How do you invest your funded pension?

You can dispose of your future pension in three ways:

- To do nothing;

- select NPF;

- consciously choose the Pension Fund of Russia as the insurer, and then the management company from its register.

If the NPF was chosen without you

For many people, including me, scammers managed their funded pensions. I chose a non-state pension fund and transferred money there, and then, without my knowledge, they transferred it to another fund. My signatures on the contract and application were forged and the matter was presented as if I myself had transferred to a new NPF. At the same time, I lost investment income - the money that my previous fund earned me.

As a result, I managed not only to return the money, but also to compensate for moral damage. Read what we have already written about this:

If you deliberately choose the Pension Fund of Russia as your insurer, it will ask which management company from the list to send the money to. You cannot divide pension money between several management companies; you can choose only one, and do it yourself: there is no “default” option here.

Important warning sign

It is always difficult to evaluate the activities of non-state pension funds and compare them with each other - for two reasons.

The activities of funds are assessed according to various criteria. Any rating is compiled on one or more grounds, this allows the compilers to draw the necessary conclusions.

You don't have to fudge data to boost your favorite fund. For example, in terms of profitability over the last year, Fund A will be in first place, in terms of accumulated returns over the last ten years - Fund B, in terms of the number of clients at the moment - Fund C, and so on.

The non-state pension fund where I worked also once compiled a profitability rating in which it took first place: for this it was necessary to select the 20 largest funds and take indicators for three years only among them.

The market is constantly changing. Nowadays, players in the non-state pension fund market are becoming larger, funds are constantly merging or being absorbed. In 2011, 104 funds worked with the funded part of pensions, now there are 32. Some funds stopped working, others merged, and others recently entered the market.

It is not clear how to generalize and draw conclusions: take all non-state pension funds, only the best, or only funds that have always existed. Therefore, the generalizations and conclusions in the article are not meant to be automatically believed. But the article will help you understand what to do with your funded pension.

Choice options: NPF or management company

You can dispose of your funded pension in three ways: do nothing, choose a non-state pension fund, or deliberately choose the Pension Fund of Russia as the insurer, and then the management company from its register.

If you don’t choose an insurer, the Pension Fund becomes it, and you are called silent. The Pension Fund sends your money to the management company Vnesheconombank - VEB. It was her who was appointed by the state to manage the money of the silent ones. VEB Management Company invests your savings, reports to the Pension Fund, and the Pension Fund to you.

More on the topic Disability pension for disabled people of group 3: increase in 2020

If you deliberately choose the Pension Fund of Russia as your insurer, it will ask you which management company from the list to send the money to. You cannot divide pension money between several management companies; you can choose only one, and do it yourself - there is no “default” option here.

I chose the Pension Fund of Russia as my insurer, I independently identified a management company for my pension savings, and I consider this the most profitable option.

What should you do

Decide what is best for you: a non-state pension fund or another management company within the Pension Fund of Russia.

If you decide to change the management company. Find out the profitability of your potential company, whether it offers investment portfolios, and what is their difference. To do this, explore the site, talk to the hotline. As a result, it will become clear whether it is worth contacting them.

If you decide to switch to a non-state pension fund. Find out from the pension fund in which year an urgent transfer is possible. There they will tell you the amount of possible losses in case of early withdrawal.

If you have a question about personal finance, rights or laws, please write. We will answer the most interesting questions in the magazine.

My advice is to simply take note of the calculations and choose your own retirement strategy. Honestly, I don’t know whether it’s worth changing the Pension Fund to the Non-State Pension Fund or vice versa. The results over the past eight years do not mean that trends will not change further. Or maybe all the savings will be taken away and divided. You certainly shouldn’t mindlessly rush into places where the results are better, simply because T—J wrote about it.

My funded pension is in the VTB Non-State Pension Fund - this is a large fund that ranks fourth in terms of profitability for 2011-2018. Its result is 8.1% per annum, which is higher than inflation, better than the average of the Criminal Code and VEB. So I won't change anything for now.

My NPF reports that the funded pension has increased. I can view the amount of pension savings in my personal account on the fund’s website

In general, to sort out your pension savings, I suggest the following sequence:

- Find out if you have a funded pension. If you were born before 1967, you either have no pension savings at all, or they are small because they were formed from 2002 to 2004. In the latter case, you don’t have to do anything; you will receive them in a lump sum upon retirement. If you officially started working in 2014 or later, you are subject to a moratorium - you also do not have a funded pension.

