What kind of NPF is it and what does old age have to do with it?

Our future pension is divided into two parts: insurance and funded.

You can deliberately choose the Pension Fund of the Russian Federation as your insurer by writing a statement about it. Then you will also remain in the Pension Fund of Russia, but you will not be considered a “silent” person. You can also invest your funded pension through a non-state pension fund (NPF) and receive income with its help. If the income is good and in the next 25 years no one decides to use it for the imperial ambitions of our country, then in old age you will have something to live on.

https://www.youtube.com/watch?v=ytcopyrightru

Non-state pension funds earn money from the profits they make for their investors, so they compete for clients. The more clients, the more money and the greater the potential profit. Sometimes, in pursuit of turnover, funds begin to play unfairly - and let’s talk about this.

How our pension is structured now - a diagram from the training manual of the Trust Foundation

VEB vs NPF. How to secure your pension?

In March 2020, VEB transferred almost 260 billion rubles of pension savings to non-state pension funds. This is the amount of applications submitted from clients who decided to independently choose a management company. Taking into account the transferred funds, non-governmental pension funds increased their capital to 1.9 trillion rubles, surpassing Vnesheconombank in this indicator. At the moment, the bank manages funds of undecided citizens in the amount of 1.8 trillion rubles.

Vnesheconombank and its subsidiaries are experiencing serious problems with liquidity and capital, and by the end of 2020, VEB’s obligations on external and internal debt are estimated at 300 billion rubles. According to the Vedomosti newspaper, VEB's supervisory board approved the idea of repaying the state corporation's debts using former pension savings contributions. This year the state will allocate 150 billion rubles to support VEB.

Mikhail Alenushkin

CEO

Of course, NPF is a more interesting option for accumulating a pension than saving money in the state pension fund. But both options have their significant drawbacks. VEB is currently experiencing significant financial difficulties, and NPFs face risks of capital outflow and difficulties with long-term investing. Therefore, it is worth consciously approaching the issue and preparing alternative pension savings yourself using trust management. In modern conditions, it is necessary to save some of the funds yourself and invest them in long-term investments in order to be confident in the future. Pension funds, state and non-state, have their hands tied. They can work and earn only in a growing market, while wealth management companies do not have such strict restrictions. At the same time, the transparency of investment companies is much higher; the client can choose the level of risks and monitor the actions of managers on a daily basis.

Non-state pension funds can also be a potentially risky investment. The choice of companies to manage NPF funds is not always transparent. In addition, many NPFs act in the interests not of clients, but of owners, investing a significant share of savings in their projects, as indicated in a recent report by Sberbank CIB analysts. In the near future, it is planned to tighten the liability of funds to the state for investment losses and oblige structures to compensate for the shortfall. Let us recall that according to the DIA, in 2020 the licenses of 19 non-state pension funds were revoked, under the management of almost 65 billion rubles.

History of the foundation

This company was developed by Vnesheconombank. The formation was carried out on the basis of the provisions of the decree developed by the President of 1992 under No. 7. In addition, it is worth taking into account the data of Federal Law No. 75 of 1998. These acts are aimed at regulating the activities of non-state funds.

In 2020, the activities of the company in question were reorganized. From this moment on, it began to be called the Joint Stock Company “Non-State Pension Fund “Vnesheconomfond””, in an abbreviated format the name is expressed as JSC “NPF “Vnesheconomfond”.

Registration was carried out in the capital of the country in 2016. The organization has been assigned the details necessary for its activities. An important point is that the organization has a license that allows it to work in the direction in question. The permit concerns work on pensions and insurance.

It is worth pointing out that currently the organization in question does not carry out activities related to compulsory insurance in the pension sector. The organization has several branches, the addresses of which can be found on the official portal.

