Subscribe to news

On January 1, 2020, changes to pension legislation came into force, providing additional financial support for village residents.

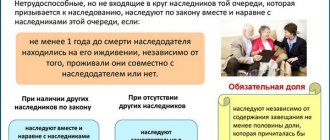

What categories of pensioners are entitled to an additional 25% payment?

- persons receiving old-age or disability insurance pensions;

- having 30 years of work experience in certain positions* in agriculture;

- living in rural areas**;

- non-working.

What size?

A 25 percent supplement to the fixed payment of old-age and disability insurance pensions. The amount of the supplement is 1333.55 rubles.

Articles on the topic (click to view)

Is the amount of the supplement the same for all categories of citizens?

Yes, with the exception of recipients of the third group disability pension. For this category of citizens, the fixed payment is half the generally established amount, and, accordingly, a 25% bonus will be calculated from this amount.

Will the bonus for “rural” experience remain in the event of moving to a new place of residence outside the rural area?

When citizens move to a new place of residence outside of rural areas, a pension supplement is not paid. If the recipient of the bonus decides to change his place of registration or move to live in an urban area, he is obliged to inform the Pension Fund about this in order to stop paying the bonus. Otherwise, he will be obliged to reimburse all illegally obtained funds.

Will the pension supplement be maintained when moving from a rural area of one region to a rural area of another region of the Russian Federation?

Yes, since the place of residence remains in the countryside.

For what periods is the length of service calculated?

The length of service is calculated in calendar order for all periods of official employment in designated professions. The length of service also includes periods of incapacity for work, paid vacations and periods of child care up to 1.5 years (but in total no more than 6 years).

The List includes the main agricultural professions, for example, “agricultural technician”, “veterinarian”, “animal technician”, “fish farmer” and others.

Periods of work on collective farms, at machine and tractor stations, at inter-collective farm enterprises, on state farms, peasant (farm) farms, agricultural artels, which were carried out on the territory of the former RSFSR before 01/01/1992, are included in the “rural” experience, regardless of the name of the profession, specialty and the position held.

Is it possible to increase the pension for working on a state farm as a milkmaid for a total duration of 29 years 11 months 4 days?

An increase in the fixed payment to the insurance pension is established for persons who have worked for at least 30 calendar years in agriculture.

If a citizen completes the required work experience in agriculture, then the amount of the fixed payment to the insurance pension will be revised upward. To recalculate the amount of your pension, you must submit an application to the territorial office of the Pension Fund. The specified recalculation will be carried out from the 1st day of the month following the month of circulation.

How to get an additional payment to your pension for working in agriculture?

The pension increase is carried out without a request, according to the documents available in the pensioner’s payment file. In this case, a citizen can contact the Pension Fund and submit additional documents confirming the right to increase the fixed payment towards the pension. If applied before the end of 2020, recalculation will be made from January 1, 2020. If an application is submitted starting from January 1, 2020, the pension amount will be revised from the month following the month of application.

If a pensioner has not received an increase, but believes that he is entitled to it, he can contact the client service of the Pension Fund of the Russian Federation with the relevant documents confirming work experience in agriculture, which for some reason was not taken into account earlier when assigning a pension.

Example: let’s consider the right to a bonus for “rural” experience using the example of the fishing collective farm “Baltika”, which is engaged in catching fish and producing fish and other products. This industry does not relate to agricultural production and the agro-industrial complex in general. However, if the collective farm charter reflected information about the employment of workers in fish farming, and indicated the allocation of the corresponding agricultural structural units, then the workers would have the right to receive this bonus with the appropriate entry in the work book.

Thus, in order to take into account periods of work, it is necessary that from the title of a citizen’s position it is possible to establish a connection with the crop, livestock and fish farming areas of agriculture. For example, working in the position of “Operator of feed preparation workshops at the Roskar poultry farm.”

Based on the results of the work carried out, in 2020, 5,610 non-working pensioners living in the Leningrad region received an increase in fixed payments.

* Lists of jobs, industries, professions, positions, specialties, in accordance with which an increase in the amount of the fixed payment to the insurance pension is established, are approved by the Government of the Russian Federation (Resolution of the Government of the Russian Federation dated November 29, 2020 No. 1440).

** Rural area is the totality of all lands outside the boundaries of urban settlements, on the territory of which agriculture is carried out.

Supplement for rural pensioners with 30 years of service

The procedure for its appointment is determined by the “Rules for establishing and paying an increase in the fixed payment to the insurance pension for persons who have worked for at least 30 calendar years in agriculture and living in rural areas.”