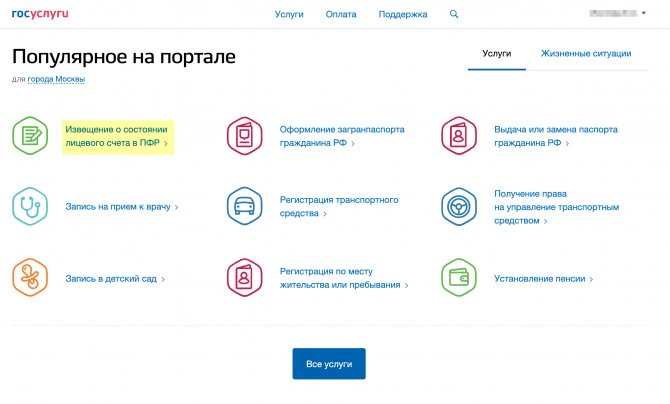

- Find out where your funded pension is. This can be done on the government services website by selecting the “Notification of the status of a personal account in the Pension Fund” section in your personal account.

- Find out how much you have in retirement savings. This is done through the Pension Fund or Non-State Pension Fund, depending on where the money is.

- Estimate the investment period - this is the period you have left until retirement.

- Assess whether you are satisfied with your current insurer and current profitability. This is where this article and links from it will come in handy. Information about the profitability of non-state pension funds and management companies is posted on their websites.

The Pension Fund has issued a memo that will help determine losses when transferring a pension to another fund. In 2020, the following can apply for a transfer from the Pension Fund to the Non-State Pension Fund without loss:

- those who started working in 2011 or earlier and did not change insurer after 2011. The year of their transition without losses was 2016, and then 2021;

- those who changed insurers in 2020. To do this, the application for transfer had to be submitted a year earlier, in 2020. Then the next year of transition without losses is 2021.

In all other cases, you will lose some of your profitability. For example, if you changed the fund in 2020, and in 2020 you decide to change it again, you will lose the investment results for four years: from 2017 to 2020. In this case, you can switch and maintain profitability in 2022, but the application must be written in 2021.

How to fix the situation?

Correcting the situation in this generally noble idea of the Pension Fund is as follows:

- The state must loudly announce to its citizens that their money in the Pension Fund still belongs to them and without any conditions.

- Any citizen can at any time find out the amount that he has personally accumulated (the state has accumulated for him - and there is nothing reprehensible in this, let’s not forget about our lack of organization in life and the state’s assistance to us in this matter).

- Any citizen has the opportunity to refuse to participate in the formation of his pension and take all accumulated funds for himself. The reason, yes, any: from the confidence that this will be enough for him until hour “X”, to the reluctance to leave something behind, and over 60 he no longer sees himself or does not want to see himself.

- The state, respecting the opinion of its citizens (A CORNER MESSAGE TO WHICH NEEDS TO BE CONSTANTLY PAYED ATTENTION) and caring about their future, can only constantly remind them of the need to think, not to let things take their course, they say, we'll see. The state needs to constantly pursue targeted lifestyles. You shouldn’t be afraid that everyone around you is so stupid that they will definitely do everything wrong (and we’ll just add - as the official wants).

More on the topic Pension in Ulyanovsk in 2020, how to get the minimum amount of additional payment, registration when moving, addresses of branches of the Pension Fund of the Russian Federation where you can apply for and receive SNILS in Ulyanovsk

Pension accumulation programs

A funded pension has the following advantages for individuals:

- Accounting is carried out in rubles.

- Citizens' savings are invested in various projects, which allows NPF clients to receive additional profit.

- Since 2020, the Russian government has launched a state system of guaranteeing the rights of insured citizens, which allows Russians to remain confident in the safety of their contributions and an increase in the guaranteed amount by the amount of profit from investments every 5 years.

- The pension is calculated by dividing the amount of available contributions by the expected period of payments, which is established when taking into account statistics.

- Pension benefits may be inherited before benefits are awarded.

There is a pension calculator on the official website of NPF Sotsium. With its help, a citizen can calculate the amount of his future pension, indicating the necessary data.

Let's look at an example of what the payment amount will be under certain parameters:

- Gender – male.

- Age – 30 years.

- Year of starting work – 2010.

- Monthly salary – 30,000 rubles.

- The current amount of pension contributions is RUB 477,000.

- Profitability – 7 percent.

As a result, it turns out that the amount of monthly pension payments provided will be 14,760 rubles.

