Many people, especially among the younger generation, try not to think about what awaits them in the future in 15/20/30 years. For better or worse, modern life dictates the need to make choices about your retirement future early in your meaningful work life.

The key issues in this choice are how to secure retirement savings, how to help relatives make a choice, and how to preserve savings for their descendants.

Citizens of our country find answers to these questions in non-state pension funds (hereinafter referred to as NPFs), which undertake not only to save your savings, but also to significantly increase them.

At the beginning of 2020, one of the leaders in the Russian non-state pension provision market was NPF Blagosostoyanie JSC, which began its work back in 1996.

The reliability of the company’s activities is confirmed by many independent experts and government organizations, as well as a huge number of clients, most of whom are employees of Russian Railways, since for 18 years NPF Blagosostoyanie JSC has been servicing the largest transport company in Russia.

As employees say, their future pension is in good hands, and they can work peacefully, without having to think about their well-being after retirement.

But is this really the case? Do Blagostostoyanie have any negative aspects and how have they proven themselves in the pension services market? How to register on their website and control the availability of funds? You can find answers to these and other questions in this article.

How to register on the official website

The official resource of the non-state pension fund “Blagosostoyanie” in question is the website - https://npfb.ru, which has a red and white interface familiar to many clients of the Russian Railways company with an abundance of information blocks and a fairly clear navigation panel.

Official site

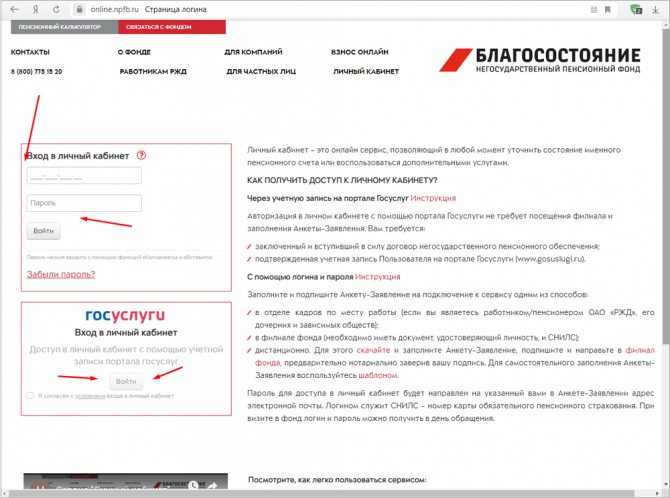

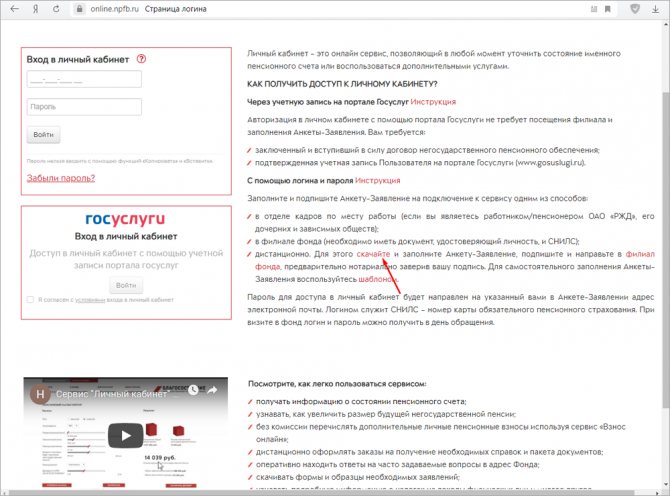

In order to register on the site, you need to click on the “Personal Account” section and select one of the two options presented:

Section "Personal Account"

Two login options

- “Login using login and password.” It should be understood that in order to gain access to the personal account of NPF Blagosostoyanie, you must be listed as one of their clients.

Click on "Download"

To obtain this status, you must fill out an Application Form, the template of which can be downloaded here on the page by clicking on the “Download” button.

