Moscow pension in the Moscow region

2.1. If you are registered in the Moscow region, you will lose the right to the Moscow supplement to your pension. If you have already checked out (9 deregistered) in a Moscow apartment, then you have already lost the right to this additional payment.

4.3. Hello, Tatlyana! The Moscow pension is available to citizens who have been registered in the capital for at least 10 years; all periods are taken into account, regardless of breaks; other pensioners have the right to an additional payment up to the subsistence level. Sincerely, STANISLAV PICHUEV.

Which citizens have the right to receive a Moscow pension?

There is a certain category of people who can have such privileges, for this you need:

- have official registration in the capital;

- live in the city for ten years;

- not be officially employed, the only exception being low-paid professions, for example, librarians, cleaners, housing and communal services workers, concierges and others.

Moscow benefits are not available to the following citizens:

- receiving a pension in another Russian region;

- those who left Russia for six months or more;

- in a psychiatric clinic or in prison.

What kind of pension do visiting pensioners receive in Moscow?

- Pensioners employed in budgetary institutions in the field of education, culture, social protection, healthcare, whose income does not exceed 20 thousand rubles. monthly.

- Pensioners employed as concierges, watchmen, doormen, whose income level does not exceed 20 thousand. Rub. monthly;

- Pensioners employed as cloakroom attendants in budgetary organizations in the fields of education, sports and healthcare, with an income level not exceeding 20 thousand rubles.

- Pensioners employed in the landscaping and cleaning industry. This institution must be included in the List of Housing and Communal Services Organizations, and the employee’s salary must not exceed 20 thousand rubles. monthly;

- Disabled citizens with disability group 3, who received it as a result of the liquidation of the Chernobyl disaster. The salary of such a pensioner cannot exceed 20 thousand rubles.

- Passport and photocopy with a mark of permanent registration in Moscow;

- Pensioner ID;

- A certificate from the Pension Fund about the amount of pension payment and the timing of its appointment;

- Work record book with a note on termination of employment;

Minimum pension in Moscow

This amount depends on whether this citizen works or not. There are certain restrictions for working citizens.

For non-working people

Pensioners who do not work are subject to indexation of payments and are entitled to all established additional payments.

If the payments received are less than the City Social Standard, an additional payment is made to non-working pensioners.

In 2020, the old-age pension is 17,500 rubles.

For working pensioners

For those who continue to work, pension indexation has not been carried out since 2020.

How is the old age pension calculated in 2020? Will there be an additional payment to the pension of labor veterans in 2020? Find out here.

There was no increase in the payment in 2020 and there are no plans to do so in the near future.

The average pension of non-working Moscow pensioners is higher than that of working ones.

The minimum pension value for them is established without taking into account the State Social Insurance Fund. Today this value is 11,816 rubles.

However, in some cases, for working pensioners, the city supplement continues to apply.

This applies to the following categories of workers:

- Disabled people of the Great Patriotic War.

- Disabled people of the first or second group.

- Young people aged 18 to 23 who are full-time students.

Also, working citizens whose income does not exceed 20 thousand rubles, but at the same time they work in certain positions, receive an increase.

Here are some examples:

- Work in budgetary institutions that deal with issues of culture, social protection, health or education. At the same time, monthly income cannot exceed 20 thousand rubles.

- This category includes those who were employed as a watchman, doorman or concierge in one or another budget institution. The limit on income received, the same as in the previous case, is 20 thousand rubles.

- If you work as a cloakroom attendant in one of the government agencies and have an income that does not exceed the limit specified here, a social supplement will be paid.

- If we are talking about an organization that relates to housing and communal services, and the work relates to cleaning or landscaping, the income is within 20 thousand, then social benefits will be paid to such a pensioner.

Payments are due to disabled people of the third group who suffered during the liquidation of the consequences of the Chernobyl nuclear power plant accident, provided that the amount of income is within 20 thousand per month.

Those who are not included in such lists do not receive an additional payment to their pension up to the level of 17,500 rubles.

Pension for those who have just registered in Moscow

A citizen of the Russian Federation has the right to one type of pension, either labor or disability. From January 1, 2007, continuous work experience for calculating a pension does not matter; everything will depend only on the periods during which contributions were made to the Pension Fund. The procedure for calculating and paying pensions in Moscow does not differ from the payment of pensions in other cities of Russia.

The labor pension and disability pension consists of three parts: basic, funded and insurance. Labor pension in case of loss of a breadwinner consists of two parts: basic and insurance. The coefficient will be calculated for you and accruals will be made to the pension fund of any city in Russia. The concept of a Moscow pension does not exist. In the city of Moscow, unlike other cities, there is a regional surcharge, previously it was called the unified city standard, even earlier people called these charges Luzhkov. If a pensioner has been registered in Moscow for less than 10 years, he will receive a pension according to his labor prowess. It doesn’t matter when he will be registered yesterday or tomorrow. The PF must fulfill all its obligations. You will no longer be able to demand anything from the USZN.