Corporate programs are available for legal entities. This is an effective personnel management tool with the following advantages:

- Corporate NPO is a means of long-term motivation of the main categories of employees, allowing to reduce personnel turnover. The modified state pension system can guarantee a pension level of only 25 percent of average earnings.

- Corporate NPO allows you to flexibly manage personnel and use a pension program that meets all the requirements of a particular organization.

- By introducing corporate NGO, the company gains a reputation as an employer who cares about the social security of its employees.

- Tax benefits are provided for employers and employees of companies.

To select a corporate program, the employer must determine:

- The goals that are planned to be achieved with the help of the program.

- Sources from which employee NGOs will be financed.

- The conditions under which the company's employees are included in the NPO program.

- Indicators that determine the size of NGO workers.

- The period after which the employee becomes entitled to the contributions available in the fund.

- Conditions under which workers are excluded from the NGO program.

- The date on which the program is to take effect.

By becoming a client of Sotsium, an employer will be able to:

- increase the level of employee loyalty to the employer;

- reduce staff rotation levels to normal levels;

- motivate qualified specialists to continue working in the company.

ADVANTAGES

1. JSC NPF Social Development is a participant in the System for Guaranteeing the Rights of Insured Persons .

2. The investment portfolio of NPF Social Development JSC is maximally diversified - instruments are selected for investment that, along with efficiency and reliability, have high returns and minimal risks. Investment income allows you to index the amount of pension savings.

3. A non-state pension fund has the right, unlike the Pension Fund of Russia and Management Companies, to work with several management companies , which ensures a higher degree of diversification of pension savings.

4. Unlike the Pension Fund of the Russian Federation, for NPFs a wider range of financial instruments in which pension savings are allowed to be invested. This indicates potentially high returns on pension savings.

5. Today, non-state pension funds have the strictest regime of state regulation and control over their activities .

6. 20 years of experience in the non-state pension market

is an additional guarantee of the stability and reliability of the fund.

7. The insured person can contact the fund at any time and receive the information provided for in the contract. The insured person has the right to indicate his legal successors (heirs) in the contract.

History of the Foundation

This organization is one of the oldest in the country in this area, since it was formed back in 1997, but initially operated as a non-profit. Due to changes in the law in 2014, Social Development was transformed into a joint-stock company.

As required by law, its exclusive areas of work are participation in the compulsory pension insurance system and the formation of non-state pension provision.

The sole shareholder is registered in Moscow. The owner of the latter is the individual Sudarikov Sergey Nikolaevich. The fund is part of the savings insurance system, has more than 20 years of experience in this area and declares maximum diversification of investments, which is generally confirmed by its performance indicators.

Important! On September 30, 2020, the NPF shareholder decided to reorganize it by merging with NPF Evolution. Together with him, the merged company will also include the Education and Soglasie funds.

All funds of citizens managed by Social Development will be redirected to the legal successor of NPF Evolution.

brief information

The organization NPF "SOCIAL DEVELOPMENT" was registered on June 15, 1998 by the registrar: Interdistrict Inspectorate of the Federal Tax Service No. 6 for the Lipetsk Region

.

After registration, the company was assigned: OGRN: 1024800834178, INN: 4826021717 and KPP: 482601001. The main type of activity is “ Activities for non-state pension provision

”. Legal address of NPF "SOCIAL DEVELOPMENT" - 398059, Lipetsk region, Lipetsk, st. Frunze, 6, a, -.

Address on the map

Which NPF to choose?

What criteria should you use to choose a non-profit pension fund:

Profitability. It is advisable to evaluate Russian NPFs according to this criterion based on the results of a long period - at least 8-10 years. Reliability. You can find out whether the fund is fulfilling its current obligations and whether it will be able to fulfill them in the future using the Expert RA rating. The choice should be limited to those funds that have this rating, since for many NPFs it may be withdrawn, and this is not the best indicator of its performance. Founders and shareholders. If the fund is headed by large industrial and resource-extracting companies, then this is an additional guarantee of its reliability. The age of the fund and its official statistics on pension savings and the number of clients. The older the company, the more experience it has in financial management. Geography of presence. It is advisable to choose a fund whose representative office is located in your region. There is no need to visit the fund’s office, but resolving some issues requires personal presence. Service

It would be useful to pay attention to the availability of online services, a personal account on the website and hotline numbers. You should always be able to contact the fund.

When choosing a non-state pension fund, also take into account customer reviews: what people write about the company, does the fund actually make payments, what pitfalls have the insured persons encountered?

