Certain groups of citizens who have officially worked a sufficiently large amount of time are entitled to an additional payment to their pension. For these persons, the Pension Fund of the Russian Federation provides for the calculation of payments with some features.

In this article you will get the following information:

- who has the right to establish bonuses by the pension authority, and under what circumstances;

- a clear definition of the concept of experience, what it includes;

- on the procedure for processing additional payments established by the Laws of Russia;

- what documentation is required for this procedure;

- What is the size of the bonus for additional work time?

Who is entitled to

Such citizens can be divided into four categories. An additional state supplement to the pension for service of 30 years or more is due:

| women | engaged in official work for 30 years |

| men | have worked for 35 years |

These citizens are awarded another individual point by the Pension Fund.

The second category, receiving 5 bonuses from the Pension Fund of the Russian Federation:

- male representatives who have worked for at least 45 years;

- women with 40 years of experience.

The price of one pension point for 2020 is 78 rubles 58 kopecks.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

8 (800) 700 95 53

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

The pension authority does not award additional points to persons of the third category. They are entitled to a monthly supplement in the form of a certain amount of money. This :

- men who worked 50 years or more;

- and women who worked the same amount of time.

The peculiarity here is the equality of the periods included in the length of service. In almost all provisions of Federal Laws, the requirements for female and male representatives are different.

The last group is labor veterans. These are persons who meet at least one of the following conditions:

- the person was engaged in labor activity during the Great Patriotic War and did not reach the age of majority at that time. Currently, it has 35 (female) or 40 (male) years of experience;

- the citizen has already accumulated the time necessary to receive an insurance pension, and during the period of his working life he was nominated for a State award, regardless of the country (USSR or Russian Federation). This also includes departmental orders and medals for labor achievements.

Work experience at one company

1) persons awarded orders or medals of the USSR or the Russian Federation, or awarded honorary titles of the USSR or the Russian Federation, or awarded diplomas of the President of the Russian Federation or awarded the gratitude of the President of the Russian Federation, or awarded departmental insignia for merits in labor (service) and long-term work (service) for at least 15 years in the relevant field of activity (sector of the economy) and having a labor (insurance) length of service taken into account for the assignment of a pension of at least 25 years for men and 20 years for women or the length of service necessary for the assignment of a long service pension years in calendar terms;

We recommend reading: Wwwsogufondru list of large families list for 2020

Advice from lawyers:

2) persons awarded

as of June 30, 2020, departmental insignia in labor and having a labor (insurance) length of service taken into account for the assignment of a pension of at least 25 years for men and 20 years for women or the length of service necessary for the assignment of a pension for long service in calendar terms ;

- A certificate confirming the care of a child under 1.5 years of age. No more than 6 years in total;

- Military service;

- A document confirming the provision of services to disabled family members who, due to their physical characteristics, cannot work. These are disabled children, old people over 80 years old or disabled people of group I.

In this case, the pensioner must permanently reside in a rural area. If an elderly person is registered in a village and receives money at his place of residence, the Pension Fund will independently make the necessary adjustments.

What amount of additional payment can I expect?

The established additive is a quarter of the established amount, which equals 1333 rubles 55 kopecks . Payments will increase by this amount for farmers who receive old-age benefits or have a Group II disability.

Since the service life of an employee of the Ministry of Internal Affairs is in the range from 20 to 25 years, this means that he is entitled to a length of service bonus of 30%. Supplement amount: (12000+10000)*30% = 6600 rubles; Amount of allowance: 6600+12000+10000 = 28600 rubles. Supplement to the salary of military personnel Legislation establishes the right of a military personnel to receive a bonus for length of service, which is paid monthly and amounts to: Duration of service, years % of bonus from the official salary 2-5 10 5-10 15 10-15 20 15-20 25 20-25 30 25 and more than 40 The procedure for calculating length of service is also established by regulatory documentation (special rules), which specifies the categories of military personnel, periods of service included in length of service, preferential conditions of service and other conditions necessary for the correct determination of length of service.