Directions to NPF "VNESHEKONOMFOND" where it is located

Also look at companies and organizations with a similar type of activity as NPF “VNESHEKONOMFOND”: NPF “AVIVA” | NPF "AVIAKOSMOS" | PREVIOUS IN RUBTSOVSK JSC "ZHASO-M" | LLC ISO "TRANSDEPENDABILITY" | LLC "BILL"

The company was registered on November 10, 2000 (Interdistrict Inspectorate of the Ministry of the Russian Federation for Taxes and Duties No. 39 for Moscow). Full name: “VNESHEKONOMFOND”, NON-PROFIT ORGANIZATION NON-GOVERNMENTAL PENSION FUND OF VNESHEKONOMBANK, OGRN: 1027739220794, INN: 7728224464. Region: Moscow. The organization NPF "VNESHEKONOMFOND" is located at the address: 117342, MOSCOW, st. OBRUCHEVA, 38. Main activity: “Insurance / Non-state pension provision / Non-state pension provision activities.” Industry: “Non-state pension provision”.

NPF agents

Non-state pension funds are financial companies, they deal with money: a million here, a million here, bought papers, sold papers, debit-credit. They do not always have a network of offices throughout Russia and their own salespeople.

To attract money from the public, NPFs quite often turn to the services of agents. An agent sells NPF services for a fee - this can be a person or a company. For example, a non-state pension fund can agree with a well-promoted bank so that it sells the services of this non-state pension fund to its clients. For each executed contract, the NPF pays the bank a fee. Everyone is happy.

Agents can be banks, stores, website owners, your postman, your Apple dealer, your employer, and even all sorts of shady characters. By and large, the NPF does not matter through whom you signed the agreement: the main thing is that you agree to transfer your money to this NPF. And the main thing for an agent is to fill out the paperwork and receive his fee. Nobody cares, so it turns out...

NPF "VNESHEKONOMFOND": address, phone, fax, email, website, work schedule

"VNESHEKONOMFOND", NON-PROFIT ORGANIZATION NON-GOVERNMENTAL PENSION FUND OF VNESHEKONOMBANK

Region: Moscow

Address: 117342, MOSCOW, st. OBRUCHEVA, 38

Telephone:

Fax: no data

Email: no data

Website: no data

General Director/responsible person/owner of NPF “VNESHEKONOMFOND”: no data

Working hours: Mon-Fri: 7-19, Sat-Sun: closed

Found an inaccuracy in the description or want to provide more information about the company? - Write to us!

Detailed information about NPF “VNESHEKONOMFOND”: accounting, balance sheet. Download bank details, tenders, credit history, taxes of NPF "VNESHEKONOMFOND".

Reliability and profitability rating

The profitability indicators of this company are reflected by year. For example, if we consider data for 2020, a coefficient of 4.3% is applied. On average, many pension authorities currently have similar indicators in this area. For example, these are Sberbank and Gazfond.

These provisions indicate that the activities of Vnesheconomfond are quite profitable. Due to the fact that the value of net assets, according to the expanded portfolio of Vnesheconombank, is currently declining, this indicates a transfer of funds to the NPF in question.

According to the Expert RA rating agency, in 2020 the NPF was assigned an A rating. This assessment indicates an increased degree of trust in the organization in question. Citizens can safely invest their pension savings in it.

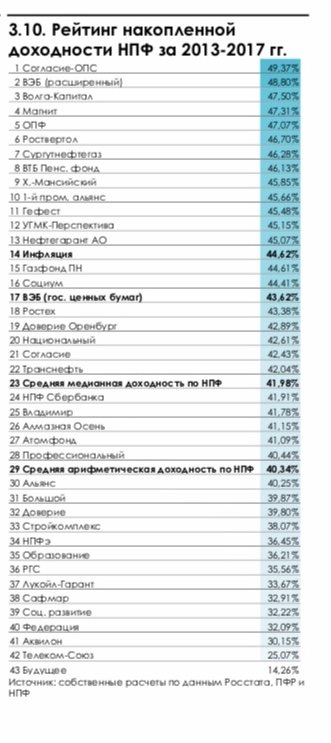

The largest non-state pension funds have surpassed VEB in terms of profitability of savings

