How much have payments to parents of disabled children increased?

I am caring for my disabled child and have heard that the care allowance will be increased for such parents. When will this happen and where should I go?

I. Samsonova, Krasnoyarsk region

– From July 1, 2020, the Pension Fund will begin providing increased monthly payments to non-working parents and guardians of disabled children and people with disabilities from childhood of the first group. The size of the payment will be almost doubled, from the current 5.5 thousand to 10 thousand rubles. For citizens living in the Far North and equivalent areas, the amount of monthly payments increases by the corresponding regional coefficient.

In this case, the increased payment will be automatically established for all caregivers and will not require them to apply to the Pension Fund.

What will SNILS be like?

They say that paper SNILS has been cancelled. So now the green card is no longer valid?

N. Nazarov, Kostroma

– According to the amendments that were made to the law on personalized accounting, information about SNILS will be provided in the form of an electronic or paper notification. It will include all the information that is reflected in the insurance certificate: the person’s last name, first name and patronymic, date and place of birth, gender and SNILS itself. A paper version of the notification will be available from the customer service or the management of the Russian Pension Fund, as well as from the MFC. The electronic notification will always be available in your Personal Account.

All previously issued insurance certificates will continue to be valid; there is no need to surrender or change the document. However, if the insurance certificate is lost or damaged, it can no longer be restored or exchanged. Instead, insured persons will receive notifications of a new type.

What is the Personal Account capable of?

A colleague received a statement from the MFC about the number of pension coefficients she earned over all the years of her work. Honestly, I don’t have time to go to the Pension Fund or MFC. Can I find out the same on the Internet?

N. Khokhlov, Tver

- Of course yes. You can receive an extract on the status of your individual personal account through your Personal Account on the Pension Fund website. Every participant in the compulsory pension insurance system has it. But, since the Personal Account contains personal data, the protection of which is required by law, access to it is possible only after registration in the Unified Identification and Authorization System (USIA). You need to register and get a confirmed account on the government services portal gosuslugi.ru. If you are already registered on the portal, use your login and password to log into your Personal Account on the Pension Fund website.

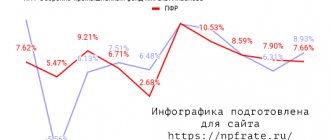

Today you can access over 60 electronic services through your Personal Account: apply for a pension, a number of social benefits, change the method of pension delivery, register maternity capital, calculate your future pension and much more (see infographics).

Every year more and more people discover the possibilities of the Pension Fund’s electronic account, its audience is constantly growing. The PFR application for smartphones, which provides access to a number of Personal Account services, is also becoming more popular. Over the past year, the application was installed by 405 thousand people – 55% more than the year before.

In April my second child was born. I am registered in Ivanovo, but live in Moscow. Where should I go to receive payments from maternity capital?

E. Shchukina, Moscow

– In May 2020, the extraterritorial principle of filing an application was legislated. This means that you can apply for a monthly payment for your second child from maternity capital funds at any client service or Pension Fund office, regardless of your place of residence. Registration, regardless of the place of registration of the certificate holder, has also been launched through the Personal Account on the Pension Fund website.

We remind you: families in which a second child was born in the family after January 1, 2020 are eligible to receive a monthly cash payment. The payment is provided until the child reaches 1.5 years of age.

You can submit an application at any time within 1.5 years from the birth of your second child. If you contact the Pension Fund in the first six months, the payment will be provided from the date of birth or adoption, and the family will receive funds for all past months. If you apply later than 6 months, payment is provided from the date of application. By the way, in 2020 and the first two months of 2020, the Pension Fund of the Russian Federation accepted 55.6 thousand applications for monthly payments and sent 3.7 billion rubles to families.

They say that the rules for calculating family income when assigning payments from maternal capital have changed. What exactly has changed?

I. Golubeva, Tomsk

– A bill is ready according to which families with an average per capita income below 2 subsistence levels per person will receive a monthly payment from maternity capital. The changes should take effect from January 1, 2020. President Vladimir Putin gave this instruction in his message to the Federal Assembly.

Until the end of 2020, the same rules apply: families are entitled to a monthly payment if the income per family member does not exceed 1.5 times the subsistence minimum.

