The laws governing pensions in the Russian Federation have been changing at alarming speed in recent years. They had only just managed to introduce a funded pension and build an institution of non-state pension funds for its investment when it was “frozen” (at least until 2020), while NPFs continue to hunt for the so-called “silent ones” who left funds in the Pension Fund. In this regard, the average person is left with many questions: what awaits the “silent people” in 2020, how to receive the funded part of the pension, how to find out the amount according to SNILS in 2020, etc.

Let us tell you in more detail how the funded part of the pension is regulated in 2018-2019. Latest news and legal analytics on takovzakon.ru.

Funded pension in 2020

Since 2002, Russians have had the right to direct part of their pension contributions (6% of 22%) not to the state pension fund, but to management companies or commercial funds.

In 2020, a freeze on this type of transfer was announced. Employees were offered a choice: transfer all the money (22% of wages) to form an insurance pension or continue to divide the funds into 2 parts. At the same time, the funded part is spent by the Russian Pension Fund to cover the budget deficit, and employees receive points in return. After the savings system resumes operation, they will be converted into rubles.

Those who did not have time to write an application for the second type of contributions before the end of 2020 can only wait until the moratorium on the funded type of pension is lifted.

The first option ensures an increase in the amount of insurance payments from the state fund in proportion to the increase in deductions from the amount paid to the employee.

The second allows employees to invest 6% of their wages in any fund that, in the opinion of payers, will bring them greater profits.

When refusing a full state pension, employees must understand that their choice of insurer may be unsuccessful. If the commercial fund does not make a profit, the contributions made will not increase, incl. will not be indexed, unlike contributions to the state budget.

The peculiarity of investing in private organizations or management companies is that the payer’s money is in the accounts of policyholders, while the state savings fund is spent on payments to today’s pensioners and may become empty. In the event of bankruptcy of a commercial fund, the employees' money is transferred to the state fund without indexation.

By collaborating with the management company, the fee payer himself chooses in which projects his money will be invested. Non-state savings funds dispose of the funds received as they wish.

Despite the fact that in 2020, as a general rule, organizations do not have the right to transfer part of the funds calculated based on the salaries of their employees to form a pension savings account, several exceptions are provided. The following persons can divide the deductions into 2 parts:

- citizens who have officially worked for less than 5 years;

- citizens under 23 years of age (even if their work experience is more than 5 years).

The rest of the Russians, upon reaching retirement age, are paid in a lump sum or in the form of monthly payments the amount that they managed to accumulate in the period from 2002 to 2014.

In addition to funds contributed by the employer, citizens can transfer additional amounts under pension insurance programs on their own. In this case, the insurers are banks—Russians often turn to Sberbank—or non-state pension insurance funds. These organizations make payments no earlier than their client receives the right to a labor pension or old-age social security.

How to get

Several categories of Russians have the right to receive a funded pension:

- Citizens born before 1967. They are compensated for funds transferred by their employers to the state in the period from 2002 to 2014. If employees of this group were employed before 2014, by the end of 2015 they decided to form a funded part of the pension, 6% of their earnings is still deducted towards this type of insurance.

- Citizens born before 1966 inclusive, subject to payment of insurance premiums in 2002-2004.

- Employees who invested money under the co-financing program.

- Families using maternity capital as a source of increasing pensions.

In addition, their heirs can dispose of pensioners’ savings if this is provided for in an agreement with a fund, bank or management company. In particular, you can become a legal successor only under term insurance agreements. If a citizen signs a document according to which he will be accrued a portion of the accumulated amount and interest on it monthly until his death, his relatives do not have the right to claim payments, even if the person did not live to see his pension, but paid contributions all his life.

The legislation establishes several forms of transfer of funds:

- Monthly cash payments (MCB) throughout the entire pension period.

- Monthly payments for a limited period. Its term is at least 10 years.

- Transfer of money to the heir of a deceased citizen.

- A one-time payment of the amount accumulated in a pension account. It needs a reason. This could be disability, loss of a breadwinner.