What is included in the internship

This includes all periods provided for by Russian legislation during which a citizen was engaged in official work or other activities.

Both women and men must have at least 9 years of experience in 2020. In addition to this requirement, there are another units - points of the Pension Fund of the Russian Federation. For this year, their minimum is 13.8 individual bonuses.

The following are also included in the length of service:

- time of service in the Armed Forces of the Russian Federation;

- maternity leave.

Maternity leave is periods of caring for a child (or several children), as well as pregnancy and childbirth. If the duration of such leave is more than 4.5 years, then this time will not be counted towards the length of service.

Social benefits for pensioners in 2020

- tax on a vehicle with a capacity of no more than 100 hp. With. (not for all regions);

- the right to a tax deduction when purchasing real estate;

- partial exemption from land tax;

- exemption from paying state fees when filing lawsuits regarding pension disputes;

- exemption from personal income tax in relation to state pension provision and insurance and funded pensions paid through the Pension Fund and government agencies, social supplements to pensions.

Benefits for medical care

Property benefits for pensioners completely exempt elderly citizens from paying taxes on the real estate they own. This right can be used by working and non-working pensioners who own an apartment, country house, dacha or garage. The benefit applies only to one piece of real estate at the citizen’s choice. In addition, the program covers:

However, during 2020, a transitional provision is in force, allowing men who have reached the age of 60 to retire not at 61, but six months earlier. The same rule will apply until the end of 2020, when it will be possible to apply for a pension not at 62 years old, but at 61 years and 6 months.

Thus, starting from this year, a man who turns 60 and has the necessary length of service has the right to receive a well-deserved pension. But during the transition period (the first years of reform) it will not be 24 months earlier, but for fewer years.

Is military service included in the 42 years of service?

- work with official employment (confirmed by a work book or a corresponding certificate from the archive or from the place of work), from the payment for which insurance contributions to the Pension Fund were paid - Part 1 of Art. eleven;

- periods of being on sick leave - clause 2, part 1, art. 12.

In 2020, a supplement was finally introduced for citizens who continuously live in rural areas and have at least 35 years of employment in agriculture. To receive the bonus at the time of recalculation, the applying pensioner must complete his career and not work. The list of enterprises and organizations whose former employees have the right to apply for additional payment for long experience is established by a Government decree. Allowances for citizens employed in other sectors of the economy are set separately in each region and vary greatly.

All recalculations related to increasing length of service and indexation of pensions are made annually automatically. They are based on pension contributions made by the employer. To receive an additional bonus, citizens with more than 40 years of experience and the official status of Veteran of Labor should contact the district office of social protection authorities. You can also get all the related advice and clarifications there.

We recommend reading: When an Agreement is Executed for an Indefinite Period, the Civil Code of the Russian Federation Provides that Termination of the Agreement is Possible Only from the Moment of Sending a Notice by the Initiating Party of the Intent to Terminate the Transaction If There Is a Desire to Move In the Case of the Landlord - Vacancy of the Rented Premises It is necessary to Send Notification in Advance Three Months Before the Intended Actions

Calculation of experience

In 2020, Federal Law No. 400 was adopted. It establishes, among other things, an additional payment to the insurance pension for citizens with extensive work experience - more than 40 years. The procedure for recalculating payments and the conditions for receiving the bonus remained unclear for most citizens. Pensioners whose work experience is documented have nothing to worry about. The rest would like to know where and what to contact to resolve this issue.

The calculations take into account not only the duration of work, but also the amount of wages. If a Russian citizen has worked for more than 30 years (for women) or more than 35 years (for men), then the state provides additional accruals.

According to paragraph 14 of Art. 18 Federal Law “On Insurance Pensions” for persons who have worked for at least 30 calendar years in agriculture and are not engaged in work and (or) other activities, during which they are subject to compulsory pension insurance in accordance with the Federal Law of December 15, 2001.