There is a calculator on the PFR website that allows you to determine a family’s right to a payment and find out its size in a specific region.

Photo: Shutterstock.com

Insurance premiums

The Pension Fund of the Russian Federation operates thanks to national payments, which are considered its income. This serves as the basis for opening a large number of branches. Special contributions and taxes occupy an important place. Their size is established by law.

Benefits are considered the largest expense. This amount is so large that the management of an organization often raises the question of where to get the money. The main income is insurance premiums. Every month, employers transfer specific amounts determined from wages.

The Pension Fund is an organization that still collects payments, even if they are not paid voluntarily. In these cases, penalties accrued for 1 day of delay are also charged. If the payer’s property was rented based on a court decision or financial transactions were suspended, the Pension Fund only then submits a request for the transfer of money. No penalty will be charged during this time.

Difference between Pension Fund and Non-State Pension Fund

NPF is a non-state pension fund. The task of a non-state pension fund is to accumulate funds in the taxpayer’s account. Savings can be made by the employer monthly or by the person himself at a selected frequency. NPFs approach each client individually and offer additional pension accumulation programs. When a non-state pension fund is closed or for any other reason, funds can be transferred to the account of another non-state fund.

The basis for the formation of savings is the official salary - the rule applies to all funds, including the state one.

Not the entire amount transferred goes to the account; part of the contributions goes to provide pensions for those who receive it now. You can manage the funds only after retirement.

Registration of pensions

When retirement age approaches, a citizen must contact the territorial branch of the Pension Fund of the Russian Federation. Employees will make a calculation based on the amount of contributions that are in their personal account. State-approved surcharges are also taken into account.

Since the money has been accumulated for many years, an adjustment is made based on the level of depreciation. The result is the amount of the pension of a particular citizen. Then a pension document and payment instructions for disbursement of funds are created.

The Pension Fund periodically operates different programs. One of them is co-financing. It is valid for 10 years. Citizens are invited to independently invest 12,000 rubles into their funded pension. The same amount is added by the state. In 10 years, it turns out to collect 240,000 rubles, and increase the savings portion by 1,111 rubles. There may be other types of programs, you just need to participate in them.

How to find out your pension savings using SNILS

- The pension was divided into two parts – insurance and funded.

- It has become possible to invest not only in state pension funds, but also in alternative pension funds.

- Funds for pensioners who continue to work are accounted for as a separate item.

IMPORTANT! Information about the funded share of the pension, if it is placed in a non-state pension fund, will not be reflected on the government services portal. Requests for information of interest should only be made on the relevant official websites of certain NPFs.

Other types of work

The main task of the fund is to pay payments to citizens who have the right to do so based on current legislation. In addition, the institution works with issues of providing maternity capital.

A decrease in the birth rate leads to a decrease in the number of working-age population, and this becomes the reason for the insufficient filling of the RF Pension Fund. This is due to citizens receiving unofficial salaries. Because of this, the government is increasing insurance premiums for enterprises.

What is the difference between Pension Fund and Non-State Pension Fund?

The funds that the Pension Fund of the Russian Federation accumulates are in state ownership, but are not part of budgets or other funds and are not subject to withdrawal (clause 2 of the Resolution of the Armed Forces of the Russian Federation dated December 27, 1991 N 2122-1). The expenditure of these funds, with the exception of contributions to the funded part of the pension, is associated only with financing pension payments and the activities of the Pension Fund (see Article 18 of the Law “On Compulsory Insurance”). When assigning pensions, the distribution principle applies, and contributions to the funded part of the Pension Fund can be invested (information about this is disclosed in accordance with Order of the Ministry of Finance of Russia dated August 22, 2005 No. 107 n).

From funds received by non-state pension funds, pension reserves and pension savings are formed (Article 18 of the Law “On Non-State Pension Funds”), which can be invested either by the funds themselves or with the involvement of licensed management companies. Such activities of NPFs are carried out solely for the purpose of preserving and increasing funds in the interests of citizens (clause 2 of Article 25 of the Law “On NPFs”). By concluding an agreement with a non-state pension fund, a citizen can stipulate in advance the amount of a future pension and, if there are pension grounds, receive its amount immediately or in installments. The charter of a non-state pension fund must specify the maximum share of the fund from income received through investment of funds (clause 3, clause 2, article 6 of the Law).

