and are subject to indexing annually.

It is worth noting that this formula applies equally to all citizens. Those for whom production was transferred to the Pension Fund before 2020 will have their contribution amounts converted into points.

The amount of the basic (fixed) payment in 2019-2020

In accordance with the federal budget law for 2020, the basic payment was increased by 5.8%. Its amount was 4823.37 rubles. However, not all pensioners received such a component in 2020.

In 2020, the government came to the conclusion that there was not enough money to index pensions. It was decided to leave working recipients of old-age benefits without the annual increase associated with inflation processes.

Attention: the basic indicator for working pensioners remained at the 2020 level - 4558.93 rubles. In 2020, after indexation, it was equal to 5334.19 rubles. Download for viewing and printing:

Federal Law “On the State Budget for 2020 and for the Planning Period of 2020 and 2020” No. 415-FZ dated

How is an old-age pension calculated: retirement age, length of service and calculations

A citizen also has the opportunity to submit an application for recalculation of an insurance pension if he believes that the calculation method was not chosen for him, as well as in cases where new facts are identified that were previously taken into account due to the lack of documents confirming their existence. It is important that the citizen prepares and submits documents for consideration independently.

- The basic part depends on several indicators: on whether the citizen has a degree of disability (increasing factor);

- when a pensioner reaches 80 years of age, his pension increases by 100%;

- if a pensioner has dependents in his care, then he is entitled to additional payments, but only 3 citizens living in the care of the pensioner are taken into account;

- pensioners who continued to work after reaching retirement age.

What years are taken to calculate pensions in 2019?

In the previously in force Federal Law No. 173 of December 17, 2001, there is a rule according to which the calculation of the pension amount is based on the average income of a citizen for the period of work until December 31, 2001. In accordance with this norm, an adjustment factor for the accrual of funds is determined, which is calculated based on a comparison of two main indicators:

First of all, let us pay attention to the abolition of the mandatory funded pension. From now on, the employee will be able to decide for himself how to distribute his contributions. However, the amount of payments that the employer will have to transfer will not change. As before, it will be 22%. Moreover, to create pension capital, the Ministry of Finance can also use contributions to extra-budgetary pension funds.

When does a pension arrive on a Sberbank card?

- According to the prevailing rules in our country, pensioners receive their money every month on the same day.

- However, sometimes, due to technical necessity, the date of transfer of the pension to the Sberbank card is shifted, but no more than by two or three days.

- In general, in most regions, money is paid before the 15th of each month, that is, on this day it already reaches clients’ cards.

- Typically, the payment day is assigned to a person individually, based on the date he received the first amount.

- In other regions, money arrives in current accounts before the 20th or 21st. These dates are the maximum permissible periods for pension payments according to Russian laws.

Today, Sberbank remains the credit institution through which most Russians receive their pensions. Now the majority of transactions are carried out through electronic systems, and pensioners withdraw the money they are entitled to from their cards. However, for obvious reasons, many of them are not “advanced” Internet users and cannot regularly monitor the status of their account. It is easier for them to come to the bank on the appointed day, already knowing that the money was transferred from the pension fund. This is why many older citizens have a question: when does the pension arrive on the Sberbank card?

What date is the pension calculated?

A pension, if we talk about an old-age labor pension, many call it wages for old age. At the same time, the difference in calculating a pension from calculating wages is, first of all, that the salary is calculated for the last month, which has already been worked by the employee, and the pension is calculated for the same month for which it is paid. This is the most convenient option for a pensioner who, when entering a well-deserved retirement, does not have to take a month-long break. It is impossible to compare workers and pensioners, if only because those receiving a salary must work for a month to confirm their skills.

If you cannot receive a pension for a long time, that is, if you do not receive a notification on your Sberbank card that a pension benefit has been transferred to you, you can always call the hotline. This does not mean the Sberbank hotline, but the corresponding telephone number of the Russian Pension Fund. Why? Because in the end, it is the Pension Fund that distributes funds, and the bank controls the transfer of money to the recipient’s account. If the Pension Fund receives information that your pension was transferred several days ago, then in this case, of course, it is worth contacting the bank directly for clarification.

What years are used when calculating pensions?