The rules are approved by decree of the Government of the Russian Federation. Let's take a look at them in full; they include four conditions for assigning an additional payment to a pension.

Condition one: you have at least 30 years of insurance experience in agriculture

The length of service includes five periods, including parental leave until the age of 1.5 years, but in total no more than 6 years.

Returned pension supplement for rural residents

The pension supplement for villagers is not a legislative innovation of the coming year. It is provided for by Federal Law No. 400-FZ of December 28, 2013 “On Insurance Pensions” (Article 17, paragraphs 14 – 15).

Due to economic difficulties in the country, from 2020 the authorities decided to “freeze” the operation of these points. The “freeze” was supposed to last until the beginning of 2020, but it was canceled one year earlier (Federal Law No. 350-FZ of October 3, 2018, Article 9).

Employees of the Pension Fund of Russia (hereinafter referred to as the Pension Fund) assure that rural pensioners do not need to specifically contact their department to apply for an additional payment. If the Pension Fund of Russia database already contains all the necessary information confirming the pensioner’s right to a cash increase, it is assigned to him “automatically.”

However, if a citizen believes that he is entitled by law to an additional pension for agriculture, but it is not paid to him, it is necessary to appear at the Pension Fund of the Russian Federation with all documents that can prove the applicant’s right to receive a pension in an increased amount. This is, first of all, a passport (indicating the place of permanent registration) and a work book.

Pension Fund employees recalculate all pensions within several months - from the beginning of the year until September 1. Pensioners who have not received an increase since January due to protracted recalculation will be paid it immediately for several months.

The cash increase is provided for only insurance pensions, and is calculated based on the fixed part of the pension payment. For pensioners who worked in rural areas, it was increased by 25%.

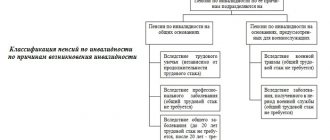

According to Article 10 of Law No. 350-FZ, from January of this year the fixed part of the insurance pension is 5334.19 rubles. This means that the pension supplement (25 percent of this amount) is equal to the amount of 1333.55 rubles. This payment is added to rural pensioners receiving pensions from the state:

- old age (if you have reached retirement age);

- for disability (if group 1/2 is established).

In case of disability of the 3rd group, the pension supplement in rural areas is 666.77 rubles. This is due to the fact that for this category of disabled people the fixed payment is less - 2667.10 rubles. (50% of its full value).

Why was the list of rural professions added?

To eliminate confusion in determining professions, specialties, and positions that may be included in preferential length of service, the Government issued Resolution No. 1440 of November 29, 2018 with a complete list of them. However, many collective farmers were unable to receive the promised benefit. The situation looked absurd: people had worked in agricultural work for decades, but did not receive the promised money. The Pension Fund of Russia justified the refusals by the absence of certain professions in the approved list.

They let in not only office workers, but also veterinarians and mechanical workshop workers, who were removed from collective farms in the 90s when inter-district technical enterprises were created. Many related professions, such as land reclamation workers and individual entrepreneurs, were also not included in the list.

Therefore, the Ministry of Agriculture proposed expanding the list of beneficiaries. The new edition of the list of professions for pension supplements for agricultural workers was approved by Resolution No. 805 of June 25, 2019, which made it possible for village residents who did not receive the supplement to apply for the benefit retroactively.

Rice. 1. Not all agricultural professions are included in the preferential list

But, unfortunately, as the special project “Russkaya Gazeta” reports, even the new document does not take into account all the nuances that collective farmers voice in letters sent to the “Pension Bank of Issues”.

To receive a 25% bonus, a village resident must have worked for more than 30 years in a position or profession included in the approved list.

For the period until 1992, there are no requirements for certain professions. The main thing is that the employee is employed:

- on a collective farm;

- on a state farm;

- at the machine and tractor station;

- at an intercollective farm enterprise or organization;

- in a peasant or farm enterprise;

- in the agricultural artel.

Rice. 2. Active development of livestock farming

For the period after 1992, a precise list was approved, divided into three areas:

- livestock farming;

- crop production;

- fish farming.

