At what age do miners in Russia retire?

Employment in underground and open-pit mining is one of the types of activities that are included in the lists of work with harmful and dangerous working conditions by the current legislation of the Russian Federation. This fact guarantees employees of this type of employment access to pension benefits on preferential terms. In accordance with Federal Law No. 400 , Government Decree No. 665 and other regulatory legal acts of the Russian Federation, pensions are assigned to miners until they reach the generally established retirement age. Payments are based on the duration of work under difficult conditions. The provisions of Article 30 of Federal Law No. 400 establish that preferential insurance benefits are assigned to persons upon reaching 45 and 50 years of age for women and men, respectively.

Conditions of appointment

According to the provisions of these legal acts, a miner's pension in Russia can be accrued:

1. With full-time employment in underground and open-pit mining (coal, ore mining, etc.), regardless of age, provided that you have:

- no less than 25 years of work experience;

- individual pension coefficients. This figure is increasing every year; for the current year it is 13.8.

For workers in leading professions (miners, machinists, etc.), the indicator of duration of work, in accordance with the law, can be reduced to 20 years;

2. Upon reaching 45 and 50 years of age (for women and men, respectively) and if the person has been employed in jobs with hazardous working conditions for at least 10 and 7.5 years, as well as 20 and 15 years (for men and women, respectively ) general insurance experience.

Why in the Republic of Kazakhstan ex-customs officers retire at 48 years old, and miners at 63 years old

As is known, in June of this year in Kazakhstan, the Ministry of Finance adopted a resolution according to which former customs officers were equated to military personnel and the law was given retroactive force. Thus, all customs officers who transferred to the economic investigation service of the Ministry of Finance, as well as former customs officers who have already been dismissed from the SER, can retire to a well-deserved pension upon reaching the age of 48.

Let us remind you that this event was preceded by a small “battle” between former customs officers and the Ministry of Finance. This issue was raised at the minister’s reporting meeting with the population, trials were held, then there was an action with a poster “Ministry of Finance, return your well-deserved pension.” And the Ministry of Finance returned it. As Alikhan Smailov, who has now moved to the post of Deputy Prime Minister, previously stated when he was head of the Ministry of Finance, there are more than five thousand people in the customs authorities.

“Then they will all have to make payments based on length of service, which will require more than 10 billion tenge,” reported Alikhan Smailov. As is known, former customs officials who transferred to the SER belong to the Ministry of Finance division. Thus, they went to meet “their own people” halfway.

However, the Ministry of Finance is not the only government agency that is worried about its employees. Just last week, the Ministry of Foreign Affairs initiated changes to the law on the diplomatic service. According to the innovations, veterans of the diplomatic service of the Republic of Kazakhstan who held the position of Ambassador Extraordinary and Plenipotentiary of Kazakhstan, permanent (plenipotentiary) representative of the Republic of Kazakhstan to an international organization, or having the diplomatic rank of Ambassador Extraordinary and Plenipotentiary, with a total work experience of at least 25 years, including 15 years of work in the diplomatic service bodies of the Republic of Kazakhstan, a monthly monetary payment is paid in the manner and amount determined by the government of the Republic of Kazakhstan.

Meanwhile, besides customs officers and diplomats, there are a lot of professions that are left behind in terms of early retirement. For example, every year on the eve of Miners' Day, the industry trade union of coal industry workers raises the issue of revising the rules for the retirement of workers in this industry. If customs officers and diplomats are white-collar workers and they were met halfway, it is puzzling why such a step is not taken towards miners and miners, who literally do not see the white light.

At the same time, for example, in neighboring Russia there is a list of industries, jobs, professions and indicators in underground work, in work with particularly harmful and difficult working conditions, employment in which gives the right to an old-age pension on preferential terms.

Thus, the list lists vacancies with so-called hazardous working conditions (this means that factors in the working environment, such as radiation, noise, waste, chemical reactions, have a negative impact on the human body). A total of 24 industries are included, mainly related to the mining and manufacturing industries. Thus, men employed in the industry retire at 50, women at 45.

It turns out that Russian colleagues of Kazakh miners retire at 50, Kazakhs work in mines until they are 63, and soon, with the retirement age raised, they will work until they are 65, that is, the difference will be as much as 15 years.

It is worth recalling that the list of professions eligible for early retirement was compiled in Soviet times according to scientific medical data, according to which 50 years is the upper limit for working in conditions hazardous to health. Since gaining independence, the Kazakh Ministry of Health has already confirmed these data. However, this did not change the situation - officials believe that miners are healthy enough to engage in heavy physical labor until they are 63 years old.

Will a wave follow the miners?

The Kazakh government is afraid to raise the issue of early retirement of workers who work in conditions dangerous to life and health. However, if they went to meet some people halfway, then why don’t they go to others? It turns out that officials believe that the early retirement of customs officers will not lead to a wave of discontent among representatives of other professions, but the exit of miners will certainly raise a wave of indignation.