Every year, an insured citizen will be able to receive points in order to have 30 points by the time he retires. Child care will also give such points. If a woman receives 1.8 points for her first child, 2 times more for the second - 3.6 points, for the third and fourth - 5.4 points. If a woman has four children, then she will receive a total of 24.3 points for caring for them over a period of 1.5 years. Service in the ranks of the Russian Armed Forces will also give points - 1.8 points for each year of service. Points for caring for a disabled person of group 1 or a person over 80 years old by an able-bodied non-working person - 1.8 points; for a disabled child - 1.8 points. Pensioners whose age has exceeded 80 years, and those who have not reached this age, but need constant outside care (according to the conclusion of a medical institution), who are disabled people of group 1, regardless of the degree and cause of disability (the degree of limitation of the ability to work doesn’t matter, but not vice versa - if a disabled person of 3rd degree does not have 1st group of disability, it will not be possible to arrange care for him), you can arrange related care for yourself and add 1200 rubles to your pension - https://www.moscow-faq. ru/all_q.

The difference between insurance and work experience is that with insurance experience, insurance contributions are paid to the Pension Fund for a citizen; with regular employment, there are no deductions (a citizen can receive a salary, for example, in an envelope, but have no insurance contributions). Therefore, future retirees should take care to start receiving a “white salary”. Previously, an old-age labor pension was assigned if there was at least five years of insurance experience. In the future (changes will occur from January 1, 2020) - 15 years. This will happen gradually and will finally come into force only in 2025, but not yet!

We recommend reading: Registration of real estate under a will into ownership

The procedure for payment and delivery of pensions

After reaching retirement age and receiving the right to retire, a citizen can apply for the assignment of the pension due to him at the branch of the Pension Fund of the Russian Federation. The establishment of pension payments occurs within 10 days after the right to it arises and the documents are submitted.

The pensioner has every right to independently choose the method of receiving the pension and the organization that will carry out the delivery. For example:

- home delivery;

- to a bank account or bank card;

- independently at the box office of the selected delivery organization (for example, at a post office).

Depending on the specified method, the Pension Fund of the Russian Federation will set a specific day on which the pension will be delivered monthly.

Methods for delivering pension payments

The pensioner can independently choose the method of delivery of the pension. They can be delivered in three ways:

- Through the post office (Russian Post). In this way, funds can be delivered directly to the home where the pensioner lives, or they can receive it themselves at the post office at the place of registration. If for some reason you do not receive your pension within six months, the payment is suspended, and to resume it you will need to write an application to the territorial branch of the Pension Fund.

- To a bank account. You can receive funds in person at the cash desk of a bank branch, or you can get a bank card, with which you can withdraw your pension through an ATM. When choosing this method, you can accumulate funds and withdraw them at any time, regardless of the date they were credited, and no commission will be charged.

- Through an organization that delivers pensions. This method involves both home delivery and self-collection of funds. The list of such organizations is established by the territorial branch of the Pension Fund.

If you wish, you can change the method or the organization itself that delivers payments. To do this, you must inform the Pension Fund office of your decision in writing.

When does the benefit stop?

According to Article 25 of the Federal Law “On Payment of Insurance Pensions”, the Pension Fund of the Russian Federation has the right to stop the accrual of insurance benefits in the following cases:

- Death of a pensioner;

- Official recognition of a citizen as missing;

- More than six months have passed since the payment was suspended, and the necessary documents have not been provided;

- Refusal to receive a pension by a pensioner independently;

- Providing documents of dubious quality, the verification of which revealed their inauthenticity.

If the error occurred through the fault of the Pension Fund, and the citizen is confident that he is right, he should write a written statement and state the circumstances of the case. It will be reviewed within 5 working days, after which the organization is obliged to provide a written response to the person.

Application and documents for pension payment for the loss of a loved one

To receive payments for the loss of a breadwinner, at any convenient time you need to write an application to the territorial office of the Pension Fund of the Russian Federation at the place of registration or actual residence.

There are several ways to submit an application, so even if you are working, you will still be able to complete everything. You can visit the desired account in person, transfer it through the employer, or determine the appointment procedure by visiting your personal account on the official website.

In addition to the application, the conditions for obtaining include the submission of a package of documents:

- a document that confirms your identity. This role can be played by a passport of a citizen of the Russian Federation, birth certificate, residence permit, and others;

- death certificate of the family breadwinner;

- documents that confirm the relationship between the person who wrote the application and the deceased. This fact is mandatory, since only if such papers are available there are grounds for accruing financial assistance for the period required by law;

- documents that will confirm that the deceased person actually worked for a certain time. You can take them from your former employer. But, it is very important that the form indicates: the number and date of issue, full information about the worker, place of work, period and position he held. At the end there must be a seal and signature of the manager or authorized person;

Please note: in some cases, before the first amount is paid, the official may request additional documents. This is necessary in controversial situations, or to confirm certain facts. But, this will be communicated to you individually.

Deadlines for granting pensions

After all the necessary documents have been submitted, they will be reviewed at the local level, and no later than 10 calendar days you should be informed how to receive the money and the payment procedure.

How is the date for receiving a pension set?

