Assignment of pension benefits

Citizen Ignatov retired in May 2020, but continued to work. On the individual pension account gr. Ignatov by July 2017 had accumulated 2.5 points according to insurance premiums from his salary during this time. The pension provision accrued to Ignatov in 2020 was calculated taking into account the cost of the PC that existed at that time, i.e. 71.41 rubles. The coefficient has not changed since the pension was calculated, as the citizen continued to work.

Everything is free. The form is very short: just the question itself, phone number and your name. Additionally, you can specify the topic of the question, but this is not required.

This was the forecast for current inflation. But the reality turned out to be much more positive. Now, according to fresh data from Rosstat, over the past year (since last September) prices have increased by only 3%. Therefore, the Cabinet of Ministers decided not to wait for official figures and immediately budget an increase of 3.7%.

In the period from 2020 to 2024, insurance pensions of unemployed Russians will be indexed every year in January. According to M. Topilin (Minister of Labor and Social Protection), the pension reform carried out will increase the pension provision of current pensioners and the pension coefficient of future persons disabled by old age.

Speaking about what kind of insurance pension is in Russia, it should be noted that the lower threshold is set directly at the level of the pensioner’s subsistence level (PL) in each region of the country. The amount of the indicated payment should not be lower than the amount fixed by the Government of the country.

For some categories of citizens, the state has approved an increased amount of payments.

These include:

- disabled people of group 1;

- citizens who have reached 80 years of age;

- workers performing labor duties in the Far North or in territories that are equivalent to it.

Last changes

In 2020, no significant changes are expected regarding the assignment of old-age pension payments in the legislative acts of the Russian Federation. It is planned to index pensioner benefits in January 2020.

Find out more about the formation of a funded pension in 2020. Read the article about the reasons for suspending and resuming pension payments.

What is the minimum period for accruing a pension? Read more.

However, you should not get upset ahead of time, since 2020 is the year of choosing the President. The best solution for maximizing the number of votes for the current leader would be to sign legislation providing for an increase in pension benefits.

Video consultation on the topic

Attention!

- Due to frequent changes in legislation, information sometimes becomes outdated faster than we can update it on the website.

- All cases are very individual and depend on many factors. Basic information does not guarantee a solution to your specific problems.

That's why FREE expert consultants work for you around the clock!

- via the form (below), or via online chat

- Call the hotline:

- 8 (800) 700 95 53

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

Insurance

When was the recalculation of pension benefits for working pensioners carried out?

After the April indexation of 2020, the average old-age insurance pension is 13,714 rubles. The minimum amount cannot be less than the subsistence level calculated for pensioners in the region where the citizen lives. Consequently, if, when calculated, pension payments turn out to be less than the subsistence level, then they are brought to the minimum value by calculating a social supplement.

Citizens may not apply for benefits immediately, but several months or years after reaching retirement age. In this case, their social security (fixed payment and IPC) increases by a certain percentage.

Also, social pensions for both working and non-working pensioners will be indexed by 1.5%. Thus, in 2020, the average social pension will be 102.4% of the cost of living or 8,742 rubles.

In addition, from April 1, social pensions of Russians will increase by one and a half percent, according to the government decree of March 16 this year.

From amounts exceeding this threshold, insurance premiums are also transferred to the Pension Fund, but at a different rate - in the amount of 10% and they go not to the individual personal account of the citizen, but to the “common pot” of the Pension Fund. The maximum value of the base is established annually by government regulations.

It's amazing how evil commentators are! An ordinary family, most likely Europeans, normal, loving each other, since they have been together for so many years and have not divorced, they raised a son. But no, the Pikabutians are all handsome men, dressed in the latest fashion! A normal person pays attention to clothes last. The first thing that caught my eye was the smiles. Stay up to date with the latest banking news! Receive notifications about important events in the economy of Russia and the world.

The amount of financial support for a pensioner is determined as the total amount of the insurance pension and a fixed payment.

Deadlines for appointment and payment of old-age pensions

Pension Fund employees are given 10 days to check documents and calculate the pension amount. The pensioner will receive the first payments no later than the third month from the date of receipt of the application. As a rule, there are no problems in calculating pensions. If the application is filled out incorrectly, PF employees will ask the citizen to rewrite it. It is worth noting that it is recommended to apply for payments immediately after reaching retirement age. In this case, the funds are assigned from the moment the right to a pension arises. If the deadline for submitting documents exceeds 3 months, payments will be calculated from the actual day of their receipt. No one will return funds for missed deadlines.