A template is also available for review, which shows the procedure for completing all the key points of the questionnaire.

Click on the inscription “Template”

Particular attention should be paid to filling out the email address, since it is to this address that the password for entering your personal account will subsequently be sent.

The login is the SNILS number, which is also indicated in the application form.

You can submit your completed application for consideration in three ways:

- If you are an employee of Russian Railways or other dependent and subsidiary representatives, contact the HR department at your place of work.

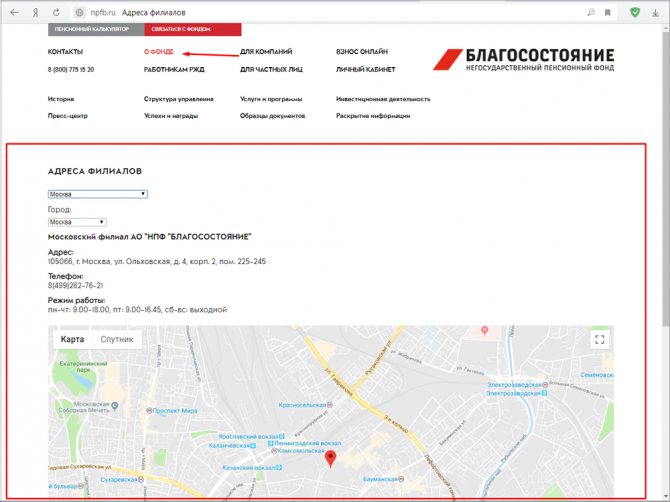

- Visit a company branch in person. Information about the location of branches is available at this link https://npfb.ru/o-fonde/adresa-filialov/; you only need to select your region and familiarize yourself with the contacts and operating hours of the branch convenient for you.

Branch addresses - Submit the questionnaire remotely using the contacts received from the option discussed above. Please note that your signature must be notarized.

After confirmation of registration and receipt of the “Client” status, authorization data to enter your “Personal Account” will be sent to the specified email address.

- “Entrance through STATE SERVICES.” To implement this option, you will need a non-state pension agreement that has entered into force with the joint-stock company “Blagosostoyanie”, as well as an account on the “Official Internet portal of public services” confirmed in the manner prescribed by law.