Meanwhile, if we use numbers, then during the collapse of the Soviet Union, according to the trade union, over 200 thousand people worked in the coal industry of Kazakhstan. Currently, their number has decreased by 10 times. Today, the industry employs 29 thousand people with all the mines, plants, factories and open pits in the coal industry. Not all of them can qualify for early retirement - from them it is necessary to isolate only miners who work directly underground, and open-pit mining workers who work at depth in open pits. Thus, it turns out to be less than 20 thousand people. It can be assumed that this number is not so catastrophic that their early retirement will hit the budget hard. In addition, if you believe official data, the Unified Pension Fund has accumulated 11 trillion in pension contributions; surely, the retirement of a small number of miners will not ruin the pension fund. If we draw an analogy with former customs officials, of whom there are five thousand people and it took 10 billion tenge to ensure their early retirement, then in order to send 20 thousand miners to retire, 40 billion tenge will be required. This is only 0.0036% of the existing 11 trillion pension savings.

According to the Statistics Committee, the number of victims of work-related accidents, including deaths, in 2020 (latest data) in Kazakhstan amounted to 2,160 people, of which the first place is occupied by the Karaganda region - 430 cases and East Kazakhstan region - 282. Let us note that most of Kazakhstan's mines and mines are concentrated in these two regions.

According to official data, the average life expectancy of men in the Republic of Kazakhstan is 63.2 years, which is not much longer than the required retirement age - 63 years. Thus, the state gives the right to live in retirement for a short time, but for the majority of miners and miners, retirement at 63 is synonymous with “never.” Nobody keeps official statistics on how much the miners' survival rate to retirement is. However, given that the average Kazakh man does not live to see retirement, this figure is about 40%. Those who survive, unfortunately, do not live long in retirement - a year or two; the ever-increasing retirement age does not allow them to live longer. Hence the question: why can ex-customs officers, diplomats and military personnel theoretically live 15 years in retirement, while miners, with equally hard and dangerous work, are forced to work these 15 years and theoretically not live to see retirement?

Mayra Medeubaeva

Subscribe to our Telegram channel!

Tags:

pension Customs officers Miners Work customs officers economics SER Ministry of Finance of the Republic of Kazakhstan Work experience working conditions retirement early retirement

Watch and read inbusiness.kz on Telegram

Who made the 700 list?

02 September 2020 14:55 1596

Yesterday's message from the President of Kazakhstan to the people sparked discussions in the Kazakh Facebook segment. The issue of using pension savings for the purchase of housing, treatment, or transfer to financial companies for management has generated heated debate. Economic commentator Sergei Domnin shared his opinion.

“It seems to me that the mission of the pension system and, accordingly, any reforms associated with it, should remain “reducing the risk of poverty in old age...”. Early withdrawals from accumulated mandatory pension contributions for any purpose, in my opinion, contradict the fulfillment of this mission,” wrote economist and managing partner of Tengri Partners Anuar Ushbaev on his Facebook page, which caused a heated discussion among Internet users.

Some supported him, others, on the contrary, stated that “you need to live today, not tomorrow,” and therefore it is better to use your accumulated pension money to buy the same home, rather than rely on it in old age.

Our regular economic observer Sergei Domnin shared his vision on this issue.

The country's president said that 700 thousand Kazakhstanis will be able to use pension savings for housing and treatment from 2021. This caused a mixed reaction among Kazakhstanis. How do you evaluate this idea?

The three main problems of the Kazakh pension system, which are recorded from expert reports and statements, media publications and public responses on social networks, are as follows.

Firstly, there is a crisis of confidence in the pension system after multibillion-dollar write-offs and corruption scandals in recent years. People do not believe that their money is managed by professionals, that these professionals work ethically, and that clearly structured work procedures are built in such a way that they exclude corruption and moral hazard.

Secondly, the low return on assets of the pension system. For example, at the end of 2020, the investment income of the UAPF was at the level of 6.6%, while the annual consumer inflation in the country was 5.4%. During the same period, the base rate was at 9.0%, and deposit rates for deposits for a period of more than one month were above 9.0%. That is, even on a tenge deposit in a second-tier bank, the depositor would earn more: the real yield is 1.2% versus 3.6%.

Thirdly, and this is an expert opinion, the majority of pension system contributors do not have enough money to provide them with a decent standard of living in retirement. By a decent level, experts usually mean the amount of lifetime payments not lower than the minimum pension. This was precisely the reason for the proposal to impose an additional payment of 5% of an employee’s salary from his employer starting in 2020.

The moratorium on the payment of an additional five percent payment to the UAPF, which Tokayev announced in his first message, in September 2019, in this sense, was the right decision. When your restaurant's food tastes bad, you won't gain much by increasing portions and raising prices. But a mechanism that suggests giving people the opportunity to use a certain part of their pension savings to purchase housing, pay for treatment, or transfer it to private managers does not solve the above-mentioned problems, and even worsens them.

And what is needed so that “the wolves are fed and the sheep are safe”? I mean, how, given the problems of our pension system that you listed above, can you withdraw your pension savings to buy the same home and at the same time ensure a decent standard of living in retirement, which seems a very distant prospect for young people?

To increase trust, we need effective and transparent mechanisms for the work of managers, so that investors are convinced that the profitability is sufficient, it is necessary to give them the opportunity to choose between the most effective investors.

And a high income replacement rate can be achieved with an increase in the income of system participants (and their contributions), the share of this income directed to the Pension Fund, and investment income. It turns out that this is a very strange approach - on the one hand, allowing people to withdraw money, and on the other, expecting an increase in the volume of savings. To provide the population with affordable housing, as is known, a system of housing construction savings is already in place, and, for example, with health care services - compulsory medical insurance.

What can you say about transferring pension funds to financial companies for management?

As for private pension asset managers, this institution is really capable of returning to investors the idea that contributions to the Unified Pension Pension Fund are not a tax, but an investment, but it is precisely with the launch of this mechanism that we have problems.