Conditions for assigning old-age insurance pensions

After the reform of the pension system in 2020, the requirements for the minimum length of service for the assignment of an old-age insurance pension began to increase annually.

- Even before 2002, the establishment of a pension and its size did not depend on length of service.

- After the law “On Labor Pensions in the Russian Federation” came into force, pension payments began to be assigned after 5 years of work.

- After the 2020 reform (with the introduction of the Law “On Insurance Pensions”), the length of service standard increased to 15 years (with a gradual change during the transition period).

Disabled people of groups 1, 2 and 3, as well as disabled people from childhood who have become adults. These citizens have never been officially employed. At the same time, the reason for the disability and at what time it was received does not matter.

As part of the 2020 pension reform, the government decided to increase pension payments, including for working pensioners. The new pension amount will be calculated using the increased coefficient. To compensate for spending from the state budget on increasing pension payments, the government decided to increase the retirement age.

Disabled people of groups 1, 2 and 3, as well as disabled people from childhood who have become adults. These citizens have never been officially employed. At the same time, the reason for the disability and at what time it was received does not matter.

My pension is 9258.59 and this is in the Moscow region, you take the amount of the pension in Moscow and also your officials, it turns out that I worked and did not earn. Well done guys, again deception, vouchers, now a pension. We take the average, but why not take the minimum from your salary? Sorry, but 5 km from the Moscow Ring Road.

Algorithm of old-age insurance pension. In each specific case (early exit, northern features, etc.) additional questions may arise.

As a rule, these are disabled people, war veterans, children left without a breadwinner in the family and other beneficiaries, as well as those who have not earned the required length of service. Now the average social pension is 8,742 rubles.

Of these, approximately a third (14 million people) are employed. Pension indexation does not apply to them. Several years ago (after another reform) it was canceled.

This algorithm for calculating pensions has been used from January 2020 to the present day, and if pension legislation does not change, it will be in force in the coming years.

Posts and comments from readers of the site posted without editing. The editors reserve the right to remove them from the site or edit them if these messages and comments constitute an abuse of freedom of media or a violation of other legal requirements.

The head office of Voronezh Legal is located in the business and historical center of Voronezh, in close proximity to Revolution Avenue, the House of Officers, the Yunost cinema, and the Chamber Theater. It is in this area that the main administrative, business and infrastructure resources of the city are concentrated.

Amount of social old age pension in 2020

The size of the social old-age pension in Russia established for 2020 is 5,180 rubles 24 kopecks.

However, the actual pension amount is higher. The fact is that, according to Russian laws, an old-age pension should be no lower than the cost of living of a pensioner in the region where he lives. A person, even if he has never worked or worked very little, should not vegetate in poverty. This is also unprofitable for the state itself, including because people will have no choice but to break the law in order to feed themselves.

The living wage for a pensioner is set by the authorities of each Russian region, and it depends on the price level for basic products in a given region. Most often we are talking about an amount of about 8.5 thousand rubles. In some regions it is more, in others it is less.

Thus, the above figure of just over five thousand rubles means nothing in practice. We are talking about domestic accounting. This money is the part of the pension that comes from the Pension Fund budget. The supplement to the subsistence level is financed by the general budget of the country.

Pension calculator, online pension calculation

Landmarks: a nine-story administrative building - the left wing of the complex of buildings of the Administration of the Central District of the city district.

Those with working experience in areas equivalent to the CS of 20 years and a total of 25 years (20 for females).

Earlier, Deputy Minister of Labor and Social Protection Andrei Pudov said that the Pension Fund’s plans include indexing pensions according to the inflation index for the previous year.

The main condition is reaching the required age. This year, the retirement age is 65 for men and 60 for women. But there are a number of reasons why a person may retire earlier than these years.

The size of the insurance pension in 2020 may be about 13.2 thousand rubles

The social pension is financed directly from the federal budget, while the insurance pension is financed by the pension fund, the budget of which consists of:

- Insurance premiums.

- Social tax deductions.

- Funds from the federal budget.

- Funds deducted from capitalization.