This payment can be requested no more than once every 5 years. It is not provided to working citizens, like a fixed-term pension.

Also, a lump sum payment to pensioners is due under the following conditions:

- they assessed contributions in 2002-2004. and were born before 1966;

- the accumulated amount is less than 5% of the insurance pension;

- they do not have a minimum work experience.

If a citizen has entered into an agreement with a bank or fund and forms additional pension savings that are not tied to the amount of wages and are not compensated by the employer, he receives a one-time payment on the terms established by the agreement, regardless of the above factors.

Pensions in the funded part are paid only to those citizens who have already been provided with insurance. To increase the amount of the first, its payment can be deferred, but for no more than 5 years. In this case, when calculating, the total amount is divided into fewer months. Accordingly, the monthly payment increases.

For example, in 2020, the established average period for pension payments is 20.5 years, or 246 months. If you defer the provision of accumulated collateral for 5 years, it will be 186 months. Provided that the citizen is not a working pensioner and his contribution does not grow, the monthly payment will increase by 32% (246/186). Delays of less than 1 year are not permitted.

How will they be paid?

The part of the pension, called the funded one, is lifetime monthly payments of the pensioner’s savings. The monthly payment is calculated by dividing all accrued funds by 21 years. This is the period of time that a citizen who has retired can presumably still live. And if the average pension for 2020 is approximately 14 thousand rubles, then 700 rubles is the same 5% of the funded pension. In order for these additional payments to be made, the pensioner must have accumulated at least 170 thousand rubles - that’s 21 years or 252 months of 700 rubles each.

See also: Dollar exchange rate forecast for February 2020

The Pension Fund offers the condition of payment from this part upon accumulation of an even larger amount. Thus, the funded pension will be accrued only to those pensioners whose level is 20% higher than the established minimum subsistence level for a pensioner. On average, savings should be no less than 440 thousand rubles. In addition, every year the Ministry of Labor increases the survival period. From 2020, this period will no longer be 21 years, but 27 years.

Due to the fact that funded pensions have been frozen for five whole years, not many people have accumulated such impressive sums. On average, 73 thousand rubles have accumulated in pension accounts in non-governmental organizations. And in the accounts of the state pension fund, these savings are even less.

A freeze is a so-called moratorium on transferring savings to any non-state pension fund. Now these deductions do not form the cumulative part of the working citizen’s deductions. With their help, the Pension Fund pays pensions to citizens.

The third type of pension, in addition to state and insurance, called funded, appeared relatively recently, in 2002. But Russians do not understand it in detail, even citizens receiving pensions. Many people do not know that they can receive their funded pension in the form of lump sum payments. But only on condition that the pensioner meets the criteria.

How to check

Citizens investing in pension savings have the right to receive information about their size, profitability and the possible amount of monthly payment after reaching retirement age on the date of the request.

If an employee (including through his employer) transfers money to a government fund or to a commercial investment company whose name he knows, he should contact this organization directly and request information about the account balance.

In the event that a citizen does not remember or does not know where his savings are stored, he can obtain information from several sources:

- from the employer;

- in the savings fund department at your place of residence;

- in the Pension Fund of the Russian Federation;

- in multifunctional centers (MFC);

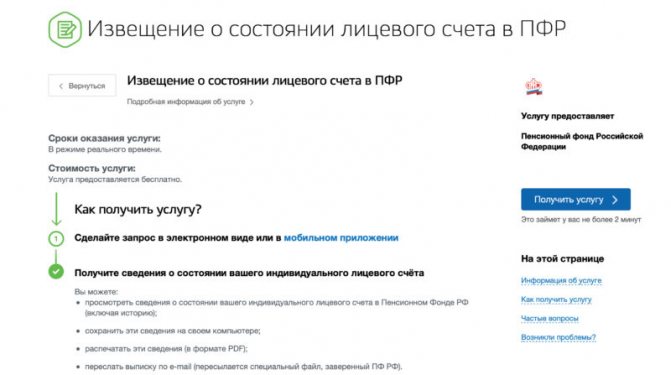

- on the State Services portal;

- in the bank.