But since we have problems with the mechanism for implementing this idea of the president, will it be realized? Some Kazakhstanis express the opinion that the proposal to withdraw pension savings for the purchase of housing is connected with the desire to help construction companies, namely to sell expensive apartments, where the price per square meter is very high and is far from the real income of the people?

Indeed, representatives of developers have broadcast this idea several times over the past few months: supposedly, in order to save the real estate market, it is necessary to allow citizens to use part of their pension savings to purchase housing.

Explaining the reasons for this decision in the message, President Tokayev emphasized that this measure “should improve labor relations and create incentives for people to participate in the pension system.” What does labor relations have to do with it, it is not entirely clear, but the incentive for citizens to participate in the pension system is not the opportunity to use pension savings before retirement age, but the confidence that these savings will be saved, invested in reliable assets and will generate a stable income, providing for citizens in retirement decent standard of living.

Above I argued that this mechanism does not solve this problem. Why did the president still decide to choose this path? Probably the fact is that Akorda does not strive to solve key problems (trust in the pension system, stable income, ensuring a decent standard of living in retirement), but to satisfy as many interested parties as possible.

What explains this approach?

Only those who participated in the preparation of this decision or observed this process can answer this question accurately. From the outside it seems that such steps could be dictated by the desire to gain greater support among the population.

But if this explanation is correct, it means that the president’s consultants do not fully understand what is really happening in the country: now is the second year of Tokayev’s presidency, his positions are clearly not in danger, a certain credit of trust has been formed - including for carrying out painful reforms.

Kulpash Konyrova

Subscribe to our Telegram channel!

The Financial Market Regulatory Agency proposes changes to legislation.

24 May 2020 08:00 4409

The Financial Market Regulatory Agency plans to make changes to the legislation on the insurance market. The proposed initiatives are posted on the regulatory and legal acts platform.

One of the issues discussed in the document is changing the sufficient amount of pension savings to conclude a pension annuity agreement. As noted in the changes, currently, in accordance with the law, the amount of the minimum payment for a pension annuity should not be lower than the size of the minimum pension, which from April 1, 2020 is 40,441 tenge. Thus, today the amount of sufficiency for concluding a pension annuity is: for men aged 55 years - 11.3 million tenge, for women aged 51.5 years - 15.5 million tenge.

As stated in the document, the amount of adequacy is determined based on the size of the minimum pension, which, according to statistics, grows independently (political decisions) and often outpaces inflation. Currently, most state social payments are tied to the subsistence level, and only the possibility of transferring money from the Unified Accumulative Pension Fund (USAPF) depends on the size of the minimum pension. As a result, the increase in the minimum pension makes the possibility of concluding pension annuities less accessible for the population.

In this regard, it is proposed to make changes regarding the transition of the calculation from the minimum pension to the subsistence level. In this case, as the developers believe, the minimum sufficiency of pension savings for concluding annuities will decrease by 24% and will be: for men aged 55 years - 9.1 million tenge, for women aged 51.5 years - 12.5 million tenge.

The above transition from the minimum pension to the subsistence level will allow the number of potential policyholders to more than double, according to the agency for regulating the financial market.

Also, in order to expand the line of pension annuity products, it is proposed to introduce joint annuities, implying the participation in the pension annuity agreement of not one person, but a married couple. A joint annuity will allow you to combine the retirement savings of spouses and redistribute income under the annuity agreement. If one spouse does not have enough retirement savings to purchase an annuity from a life insurance company, and the other has a surplus, a joint retirement annuity provides a lifetime benefit for both of them.

Another innovation being discussed is the introduction of deferred annuities. According to the Agency, this will allow investors who have a sufficient amount in the UAPF to conclude a pension annuity to purchase an instrument of lifetime pension payments with indexation, starting at the age of 45 years. In this case, payments under the pension annuity will be made upon reaching the age of 55 years.

It should be noted that, according to the Law “On Pension Provision in the Republic of Kazakhstan”, a separate category of citizens, upon reaching a certain age, subject to the sufficiency of pension savings formed through mandatory pension contributions, can enter into a lifelong pension annuity agreement using these savings in a life insurance company and receive pension benefits payments for life, i.e. as long as the person is alive. The amount of the insurance (annuity) payment is determined in accordance with the requirements of the methodology of the National Bank of the Republic of Kazakhstan and is paid monthly throughout the client’s life. In this case, the amount of the annuity payment cannot be lower than the minimum pension in force on the date of conclusion of the pension annuity agreement.

For example, currently citizens who have a sufficient amount in the UAPF (for men aged 55 years - 11.3 million tenge, for women aged 51.5 years - 15.5 million tenge) can enter into an agreement with an insurance company and receive pension (insurance) payments in the amount of the minimum wage (42,500) and continue to work. Upon reaching retirement age (59.5 for women and 63 for men), pension payments from the Unified Pension Fund will be added to these insurance payments.

Let us recall that in September 2020, the country’s President Kassym-Jomart Tokayev gave instructions to develop a mechanism for using pension savings. According to the Ministry of Labor, this option could be used by a limited number of people.

Thus, at the age of 40, men must have at least 6.8 million tenge in their account for early withdrawal. 4,127 people meet these criteria. There are 2,906 50-year-old men with the required 7.2 million tenge in Kazakhstan today. There are 1,060 60-year-old compatriots who managed to accumulate the sufficiency threshold of 7.9 million tenge. For women, the sufficiency threshold is higher, the Ministry of Labor reported.