Non-state funds rating by the number of insured persons should also be considered when choosing a non-state pension fund. The rating shows the number of insured citizens in the fund, as well as the market share.

Directions to NPF "SOCIAL DEVELOPMENT" where it is located

Also see companies and organizations from the register with a similar type of activity as NPF "SOCIAL DEVELOPMENT": LLC "AUTOLIDER" | FL TUYMAZINSKY LLC "ROSGOSSTRAKH-ACCORD" | STATUS LLC | INSURANCE BROKER FINTIME LLC | LLC DVS SK "VOSTOK-GARANT"

The company was registered on February 27, 1997 (Inspectorate of the Ministry of the Russian Federation for Taxes and Duties for the Central District of Lipetsk, Lipetsk Region). Full name: “SOCIAL DEVELOPMENT”, NON-STATE PENSION FUND, OGRN: 1024800834178, INN: 4826021717. Region: Lipetsk region, Lipetsk. The organization NPF "SOCIAL DEVELOPMENT" is located at the address: 398059, LIPETSK, st. FRUNZE, 6A. Main activity: “Insurance / Non-state pension provision / Non-state pension provision activities.” Industry: “Non-state pension provision”.

Login to your personal account of NPF “Blagosostoyanie”

You can use your account after completing an agreement and registration, which takes place in three stages. Enter in the appropriate fields:

- email address;

- password;

- re-entering the password to confirm its correctness;

- enter first name, last name, patronymic;

- come up with a security question that will be used to confirm your identity;

- answer the security question. It should be least associated with you so that third parties cannot guess it.

To log into your personal account, enter your email and password. Second authorization method: click on the orange button and log in through Sberbank. If you have lost your login code, click "Forgot Password". Restore it according to the instructions.

Pros of registering to get your own account:

- ;

- access from any device: computer, tablet or phone;

- online payments;

- forms and samples to fill out;

- registration and submission of applications;

- saving payment history;

- information about pension savings.

How to find out the amount of savings:

- through your personal account;

- via terminal;

- at the office of a non-state pension fund or bank.

Information about the fund

The Social Development Pension Fund has existed since 1997.

And recently, the institution’s management has invested a lot of money in modernizing the platform for working with clients, which attracted the younger generation to the institution. The fund's activities are aimed at increasing citizens' pension savings. That is, the company uses people’s funds, and they will be able to receive good dividends when they retire.

Download for viewing and printing:

The official online page of the NPF is https://npfsr.ru/. Let's look at the main sections of the site:

- information about the fund;

- pension programs;

- information for existing clients;

- news feed;

- contacts.

Good to know! For citizens who are already clients of Social Development, there is a button on the left to enter their personal account.

Profitability

The Pension Fund's profitability over the past year was 3.3%, which is lower than the figures of previous years.

On the one hand, it is worth giving preference to institutions with a high percentage of profit; on the other hand, very high indicators mean that management is investing money in risky projects, which is dangerous for investors. When analyzing the data for the last three years, it can be said that until the last year the figures were higher. Let us note that this trend is typical for many NPFs in Russia.

How to become a client

The easiest way to transfer to the Social Development Fund is to use the online form on the website. The procedure looks like this:

- The citizen fills out personal information and sends a request for processing;

- Fund specialists contact the applicant to clarify details;

- Next, a personal visit to the Pension Fund or other non-state fund is required, where the funds are located and the writing of an application there.

The money is transferred in March to the next year after signing the papers.

Attention! It is not recommended to change NPF more often than once every five years, as there is a risk of loss of income and savings themselves by agreement with the organization

Contacts

The main office of the company is located in the city of Lipetsk.

The exact address is st. Frunze 6A. Reception of citizens is carried out from nine in the morning to six in the evening. For all questions, citizens can consult the hotline number - 88002000148. The phone call is free.

Branch addresses

Today the company is represented in most major cities of Russia. Branches are open in Moscow, St. Petersburg and cities located near Lipetsk. Below are the addresses of a number of branches:

- Moscow - Vernadsky, 41;

- Stary Oskol - Koneva, 17;

- Nizhny Novgorod - Markina, 15.

A detailed list of all branches and their contacts can be found on the official website of the NPF.

Healthy! To clarify the availability of a company representative in the region, you can call the hotline 88002000148.

How to go

Pension savings will be transferred to the management company the next year after submitting the application.