Russian non-state pension funds (NPFs) started the year on the rise, according to data from private funds that have concentrated almost 90% of the compulsory pension insurance (OPI) market. The largest non-state pension funds, which regularly demonstrate good results, in the first quarter of 2020 earned the largest investment income on pension savings over the past four quarters, writes Kommersant. Thus, Sberbank NPF received 15.2 billion rubles in investment income, exceeding the figure for the first quarter of last year, when the fund earned 10.5% per annum for its clients. The results of the first quarter consisted of interest income and a positive revaluation of shares and long-term bonds, notes the head of the fund's investment department, Vasily Ivanov, pointing to improved conditions on the stock market. The Moscow Exchange pension savings indices (consisting of stocks and bonds in which pension savings can be invested) showed an increase of 9.7-11.9% per annum in the first three months.

For Gazfond PN, the result amounted to 9 billion rubles, although it did not reach last year’s 17.4 billion rubles, when the yield was 17.1% per annum. Both funds have not yet disclosed quarterly returns. “VTB Pension Fund” received 4.2 billion rubles in investment income in the first quarter, the return on the fund’s OPS was 8.1% per annum, its representative said.

After the dismal results of last year, even the 2018 outsiders showed strong results due to improved market conditions. NPFs “Future”, “Safmar” and “Otkritie”, which incurred losses on customer accounts last year, were also able to show a positive result from investment activities in the first three months - 8.7%, 9.1% and 10.7% per annum, respectively.

Thus, most of the largest private funds in the first quarter could show better results than the state management company (GMC) VEB.RF, which earned 7.7% per annum for the “silent ones” on the expanded portfolio. However, a successful start to the year does not always predetermine further dynamics - in 2018, the weighted average return on savings amounted to 8.2% per annum in the first three months, but due to the worsening dynamics of the bond market in the second half of the year, the negative situation on global financial markets, as well as under the influence geopolitical factors, the profitability of investing in non-state pension funds fell.

Early transfer to another NPF

This is exactly what happened to me. In 2020, I entered into an agreement with NPF “Doverie”. At that time, the savings account had 33,000 RUR. For two years, my NPF invested money, and I received income. When I was deceived into transferring to a new NPF, everything I earned was burned, and the original 33,000 RUR remained in the account.

https://www.youtube.com/watch?v=ytpressru

But the losses did not end there. The fact is that money is not transferred from one NPF to another exactly on January 1, but in the period from January 1 to April 1. That is, if during this period the funded pension has already left the old NPF, but has not yet entered the new one, then during this time you will not receive any income either.

I was quite satisfied with the profitability of my old NPF - 10%. This is twice the inflation rate. Now I’m 35 years old, I have at least 25 more years until retirement. All this time, the lost money would continue to work. With a yield of 10%, 8,000 R would turn into 80,000 R by 2042! I will miss this amount due to the fact that back in 2017, someone decided to transfer me to another NPF.

Pensions of “silent people” will be transferred to NPF “VEB.RF” automatically

An agreement on the creation of a non-state pension fund (NPF) “VEB.RF” on the basis of the state management company (GMC) of the corporation has been tentatively reached, the Ministry of Finance told Izvestia. As Deputy Minister of Finance Alexey Moiseev explained, the money of the “silent people”, which is now in the Pension Fund, will be transferred to the new NPF automatically.

This is one of the stages of the concept of individual pension capital (IPC), which the authorities have been preparing since 2020. It was planned to introduce it on January 1, 2020, but, as First Deputy Prime Minister and Minister of Finance Anton Siluanov explained at the end of December, the issue had to be postponed because “the pension changes were very difficult.” The Ministry of Finance added that work on the draft law on IPC is still ongoing.

VEB.RF considers it premature to comment on the initiative before the document appears. They recalled that the powers of the state corporation for the trust management of pension money have been extended until 2024. However, they added that if this or that decision is made by the Cabinet of Ministers, VEB.RF is ready to perform the functions that the government assigns to it.”