In May of this year, a new instruction was given - to develop a mechanism for using pension savings to purchase housing.

Returning to the changes to the law on the insurance market, we can assume that their main initiators are insurance companies that are losing clients in the form of wealthy citizens due to the established requirements for linking annuity (pension) payments to the minimum wage.

The discussion will last until June 4, 2020.

Mayra Medeubaeva

How to apply for a miner's pension?

In order to apply for an insurance benefit on preferential terms, a citizen interested in payments must:

- collect all necessary documents;

- draw up an application for a pension in the established form;

- submit all information to the local Pension Fund structures (at the place of registration or actual residence);

- choose a method of receiving funds.

Pensions for miners can be arranged both by future pensioners personally and by their proxies. To do this, you need to draw up and notarize a power of attorney.

Documentation

To calculate cash payments before the established retirement age, you must collect the following information:

- identification;

- work book;

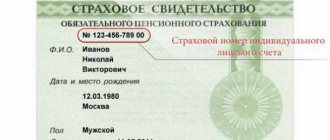

- insurance certificate (SNILS);

- certificates confirming additional periods of official employment of a person (archival information, order of appointment to work, agreement between employee and employer, etc.);

- documents indicating the special nature of work activity (if this fact is not indicated in the work book);

- military ID;

- a correctly executed power of attorney (in cases where the rights and interests of the future pensioner are represented by another person);

- a certificate of family composition and the presence of dependents, as well as other documents that confirm additional circumstances.

The application form for the assignment of a pension benefit can be found on the official Internet page of the Pension Fund.

Where to submit?

The application along with the documents is submitted to the local divisions of the Pension Fund of the Russian Federation. Also, for this procedure, a citizen can use the services:

- local structures of the Multifunctional Center (MFC);

- legal representative;

- Russian Post;

- electronic services of the official pages of the Pension Fund and State Services.

It is worth saying that via the Internet a citizen can fill out an application for a pension and set a date and time for receiving the documentation. You can read about online registration with the Pension Fund here .

Deadlines

Pension Fund divisions consider the specified notification within 2 working weeks from the date of submission of all necessary documents. If the information was not provided in full, the citizen can take advantage of additional time to resolve this problem. This period should not exceed 3 months. Benefits are accrued from the date of submission of the application, but not before the right to receive an insurance pension ahead of schedule arises.

Calculation of benefits in 2020

To retire earlier than the current deadline, miners should rely on Art. No. 30 Federal Law “On Insurance Benefits”. Based on this legal provision, in particular paragraph 11, the following conditions must be met:

- full-time employment;

- labor is associated with mining.

A miner's experience is determined based on the type of activity and profession.

An additional and mandatory condition for early withdrawal is the level of accumulated points in the pension personal account. So, in 2020 this figure was 13.8 points.

Benefits for miners in the Russian Federation for 2020

Payments for workers in the mining sector are made by the enterprise's accounting department on a monthly basis.

Contributions are transferred to the Russian Pension Fund for employees working in hazardous conditions. This year, there was no increase in the amount of material support, but indexation was made. The Pension Fund is adjusting bonuses due to changes in the volume of contributions from salaries. The increase in subsidies is carried out on the basis of an application submitted by a person. Additional payments are calculated monthly after the miner receives benefits.

Please note: calculation of additional pensions for miners are made according to the standard scheme. It is not yet known whether there will be an increase in pension benefits in 2020.

How are benefits determined?

Early retirement provision in our country is assigned if the employee operates in a field with appropriate conditions - an eight-hour day. In this format, long-service benefits are formed for those who are employed at enterprises conducting underground and/or open-pit mining activities:

- rescuers;

- mining of coal, ore, shale and other minerals;

- construction activities for the construction of mines and mines.

The list of professions whose employees have preferences for receiving old-age benefits, regardless of age, is indicated in the PSM of the RSFSR No. 481 dated September 13, 1991. This regulation lists the types of employment and positions that are eligible for early receipt of government subsidies.

Categories of applicants for additional payment to pension

In May 2010, the Government of the Russian Federation, by Decree of the President, adopted a bill establishing additional payments to the pensions of miners. The legal document remains relevant today. Based on the provisions of the act, in addition to basic material support, a number of categories of coal industry workers have the right to receive an allowance:

- Upon reaching the required age;

- If the work book states an eight-hour working period over a period of 25 years. It is important that the activity be carried out in an open or underground format. In addition, this list includes employees of mine rescue units;

- Leading specialists who have worked for at least 20 years. These include face workers, machinists, drifters and other professions.

For information: the Pension Fund of the Russian Federation uses the formula to calculate benefits: SPst = IPC * SPK, where SPst is the insurance type of benefit, IPC is the accrued points, and SP is the cost of one point (in 2020, the price of 1 point was 81 rubles 49 kopecks).

Recalculation of miners' pensions

In order to receive an additional payment to the basic financial support of pensioners, a citizen is obliged to send a corresponding application to the branch of the Pension Fund of the Russian Federation at the place of residence or registration. In addition to the application, the employee must submit a package of documents:

- application for additional subsidies;

- information confirming the required period of work;

- salary certificate issued by the employer’s accounting department for the last two years (form 2-NDFL);

- military ID;

- a certificate of family composition, issued by the chairman of the HOA or the director of the management company;

- choose one of the options for receiving money.