Moscow pensioner status: what are the conditions for obtaining it?

- You must reach the following age: for women 63 years old, for men 65 years old;

- there must be contributions to the State Pension Fund, a certain percentage of the salary;

- having relevant work experience, that is, at least ten years;

- accumulation of specific pension points – no less than 16.2.

If there is no work experience, the citizen has the right to receive a social pension; there are conditions for this:

- permanent residence on Russian territory;

- Women must reach the age of 60; men must reach 65 years;

- there should be no official work.

Useful tips: how to get a Moscow pension

- Passport. Foreigners are provided with a residence permit.

- SNILS.

- Military ID.

- Completed application for a pension. It has a prescribed form and is issued by an employee on site. It can be found on the official website of the Pension Fund.

- A document with information on the average monthly salary for 60 months of continuous service until 01/01/2002.

- Bank agreement for opening an account. The document is not provided if the applicant wishes to receive a pension at Russian Post (in person or at home) or through another organization for the delivery of relevant payments.

- Papers confirming your place of residence, if it differs from your passport details.

Upon completion of consideration of the application and a positive decision, the person is issued a pension certificate. For questions regarding the registration of surcharges, those residents of Moscow who have the right to receive it should apply here. Unemployed citizens who have lived in the city for at least 10 years can apply for it. Supplements also exist for working pensioners whose monthly income is less than 14,500 rubles.

This is interesting: Benefits for children of Chernobyl victims of the first stage for housing

Conditions for appointment and amount of social old-age pension

The assignment of a social old-age pension is made to those citizens who do not have the right to an old-age insurance pension. In what cases does this happen? This is possible in cases where a citizen, by the time a pension is assigned, has not accumulated the minimum insurance period, that is, has not worked the legally established minimum number of years, and/or has not earned the minimum required number of pension points (the value of the individual pension coefficient earned by him is less than a certain value).

If a citizen plans to retire in 2020, but his insurance period is less than 11 years and/or his individual pension coefficient is less than 18.6, then he will not be assigned an insurance pension. These minimum values are set by the state and increase annually. In 2025, the minimum insurance period will be 15 years, and the minimum value of the individual pension coefficient will be 30. After which their growth will stop.

In particular, in 2021, the minimum insurance period for assigning an old-age insurance pension will be 12 years, and the individual pension coefficient will be 21.

It is important to know that the age requirements for granting a social old-age pension

are more stringent than for the assignment of

an insurance pension.

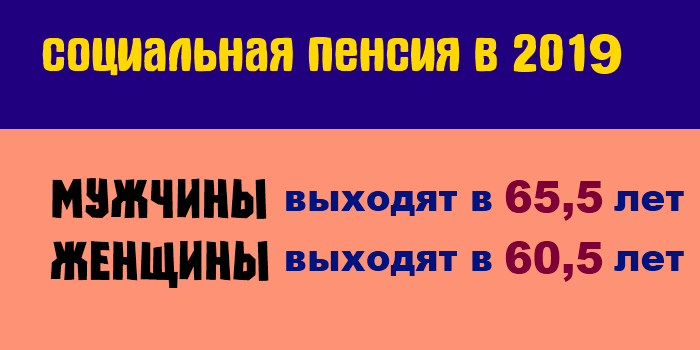

In 2028, a social pension can only be assigned upon reaching the age of 70 years (men) and 65 years (women). Until this year, the retirement age will gradually increase. In 2020, men aged 65.5 years and women aged 60.5 can receive social old-age pension.

However, there are age exceptions when a pension can be assigned earlier. This is due to the areas where retirees live. Thus, an old-age social pension is issued to persons who have reached the age of 55 (men) and 50 years (women), who not only permanently reside in areas inhabited by small-numbered peoples on the day of assignment of the specified pension, but also belong to the small-numbered peoples of the North.

But if a representative of a small people of the North at the time of granting a pension lives, for example, in central Russia, then he does not have the right to receive a social old-age pension at the age indicated above.

A document confirming belonging to the small peoples of the North is a passport or birth certificate, which indicates the corresponding nationality. If this information is not contained in the documents, then it is confirmed by a certificate issued by the local government body.

A document confirming the fact of permanent residence in areas inhabited by indigenous peoples of the North is a passport or a document confirming registration at the place of residence.

Will the pension amount be increased if I register in Moscow?

Non-working pensioners who receive a pension or lifelong allowance in the city of Moscow (regardless of the type of pension received and the body to which it is paid) and are registered in the city of Moscow at their place of residence or at their place of stay in the city of Moscow have the right to receive a regional social supplement to their pension, and also not registered in Moscow or the Russian Federation.

