Home > Types of pensions > Military > For disability

- Collapse

- Expand

Article navigation

- Which military personnel are entitled to a disability pension?

- Conditions of appointment Determination of disability

- Categories of disabled people

- Re-examination of disability

- Documents for registration

- Increasing the pension amount

- Pension payment terms

8 699

I would like to immediately note that military and labor (insurance) pensions have both similarities and differences.

- Firstly, insurance premiums for military personnel are made by the state, not the employer.

- Secondly, there are differences in the terminology itself and the procedure for processing payments, for example, the length of service in the military is called length of service, and the salary is the monthly allowance of a military personnel (MSSA).

Among the similarities, one can note the same principle: the greater the length of service (length of service) and the higher the salary, the greater the final amount of payments will be.

In the life of every citizen undergoing military service, whether a conscript or a contract employee, a man or a woman, unforeseen circumstances may occur that will seriously affect his health, and as a result, his ability to work. Despite a certain negative tone regarding the entire pension provision for this category of citizens, the law provides for compensation and payments to people who have become disabled as a result of serving in the armed forces (or equivalent structures) - military and state disability pensions.

Which military personnel are entitled to a disability pension?

The military pension system, regardless of what type of payments they receive - for length of service or for disability, is reflected in the law of February 12, 1993 N 4468-1. This document regulates all processes related to military pensions, including the conditions and procedure for assigning payments.

From Article 1 of this law it follows that the following categories of military personnel are entitled to disability payments through the Ministry of Defense of the Russian Federation (of course, if the conditions described below are met):

- citizens serving in the ranks of officers, midshipmen and warrant officers, military service (or service equivalent to it), or serving on a contract basis as soldiers, sergeants, foremen or sailors;

- military personnel serving in other states, subject to an agreement or agreement between the Russian Federation and the country where the citizen is serving, and also if the laws of the state provide for such a pension option;

- citizens serving in other countries in the absence of an agreement between the Russian Federation and the country, and also if its laws do not provide for pension provision in this option;

- persons who served as warrant officers, officers and midshipmen in the armed forces (and equivalent formations) in the former USSR.

Separately, it is worth highlighting conscript employees - their pension provision is provided through the Russian Pension Fund , they receive a state pension in accordance with Federal Law of December 15, 2001 N 166-FZ.

Definition

A military disability pension is considered to be a payment to a retiree assigned due to loss of ability to work while performing official duties. Its main characteristics:

- provided from the federal budget or the Russian Pension Fund (PFR);

- assigned to persons recognized as disabled by the Military Medical Commission (MMC);

- valid limited until:

- removal of disability;

- reaching the retirement age established by law.

The disability pension for military personnel has significant differences from the labor pension for civilians:

- insurance premiums for soldiers are paid by the state, not the employer;

- It is not earnings that are taken into account, but the military personnel’s monthly allowance (MSS).

A common feature of these two types of state support for disabled people is that benefits depend on length of service. The more a person worked, the higher his level of health loss.

Who is entitled to

Law No. 4468-1 of February 12, 1993 contains a list of persons who are entitled to state disability benefits. In particular, these include:

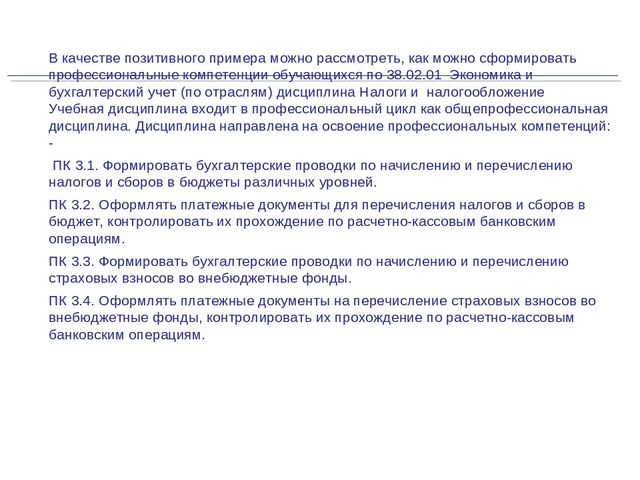

Conditions for granting a disability pension

Article 19 of the above-mentioned law states that a disability pension can be awarded to military personnel who:

- suffered health damage resulting in disability while serving in the armed forces or three months after service;

- due to injury, concussion, illness or injury received during service, they became disabled, but after dismissal .

