How do Norwegian pensioners live?

The political system in the state in question was built on the basis of socialism, with many citizens belonging to the middle class. Medical services are provided at an affordable price, including support for vulnerable segments of the population. These include students and retirees. In addition, the state has a low level of corruption.

The country also attracts with its nature and ecology. It is necessary to highlight in a separate block the amount of taxes paid by citizens. The more a person receives in salary, the more taxes he will need to pay. The population is also subject to tax payments on real estate and movable property classified as movable.

Norway is the country in which the highest level of earnings has been established. The average salary is 240 thousand crowns, after conversion to euros this amount is 80,000. The living wage for the population is no more than 210 thousand crowns.

This value is set for pensioners for an annual period. If we consider the average life expectancy, this mark is at the level of 90 years. For this reason, it becomes possible to raise the retirement age even after 70 years.

It is also useful to read: Retirement age in France

Differences between pension systems in European countries and in the Russian Federation

The governments of European countries are interested in ensuring a high standard of living for people in retirement. European pension reforms are associated with an increase in the retirement age. This is because many people are working while retired. In addition, employers give preference to experienced workers with honed work skills over young unskilled personnel.

Prosperous countries prioritize pension reforms aimed at improving the lives of older people.

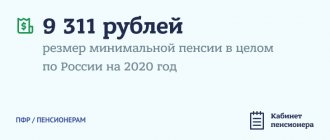

In Russia, the recent pension reform did not change the lives of citizens. The majority of pensioners living in Russia cannot pay for housing and communal services and food. The standard of living of Russian pensioners is significantly lower than European ones.

Pension systems are divided into the following types:

- solidary;

- accumulative;

- government;

- non-state;

- insurance.

European countries use several systems simultaneously. Pensioners can participate in more than just one, but for this they need to take into account length of service, salary, number of employers, total family income and other features.

Every European, being of working age, tries to fulfill all the conditions for a decent benefit in the future. In addition, many participate in corporate programs, create personal savings, and invest money in insurance companies.

The financial income of Russian citizens in 2020 does not allow them to independently provide for old age, and state pensions leave much to be desired. Pensions in the EU are significantly higher.

Let's look at the differences between pension systems in the table.

| General characteristics of the pension system | Average life expectancy of citizens | Disadvantages of the pension system | |

| Russia | The Russian PS consists of two subsystems – budgetary and insurance. The sources of their filling are different: the insurance fund is financed by the pension fund, where employees make contributions during their working career, and the budgetary one is financed by the state. These systems can be intertwined, and a budgetary one is added to the insurance payment. The average pension is 13,000 rubles. | Men: 65 years old Women: 75 years old | Pensions are paid not only to pensioners, but also to working citizens along with their salaries. Payments are made even to those who have no work experience, the only difference is in the amount. Life expectancy in retirement is low and benefits are low. |

| Germany | Germany calculates the pension using a formula that includes the amount of points that a person earned during the working period. If a resident of Germany worked for 40 years and received an average or above average salary, then he gets 1 point each year. 1 point equals 27.47 euros. Calculating using the formula, we get 1236.15 euros per month. | Men: 75 years Women: 85 years | Retirement at 67. Workers pay benefits for current retirees. The higher the contributions to the Pension Fund, the larger the pension. |

| Sweden | A pension in Sweden consists of three parts - conditionally funded, funded and guaranteed (mandatory minimum). The first is formed by contributions from the working population in the amount of 16% of wages. This money turns into liabilities and is subject to indexation. The funded part is also formed by the employee from his salary. Money is accumulated in a personal account and is allowed to be invested. A pensioner can receive several pensions at once. The state pays the mandatory minimum to pensioners from the budget. The pension amount is about 70% of salary. | Men: 79 years Women: 83 years | Investment activity is limited. |

The structure of the pension system

Norway is a country that has a fairly transparent and liberal system, for this reason it attracts people from other countries to resettle. However, the question arises at the moment when people find out the age at which they will be able to obtain a pension status. This figure is one of the highest in the world and is 67 years.

It is worth paying attention to the fact that the indicated value applies to both male and female representatives. There are a certain number of companies whose employees have the opportunity, by agreement with management, to take a well-deserved retirement upon reaching the age of 62 years. In some cases, citizens prefer to work until they are 70 or more years old.

