Legislative framework

The main regulatory documents that establish key aspects regarding pension provision for citizens are Federal Law No. 166-FZ of December 15, 2001 “On State Pension Provision in the Russian Federation,” as amended in 2019, as well as Federal Law No. 400 -FZ of December 28, 2013 “On insurance pensions”, as amended in 2020

These key pieces of legislation determine that any Russian has the right to apply for financial support from the state, subject to certain conditions. And these conditions are the grounds for assigning and paying pensions.

For example, you can receive pension payments not only upon reaching a certain age, but also, for example, for medical reasons. This standard establishes a state guarantee for citizens who have lost the opportunity to work independently and provide themselves with everything they need. In simple words, if a citizen has been injured or injured and is now unable to work, and therefore, provide himself with housing and food, he will be awarded a disability pension. Of course, you will have to undergo a special examination of health limitations, that is, confirm your disability by passing a medical commission.

Law No. 400-FZ is not the only regulatory act that regulates the procedure for paying pensions. There are also regional measures to support older people and people with disabilities. Thus, each of the constituent entities of Russia has approved the minimum values of the insurance pension. Payments should not be lower than this amount. If the calculated amount does not reach the specified minimum, then a social supplement must be assigned.

In addition to regional measures to support the population, similar provisions have been developed and approved at the level of law enforcement agencies and departments. So, for example, military personnel, law enforcement officials, prosecutors, the Investigative Committee, courts and other structures have additional financial guarantees.

Types of insurance pensions

There are three types of insurance pension:

- by old age;

- in case of loss of a breadwinner;

- on disability.

Old age is the most common type. We learn about it from Article 3 of Law No. 400-FZ “On Insurance Pensions”. This regulatory act came into force in 2013, and from that moment on, instead of a single labor pension (as was previously), the benefit consists of three parts:

- basic part of the pension;

- insurance part of the pension;

- funded part of the pension.

Old age payments: there are differences

It is generally accepted that upon reaching a certain age, the state will fully provide for us. However, this is not quite true. Officials adjusted the legislation back in 2013. The pension reform established minimum requirements for the provision of state support to elderly citizens.

Now you can apply for a payment not only upon reaching a specific age, but you will also have to meet the conditions for length of service and personal points. So, if a citizen has reached the age of retirement, for example a man - 60 years old in 2020, but has never officially worked anywhere in his entire life, then he does not have the right to a pension. Such a person will have to wait another five years to receive his old-age pension.

Consequently, old-age pension and insurance pension are not entirely identical concepts. Although many are confused about the definitions.

Let's take a final look:

- An old-age insurance pension is a payment from the funds of the Pension Fund of the Russian Federation in favor of a citizen who has reached a certain age (60 and 65 years) and has a certain insurance period not lower than the minimum values.

- Social old-age pension is a similar state payment, which is also assigned to citizens upon reaching a certain age (65 and 70 years old) subject to the absence of insurance coverage or its insufficient value (below the approved minimum).

How to understand who gets what?

Let's take the average family. Let’s assume that the husband, Bukashka Alexander, worked all his life, provided for his family, and earned money. And his wife, Korovkina Glafira, in turn, was raising children and did not have an official job.

Alexander Bukashka will be able to retire upon reaching the age of 65 (with the exception of the transition period from 2020 to 2022). His state pension will be calculated based on his existing insurance coverage, salary level and accumulated pension points. Please note that, according to the conditions of the example, Bukashka Alexander does not have grounds for early retirement. However, some other categories of Russians retain this right (northerners, workers in hazardous industries, and so on).

Glafira Korovkina can also count on pension payments from the state, but only upon reaching 65 years of age. Let us remind you that for “working” women the period for assigning an insurance state pension is 60 years. However, Glafira will be assigned a fixed payment - a social pension, the amount of which is approved for the corresponding period and indexed in the general manner.

The social old-age pension is not an insurance payment; it is regulated by the provisions of Law No. 166-FZ. But insurance coverage for old-age pensioners, in turn, has components. Let's look at them in more detail.