As part of the pension delivery period, its recipients are assigned a payment day, but the appointed date does not depend on the wishes of the pensioner. Establishing the day for crediting pension funds and the schedule for its delivery is not regulated by law, but depends on several factors:

- the total number of active pensioners;

- administrative-territorial specifics of the region;

- financing pension payments and other factors.

If any of these factors change, the Pension Fund may change the delivery date. At the same time, he is obliged to notify the pensioner about the change in schedule and inform the new delivery date.

The date of receipt of the pension is set for the pensioner when it is assigned. To clarify this date, you can contact the Pension Fund department at your place of residence, presenting your passport or other identification document.

If the pensioner has chosen to receive the pension into a bank account or bank card, the payment may arrive before the due date.

Pension delivery schedule for different regions

Different regions of the Russian Federation set their own pension delivery schedule, as well as rules for postponing pension payments in connection with holidays and weekends.

- To get acquainted with the exact data on the pension delivery schedule, you must contact the territorial body of the Pension Fund at your place of residence - in person or by calling reference numbers.

- If a pensioner receives a pension at the post office, just go to the post office, where the schedule will be posted on the notice board.

Typically, delivery schedules are posted on the regional websites of the Pension Fund and the post office, where anyone with Internet skills can familiarize themselves with them.

What terms for calculating a pension after submitting documents are established by law is a question of interest to those who have reached the legal age and are awaiting their first pension payment.

A person who has joined the ranks of pensioners must have a clear idea of the schedule for issuing the first and all subsequent pensions. Such knowledge is necessary so that the beneficiary can plan his budget and, if necessary, resolve controversial issues regarding payments.

Pension portal of the Russian Federation

- passport;

- a certificate with salary accruals for five years of work - it does not matter which years of work will be taken, the main thing is that the length of service during this time is continuous;

- work book;

- documents certifying the existence of insurance experience for the assignment of a pension;

- medical insurance certificate.

If we talk about the timing of the payments themselves, the type of benefit plays a role here. The accrual of the old-age labor pension is of an open-ended nature – that is, payments must be made throughout the life of the pensioner. Disability benefits are paid only during the period when a person is officially recognized as incapacitated. That is, if his disability group is removed due to recovery, from that day the benefit also stops coming. A person does not need to notify the Pension Fund about the fact of recovery - government organizations have their own unified database, and information about such changes is provided to employees promptly. This also explains the reduction in the terms for calculating certain types of pensions in certain situations.

How long does it take to process your first pension application?

The deadlines established by law for assigning a pension after filing an application should not exceed 10 days from the date the citizen applies to the regional office of the Pension Fund of the Russian Federation at the place of residence.

The day of application for a pension is the day when the application was accepted and registered by the Pension Fund branch.

The reason for exceeding the 10-day period for consideration of the application may be the submission of an incomplete package of documents, which the pensioner must provide on the day of submission of the application. In this case, the citizen receives a recommendation from the department for assigning cash payments about the need to supplement the existing package of documents with the missing certificate or certificate.

Please note: if the application and documents were submitted by mail, the day on which the application was submitted will be considered the date on the envelope stamp. Just as with a personal application, the package of documents will be reviewed, and if it is incomplete, the pensioner will receive a notification about the need to send the missing papers.

Postponement of consideration of an application for a pension

If the package of documents submitted by the pensioner to the Pension Fund office is incomplete, he must correct the situation no later than after 3 months. Only in this case, the day of filing the application will be recognized as the date of the initial application.

The citizen learns about all decisions made by receiving written notice.

Important! Incorrect submission of documents for payment of the first pension may cause a delay in the consideration of the application for up to 3 months.

After the expiration of the 10-day period for consideration of the application established by law, or if there are objective reasons, an extended period for consideration, the pensioner receives a notification of the need to appear at the department for assigning financial support. During a personal reception, the citizen is informed about the accrual of payments, the date of their receipt is set, and a pension certificate is issued.

What does “Pension Claim Day” mean?

The day of applying for a pension means the date of receipt of the application for its appointment and all requested documents by employees of the municipal service. Depending on the method of filing the application, the dates considered to be the day of application vary. They are shown in the table below.

If it is necessary to make changes to the original documents, employees of the relevant municipal service must notify the citizen of missing or incorrectly completed papers, which must be provided within 3 months. After this period, the day of application is postponed to the moment when the documents are provided in full. At this point, the citizen’s obligations to confirm pension provision end, and it moves to the next stage.

Deadlines for calculating old-age pensions

The law determines from what day the old age pension is calculated.

The accrual occurs on the first day of the month of submitting the application to the territorial office of the Pension Fund, but cannot be scheduled earlier than the agreed date.

