Pension reform in Russia has been going on for quite some time, mandatory indexation of pensions is being carried out, the retirement age is rising, the minimum social pension has recently increased, but there are quite a few results, especially positive ones.

The situation is aggravated by the current global crisis, so it is not surprising that Russian residents are actively interested in the question of how many percent their pensions will be increased and what can be expected in the near future. Moreover, there is quite a lot of news about the pension system.

Pension Fund News

Not long ago, Anton Drozdov, who is currently the head of the Pension Fund, emphasized that by 2022 the average pension should increase by 18%, as a result of which payments will reach 18,290 rubles. In connection with the plan of the Ministry of Economic Development, pension benefits should increase by 2% in 2021.

Moreover, Anton Drozdov emphasizes that even if inflation is low, which already seems unrealistic today, the increases will be much higher.

The head of the Pension Fund reminds that Russians who have reached the age of 80 can count on an increase in pension payments due to an increase in the fixed amount. Last year its size reached 5,686 rubles, but in 2021 the value will be 6,044 rubles.

At the same time, the indexation of pension payments continues, according to the plan, which says that savings should increase by an average of 1000 rubles. The growth of old-age insurance pensions continues to be regulated by the mechanism that was adopted back in 2019. Non-working pensioners can also count on amendments; for them they have been included in the pension reform, but this will be discussed a little below.

Related news:

- Labor and social pensions in 2021 in Russia

- What awaits pensioners of the Ministry of Internal Affairs in 2021?

- Minimum pension in Russia in 2021

- Maternity payments in 2021 in Russia

- Latest news about pension reform 2021

- Federal benefits for labor veterans in 2021 in Russia

What do you need to know?

Speaking about what the pension will be like in 2021, it is worth saying that since last year the country has had a system of increased indexation of pension payments. In connection with this system, indicators should grow quite rapidly and even a crisis should not become an obstacle to this.

Today, indexation is the only available method of increasing pension benefits, so no one plans to abolish it. The amount of indexation for 2021 is not yet known exactly, but it is estimated that benefits will increase by 6.3%.

At the same time, it is immediately worth emphasizing that each pensioner’s allowances are individual, because they depend on the size of the benefit. Taking into account the fact that the minimum old-age pension in 2021 in the Krasnodar region or in Moscow is clearly different from each other, accurate figures can only be given using the example of a specific person.

Pension reform continues, which is associated with an increase in the retirement age. Nothing changes here; in 2021, the indicators will increase by six months – 56.5 and 61.5, respectively. And it is worth mentioning separately that the age that gives the right to social pensions is changing. It increases by five years and also involves a gradual transition period.

By 2028 (when the current reform of the pension system is completed), men will be able to claim this payment if they are 70 years old; for women, the value is five units lower.

The minimum wage in Krasnodar and the Krasnodar region

In the Krasnodar Territory, the minimum wage is 10,490 rubles. This figure is based on the minimum value determined by law in the amount of 7,500 rubles, which from January 1, 2020 will be about 7,800 rubles.

To this amount set aside by the government, the Krasnodar Territory makes an additional charge of minimum interest, based on which enterprises must pay staff no less than the established wage rate.

Minimum pension amount

Naturally, such a concept as a minimum pension deserves special attention. As mentioned above, in 2021 you can count on the indexation of social payments - they will be multiplied by 6.3%. Here it must be said right away that the amount of government payments largely depends on the cost of living in the region, because each region introduces its own rules in this regard.

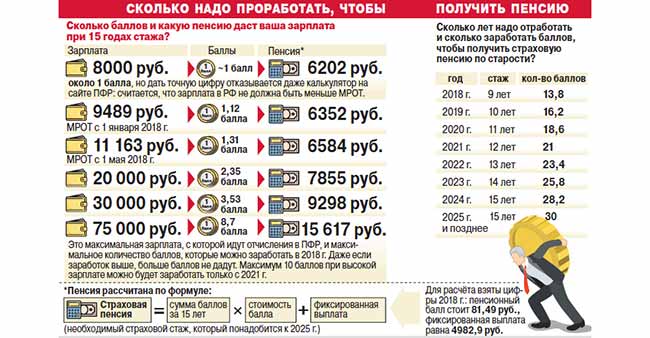

The decision on what the minimum old-age pension will be in 2021 in Volgograd, the Rostov region, St. Petersburg, the Krasnodar Territory or Omsk is made by the local municipality. However, there is a basic formula that allows you to calculate the amount of old-age benefits, but it presupposes the presence of a certain length of service and insurance points. At the same time, the amount of social payments correlates with the subsistence minimum, which is set specifically for 2021.