Table 1. List of professions and positions of agricultural workers giving the right to a pension increase, selectively

| Type of production | Profession, position |

| Crop production | Agronomists and agricultural technicians |

| Agrochemists | |

| Foreman and team leaders | |

| Melon growers | |

| Heads (manager, chairman, director) and ch. engineers and their deputies | |

| Mechanics and power engineers | |

| Workers of all types | |

| Adjusters, mechanics, technicians | |

| Managers and engineers | |

| Researchers and laboratory technicians | |

| Machinists and millers | |

| Collective farm members | |

| Livestock | Veterinarians, technicians, paramedics, etc. |

| Chief engineers and consultants | |

| Surveyors, hydrogeologists, hydraulic engineers | |

| Mechanics, mechanics, power engineers | |

| Directors, chairmen, managers, etc. | |

| Livestock specialists and instructors | |

| Laboratory assistants and livestock breeding specialists | |

| Workers of all types engaged in livestock farming | |

| Tractor drivers, drivers | |

| Members of a (farm) household | |

| Fish farming | Chairmen, directors, etc., their deputies |

| Fish farmers and ichthyologists | |

| Livestock specialists and fish farming engineers | |

| Marine hunters | |

| Workers of all types engaged in fish farming | |

| Turners, mechanics, mechanics, radio operators, electricians | |

| Collective farm members |

The new list of specialties that give the right to an increase included, first of all, individual entrepreneurs engaged in agriculture.

Rice. 3. Entrepreneurship in rural areas

Also added here are works related to:

- security and maintenance of production agricultural facilities;

- equipment repair;

- equipment maintenance.

The list has been expanded to include:

- auxiliary workers;

- full service workers;

- gas welders;

- stokers;

- turners;

- hammermen;

- storekeepers;

- electrical engineers, instrument engineers, machine and tractor fleet engineers;

- security guards and watchmen;

- managers of warehouses and garages, etc.

After the amendments were made, an additional 30 thousand rural pensioners received the right to receive an increase.

Note! As of the end of the 1st quarter of 2020, 923 thousand people received the benefit.

Persons who, thanks to the expansion of the list, have become entitled to a bonus, will be paid the money on an accrual basis from January 2019, if the documents for its registration are submitted before the end of the current year. Those who apply for benefits after January 1, 2020 will receive an increase from the 1st day of the month following the submission of documents.

poultry farm engineer, head. heating engineer, engineer (senior engineer) for occupational safety and health, senior engineer (for grain cleaning machines, seed cleaning complex, poultry farming, mechanic), engineer (livestock workshops, dairy farms, mechanization of labor-intensive work in livestock farming, mechanic feed shop, cultivation shop, livestock shop, tractor mechanic and agricultural.

In the labor record there is an entry “foreman of the brigade”, and nothing else.

Is it possible to somehow prove that these works also relate to agricultural work? 6.1. Resolution of the Plenum of the Supreme Court of the Russian Federation dated December 11, 2012 N 30

“On the practice of courts considering cases related to the implementation of citizens’ rights to labor pensions”

in court you can try “” PLENAUM OF THE SUPREME COURT OF THE RUSSIAN FEDERATION DECISION of December 11, 2012

N 30 ABOUT THE PRACTICE OF CONSIDERATION BY COURTS OF CASES RELATED TO THE IMPLEMENTATION OF CITIZENS’ RIGHTS TO LABOR PENSIONS 15.

When considering the requirements related to the procedure for confirming insurance experience (including experience that gives the right to early assignment of an old-age labor pension), courts should distinguish between the periods that occurred before the citizen was registered as an insured person in accordance with the Federal Law of April 1, 1996 N 27-FZ

“On individual (personalized) accounting in the compulsory pension insurance system”

and after such registration.

A similar procedure is applied when calculating periods of work in structural divisions of organizations, the list of which is given in paragraph 6 of the Rules. LIST OF STRUCTURAL DIVISIONS OF HEALTHCARE INSTITUTIONS AND POSITIONS OF DOCTORS AND NURSING MEDICAL STAFF, WORK IN WHICH DURING THE YEAR IS COUNTED INTO WORK EXPERIENCE, GIVING THE RIGHT TO EARLY ASSIGNMENT OF A LABOR PENSION OLD AS A YEAR AND SIX MONTHS.

3. I am a former health worker and live in an urban-type settlement. Housing and communal services benefits are the same as for someone working in a rural area.

When calculating my pension, I am entitled to a bonus for 33 years of experience in rural areas, our town. is now called a rural settlement.

3.1. What's the question? How to get it or what? Hello! 4. I don’t understand in what cases the law on retirement of health workers in rural areas with 25 years of experience works.