Promotion Information

Officials have not planned any increase in social pensions in 2020. But all categories of recipients are subject to recalculation, which is traditionally carried out in Russia annually on April 1. In 2019, no legislative innovations are envisaged regarding indexation periods. This means that pensioners will receive benefits in the new amount starting in April, while in the first quarter they will remain unchanged. The expected increase will be 2.4%, or in monetary terms an additional 200-500 rubles. depending on the category of the recipient. The size of the increase is determined based on the rate of increase in the pensioner’s subsistence level (PLS) over the past year. By the way, in recent years this type of benefits has not been subject to significant revisions: in 2020 they increased by 4%, in 2020 - by 1.5%, in 2020 - by 2.9%.

The size of the old-age benefit is taken as the basis for calculating social benefits, which after an increase of 2.4% in 2019 will amount to RUB 5,304.57. Thus, we can roughly calculate what social pension the remaining benefit categories of the population will have in 2020:

| Category | Benefit amount, rub. |

| By old age | 5 304, 57 |

| For the loss of one breadwinner/parent | |

| After the loss of both parents | 10 609, 17 |

| Disabled children | 12 730, 82 |

| Disabled people from childhood, 1st group | |

| Disabled people from childhood, 2nd group | 10609, 17 |

| Disabled people of the 1st group | |

| Disabled people of the 2nd group | 5 304, 57 |

| Disabled people of the 3rd group | 4 508, 91 |

If, after the planned increase, the total amount of benefits does not reach the established PMP, the recipient will receive a special additional payment in the missing amount. The value of the PMP is established for the country as a whole, but individual constituent entities of the Russian Federation can set their own indicators. When choosing the amount of additional payment (before reaching the federal or regional PMP), a larger value is always selected. The federal size for 2020 is already fixed at 8,846 rubles. (for comparison: in 2020 it was 8,726 rubles). In other words, receiving, for example, a social old-age pension in the amount of 5,304 rubles, a pensioner will receive an additional payment of 3,542 rubles in order to reach the total amount of the same PMP for a pensioner. A prerequisite for receiving it is the absence of work or other activity, the conduct of which requires compulsory pension insurance for the person.

The projected increase in social pensions in 2020, according to financial experts, will go almost unnoticed by recipients of this benefit and will not contribute to improving their financial situation. After all, it does not even cover the real inflation rate, which is set at 3-4%.

Types and amounts of insurance contributions affecting the size of the pension

Did you know that every employer contributes a significant portion of an employee’s earnings—22%! — to the Pension Fund to account for the formation of future maintenance in old age?

Did you also know that every citizen can choose whether he will form only the insurance part or also the funded one? True, all workers born in 1967 and younger had to do this by the end of 2020, and they can no longer change this decision. But young people under 23, who are just starting their working career, still have this right to choose.

If you choose to form only the insurance part of the pension, then mandatory contributions are distributed as follows:

- 16% of a person’s monthly earnings goes towards the individual tariff, that is, to create the insurance part;

- 6% is deducted towards the solidarity tariff (these funds will be used in the future to pay funeral benefits and other purposes established by law).

If you choose to form both insurance and funded pensions, then such contributions are distributed differently:

- 10% goes to the insurance part;

- 6% - for savings;

- 6% - for the joint tariff.

It can be seen that we can manage, at best, 6% of our monthly earnings. We can send it to accumulate and earn interest in any of the existing non-state pension funds or leave the management of these funds to the Pension Fund.

It should be noted that the old-age insurance pension is formed in a special way from 2020: for now there is a moratorium on deductions of contributions to the funded pension. That is, all contributions go into one pot. But for the future we can offer an independent rating of NPFs.

How does the insurance part of a pension differ from the funded one?

An appropriate insurance period is required for an insurance pension. The insurance part is formed from employer contributions, the amount of which is strictly fixed.

And the savings account is stored in a separate account in the Pension Fund. This Fund receives income from it, and a citizen can, in addition to the established deductions, make additional ones on his own behalf. We talked about this in a separate article.

Accordingly, the amount of pension payments in old age depends on two factors:

- profitability of the Fund's activities (accumulative part);

- amount of contributions (insurance part).

Only Russian citizens born in 1967 and later have a funded part of their pension. The rest don't have it.

How to find out your age and points to receive an insurance pension

To receive an old-age pension from the state, three conditions are required:

- reaching a certain age;

- having a minimum work experience, now you need to work for at least 10 years in 2020, the figure will increase to 15 years by 2025;

- the sum of pension points is at least 16.2 (data from 2020, this figure will grow every year and in 2025 it will be equal to 30).

During the reform, this indicator replaced pension capital; it takes into account the individual characteristics of the citizen, but in fact means the amount of accumulated contributions.