It is worth noting that if the cause of injury or another factor leading to disability is the unlawful actions of a serviceman (in other words, if he has committed a crime), instead of a military disability pension, a social .

Determination of disability

As in the case of social or insurance disability pensions, the main document for assigning payments to military personnel of this nature is a certificate of disability , or in other words, an ITU certificate , in most organizations referred to as a “pink certificate”.

This certificate is issued by a medical and social examination (MSE), which conducts an expert assessment of the health status and social adaptation of a potential disabled person.

The process of obtaining this certificate for military personnel is not fundamentally different from that of “civilians” - drawing up a delivery note at the hospital, a detailed description of the injuries that resulted in disability, confirmation that the injury is related specifically to military service, etc.

Categories of disabled people taken into account when assigning a pension

Article 21 of the Law of the Russian Federation of February 12, 1993 N 4468-1 distinguishes two groups of persons who can receive a military disability pension. Whether a citizen belongs to one category or another depends on the causes of disability:

- persons whose disability occurred due to military trauma - concussion, injury, illness or injury received in connection with military operations, service on the border or other types of state protection, as well as being in captivity (provided that the captivity was violent and the citizen did not commit crimes against the Motherland during it) or serve in the active army as cabin boys and students;

- citizens whose disability is caused by illness, injury, etc., received during military service, but not related to the direct performance of official duties.

Establishing the fact of a connection between an injury or illness and military service (as well as the absence thereof) is not the responsibility of the ITU, but of military medical commissions.

Re-examination of disability

Depending on the period of disability, the pensioner may require re-examination by the federal medical and social examination authorities. There may be two options here:

- The ITU certificate was issued for a clearly defined period (it is indicated in the certificate). This means that after this period you need to undergo a re-examination , the date of which is indicated on this document. If there are indications for establishing disability, it will be extended (or the disability group will be changed, depending on the citizen’s state of health). If there is no evidence, the citizen will be deprived of his disabled status and will not be able to receive a state disability pension.

- The disability certificate has been issued for an indefinite period . In this case, the date of re-examination will not be on the certificate - because the examination found that the disabled person’s condition will not change over time, which means there is no point in confirming disability - the citizen will have the status of a disabled person and the right to receive a disability pension for the rest of his life.

Example

Citizen I. was injured during combat operations abroad and on May 14, 2020 received an ITU certificate, which establishes his I disability group. The date of the next re-examination is May 13, 2020. When is the best time to start preparing all the necessary documents for a medical and social examination so as not to lose your pension?

Clause 12 of the order dated January 29, 2014. N 59n of the Ministry of Labor and Social Protection of the Russian Federation states that the maximum period for the provision of ITU services from the moment of submission of all necessary documents is no more than 30 days.

In addition, if the re-examination does not occur on time, but for a good reason (hospitalization/long queue for examination), the suspended pension will be paid in full based on the previous disability group. (Article 27 of the Law of the Russian Federation dated February 12, 1993 N 4468-1)

Based on this rule, citizen I. is required to start collecting documents in advance, for example, a month before the end of the established disability, i.e. April 13, 2020. With this approach, all actions will be completed on time, even if there is a queue for commissions at the ITU (which is usually what employees of medical and social examination departments refer to), and after submitting a certificate of disability to the territorial body of the Pension Fund of Russia (Pension Fund of Russia), citizen I. will continue receive a state disability pension.

Documents for applying for a military disability pension

In order to become a recipient of this payment, a citizen must contact the pension authorities of the Ministry of Defense with an application for a disability pension. Additional documents will need to be attached to this application , such as:

- Passport.

- Military ID.

- Certificate of disability issued by the federal medical and social examination body.

- Results of the military medical commission (which assigns the appropriate category of disability to a citizen, depending on the conditions for the onset of disability).

- Other documents confirming the right to receive payments of this nature.

If a disabled citizen is a citizen who has served in the military , he is entitled to a state disability pension . To appoint it, he must contact the territorial body of the Russian Pension Fund at his place of residence. Again, to apply for this type of pension, all of the above documents will be required.