Initially, the age at which retirement becomes possible seems quite high. But it must be pointed out that indicators of the standard of living in this state are better expressed in comparison with other countries. In addition, the average life expectancy in the state is 90 years

Pay attention to the fact that in the state in question, people of retirement age live well. The main merit in this direction relates to the actions of government authorities. In particular, various social programs have been developed; it is possible to work after obtaining pension status. Pensioners also receive a fairly high level of income.

Then the question arises of how such a small state has such capabilities. The reason is that the country has large pension funds, which are formed by using profits received from gas and oil exports.

Reference! Also, the pension fund is fed by using tax deductions from working persons. Information suggests that in Norway there are companies that make a profit after selling oil.

The pension is formed through the following parts:

- Basic. It is calculated regardless of what total accruals are made and is based on the length of service inherent in the former employee. Citizens who are single and have accumulated 40 years of experience can count on the full amount of payments. In this case, this value must be continuous. When citizens of retirement age are married, they are entitled to a payment in the amount of 85 percent of the total value. It can also be applied for by residents of other countries who have or do not have a residence permit. In addition, these are persons who arrived from outside the EU and have been working in Norway for at least three years. Then the citizen can count on a reduced amount of payments. If a person supports dependents, then the additional payment is about 60 percent.

- Special part. It depends on the exact amount of income of a particular person, and points are taken into account. An increased pension is granted to persons who receive income in the amount of no more than six average monthly earnings. When a citizen exceeds the specified limit 12 times, no special pension is accrued. In this case, the state indicates that the citizen could independently accumulate funds for a future pension.

- Payment package . This part is accrued to persons who receive a minimum pension.

Also, the latter type of pension is also available to those who receive payments in the amount of no more than the average salary for the annual period.

Norwegian state pension

When reaching the required retirement age, many Norwegians retire. Their pension consists of the following parts:

- Basic payments;

- Special payments;

- Allowed benefits.

A Norwegian citizen who has worked there for only 3 years has the right to receive part of the basic payments upon reaching retirement age. This rule applies to those who once changed their native citizenship to Norwegian, but came from outside the European Union.

Visitors from the EU can work in the country for only a year, and based on the amount of work experience from all countries of work, they will still be entitled to pension payments.

Those who have 40 years of work experience in Norway receive a full basic pension. The basic level of pension does not take into account the salary of the future pensioner, but takes into account his marital status. Therefore, single Norwegian pensioners receive more money than family pensioners.

If the pension recipient has dependents, then he can count on a 50% increase in the amount of basic pension payments.

The special pension is calculated based on the amount of the salary; it is calculated in the form of “points” and is a significant monetary increase to the basic pension.

Another feature of the special pension is that it is calculated based on the length of service over the last 20 years of work. Previously, insurers selected the best years for payment, now in Norway they have abolished this practice, and count the last working years to determine the right to a special allowance. In a situation where the employee’s work experience is less than 20 years, the average value of all annual salaries is calculated.

Those whose annual income has been above the average for at least 3 years have the right to a special allowance.

All of the above would be good news, if not for one subtlety. When a person's annual income exceeds the average salary by 12 times, he is deprived of the right to a special pension, as he is considered too rich, and must provide his own savings.

When a person’s pension does not reach the average level, he has legal benefits. For example, such a pensioner does not pay income tax.

Be sure to read it! How to find a job for a pensioner: where can women and men get a job at an advanced age?

Minimum pension payments in Norway vary around NOK 170 thousand per year. The Norwegian Pension Fund is the largest such fund in the European Union. The employees of this institution very profitably invest citizens’ savings, providing them with decent old-age benefits.

When do you receive your state pension?

By quitting work, a newly minted pensioner begins to receive insurance payments if he has pension savings. For a state pension, the fact of deduction of insurance contributions is not at all important! You may not work a day in your life, but you will still have a pension, albeit a minimal one.

But the starting age for paying the minimum state pension is strictly regulated, and not every resident of Norway can receive it.

To apply, you must meet two criteria:

- reach the age of 67 years,

- of which 40 years have lived in Norway.