Calculation rules and types of surcharges

The procedure for assigning pension supplements is regulated by Federal Law No. 400. The federal law, adopted in 2001, talks about social supplements and government increases.

Regions and municipalities usually have additional benefits for retirees living in that area. Most often these are tax breaks, benefits on utility bills and public transport, benefits on the purchase of medicines and sanatorium treatment. I'll tell you about everything in order.

Registration procedure

If a person has from 30 to 49 years of experience, the pension authority will recalculate insurance payments independently. A person will not have to visit the office of the Pension Fund of the Russian Federation and submit any papers.

If the citizen has reached 50 or more years of experience, he or she must report to the office of the social protection authority (SZN) in his or her region.

Employees of the institution will request documents proving the person’s compliance with the conditions for the payment, then they will be processed and a decision on the establishment will follow.

If the SZN makes a positive verdict, in a month the pensioner will receive the first bonus.

There is one important nuance: a pensioner, having already met the requirements for receiving an additional payment, must contact the social security authority as quickly as possible. If he does not do this, then SZN will pay him a bonus only for the previous half of the year.

Those persons who belong to the first three categories are not granted benefits. Their state establishes for citizens who have received the title “Veteran of Labor”:

- free travel on public transport;

- free repair and production of dentures;

- the opportunity to receive leave at the request of a veteran if the citizen continues to carry out official work activities;

- discount (or additional payment in the form of compensation) equal to half the cost of housing and communal services.

To establish it, you will need other papers.

What benefits are available to a labor veteran?

Free travel on public transport. Some regions provide labor veterans with free travel. For example, in Moscow, labor veterans ride free public transport, except for taxis and minibuses, or receive compensation of 378 R per month. In the Leningrad region there is no free travel for labor veterans, but for regional benefit recipients they sell a social travel card for 400 RUR. In the Voronezh region there is no free travel for any preferential category.

Documents for registration of benefits

Periodic indexation of benefits and payments. Indexation of payments to labor veterans depends on the region. For example, from February 1, 2020, payments to labor veterans of the Voronezh region were indexed; now they receive 580 RUR. In 2020 they received 530 R, and in 2020 - 510 R.

- nurses and paramedics;

- medical laboratory personnel;

- obstetricians;

- doctors of various narrow specializations and general practitioners;

- forensic medical experts;

- anesthesiologists and resuscitators;

- specialists of sanitary and hygienic institutions.

We recommend reading: Combat veteran benefits 2020 for housing and communal services

It is important to pay attention to the position’s compliance with the list defined in the lists of government regulations. Sometimes positions are added to the staffing table, especially in private clinics, that do not correspond to the wording and codes of the lists.

FAQ

People working in certain fields have the right to retire early. This includes persons whose working conditions are recognized as harmful. The work of doctors is considered to be just that because of the large number of stressful situations and increased labor costs.

If you find it difficult to formulate a question, call, a lawyer will help you: Free from mobile and landline Free multi-channel telephone If you find it difficult to formulate a question, call a free multi-channel telephone, a lawyer will help you 1.

When calculating a pension for insurance coverage, the cost of one point is multiplied by the total number of points earned. Cumulative experience is a fixed monthly amount. The size of the bonus is affected by length of service and monthly income level.

Social benefits

If a citizen has worked for 35/40 years, then the bonus is 5 points. In addition, like any other citizen, a working disabled person, regardless of the disability group, cannot be fired without reason, dismissed from a position or not hired.

How many years do men and women need to work to receive the title of veteran? More than 10 years ago (in January 2006), with the introduction of an additional fourth paragraph in Art. 7, based on amendments adopted by Federal Law No. 163 of December 19. 2005, the order in which the title of “Veteran of Labor” is awarded, regulated in the regions of the country, was determined. Subjects of Russia adopt legislative acts that are in force in a specific territory. This allows regions to expand the number of people who can claim the title of veteran, or, on the contrary, to tighten the requirements, and also to introduce additional benefits and monetary compensation to people who have worked conscientiously for the benefit of the region. Since 2006, determining the number of years worked in order to obtain a veteran's title has become the prerogative of regional authorities.