According to the Pension Fund, at the end of the third quarter of 2020, VEB State Management Company managed 1.7 trillion rubles in pension savings. According to Central Bank statistics, in the same period there were 2.5 trillion rubles in the accounts of non-state funds within the framework of compulsory pension insurance (OPI).

The Pension Fund emphasized that nothing has been adopted at the legislative level and comments are premature.

The Central Bank did not answer the publication’s questions about the creation of VEB’s NPF and the transfer of the savings of the “silent people”. The Ministry of Labor recommended contacting the Ministry of Finance. Expert opinions were divided: on the one hand, a person will not receive additional risks from the transition, and on the other, the state will no longer actually manage his money.

The Ministry of Labor recommended contacting the Ministry of Finance. Expert opinions were divided: on the one hand, a person will not receive additional risks from the transition, and on the other, the state will no longer actually manage his money.

However, at the moment, VEB.RF earns the “silent ones” by investing their pension funds more than private funds. Thus, in the third quarter, VEB GUK provided a return on pension savings of 6.57% per annum in annual terms and 9.12% over the past three years.

At the same time, private non-state pension funds have an average market return of 2.56% per annum - the leaders earned 6.8% for their clients, while outsiders showed negative results. Banks: Source:

Statistics on NPF Vnesheconomfond

The company was registered in 2000 by the Moscow Registration Chamber of the Moscow Government. This fact can be confirmed by using the corresponding certificate No. 350/2. The company received a license to carry out activities in the field of pension accumulation.

More on the topic Rating of Russian Non-State Pension Funds 2020 in terms of reliability and profitability: statistics

According to data for 2014, the level of profitability from placing funds in the company amounted to 12,796,178.60 rubles. It can also be noted that to form property that is used to ensure the purposes specified in the charter, 2,416,514.81 rubles were placed on the accounts.

Attention! In addition, the fund has created a pension reserve, the size of which is currently 668,125.82.

On obtaining SRO status by NAPF

On March 10, 2020, a new stage in the activities of the NPF began. The Bank of Russia has assigned the National Association of Non-State Pension Funds the status of a self-regulatory organization (SRO) in the financial market. Read

Gorchakovskaya Larisa Alekseevna General Director of JSC NPF VTB Pension Fund

Topic of issue No. 2 (26) April-June 2020 03/16/2016

Foundation programs

The investment portfolio registered in the organization in question includes funds that were received by a citizen upon transfer to a non-state pension fund from the Pension Fund. In addition, the formation is implemented through the citizen’s constant deposit of funds into an account opened with the company. Several programs can be used for this.

The development is carried out by representatives of the fund, depending on the level of income the citizen receives per month.

The programs have the following expression:

- Payment of money is required every month in a certain amount. When contacting the organization in question, the employee helps the citizen select the right program depending on financial capabilities;

- funds can be received at any time and in any amount.

At the same time, it is important to point out that the programs provide for urgent or indefinite payments. In addition, the differences between them lie in whether a citizen’s savings can be transferred to his heirs. This measure is used only for urgent payments.

Our 2016

Despite the fact that last year was full of important events for the pension market, the current year will be no less significant. Current topics will be summing up the results of the transition company, considering the issue of raising the retirement age, standardization and tightening of requirements for market participants. As for the VTB Pension Fund, we have quite big plans for this year. Read

Vadim Burganov Director of Operations of the INFINITUM Group of Companies

Topic of issue No. 2 (26) April-June 2020 03/16/2016

How people cheat when touring apartments

Sometimes agents deceive during door-to-door visits, when you can talk to a person one-on-one, without witnesses. For example, agents pose as employees of a pension fund. From the point of view of the law, everything is clean here, because NPF is also a pension fund, only non-state. The potential client thinks that they came to him from the Pension Fund of the Russian Federation, and trusts the guest.

When offering an agreement, agents can intimidate, saying that you must sign it, otherwise you may lose part of your future pension. This, by the way, is also a half-truth: the agent can show the fund’s profitability - if it is higher than your current NPF, then part of the future pension is actually lost.

Our competitors even opened and issued IDs for agents with this inscription - and sales soared. Conscientious non-state pension funds never do this - in our country the phrase “I am from a pension fund” was prohibited.