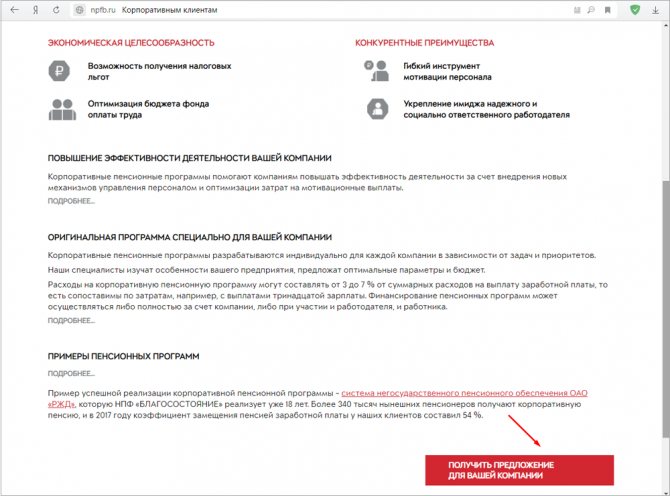

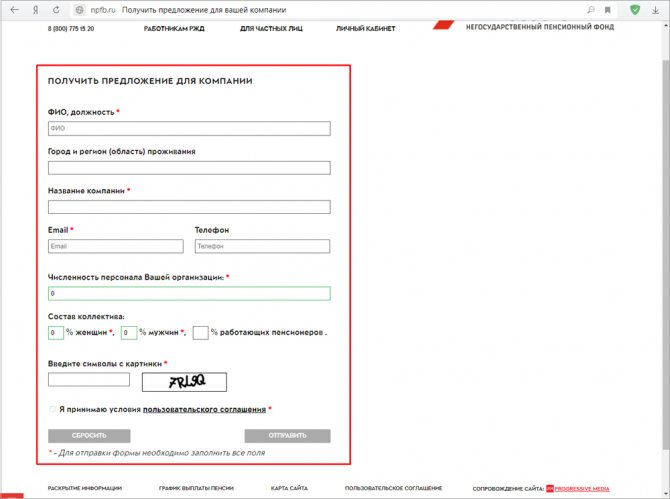

It would not be amiss to note that if you yourself are an employer and want to become a corporate client of the NPF “Blagosostoyaniye”, in order for your employees to receive a pension calculated according to an individual program, then you will need to go to the “For companies” section (https://npfb .ru/korporativnym-klientam/), click on the “Get an offer for your company” button and fill out a short form with basic information about the organization.

Receiving an offer for an organization

Questionnaire with basic information about the organization

After which NPF employees will contact you as soon as possible.

Payments upon liquidation of NPF Prosperity

It is also worth considering a fraudulent scheme when a pensioner enters his personal data according to SNILS on sites that offer to receive payments according to SNILS from private insurance funds.

The scheme is as follows: the user gets to the site under the pretext “Check your pension payments according to SNILS in a few minutes. It is also worth considering a fraudulent scheme when a pensioner enters his personal data according to SNILS on sites that offer to receive payments according to SNILS from private insurance funds. The scheme is as follows: the user gets to the site under the pretext

“Check your pension payments according to SNILS in a few minutes. Often these sites have the words “Support for Pensioners” in their titles.

, “Check your savings in 3 minutes”, “Interregional development and support funds” to attract attention that the resource inspires confidence. Next, the pensioner is asked to enter his SNILS number for verification.

Then, the amount that is allegedly not paid to the pensioner from third-party insurance funds is shown.

dtpstory.ru

— — Competition manager of the non-state pension fund for welfare According to the law, the rights of the insured persons are transferred from one non-state fund to another, but this can be done once every 5 years without charging fines, otherwise investment income is lost for the last year. Thus, the future pensioner, upon liquidation of his NPF, will transfer to the Pension Fund, and from there he will be able to transfer to another NPF.

But if the fund is not in the guarantee system, it is better to do this in advance and not wait until it goes bankrupt. This applies to insured persons who keep savings under one of the government programs.

Non-state pension provision will continue to be offered by funds that are not part of the guarantee system.

Consequences of bankruptcy of a non-state pension fund When a non-state pension fund is liquidated, the insured person must take care to save his savings. After all, the bankruptcy of a non-state pension fund, like any other legal entity, has its consequences.

Non-state pension fund Prosperity

— — NPF Blagodenstvie Name of NPF: Blagodenstvie Address: Irkutsk, st.

Rabochaya, 3b. Phone: 790-026 Website: www.npf.investfunds.ru License number: 201/2 Number of clients served: more than 100 thousand. Volume of savings: 2.5 billion rubles. Average annual return: no data Reliability level (NRA): - RA Expert: - NPF Blagodenstvo is the largest fund in the Irkutsk region.

It has been operating since 1994.

and has a wide branch network in the cities of the region, the Chita region, as well as Yakutia and Buryatia. During its operation, the fund has demonstrated a stable increase in all key indicators. At the end of 2013, the value of his own assets amounted to more than 4 billion.

The fund, in turn, invests the client’s money and accrues income based on the investment results.

When will pension payments be made under the NPF Blagodenstvie?

You need to contact the Pension Fund.

From the moment the license is revoked, contracts on compulsory pension insurance with NPFs are considered terminated, and the pension savings of the insured persons are returned by the NPF to the Pension Fund of the Russian Federation (hereinafter referred to as the Pension Fund of the Russian Federation), which will be the insurer for compulsory pension insurance in relation to the specified category of insured persons. Thus, the following will be transferred: - the “nominal” amount of insurance contributions for a funded pension, funds from additional insurance contributions for a funded pension, employer contributions, contributions for co-financing the formation of pension savings, funds (part of the funds) of maternity (family) capital,

For convenience, many funds have developed an online service with which you can find out up-to-date information on the amount of savings without leaving your home.