If the employee is officially employed and the employer pays 6% of his earnings to the accumulative insurance fund, the accounting department will provide him with information about where the money is transferred.

Russians can contact the state pension organization with a request about where their funds are accumulated 1-2 times a year. The response is provided in writing within 10 days. As for the local branches of the fund, they find information on citizens registered in the territory assigned to them on the day of submitting the application.

You can set the amount of accumulated funds online on the State Services portal. You must register in advance. In your personal account you should use the menu: “. In response to the request, a report on the account balance is generated.

In Sberbank you can clarify which management company receives the payer’s funds (if they are not sent to a commercial fund). It is not necessary to come to the bank in person; the information is available in the online account (section “Agreements”/“Open Insurance Agreement”).

Wherever a citizen turns to receive an answer to a request, he must provide an identity card and SNILS.

You can find out about the amount of savings by sending a request to the named organizations by mail, to which certified copies of the necessary documents are attached.

In addition, private companies offer services for searching savings fund and account information. When contacting them, you should remember that attackers can use the client’s personal data for their own purposes, and check the reliability of such organizations.

If a citizen lives at his place of registration, he receives annually by mail a report on the balance of his pension account from the Pension Fund of the Russian Federation.

Balance information is needed not only to find out the total amount of savings. The report reflects how profitable an investment in the selected fund is. If the profit percentage is lower than the indexation percentage established by the state fund, you should think about the advisability of such an investment and replacing the fund.

What does funded pension mean?

In 2020, the pension of Russians may consist of 2 parts, insurance and funded, or be fully insurance. The latter is paid by the state insurance fund. Receipts to this fund amount to 16% of workers' wages and are used to provide for today's retirees. The amounts of contributions are indexed depending on the level of inflation. The larger the amount of contributions, the more points a citizen receives and, accordingly, the higher his pension will be.

The savings system works differently. An employee of an organization, if by the end of 2020 he made such a decision and wrote an application, can send 6% of deductions from wages to any insurance fund or management company at his discretion. In addition, a citizen has the right to open a pension account in a bank or commercial pension savings fund on his own and transfer additional funds there based on what kind of pension he would like to receive and can afford.

The savings system is similar to the system of investments or bank deposits. The employee chooses the organization that, in his opinion, is the most profitable or reliable, and sends funds there. An investment can either bring profit or be unprofitable compared to contributions to the state fund. The rights of Russians to return the money deposited in the event of revocation of the license of a commercial fund are protected by law. At the same time, insurers do not guarantee profit from investments; there is an element of risk in investments.

The better a citizen understands finance and investments, the more profitable he will be able to invest his savings. Transferring money is allowed no more than once every 5 years.

The difference between funded and insurance pensions is that the first is fully returned to the payer himself (except in the case of his premature death under an open-ended insurance contract), and is not spent, incl. for the maintenance of other pensioners.

For example, employee Petrov earns 3 times more than Ivanov. Both divided pension contributions into insurance and savings. Accordingly, Petrov transferred 3 times more money to a commercial insurance fund and the funded part of the pension paid to him (with equal return on investment) will be 3 times greater than that of Ivanov.

The same cannot be said about the insurance part. Payments due to citizens from the state savings fund do not differ as much as earnings, and workers' insurance contributions are spent not only on their pensions.

By opening an additional pension account in a bank or joining the voluntary pension insurance program of commercial funds, a citizen has the right, after assessing the state of his health and plans regarding the duration of his working life, to choose one of the options for issuing savings after retirement:

- lump sum payment of a funded pension;

- monthly receipts over a specified period;

- lifetime monthly income.

Refusal of pensions in other countries

The issue of Russian citizens receiving pensions in other countries is very relevant, since many elderly people leave the country for various reasons. What should they do in this case? Can they refuse a pension in order to receive a pension from the state in which they currently live?