Pension reserves and savings are formed from contributions, funds transferred from the Pension Fund of the Russian Federation to a non-state pension fund at the request of the insured person, and other funds, including investments. The receipt of funds from pension reserves and pension savings, the results of their investment, the accrual of income and other payments are reflected in the non-state pension provision pension account and the funded pension account, respectively. NPFs do not have the right to disseminate information about government approval of the fund’s activities (Clause 3, Article 35.3 of the Law “On NPFs”).

What does Pension Fund mean for older people?

How should the Russian Pension Fund work? The Pension Fund is considered an independent organization. The institution must transfer insurance premiums and finance people who require social protection. His duty is to collect funds from citizens guilty of causing damage to colleagues and other people of the country.

When a person is injured and cannot work, the fund must pay a pension. In addition, Pension Fund employees must monitor the timely receipt of insurance premiums, as well as their proper expenditure.

What is OPS

The PFR budget and the report on its execution are reviewed annually by the State Duma of the Federal Assembly of the Russian Federation. The management of the Pension Fund of the Russian Federation is carried out by its board and a permanent executive body - the executive directorate. There are authorized Pension Funds in districts and cities. To monitor the activities of the executive directorate and its regional bodies, an audit commission of the Pension Fund of Russia is formed. The sources of formation of the Pension Fund are: insurance contributions of employers and citizens; allocations from the federal budget of the Russian Federation allocated for the payment of pensions and benefits and equivalent payments to military personnel and their families, as well as for the payment of pensions, benefits and compensation to citizens affected by the Chernobyl disaster; funds reimbursed to the Pension Fund by the State Employment Fund of the Russian Federation in connection with the appointment of early pensions to the unemployed; funds collected from employers and citizens as a result of filing recourse claims; voluntary contributions and other income. The amount of insurance contributions paid by employers to the Pension Fund of the Russian Federation is determined annually upon submission of the Fund's board by representative bodies of government. Pension Fund funds are spent on the payment of state pensions, childcare benefits for children over the age of one and a half years, provision of material assistance by social protection bodies to elderly and disabled citizens, financial, logistical support for the current activities of the Pension Fund and its bodies, and for other activities. L. I. Bulgakova

Rate the definition:

Pension Fund of the Russian Federation

PFR) is a financial and credit institution that carries out state management of the finances of compulsory pension insurance and carries out certain banking operations in the manner prescribed by law. Its main tasks are: ensuring, together with the tax authorities, targeted collection and accumulation of insurance contributions (part of the unified social tax); organizing and maintaining individual (personalized) records of insured persons in the compulsory pension insurance system; exercising, together with the tax authorities, control over the completeness of incoming insurance contributions from employers and the correctness of their spending, etc. The territorial bodies of the Pension Fund of the Russian Federation also carry out the functions of assigning, recalculating, paying and delivering pensions to recipients. Pension Fund funds are generated from insurance contributions (part of the unified social tax) of the following insurers: 1) from among persons making payments to individuals (including organizations; individual entrepreneurs; individuals not recognized as individual entrepreneurs); 2) individual entrepreneurs, lawyers; 3) individuals who voluntarily enter into legal relations under compulsory pension insurance (they are equal to policyholders). Each category of insurers has its own insurance premium rates. The amount of insurance contributions to the Pension Fund is differentiated depending on the group of policyholders and the level of income (tax base) for each employee. With a tax base for each individual employee born in 1966 and older up to 280 thousand rubles. (cumulatively from the beginning of the year) 14.0% is allocated to finance the insurance part of the labor pension. For persons born in 1967 and younger, this rate is “split” into 2 parts: 8.0% goes to finance the insurance part of the labor pension, and 6.0% goes to the funded part of the labor pension. With higher earnings, the insurance premium rate is reduced, i.e. a regressive scale is used. For insurers acting as employers, organizations engaged in the production of agricultural products, tribal, family communities of small peoples of the North engaged in traditional economic sectors, and peasant (farm) farms, a reduced amount of insurance premiums has been established. The funds of the Pension Fund of the Russian Federation are in the state ownership of the Russian Federation, are not included in the budgets and are not subject to withdrawal. Financing of employees of the civil service system and equivalent categories of workers, as well as social pensions, is carried out from the state budget. In the course of its activities, the Pension Fund interacts with the federal treasury, tax and other authorities.