If the pensioner meets both requirements, the state pension will be awarded even if he:

- never worked

- did not participate in insurance programs,

- has no pension capital.

Retirement age in Norway

Before you begin to analyze the amount of a pension in the country in question, you need to indicate the age group at which a citizen becomes entitled to a pension. For representatives of both sexes, this value is represented by 67 years.

If there is an agreement drawn up with the employer, then you will be able to retire at the age of 62. It is also permissible to work until the age of seventy.

It is also useful to read: Retirement age in Switzerland

Russians in Norway: who are they

At the end of 2020, over 17 thousand Russian-speaking immigrants lived in Norway. If we compare these figures with the beginning of 2000, the number of Russian immigrants has almost doubled.

Norwegians, Russians, Ukrainians and Belarusians are connected by a common memory of the fight against fascism

Every year, more than a thousand citizens of Russia and other CIS republics become temporary residents of Norway. At the turn of the 90s, the majority of Russian immigrants consisted of natives of the North Caucasus, who approached the Norwegian immigration authorities with a request for asylum due to the fighting in the North Caucasus. With the advent of peace in this region, the situation has changed dramatically. Today's Russian immigrants in Norway are most often represented by residents of the Kola Peninsula, the territory of which is adjacent to the Russian-Norwegian border. Also among the visitors are many residents of the Leningrad region, located relatively close to Norway.

Russian-speaking community

Russian-speaking immigrants and immigrants from the CIS republics try to live compactly in Norway. More than a thousand of them work at mining enterprises in the Spitsbergen archipelago. They chose the working-class village of Barentsburg, where they make up 90% of its inhabitants. Among Russian-speaking immigrants there are many Ukrainians.

Small communities of visitors from Russia and the CIS republics (as a rule, in Norway, natives of post-Soviet countries consider themselves members of the Russian-speaking community, regardless of citizenship) exist in Oslo, as well as in other large cities such as Bergen and Tromsø. The largest number of Russian-speaking immigrants is in the town of Kirkenes. Sometimes it is called “little Murmansk”. Russian concerts are regularly held here, and the Samovar amateur theater delights with its performances. In the northern part of the Kingdom is the Finnmark region, where almost half of the marriages are with immigrants from Russia.

In Norway, the magazine “Russian Boulevard” is published, and the everyday life of the Russian-speaking community is actively covered on the Internet resource “Russian House”.

I also lived in Bergen for a year, but, as for me, it was boring and rainy. Now I’ve been in Oslo for two years and everything is great. The main thing is to choose a normal area. We live on Frogner - we don’t see any Arabs or homeless people.

Anna

https://www.woman.ru/rest/medley8/thread/4256212/

What is easy and what is difficult for Russians to get used to in Norway

Naturally, moving to another country always causes certain difficulties in adaptation.

Norwegian nature is not only amazingly beautiful, but also fabulously rich. In the rivers and coastal waters of the Kingdom there are many different species of fish, crabs, and mussels. In Norway, you can cast a fishing rod anywhere, with the exception of commercial fishing areas. No fishing license is required in this country. Therefore, this is simply a paradise for Russian fishing lovers. There are also a lot of mushrooms and berries in the Norwegian forests, so people who prefer “silent hunting” have plenty of places to explore. The proximity of the Gulf Stream causes warm summers in the southern parts of Norway, where summer temperatures often rise to 28 °C. Russian-speaking immigrants even manage to get a light tan and swim to their heart's content in the waters of the North Sea.

A distinctive feature of the Norwegians, along with their prudent attitude towards natural resources and strict adherence to environmental standards, is their complete indifference to mushrooms, raspberries, blueberries, and blackberries growing in the forests. Norwegians practically do not value fish, although fish dishes are widely represented in the national Norwegian cuisine. This is probably due to the abundance of fish in Norway being so abundant that the locals stopped considering it a valuable resource a long time ago.

Fishing in Norway is excellent, which is appreciated by Russian fishing enthusiasts

Of course, it will not only be easy, but also pleasant for Russian immigrants to get used to all of the above. What will be hard to get used to?