This is a very complex issue, and it all depends on what kind of pension system operates in the state of residence. There are countries that pay visiting pensioners the difference between the minimum pension established in their state and the amount of payments that Russia pays to pensioners. For example, such a system works in Germany. At the same time, people who left for this country a long time ago can fully qualify for benefits under German law. In this case, they may refuse to pay in Russia. All you need is a foreign passport, documents from Germany stating that the pension will be accrued there, and a written application to the Pension Fund.

Read more: Declaration of conformity for bakery products

But, to be honest, if you carefully read the forums and reviews about transferring pensions, refusing it, etc., it becomes clear: giving up is not easy, but it is possible, especially if you live in another country for a long time.

Until the end of 2020, working citizens of the Russian Federation had a choice - to form only an insurance pension or send part of the money to the savings system. The choice of the second option was associated with the choice of a non-state pension fund or a management company, which was supposed to invest the invested funds. However, not all insured persons were satisfied with their choice and would prefer to change it.

Is it possible to refuse a funded pension in favor of an insurance one? How does this procedure work? Where should I go for this?

Payment procedure and terms

According to Law No. 424-FZ, which regulates the funded type of pension, payments can be made at a time, over a specified period or indefinitely. Russians and residents of the Russian Federation are entitled to them. Working pensioners can receive money from a non-state fund and at the same time replenish their account.

As a general rule, funds are transferred to the owner of the pension account. However, in the event of his death before he ceases to work (including if he continued to work after reaching retirement age and at that time replenished his savings account) or before full payment of the appointed urgent payments, the heirs receive the money.

In a situation where a citizen has retired and received an accrual (regardless of the amount), his relatives can only claim the balance of urgent payments.

An application for pension provision is considered within 10 or 30 days (if we are talking about a lump sum payment). The latter is transferred to the addressee no later than 2 months after the decision on the application is made.

Monthly payments start from the month you apply, if approved. Their amount is calculated by dividing the total amount of savings by the number of months of the expected payment period (the period is approved annually by the Government, in 2020 it is 20.5 years and until 2020 it will increase by 6 months per year). If an employee manages to submit an application for pension insurance within 30 days after dismissal, money will be credited to him from the day following the day of dismissal.

A one-time payment cannot be provided to a citizen who already receives funds every month, or when applying earlier than 5 years after receiving the previous payment of this type.

Funded and insurance pensions are paid together, and the method of receiving them is chosen by the recipient, for example, money can be delivered by mail.

In some cases, the accrual of funds to a pensioner is suspended (suspension period is 6 months):

- if a foreigner (stateless person) has not renewed his residence permit;

- if a Russian leaves the country without submitting an application to leave;

- if the recipient has not collected the money for 6 months.

To resume payments, you need to submit documents again to the fund that made them and eliminate the reasons for the suspension. If this is not done, payments will be stopped. The grounds for their termination may also be the recognition of the pensioner as missing or his refusal of money.

Required documents

The funded part of the pension is paid according to the application principle, i.e. is not accrued to the citizen by default, he must apply in writing for the provision of accumulated funds. An application for receiving payments and the necessary documents can be submitted in person, online or by mail. The documents certified by a notary have the right to transfer to a third party.

Documents are addressed to a state or commercial pension fund.

The following ways of presenting them are provided:

- directly to the organization that will make payments;

- in the MFC, which has an agreement with the pension savings fund;

- through the official website of the Pension Fund of the Russian Federation;

- online through State Services;

- by the employer on behalf of the dismissed employee.

Required documents: passport (or other document indicating the name, place of registration, age of the applicant) and SNILS - insurance number of an individual personal account.

In addition, it is necessary to confirm the length of service (a work book is suitable for this; in addition, employment contracts, work contracts and other papers are presented, from which it is clear how much the citizen’s work was paid), a change of name or surname, if it was made (a marriage certificate is presented or divorce, change of name), recognition as disabled, being a dependent (certificate of income level from housing authorities) - to receive a lump sum payment on appropriate grounds.

If employees of the pension service subsequently find out that any of the submitted documents are invalid, the payment of the pension will be terminated and it will be necessary to go to court to renew it.