To enter your personal account of NPF Blagosostoyanie you need to do the following:

- Sign an agreement on the provision of pension services, which has entered into legal force.

- Go to the website online.np.ru, where you need to specify a password and login.

Data on pension savings can be found on the website: client.futurenpf.ru after registration, because since 2014, NPF Blagosostoyanie received a new name - NPF Future!

- Government services website.

A year of good stories On New Year's Eve, executive director of # NPF # WELFARE Yuri Novozhilov spoke about the results of the fund's work in the past year and plans for the future in an interview with the Gudok newspaper.

NPF prosperity

- When payments are made under the NPF Blagodentstvo, it will soon be 2 years since the license was revoked.

- When will payments to depositors of NPF Prosperity begin?

- NPF Prosperity I am a participant and contributor.

- I lost my agreement with what to do.

- How to receive accumulated savings in NPF Prosperity.

- What to do next to get your money back from the NPF Prosperity.

- When will the money be paid to the depositors of the NPF Blagodentstvo?

If you find it difficult to formulate a question, call, a lawyer will help you: Free from mobile and landline Free multi-channel telephone If you find it difficult to formulate a question, call a free multi-channel telephone, a lawyer will help you 1.

NPF Prosperity Payments

NPF welfare. Individual pension schemes

Let us remind you that the Central Bank recently revoked the license of the non-state pension fund Blagodenstvo.

The sudden collapse of a fund with a 20-year history came as a shock to many Russian Railways veterans, who made up the lion's share of investors. There is a high probability that many of them will never get their money back.

According to the railway workers themselves who worked for VSZD, at the dawn of the formation of the fund they were literally forced to contribute money, promising mountains of gold.

In many media, the founders of the fund are both VSJD itself and structures close to it, for example, the VSJD trade union, VostsibZhasso and Vostsibtranskombank.

It is reasonable to assume that these structures, despite the actions of the management company that led to bankruptcy, still bear some share of responsibility for what happened. Respublika asked for comment on the revocation of the license from NPF Blagodenstvie to manage VSZD in Irkutsk.

In particular, we asked whether the management of VSJD considers itself partly responsible for the tens of thousands of people who at one time trusted the corporate NPF.

The Deposit Insurance Agency assessed the assets and property of NPF Blagodenstvie

» » » Let us recall that at the end of last year the Central Bank revoked the license of the NPF Blagodenstvie, whose investors were mainly veterans - railway workers in the Irkutsk region and Buryatia, as well as workers of large industries in both regions. We are talking about tens of thousands of people.

According to analysts, the Central Bank's main complaint was against the manager, who was involved in risky transactions, as well as the final beneficiaries, some of whom were arrested on suspicion of abuse. According to the railway workers themselves who worked for VSZD, at the dawn of the formation of the fund they were literally forced to contribute money, promising mountains of gold.

In many media, the founders of the fund are both VSJD itself and structures close to it, for example, the VSJD trade union, VostsibZhasso and Vostsibtranskombank.

The non-state pension fund "Blagodenstvie" was liquidated by decision of the Arbitration Court of the Irkutsk Region

Investors' money was transferred to a government agency

Evgeniya GUSEVA Change text size:AA As you know, we can store and invest the funded part of the pension not only in the Pension Fund of Russia, but also in other structures. Thus, the once prosperous non-state pension fund “Blagodenstvie” offered pension supplements and many other privileges.

As a result, more than 80 thousand residents of the Angara region became their clients. But the fund... collapsed. “Due to the fact that at the end of November last year the Bank of Russia decided to liquidate Blagodenstvo,” the Arbitration Court of the Irkutsk Region reported.