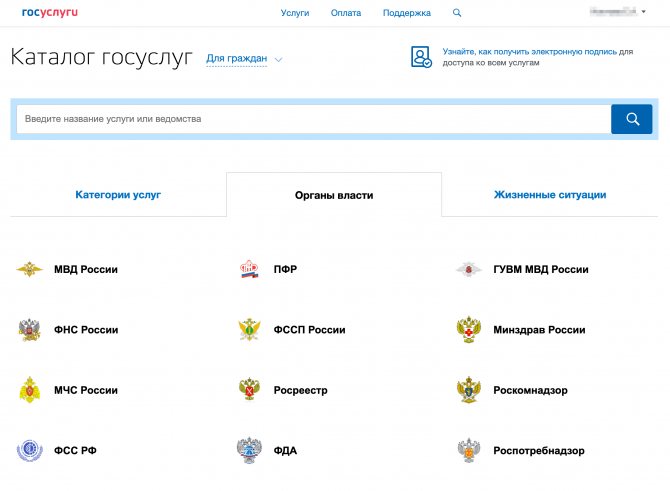

You can submit an application in person to the Pension Fund, through the MFC or through government services after full registration on the website. Application forms are available on the Pension Fund website, at the MFC or in your personal account on the State Services website. When working with your personal account, an electronic signature will be required.

If you transfer pension savings through government services, go to your personal account, follow the link “and select “PFR”

If you are transferring from a non-state pension fund, the procedure is similar, but the form will be called “Transition from a non-state pension fund to the Pension Fund”. Indicate your NPF, in the “Where” column - Pension Fund, and below, in the “Name of the investment portfolio” column, enter the name of the management company and its portfolio, if it offers a choice. In this case, the early transition checkbox becomes an important element.

Those who transferred to a non-state pension fund in 2012-2014 or 2016-2019 and submit an application to transfer a funded pension in 2020 make an early transition. If the agreement came into force in 2012-2014, five years have already passed and a new five-year period has begun, if in 2016-2019, the first five years have not yet passed.

Another option is to check the “Urgent transition” box. Then you will be transferred to the year when an urgent transfer is possible.

There is no need to conclude an agreement with the management company, since the insurer is the Pension Fund of Russia. SNILS is an analogue of an agreement between you, and you do not need to sign additional papers. You also do not need to contact the management company itself, because the account is maintained by the Pension Fund.

You can find out which NPF or which management company you are in by checking your account statement through the Gosuslugi website or on the Pension Fund website. There you will also find the number of the outgoing document on the transfer of savings.

More on the topic Pensions in 2020, latest news, increase in insurance and social payments, indexation, freezing of the funded part, how much pensions will be increased for working pensioners, military and civil servants, retirement age

To receive an extract through the state → “Get

About the fund

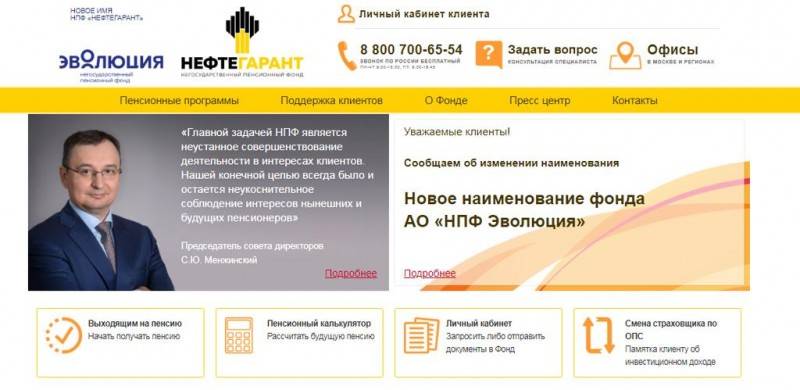

NPF Neftegarant appeared on the market of non-state pension services in 2000. Initially, the emphasis was on employees of OJSC NK Rosneft (at that time it was the main shareholder - 99.5%).

Interesting movie: the management of OJSC NK Rosneft establishes JSC NPF specifically for the company’s employees. Considering that the fund’s income is at least 15% of all cash receipts, this is a goldmine for enrichment.

In the period until 2007, Insurance and Pension Rules come into force, NPF Neftegarant opens several branches.

In 2014, after integration with TNK-BP, there was a rapid expansion of the client base. An additional flow of clients is provided by branches of the Irkutsk region, Krasnoyarsk Territory, etc. At this time, NPF Neftegarant becomes one of the largest funds in the Russian Federation and is part of the NAPF Council. Rating agencies increase the fund's reliability level to AA+.