The mentioned papers are attached to the application filled out according to the form depending on the type of payment requested.

Freezing pension savings

A significant decrease in budget revenues due to the economic crisis forced the government to decide to optimize budget expenditures, including freezing the transfer of pension savings to third-party non-state pension funds (NPFs) with expected savings of billions of rubles. As today, the funded part of the pension in 2020 is directed only to the insurance pension.

The state promises that it is not expected that this form of savings will be abolished, that all accumulated funds after unfreezing will not only return to the accounts of the NPF, but will also be indexed. Now, according to the decision taken to extend the measure until 2020, all funds from the personal accounts of compulsory pension insurance continue to serve as a source only of the insurance pension. Does this indicate the end of the pension savings system?

The Ministry of Finance has made proposals for reforms of the pension system, which also affect savings, which are proposed to be formed on a conditionally voluntary basis. Persons wishing to receive funded pension contributions will themselves send part of their salary to the NPF, and funds transferred by employers will be sent only to the PF budget for the insurance part. According to experts, internal economic processes against the backdrop of external sanctions indicate the likelihood of a long freezing of NPF funds until the state finds other sources of budget replenishment.

- How to cook condensed milk

- How to remove fat from thighs

- How to disable the melody instead of the beep on MTS

Application for the funded part of the pension

The legislation approves 3 application forms:

- for a one-time payment;

- for the fixed-term part of the old-age pension;

- for indefinite payment of savings.

In all types of applications, a citizen must indicate the following information:

- personal information about yourself (name, passport number, date of birth, registration and residence address);

- information about the legal representative, if any;

- insurance account number.

Russians who have moved abroad are entitled to receive a one-time payment and a fixed-term pension. In this case, in the document they indicate the address of residence in Russian and foreign languages.

The money is delivered to the recipient at his choice by the postal service, credit or other organization (funds are issued at the cash desk or by courier). Perpetual payments can also be made to a bank account. If the pensioner has chosen an organization with which the pension fund has not concluded an agreement, he should indicate in the application a company from the list offered by the insurer, which will deliver payments before signing an agreement with the desired company.

When filling out an application for urgent payments, a citizen selects and indicates their term (it cannot be less than 10 years).

In addition, 2 types of document contain warnings.

- Application for unlimited payments:

- the obligation to inform the fund making payments about situations where payments must be stopped no later than the next business day after such circumstances arise;

- the need to confirm registration once a year at the place of receipt of funds if they have been issued to another person by power of attorney for more than a year;

- on the one-time issuance of both types of pensions (insurance and funded);

- about the possibility of delivering money only to an organization with which the fund has an agreement;

- the obligation to inform the policyholder about moving to a permanent place of residence abroad (at least a month before departure);

- that when receiving funds the trustee must indicate the number of his nominal account.

- Application for urgent payments - the need to immediately inform the pension fund about situations when payments should be stopped, and about recalculating the payment amount (once a year and after the receipt of new funds - maternity capital, contributions, investment income, etc. ).

Positive and negative sides

The volume of the future benefit directly depends on the number of individual investment complexes located in a person’s personal account in the Russian Pension Fund. Accordingly, the lower the number of points, the lower the contributions to the pensioner will be. However, it is possible to increase the amount of maintenance by temporarily waiving the benefit, which will allow you to receive a bonus coefficient.

The size of the personal pension coefficient increases if you apply late for old-age payments. Every 12 months of deferment, but not more than ten years, you can increase the amount of insurance premiums by accruing premium points.

Advantages of a complete transfer of payments to the insurance part:

Negative factors for refusing the funded share of old-age benefits:

Having studied all aspects of waiving the funded share of benefits, each citizen will be able to independently decide on the profitability of this venture.

No matter how strange it may sound, there are several reasons why a Russian citizen may be thinking about how to refuse a pension in Russia. And a person has a legal right to this, since no one has the opportunity to limit his rights and freedoms. And further about how you can refuse an old-age pension and what needs to be done for this.