What about investors' money? “Don’t worry, the money should return in full to the Pension Fund of the Russian Federation,” former Blagodenstvie employees explained to KP. However, Irkutsk residents have concerns about this.

Prosperity NPF

Online magazine about non-state pension funds NPF Blagodenstvo in 2017 The date of foundation of the non-state pension fund Blagodenstvo is 1994 and it is one of the oldest funds in the Russian Federation.

The fund specializes in providing pension services to residents of the Irkutsk region. Over the years, the organization has proven itself to be a very stable pension fund with reliable investments.

The number of clients exceeds 100 thousand people.

Full name of the organization: Blagodenstvo OJSC NPF liquidation news At the end of 2015, the Central Bank of the Russian Federation suspended the license of the Blagodechestveniya pension fund, after which the procedure for forced liquidation of the organization began. Reason: failure by the fund to provide information about its activities and violation of the regulator’s requirements, in other words, repeated non-compliance with the law “On non-state pension funds.” According to information from the DIA website, payments to participants of the non-state pension fund Blagodenstvo continue in 2017.

NPF prosperity lists of payments to depositors

Attention!

Source: https://em-an.ru/vyplaty-po-likvidacii-npf-blagodenstvie-70519/

Customer reviews about the Welfare Fund

The most complete picture of the quality of the services provided, and reviews from real clients who have already been able to evaluate the service and reliability of the company from their own experience. But the colossal difference in value judgments can only confuse rather than help find the necessary answers to the main questions.

It is worth noting that it would be wrong to take into account someone’s negative experience of cooperation/work as a given, which will certainly await you. Even if it is a former employee of Russian Railways or the foundation itself.

Each case is a unique set of circumstances, not always formed only unilaterally, since, no matter what anyone says, the client is not always right.

To illustrate the differences of opinion, three reviews from real customers (source: independent review and recommendation sites, assessment of the veracity of reviews has not been verified):

Ilyas – general impression – “Positive”:

“We updated the website, it has become much more convenient to use your personal account - all accruals are recorded there. In two years, 43 thousand have accumulated - I think it’s very good, especially considering that this is only part of the pension - the main part will still come from the Pension Fund. I don’t regret transferring at all.”

Anonymous – general impression “Negative”:

“There is one point that consultants are unlikely to tell you about. The amount of your personal pension fund consists of the obligatory part and the ACCUMULATIVE PART, i.e. the part that you voluntarily contribute to the fund (save). When concluding an agreement with the FUND, you indicate an heir (close relative) to whom your savings should go in the event of a sudden death. And they tell you that the money you save while you work WILL NOT LOSE. There is a nuance here: if you have reached retirement age and started receiving payments, and if death occurs, your heirs will not receive the money. Since the payments have started, it doesn’t matter how much you saved and how long the payments lasted.”

As can be seen from the reviews presented, the opinions of real clients differ significantly, and this applies not only to the individual NPF “Welfare”, but in general to the activities of the non-state pension market and to the services that are promoted there.

Based on various public surveys, we can conclude that such distrust of NPFs is dictated by the fact that Russians continue to adhere to the following opinion: “If it’s state-owned, it means stable.” Whether this is really so is up to everyone to decide for themselves.

Profitability and reliability rating

The above opinion is sufficiently refuted by the profitability and reliability ratings of non-state pension funds, which are verified by government agencies.

Existing ratings are based on the data that is transmitted by NPFs to the Central Bank of the Russian Federation, since this reporting is mandatory.

There are two main expert commercial organizations on the Russian market that are involved in compiling such ratings: the Rating Agency (RA, https://raexpert.ru) and the National Rating Agency (NRA, https://www.ra- national.ru).

For the 2020 calendar year, the reliability rating according to RA is as follows:

NPF reliability rating according to “RA”

It is worth noting that none of the presented companies received the maximum ratings - “A++” - an exceptionally high level of reliability and “A+” - a very high level.

And only four companies were awarded the “ruAAA” rating - the highest level.