Pensions paid to disabled people in Russia

Citizens of the Russian Federation who find themselves limited in their capabilities due to loss of ability to work can count on receiving one of the types of pensions:

- if you have an insurance period (regardless of the number of years when pension contributions were made) for a disability insurance pension;

- for state pension provision - persons who have become disabled as a result of injuries or diseases received:

- while serving in the country's armed forces or navy;

- certain categories of participants in the Great Patriotic War (due to the long history of events, such people are becoming less and less every year);

- citizens who took part in the liquidation of the accident at the Chernobyl nuclear power plant and other radiation and man-made disasters;

- social pension payments:

- children recognized as disabled;

- when establishing 1-3 disability groups, if there is no right to receive insurance payments, including those with disabilities from birth, or those who became disabled in childhood.

- passport of a Russian citizen (working citizens of other countries and stateless persons are provided with a residence permit);

- certificate of compulsory pension insurance;

- a copy of the work book or other documents confirming the existence of insurance experience;

- an extract of the conclusion of the medical expert commission on the establishment of permanent loss of ability to work and recognition of disability;

Certain categories of citizens can receive two types of pensions at the same time.

1. persons recognized as disabled if there is a cause-and-effect relationship with military injuries.

At the same time, they have the right to receive state and insurance old-age pension payments.

2. disabled people, participants in the combat events of the Great Patriotic War and residents of besieged Leningrad, awarded with insignia, also with a state pension to provide for disabled people who have the right to receive an old-age insurance pension.

3. children recognized as disabled.

In the event of the death of a breadwinner, they are paid, along with a social pension, a survivor's pension.

If there is insurance experience, regardless of the time worked, disability is recognized in accordance with all the rules for its establishment by a medical commission of specialized medical expert institutions, a person can apply to the Pension Fund with an application for the appointment of disability insurance pension payments.

For example, even an employee who was injured on his first day of work, who was subsequently recognized as disabled, and who had no previous work experience and, accordingly, no insurance experience, has the right to receive disability insurance payments.

The following must be attached to the application:

In each individual case, additional documents may be needed to confirm certain circumstances necessary to assign a disability insurance pension.

Documents can be submitted personally to the applicant for a pension or through his authorized representative.

It is possible to send a package of basic documents by registered mail, or by email to the official website of the Pension Fund.

When checking the submitted documents, if additional certificates and confirmations are needed, the person has three months to submit them so that the pension is assigned from the moment the right to receive it arises.

Otherwise, pension payments will begin from the month of providing the entire package of necessary documentation.

At the request of the disabled person, the pension can be delivered to the home by postal workers or special organizations, or received at the post office or to a bank account.

The rules and procedure for recognizing a person as disabled due to impairment of health and body functions due to diseases or consequences of injuries causing the need for his social protection are established by the Government of the country in Resolution No. 95 of February 20, 2006, as amended on August 10, 2020.

The second part of Decree No. 95 details what conditions must be met in order for a person to be recognized as disabled.

- If the state of health is impaired and is expressed by a persistent disorder in the functional activity of the body as a consequence of illness or injuries or defects.

- Partially or completely, a person has lost the ability to self-care, independent movement, loses orientation, the ability to communicate, does not control his actions and behavior, and cannot continue further education or work.

- Needs social protection measures, including rehabilitation and measures aimed at adapting to life with disabilities.

Depending on the degree of health disorder and functional capabilities, a medical expert examination during examination establishes a disability group.

If disability is recognized, its causes are established.

- general or occupational disease;

- work injury or disability since childhood;

- consequences of a military injury or illness suffered during military service, and others.

Read more: Return of goods of proper quality protection law

If there are no documents confirming the fact of a work-related injury or occupational disease, military injury or other reasons established by law, a general illness is indicated as the cause of disability.

In any case, having in hand the conclusion of an examination by an expert medical commission and recognition of disability, a person can apply to the Pension Fund to assign pension payments.

Depending on the requirements for obtaining a pension and the available documents, he will be assigned one of the payments:

If there are all grounds for the assignment of disability pension payments, all documents are collected, the pension is assigned from the first day of the calendar month when the citizen filed an application, but not earlier than the day when the right arose.

For example, an examination by a medical expert commission made a conclusion on July 3, 2020.

If you apply to the Pension Fund before the end of the month, payments will be assigned only from July 3, 2020 for the period until the next re-examination and confirmation of disability.