Over the next 3 years:

- new insurance rules were developed and introduced;

- non-state pensions begin to be paid;

- a personal account was opened on the website of NPF “Neftegarant”;

- synchronization with the State Services portal was carried out, electronic signature confirmation was introduced.

Despite the dubious beginning (use of official position), NPF Neftegarant is mastering the market and developing:

- several branches have been opened over 18 years;

- in December 2020, a reorganization took place (with an increase in assets): JSC NPF Neftegarant-NPO and JSC NPF Soglasie-OPS joined (who followed the news: there were publications on the network that Neftegarant would rise at the expense of Soglasie) .

August 2020 brought the fund a new name - JSC NPF Evolution. On November 11, 2020, an announcement was posted on the official website that NPF Neftegarant (under the new name NPF Evolution) had absorbed:

- NPF "Soglasie";

- NPF "Education";

- NPF "Social Development".

In this connection, a decision was made on a new reorganization. The fulfillment of contracts with NPF Neftegarant remains in force (no re-conclusion is required).

Information

Statistics (for Q2 2020)

| Volume of pension savings and reserves | Savings – 123,075,014.75113 rubles. Reserves – 80,361,119.14046 rubles. |

| Amount of pensions paid | RUR 137,840.1382 |

| Number of clients | 1 470 936 |

| Profitability | 11.74% (after payments to the manager, depository and fund) (for the second quarter of 2020) |

| Reliability rating | According to the Expert RA rating agency, the reliability rating is ruAAA (maximum level of reliability), date of assignment - Q2. 2020 |

| Awards | Awards are not presented on the official website of NPF Neftegarant |

Terms and service

How to enter into and formalize an agreement with the fund: application form

All employees of Rosneft are automatically clients of NPF Neftegarant. Beginners will need to contact a specialist in charge of this issue.

For everyone else, the contract is concluded in person:

- in Moscow (main office);

- in branches.

How to transfer pension

This is a standard procedure for all NPFs:

- an agreement is concluded with Neftegarant;

- an application is written to the pension fund at the place of residence.

Additionally, you may need to contact the fund from which you plan to leave.

How to terminate an agreement with a non-state pension fund

To terminate the contract with NPF Neftegarant, a written application will be required. If you decide to transfer money to another fund, check the details in advance. They will also need to be indicated in the application.

Please note that you can terminate the contract with Neftegarant:

- before the start of non-state pension payments (if the contract is for life);

- at any time (if urgent).

For details, please visit https://www.evonpf.rufor—clientiporastorg.php.

Personal income tax refund

You can return part of the funds transferred to Neftegarant, based on the rate of 120 thousand rubles. Contact the tax office to clarify the list of documents, fill out the application correctly and bring all the necessary certificates.

Payment of fees

The fee payment schedule is specified in the contract. Regular monthly contributions to NPF Neftegarant will be made by:

- accounting (an application will be required);

- bank, if automatic monthly payments are configured.

NPF Neftegarant will not mind if the client begins to transfer additional funds at any time.

O1 Group acquired 100% of the shares of JSC NPF Social Development

Moscow, February 1, 2020

O1 Group and Fletcher Group Holdings Limited announce the closing of the transaction to acquire 100% of the shares of NPF Social Development JSC by the investment holding O1 Group. The deal was agreed upon with the Federal Antimonopoly Service and the Central Bank of the Russian Federation. JSC NPF Social Development will be transferred to the FUTURE Financial Group and will become the fourth fund of the financial group. In the future, the fund will join the largest fund of the group - JSC NPF FUTURE, which ranks second in terms of the number of insured persons and the volume of pension savings under management[1].

JSC NPF Social Development carries out activities in compulsory pension insurance and non-state pension provision, including corporate pension programs for employees of NLMK Group enterprises. The volume of pension savings under the fund's management is 7.6 billion rubles, pension reserves - 3 billion. The change of shareholder of NPF Social Development JSC will not affect customer service. All terms of pension agreements, including the calculation and accrual of investment income, assignment and payment of pensions, will continue to apply.

As a result of the transaction, the volume of pension savings managed by the funds that are part of the FUTURE Financial Group will amount to 268 billion rubles, and the number of insured persons will exceed 4.1 million people.