This requirement will be introduced by 2024. In the meantime, over the course of several years, the required amount of experience will increase by one year from the previous 5 years gradually. In 2020, the required required experience is 8 years.

The increase in the old-age pension in 2020 will be made in April, the indexation amount is adjusted every year, and this year the indexation will be 2.4%. This method helps raise the pension to the established minimum of 9,215 rubles.

From January 1, insurance pensions for non-working citizens were indexed by 6.6%. The growth of payments in the case of a particular person depends on two factors: the amount of earnings during the period of employment, as well as length of service.

Now these types of material support exist separately. Insurance payment is the monetary value of accumulated IPC points. The fixed amount for pensions in 2020 is similar to the basic part. The term “labor” applies only to a citizen’s pension rights formed before 2020.

Such socially significant periods are included in the insurance period, provided that there is direct work time before or after them.

The increase by exactly one and a half percent, and not by 5.8%, like insurance pensions, is explained by the fact that social pensions, by law, increase not by the inflation rate, but by as much as the pensioner’s cost of living increases. Moreover, from this year, if the cost of living has not increased, but has decreased, then the pension cannot decrease following it.

Plus they pinched it off during valorization, I have 6 years and 11 months, naturally 6 years were taken into account... And all this is apparently quite legal. With our pittance pensions, you fight for almost every ruble. Well, of course, there was an unplowed field for plucking from 2002 to 2014.

Calculate insurance pension in 2020

12 January 2020 12:23

In the system of compulsory pension insurance, insurance pensions and pension savings are formed for working citizens.

There are three types of insurance pensions: old age, disability, and loss of a breadwinner.

The pension rights of citizens are formed in individual pension coefficients. All pension rights formed before 2020 were converted, without reduction, into pension coefficients and are taken into account when assigning an insurance pension.

After 2020, the calculation of the number of pension coefficients for the year is based on the insurance contributions that the employer pays for his employee to the Russian Pension Fund at the rate established by the state.

The right to an old-age insurance pension arises if the following conditions are simultaneously met:

- reaching the age of 60 years for men, 55 years for women. Certain categories of citizens have the right to receive an old-age insurance pension early;

- for persons holding government positions in the Russian Federation, from January 1, 2017, an increased retirement age has been in effect, which increases annually by 6 months to 65 years for men and 63 years for women;

- availability of the required insurance period, taking into account the transitional provisions of Art. 35 of the Law of December 28, 2013 No. 400-F. In 2020, the length of the insurance period required to assign an old-age insurance pension is 9 years, with a gradual increase to 15 years from 2024.

- the presence of a minimum amount of pension coefficients, taking into account the transitional provisions of Art. 35 of the Law of December 28, 2013 No. 400-FZ. In 2018, this is 13.8 pension coefficients to 30 from 2025. The maximum number of pension coefficients for the year in 2020 is 8.70.

The number of pension coefficients depends on accrued and paid insurance contributions to the compulsory pension insurance system and the length of insurance (work) experience. For each year of a citizen’s labor activity, subject to the accrual of insurance contributions for compulsory pension insurance by employers or him personally, his pension rights are formed in the form of pension coefficients.

The insurance pension is guaranteed to increase by the state through annual indexation.

The old-age insurance pension is calculated using the formula:

INSURANCE PENSION = THE SUM OF YOUR PENSION COEFFICIENTS * COST OF THE PENSION COEFFICIENT on the date of pension + FIXED PAYMENT

or

SP = IPK * SIPC + FV , where:

- SP – insurance pension

- IPC is the sum of all pension coefficients accrued on the date of assignment of an insurance pension to a citizen

- SIPC is the value of the pension coefficient on the date of assignment of the insurance pension.

When assigning a pension from 01/01/2018 = 81.49 rubles. Indexed annually by the state.

- FV – fixed payment.

As of January 1, 2020, the fixed payment is 4,982.90 rubles, its size is indexed annually by the state.

Thus, the calculation of the insurance pension in 2020 is carried out according to the formula:

SP = IPK * 81.49 + 4982.90

For each year of later application for a pension after the right to it arises, the insurance pension will increase by the corresponding premium coefficients.

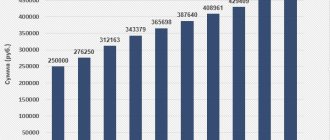

Indexation of pensions in 2016 - 2020

The pension also includes a basic amount guaranteed by the state and set in a fixed amount.