Experts, speaking about what the minimum pension will be in Russia in 2021, claim that on average this figure throughout the year will be within 9.5 thousand rubles.

The indicator is approximate, but in order to find out a more accurate amount of financial assistance from officials, you need to use a formula where the number of pension points is multiplied by the corresponding coefficient and added to the fixed rate. The formula is standard. The amount of the fixed payment is already mentioned above - 6044 rubles.

The cost of one pension point in 2021 will reach 98.86 rubles. The minimum pension is assigned if a person has not earned any insurance money, and the latter can be assigned only if he has a minimum work experience of 12 years.

The most accurate way (with the exception of pension fund employees) to calculate the amount of future payments will be the 2021 pension calculator, where you need to enter all available data, after which the program will calculate the amount of social support that the pensioner will receive. The data is not exact, but it provides some guidance on what to expect in the future.

Below is not possible

Currently, the constituent entities of the Russian Federation are working on new PMP values and their approval. After this, the regions will transfer the information to the Pension Fund of the Russian Federation, and it will publish it.

Data for some regions are already known; accordingly, we can say what the minimum pension will be for residents of these territories.

- 9173 rub. – in the Sverdlovsk region;

- 8747 rub. – in the Oryol region;

- 8522 rub. - in Mordovia;

- 8502 rub. – in Udmurtia;

- 8138 rub. – in Adygea;

- 7953 rub. - in Chuvashia.

Regional authorities will not be able to artificially lower the standards, since the calculation rules are general, and the methodology for determining the cost of living is the same for everyone. The retirement benefit cannot be lower than the established PMP.

Municipal pensions in 2021

The latest news about the municipal pension in 2021 deserves special attention, because it is provided for old age and this point must be taken into account.

They will be able to count on insurance payments from retirement age if several conditions are met:

- insurance experience of at least 10 years;

- a certain number of pension points in the account, which must be at least 17;

- special work experience for positions in the municipal service, as well as the age that must be reached in order to qualify for social benefits from the state.

Separately, it should be said that the assignment of a municipal pension in 2021 for disabled people of any group will be subject to the presence of insurance experience. Here, the availability of payments also depends on the period in which the disability occurred - during work or after its termination. Employees of municipal services have the right to receive state pensions for long service in addition to disability insurance payments, provided that they have earned 17 years of work experience.

In addition, the municipal pension in 2021, the latest news about which worries most Russian citizens, can be regulated by local governments using funds from the regional budget.

To be fair, it should be said right away that today the situation with budget money does not look so rosy, so it worries the majority of Russian citizens, however, it can be regulated by local governments using funds from the regional budget. However, it cannot be said that there is no point in hoping that money will be allocated from the local budget for a significant increase.

It is important to know! The maximum amount of municipal pensions cannot be greater than those payments that are due to civil servants in the corresponding position. And long-service pensions in this case will be canceled subject to the replacement of a municipal position - this is for working pensioners - it is prohibited to work and receive additional payments from the state budget.

Social payments to residents of the Russian Federation

Such a source of income as an insurance pension is not available to all people for a number of reasons. Therefore, some, with the accumulated number of points, are worthy of receiving exclusively social financial incentives. Next year, federal organizations will also begin to oversee the issue of calculating this benefit.

The smallest amount that vulnerable segments of the population can count on is now 5,034 thousand rubles. and 25 kopecks. In 2020, thanks to the increase coefficient, social funds will increase to 5.3 thousand “wooden”.

In addition, the servants of the people took care of other changes in the provision of social benefits. According to the new rules, in 2020, people who have reached 70 years of age (applies to men) or 68 years of age (female half of Russians) will be able to receive money.

Increases in subsidies related to the “burning” of money

The time has come to touch upon the topic of indexing banknotes for the poor. This event will take place on April 1, 2020, and the value of the increasing multiplier is approved at 3.9 percent.