One of my clients told me how agents came to her home and told her that our fund had closed and she urgently had to sign an agreement with a new NPF. In fact, our company simply merged with another NPF and changed its name. Competitors found out about this and began to scare customers.

Agents also came to my house. I let them in out of professional interest. They used this technique: they asked for SNILS “for verification,” then they immediately called somewhere and told me that I was no longer in the client database and that the contract urgently needed to be reissued. In fact, they checked SNILS with the combined database of several non-state pension funds, but I was not there, because my fund simply did not submit data there.

More on the topic Pension Fund Reutov, official website, address and phone number on the map

Selection of the investment portfolio of a state management company

- government securities of the Russian Federation;

- bonds of Russian issuers;

- bank deposits in rubles and foreign currency;

- mortgage-backed securities;

- bonds of international financial organizations.

On July 18, 2020, Federal Law No. 182-FZ “On Amendments to the Federal Law “On Non-State Pension Funds” and the Federal Law “On Investing Funds to Finance the Funded Part of Labor Pensions in the Russian Federation” came into force. In accordance with it, the State Management Company, whose functions are currently performed by the State Development Corporation "VEB.RF" (VEB.RF), invests citizens' pension savings in two investment portfolios.

Who and how can enter into an agreement with the fund

https://www.youtube.com/watch?v=ytcreatorsru

The insurer of the company in question is the country's Pension Fund. This means that in order to formalize an agreement with the NPF, you will need to submit an application to the NPF. A citizen should have a certain list of documentation with him.

In addition, you can use the services of this fund when using the Internet. It is envisaged that a citizen registers in the system through an application certified in advance by a notary office.

In addition to the application, you will need to use:

- a document by which the identity of a citizen is verified;

- SNILS.

It is also possible to submit documentation by contacting an authorized representative. To do this, you will need to form a power of attorney at a notary office.

NPF web uk extended personal account

If you find yourself in such a seemingly hopeless situation, proceed according to the following scenario:. For those who are at the beginning of their career path, it is worth thinking about choosing this very management company.

Hi all. Be careful, there is a wild long post ahead that may bring you money. Read at your own risk: I decided to write it partly for the sake of justice, because I burn with it like a burning fart of equality: First, a little prelude. On September 16, I decided to transfer my pension savings to Sber NPF, which I successfully did by writing an application at the nearest branch. There I received an answer that wait until March 17 and go to your personal account and you will see everything and everything will be chocolate. Having set myself a reminder for March 17, I conveniently forgot about it.

How to cheat during cross-selling

An employee of a bank, insurance company or microfinance organization can simultaneously work for a non-state pension fund. In this case, you may be allowed to sign an agreement under the guise of other documents. For example, when you apply for a store loan and sign a large number of papers. They may say that this is an insurance contract, it is free.

One client told me how an unfamiliar man came to their village and said that he was recruiting people for work. Under this pretext, he collected passport and SNILS data from those wishing to find a job, then had them sign some papers and left. No one got a job, but the next year everyone received a notice about the transfer to the NPF.

- OPS agreement in three copies. There will be 3 copies of the agreement in total, each of which you will sign in at least two places.

- Applications for early transfer. Usually, just in case, clients are given two statements to sign at once: on the transfer from the Pension Fund to the Non-State Pension Fund and on the transfer from the Non-State Pension Fund to the Non-State Pension Fund.

- Consent to the processing of personal data.

Web UK extended or NPF Sberbank

- choose a state-owned management company (GUK), which today is a well-known bank - Vnesheconombank;

- another criminal company that is non-state, of which there are a lot in our country, but only 38 were allowed at the beginning of 2020.

The expanded investment portfolio is formed from the pension savings of insured persons who have not yet exercised the right to choose the investment portfolio of a management company or non-state pension fund (the so-called “silent people”, as of December 31, 2013 - 58,749,675 people). Whereas the Investment portfolio of government securities is formed from the pension savings of citizens of the Russian Federation who made their choice and decided to leave their funds under state management.