In 2020, the indexation order returned to its previous order. Deputy Prime Minister Olga Golodets announced this. The first stage of indexation took place in February 2020 and amounted to 5.4%, and the second stage was carried out on April 1, the indexation amount was 0.38%, thus, in 2020, insurance pensions were indexed by 5.8%. This is even higher than the inflation rate at the end of 2020 (5.4%).

So should we expect pension growth in 2020? What basic insurance pension amount was established as of January 1, 2020? Was indexation and recalculation carried out for working and non-working pensioners? What percentage of indexation was included in the 2017 budget? Let's look at these questions in this article.

Carrying out annual indexation of old-age pensions

The insurance pension, like other types of government payments, is subject to annual recalculation. As a rule, it is carried out based on the level of inflation in the country based on the results of the previous year. In 2020, this figure was almost 4%. The increase was carried out in April. The increase in pensions is insignificant; most pensioners did not notice the increase. On average, the increase was 200-400 rubles. Only non-working pensioners can count on indexation of their insurance pension. If a citizen continues to work after retirement, his payments are not subject to indexation. When a pensioner resigns, the pension will be indexed for all previous years. However, working pensioners should not be upset by the refusal to index their pension. At the beginning of August, payments will be recalculated for them taking into account the points earned over the previous year.

Labor pension in 2020 - size and length of insurance pension

I wonder where these pensions are, I’m a pensioner, I get a pension of 6300, I have to work, so now I don’t get indexation, I just want to ask you, at least you’re lying, don’t fool people, we pay taxes, you yourself are pushing us into shady business, leaving, then there will be nologies receive less. And you can check the pensions in the Orenburg region and have more than 30 years of experience.

You must submit a salary certificate for the period before 2002. During this period, I changed my place of residence and job twice, but without a break in my experience. Is it possible to provide a salary certificate from all organizations where I worked at this time? After all, after that I have been at the same school for 16 years. A fixed amount is assigned and issued along with the insurance pension. The payment is sponsored by the federal budget through the Russian Pension Fund. For these purposes, employers contribute 6% of the salary for employees to compulsory pension insurance.

About the insurance pension

To understand the essence of the new rules for calculating pensions, it is necessary to have information about the main part - the insurance pension.

The insurance part is a kind of wallet where the earned points will be added up, which will be transferred into real money when calculating the pension benefit.

An insurance pension is an innovation in legislation. It includes, in addition to the point system, well-known parameters: length of service and retirement age. To understand the essence of the insurance part, you need to have information about what it consists of and what its size will be upon reaching the required age.

Before talking about the specific amount that will be provided to the pensioner monthly in the form of earned benefits, you need to know that the calculation can be made using a formula in which each parameter has a specific meaning:

SP = IPK x PC

SP – insurance pension

IPC – individual pension coefficient

PC is a personal coefficient, but, despite the name, it is the same for everyone. It changes its value several times a year, depending on the level of inflation, the ruble exchange rate, the cost of living, etc.

This figure is the result of the analytical work of economists. According to data as of 01/01/16, the coefficient is 74.2 rubles.

The IPC is a piggy bank of points that will be converted into rubles. The IPC is calculated taking into account the contributions that the employer makes monthly to the Pension Fund. The higher the salary, the larger the contribution, the more points.

It is beneficial for some unscrupulous employers to give employees salaries in envelopes, since they do not need to deduct interest on it to the Pension Fund.

IPC = MF/S

SC – insurance part or employer contributions for the period of work

C – cost of one point.

The cost of the point is set by the government. This figure is not static; it will increase over time. As of 01/01/15, the minimum ratio was 6.6. By 2024 and beyond, it will be 30.

Thus, summing up the interim results, we can draw the following conclusions:

- The size of the future pension directly depends on the salary: the higher it is, the greater the contributions to the Pension Fund, the more points on the IPC.

- A preliminary calculation of the earned pension can be done by the employee himself, for example, once a year, in order to know about the accumulated funds.

- It is beneficial for a future pensioner to work after reaching retirement age, since the longer he works, the more points he will earn. A pensioner who continues to work for another 5 years and does not write a retirement application will receive an addition to the fixed surcharge of 36%.