Moreover, during re-examination, the health status may remain the same, improve, or, on the contrary, become worse, as a result of which the disability group may change.

For example, when passing a recommission, a disabled person of group 2 can receive both the first and third groups.

Accordingly, the amount of monthly payments will change.

When assigning insurance payments, the number of dependents supported by a disabled person is taken into account.

The size of the insurance pension consists of the pension itself, which depends on the individual pension coefficient and the cost of one coefficient on the day of payment assignment and a fixed payment, which is indexed with inflation.

In 2020 it is provided:

- for disabled people of group 1 – 9610.22 rubles;

- for group 2 – 4805.11 rubles;

- for group 3 – 2402.56 rubles.

For persons who have worked in the Far North for at least 15 years, pensions are increased by 50% and by 30% if they have worked for 20 years in conditions close to the northern climate.

According to official data from the Pension Fund after indexation carried out in April 2017, the average size of pension payments to disabled people is:

- insurance pensions – 8465 rubles;

- social pensions for children recognized as disabled - 13,026 rubles;

- disabled people due to military injuries and participants of the Second World War - 30.3 thousand rubles and 34.3 thousand.

The size of military disability pensions in 2020

Current legislation divides the amount of disability payments depending on which category of disabled pensioners the citizen belongs to. In order to calculate the amount of military disability pension for contract military personnel

, you can use the table (percentages are indicated on the amount of monetary allowance taken into account when calculating payments):

| Category of disabled people | If you have disability group I | If you have disability group II | If you have disability group III |

| Cause: war trauma | 85% | 85% | 50% |

| Cause: illness acquired during service | 75% | 75% | 40% |

Amount of pension payments for conscripted military personnel

who received disability is shown in the table below, which is set

as a percentage of the social pension (from April 1, 2020 - 5606.17):

| Category of disabled people | If you have disability group I | If you have disability group II | If you have disability group III |

| Cause: war trauma | 300% | 250% | 175% |

| Cause: illness acquired during service | 250% | 200% | 150% |

It is worth noting that this table also reflects the minimum amount of a military disability pension .

Disability pensioners are entitled to the following allowances:

- When the first disability group is established or the age of 80 is reached, 100% of the social pension is paid in addition.

- If a disabled person of the first and second groups does not work, and he has disabled family members dependent on him, 32%, 64% or 100% of the calculated pension amount is added to him (depending on the number of dependents - 1, 2 or 3 (or more)).

Increasing pensions for military pensioners

The state provides for an increase in the amount of payments in connection with rising consumer prices - indexation . Pension provision for military personnel depends on the amount of monetary allowance and the reduction factor used in calculating the pension. In 2020, it is planned to increase the monetary allowance at the rate of inflation - by 3% , but the value of the reduction coefficient will be left unchanged - 73.68%.

Because the amount of additional payments to the military disability pension depends on the calculated size (the size of the social pension); with each indexation of social disability pensions, the amount of payments to the military also increases. From April 1, 2020, all social pensions were indexed by 6.1% , which means that the calculated amount will also increase.

Additional payments to the disability pension for military personnel are also determined from the calculated amount of the pension. At the same time, there are a number of features outlined in Art. 46 and 48 of the Law of the Russian Federation of February 12, 1993 N 4468-1, concerning the conditions for assigning the allowance :

- If the pensioner has received the following titles:

- Hero of the Russian Federation, Hero of the Soviet Union, or he is awarded the Order of Glory of three degrees, then 100% of the pension amount is added to him.

Hero of Socialist Labor, Hero of Labor of the Russian Federation - pension increases by 50%.

- An allowance for disabled family members who are dependent on a military pensioner, provided that two or more people receive such a pension, is assigned to only one of such pensioners. In other words, if a father and mother receive a state disability pension and they have two children, then only one parent can receive the allowance for two children (or each parent will receive the allowance for one dependent).

- If a pensioner has the right to several increases in the pension amount, then the largest one is selected . This will be taken into account when increasing the payment.

- When receiving two pensions at the same time, bonuses are established for only one of them .

In the case when a pensioner is awarded these awards or titles, the pension increases for each title received .

Changing the disability group and revising the pension amount

There are cases when a disabled person’s health status changes (for the worse or for the better) - in this case, the medical and social examination bureau has the right to revise his disability group . Depending on various factors, the ITU can determine both the group that is entitled to a larger pension payment and the one that is entitled to a smaller pension.