Foundation contacts

The name of the company currently remains as JSC Vnesheconomfond. To send requests, you need to use the address: Moscow, Profsoyuznaya str., 57

In addition, a person has the opportunity to ask questions that interest him when using the hotline; to do this, he will need to call the following numbers:

- 7 – applied in the capital;

- 7 – used by residents of St. Petersburg;

- 7 – for the rest of the country’s population.

An important point is that the operation of these services is 24/7. The organization also has an official portal.

Attention! License number - 350/2. Currently, the fund's clients are 1.4 thousand citizens.

VEB UK extended

Although Vnesheconombank is in “reliable” hands, this still does not guarantee the constant stability of pension increases. After all, the company's constant profit will sooner or later be replaced by a deficit. In this case, the money can be returned, but only if the amount was paid together with your employer.

The investment portfolio includes assets formed under an agreement due to funds from the Pension Fund. Also, it is formed in connection with the investment declaration rule, but these amounts are isolated from other assets.

Forgery of signatures

This is what happened in my case. As I later found out, I was transferred to a new fund by an employee of the bank where I received the card. She scanned my passport and SNILS, which was in the cover of the passport, quietly filled out the documents and reported to the fund: “Here, they say, I brought you a new client, give me the money.”

Some NPFs require agents to provide a photo of the client’s passport. True, scammers manage to bypass these barriers, buy databases of scanned documents, and add their own phone numbers to the contract in order to answer calls from NPFs on behalf of clients.

One of my colleagues from NPFs told me that scammers open entire factories to produce forged contracts: they hire special people who forge signatures, other employees answer NPF phone calls, confirming the transfer, and still others hand over documents.

Some NPFs require agents to take a photo of the client along with his documents - so that they can later prove that the person signed the papers himself

According to the law, forging signatures, providing copies of a passport and answering the phone for a client is not enough to transfer a pension. After that, my identity and signatures are certified in one of three options: a personal visit to the Pension Fund or MFC, with the help of a notary, or with an electronic signature. I don’t yet know who confirmed my identity. My new NPF ignored this question, and now I am waiting for an answer from the Pension Fund.

Web uk extended how to check savings

The state management company invests funds, seeking to ensure their growth with a minimum level of risk and observing the absolute priority of the interests of insured citizens.

The State Management Company manages two portfolios that allow citizens to effectively invest funds in various financial instruments. What investment programs does this organization offer? And which program is better? These issues will be discussed below. Before considering issues related to the activities of VEB Management Company, we need to remind our readers how the pension system functions. An old-age pension is a monthly cash payment to people who have reached legal retirement age and are no longer working.

Official portal

The organization in question has an official website, which can be visited by following the link:.

This resource has certain capabilities:

- find out the amount of savings;

- use the capabilities of your personal account;

- learn about the programs operating in the NPF;

- clarify the operating hours of the branches.

In addition, the citizen will be able to find general information about the activities of the organization in question. This includes information about the creation and further development of the company.

Report on the activities of NPF "Vnesheconomfond" for 2020

We are publishing a report on the activities of NPF Vnesheconomfond for 2015.

Non-state pension fund of Vnesheconombank “Vnesheconomfond”

(02/04/2016 reorganized by transformation into the Joint Stock Company "Non-State Pension Fund "Vnesheconomfond")

License of the Federal Financial Markets Service to carry out activities related to pension provision and pension insurance

No. 350/2 dated June 30, 2009.

Address: 117342, Moscow, st. Obrucheva, 38. Phone: (495) 783-25-98. Email

Managers, LLC "Manager", CJSC "Leader".

Specialized depository: CJSC VTB Specialized depository.

Registered in the Unified State Register of Legal Entities under No. 1027739220794 dated September 19, 2002.