4.1. Good afternoon Marina, if you have 25 years of work experience in rural areas (not including work in the city), you will be entitled to early retirement.

Benefits for agricultural workers and farmers

Working in rural areas presents various challenges. They are connected not only with climatic conditions and living conditions, but also with the amount of wages. People from small villages have significantly less opportunities to earn money than residents of big cities. In order to somehow attract hardworking citizens here, the state provides benefits to rural workers.

Who is eligible?

Social and material support is provided to rural residents at the country level as a whole and in accordance with regional legislation. The latter often becomes an additional bonus for a person working in the village. However, simply living in a rural area is not enough to qualify for a benefit. The following are entitled to various benefits:

- employees of the pedagogical sphere (teachers, educators);

- medical employees;

- social workers;

- cultural workers;

- farmers with peasant farms.

However, to receive preferences, a number of conditions must be met. Thus, Russians who permanently live in rural areas are eligible for support (exceptions are possible for teachers - they do not have to live here, but then the list of benefits will be smaller).

Cash payments

Specific cash payments for agricultural workers are rare. However, they can be expressed in the following forms:

- additional payments to wages or establishing a minimum salary for a specific position, based on the cost of living or the average salary in the region;

- grants.

The latter are especially common among farmers who want to develop their own farms. The amount of the subsidy can reach 40,000,000 rubles, however, the person is not given the money for the entire time - within 5–15 years he will have to return it. In essence, this is preferential lending to businessmen involved in agriculture.

Be sure to read it! How to find a job for a pensioner: where can women and men get a job at an advanced age?

Monetary incentives are also found among social workers. But to receive them you will have to win a government competition in one of the categories or become a prize-winner. The payment amounts here are also significant: 200,000–500,000 rubles.

Non-working pensioners who have worked in the agricultural sector for over 30 years can count on an additional increase in their pension. According to paragraph 14 of Art. 17 of Federal Law No. 400-FZ of December 28, 2013, the surcharge for them is 25%. It applies to the fixed part of the payment, which from January 1, 2020 is equal to 5,686.25 rubles.

Therefore, the amount of the increase is RUB 1,421.56. When calculating “rural” experience, not all specialties are taken into account, but only those listed in Decree of the Government of the Russian Federation No. 1440 of November 29, 2020. These, for example, include: the head of a peasant farm, a mechanic for repairing agricultural machines, laboratory assistants, etc. In general, these are specialties related to the fields of crop production, livestock farming, and fishing.

Labor benefits

Labor preferences for a working person play an important role. So, for those living in rural areas they are as follows:

- the possibility of retraining, the need for which arose as a result of changes in working conditions, without additional personal expenses;

- establishing monthly payments equal to 1 minimum wage for the period of forced unemployment (for example, if a school is closed and the teacher simply has nowhere to work).

Even in Soviet times, most agricultural work, including physically difficult work, was performed by women. At the same time, expanded labor benefits were provided for them (Resolution of the Supreme Court of the RSFSR No. 298/3-1 of November 1, 1990). Many points of this regulatory act are still valid, but with some changes prescribed in the Labor Code of the Russian Federation. The most important ones look like this (true for women working in rural areas):

- reduction of the working week to 36 hours while maintaining the wage rate (if more hours are worked, the excess hours are paid as overtime);

- the possibility of receiving an additional day off without saving a salary once a month at the request of a woman (paragraph 2 of Article 262 of the Labor Code of the Russian Federation).

For teaching staff, other formats of labor benefits are established if they work in rural schools. The preferences look like this:

- the working week has been reduced to 18 hours;

- annual paid leave is 56 days;

- possibility of part-time work.

Such employees have the right to retire early, having completed 15 years of teaching experience with a total experience of over 25 years. True, they do not establish an additional payment of 25% to the fixed payment to the pension. The nature of salary calculation there is different.

Housing benefits

The housing problem is one of the most pressing for Russian citizens, even if they live in rural areas. Housing benefits provided for these people can be divided into 2 types:

- Providing housing . Mostly these forms of support apply to workers in the teaching, medical and social spheres. For example, under the “Zemsky Doctor” program, young doctors receive a one-time compensation payment in the amount of about 70% of the cost of the purchased housing. It also provides for the transfer of provided public housing into the ownership of the employee after 10 years of work in his position.