If, as a result of a military injury, disability increases due to a general illness, work injury or occupational disease, the pension is recalculated according to the new disability group , preserving the previous cause.

Social and insurance pensions for disabled people: conditions of appointment, amount of payments and their indexation

Pension provision for disabled people includes, among other things, insurance and social pensions. They are assigned in the following order:

- Social pension: upon the onset of disability and the presence of Russian registration.

- Insurance pension: if a disabled person has worked for at least one day (main condition: having 1 day of experience). Appointed for the period of established disability and until the generally established age for pensioners.

In general, if there is no work experience, a disabled person may be assigned a state pension or disability social pension. The amount of social pension will be indexed until 04/01/2019. As for the insurance, the monthly size of its fixed part for 2020 is 5,334 rubles. 19 kopecks

Read more: How profits are distributed in a joint stock company

The amount of the disability insurance pension payable depends on the disability group, the presence of dependents and the territory where the beneficiary lives. It should be remembered that in the Far North and other equivalent territories, regional coefficients have been established, which are taken into account when calculating social payments.

Disabled people due to war injury can receive two types of pensions at once: state pension and old-age insurance.

The old-age insurance pension (hereinafter referred to as SPS) is assigned to military personnel if the requirements for length of service and age are met. The recipient of the ATP from among the military must reach the generally established age and have the necessary experience in civilian life. In 2020 it is equal to 10 years, which corresponds to 16.2 pension points.

Payment of pensions to military pensioners

As with insurance or social pensions, there are several ways to receive funds. Payments can be received either by the pensioner himself or by an authorized representative in the following types of organizations (the pensioner has the right to determine for himself where it is more convenient for him to receive his pension):

- Russian Post - in this case, the pension comes to your home or to the nearest post office. The only thing that needs to be taken into account if you choose this option is the delivery period , which may differ from the date of payment of the pension.

- A bank account is the most common way to receive pensions. It doesn’t matter whether it’s a bank card or a Sberbank book - on the day the funds are transferred from the territorial office of the Pension Fund of the Russian Federation, the money will go to the pensioner’s account.

- A third-party organization engaged in the delivery of pensions - everything is similar to Russian Post. A complete list of such companies can be obtained from employees of Pension Fund branches.

Please note that according to Art. 56 of the Law of the Russian Federation of February 12, 1993 N 4468-1, the third point (payment through a third-party organization) is not indicated as possible for military pensions. You will have to choose between Russian Post and Sberbank.

Deadlines for payment of disability pension

It is worth noting that the military disability pension has certain features regarding payments.

- A military disability pension is assigned for the period of validity of the disability certificate , and for disabled people over 55 and 60 years of age (women and men, respectively) - indefinitely; re-examination can only be assigned at the request of the pensioner (for example, if there are conditions for changing the disability group).

- If a pensioner who has not reached the age specified in this article is recognized as able-bodied, the pension is paid to him until the end of the month in which he was recognized as able-bodied , but no longer than until the day before which the disability was established.

Suspension and resumption of payment

In general, the rules for suspending and renewing a military disability pension are similar to other cases - if a citizen has temporarily lost the right to receive payments, they are suspended until he regains these rights.

In Art. 27 of the Law of the Russian Federation of February 12, 1993 N 4468-1 considers the case when a disabled person missed the deadline for re-examination . According to this document, if a disabled person missed the deadline for re-examination at the Federal Bureau of Medical and Social Expertise, then the payment of the established pension is suspended from the moment the disabled status is lost ; if the citizen is recognized as disabled again, the pension is resumed from the day the disability is restored.

If the deadline for re-examination was missed for a valid reason and the disability is established by the federal ITU authorities for the past, then the payment of the pension is resumed from the day the citizen was again recognized as disabled.

In the event that a disabled person receives a new disability group, payments for the past are assigned according to the previous disability group .

Pension due to military injury or illness

Disabled persons whose disability occurred during military service or within a period of up to three months after dismissal from military service, as well as if disability occurred later than 3 months after dismissal, from a wound, injury, concussion or illness received during the period in military service are entitled to receive a state disability pension. Moreover, such a disabled person can combine receiving a state pension with paid work.

Depending on the cause of disability, disability pensions for military personnel (both contract soldiers and conscripts) are divided into two categories:

1. due to military trauma; 2. due to a disease acquired during military service.