Activity report for 2020

(in thousands of rubles)

| Fixed assets | 3 494 | Total contribution of the founder | 312 000 |

| Reserves | 18 | Other components of property intended to support statutory activities | 105 680 |

| Accounts receivable | 119 174 | Pension reserves including: | 3 327 343 |

| Short-term financial investments | 3 318 708 | insurance reserve | 101159 |

| Long-term financial investments | 173 074 | ||

| Cash in the current account | 172 144 | Accounts payable | 41 589 |

| Balance | 3 786 612 | 3 786 612 | |

| Fund obligations | 3 222 743 |

| Number of fund participants | 3 366 |

INCOME FOR THE YEAR | thousand roubles. | EXPENSES FOR THE YEAR | thousand roubles. |

| Pension contributions | 1 945 778 | Pensions | 71 248 |

| Profit from the placement of pension reserves | 211 974 | Redemption amounts and payments to heirs | 33 845 |

| Profit (loss) from the placement of property intended to support statutory activities | 13 489 | Expenses for ensuring statutory activities | 30 138 |

| TOTAL: | 2 171 241 | TOTAL: | 135 231 |

| Structure of placement of pension reserves as of December 31, 2015 | % |

| Cash in bank accounts | 0,26 |

| Government securities of the Russian Federation, constituent entities of the Russian Federation, municipal bonds | 40,53 |

| Corporate bonds | 46,05 |

| Bank deposits | 10,22 |

| Other investment areas | 2,94 |

General Director V. A. Komarov

Chief accountant N.N. Gordienko

The reliability of the financial statements of NPF "Vnesheconomfond" for 2015 is confirmed by the conclusion of the auditing organization CJSC "Auditorskaya" (State registration number 1067746799560, certificate dated July 11, 2006, number in the register of auditors and audit organizations 10706012245, protocol No. 5 dated November 16, 2009).

other materials No. 2 (26) April-June 2016

Zargaryan Ivan Viktorovich Editor-in-Chief

№2 (26) April-June 2020 03/16/2016

How to check if your money is safe

It will not be possible to find out whether you were transferred ahead of schedule without your knowledge until the money leaves one NPF to another. In the old fund they learn that the client has dropped out, after the fact - from the Pension Fund. You will receive a letter stating that your money is in the new NPF, also only after the transfer.

More on the topic The size of the Hero of Russia’s pension in 2020

The size of the funded pension and profitability are not reflected in the statement; they can be found in the fund - on the website or by calling the hotline.

State management company

The management company separates investment portfolios, which are formed from pension savings, from other property (including its own), and opens separate accounts for each (with the Bank of Russia, credit institutions, etc.).

According to the legislation of the Russian Federation, an insured person can transfer his savings to the management only of those management companies that are annually selected based on the results of competitions held by the Federal Service for Financial Markets, and with which the Pension Fund of the Russian Federation has concluded a trust management agreement.

What to do

To do this, request by registered mail from your new fund an agreement and consent to the processing of personal data that you allegedly signed. They can be used in court as evidence. When I received my documents, I saw that the signatures for me were made by someone else. Now I have filed a lawsuit.

You can go to court even if you signed the agreement yourself, but you were not told about the loss of profitability. As practice shows, the courts also satisfy such claims.

Remember that the law is on your side. If you yourself did not sign the contract or you were misled, then you will be able to prove everything in court.

https://www.youtube.com/watch?v=ytdevru

Unfortunately, many people, when they learn about a transfer to a new non-state pension fund, simply wave their hand at it: they say, the money is small, why bother now, maybe the new fund will be better. There are three things you need to understand here:

- Now the money is small, but in 10-20 years it will accrue significant interest.

- Choosing an insurer for compulsory pension insurance is your legal right. If you did not choose this NPF, there is no reason to stay in it.

- Most likely, you will only be required to collect documents and appear at the court hearing. My lawyers say that they are not needed there and that I can do everything myself.