Good afternoon The person has been registered in the Moscow region for 25 years. He has been assigned a pension of 9,000 rubles from December 2020. If I register him in the Central Administrative District of Moscow (I am a close relative), will she be permanently assigned a Moscow pension (increased)?? Thank you in advance! If possible, then with reference to the law.

If I register in Moscow, what will my pension be?

I am going to register and live with my sister, a citizen of the Russian Federation. read answers (1) Topic: Privatization of housing My husband and I gave our municipal apartment to our daughter and son-in-law, and we ourselves live in the Moscow region. They want to privatize it, but without counting the answers (1) Topic: Pensioners My sister wants to change her apartment in Moscow to the nearest Moscow region. Will she keep her Moscow pension or not? She lived and worked in Moscow all the time. read answers (1) Topic: Pension Will I be paid a Moscow pension if I change my residence permit near Moscow to Moscow?

And is it true that a law is being prepared stating that it is necessary to read the answers (1) Topic: Question on the Moscow so-called. Luzhkov's pension supplement. Is it transferred to a bank account? For some reason they told me that social security may refuse this. read answers (1) Topic: Temporary registration I am permanently registered in Moscow, a pensioner. Pensions in Moscow are among the highest in Russia. This is due to the fact that the cost of living in the capital is significantly higher than in other regions.

Moscow is considered the most expensive city in Russia, and also that the level of pension payments in Moscow is one of the highest. Telephone consultation Free call 1 2 3 4 5 6 7 8 9 10 16 NEXT. Topic: ArchiveI am transferring my grandmother's pension from Yarosl. Regions to Moscow.

The Moscow Region Pension Fund said that it is difficult to read the answers (1) Topic: Certificate of salary for a pension I am registered in the Moscow region. Thus, the minimum pension for non-working pensioners with more than 10 years of residence in Moscow will be 17,500 rubles. See also: - Bank of Moscow deposits for pensioners: favorable interest rates - Sberbank pension cards: types, interest, cost Increasing the amount of benefits for veterans in Moscow In addition, Sergei Sobyanin proposed returning to the issue of increasing benefits for veterans and the elderly. “It is obvious that taking into account inflation, taking into account rising prices, it is necessary to return to increasing benefits for veterans,” said the mayor of Moscow. He emphasized that these issues will be taken into account when forming the budget for next year.

And now some details have become known. Chairman of the Moscow City Duma Alexei Shaposhnikov said that monthly payments to regional preferential categories will be increased at least 2 times: labor veterans, home front workers and rehabilitated people. The easiest option is to register with relatives or other persons who will consent to registration in their apartment. If this is not possible, then there are other options for obtaining a metropolitan residence permit: purchasing residential premises or concluding a lease agreement with the possibility of obtaining temporary registration. In addition, temporary registration in the capital is issued to all nonresident students of capital universities living in Moscow. Formulas for calculating pensions for Muscovites From the point of view of legislation, a person who has lived in the capital for at least 10 years before reaching retirement age has the right to receive a “Moscow pension.” How to arrange the transfer of her pension and how its size will change ? read answers (1) Topic: Pension Is it possible to legally save a pension with a Moscow supplement when moving for permanent residence to another region of Russia? read answers (1) Topic: Pension My mother lived all her life in Kursk areas. He receives a pension there. If I register her in Moscow, will she receive a Moscow pensionread answers (1) Topic: Pension I have a Moscow residence permit and registration, now I temporarily live with my parents in Maykop.

In the apartment where my son is registered read answers (2) Topic: Working on a pension based on years of service How can a military pensioner from Belarus get a military pension in the Moscow region.

Is it necessary to re-register a pension when changing place of residence in Moscow?

In fact, this does not apply to a change of residence of a pensioner within the same city (Moscow). Since payments of old-age pensions and additional payments up to the regional subsistence level of a pensioner are made not by district departments, but by city ones.

You will read on the Internet that if a pensioner changes the address of his permanent place of residence, he is obliged to notify the Pension Fund and Social Security about this within a month, even if he moves from one district of the city to another.

The amount of social pension in the current year

Let us note right away: the size of the social pension in our state is always related to the size of the subsistence minimum.

If the cost of living increases, then the minimum pension should also increase. Thus, the pension can never be less than the established minimum subsistence level for a disabled person in the region in which the pensioner lives. We remind you that each region has the right to set its own size of this indicator: it can be higher than the federal one, but not lower than it.

According to official data from the Pension Fund, the size of pensions in 2018 is as follows:

- old age insurance pension – 14,151 rubles;

- disability insurance pension – 8,738 rubles;

- insurance pension for the loss of a breadwinner - 8869 rubles;

- old-age social pension – 9062 rubles;

- social pension for disabled children – 13,410 rubles.