The number of citizens entitled to a state disability pension due to a military injury or illness received during military service includes the following categories of persons and their families: ♦ military personnel of the Russian Armed Forces, OVSSNG, FPS, VVMVD, ZhVRF, civil defense troops; ♦ served in FAPSI, FSB agencies, federal state security agencies, foreign intelligence of the Russian Federation, and other military formations of the Russian Federation created in accordance with the legislation of the Russian Federation; ♦ served in the Ministry of Internal Affairs; ♦ employees of institutions of the General Prosecutor's Office of the Russian Federation with class ranks; ♦ employees of customs authorities, tax police; ♦ employees of Mrs. services, FSKN, employees of FSIN institutions; ♦ those who served in military formations of the former USSR, including citizens living in other states - former republics of the USSR, subject to the existence of appropriate interstate agreements.

All of the above persons have the right to receive a pension for long service or, and in the case of acquisition of disability, a disability pension. If the death of these persons occurs, their families will be entitled to a survivor's pension regardless of the length of service of the deceased. The family will receive a survivor's pension, even if the deceased was already a pensioner.

Important. For the purpose of granting a disability pension due to a military injury or illness, the length of service, as well as the presence (absence) of work experience, do not matter at all. The size of a disabled person's pension will be determined depending on the disability group and its cause.

On May 1, 2016, Federal Law No. 125-FZ was signed, which ensures that disabled people due to military trauma receive compensation depending on the degree of disability, and not on the type of pension received.

The law establishes that if a disability is established as a result of a military injury, which excludes the citizen from further service, he is paid monthly monetary compensation, with the subsequent recovery of the amount of compensation from the perpetrators. The amount of such compensation is calculated based on the size of the monthly salary (maintenance) and the size of the monthly bonus for length of service, using the following coefficients:

• for disabled people of group 1 - 1; • for disabled people of group 2 - 0.5; • for disabled people of group 3 - 0.3.

Citizens who become disabled as a result of a military injury have the right to simultaneously receive both the State Disability Pension and the Old Age Insurance Pension, or any other pension established in accordance with Russian legislation. In addition, the same right is granted to the parents and widows (who have not remarried) of a conscripted soldier who died (died) during his service or who died after being discharged from military service due to a military injury (Clause 3 of Article 3 No. 166-FZ and Art. 7 No. 4468-1). Establishing the right to simultaneously receive two pensions is made on the basis of an application submitted to the territorial branch of the Pension Fund of the Russian Federation.

For all disabled people due to a military injury or illness received during military service, living in the regions of the Far North and in areas equivalent to them, the pension amount is increased by the corresponding regional coefficient for the entire period of residence in such areas (Clause 5 of Article 15 No. 166-FZ).

Disabled pensioners due to military injury upon reaching the age of 60/55 (male/female) receive an increase equal to 100% of the minimum social pension to the assigned disability pension (Article 24 No. 4468-1).

Disability pensions due to illness received during military service for military personnel (including conscription), depending on the disability group, cannot be assigned less than the following amounts:

This is interesting: Calculation of long-service pensions for civil servants 2020

♦ for disabled people of group 1 - 250% of the amount of the social pension established by law; ♦ for disabled people of group 2 - 200% of the amount of the social pension established by law; ♦ for disabled people of group 3 - 150% of the amount of the social pension established by law.

For disabled people due to war injury and illness, who have dependent disabled family members, the state pension is established with an increase in its size by an amount determined by law for each dependent, but in number not more than three (Clause 3 of Article 15 No. 166-FZ).

By Decree of the President of the Russian Federation dated August 1, 2005 No. 887, disabled people due to military trauma are given the right to additional monthly financial support in the amount of 1000 rubles. In addition, all disabled people have the right to a monthly cash payment (MCA). Additional information can be obtained from the Pension Fund office at your place of residence.

Family members of a pensioner are considered his dependents if he fully supported them or they received funds from him that were their main source of livelihood. Some such dependents, in the event of the death of a pensioner, may be awarded a survivor's pension. In the event of the death of a serviceman as a result of a military injury, concussion, injury or illness received while defending the Motherland or while performing other duties related to military service, each disabled member of his family is established a survivor's pension in the amount of 50% of the amount of his former monetary allowance. The same amount is established for the survivor's pension for the families of a deceased military pensioner who received a disability pension due to a military injury, regardless of the cause of his death. For families of military pensioners who are disabled due to illness, the amount of the survivor's pension will be 40% of the amount of the deceased's former allowance (Article 36 No. 4468-1).