Inheritance

Funds accumulated by an employee in a pension account are inherited in 3 situations:

- death of the account holder before the assignment of his pension (or before its first payment);

- death before the balance is recalculated in connection with new receipts of funds (or before the first payment based on the changed amount), for example, if the deceased worked on a pension and continued to make contributions while receiving payments;

- the recipient was assigned a fixed-term pension and the entire amount was not paid.

Inheritance occurs by application (if the deceased wrote it) or by turns. The document allows you to indicate one recipient of pension payments or several, distributing shares between them.

In the absence of an application, as in the case of a will, the 1st stage includes children (including adopted ones), spouse and parents, the 2nd stage includes grandchildren, brothers, sisters, grandparents. Heirs of the 2nd stage can receive money only if representatives of the 1st stage are absent, refused the inheritance or were deprived of it by a court decision.

In a special procedure, the right to a one-time payment is granted. It, like other income of the deceased that he did not manage to receive - wages, benefits, etc., will be paid only to relatives who lived with the owner of the pension deposit, or to his disabled dependents (regardless of place of residence).

When concluding an agreement with a non-state fund, the document can indicate the names of the heirs and the period for payment of funds to them.

Maternity capital, if it was allocated for pension provision, is not inherited. The right to it passes to the spouse and children.

Is it possible to withdraw a funded pension?

Accumulating funds that will be converted into pension benefits is a type of insurance. An insured event is considered to be retirement by age. You cannot withdraw money from your account before the due date.

An exception can be made in 2 cases:

- Death of the account holder. The money is transferred to the heirs regardless of the age of the deceased.

- Early termination of work. Specialists working in difficult conditions are entitled to a long service pension. Along with their labor pension, doctors, teachers, geologists, railway workers, etc. also receive a funded pension.

Is it possible to refuse a pension in the Russian Federation?

The question then arises: can a person not retire in old age, but simply refuse it for a certain period in connection with the continuation of his work activity?

In addition, during official work, a person of retirement age can increase his insurance period, which in turn will allow him to increase the future amount of his pension.

In order to refuse pension payments, you must inform the Pension Fund of your intention. There you will need to write a statement stating that you wish to continue your work activity. In this case, the Pension Fund will make a corresponding note, and the pension will not be assigned.

If the pension has already been accrued and the person simply wants to interrupt receiving it, then it is also necessary to contact the Pension Fund and write an application. There should be no difficulties in resuming payments. When a person of retirement age wishes to stop working, he will quit his job and report this to the Pension Fund. Payments will be restored immediately.

In case of refusal, you must write a written complaint to the Labor Inspectorate. The main thing is that the work book must contain a note that “dismissed due to retirement.” No other reason should be given.

If a person works more than 2 months after the due retirement date, then he will automatically, regardless of the length of work, receive a 1% bonus to his pension. If the work period is less than 2 months, then there will be no increase.

Many pensioners are also concerned about the question: is it possible to receive two pensions at once, for example, a long-service pension or an old-age pension? Of course not. The citizen must choose what payment he wants to receive. For example, if a subject has reached retirement age and he wants to receive security in connection with the onset of old age, then he must contact the Pension Fund and write a refusal to pay for length of service. If such a refusal is not written, then the Pension Fund will continue to accrue a pension based on length of service, but not old age.

Read more: Where to apply to obtain a plot of land

Contributory pension of the deceased

If, according to the law, the heirs of the deceased have the right to his pension (funded part), they should submit the necessary documents within the prescribed period.

The deadline for writing an application to the state pension organization is 6 months from the date of death.

In the case of a lump sum payment, it is reduced to 4 months.

In non-state funds, the conditions of inheritance are specified in the contract.

In addition to identification documents, the following documents are attached to the application:

- confirmation of family relationships (birth or marriage certificate);

- pension certificate and individual account number of the deceased;

- application for refusal to pay heirs of the 1st stage (for representatives of the 2nd stage);

- a certificate from the housing authorities confirming joint residence (to receive the entire amount in a single payment).