- Compensation for housing and communal services . In fact, compensation is broader in nature. For example, at the expense of the state, you can reimburse the costs of purchasing firewood for heating during the cold season, renting housing in the absence of your own. As for housing and communal services, the amount of compensation varies from 50 to 100% and is assigned to certain categories of workers. The final refund amount is determined at the regional level. There are regions where doctors are compensated 70–100% of the normal utility costs. Reimbursable housing and communal services include, in particular: water supply, electricity, heating, gas.

A housing program is usually associated with the need of a specialist or his family to improve living conditions. That is, having your own house or apartment often deprives you of the right to receive assistance from the state.

Large families raising 3 or more young children at the same time can receive an apartment for 5 years to live under a social rental agreement. And for young parents there is a regional program “Young Family”, under which you can buy housing at partial cost (the rest is paid by the state).

Other forms of benefits

The state tries to help village residents who work conscientiously in every possible way. Therefore, other forms of benefits are provided for them. This, for example, includes free (not for everyone):

- medications and prescription medications;

- vouchers to a sanatorium;

- provided medical services.

It may also provide for free travel on public transport or, more often, discounts on tickets.

All together allows a rural resident to reduce their own costs, and therefore improve the quality of life of their family. To do this, it is enough to conscientiously fulfill your job duties or go to work in one of the budget sectors, where the list of preferences offered in villages is maximum.

Who is entitled to the bonus?

Not all rural workers will be able to apply for an increase in pension. The state has defined several conditions for obtaining it, each of which must be met:

- In agriculture you need to work for a long time - at least 30 years.

- A pension supplement for 30 years of service is accrued if the pensioner worked in the professions (positions, specialties) listed in a special List. It was approved by Government Decree No. 1440 of November 29, 2018. In particular, the list of the Cabinet of Ministers included zoologists, tractor drivers, beekeepers, veterinarians, mechanics, etc. It also contains rare job titles, for example, “boar manager.” In total, the document names more than 500 specialties/professions/positions related to agriculture.

- Among those who are entitled to a 25% pension supplement are only non-working pensioners. Upon employment, the right to an additional increase is lost.

- The recipient of the allowance must permanently reside in a rural area. Clause 15 of Article 17 of the Law “On Insurance Pensions” stipulates that when moving outside its borders, the pension will be paid in the usual amount (that is, a supplement to the pension for agricultural workers in this case is not due).

The draft law assumes that a bonus for 35 years of experience in agriculture will be assigned to pensioners receiving old-age or disability insurance pensions. In addition, on the date of assignment of the additional payment, the citizen must be unemployed. This means that he should not carry out any activity during which he is subject to compulsory pension insurance (that is, pays insurance contributions to the Pension Fund).

The length of service giving the right to receive an increase for 35 years of work will be calculated according to the same principle as for additional payment for 30 years of rural experience:

- The duration of work will be calculated on a calendar basis, while the citizen had to work full time and pay insurance contributions to the Pension Fund.

- The periods of work in the profession provided for by the list agreed by the Government will be taken into account (it is the same as for 30 years of experience).

- In addition to periods of work, the duration of parental leave of up to 1.5 years and official sick leave (time of receipt of disability benefits) will be taken into account.

This length of service will still not include service in the Soviet army, caring for disabled citizens, registration with the employment service, and so on. This bill also does not envisage expanding the list of agreed positions and professions.

Supplement for rural pensioners with 30 years of service

If the pensioner is registered in a rural locality, an increase will be established.

When a pensioner actually permanently resides in a rural area, but is registered in a city, it is necessary to submit a personal statement to the Pension Fund, which confirms residence in a rural area. In the future, the fact of residence in the village requires annual confirmation. The application is submitted to the territorial body of the Pension Fund or MFC for delivery of the pension to the place of actual residence of the pensioner in a rural area.

As the Pension Fund emphasizes, non-working pensioners and living in rural areas are the main conditions necessary to receive an increase.

How is rural experience calculated?

The rules for calculating periods of labor activity that are included in rural experience differ from the classical calculation.

Time is counted in agricultural output:

- Work before 1992 on the territory of the USSR in rural areas, regardless of position.

- Labor activity on the territory of the Russian Federation after January 1, 1992 at work according to the list.

In addition, periods of child care for up to one and a half years, in total no more than 6 years, and periods of temporary disability (paid sick leave) are added to the rural experience.

In contrast to the principles for calculating work experience, the time spent in the army, being registered at an employment center, or caring for the disabled is not added to the rural one.

Unresolved issues

Professions that do not involve direct work with animals or in the field were not included in the preferential list. Therefore, workers holding the positions of accountants, secretaries, economists, librarians, accountants, personnel officers employed at agricultural enterprises did not have the opportunity to receive a pension supplement.