Required documents

Pensioners belonging to the third category (those with 50 or more years of experience) appear at the SZN and submit documentation:

- citizen's identity card - Russian Federation passport;

- certificate of pension insurance of the applicant;

- pensioner's certificate;

- documentation proving the necessary work experience (work book or relevant certificates).

- a citizen’s personal account if he wishes to receive funds through the banking system with which he deals.

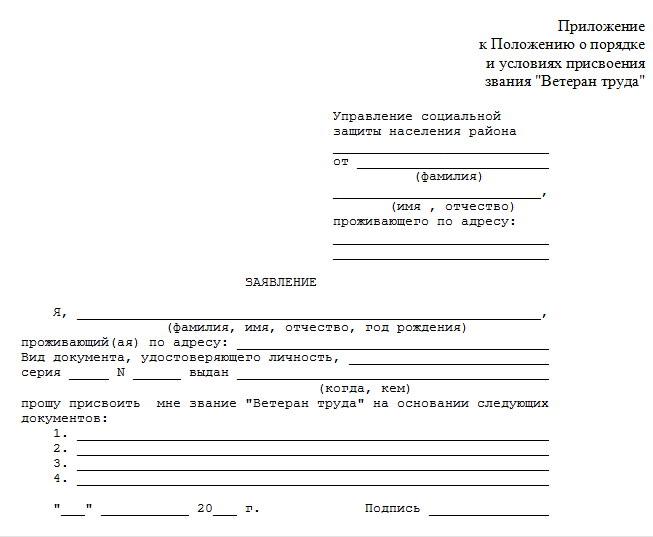

To obtain the title “Veteran of Labor” the following documents are required:

- Russian passport;

- documentation evidencing work experience;

- photo for the appropriate ID (it will be issued after the operation is completed);

- certificates of awards;

- statement.

The last document looks like this:

Pensioner 42 years of experience, what are the benefits?

Will there be a pension supplement for 35, 40 and 45 years of service per year? Should pensioners with long experience expect an increase in their pension? Let's look at this in more detail. Back in 2018, there were many publications that pensioners would receive an increase for service of more than 40 years. Some sources even provided specific data that supposedly the increase would be due to the accrual of additional pension coefficients of pension points to pensioners:.

What's changing for retirees in 2020

The innovation corrects the injustice faced by low-income pensioners. Special project. Pension bank of questions. Project news. The Ministry of Finance plans to switch to a new system of funded pensions starting this year. The Central Bank is developing amendments to prohibit the early change of non-state pension funds. A bill on pensions for rural workers who moved to the city has been submitted to the State Duma. The head of the Pension Fund of the Russian Federation has supported the project of a new system of pension savings. The head of the Central Bank does not see readiness for individual pension capital. The Cabinet has denied rumors about preparations for raising the retirement age The Ministry of Labor named the number of working pensioners in Russia Sobyanin increased the minimum pension in Moscow from September 1 Sobyanin approved the proposal of veterans to increase additional payments to pensions Putin ordered to correct the norm that deprived a number of pensioners of bonuses Muscovites will be able to monitor their pensions online mode The list of villagers who are entitled to an increase in pensions has been expanded Kudrin: Indexation of pensions above inflation may require funds from the National Welfare Fund Rostrud named the number of pre-retirees receiving increased unemployment benefits NPF clients will be able to retire according to the old rules Rospotrebnadzor gave advice to pensioners on protecting themselves from fraudsters Muscovites of pre-retirement age will be able to undergo vocational training The Ministry of Labor proposed to calculate pensions based on life expectancy forecasts The Budget Committee of the Federation Council supported the law on pre-indexation of pensions The Pension Fund asked pensioners to inform about their employment Veterans will have their pensions increased from May 1 The Cabinet of Ministers expanded the list of government services for citizens of pre-retirement age The Federation Council approved the law on alimony for persons of pre-retirement age All regions supported the bill to increase pensions The State Duma refused to introduce inheritance of pensions The State Duma approved the schedule for consideration of the bill to increase pensions Medvedev: Payments as part of the recalculation of pensions will be made before July 1 More than 4 million people will receive recalculation of pensions by July 1 What the Pension Fund of Russia teaches pensioners Pensioners will receive additional payments above the subsistence level The Ministry of Labor proposed new grounds for stopping the payment of insurance pensions The State Duma did not have time to consider the bill on inheritance of pensions Vladimir Putin called for recalculating pensions In St. Petersburg they were going to introduce work quotas for pre-retirees Oreshkin: In the Russian Federation there is no provision for a new increase in the retirement age The Pension Fund of the Russian Federation told how much pension savings should increase Pension savings of Russians increased by 7.2 billion rubles Ministry of Labor: There are no cases of illegal dismissal of pre-retirement people in Russia Residents of the capital of pre-retirement age will receive benefits on the Muscovite card Are working pensioners allowed to take two days for medical examination The procedure for classifying citizens as pre-retirement has come into force age The program of the forum “Healthy Society.