After the 6-month period, in the absence of applications, the pension is included in the inheritance.

If the relatives of the deceased missed the deadline, they still need to submit an application to the fund with which the pension insurance agreement has been concluded, and then, with a written refusal from the representatives of the fund, go to court. Provided that the judge considers the reason for the delay to be valid, the inheritance will be transferred to the applicant.

The algorithm for processing documents for inheriting a pension in a state fund is as follows:

- Applications are received within 6 months. The processing time for each is 5 days. Those. if the paper cannot be accepted, then no later than 5 days later the applicant will be notified about this.

- After the specified period of 1 month, the fund distributes the remaining amount in the deceased’s account among his relatives.

- Notifications are sent to heirs within 5 days about the decision on their applications.

- Before the 20th day of the payment approval month, the money is transferred to the recipients.

The funds are distributed equally among the heirs of the same line. Thus, relatives, for example the wife of the deceased husband and his two adult children, will receive a pension in approximately 8 months, each 1/3 part.

Registration of refusal of pension contributions

When deciding whether it is possible to refuse your pension transfers, you need to understand that the choice to form a funded pension had to be made before January 1, 2016. As confirmation, the citizen sends an application to the Russian Pension Fund according to the established form or to the Non-State Pension Fund.

Insurance premiums are automatically assigned to the following citizens:

Regardless of the fund to which the application was submitted, a citizen has the right to formalize a waiver of the funded part of the pension. If you go through this procedure, then the entire volume of deductions will be directed to insurance payments.

At the same time, voluntary refusal of the funded formation allows the citizen to continue to replenish the account in the NPF, for example, by transferring money from maternity capital.

Bodies to appeal

Before deciding to refuse the funded part of a future benefit, you should consider all aspects of the situation. It will not be possible to return to the previous method of provision, since this is not provided for by the legislator. To undergo the procedure, you must visit the Russian Pension Fund and submit an application.

Note: during the subsequent period following the year in which the application was submitted, the person has the right to withdraw the application. This is the only option for returning to the previous formation of savings.

An application for refusal in favor of insurance premiums can be submitted as follows:

List of conditions

Based on current regulations, a citizen has the right to submit a voluntary refusal of benefits if he belongs to one of the following categories:

- the insurance part of the benefit has been assigned, and payments are already being made;

- the security has not yet been assigned, but the acquisition of the right to payments has already occurred.

After the waiver period has expired, the benefit recipient will be accrued and paid savings increased by the flat rate increase factor. The volume depends on several factors:

- deferment period for payments from the funded portion;

- type of benefit - insurance, social, etc.;

- The procedure for retirement is based on length of service, earlier than the established time, due to circumstances.

In addition, the procedure for refusal depends on whether the person applied for an appointment or not. Accordingly, in order to initiate the refusal process, it is necessary to send an application drawn up according to the sample. Forms and templates can be obtained from the Pension Fund. When you contact the authority, you should take your passport with you.

Read more: How to obtain SNI for an individual via the Internet

The termination of deductions begins on the 1st day of the next month, after filing an application and registering an application with the department. The maximum period for suspension of collateral, in accordance with current regulations, is ten years.

Latest funded pension news

The latest news regarding the labor pension for several years is that the funded part has been frozen. In 2018, this process was extended until 2020. It is unknown whether there will be changes in 2020. In this regard, voluntary insurance is being extended - employees opening pension accounts in banks and commercial funds.

In addition, citizens who managed to accumulate funds in 2002-2014 can invest them and change savings funds. This is allowed to be done once a year, and it is recommended - no more than once every 5 years, because otherwise the profit received over the last year is lost. Apart from those who have already transferred savings over the past 5 years, analysts do not recommend changing the fund in 2020 for “silent people” - citizens who have always been accumulating money in one organization.

The leaders in 2020 were the funds of Sberbank (account balance increased by 13%), Lukoil-Garant, Neftegarant and VTB Bank; cooperation with them may be profitable in 2020.