Despite the fact that at the beginning of the article it was indicated that NPF “Welfare” is among the leaders, in many ratings of reliability and profitability it cannot be found in the top ten.

As for the NRA ratings, they differ significantly from those presented above:

NRA rating

As you can see, only four companies were updated in 2020 and received high scores. And NPF Blagosostoyanie and a number of other organizations had their assessment statuses revoked without explanation, and what this might be connected with was not disclosed.

Profitability

Profitability ratings are compiled on a quarterly basis, based on previously announced financial reports.

At the beginning of 2020, the ratings compiled as of July 1, 2020 have not lost their relevance. As an example, here are the indicators of the 20 largest Russian non-state pension funds according to RIA Rating:

20 largest Russian non-state pension funds

Everything is extremely clear and logical. The first five places are occupied by the largest companies from the banking, transport and fuel sectors.

The presence of a subsidy provision and colossal client interest could not but lead to these extremely high indicators.

How to withdraw money from a pension fund

Perhaps this is the key question for many when choosing a company to which they plan to literally entrust “their future.”

Huge capital/profitability and a place in the reliability rating are not always a guarantee of stability.

It is important for every citizen to understand that at any time, at his own request, he can withdraw his own savings (money) and terminate the existing client agreement.

First, you need to understand that funds entrusted to any non-state pension fund, including NPF Blagosostoyanie, have nothing in common with bank deposits. The law does not provide for the opportunity to contact a branch of a non-state pension fund and request your own pension savings in cash or by transfer to a bank account.

If we simplify the entire functionality of these companies as much as possible, then the peculiarity of a funded pension is that, in essence, these are insurance contributions that a citizen cannot claim until retirement.

In this case, exit from a non-state pension fund means transfer of the funded part to another organization, which fully complies with current legislation.

To transfer to another NPF, it is enough to contact the desired organization with the appropriate application for obtaining client status, after which the selected fund will independently apply for the transfer of savings “under its own wing”, accordingly interrupting the existing pension program in another organization.

Contacting NPF Blagosostyaniya

This also applies to Russian Railways employees, who also need to contact their own HR department with an application to transfer savings and terminate participation in the corporate program.

A separate issue is the procedure established by law for inheriting the funded part of the pension of a deceased citizen who is a client of a non-state pension fund.

Inheritance rights and the number of possible heirs are determined in a standard form, which is regulated by current legislation.

The first category includes spouses, children and parents, the second includes grandchildren, brothers/sisters, and grandparents.

But it should be understood that they also cannot directly use the funded part and simply withdraw it, but no one can deprive them of the right to choose for themselves whether to enter into an inheritance.

Each citizen can influence the order of inheritance in the event of his death and determine what share and in what order will be distributed among relatives and other persons.

In this regard, NPF “Blagosostoyanie” is no different from other organizations. All possible individual difficulties are of an exceptional nature, as, for example, from the review above, and cannot fully characterize the company’s activities.

NPF prosperity official website

Hello, first you need to review your contract concluded with them. Citizens can legally receive pension savings before retirement only in the form of a lump sum payment and only if they are disabled people of groups 1, 2 or 3. You can switch to another pension fund, for example a state one, by contacting any department of the Pension Fund and writing an application. In accordance with the decision of the Arbitration Court of the Irkutsk Region, the operative part of which was announced on December 17, Irkutsk, st. Rabochaya, d. B, hereinafter - the Fund is subject to forced liquidation.

How to find out your savings

No one has the right to restrict your access to information about the amount of your “assets” or to your pension account, therefore for clients of JSC NPF “Blagosostoyaniye” it is enough to choose one of three methods to obtain the information they need:

- The simplest option would be to use the previously mentioned “Personal Account”, which will become available after concluding the relevant agreement.

- There is an option for personal contact at any convenient branch of the company, where it is enough to present your passport to request the necessary information.

- You can also request the status of savings remotely by sending a corresponding request to the postal address of the branch. The response will be sent to the contacts indicated in the main agreement.