Old age is a relative concept; many people still have good spirits even at 80 years old, but previously the legislator determined that old age can be considered:

- 55 years - for representatives of the fair half;

- 60 years - for men.

But since 2020, everything has changed dramatically. Officials carried out another reform, increasing the retirement age by five years. Now a man can apply for state support only after reaching 65 years of age, and a woman - 60.

Age restrictions for the transition period:

| Year of birth of Russians | The period for the emergence of the right to state support is the date of retirement | ||

| Men | Women | What would it be like if the age had not been increased in 2018? | How will it be now, after the innovations |

| 1959 | 1964 | 2019 | 2020 |

| 1960 | 1965 | 2020 | 2022 |

| 1961 | 1966 | 2021 | 2024 |

| 1962 | 1967 | 2022 | 2026 |

| 1963 | 1968 | 2023 | 2028 |

Please note that a gentle transition period is provided for Russians. For example, a man who turns 60 in 2019 or 2020 will not have to work for an additional five years. For such a citizen, the term has been significantly reduced; he will only have to work for six months (6 months).

Also, preferential conditions have been provided for persons who have a solid insurance record. They were given the opportunity to retire two years ahead of schedule. To take advantage of this privilege, a long work history is required, for a man - 42 years, and for a woman - 37. However, this only applies to citizens who have already reached the age limit of 60 years. - men and 55 years old. - women.

Retirement in 2020

Pension legislation (Article 8 of Law No. 400-FZ of December 28, 2013) establishes 3 mandatory conditions, the fulfillment of which allows you to apply for an old-age insurance pension:

- Reaching retirement age.

- Availability of the minimum required insurance experience (official work experience during which insurance contributions were paid to the Pension Fund of the Russian Federation).

- Availability of a certain number of pension points generated from insurance contributions (IPC).

The requirements for length of service and the number of individual industrial complexes have been gradually increasing since 2020, and the retirement age will begin to increase from January 1, 2020. As a result, the minimum requirements, the fulfillment of which will allow a citizen to retire in 2020, are presented in the table:

| Retirement age | Insurance experience | Pension points (IPC) |

| Women - 55.5 years | 10 years | 16.2 points |

| Men - 60.5 years |

Note: the table shows the minimum conditions for applying for an old-age pension in 2020, taking into account Vladimir Putin’s amendments to soften the pension reform.

Only the simultaneous fulfillment of all three conditions will allow you to retire in 2020. If any of them are not met (there is not enough length of service, pension points or the established age has not been reached), then you must keep in mind that in 2020 these values will be even higher.

Increasing the retirement age in Russia from 2020

The most discussed change in the conditions for retirement in 2020 is the increase in the generally established retirement age, the achievement of which allows a Russian to receive an old-age insurance pension. Before 2020, it was 55/60 years (women/men, respectively). In total, as a result of the reform, it is planned to increase the retirement age for women and men by 5 years - i.e. up to 60 and 65 years, respectively.

However, in 2020, the final value of the retirement age will not be established, since the law provides for a transition period during which intermediate provisions will apply. Therefore, in 2020, payments can be made upon reaching:

- 55.5 years for the female population;

- 60.5 years for the male population.

In other words, those citizens who, according to the old law, were supposed to retire in 2020, having reached the age of 55/60, will receive payments only six months after reaching this age.

It should be noted that initially the increase in the retirement age in 2020 in accordance with the Government schedule was planned for 1 year (to 56 years and 61 years, respectively), however, on instructions from the President for those pre-retirees who, according to the old law, were supposed to retire in 2020 and In 2020, an additional benefit will be provided - the opportunity to apply for a pension six months earlier than the new retirement age.

Who will retire in 2020 in Russia?

Taking into account the schedule for increasing the retirement age under the new law:

- in the first half of 2020, on a general basis, no one will be able to apply for an old-age insurance pension (until a woman or man turns 55.5 and 60.5 years old, respectively);

- in the second half of 2020 will be able to retire upon reaching a new retirement age: men born in the first half of 1959,

- women born in the first half of 1964

Those citizens who:

- reached retirement age even earlier (before 2020), but delayed retirement;

- have the right to early registration for any reason.

Thus, the transitional provisions under the new law provide for such adjustments that there will be virtually no new pensioners in the first half of 2020—citizens will begin reaching the new retirement age only in the second half of 2020.