The interests of the pensioner can be represented by a person authorized by a power of attorney. The document must be prepared at a notary office. A complete package of papers is subject to the employee's approval.

It is noteworthy that the preferential system operates in such a way that if a miner, having retired, decides to continue his activities after some time, then the contributions will be suspended. At the same time, in order to re-initiate benefits, the citizen will be required to re-collect documentation.

What is the miners' pension?

The size of the pension benefit for this category of the population is influenced by many factors, including the length of the insurance period and periods of employment in jobs with hazardous working conditions, the number of pension points, etc.

Calculation

What is the pension for miners in Russia? The calculation formula for old-age insurance benefits is determined by the provisions of Article 15 of Federal Law No. 400. Thus, this law states that the amount of accruals is determined as follows:

A=B*C+D, where: A is the amount of payments for compulsory pension insurance; B — the number of pension points earned; C is the cost of one individual coefficient at the time of granting the benefit. For the current year, the price of this indicator is 81.49 rubles; D is a fixed payment determined at the legislative level.

The minimum pension of a miner in Russia must correspond to the minimum subsistence level established in a particular subject of the Federation. The indicated figure for the Russian Federation as a whole is 8,726 rubles (according to Federal Law No. 362).

Fringe benefits

In addition to early retirement, miners can also qualify for additional preferential accruals. In accordance with Federal Law No. 84, this category of the population has the right to a monthly supplement to the basic amount of pension provision, subject to employment in underground and open-pit mining for at least 25 years, or 20 years of activity in leading professions. This bonus is paid from contributions to the Pension Fund of the Russian Federation, which are made by organizations in the coal industry.

The amount of this surcharge is calculated using the procedure established by current legislation. So, this amount is influenced by the following factors:

- average monthly earnings of a citizen;

- the size of the average salary in the Russian Federation for a certain period;

- average monthly amount of contributions to the Pension Fund, etc.

Additional payment for miners

From January 1, 2011, retired miners can apply for an additional payment to their pension at the territorial office of the Pension Fund of the Russian Federation.

Federal Law of May 10, 2010

No. 84-FZ

“On additional social security for certain categories of employees of coal industry organizations”

a new type of social security was established in the form of an additional payment to the pension of a separate category of miners.

How the calculation procedure is determined, who is entitled to additional payments, how the amount of additional payment will be calculated - these and other questions are explained by Evgenia Ochertarova, head of the department for assessing the pension rights of insured persons of the Pension Fund Branch of the Republic of Belarus.

Evgenia Grigorievna, who still has the right to additional payment - all miners or only certain categories?

— Employees of the coal industry who worked directly full time in underground and open-pit mining (including personnel of mine rescue units) have the right to a monthly supplement to their pension.

Useful video about miners' pensions

Do you want to know how early retirement is processed? You should watch the following video:

posobie.center

Miners are a category of workers belonging to the list of professions with hazardous working conditions.

For this reason, the Government of the Russian Federation provides benefits for these employees.

In 2020, there will be no reduction in the list of benefits for former miners; on the contrary, it is planned to increase social support for this category of persons.

Early

The opportunity to retire earlier than other citizens of the Russian Federation is the main privilege of miners.

This is explained by the fact that their working conditions are considered harmful. Early retirement is regulated by Law No. 400-FZ of December 28, 2013.

The state guarantees early pensions for miners if they have a certain amount of work experience in the mine.

Law No. 173-FZ of December 17, 2001 states that early pension provision is provided to the following categories of citizens:

- have worked for 25 years in the coal industry on a full shift (this must be indicated in the work book);

- employees of the mine rescue service;

- quarry miners;

- persons who are engaged in the arrangement of communications and structures in mines;

- who have reached retirement age.

Citizens whose work activity consists directly in the extraction of mineral resources (shale, ore, uranium miners) and coal are entitled to a pension after twenty years of experience in such work.

20 years of work experience is sufficient for retirement for the following categories of workers:

- miners at the working face;

- miners;

- coal combine operators;

- miners who extract coal using jackhammers.

If you have not worked for 20 or 25 years as a miner, and the retirement age has arrived, then the existing length of service (for example, 10 years) is calculated on a preferential basis.

What payments are due upon retirement?

› › Retirement is the cessation of work.

In the application for payment, the following must be written as justification: I ask you to dismiss me at my own request due to retirement.

For citizens who have received the right to a well-deserved rest and continue to work, receiving pensions is an additional source of income to their wages.

Retiring means that a person will live only on the Social Security benefits that he has earned. After submitting an application for payment, a pensioner has the right to count on certain types of additional payments guaranteed by the state. ? Let's figure it out. Contents Retirement does not mean a ban on continuing to work.

A pensioner has the right to keep his job. He can resign only of his own free will.

Receiving a pension does not mean retiring.

The application for calculation must include the following as justification:

“I ask you to resign at your own request due to retirement”

.

How old are they?

Many people are interested in information about what time miners retire.

- Citizens who work full time in open and underground mining areas, as well as mine rescuers and those who construct mines and shafts, regardless of age, can retire if they have 25 years of experience.

- Miners who work with jackhammers, mining face workers, and mining machine operators only need to work for 20 years to qualify for a pension.

- An accident is added to the length of service if it occurred at work. In this case, the employee’s age is reduced by 1 year (that is, 1 year is added to the length of service).