JSC NPF VNESHEKONOMFOND (OGRN 1167700051727 INN 7728329636)

VNESHEKONOMFOND" indicated the following types of economic activities in the Unified State Register of Legal Entities

65.30 Activities of non-state pension funds This group includes: - activities of legal entities (non-state pension funds): for non-state pension provision (accumulation of pension contributions, placement and organization of placement of pension reserves, accounting for pension obligations of funds and payment of non-state pensions to participants of a non-state pension fund), in as an insurer for compulsory pension insurance (accumulation of pension savings, organizing the investment of pension savings, accounting for the pension savings of insured persons, assignment and payment of the funded part of the labor pension to insured persons) This group also includes: - one-time payment of pension savings; - urgent pension payment to insured persons This group does not include: - management of assets of non-state pension funds, see 66.30; - compulsory social insurance, state pension provision, see 84.30

65.12.3 Civil liability insurance This group includes: - civil liability insurance (owners of vehicles, carriers, enterprises - sources of increased danger); — employer liability insurance in case of harm to an employee’s health; — insurance of personal liability to third parties due to the negligence of the insured or his family members; — insurance of liability of the product manufacturer (intermediary or seller) to consumers and other persons for harm, illness or loss (damage) arising from the consumption of the product; — insurance of liability for environmental damage; — shipowners' liability insurance; — professional liability insurance (for example, lawyer, notary, doctor and other specialists); — liability insurance for the owner of a vehicle when traveling abroad; - other types of liability insurance This group does not include: - risk insurance services, see 65.12.5

65.12.9 Other types of insurance not included in other groups This group includes: - types of insurance not included in other groups, for example: children's insurance, animal insurance, mortgage insurance, etc.

Remember

- If you change NPF more than once every five years, you will lose investment income.

- Seemingly small lost amounts of investment income for retirement can turn into tens or even hundreds of thousands of rubles.

- Carefully read all the documents you sign when receiving a loan or employment (and generally always).

- Fraudsters only need your passport and SNILS to transfer you to a new NPF.

- If you have become a victim of unscrupulous agents, complain to your new NPF, the Pension Fund of the Russian Federation and the Central Bank.

- To return the funded part of your pension and income, go to court with a claim to invalidate the compulsory pension agreement.

Professional ethics of a retirement community

The topic of professional ethics takes on special significance in the context of a conversation about the “ideal non-state pension fund,” which, at its core, can be a fund that ensures exemplary behavior in all respects, consistent with ethical norms and standards recognized in the pension community. Read

Drobyashchenko Natalya Yurievna Head of the Center for Structuring Investment Transactions, Alfa Capital Management Company

Topic of the issue: “Ideal NPF: obvious or incredible” No. 2 (2) April-June 2010 12/20/2011

Information about the fund

- Full name of the organization (name of NPF): Joint Stock Company "Non-State Pension Fund "Otkrytie"

- Status in 2020: Active - Valid license

- License No.:

NPF Otkritie has extensive experience in the field of pension insurance and occupies a leading position in the ranking in terms of the size of its client base. NPF Otkritie, organized on the initiative of Lukoil-Garant, in 2020 united several less successful NPFs and was renamed Joint Stock Company Non-State Pension Fund Otkritie.

This is one of the larger insurance companies with assets exceeding 500 billion rubles. NPF Otkritie is the leader among funds in terms of the size of its client base (over 7.5 million people) and the volume of accumulated funds. Investment returns from 2005 to 2017 exceeded 175%.

Affiliated funds

In 2020 the following were added:

- NPF Lukoil-Garant

- NPF Electric Power Industry

Requisites

View details

OGRN 1147799009104

INN/KPP 7704300571 770201001 OKPO 18406961 OKATO 45286570000 OKOGU 4210014 OKTMO 45379000000

Funds are invested in web uk extended what is it

Currently, VEB stores the savings of about 54 million future pensioners (about more than 80% of the economically active population), including the so-called “silent ones” who have not chosen for themselves any of the portfolios of the state management company or private management company, or have not transferred your NPF savings. The payment reserve of the Pension Fund of Russia (PFR), intended for payment of the funded part of the old-age labor pension, was also transferred to the management of VEB.

The return on pension savings for the state manager's expanded investment portfolio was only 2.68%. Today, management companies hold pension savings of citizens formed for the period before the end of the first half of 2013.