Preferential pension from 2020

Changes to pension legislation in 2020 will also affect some recipients of early pensions on preferential terms. From January 1, 2020, the rules for retirement will be adjusted for them in the same way as the generally established retirement age. These adjustments will affect:

- Northerners, i.e. working in the Far North or in areas equated to CS areas. For them, the retirement age will be increased from 50/55 for women/men, respectively, to 55/60 years. Taking into account the transitional provisions, northerners who have reached the age of 50.5/55.5 years can retire in 2020.

- Teachers, medical and creative workers who have the right to early retirement upon receipt of the required professional experience. For them, it is proposed to maintain the requirements for special work experience, but payment processing will be delayed for 5 years from the date of acquisition of the required work experience.

Due to transitional provisions in 2020, it is expected that retirement for teachers and health workers will only be delayed by six months - i.e. Having received work experience in 2020, it will be possible to apply for a pension only in the second half of 2020 or in the first half of 2020.

Early retirement with long service

Changes to pension legislation also provide for an additional opportunity for early retirement if you have a long work history: 37 years for women and 42 for men. They can issue payments 2 years earlier than the established retirement age, but not earlier than 55 years for women and 60 for men.

Accordingly, in 2020, it will be possible to retire according to the old retirement age standards - at 55 and 60 years old if you have a long work experience - this can be done by citizens who started working early and were officially employed for 37 and 42 years (women and men respectively).

Formula for calculating the insurance part of a pension

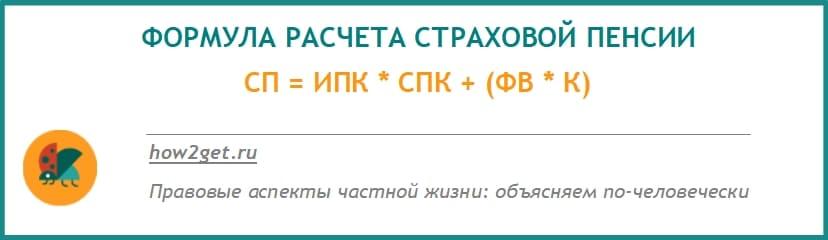

Many people begin to find out the size of the old-age insurance pension in the year of retirement, and we will set ourselves this task right now. The calculation formula can be depicted as follows:

The abbreviations mean the following:

- SP is the actual insurance pension (its size);

- IPC - the previously mentioned sum of points, or individual pension coefficient, it is established at the time of determining the amount of benefits;

- SPK is the cost of a pension point (coefficient), in 2020 it is equal to 8,724 rubles;

- FV - fixed payment - this is actually the amount that the state is guaranteed to pay monthly towards this benefit;

- K is the PV increase coefficient, which is used when delaying the application for the appointment of the insurance part (that is, the longer you do not apply for a pension, the higher this coefficient).

So, we have found the answer to the question: the insurance part of the pension, how to find out the amount. You can use this formula. Or you can learn about everything in relation to your specific situation at a consultation with the Pension Fund.

Indexation of pensions in 2020 in Russia for those who are already retired

Despite the pension reform, pension increases in 2020 will continue to be carried out in the form of indexation (a proportional increase in pension benefits for everyone by the same percentage), however, the procedure for this indexation will be changed.

Starting from 2020, insurance pensions will be indexed from January 1 by an amount that will be almost 2 times higher than the inflation rate in the past year. Indexation of other social payments of the Pension Fund (EDV, NSO, etc.) will be carried out as usual - from February 1 to the inflation rate.

The stages and planned amount of indexation of pension provision for Russians for 2020 are presented in the table:

| What will be indexed | Indexation date | By what percentage |

| Insurance pensions (cost of 1 IPC and fixed payment) | 01.01.2019 | 7,05 |

| Social payments from the Pension Fund of Russia (EDV, NSO, funeral allowance, etc.) | 01.02.2019 | 3,1 |

| State and social pensions | 01.04.2019 | 2,4 |

Thus:

- Insurance pensions will be indexed from January 1 by 7.05% in order to fulfill the Government's plan to increase the average pension provision of Russians in 2020 by 1,000 rubles. The planned increase for 2020 is 1000 rubles. will be made at the expense of funds released as a result of raising the retirement age, which the Government plans to use in full to increase the pension provision of Russians. The Cabinet of Ministers plans to make this additional payment annually in order to bring the average benefit in 2020 to 20,000 rubles.