In Norway there are great difficulties with strong alcohol. The state strictly maintains a monopoly on its production. There are few places where strong alcohol is sold in Norway; it can only be bought in specialized stores and at a very high price. For example, a bottle of Finlandia vodka can cost from 70 to 100 euros. A similar situation is observed with wines. Stores selling alcohol are closed on Saturday and Sunday. On weekdays they work only a few hours. Large supermarkets have a huge amount of beer. There are few familiar products for Russians in Norway; the Russian food industry practically does not export the results of its activities to Norway, so it is very difficult to buy Russian-made goods here. In addition, it will be strange for a Russian that almost all grocery and department store stores are closed on weekends. Working Norwegians have time during the working week to visit them and stock up on supplies. By the way, Sweden recently officially introduced a 6-hour working day. Norway is also preparing to adopt a similar law. It’s not for nothing that they say that you need to work not from 8 a.m. to 5 p.m., but with your head.

This is my last year of study... that is, there is only one more semester left... and I hope that I will be lucky to find a job and stay further. I just feel more at home here than at home with my mother (in Ukraine). And always when I go somewhere on vacation, no matter how good it is, I still feel drawn back to Norway. Get started with the language right away - this is probably the most important thing for newly arrived foreigners, and communicate, do not isolate yourself in a close circle of communication with Russian speakers. Norwegians may look cold (as many people say about them) - but in fact there are many warm-hearted people among them.

tavor

https://www.russisk.org/showthread.php/1570-%D0%9F%D0%BB%D1%8E%D1%81%D1%8B-%D0%B8-%D0%BC%D0%B8 %D0%BD%D1%83%D1%81%D1%8B-%D0%B6%D0%B8%D0%B7%D0%BD%D0%B8-%D0%B2-%D0%9D%D0% BE%D1%80%D0%B2%D0%B5%D0%B3%D0%B8%D0%B8

Features of adaptation

Probably the main condition for successful adaptation to Norway is learning the Norwegian language and regularly improving your skills in it. The Norwegian language is difficult to learn for those who are used to communicating in one of the Slavic languages. In addition, although Norwegians understand English, it can in no way be recognized as an alternative language at the level of communication. Native Norwegians do not understand Russian. Without knowing Norwegian it is very difficult to get a good job and communicate with the local population.

Another difficulty in adaptation will be the need to get used to the thriftiness of the Norwegians, which in the Russian understanding borders on stinginess. For example, if a guy and a girl come to a bar together, then each of them pays for himself. A Russian who treats his tablemates to astronomically expensive alcohol in Norway will be perceived as an alien.

Attitude towards Russians in Norway

A public opinion poll conducted in Norway shows that more than half of Norwegians are in favor of limiting immigration traffic from problem regions. In many ways, such indicators are due to negative emotions caused by natives of Muslim countries who fundamentally do not want to integrate into Norwegian society. The attitude towards Russians is much more loyal. Most Russians living in Norway focus on the friendliness and friendliness of the local population towards them. The gradually emerging negative trends in the attitude of traditionally friendly Norwegians towards immigrants from Africa and the Middle East are characteristic, in general, of all European countries.

Video: attitude towards Russians in Norway

Where do Russians work?

Most Russian immigrants are quite wealthy, and it is even difficult to distinguish them from Norwegians. Russian specialists are in demand in fishing, medicine, and company management. In Norway, as in many countries around the world where English is not the official language, English teachers are required. Russian specialists are highly valued in the oil and gas industry, although getting a job in a company engaged in this type of activity is very difficult due to obtaining many licenses, permits, document nostrification, health checks, and so on. Many Russians who do not have high qualifications find themselves in the service sector as waiters, maids, and cooks. There are many passenger ships in Norway, so working on any of them will give you the opportunity not only to gradually become legalized in Norway, but also to see the world and earn quite decent money. Social workers are in great demand in Norway. For many years in a row, she has been in need of social service specialists who are ready to help older people or difficult teenagers. This is the easiest job for a Russian immigrant to get in Norway.