Rate the definition:

Structure

The main department of the fund is the Board. It includes the main functional body – the Executive Directorate. The latter carries out work with the rest of the branches that exist throughout the country. These also include administrative-territorial and state entities. They are located in areas.

The Russian Pension Fund Administration consists of city and district structures. They collect insurance money, work on regional programs, and monitor funds. They are the ones who interact with citizens. In addition to the Pension Fund of the Russian Federation, the Ministry of Communications and Labor works on pension issues. The organization carries out the assignment, redistribution and delivery of funds for payments.

The Board generates reports on tasks, budgets, and expenses. It operates on the basis of legislation, as well as the adopted budget. The head of the Pension Fund is Anton Drozdov. He is recognized as an Honored Worker of the Russian Federation.

WHAT YOU NEED TO KNOW ABOUT THE NEW PENSION LAW

The legal regime of the Pension Fund is determined by its Regulations. The funds of the fund are state property, are not included in the budgets and are not subject to withdrawal. The PFR budget and the report on its execution are reviewed annually by the State Duma of the Federal Assembly of the Russian Federation. The management of the Pension Fund of the Russian Federation is carried out by its board and a permanent executive body - the executive directorate. There are authorized Pension Funds in districts and cities. To monitor the activities of the executive directorate and its regional bodies, an audit commission of the Pension Fund of Russia is formed. The sources of formation of the Pension Fund are: insurance contributions of employers and citizens; allocations from the federal budget of the Russian Federation allocated for the payment of pensions and benefits and equivalent payments to military personnel and their families, as well as for the payment of pensions, benefits and compensation to citizens affected by the Chernobyl disaster; funds reimbursed to the Pension Fund by the State Employment Fund of the Russian Federation in connection with the appointment of early pensions to the unemployed; funds collected from employers and citizens as a result of filing recourse claims; voluntary contributions and other income. The amount of insurance contributions paid by employers to the Pension Fund of the Russian Federation is determined annually upon submission of the Fund's board by representative bodies of government. Pension Fund funds are spent on the payment of state pensions, childcare benefits for children over the age of one and a half years, provision of material assistance by social protection bodies to elderly and disabled citizens, financial, logistical support for the current activities of the Pension Fund and its bodies, and for other activities. L. I. Bulgakova

Rate the definition:

Pension Fund of the Russian Federation

PFR) is a financial and credit institution that carries out state management of the finances of compulsory pension insurance and carries out certain banking operations in the manner prescribed by law. Its main tasks are: ensuring, together with the tax authorities, targeted collection and accumulation of insurance contributions (part of the unified social tax); organizing and maintaining individual (personalized) records of insured persons in the compulsory pension insurance system; exercising, together with the tax authorities, control over the completeness of incoming insurance contributions from employers and the correctness of their spending, etc. The territorial bodies of the Pension Fund of the Russian Federation also carry out the functions of assigning, recalculating, paying and delivering pensions to recipients. Pension Fund funds are generated from insurance contributions (part of the unified social tax) of the following insurers: 1) from among persons making payments to individuals (including organizations; individual entrepreneurs; individuals not recognized as individual entrepreneurs); 2) individual entrepreneurs, lawyers; 3) individuals who voluntarily enter into legal relations under compulsory pension insurance (they are equal to policyholders). Each category of insurers has its own insurance premium rates. The amount of insurance contributions to the Pension Fund is differentiated depending on the group of policyholders and the level of income (tax base) for each employee. With a tax base for each individual employee born in 1966 and older up to 280 thousand rubles. (cumulatively from the beginning of the year) 14.0% is allocated to finance the insurance part of the labor pension. For persons born in 1967 and younger, this rate is “split” into 2 parts: 8.0% goes to finance the insurance part of the labor pension, and 6.0% goes to the funded part of the labor pension. With higher earnings, the insurance premium rate is reduced, i.e. a regressive scale is used. For insurers acting as employers, organizations engaged in the production of agricultural products, tribal, family communities of small peoples of the North engaged in traditional economic sectors, and peasant (farm) farms, a reduced amount of insurance premiums has been established. The funds of the Pension Fund of the Russian Federation are in the state ownership of the Russian Federation, are not included in the budgets and are not subject to withdrawal. Financing of employees of the civil service system and equivalent categories of workers, as well as social pensions, is carried out from the state budget. In the course of its activities, the Pension Fund interacts with the federal treasury, tax and other authorities.