This amount is indicated taking into account the indexation that was carried out on April 1, 2020.

And here is a very interesting point. As can be seen from the Pension Fund, the minimum social pension in 2018 is 9,062 rubles. It is said that such payment cannot be lower than the subsistence level. But, for example, in Moscow the minimum for a pensioner is 11,816 rubles, in Arkhangelsk - 10,258 rubles, etc. What to do in this case, what size of social pension will the pensioner receive?

In this case, every pensioner should receive a social supplement up to the subsistence level. There are two options for paying this bonus:

- From the federal budget. Paid if the amount of the payment does not reach the established federal level of subsistence;

- From the regional budget, if the regional cost of living exceeds the federal cost of living.

True, there is a certain peculiarity here: when calculating the size of a social pension, they take into account not only the direct amount of monetary payment, but also the value expression of all additional services provided to this category of citizens.

For example, when comparing the amount of material support with the established subsistence level in the region, the following is taken into account:

- Amount of social pension;

- All types of additional payments and pension supplements;

- All types of social security that are provided to the subject: free medicines, medical care, free travel, subsidies for housing and communal services, etc.

Therefore, as a rule, if the size of the social pension in monetary terms is about 9,000 rubles, and the pensioner also receives free travel and a subsidy, then he is not entitled to any additional payment.

How to get a Moscow old-age pension

- An application addressed to the Chairman of the Board of the Pension Fund of the Russian Federation is submitted by federal civil servants. This application must be accepted by an employee of the enterprise where the citizen previously worked;

- Relevant departments and ministries handle paperwork for certain military and police positions.

Representatives of the territorial branches of the Pension Fund are contacted only when it comes to state pensions for the loss of a breadwinner, old age or disability. The main thing is to submit documents that give you the right to receive one or another type of assistance. This also applies to citizens who are interested in how to receive a Moscow pension for a nonresident.

New age requirements for calculating social pension in 2020

The previous requirements, in which certain age conditions were sufficient for retirement, are now changing.

If you don’t know the difference between insurance pensions and social pensions, there are detailed articles in the ProfiKomment magazine:

- old age insurance pension

- social old age pension

- disability pension.

From January 1, 2020, as an echo of the pension reform, a gradual increase in the retirement age begins for all Russian citizens without exception.

Requirements for a person to receive a social old-age pension in 2018

From January 1, 2020, the requirements for receiving old-age insurance (labor) pensions are becoming more stringent. Even for those who have worked a certain number of years and acquired some experience, even they will face difficulties - if they do not have enough points or experience, they will be denied a labor pension and such people will only have to wait for the old-age social pension.

Requirements for a person to receive a social old-age pension in 2019

The main requirement for a person to be assigned a social (minimum) old-age pension is reaching the age limit. It was also decided to gradually raise this maximum retirement age following the increase in the retirement age for insurance pensions.

If you register a pensioner in Moscow, your pension will change

Indeed, based on the current order of the mayor, a supplement to the pension benefit is provided in the territory of the city of Moscow, which should equate the amount of payments received to the amount of the city social security. standard At the moment, the maximum amount of pension benefits in the capital is 17,500 rubles.

Increased amounts of pension benefits also provide for special conditions for receiving them, which, first of all, relate to the payment of pensions upon reaching a specific age (55 years for women, 60 for men).

Registration in the capital - advantages and difficulties

Applying for permanent or temporary registration in Moscow is as easy as in any other locality in Russia, since the legislative framework for this procedure is the same everywhere. The easiest option is to register with relatives or other persons who will consent to registration in their apartment. If this is not possible, then there are other options for obtaining a metropolitan residence permit: purchasing residential premises or concluding a lease agreement with the possibility of obtaining temporary registration.

There are many legends circulating around the country about the fabulous size of Moscow pensions. Pensioners throughout the country envy the life of the capital's elderly. However, with the capital's pension, not everything is so simple. Indeed, in the capital there is a mayor’s order providing for an additional payment to the pension of all capital pensioners up to the amount of the city’s social pension standard. In 2017, the size of this standard is 14,500 rubles. , that is, those pensioners whose pension is less than this amount receive an additional payment so that their income level is not lower than this amount.

But to receive this kind of additional payment, there is a residency requirement - ten years of residence in the capital. Thus, in order to receive a Moscow pension, nonresident pensioners must live in the capital for at least ten years from the moment of moving or document that they previously had a capital residence permit. In addition, temporary registration in the capital is issued to all nonresident students of capital universities living in Moscow.

Some enterprises provide official housing with the possibility of registration in it for both employees of these enterprises and members of their families.