Separately, it is worth mentioning business immigration to Norway. Taxation in Norway is progressive, and the tax rates themselves are quite high even for European countries. But at the same time, the business owner has the right to count on legalization in the country as a temporary resident and can bring his family with him. Opening your own business in Norway is easy and relatively inexpensive. For example, you can register an analogue of an LLC for a thousand euros, and the size of its authorized capital must exceed 30 thousand Norwegian kroner (less than 4 thousand dollars). The best way is to register a business on partnership terms with Norwegian citizens, since in this case there are no requirements for a minimum authorized capital. You can register a private enterprise, which will cost only one hundred euros. There are no separate programs for obtaining a residence permit through investment, since Norway is a very rich country and a priori does not have a great need for investments from citizens and organizations of other countries. A Russian can purchase real estate in Norway, for which it is not necessary to be a resident of the European Union, as is required in other countries. But owning real estate in Norway will in no way advance him one step in the process of legalization in the Kingdom.

A Russian mining enterprise operates in the Spitsbergen archipelago

Russian pensioners in Norway

“Norwegian socialism” is also characterized by the fact that in this country there is practically no social stratification of society. But if “Soviet socialism” strived for social equality through the absence of the rich, then the Norwegian one almost completely achieved the absence of the poor in the country. Russian pensioners can immigrate to Norway as financially independent persons, but there are no special immigration programs for them. One of the documents required for immigration will be an extract from the pension fund in your home country. It is unlikely that the size of the pension will allow Russian pensioners to live comfortably in Norway. Therefore, additional evidence of a high level of material support will be required. This suggests the idea that only wealthy Russian pensioners who have managed to accumulate sufficient capital by the time of retirement can immigrate to Norway. The retirement age in Norway for both men and women is 67 years. The size of the pension provision in the Kingdom is such that it will allow pensioners to live for their own pleasure, traveling to different countries of the world and in no way feeling disadvantaged.

A happy and secure old age is guaranteed to almost all Norwegian pensioners

The minimum annual pension in Norway is 176 thousand Norwegian kroner (if you convert this into dollars, you get 22 thousand). The basic pension in Norway is 60% of the recipient's average salary. If a married couple is retired, then each of them will receive 85% of their average salary. But to receive a full pension in Norway, you must have 40 years of work experience. You can retire earlier, but the amount of pension payments will be proportionally reduced. The average salary is taken to be a certain period (the last 10 years) of the pensioner’s work experience.

Interestingly, the Norwegian pension fund is considered the largest on the European continent. Despite the country's small population, its budget exceeds even the similar budget of the Pension Fund of densely populated California. All statistics and research put Norway at the top of the world's age-friendly countries, with high pensions and the highest level of health and social security for older people.

Some Norwegian pensioners travel to cheaper European countries, where they justifiably feel like mini-oligarchs.

What is the pension in Norway?

The authority to determine the amount of the payment in question is vested in the local parliament. The average pension value currently includes basic and special types of payments, as well as benefits that a citizen is entitled to. The functions of transferring money have been transferred to the Pension Fund.

Registration of a pension in full, including required additional payments, will only be possible if the citizen has 40 years of service. At the same time, all years must be worked out in the territory of the state in question. T

Attention! It is also necessary to take into account the marital status of the citizen and for this reason single persons will receive a smaller amount of support.

According to USNews & World Report for 2020

About the study:

- Conducted annually by the American publication USN&WR, and the results are published at the beginning of the next year.

- The methodology consists of surveying residents of eighty countries, and the total number of respondents is 21,000 people in appropriate gender, racial and age proportions.

- Among the issues there are the topics of quality of government, medicine, social security and education, ecology and business climate and others.

- Based on the results, a rating is formed based on several aggregate indicators, such as quality of life, population mobility, investment climate, etc.

results

Are common:

- Based on the totality of indicators, the first place went to Switzerland, and the last place out of eighty went to Algeria.

- Norway did not make it into the top ten this year, settling in 12th position.

- Russia ranks 26th.

Places of the Kingdom of Norway and the Russian Federation in certain areas:

| Index | KN | RF |

| Ensuring civil rights | 1 | 39 |

| The quality of life | 4 | 38 |

| Investment climate | 8 | 80 |

| Freedom of enterprise | 10 | 24 |

| Cultural life | 22 | 2 |

| Interest in life | 26 | 56 |

| Military potential | 27 | 2 |

| Population mobility | 37 | 8 |

| Vlad in world culture | 44 | 16 |

Salaries in Norway – you can live if your salary is from 3500 Euros!