Today, including JSC NPF Social Development, the financial group includes four NPFs: JSC NPF FUTURE (the former name of JSC NPF BLAGOSOSTOYANIE OPS, in 2020 JSC NPF StalFond was added to the fund , JSC NPF URALSIB and JSC NPF Our Future), JSC NPF Telecom-Soyuz and JSC NPF Obrazovanie. The share of the FUTURE Financial Group in the pension market exceeds 13% in terms of the number of insured persons and more than 12% in terms of the volume of pension savings.

Marina Rudneva, General Director of PJSC FG FUTURE:

“The entry of NPF Social Development JSC into the perimeter of the FUTURE Financial Group is a follow-up to our strategy to expand our market presence. The merger of the fund with the flagship NPF FUTURE JSC, its competence and expertise, will allow clients of NPF Social Development JSC to receive not only a high level of service, but also to use new funded pension insurance products.

Galina Gut, member of the board of directors of Fletcher Group Holdings Limited:

The FUTURE financial group is a large structure with an open and transparent management system, the funds of which are part of the DIA system.

As part of a financial group, the fund will be able to effectively develop in accordance with all regulatory and legislative requirements. Previous news Next news

Savings and reserves

The average percentage increase in pension savings for the entire period of work is -1%, reserves -5%. The fund ranks 20th in pension savings and 26th in reserves for 2020.

| Year | Pension savings (market value) | Pension reserves |

| 2019 | 5,673,359 t. rub. -22% | 2,219,283 t. rub. -39% |

| 2017 | 6,934,390 t. rub. -10% | 3,091,026 t. rub. +1% |

| 2016 | 7,609,882 t. rub. +11% | 3,063,490 t. rub. +8% |

| 2015 | 6,751,429 t. rub. -12% | 2,820,630 t. rub. +9% |

| 2014 | 7,554,540 t. rub. +0% | 2,558,190 t. rub. +0% |

| 2013 | 7,543,135 t. rub. +19% | 2,550,392 t. rub. +9% |

| 2012 | 6,076,902 t. rub. +23% | 2,331,563 t. rub. +6% |

| 2011 | 4,658,429 t. rub. -22% | 2,190,941 t. rub. -39% |

| 2018 | 5,664,985 t. rub. | 3,041,176 t. rub. |

Savings and reserves on the chart

Otkritie Foundation programs

In accordance with the peculiarities of Russian legislation, for each working citizen, organizations are required to pay certain amounts of money to the state pension fund. They are called insurance premiums because they go towards creating pension savings.

It should be noted that, in addition to the insurance one, the funded part of the pension can also be formed. In this case, part of the insurance premiums is directed to these purposes in the same way. A citizen has the right to determine an organization that will accumulate his savings. This can be either the Pension Fund or non-state pension funds.

NPF Otkritie participates in the mandatory pension program, so its main activity is the formation and payment of pension savings to citizens.

At the end of 2020, the formation of funded pensions in our country is frozen. At the moment there is no data regarding whether this system will subsequently function in one form or another.

In addition, the fund offers citizens to form their pension by making additional insurance contributions (ASC). The essence of this program is that an OPS participant can transfer his own funds to his account in the fund. This allows you to significantly increase the size of your funded pension. In addition, the moratorium does not apply to DSV.

The NPF participated in the program of voluntary co-financing of pensions. Despite the fact that it was possible to join it until the end of 2015, more than 15 million citizens across the country became its participants. Its meaning lies in the fact that the state has pledged, at its own expense, to double the amount of savings generated for the funded pension.

Attention! To date, the pension co-financing program is not recruiting new participants.

The Otkrytie Foundation also proposes concluding a non-state pension insurance agreement to receive additional financial security in old age. Its conditions are selected for citizens within the framework of programs established by the fund itself.