Amount of supplement to pension for service of more than 30 years

The latest pension reforms concern the introduction of new formulas for calculating pensions. There are two parts from which pension payments are formed:

| insurance part | During periods of official labor activity of a citizen, individual coefficients (points) are accumulated. Ultimately, their total number is multiplied by the current price of one pension bonus. This number is called the insurance part of the pension |

| cumulative | it depends on the amount of all transfers of funds to the Russian Pension Fund. In 2020 it is equal to 4805.11 rubles |

The amount of additional payment to the pension for long service is different for all individuals. The amount of the bonus depends on the place (region) of employment, profession, and employee’s salary. The presence or absence of bonuses is also taken into account in the calculation.

For pensioners who have worked or continue to work for more than 50 years, the state pays 1,063 rubles every month.

Workers in the Far North who have worked for 15 years receive a pension increased by 1.5 times. Additional payment is also due to citizens who have worked in a similar area for 20 years.

Persons working in difficult or harmful working conditions are not entitled to bonuses. Such people are provided with other benefits related to early retirement, additional vacations, treatment in sanatoriums, and so on. The pension payments themselves are set by the state as standard.

Citizens with sufficiently long experience have the right to receive additional government payments. In total, four categories of such recipients can be distinguished: each of them differs in the number of years, remuneration and other nuances.

For persons who have worked for 30-49 years, the bonus is set automatically, without registration. Citizens with 50 or more years of experience receive a fixed payment, and labor veterans are entitled to benefits from the state in the form of discounts and free services.

The size of such payments depends on contributions to the Pension Fund of the Russian Federation, the number of coefficients, place of employment and length of service.

What length of service is required for early retirement?

Those who have worked for most of their lives without neglecting labor laws, and have made insurance contributions for them, will be able to retire in advance for a well-deserved rest. For these citizens, the Government has developed a new benefit - to stop working 2 years earlier.

In addition to length of service, other requirements will also apply. Early retirees must be at least 55, and pensioners - 60. Let us remind you that our country is currently undergoing a pension restructuring, according to which the age for retirement is increasing. By 2028, men and women can count on a contributory pension at ages 65 and 60 respectively.

This is important to know: Maternity payments: if the experience is less than 2 years

For women

For representatives of the fairer sex, the value of 37 years of work experience is established. With this amount, a woman aged at least 55 can retire earlier than usual.

For men

Men over the age of 60 with 43 years of service can also count on early old-age payments.

Having the required length of service does not give you the right to retire as soon as you are exhausted. The working life in this case is reduced by 2 years.

Specific filters apply to work experience. It is not calculated like regular insurance.