Average and minimum benefits received by Norwegian pensioners

According to government data, the average value of payments is 250 thousand per year. For a month this amount is 21 thousand. At the same time, in accordance with the rate established by the National Bank, this figure is 161 thousand.

The minimum amount is 179 thousand crowns, while in rubles - 1.3 million per year . This amount is paid to a citizen who does not have enough work experience. Those with small earnings will also receive.

Work and salaries in the country

Read also:Norwegian citizenship

The average annual salary of a local resident is more than 55 thousand euros. A person who earns less than 23 thousand euros per year is considered poor in this country. Employees in the computer, oil, and business industries receive increased income. The living wage in Norway consists of several indicators. As a result, you can receive an amount not exceeding 2000 euros. This is the money needed to live for two adults for a month.

Norway tax system

Residents have to pay according to their income. The more successful a person is, the higher taxes in Norway he pays to the state. If we talk about amounts, then on average we have to share one third of the salary. With an income of 27 thousand euros, 36% will have to be paid in taxes. If a Norwegian earns 120 thousand euros a year, then he will give 55% of these funds to the state. The highest tax in the country is 80%. Luxury items are also subject to taxation: villas, expensive yachts, luxury cars, jewelry, antiques, jewelry.

Pension in Norway for foreigners

If a citizen arrived from the territory of another state and did not receive a residence permit, then he has the right to receive a pension. For citizens of states that are no longer members of the European Union, they are allowed to work for a one-year period.

After this, they will be able to apply for pension status. Next, they are accrued basic payments. If the country has not previously been included in the European Union, then the service must be 3 years.

Thus, according to world data, pensions in Norway are one of the largest in the world. Pensioners live quite well in the territory of this state.

Norway: getting to know each other better

The Kingdom of Norway is a state in which the form of government is a constitutional monarchy, by the way, one of the oldest in the world. The reigning monarch is Harald V. The country is divided into 19 provinces. Norway is a signatory to the Schengen Agreement and a member of the Scandinavian Union. The country is practically mono-ethnic, 95% of its population are Norwegians.

Since 2009, Norway has been at the top of the ranking of countries in the world according to the Human Development Index (HDI).

The nature of Norway is amazingly beautiful. The coastline is indented in many places by fjords, which have become, in a sense, a symbol of the Kingdom of Norway.

Fjords represent Norway

Norwegians rightfully consider themselves descendants of the Vikings. A typical Norwegian looks like this: tall, fair-haired and somewhat phlegmatic. Native Norwegians have a mentality typical of the countries of the Scandinavian Peninsula. Conventionally, it can be called northern. They are not aggressive (unlike their distant ancestors), friendly towards compatriots and foreigners, and are always ready to help. But at the same time they are very economical and zealous, they respect private property and, in a sense, are selfish. For a Norwegian, family is sacred. For a Russian person, the most unusual thing about the Norwegian mentality will be their economy, a special culture of communication and the desire for self-sufficiency, in which noisy companies and associations in large and small social groups or communities are unusual for native Norwegians. The daily life of Norwegians is measured, they are not prone to excesses. But in the modern globalized world, it is difficult for them to preserve their national identity, since the younger generation of Norwegians strives to be in no way different from the average residents of other countries, for example, Germany or the United States. Therefore, every day mental boundaries are erased. But in general, it is quite easy for a Russian person to adapt to Norway, especially if we are talking about natives of the northern regions of Russia, who are closer to the Norwegians in character type and are accustomed to the harsh climate.

The obverse of the 50 kroner banknote depicts a portrait of the 19th century Norwegian writer and storyteller Peter Christen Asbjornsen, and the reverse features an abstract drawing depicting a summer night, by a Norwegian artist

The national currency of the country is the Norwegian krone, the exchange rate of which to the dollar is:

1 USD = 8 NOK.

Winter in Norway is very cold and windy. High humidity due to the proximity of the ocean only aggravates the negative sensations from the Norwegian climate.