- Compensation for landline telephone communication;

- Free travel on all types of public transport or monetary compensation for it;

- Subsidies for utility bills;

- Annual spa treatment if there are appropriate medical indications;

- Social services by special services;

- Providing food and clothing packages for low-income and single pensioners.

If I register in Moscow, what kind of pension will I have?

After changing your registration, when will the supplement to your pension be paid?

For emigrant pensioners, the rule for issuing an advance applies - such an applicant can receive a pension “in advance” for six months. For this purpose, a separate application along with other documents is also submitted to the Pension Fund office. The pension is extended every year. This is done so that the Pension Fund authorities can verify that the recipient is alive.

To do this, the pensioner must notify in writing about his decision the territorial body of the Pension Fund at the new place of receiving the pension. In the application, the pensioner will need to indicate the delivery organization and method of delivery of the pension, as well as account details (if the pension is delivered through a bank). Methods for delivering a pension to a change of place of residence of a pensioner Through Russian Post A pensioner can receive a pension at home or independently at the post office at the place of residence. In this case, each pensioner is given a date for receiving a pension in accordance with the delivery schedule, and the pension can be paid later than the established date within the delivery period. It is better for the pensioner to find out the end date of the payment period in advance, since each post office has its own.

This is interesting: How to Find Out How Much Your Old Age Pension is Accrued

What is the size of the social pension in 2020 in Russia

The size of the minimum social pension in 2020 depends on its type. Not only old-age citizens can receive such benefits, but also disabled people of various groups, children with disabilities, representatives of northern peoples, children without one or both parents, etc. (stat. 11 No. 166-FZ).

For each category of recipient, its own fixed amount of social pension is approved - benefits have been indexed since April 2020. The coefficient was 1.02 according to PP No. 271 dated March 15, 2019. That is, the amount of the social old-age pension in 2019 increased from 5180.24 rubles. up to 5283.84 rub. Citizens have the right to apply for benefits upon reaching a specified age, which will gradually increase from 65 to 70 years (for men), from 60 to 65 years (for women).

Read: What is the age of social pension

What kind of pension do visiting pensioners receive in Moscow?

If the period of permanent registration in Moscow is less than 10 years, then such a person is entitled to an additional payment up to the cost of living of a pensioner in Moscow. The cost of living for a pensioner in Moscow in 2020 is 11,816 rubles. Conditions for receiving an additional payment up to the living wage of a pensioner in Moscow in 2020:

How many pensioners go to Moscow? According to the city department of social protection, in the first half of the year alone, 6,177 people who arrived for permanent residence in Moscow from other regions were registered with the social protection authorities. Additional payment up to 12 thousand rubles. assigned to 5,716 visiting pensioners. Moreover, its size is higher than the Moscow average, it is 4,400 rubles. True, pensioners also leave Moscow, but much less. During the same six months, 1,821 people were deregistered due to leaving the capital. Over many years, only 80 thousand visiting pensioners have taken advantage of the right to Moscow bonuses. To be fair, it must be said that these are mostly elderly parents who have moved closer to their children - first-generation Muscovites.

Will a nonresident pensioner registered in Moscow receive Moscow pension supplements?

What will the “new Muscovites” get? Residents of territories annexed to Moscow, registered in Troitsk, Moskovsky and other settlements, received all the rights of Muscovites, including a social supplement up to the city standard. But those who apply for an additional payment starting in the new year will need to confirm their 10-year registration.

Moreover, if they were previously registered in areas that were part of the new Moscow, and then left, these years will also be counted towards them. For many Russian residents, their cherished dream is to move to the capital. Residents of other cities have formed a strong opinion that life in Moscow is better, more secure, simpler, etc. To a certain extent, this opinion is quite justified, since acquiring the status of a Muscovite entails the provision of a certain set of social benefits and certain advantages. Moreover, some (having registered in Moscow) no longer even live there, returning to the region, but already receiving additional payments from the capital. Is this fair to Muscovites who have worked here all their lives? By the way, the indigenous people themselves raise this issue in their appeals to the government.

Social support measures should be targeted, aimed at needy Muscovites. How many pensioners go to Moscow? According to the city department of social protection, in the first half of the year alone, 6,177 people who arrived for permanent residence in Moscow from other regions were registered with the social protection authorities. Additional payment up to 12 thousand rubles. assigned to 5,716 visiting pensioners.

Moreover, its size is higher than the Moscow average, it is 4,400 rubles. True, pensioners also leave Moscow, but much less. During the same six months, 1,821 people were deregistered due to leaving the capital.

Over many years, only 80 thousand visiting pensioners have taken advantage of the right to Moscow bonuses. To be fair, it must be said that these are mostly elderly parents who have moved closer to their children - first-generation Muscovites.