Rate the definition:

Fund problems

Due to the 2008 crisis, the fund stopped some payments. To eliminate such problems, several measures have been used. Although it was possible to make up for the lack of funds, the same problem appeared in 2009. In 2010-2011 the same thing was observed.

Each branch of the Russian Pension Fund worked to overcome the crisis. As the number of people who need to pay benefits increases, the imbalance in the work of the organization’s branches causes the situation to worsen.

To neutralize problems, the state increases the amount of funds transferred to the Pension Fund. Work with the tax and contribution collection services has been strengthened. Since 2010, insurance principles relating to the payment of social funds have been in force. Instead of a single tax, special payments began to be paid. This made it possible to restore the work of the fund and improve efficiency.

Pension Fund structure

According to the established legislation of Russia, the Pension Fund of Russia is not only a simple government institution, but is also endowed with certain public authorities. In addition, the Pension Fund has been granted special legal capacity, which distinguishes this fund from other state and budgetary organizations.

The Pension Fund has a multi-level system, which is centralized and has the following hierarchical sequence:

- The federal level, extending its powers completely to the entire system.

- Management in federal districts can influence the structure only within its district, which unites several constituent entities of the country.

- Territorial branches within districts at the level of constituent entities of the Russian Federation have powers that extend only to a given region.

- The local level represents management on the territory of one locality.

Accountability of this hierarchy is carried out from lower to higher authorities. The highest body is the Board of the Pension Fund with its executive body. In the regions, branches operate legally independently within the limits of the individual tasks assigned to them. The main ones are:

- calculation of pension benefits;

- assignment of payments;

- centralization of local government activities.

Local administrations located in cities are assigned only the functions of calculating and paying pensions.

Supreme board

Since the system is hierarchical, all the most important functions are performed by the board itself, located at the federal level. Their main functions include the following:

- Solve current problems for the development of the pension system, and also outlines further development plans.

- Approves the annual budget and also confirms it with estimated estimates.

- Approves the number of staff and the structure of its divisions in order to optimize the budget.

- Appoints and removes the sole executive body of the Pension Fund, deputies and other main managers.

- Approves the powers of key managers, the directorate, the audit commission, and some other persons.

- Issues various regulations according to its powers.

Directly subordinate to this governing body is the directorate, which is the executive body. It was created to implement the following tasks:

- budget formation, as well as timely control over them;

- compilation of reports and analysis of fund finances;

- operational management and redistribution of funds within regions if necessary;

- accounting.

Thus, thanks to the complex hierarchical system of the Pension Fund, as well as the clearly separated functions of each body, the tasks assigned to the Pension Fund are fully implemented.

The role of pension reform

Today in Russia there is a funded pension system. With its help, it will be possible to regulate the accumulated money that will be given to people in old age. The amount of payments is determined by how long the person worked and whether the employer made payments. Thanks to this, the organization's expenses are reduced.

Funds transferred by the employer do not go towards benefits for pensioners at the moment. The money accumulates, and when the pensioner is unable to work, he will be paid a benefit in the established amount.

The storage system is more convenient than the distribution system. The reason for this is that pension funds are recognized as the property of the individual, not the state. This principle increases the reliability of the system. Thanks to the accumulative principle, the economy is normal, which is an important task of the Pension Fund.

What does IPK mean in a pension fund 108

Accordingly, today, if a citizen received more income in 2020 than in 2020, then the individual pension coefficient (pension point) will be higher. It is also worth considering that there is a special transition period from 2020 to 2025.

This is what we will do. What is the insurance part of a pension? This concept means the conditions for calculating future pension payments. This eliminates the pension equation entirely. And this has a positive effect on her growth.