Rice. 4. Everyone worked in the field, regardless of specialty

The significant contribution of such workers to making the enterprise economically stable, as well as the fact that during the season, almost all employees of the “offices” went to work “in the field”, were not taken into account.

Specialties related to the processing of agricultural products did not appear in the list in cases where the enterprise was located on the territory of a collective farm, for example, bakers. Also left out are those persons who correspond to the approved list by profession, have the necessary experience, but live in the suburbs or towns. They were denied a bonus based on their place of residence, although they had been going to work on nearby collective farms for decades.

So far, there is no information on how such painful issues will be resolved in the future. Clearly, in order to adjust the list, it will be necessary not only to adopt new laws, but also to revise the Pension Fund budget to find additional funds. Therefore, employees who have dedicated their lives to working in rural areas, but are not included in the list, can only wait.

Additional payment for rural experience. Explanation of the Pension Fund of Russia

From 2020, some pensioners can count on a “rural” pension supplement.

The legislation stipulates three mandatory conditions for receiving a 25% bonus to the fixed payment (in 2020 its amount is 1333 rubles 55 kopecks). Firstly, at least 30 years of work in certain positions and industries in agriculture.

Secondly, living in rural areas. And the third condition is the absence of the very fact of work.

Until recently, such a concept as “work experience in agriculture” had no legal meaning.

Old-age pensions for rural workers are established on the same basis as for urban workers.

However, from January 1, 2020, villagers will receive the right to a pension benefit for work experience in rural areas. What does rural experience include, the Zen Channel found out. The pension benefit is the right to a 25 percent additional payment to a fixed payment to the old-age insurance pension or disability insurance pension for those agricultural workers who have worked in agricultural enterprises for at least 30 years. and more.

The size of the fixed payment for pension in 2020 is 5334.19 rubles (read how the payment will increase year by year until 2024). 25 percent of 5334.19 rubles is 1333 rubles 54 kopecks. This will be the amount of the supplement to the pension. The size of the fixed payment in the territories of the Far North and equivalent areas increases by the regional coefficient.

Draft law No. 673331-7 on the rural allowance, regardless of the actual place of residence of the pensioner, was prepared by deputies from the LDPR faction and members of the Federation Council. The draft contains the following proposals:

- establish an additional payment to the pension of agricultural workers with more than 35 years of experience;

- assign this increase regardless of their actual place of residence;

- The amount of the bonus should be set to the same as for 30 years of service - 25% of the fixed payment to the insurance pension.

It is proposed to set the effective date of this law as January 1, 2020. Therefore, if such a law is approved, those pensioners who worked in agriculture but moved to live in the city will receive additional payments only in 2020. In this case, the amount of the additional payment will already be equal to 1421 .56 rubles, since from 01/01/2020 the fixed payment amount will be 5686.25 rubles.

As noted in the explanatory note to the bill, the document was developed due to the fact that some agricultural workers did not receive the bonus they were entitled to for the following reasons:

- After retirement, they moved to live in the city due to serious health conditions and the need for care from relatives.

- In some settlements, the boundaries of municipalities have changed, and those settlements that have always belonged to rural areas have lost such status.

Procedure for making additional payments

To receive the required benefit, a rural pensioner must first collect documents confirming this right. It is necessary to prove:

- Permanent residence in the village.

- Presence of agriculture for at least 30 years.

The most common problems a citizen encounters are in the process of confirming his experience. The last three decades include the time of the collapse of the USSR. During this period, many collective farmers were forced to work in small firms that replaced collective and state farms.

Such new organizations did not make any official entries from their work books. Also, insurance premiums for employees were not deducted.

If there are no entries in the work book, and also if the company has been liquidated, and it is not possible to provide papers on extra-budgetary funds, the length of service can only be confirmed by testimony.

To avoid problems with confirming your experience, experts advise collecting documents in advance. It is important to find as many documents as possible confirming work experience in the agricultural sector.

Those pensioners who, in the process of applying for a labor insurance pension upon reaching age, have already had a work experience of 30 years or more indicated and confirmed, will not have to submit documents a second time. You will not need to write an application for an increase in payments. Due payments will be recalculated without a pre-written statement.

![Alfa-Bank Credit cards [CPS] RU](https://7daystodie.ru/wp-content/uploads/alfa-bank-kreditnye-karty-cps-ru-330x140.jpg)