- When working underground, there is a reduction of ten years for men and seven and a half years for women.

Study and military service are also included in the preferential miner's length of service, which allows such citizens to become pensioners earlier.

Payment of pallbearers upon retirement

- Question No. 3564420

G.

Novokuznetsk • Questions: 03/18/2014 at 10:56 At the mine, upon retirement, a lump sum payment is paid (called coffin payments). Ten years ago this happened to me. As a result, spinal damage, group 1 (indefinite), 100% disability (wheelchair).

When registering a work injury, all formalities were observed. This year I turned 50 years old. Can I count on the above mentioned payment?

My total experience is 20 years, 15 of them underground. Or it doesn't apply to me. Thank you. Question number No. 3564420 read 2622 times

Is there a promotion planned?

Additional payment to the security is carried out through the Russian Pension Fund and is accrued along with the pension.

Payments to pensioners are financed by employers, who transfer funds to the Pension Fund every month for employees working in hazardous conditions.

There are no plans to increase miners' pensions in 2020, but recalculations will be made. The Russian Pension Fund will adjust the amount of additional payments, since the amount of contributions made to the Pension Fund has changed. The increase is made after the citizen submits an application for recalculation.

Additional social security for miners

Since July 2020, a new service has been launched, which allows you to electronically submit an application for the appointment and payment of additional payments to miners for retirement.

Therefore, in this article we consider how to apply for this additional payment and how much it can amount to. Funds to supplement miners' pensions come from contributions made by coal industry enterprises to the budget of the Russian Pension Fund. Note that the additional payment in question is an independent social payment.

personnel of mine rescue units) in coal and shale mining and mine construction for at least 25 years; Or from 20 years as workers in leading professions and currently receiving a pension:

Additional payment to miners for pensions in 2020

When miners retire and payments are made, they are entitled to an additional payment accrued every month. Many people are interested in how the surcharge is calculated in Russia and its size.

The calculation of the amount of the surcharge is made by multiplying the values:

- average wages for the period July-September 2001;

- quotient from dividing the average monthly salary for 24 months of work in hazardous conditions (60 months of work in another position) and the average salary in the Russian Federation for the same period of time;

- private, obtained by dividing the average amount of contributions to the Russian Pension Fund and the total amount of money in the form of additional payments to pension provision;

- coefficient of average employee payments.

A revision of the formula according to which the pension supplement for miners is calculated is planned for November 2020.

Perhaps after this the surcharge will be increased.

Size

What additional payment to the miner's pension will be does not depend on the amount of security, but it is approved specifically for it.

Factors on which the size of pension benefits depends:

- duration of work in the coal mining industry;

- average monthly salary of a former miner;

- contributions transferred by the employer to the Russian Pension Fund.

In the case where the bonus is calculated based on the amount of security for length of service, its value in 2020 will be 55%. If a citizen works for one year in excess of the required length of service, then another percentage (56%) is added to the amount due to him.

Interest accrual above 55% continues until the value of 75%, calculated from the pension provision, is reached.

Parental leave and sick leave are excluded from the list of factors influencing additional payments.

The average monthly salary of an employee applying for a security supplement includes:

- bonuses;

- government cash rewards.

Design features

It is impossible to accrue additional payments to miners' pensions in 2020 by default.

To receive money, a citizen must write an application to the Pension Fund of the Russian Federation and attach a package of documentation to it:

- papers confirming the duration of work activity, according to which it is possible to receive a bonus;

- a document containing information about the average monthly salary for the last 24 months.

The interests of the pensioner can be represented by a representative, provided that a notarized power of attorney is issued in his name.

Privileges

If in the past a pensioner was a miner and he has papers that confirm this, then such a citizen has the right to benefits at the federal and regional level.

List of benefits at the federal level in 2018:

- medical care in state hospitals for a former miner will be free;

- prostheses made from inexpensive materials are installed free of charge;

- state pharmacies provide preferential distribution of medicines (but there are few such points left in the Russian Federation, so a limited number of pensioners can take advantage of this benefit).

Regional benefits include free travel for pensioners on public transport.

If a citizen does not want to receive medicines for free, then he has the right to submit an application to the Pension Fund with a request to receive this amount in cash equivalent.

Preferential medical care includes:

- insurance;

- free diagnostics;

- free prosthetics and dental checks;

- free treatment for work-related injuries.

List of benefits for children of miners:

- free breakfasts at school twice a week;

- provision of new school uniforms free of charge;

- priority admission to educational institutions.

Miners are rewarded for their length of service or quality of work done - a lump sum payment is made once a year.

Former miners have the right to choose this or a pension supplement.

If injured or disabled, a miner has the right to receive financial assistance.

If a miner dies, his family members have the right to receive the following assistance:

- from an insurance company (500 thousand rubles);

- benefits in the amount of one million rubles from the government;

- free funeral of the deceased is provided.

Upon receipt of disability, a miner has the right to choose a specialty and study for free in order to subsequently work elsewhere.

After the official assignment of a disability group, the former miner becomes entitled to benefits for the disabled.

Payment terms

The calculation of the additional payment to the security is based on the fact that the miner has already retired; for a pensioner who returns to work, the payment of the additional payment stops. This is done from the first day following the month of employment.

- From October 1, 2020, pension provision will be recalculated (updated) in Ukraine. According to the new reform adopted by the Verkhovna Rada on July 13, 2017, pensions will be calculated using a single indicator of the average salary of UAH 3,764.4.