The deadline for providing a response will depend on many additional nuances.

"Prosperity" NPF (JSC)

The license was canceled by the Bank of Russia, as reported on the financial institution’s website. Such enforcement measures were taken against NPFs for repeated violations of the requirements for dissemination, provision or disclosure of information. Fund investors can obtain information about the amount of savings by contacting the Pension Fund at their place of residence. You can submit requests for payment of pension reserve funds here in writing.

Head of the organization: President Polyntsev Evgeniy Petrovich. The organization's activities are not specified. Of course, during this period you will not receive any additional accruals in any fund. An unpleasant moment that no one warns about. Here, as the participants assure, a very interesting and simple scheme is used: you are simply refused to terminate the contract for one reason or another. Either the application was written incorrectly, or the conditions for transferring to another pension fund were not met. If you really intend to leave the fund, you will have to prepare to do so with a fight. Several complaints, repeated applications and a long wait for the transfer of funds - and you will achieve your goal.

Details of NPF Blagosostyaniya

Help Desk

Tel.: +7 (499) 262 3336;

email mail

Full name: Joint Stock Company "Non-State Pension Fund"

"WELL-BEING"

Head office address: 127006, Moscow, st. Malaya Dmitrovka, 10

TIN 7707424367

Gearbox 770701001

OKPO 35094339

OKVED 65.30

OGRN 1187700022465

In total there are more than 70 branches throughout the Russian Federation.

The official website also provides a feedback form with a convenient and user-friendly interface.

Tool for reflection

But recently, again, at the initiative of the state, a new reason has arisen for those shaping their lives “after work.”

These are NPFs – Non-State Pension Funds.

Again, it's very simple. NPFs are specialized commercial structures that are ready to accept pension money, work with it much more actively, invest it in business, as they say, and due to this provide noticeably higher interest on such a pension contribution.

More on the topic Is it possible to pay for kindergarten with maternity capital in 2020?

Something looks too much like the same “Khoper”. Yes, there is a risk of losing your investments and the main danger of non-state pension funds. Unfortunately, the recent situation is not very encouraging for investors. Thus, in 2016, the Central Bank of Russia revoked the licenses of four non-state pension funds with rather sonorous names - “Sun. Life. Pension", "Savings Fund Sunny Beach", "Savings", "Protection of the Future".

But, okay, these are all little-known NPFs. So, after all, the very respectable “Renaissance Life” ceased to exist.

Take a look at the list of Non-State Pension Funds accredited in 2020.

And again, the conclusion is that when choosing a non-state pension fund, be sure to “scan” its entire “pedigree”; do not immediately rush to 13% per annum, while the Pension Fund offers only 7%. In any case, the choice between the NPF “We wish you happiness” with 15% and the NPF under Sberbank of Russia (there is one) with 12% must definitely be made in favor of Sberbank.

The choice of an Independent PF (you can even call it “commercial”, and the future pensioner himself becomes a “businessman”) instead of a “state” one is also due to another component of the relationship.

This is a long-standing problem of government organizations - openness and transparency of their actions. The NPF has taken publicity (potentially, of course) to the widest possible extent. When you come to the Independent Foundation, you come “to your home”, you are the boss here, you are received at the highest level (dreams, of course, quite according to Poe). I don’t even want to talk about how you are greeted at the State Pension Fund - there is no time for dreams, it’s just reality (or rather, “dust”).

The state protects its citizens from failed NPFs!? Yes, and that's true. The funds will be transferred to the Pension Fund, but only in full and as a percentage. Everything will be done quite quickly - but the nerve cells still do not recover, and there is running around to notaries in an attempt to request the necessary paper, and these incomprehensible questions: “Perhaps you will transfer to another non-state fund” (yes, “healthy again”).

![Alfa-Bank Credit cards [CPS] RU](https://7daystodie.ru/wp-content/uploads/alfa-bank-kreditnye-karty-cps-ru-330x140.jpg)