Pension supplement up to 17,500 in Moscow

Before applying for a pension supplement, the applicant must prove his official residence in Moscow, which must be at least 10 years. In addition, the pensioner will need to provide the following documentation:

The amount of the increase in pension accruals depends on how long the pensioner has been registered in the capital. If he has officially lived in Moscow for less than 10 years, then his pension can only be increased to 11,603 rubles, that is, to the Moscow subsistence level. However, if a pensioner has been registered in the capital for more than 10 years, he can count on a maximum increase up to the social standard of 17,500 rubles.

Social pension in 2020 – size by region

The table above shows the amounts of minimum pensions. However, if a higher minimum subsistence level is approved in the region of residence of the pensioner, an additional payment is required up to the value of the PMP (federal or regional). You can find out which PMP is installed in a particular subject of the Russian Federation on the PFR website (https://www.pfrf.ru/grazdanam/pensionres/soc_doplata~4326). In the country as a whole, in 2020 there is a living wage of 8,846 rubles. But each region additionally accepts its own PM for a pensioner.

Read: Social supplement to pension in 2020

How can a pensioner apply for a supplement to his pension?

- heroes of the USSR and Russia, full holders of the Order of Glory;

- heroes of Socialist Labor and Labor of Russia, full holders of the Order of Labor Glory;

- disabled people and participants of the Great Patriotic War;

- participants in the defense of Moscow;

- patients with pituitary dwarfism (Lilliputians) and disproportionate dwarfs;

- children whose parents died as a result of terrorist attacks, man-made and other disasters;

- veterans from among the flight test personnel;

- citizens who have merit in the field of physical education and sports;

- citizens who have merits in the field of culture.

The regional social supplement to the pension is set to the city social standard (in 2020 it is 17,500 rubles per month), if the non-working pensioner has been registered at his place of residence in Moscow for a total of at least 10 years.

Pension supplements reduced for visitors

Over the years, 80 thousand visiting pensioners have taken advantage of the right to capital bonuses. From January 1, the procedure for providing regional social supplements to pensions will change in Moscow.

Now (according to Moscow government decree N 396-PP of August 8, 2012), non-working pensioners who apply for a “metropolitan allowance” will be asked “how many years have they lived in Moscow?” If it is less than 10, then the additional payment will be assigned only up to the living wage of a Muscovite, and not up to 12 thousand rubles - the social standard established in the city. What is a social standard? For non-working pensioners in Moscow, a social standard of minimum income has been established (pension + additional payment). This year it is 12 thousand rubles (this is 1.7 times the subsistence minimum). Whatever pension a Muscovite has, the city budget makes up the difference to the standard. The average additional payment is 4 thousand rubles per month. According to the Department of Social Protection of the Population, currently 2.1 million out of 2.9 million Moscow pensioners receive it. Who doesn’t see the additional payment? The restrictions will affect only those who will receive a regional pension supplement starting January 1, 2013. Everyone who already receives additional payment will continue to receive it, regardless of the period of residence in Moscow. And if any of the visitors apply for it before December 31 of this year, they will also receive it according to the current rules. But from the new year they will begin to take into account the duration of registration at the place of residence in Moscow. It must be at least 10 years old in total. If, for example, a person was once registered in the capital, then left and returned, all previous years of residence are summed up for him. A certificate of the general registration period in Moscow can be obtained from the passport office at your place of residence. What will the “new Muscovites” get? Residents of territories annexed to Moscow, registered in Troitsk, Moskovsky and other settlements, received all the rights of Muscovites, including a social supplement up to the city standard. But those who apply for an additional payment starting in the new year will need to confirm their 10-year registration. Moreover, if they were previously registered in areas that were part of the new Moscow, and then left, these years will also be counted towards them. Will newcomers be given a Muscovite social card? The resolution deals with only one measure of social support - the city supplement to pensions. As the Department of Social Protection assured, everything else: a Muscovite’s social card, free travel on city public transport, free dental prosthetics, benefits for housing and utilities - a visiting pensioner who has registered for permanent residence in Moscow will receive in full. Even if he has temporary registration in the capital and his income does not reach the subsistence level established in Moscow, the city authorities will compensate him for this difference in money. Why was the “residence qualification” needed? Conversations about the need to introduce a “residence requirement” in Moscow did not begin yesterday. The Moscow City Duma discussed such a measure last spring. The deputies argued: closer to retirement, many move to the capital to live with relatives in order to register and receive Moscow additional payments, which are higher than in their home region. Moreover, some (having registered in Moscow) no longer even live there, returning to the region, but already receiving additional payments from the capital. Is this fair to Muscovites who have worked here all their lives? By the way, the indigenous people themselves raise this issue in their appeals to the government. Social support measures should be targeted, aimed at needy Muscovites. How many pensioners go to Moscow? According to the city department of social protection, in the first half of the year alone, 6,177 people who arrived for permanent residence in Moscow from other regions were registered with the social protection authorities. Additional payment up to 12 thousand rubles. assigned to 5,716 visiting pensioners. Moreover, its size is higher than the Moscow average, it is 4,400 rubles. True, pensioners also leave Moscow, but much less. During the same six months, 1,821 people were deregistered due to leaving the capital. Over many years, only 80 thousand visiting pensioners have taken advantage of the right to Moscow bonuses. To be fair, it must be said that these are mostly elderly parents who have moved closer to their children - first-generation Muscovites. Price of the question: How much will the city save on visitors? As stated in the explanatory note to the draft resolution, “since the additional condition for assigning a regional social supplement will affect a limited number of citizens, the release of budget funds in 2013 will be insignificant,” or more precisely, 80 million rubles. The amount is relatively small, considering that the Moscow budget allocates about 110 billion rubles for social supplements to pensions, and more than 200 billion rubles for all types of social assistance for pensioners. Details: https://www.rg.ru/2012/09/06/pencia.html Illustration: https://www.pencioner.ru “NP”