This is interesting: Compensation for the funeral of a siege survivor in St. Petersburg

Office of the Pension Fund of Moscow

Each subject of the Russian Federation has a territorial Pension Fund. For any questions, citizens should contact the organization at their place of residence. There is more than one PFR office in Moscow; each of the institutions helps residents of the capital and region resolve all issues that arise.

The main branch is located on Tverskoy Boulevard, building 18. The work schedule is as follows:

- 9:00 – 17:45 daily, except Friday;

- break: 12.30 – 13.00.

In addition to the main institution, there are other Moscow branches of the Pension Fund of Russia that are open to receive citizens. As you can see, the structure of the Pension Fund is not so complicated. An important aspect of the organization’s work is how honestly citizens pay their dues. If there is a white salary, then the funds are transferred to the country’s budget regularly. It must be remembered that the fund works to protect the interests of citizens of the Russian Federation.

In addition to state funds, there are now non-state funds. Each of them offers its own programs. Before joining any, you must read the terms and conditions. Funds operate on the basis of contracts.

Meaning of "pension fund"

- Explanatory You can find the meaning of a word in the explanatory dictionary of the Russian language. Each explanatory “article” of the interpreter interprets the required concept in the native language and examines its use in the content. (PS: You will read even more cases of word usage, but without explanation, in the National Corpus of the Russian Language. This is the most voluminous database of written and oral texts of native speech.) Authored by V.I. Dahl, S.I. Ozhegov, D.N. Ushakov . The most famous thesauruses with interpretation of semantics in our country have been released. Their only drawback is that the publications are old, so the vocabulary is not updated.

- Encyclopedic Unlike explanatory ones, academic and encyclopedic online dictionaries provide a more complete, detailed explanation of the meaning. Large encyclopedic publications contain information about historical events, personalities, cultural aspects, and artifacts. Encyclopedia articles tell about the realities of the past and broaden one’s horizons. They can be universal or thematic, designed for a specific audience of users. For example, “Lexicon of Financial Terms”, “Encyclopedia of Home Economics”, “Philosophy. Encyclopedic glossary", "Encyclopedia of fashion and clothing", multilingual universal online encyclopedia "Wikipedia".

- Industry-specific These glossaries are intended for specialists in a specific profile. Their goal is to explain professional terms, the explanatory meaning of specific concepts in a narrow sphere, branches of science, business, and industry. They are published in the format of a dictionary, terminology reference book or scientific reference guide (“Thesaurus on advertising, marketing and PR”, “Legal reference book”, “Terminology of the Ministry of Emergency Situations”).

- Etymological and borrowings The Etymological Dictionary is a linguistic encyclopedia. In it you will read versions of the origin of lexical meanings, from what the word was formed (original, borrowed), its morphemic composition, semasiology, time of appearance, historical changes, analysis. The lexicographer will determine where the vocabulary was borrowed from, consider subsequent semantic enrichments in the group of related word forms, as well as the scope of functioning. Will give options for use in conversation. As an example, an etymological and lexical analysis of the concept of “surname”: borrowed from Latin (familia), where it meant family nest, family, household members. Since the 18th century it has been used as a second personal name (inherited). Included in the active vocabulary. The etymological dictionary also explains the origin of the subtext of catchphrases and phraseological units. Let's comment on the stable expression “genuine truth”. It is interpreted as the real truth, the absolute truth. Believe it or not, etymological analysis revealed that this idiom originates from a method of medieval torture. The defendant was beaten with a whip with a knot tied at the end, which was called a “line.” Under the line, the man revealed everything frankly, the real truth.

- Glossaries of obsolete vocabulary How do archaisms differ from historicisms? Some items consistently fall out of use. And then lexical definitions of units fall out of use. Words that describe phenomena and objects that have disappeared from life are classified as historicisms. Examples of historicisms: camisole, musket, king, khan, baklushi, political instructor, clerk, purse, kokoshnik, Chaldean, volost and others. You can find out what the meaning of words that are no longer used in oral speech is from collections of outdated phrases. Archaisms are words that have retained the essence by changing the terminology: piit - poet, brow - forehead, tselkovy - ruble, overseas - foreign, fortecia - fortress, zemsky - national, tsvibak - sponge cake, cookies. In other words, they were replaced by synonyms that are more relevant in modern reality. This category includes Old Church Slavonicisms - vocabulary from Old Church Slavonic, close to Russian: grad (starosl.) - city (Russian), child - child, gate - gate, fingers - fingers, mouth - lips, dragging - dragging feet. Archaisms are found in the circulation of writers, poets, and in pseudo-historical and fantasy films.