- In the Russian Federation, in accordance with Decree No. 610 of December 9, 2015, there is a “Putin bonus” to the pensions of firefighters, military personnel, former employees of the penal system, and internal affairs bodies.

From February 1, 2020, the amount of the supplement is 4,900 rubles. per month.

When do miners retire?

The main preference for underground workers in the Russian Federation remains early retirement, unlike other citizens of the country.

Additionally, miners have the opportunity to apply for benefits based on harmful working conditions. The full list of subsidies associated with retirement is prescribed in Federal Law No. 400 of December 28, 2013. At the same time, guarantees are provided at the state level that upon receipt of the work experience specified in the regulation, the miner has the right to apply for early pension coverage.

Download for viewing and printing:

Federal Law of December 28, 2013 No. 400-FZ “On Insurance Pensions”

Minimum benefit level

The amount of the minimum pension for miners in 2020 depends on several circumstances - the national average was seventeen thousand rubles.

The cost of living in the regions plays a decisive role in the size of pension contributions. However, benefit calculations for the current year have not changed in relation to the mining sector. However, it should be understood that when forming a long-service pension, coal industry workers receive additional payments every month.

The premium is calculated based on the multiplication of the following factors:

- average wages calculated from June 1 to September 31, 2001;

- partial value when dividing two indicators - the average salary for a two-year period of activity in hazardous conditions and five years in any other position;

- average coefficient of the sum of all payments;

- obtaining a partial value by dividing the average level of contributions to the Russian Pension Fund and the general financial indicator to provide allowances for benefits.

Is a miner’s experience “bought”?

Innovations in the 2020 pension reform brought a number of changes, including the possibility of additional acquisition of length of service for calculating benefits.

To increase working years, a citizen must contact the Federal Tax Service and enter into an agreement. The essence of the agreement with the tax authority is that the future pensioner gives the go-ahead for payments of an increased social percentage from wages. Thus, the length of service will be calculated not from time, but from payments made.

For example, if the employer transfers social benefits not for one month, but for three, i.e. deducts up to 22%, then you can go on old-age leave not at 55, but at 50.

Experience gap and work abroad

The current economic situation often forces miners to quit their jobs and look for another profession, including abroad.

Some miners in another state continue to work underground. Therefore, the question remains of how the pension for a miner in Russia will be taken into account. At the state level, a decision was made to conclude a pension agreement with a number of countries regarding the mining industry. Therefore, the time worked in the Russian Federation will be added to the period of work in another country. More detailed information should be obtained from employees of the Pension Fund of the Russian Federation.

Video: “Payments for disabled miners will not increase”

urpravo24.ru

The miner's profession is associated with many harmful factors that have a negative effect on the worker's body. Workers carry out official functions underground, experience bouts of claustrophobia, and are forced to spend most of their time in the dark and breathe stale air. In this regard, certain benefits for miners have been established at the federal level. From this article you will learn about who has the right to retire early, what benefits and payments can be obtained, and what privileges members of miners’ families can count on.

One-time benefit to miners upon retirement

- Question No. 5052035

G.

Belovo • Questions: 10/06/2014 at 08:15 pm One-time one-time benefit for a miner upon retirement I retired, and a few years later I learned about the required coffins. How to get them? question number No. 5052035 read 2448 times Lawyer Rating: 3.9

• reviews: 123,123 • replies: 328,940 • g.

Novosibirsk 10/06/2014 at 20:17 Contact your employer in accordance with the collective agreement (Article 8 of the Labor Code of the Russian Federation).

The payment will be made if it is provided for in the collective agreement of the mine

Lawyer Rating: 0 • reviews: 468 • replies: 1,407 • Mr. Kamyshin 10/06/2014 at 20:19 The statute of limitations has expired.

It is necessary to restore it in court, however, this is unlikely to succeed. One of the cases of dismissal of employees is due to the employee’s retirement.

Benefits for miners in the field of pensions

Important! A miner has the right to choose between receiving an annual bonus while working in the mine and a pension supplement after leaving work at the mine.

Regarding the pension provision of miners, the following points must be taken into account:

- 25 years of work experience in the mining industry in ordinary positions (or 20 years if the miner worked in a leading profession, for example, a mining machine operator).

- If a miner worked with a jackhammer, participated in rock excavation or in the face, the work experience must be equal to 12 years .

- An injury received during work allows you to retire 1 year earlier than the length of service is reached.

- If a miner worked underground, you can retire 7.5 and 10 years earlier for women and men, respectively.

- The period of receiving specialized education and military service is counted towards the length of service.

- After retirement, you can continue to work at the mine, but you lose your right to a bonus.

Follow the link to view ⇒ Sample application to the Pension Fund for early retirement.

You can get an answer to your question by calling the numbers ⇓

Free consultation Moscow, Moscow region call: +7

St. Petersburg, Leningrad region call: +7

Upon retirement, what payments are due to employees and miners?

24 24 Retirement is the cessation of work. For citizens who have received the right to a well-deserved rest and continue to work, receiving pensions is an additional source of income to their wages.

Retiring means that a person will live only on the Social Security benefits that he has earned.

After submitting an application for payment, a pensioner has the right to count on certain types of additional payments guaranteed by the state.

Retirement does not mean a ban on continuing to work.

A pensioner has the right to keep his job. He can resign only of his own free will. Receiving a pension does not mean retiring.