How Muscovites' pensions will change in 2020: latest news

To help low-income citizens, the Moscow administration provides them with social support. Elderly people get sick often and need constant medical care. Residents of the capital have access to discounts on the purchase of expensive medicines. They have the right to free treatment in rehabilitation centers.

This is interesting: Recalculation of Pensions for Children in 2020

Muscovites' pensions be paid to disabled citizens in 2020 ? Disabled people will be provided with the technical devices necessary for rehabilitation. The capital administration will continue to provide food and clothing assistance to low-income residents.

Minimum amounts of social pensions in 2020 - table

The exact amounts of social pensions in 2020 for individual recipients are given on the Pension Fund portal. The recalculation was made after the indexation of benefits from April 1, 2020. In 2020, payments are also expected to increase from April 1, 2020 by the planned percentage of 3.9% (not exact). Find out from the table how benefits have changed in 2020. How much have social pensions increased since April 1, 2020 (indexation coefficient = 1.02):

| Category of social benefits recipients | Minimum social benefit in 2020 (in rubles) | Increase (in rubles) |

| Minimum social pension in 2020 for old age | ||

| By old age | 5283,84 | 103,60 |

| Minimum social pension in 2020 for disability | ||

| 1 group | 10567,73 | 207,21 |

| 2nd group | 5283,84 | 103,60 |

| 3 group | 4491,30 | 88,06 |

| Children with disabilities | 12681,09 | 248,65 |

| Disabled people since childhood with group 1 | 12681,09 | 248,65 |

| Disabled since childhood with group 2 | 10567,73 | 207,21 |

| Minimum social pension in 2020 for loss of a breadwinner | ||

| Loss of one parent | 5283,84 | 103,60 |

| Losing both parents | 10567,73 | 207,21 |

| If both parents are unknown | 10567,73 | 207,21 |

Who in Moscow is paid a pension supplement of up to 17,500 rubles

- are not registered;

- receive pensions in other regions;

- permanently or temporarily (more than 6 months) reside in another state;

- undergo compulsory psychiatric treatment;

- are in correctional institutions.

Native Muscovites in retirement receive an additional payment up to the social standard - 17,500 rubles. Pensioners with Moscow registration for less than 10 years have the right to an increase to the local PMP - 11,816 rubles. Visiting pensioners without registration can receive additional payment only up to the federal subsistence level - 8,726 rubles.

Summary of social pensions in 2020

Summarizing all the changes that await us in terms of pension reform, it is worth noting that it did not affect the definition of citizens who have the right to claim a social pension: it, as before, is assigned to residents of the country who have lost their ability to work, but have not accumulated enough work experience to receive insurance pension.

These are old-age pensioners (very often freelancers, people who have worked a significant part of their lives without registration, and a number of others fall into this category). You cannot receive a social pension if you are currently officially employed.

[ads_middle_center2]

For all of them, with the exception of preferential categories, a pension is available at 65 and 60 years old, if they do not work. If carried out - at 70/65. Or upon the occurrence of a preferential case (disability, loss of a breadwinner, orphanhood, etc.). This pension is set at the minimum level permitted by law, namely, by type in 2020:

- residents of the Far North/disabled people of group 2 (except from childhood)/for the loss of a breadwinner – 5,180.24 rubles;

- disabled children/disabled children of group 1 since childhood – 12,432.44 rubles;

- disabled people from childhood, 2nd group/disabled 1st group/completely orphaned children – 10,360.52 rubles;

- disabled people of group 3 – 4,403.24 rubles.