- Pension Fund social payments will be indexed according to the usual plan (from February 1) depending on price increases in 2020. Because The Ministry of Finance predicts the inflation rate to be within 3.1%, this indexation will be carried out from February 1 by approximately 3.1%.

- Social pensions will be indexed in 2020 taking into account the increase in the pensioner’s subsistence level (PMP), i.e. by 2.4%.

Changes in pension payments in 2020 as a result of all planned indexations can be presented in the form of a table:

| Type of payment | Indexation, % | Size, rub. | |

| in 2020 | in 2020 | ||

| Cost of 1 IPC | 7,05 | 81,49 | 87,24 |

| Fixed payment amount | 4982,90 | 5334,19 | |

| Average annual old-age insurance pension | 14414 | 15430 | |

| NSO | 3,1 | 1075,19 | 1108,52 |

| Funeral benefit | 5701,31 | 5878,05 | |

| Social old age pensions | 2,4 | 5240,65 | 5366,43 |

Will there be indexation of pensions for working pensioners in 2020?

The increase in pensions by 1,000 rubles planned by the Government in 2020 will not affect working pensioners due to the so-called “freeze” - from 01/01/2016, for this category of citizens, pension provision is not indexed at all as long as they continue to work.

The cost of one pension point (IPC) and the value of a fixed payment for workers remain at the level of those values that were established on the date of the person’s retirement. Each year, these values are not indexed in accordance with the level of inflation, so the pension provision of working pensioners remains the same.

As in 2020, an increase in pension in 2020 for this category of pensioners will be carried out only in August, when the traditional recalculation of the pension amount will take place, which will take into account the accumulated pension points during working life. But a significant increase in payments as a result of such recalculation is not expected for a number of reasons:

- In 2020, IPCs formed through the payment of insurance premiums in 2020 (i.e. for the past year) will be taken into account.

- The maximum increase is limited to the cost of three SPCs. The remaining IPC will be taken into account only when recalculating next year, or upon dismissal.

- The cost of one pension point due to the above-mentioned moratorium depends on the date of retirement of the person, i.e. The increase will be smaller the earlier the pension payments were made.

The maximum amount of increase for working pensioners in 2020, depending on the cost of one individual investment complex established for them, can be presented in the form of a table:

| Retirement date | Cost of pension point, in rubles. | Maximum increase from 01.08.2020, in rubles. |

| until February 1, 2016 | 71,41 | 214,23 |

| from February 1, 2016 | 74,27 | 222,81 |

| from February 1, 2017 | 78,28 | 234,84 |

| from April 1, 2017 | 78,58 | 235,74 |

| from January 1, 2018 | 81,49 | 244,47 |

It is worth noting that recalculation in August 2020 will be made only to those pensioners who retired before December 31, 2020 - those who made payments in 2020, when determining their pension benefits, all accumulated pension points for 2020 are taken into account. For them, the August recalculation will be made only in 2020, as a result of which the IPC will be counted for periods of work in 2020.

The procedure for indexing pensions in 2020

Raising the retirement age led to a wave of discontent among the entire population of the country, which has not yet reached its well-deserved retirement. In order to somehow compensate for the inconvenience caused to future pensioners, legislators decided to increase the indexation of citizens' pension savings. Please note that indexation applies only to already assigned pensions.

So, how will Russians’ pensions be increased in 2020? Almost every one of us has seen or read about officials’ promises to increase payments by a whole thousand rubles. Is it so?

From 01/01/2019, all insurance payments were indexed by 7.05%. Consequently, not all pensioners will receive the promised 1000 rubles. But why? Yes, because the size of the increase directly depends on the amount of the assigned payment.

So, for example, if your pension in 2020 was 10,000 rubles, then expect an increase of 705 rubles. Consequently, pensioners who received at least 15,000 rubles monthly can apply for a thousand ruble increase.

So, have we been deceived again? No, after all, no one stated that a thousand rubles are due absolutely and everywhere. Officials immediately stated that the increase was calculated on average, that is, for all pensioners in the country at once. Those who had a higher pension will receive a significant increase, while a pensioner with a minimum payment will receive a small increase.

Let us repeat once again, the indexation size is determined to be the same for everyone. It amounted to 7.05% for 2020. There is no need to submit applications to the Pension Fund, the money will be added automatically.

Indexation of social pensions and payments.