In the event of the death of a pensioner receiving a disability pension due to a military injury received during conscription, his disabled dependents will receive a survivor's pension in the amount of 200% of the social pension (clause 4 of Article 15 No. 166-FZ) . And in the event of the death of a pensioner receiving a disability pension due to illness, received during military service by conscription, his disabled dependents will receive a survivor's pension in the amount of 150% of the social pension (clause 4 of Article 15 No. 166-FZ ).

An amendment has been made to Article 108 of the Federal Law on Education, according to which combatants are given the right to be admitted to undergraduate and specialist programs at the expense of budgetary allocations within the established quota. For disabled people due to military injury or illness received during military service, this right is enshrined in Article 71 of this law.

Right to receive a second pension

There are cases when, after leaving military service, citizens go to work outside the armed forces, for example, as security guards for private security companies or teachers at colleges. At the same time, they continue to receive a military pension for long service or disability.

If their employers pay insurance contributions to the Russian Pension Fund, and this is possible if the employee is registered in the compulsory pension insurance system (in other words, he must have SNILS - an insurance certificate, popularly called a “green card”), then if satisfied with the following criteria, such citizens can receive an insurance pension in addition to the military one:

- reaching the generally established retirement age - 55 years for women, 60 for men. If a citizen works in the Far North, life-threatening conditions, etc. - this age can be reduced in accordance with the Federal Law of December 28, 2013. N 400-ФЗ;

- availability of the required number of pension points;

- availability of a pension for long service or in connection with disability through the Ministry of Defense;

- having an insurance (civil) experience of at least 11 years in 2020 (and further with an increase of 1 year annually to 15 years in 2024).

It is worth noting that periods of military service taken into account when assigning a pension through the Ministry of Defense cannot be used to calculate the insurance pension. It is also worth paying attention to the fact that military pensioners receive an insurance pension without a fixed payment .

As with “civilians,” in the case when a military pensioner receiving a second (insurance) pension continues to work, this pension is recalculated automatically on August 1 annually (no applications for recalculation of the pension are required to be submitted to the Pension Fund).

8 699

Answers to frequently asked questions

Question No. 1: Will payments stop if a disabled service member does not undergo re-examination on time?

Yes, the payments previously assigned to him will be suspended until he undergoes re-examination.

As established, a disabled person must undergo re-examination when the period specified in the certificate from the ITU has expired. Why is this being done? Based on the results of the re-examination, the commission can cancel the disability group or change it (for example, establish a lighter one). Accordingly, when the disability group changes, the amount of social benefits will also change.

When a disabled person reaches the generally established retirement age or in the absence of positive changes in his health, disability is established indefinitely.

Question No. 2: Can a foreign citizen apply for a state pension for a disabled person due to a military injury (i.e., be his representative)?

Yes, it can, if you have a power of attorney executed in accordance with the established procedure. For information, when filling out the application form in this situation, indicate the personal data of the authorized representative in foreign and Russian languages.

Read more: Dacha consumer cooperative: pros and cons

I receive a pension as a 3rd grade disabled person. due to military trauma - conscription service. In a month, 55 years. I have 25 years of work experience in the Kr. North (Chukotka). Do I have the right by law to receive TWO pensions? I read that there is such a law!

No, no one will assign you two pensions.

Federal Law of December 28, 2013 N 400-FZ “On Insurance Pensions” in Art. 5 talks about this.

Persons entitled to simultaneously receive insurance pensions of various types, in accordance with this Federal Law, are established one pension of their choice.

In cases provided for by Federal Law No. 166-FZ of December 15, 2001 “On State Pension Security in the Russian Federation”, it is permitted to simultaneously receive a state pension pension established in accordance with the said Federal Law and an insurance pension in accordance with this Federal Law. by law.

And Federal Law of December 15, 2001 N 166-FZ “On state pension provision in the Russian Federation” indicates:

Disability pensions for military personnel who served on conscription as soldiers, sailors, sergeants and foremen, and survivor's pensions for disabled members of their families are paid in full, regardless of the performance of paid work.