Benefits for miners in the healthcare sector

Important! Miners are subject to compulsory life and health insurance at the expense of federal appropriations for the corresponding year.

Miners have the right to an annual medical examination free of charge, and travel to the examination site is paid for (in both directions). In addition, they are entitled to free production, installation and repair of dentures. The only thing is that they cannot be made from expensive materials such as porcelain, ceramics, metal ceramics, and precious metals.

If a miner suffers a work-related injury or injury, treatment will be provided free of charge; in addition, the worker will be provided free of charge with prosthetics and orthopedic products necessary for rehabilitation. Occupational diseases are also subject to treatment at public expense.

Miners are provided with free trips to sanatoriums and resorts to improve their health after difficult and harmful work.

Benefits for children of mine workers

Not only the miners themselves, but also their children can claim certain privileges, including:

| Benefit | A comment |

| Free breakfast in educational institution | Twice a week |

| Free school and sports uniforms | From an educational institution |

| Priority admission to educational institutions | In preschool educational institutions and schools |

| Vouchers to health organizations | To summer health camps |

What are the compensations for mine workers?

The work of a miner is associated with risks to life and health, and therefore in some cases the worker himself or his family may be paid compensation (one-time or on a regular basis):

- upon receipt of a work injury or occupational disease;

- when assigned to a disabled group due to an industrial injury or illness while working in a mine (in addition, a former miner can learn a new profession for free in order to find another job);

- if a miner dies while working in a mine or if he dies after leaving work due to an injury (injury, illness) received during his work.

In the event of the death of a mine employee, compensation is paid to the family of the deceased (in equal shares). The money will be paid under the insurance program, as well as 1 million rubles from the federal budget. In addition, the miner's burial is carried out at state expense.

Possibility of increasing benefits for miners

A legislative package of innovations regarding increasing pension benefits for coal industry workers came into force at the beginning of 2020.

However, very late. Based on the same bill, it was planned to increase benefits, but in reality this did not happen, with the exception of the planned indexation. Along with this, the profession of a miner is associated with risks to life and health on a daily basis, and persons engaged in such work need a decent salary and adequate security in old age. It should be borne in mind that employees in this industry often become disabled.

In 2020, the municipality adjusted social supplements by increasing the cost of living. The procedure was carried out throughout the year - May, August, November.

Common mistakes

Error: A miner who is injured during work and becomes disabled does not require payment for additional education, which would allow him to obtain a new specialty and find a new job.

Comment: If, due to a work-related injury or occupational disease, a miner cannot continue working at the mine, he is paid compensation and paid for vocational education for employment in a new place.

Error: The employer claims that he uses the latest mining technology, which is why working as a miner is no longer harmful. In this regard, he does not pay bonuses for “harmfulness”.

Comment: In this way, employers are trying to avoid unnecessary costs for paying salaries to miners. The bonus is due to all mine workers without exception, regardless of what technologies were introduced into the production process.

Answers to common questions about what benefits miners are entitled to

Question No. 1: I worked as a miner and received a preferential pension, after which I got a job in a commercial enterprise that had nothing to do with the mining industry. Will I continue to receive a pension supplement for working in the mine?

Answer: Yes. The bonus is lost only if the miner continues to work at the mine after retirement.

Question No. 2: What is the amount of the pension supplement for a miner?

Answer: The supplement is more than 7% of the preferential pension.

Rate the quality of the article. Your opinion is important to us:

You can get an answer to your question by calling the numbers ⇓

Free consultation Moscow, Moscow region call: +7

One-click call

St. Petersburg, Leningrad region call:

+7 One-click call

Calculation of preferential benefits

The calculation and assignment of early pensions 2020 is carried out on the basis of Federal Law No. 400 of 2013 “On Insurance Pensions”.

The calculation operations performed to determine the size of the preferential pension payment are no different from how a regular pension is calculated. Insurance amounts due to citizens are subject to accounting.

They vary depending on the reasons a person receives:

- diseases in the chronic stage that appeared in the employee while working in the organization;

- restrictions regarding working capacity associated with injuries received in hazardous industries;

- an illness that cannot be cured, provided that it was associated with activities in the company.

Employees of the pension authority take into account the length of service when calculating the amount. The time during which the citizen worked in general and separately the period worked in hazardous production is taken into account.

Experience does not include:

- the period while the person was undergoing training, provided that the referral was not issued by the employer;

- leave granted to care for a baby (child's age after 1.5 years).

After this, the value is added to the time during which a person is released from work due to unsatisfactory health, the time when a woman gives birth and cares for a baby, the use of time off for days worked and vacation that is subject to pay. In addition, the time while the company was downtime is taken into account. The blame for this should be placed on the organization.

Preferential pension due to harmfulness

If a person has incomplete experience in one of the preferential professions, the age at which retirement is possible is lowered. The list of professions was developed by the Government of the Russian Federation.

The calculation of pension payments is regulated by Federal Law No. 400 of 2013 . The document indicates at what age citizens can retire and the rules for calculating pensions. The reform did not affect these provisions; they remained unchanged.

Formula for calculating benefits

The amount of early old-age pension depends on the indicators that are taken into account in the calculation.

The formula looks like this: C = IR*P+F*K , where

- C—amount of pension benefit;

- IR - coefficient established for a pensioner;

- F - the size of the fixed payment;

- K is an indicator of bonus value, which depends on the number of years worked.

The fixed amount in 2020 was 5,686 rubles .