There are many beautiful ski resorts on the territory of the state. In summer, tourists from different parts of the world come to the country to admire the unique Scandinavian nature and even go skiing at some stations located among the glaciers. In Norway, the sun does not shine for almost half the year, so winter for Norwegians is usually spent indoors. During the remaining six months, the sun hardly sets—Norwegian white nights are famous all over the world. But this state of affairs in no way contributes to psychological relief, since winter depression becomes commonplace, and summer insomnia has a depressing effect on the psyche. Therefore, visiting a psychologist has long become a common habit among Norwegians. In addition, Norway has a fairly developed professional system of psychological assistance.

Norway has a small section of the border with the Russian Federation with a length of only 196 km. The Kingdom is a member of the North Atlantic Alliance and has, although not numerous, well-equipped, trained and highly mobile armed forces. Every Norwegian and immigrant with the status of a permanent resident of the country (which is important) is required to undergo compulsory military service, although the Norwegian army is mainly recruited on a contract basis.

Norway is a major exporter of carbon-based energy. It is in fifth place in the world in oil exports and third in gas exports. Income from their sale amounts to over 20% of the country's GDP, and their share in total exports is more than 50%.

Pros and cons of living in Norway

Pros:

- Visa-free regime with EU countries and other members of the Schengen area - Iceland, Switzerland, Liechtenstein.

- The beauty and majesty of nature - mountains, rocks, waterfalls and the sea, although cold.

- One of the highest indicators for environmental conditions. Clean air and water that does not require many levels of filtration before use.

- Social standards that make it possible to qualify the existing socio-political system as socialism. There are no extremely rich people in the country, but the majority of citizens belong to the middle class.

- Excellent education.

- In practice, there is no corruption component, and other types of crime tend to zero.

- The word bureaucracy in KN has a positive narrative, since the system of government bodies is built in such a way that it makes life much easier, rather than complicating it. Any procedure, even the registration of a real estate purchase transaction, lasts no more than a day.

- The highest average salary in Europe.

- The law-abiding and goodwill of the population, accustomed to helping others in difficult situations. Smooth and predictable life, allowing you to make long-term plans.

- Promoting healthy lifestyle standards, banning smoking in public places.

Minuses:

- High taxes, absorbing up to 55% of earnings.

- Cold climate and a small number of sunny days per year, which leads to the development of such a complex mental illness as light depression, accompanied by symptoms of apathy and prolonged insomnia.

- Limited number of fresh products.

- High cost of food, clothing, transport.

- A slow way of life that leads to boredom, especially for immigrants from countries such as Russia, who are accustomed to more active pastimes.

- Limited number of ways to organize leisure time.

- Very expensive alcohol.

- High prices for real estate, utilities, rental of industrial and residential space.

Finding a job in Norway - mission impossible?

Parameters significant for life

Politics and economics:

- The government adheres to the concept of a social society, purposefully striving to average the income of the population. A progressive taxation scale has been introduced, with additional levies imposed on excess income.

- The prevailing principle is that the larger the middle class, the more stable the state.

- The dynamics of GDP directly depends on the price of energy resources, since the two main items of budget replenishment are income tax and the sale of extracted oil and gas.

- Since 1963, all deposits have been nationalized. Their development on the continental shelf is the exclusive prerogative of local state companies. Foreign companies are allowed only to those deposits that are located on land, but income from their activities is taxed at inflated rates, reaching 75%, so they still replenish the country’s budget.

- Given the absence of corruption, we can conclude that almost all income from national wealth goes to the needs of society.

- A Fund for Future Generations has been created, which receives funds from the sale of energy resources when prices exceed those budgeted. Every year it is replenished by approximately 20 billion in the equivalent of the US dollar.

- When developing deposits and in other types of industry, the most advanced technologies are used, so the cost per barrel is low, and production does not pollute the environment, preserving the environment.

- The country has developed ecological and ski tourism, which brings good income to the treasury.

Professions in demand in Norway – doctors and social workers in short supply?

Social indicators:

- The retirement age has no gender differences and is 62 years old as of 03/07/2018. At the same time, it tends to decrease, since the previous value was 67 years.

- In terms of life expectancy, according to the World Health Organization for 2019, Norway ranks 10th, and this indicator continues to show a positive trend:

| View | Age (years) |

| · average | 82,5 |

| · men | 80,6 |

| · women | 84,3 |

Employment and salaries

Unemployment:

- Recently, the value has not gone beyond 5% with a downward trend.