In this case, the amount is always adjusted in accordance with the minimum subsistence level established in each region for a pensioner of the corresponding category (assigned at the minimum level or higher, see the listed amounts).

As you can see, the RUB 9,215.00 mentioned at the beginning of our conversation. On average for social pensions in the country, these are figures from the category of “average temperature in a hospital.” And this group of citizens was the least well-off and most offended by the authorities, and remains so.

I would like to believe that next year the economic situation in Russia will finally emerge from the crisis, and the state will have the means to adequately support these categories of Russians.

Can a Moscow pensioner lose his pension supplements when moving?

If such a pensioner sells his apartment in Moscow and then moves for permanent residence to another apartment he bought in any city in Russia, will the size of his pension change, provided that he will still be registered in Moscow (somewhere relatives), but is it really possible to live in another city?

When Luzhkov was mayor of Moscow, he approved a pension supplement for all Muscovite retirees, the so-called Luzhkov bonus. It does not apply to other regions, only in Moscow, and is tied to registration. If a pensioner is discharged and travels to another region of Russia, for example to the warm Krasnodar region - Sochi, Krasnodar, the allowance is canceled.

Pension and registration

- Passport. Foreigners are provided with a residence permit.

- SNILS.

- Military ID.

- Completed application for a pension. It has a prescribed form and is issued by an employee on site. It can be found on the official website of the Pension Fund.

- A document with information on the average monthly salary for 60 months of continuous service until 01/01/2002.

- Bank agreement for opening an account. The document is not provided if the applicant wishes to receive a pension at Russian Post (in person or at home) or through another organization for the delivery of relevant payments.

- Papers confirming your place of residence, if it differs from your passport details.

There are many legends circulating around the country about the fabulous size of Moscow pensions. Pensioners throughout the country envy the life of the capital's elderly. However, with the capital's pension, not everything is so simple. Indeed, in the capital there is a mayor’s order providing for an additional payment to the pension of all capital pensioners up to the amount of the city’s social pension standard. In 2020, the amount of this standard is 14,500 rubles, that is, those pensioners whose pension is less than this amount receive an additional payment so that their income level is not lower than this amount. But to receive this kind of additional payment, there is a residency requirement - ten years of residence in the capital. Thus, in order to receive a Moscow pension, nonresident pensioners must live in the capital for at least ten years from the moment of moving or document that they previously had a capital residence permit.

10 Jun 2020 lawurist7 6065

Share this post

- Related Posts

- What a Young Family Can Get

- Property Without Encumbrance

- Benefits for labor veterans in Tver!

- Compensation for Telephone to Labor Veterans in Vologda

If you register in Moscow, what will your pension be?

Good afternoon The person has been registered in the Moscow region for 25 years. He has been assigned a pension of 9,000 rubles from December 2020. If I register him in the Central Administrative District of Moscow (I am a close relative), will she be permanently assigned a Moscow pension (increased)??

Thank you in advance! If possible, then with reference to the law. 20. My friend asks to register her in Moscow in order to receive a Moscow pension (pension + Moscow additional payments). She received Russian citizenship 2 years ago and lives in Kabardino-Balkaria (she herself is Armenian, she left Yerevan 10 years ago). Now she has been assigned an old-age pension at her place of residence of 5,700 rubles.

Can I register her in an apartment where I am the owner, but am not registered (my daughter and grandson are registered there), will she be assigned a Moscow pension, what is needed to register her (if possible) and what does this mean for me, if necessary? will write her out. Thank you in advance. It should be noted that processing payments is available not only to nonresidents, but also to those who have just received Russian citizenship.

In addition, foreigners living in Russia on the basis of a temporary residence permit or residence permit have the right to count on a pension, provided that the Russian Federation has concluded an appropriate international treaty with the state of which they are citizens (in particular, such rules apply to citizens of the majority CIS countries). Applying for permanent or temporary registration in Moscow is as easy as in any other locality in Russia, since the legislative framework for this procedure is the same everywhere. The easiest option is to register with relatives or other persons who will consent to registration in their apartment.

If this is not possible, then there are other options for obtaining a metropolitan residence permit: purchasing residential premises or concluding a lease agreement with the possibility of obtaining temporary registration. The pension certificate is collected immediately after confirmation has been received from the Pension Fund that the review procedure has been completed. The sooner the document is received, the faster the first financial aid is transferred to the citizen.

The certificate indicates the amount of benefits from the state, with the definition of the national currency. Small pension in Moscow in 2020. As is clear, pensioners in the Russian Federation cannot receive a pension below the average annual subsistence level for a pensioner in their area of residence. If the accrued pension is less than this level, then an additional Regional Social Payment (RSD) is paid from the budget in addition to the pension.