Social pensions will increase by 0.4% from April 2020. Social payments, such as monthly cash payment (MCB), set of social services (NSS), funeral payments, will increase by 3.1%. Indexation will take place from February 2020.

If a pensioner received a social supplement to the pension that is below the subsistence level, the pension is indexed without payment.

Example: a pensioner received a pension of 12,150 rubles. The cost of living in this region is 12,680 rubles. That is, the pensioner received a social supplement of 530 rubles. Due to indexation, the pensioner will receive 13,007 rubles (we multiply 12,150 by 0.0705). Thus, the pensioner’s pension increased by 327 rubles.

If, after indexation, a person’s pension is less than the minimum subsistence level established in a given region, he is required to receive a social supplement up to the minimum subsistence level.

However, following Vladimir Putin’s address to the Federal Assembly in 2020, clarifications were announced in the indexing mechanism that will compensate for possible injustice. A detailed analysis of the appeal is given here.

Disability pension

Some diseases and significant deviations in health are the key reason why Russians cannot work stably and provide for themselves. Of course, medicine in Russia is free, but sometimes this is not enough. After all, most medications will have to be purchased at your own expense, and you have to wait a very long time for quotas for operations. But these are not the only cost items. After all, you still need to eat something, somewhere to live, something to put on and put on shoes, and if you also have children, what to do?

In this case, citizens with health problems are sent to undergo a medical commission, according to the results of which the patient is recognized as disabled (or not). After receiving an official conclusion, the citizen is transferred to state support. That is, a disabled person is assigned a state pension.

The amount of payments depends on the disability group. There are several of them in Russia. So, in addition to the main classification: groups 1, 2 and 3, separate statuses are distinguished, such as “disabled child” or “disabled since childhood”, “disabled WWII” and so on.

Please note that the assignment of a state insurance pension does not in any way affect disability payments. That is, a citizen can be recognized as disabled after reaching retirement age. As a result, such a person will be able to receive two payments at once - a well-deserved insurance and a state disability pension.

In addition, it should be taken into account that if a disabled person has absolutely no insurance experience, then he will be assigned a social state disability pension. These categories usually include children, as well as Russians who, for various reasons, could not work or did not work officially.

Who will have their pension increased from April 1 and by how much?

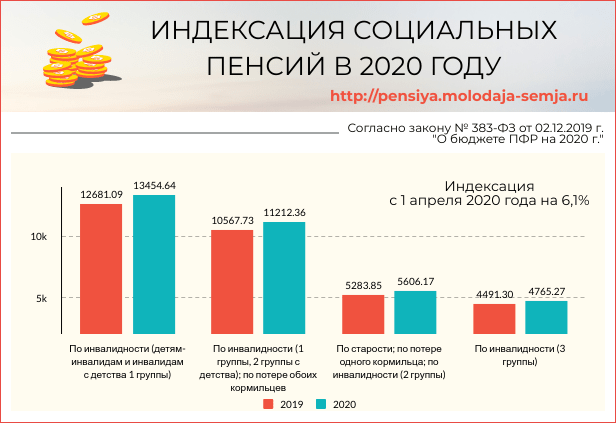

The 6.1% indexation approved on April 1, 2020 will affect recipients of the following types of social pension:

- By old age:

- women over 65 years of age and men over 70 who are not entitled to an insurance pension due to lack of experience, the required number of pension points, etc.;

- representatives of small peoples of the North (women over 50 and men over 55).

- For disability:

- 1, 2 and 3 groups;

- for disabled children and people with disabilities since childhood.

- For loss of a breadwinner:

- children under 18 or full-time students under 23 years old who have lost one or both parents;

- children under 18 or full-time students under 23 years old, whose parents are unknown.

The increase will be made in accordance with the scheme presented below:

Infographics: how much will social pensions increase in 2020

It should be noted that in connection with the increase in the social pension, from April 1, 2020, state pension payments will increase. They are received by WWII participants, flight test personnel, victims of radiation and man-made disasters, including members of their families, and so on.

Be sure to read it! Is it possible for pensioners to work and receive a pension?

In addition, the amount of some additional payments to military pensioners is tied to the amount of the old-age social pension. In particular, due to the indexation of social pensions, additional payments will increase:

- 80-year-old pensioners;

- WWII participants and combat veterans;

- disabled people of group 1;

- as well as citizens who have dependents (for example, minor children).