- The historical minimum was recorded at the end of June 2019 – 3.8%;

- Current indicators compared to the EU:

| Subject | General | Among young people |

| Norway | 4 | 10,1 |

| European Union | 6,2 | 15,3 |

- These low rates are explained by several factors, including economic stability, as well as high levels of education and a common labor market with EU countries, which leads to graduates preferring to seek vacancies in countries where tax laws are less stringent and the climate is less harsh.

Wage:

- Norway is one of the countries where the minimum wage is not set at the state level.

- The average is:

How to get a visa to Norway for Russians - to see the famous Norwegian fjords?

| Currency | Gross | Net |

| Kr | 43800 | 31700 |

| € | 4155 | 3309 |

| $ | 5885 | 4256 |

| Purchasing power parity | 3108 |

Taxes:

- Main fiscal levies:

| Bid % | Note | |

| Legal entities: | ||

| from sales (VAT) | 25 | |

| corporate | 24 | |

| social contributions (Trygdeavgift) | 14.1 | for each employee |

| Individuals | ||

| income tax (Inntektsskatt) | 0–38,2 | Non-taxable minimums: 36000kr – for those who have a dependent 29800 – for single payers |

| for excess income (Toppskatt): | Added to the Inntektsskatt rate if it exceeds the amount of 550550 per year | |

| general | 9 | |

| · for northern regions | 7 | |

| Social Security contributions | 8.2 | Non-taxable minimum 49650 |

| private | – | Individually for everyone |

| For wealth | 28 | Charged on passive income |

| For property | 0,85 | If the total assets are valued at an amount exceeding 1200000kr. |

- In total, taxes and contributions by an individual can reach 55%, but there are deductions and benefits, so in practice the average Norwegian contributes about 40–50% to the treasury.

Pension system

Payment structure in kr:

- Base rate:

- for the year – 96883.0;

- per month – 8073.6;

- However, in reality, the average Norwegian pension is 21,000, since there are allowances:

- social;

- for dependents.

Interesting! Because such a large pension is higher than the average salary, for example in European countries such as Greece or Spain, where life is much cheaper, many older Norwegians move there and feel wealthy.

General information:

- a full pension is provided to citizens who begin working at the age of 16 and have lived in the country for at least forty years;

- the more a person earns, the greater his payment will be, however, if it does not reach the base rate, he is entitled to a social supplement;

- If the pensioner has a non-working spouse or disabled children, dependent supplements are calculated.

Taxes in Norway – deductions up to 55%!

Organizational structure of the State Pension (Oil) Fund:

- The so-called Oil Fund consists of two social and financial organizations that manage accumulated funds, entering large stock and currency exchanges and thus increasing assets many times over:

| Fund | Information |

| National Insurance | Limited to exchanges and over-the-counter assets (real estate) of the Scandinavian countries. Besides Norway itself:

|

| Global | Has the right to invest money in securities of international and foreign companies, including purchasing them on major world stock and currency exchanges. |

- The share of government funding for the Oil Fund is 40%, thus its current capitalization is 60% in the amount of NOK 8,488 trillion or US$900 billion (as of 01/01/2018).

- Investment structure:

| 66,6% | Shares of commercial companies |

| 30,8% | Bonds and other fixed income securities |

| 2,6% | real estate |

Health care system

Territorial structure:

- The entire country is divided into five medical regions, at the center of each there is a university clinic with regional, regional and municipal hospitals.

- Medical personnel are also trained at these clinics.

Real estate in Norway – the deal is completed within 24 hours!

What you need to know about the pension fund

The pension fund is a financial structure that provides government cash payments for old age or disability. It is accumulated through pooled cash contributions from employers, trade unions and other organizations, as well as voluntary contributions, accumulating huge funds.

Therefore, today pension funds are the largest investors and in most developed countries they dominate the stock markets.

Funds managed by professional managers invest money so that it does not lie dead weight, but generates income.

Profits are distributed in proportion to the contribution, which is a good incentive to save for retirement as early as possible and make generous contributions. Unfortunately, this wonderful scheme does not always work perfectly.

Conclusions: the money in the pension fund is the biggest money in the country. One percent loss or gain on such amounts is colossal amounts. If they are not managed correctly, they will be eaten up by inflation.