Development of non-state pension funds in the Russian Federation

Contents Introduction……………………………………………………………………………………………………………………………………………… ….. 5 Chapter 1. Problems of the modern pension system………………………………………………………. 8 1.1. Pension policy of the Russian Federation………………………………………………………………………………….. 8 1.1.1. History of the formation of the Russian pension system……………………………………………………………………. 8 1.1.2. Observed trends in modern pension policy in Russia………………………10 1.1.3. Prospects for the development of the pension system of the Russian Federation………………………………………………………. 13 1.2. Features of the formation and development of non-state pension funds in the Russian Federation……………………………………………………………………………………………………………… 15 1.2.1. Historical features of the emergence of non-state pension funds……………………………………………………… 15 1.2.2. Problems of development of the non-state pension fund system in Russia…………………………………………………………….. 17 1.2.3. The future of the funded part of the pension………………………………………………………………………………… 19 1.3. International practice of forming a pension system……………………………………..21 1.3.1. Experience of developed countries……………………………………………………………………………………….21 1.3.2. Experience of developing countries………………………………………………………………………………….. 23 1.3.3. Experience of countries with transition economies……………………………………………………………………… 25 1.4. Conclusions…………………………………………………………………………………………………………………………………… 27 Chapter 2 Peculiarities of the Institute of Non-State Pension Funds…………………………………………………………………………………………………………28 2.1. Literature review…………………………………………………………………………………………………………. 28 2.1.1. Assessing the effectiveness of non-state pension funds……………………………………………………………… 28 2.1.2. Specifics of the population’s attitude to the non-state pension fund system………………………………………………………. 31 2.1.3. The role of state regulation in the non-state pension fund system………………………………………………………… 33 2.2. The role of the NPF institution in the modern pension system of the Russian Federation……………………………………………. 36 2.2.1. Structure of the modern pension system……………………………………………………….. 36 2.2.2. Conditions for receiving pensions in the compulsory pension system………………………………………………………………. 40 2.2.3. Mechanism of interaction between subjects of the security guard system……………………………………………………………………. 43 2.3. Conclusions…………………………………………………………………………………………………………………………………… 45 Chapter 3 Results of empirical research……………………………………………………………………………………….. 46 3.1. Description of data…………………………………………………………………………………………………………..46 3.2. Research hypotheses……………………………………………………………………………………………………………. 47 3.3. Calculation results………………………………………………………………………………………………………………… 49 3.3.1. Results of cluster analysis……………………………………………………………..49 3

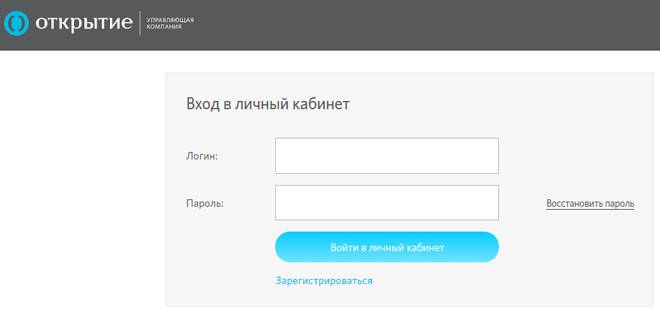

How to register a personal account

Using LC has several positive aspects:

- user-friendly interface;

- receiving services around the clock;

- obtaining information about funds.

To enter the account, a citizen will need to use an email address and password. This data is reflected when registering on the portal. If a password is lost, a person can use a special tab that allows recovery. Initially, the system asks you to enter your email address and verification code. This is necessary to protect the site from robots.

Recovery instructions will be sent to your email address. The registration process on the portal is not difficult.

A citizen needs to perform a certain sequence of actions:

- log in to the company website;

- select the “Registration” button;

- enter all the data requested by the system;

- agree to the rules for using electronic signatures;

- confirm email;

- Log in to your personal account and change your password.

If we consider this process from the point of view of clients - organizations, then it has certain features. In particular, you will not be able to complete the registration process online. To gain access to your account on the portal, you need to issue a letter requesting a password and login. It is sent to the NPF.

Only after the company sends a response to the organization with attached login data does it become possible to use the capabilities of your personal account. The letter requires you to indicate the details of the organization’s representative, including his personal details – full name and contact telephone number.

Attention! The fund has a period of 10 days for consideration of the application.

Official site

This Internet resource is official, in this regard, the information posted on it should be considered as a priority.

Attention! If you have any urgent questions, you can contact the hotline

How to register a personal account

NPF Otkritie, for convenience, offers to create a personal account for individuals on its website. This is an effective tool for interacting with the fund, which allows you to solve many current issues in real time.

So, what opportunities become available after registering your personal account?

- obtaining information about the status of your personal account and the ability to find out the amount of savings;

- concluding a non-state pension agreement online;

- replenishment of a non-state pension account;

- submitting an application for payment;

- submission of details for pension transfer.

Registration and login instructions

Registering a personal account on the fund’s website is quite simple and does not take much time.

To do this, go to the “Personal Account” section. In the form that appears, you must select “Register”. Next, you need to enter either SNILS or passport details and date of birth. After this, confirmation occurs, a login and password are selected, and then the citizen can start using the account.

Reference! Only a person who is a client of the fund can register a personal account.

Logging into it, if you have registration, is not very difficult. To do this, enter your password and login in a special form.