The indicator coefficient is formed based on the subsistence level established by a specific region of the Russian Federation.

According to the initial plans of officials, the regional level PM in 2020 is 8.846 thousand units of national banknotes. However, in anticipation of the date of recalculation of payments, this figure may change.

Pre-retirees and their benefits

The concept of pre-retirement was introduced quite recently. It says that over the course of several years of retirement, a person receives some kind of social protection from the state. Today, people of pre-retirement age can count on benefits that were previously provided to so many pensioners:

- free medicines;

- travel discounts;

- discounts on housing and communal services;

- abolition of some taxes and so on.

Important! The concept of pre-retirement age was introduced in Russia for a reason. Now employers who dismiss workers with this status or refuse to hire them will bear administrative and criminal liability.

Employers also receive an additional obligation to provide people in this category with two additional days, while maintaining their earnings, so that they undergo free medical examination. The changes have already come into force and are in effect, so nothing will change in this regard next year.

The right to receive benefits and everything due under pre-retirement status arises five years before retirement. The five-year period is also relevant when assigning special pensions, which take into account the presence of professional experience in hazardous professions, and so on.

Not long ago, the Russian Pension Fund launched a service that informs Russians that they have reached pre-retirement age. The data sent with this service is used by authorities and employers to compile a list of social benefits. They are transferred to the employment center, because from 2020, people who have less than five years left before retirement, but are left without work, are entitled to increased unemployment benefits.

In parallel, they have the right to engage in free professional retraining or advanced training programs in order to get a job. Data is sent in electronic format through a unified social security system.

What awaits non-working pensioners?

Recently, the Ministry of Labor of the Russian Federation calculated pensions for 2021 for those pensioners who do not work. In 2021, this value will reach 17,432 rubles. In the future, additional payments are provided, so overall the situation looks quite good. 2022 will increase the above figure by another 900 rubles, and in 2023 the same increase can be expected.

In any case, these are the characteristics included in the budget of the Pension Fund, so the minimum pension in 2021 for non-working pensioners will increase, which indicates an increase in the economic well-being of the country.

Naturally, no one forgets about the indexation of the minimum insurance pension, which, according to preliminary data, will increase by 6.3 percent in 2021. The budget also contains figures for 2022 - indexation will increase the figures by almost 6%, while the size of the fixed value from January is set at 6,044 rubles.

Previously, it was planned that insurance pension savings would be increased annually by the inflation rate of the previous year. The authorities are planning to launch this rule in 2025; additional indexation of the amount of the insurance pension at the mandatory level will be abolished, and it will be possible to count on such manipulation only if the nominal salary for the previous reporting period grows faster than inflation. Vladimir Putin proposes to consolidate this rule in the new Constitution of the Russian Federation.

Automatic calculation of pensions

In addition to the fact that the increase in pensions in 2021 in Russia is being discussed, it is worth saying that from the beginning of the year it is planned to automatically accrue pension payments. Not long ago, specialists from the Ministry of Labor developed a bill that allows citizens to be informed in advance about how much they will be able to receive in retirement.

Notifications should be sent to people who have reached the age of 45, and if we talk about the pension for municipal employees from 2021, and take into account the fact that its size is not too large, from this age a person still has the opportunity to influence how much he will receive from the state in the future.

The Russian government has developed a program according to which notification of how much a pensioner will be able to receive will be received through the government services portal and personal account. The program will automatically remind you of the pension amount every three years after the age of 45; in parallel, the data can be obtained from the Pension Fund department.

Usually, by the above age, most citizens of the country already have some kind of pension capital, on the basis of which the analysis will be carried out. And according to experts, those people who intend to receive insurance pensions (the same applies to state pensions) will be able to take advantage of the opportunity to change their size.

You can change the amount by making voluntary contributions, which will be displayed as an additional increase to payments. In this case, the program will calculate a forecast of how much a person can count on if their current income increases.

The initial distribution of such information to future pensioners is planned for 2021.

In the future, it is recommended to closely monitor news about the pension system, because changes occur literally every day. Today, the crisis does not leave the authorities much “distance” for the space of all possible options; they can simply be content with what they have and hope for a favorable solution to all financial problems. As soon as the country improves its economy, pension provision will begin to increase.