- Translation, foreign Bilingual dictionaries for translating texts and words from one language to another. English-Russian, Spanish, German, French and others.

- Phraseological collection Phraseological units are lexically stable phrases, with an indivisible structure and a certain subtext. These include sayings, proverbs, idioms, catchphrases, and aphorisms. Some phrases migrated from legends and myths. They give the literary style artistic expressiveness. Phraseological phrases are usually used in a figurative sense. Replacing any component, rearranging or breaking a phrase leads to a speech error, unrecognized subtext of a phrase, and distortion of the essence when translated into other languages. Find the figurative meaning of such expressions in a phraseological dictionary. Examples of phraseological units: “In seventh heaven”, “A mosquito won’t spoil your nose”, “Blue blood”, “Devil’s Advocate”, “Burn bridges”, “An open secret”, “As if I was looking into water”, “To throw dust in my eyes”, “Work carelessly”, “Sword of Damocles”, “Gifts of the Danaans”, “Double-edged sword”, “Apple of discord”, “Warm up your hands”, “Sisyphean labor”, “Climb the wall”, “Keep your eyes open”, “Throwing pearls before swine”, “With a gulkin’s nose”, “Shot sparrow”, “Augean stables”, “Caliph for an hour”, “Puzzling”, “Doting your soul”, “Flapping your ears”, “Achilles’ heel”, “Eate the dog”, “Like water off a duck’s back”, “Grab at a straw”, “Build castles in the air”, “Be on trend”, “Live like cheese in butter”.

- Definition of neologisms Language changes are stimulated by dynamic life. Humanity strives for development, simplification of life, innovation, and this contributes to the emergence of new things and technology. Neologisms are lexical expressions of unfamiliar objects, new realities in people’s lives, emerging concepts and phenomena. For example, what does “barista” mean? This is the profession of a coffee maker; A coffee professional who understands the varieties of coffee beans knows how to beautifully decorate steaming cups of drink before serving to the client. Every little word was once a neologism until it became commonly used and entered the active vocabulary of the general literary language. Many of them disappear without even being actively used. Neologisms can be word-forming, that is, completely newly formed (including from Anglicisms), and semantic. Semantic neologisms include already known lexical concepts endowed with fresh content, for example, “pirate” is not only a sea corsair, but also a copyright infringer, a user of torrent resources. Here are just some cases of word-forming neologisms: life hack, meme, google, flash mob, casting director, pre-production, copywriting, friending, PR, moneymaker, screenshot, freelancing, headliner, blogger, downshifting, fake, brandalism. Another option is that a “copymaster” is the owner of the content or an ardent supporter of intellectual rights.

- Other 177+ In addition to those listed, there are thesauri: linguistic, in various areas of linguistics; dialectal; linguistic and cultural studies; grammatical; linguistic terms; eponyms; abbreviations; tourist vocabulary; slang. Schoolchildren will find useful lexical dictionaries with synonyms, antonyms, homonyms, paronyms and educational dictionaries: spelling, punctuation, word-formation, morphemic. Orthoepic reference book for setting stress and correct literary pronunciation (phonetics). Toponymic dictionaries-directories contain geographical information by region and names. In anthroponymics - data about proper names, surnames, nicknames.

This is interesting: List of honorary lawyers of the Russian Federation

It is easier to express yourself, to express thoughts specifically and more succinctly, to enliven your speech - all this is possible with an expanded vocabulary. With the help of the How to all resource, you will determine the meaning of words online, select related synonyms and expand your vocabulary. The last point can be easily completed by reading fiction. You will become a more erudite, interesting conversationalist and support conversations on a variety of topics. To warm up the internal generator of ideas, it will be useful for literati and writers to find out what words mean, say, from the Middle Ages or from a philosophical glossary.