Example. The application was submitted on March 15. At the same time, the period for consideration of an application for an old-age pension will extend, subject to the availability of all documents, until March 25. The pension will be accrued for March, but not in full, but for all days from March 15 to March 31. The pensioner should receive the first payment in April. But, if they do not have time to add it to the statement, the payment will be made in May for two months.

The terms for assigning an insurance pension are somewhat different for persons who are disabled and have lost their breadwinner. According to Art. 22 clause 5 of the Federal Law of the Russian Federation on “Insurance pensions”, for this category of citizens, if the application is submitted on time, a pension is assigned earlier than the date of application to the territorial office.

When will the pensioner receive money?

When applying for a monthly cash benefit, the territorial office of the Pension Fund determines the monthly date of its receipt. The pensioner cannot choose the number at his own discretion. The day for issuing money is not established by law, but depends on the decision of local executive bodies.

The only requirement for the accrual day is the condition that funds should not be paid later than the 10th.

Determining the date on which funds will be issued is influenced by:

- regional features;

- number of pensioners served;

- possibilities of the federal budget.

Important! If you change your place of residence inter-regionally, the timing of pension payments may change. The date of its receipt will be set in accordance with the regional schedule.

Shifting the date of pension payments

The date of receipt of money may be adjusted if it falls on holidays or weekends. In this case, the money is always paid before the due date.

The maximum schedule shift is possible by no more than 3 days. This optimal, established limit for early payment of pensions is most often used when changing the schedule in Moscow.

How do different methods of receiving a pension affect the timing?

Many people are interested in the dates by which money is paid to pensioners when they receive it in various ways.

The following options for receiving a pension are available:

- at the post office: issuance is made directly at the post office or the money is delivered home by the postman. The payment schedule is established by Russian Post. The same organization reports changes to the schedule due to holidays;

- Bank branches: money can be received any day. Payments are received by the 15th of each month. It is possible to use a storage system;

- organizations: the payment schedule is similar to Russian Post.

If the pensioner was unable to receive accruals on time, this can be done later.

Deadlines

The period for delivery of pensions is determined personally by the postal or delivery organization, while control over the implementation of timely payments is carried out by the Pension Fund. The beginning of such a period is set no earlier than the 3rd day of the current calendar month. The payment schedule is provided to the pensioner in the organization of his choice.

If delivery falls on an official holiday or day off, it will be postponed, but payment can be made no earlier than 3 days before the scheduled delivery date. According to Article 26 of Federal Law No. 400-FZ, delivery of pensions can be made at any time within the payment period, but not before or after it.

The fact of delivery is certified by the personal signature of the insured person or his representative (guardian) in case of incapacity of the person.

Answers to frequently asked questions

Can a pension be assigned earlier than the day when a citizen first applied to the Pension Fund? When do you receive the first amount of money in case of loss of a breadwinner?

Yes, this option is provided for by law. This type of appointment is possible in the following cases:

- when applying for an old-age labor pension: when applying for payment no later than 30 days from the date of dismissal. The date of accrual will be considered the next day after the date of dismissal;

- calculation of disability pension payments: after official recognition of the fact of disability, a citizen must contact the Pension Fund office within 12 months in order for the first payment to be assigned to him. In this case, the date of registration of disability will be recognized as the day of accrual.

If a pension payment is assigned due to the loss of a breadwinner, the date of assignment will be the day of death of the breadwinner, provided that the application is made no later than 12 months after the right to this payment arises.

I retired in December, when I will receive my first pension if I quit on December 10, and submitted the application on January 4. What number will be considered the accrual date?

Your documents will be verified by January 14th. The data will then be entered into an electronic database. You will receive a notice of the need to appear at the Pension Fund, where the date for payment of the money will be agreed upon. The accrual date will be December 11. You can receive money for December depending on the schedule: in February or March. If funds are disbursed in March, then you will be able to receive two pensions at once - for December and January.

When applying for a disability pension, which month is considered the first to start accruals?

The first month is considered to be the month of official recognition of a citizen as disabled, regardless of the date of submission of the application to the territorial office of the Pension Fund. In this case, a time limit for submitting documents is set - no more than 1 year.

Cumulative

The principle of forming savings is based on the amount of your contributions to the fund and income from their investment. If you were born after 1967 and before the end of 2020 you made your choice in favor of this particular type of pension, then the formation process will begin. For citizens born in 1966 and older, contributions are made on a voluntary basis.

Regardless of whether you refuse a funded pension or opt for it, your savings will not go away. As soon as you receive the right to a well-deserved rest, the funded part will be paid to you (from the moment you submit your application).