Social package 2020: size, what is included and how to refuse

In accordance with the response of the pension recipient, the social package may be indexed to a financial equivalent, which will be included in the amount of the basic pension.

For people with disabilities and disabilities, a social package can provide regular treatment.

Any citizen of the Russian Federation who has the right to additional benefits can purchase it on the basis of their own application to the regional Pension Fund. For Russians living abroad, in addition, payments are provided through the Pension Fund of the Russian Federation.

Basic Concepts

A social package is a set of necessary accessories and conditions provided to people with disabilities. Its registration is carried out in social funds: MFC or Pension Fund of the Russian Federation. The list of benefits is individual for each citizen. You can find out more about it on the Unified Portal. The social package includes:

- drug benefits;

- sanitary resort treatment;

- preferential travel on suburban and intercity transport.

Refusal of a social package for disability is a procedure aimed at terminating the provision of social benefits

The concept of “social package” - what does it mean?

The concept of “social package” means carrying out a number of activities aimed at improving the financial situation of certain categories of citizens, strengthening their health, protecting labor rights, etc.

The social package is provided by the state free of charge and is one of the ways to provide targeted assistance to categories of citizens with low income.

Employers provide social support to working citizens. The main task of enterprise managers in this case is to retain qualified personnel.

The social package includes various preferential payments and compensations. For example, for old-age pensioners, vital medications are included in the social package. All this helps improve their quality of life.

Benefits for pensioners in the Krasnodar region

The program to provide assistance to residents of the Krasnodar Territory provides financial support for making rent payments. If a consumer of housing and communal services spends more than 22% of his income on paying bills, he is entitled to compensation or a subsidy. Resolutions of the authorities of Krasnodar and Novorossiysk reduced the threshold to 15%. For the low-income population, the percentage is adjusted based on the regional cost of living.

The Tax Code exempts benefits, compensation and other social payments from personal income tax withholding. The federal concession is valid throughout Russia. Property fees and the amount of tax benefits for pensioners in 2020 in the Krasnodar Territory are regulated at the regional and local level.

Legislative regulation

You can find the answer to the question of how to refuse a social package for a pensioner and what it includes, the categories of pensioners who can count on receiving assistance, in the Federal Law “On State Social Assistance” dated July 17, 1999 N 178-FZ. The procedure for applying for a social package and refusing it is regulated by Order of the Ministry of Health and Social Development of Russia dated December 29, 2004 N 328 (as amended on March 1, 2012) “On approval of the Procedure for providing a set of social services to certain categories of citizens.”

Citizens should remember three things:

- the social package consists of three services: reimbursement of travel expenses, for the purchase of medicines and sanatorium treatment;

- the social package can be provided in kind or cash;

- monetization or return to kind is carried out exclusively upon the application of the pensioner, which is submitted before October 1 of the current year.

Before submitting an application to refuse to receive a social package in kind, you need to weigh the pros and cons, since health problems can arise at any time. And then you will have to undergo treatment at your own expense, and you will be able to return the benefit only after a year.

Benefits for pensioners in 2020

- residential building, apartment or separate room;

- workshop, studio, atelier or other similar premises;

- an outbuilding with an area of up to 50 square meters, which is located on a site for dacha farming or individual housing construction;

- garage or parking space.

We recommend reading: Kindergarten Fees in 2020

The municipality provides additional benefits for certain categories of Muscovites. Thus, home front workers, victims of political repression and some other pensioners have the opportunity to receive a monthly payment from the city budget. In addition, the city authorities make additional payments up to the social standard, compensate for the purchase of medicines and telephone fees. You can find out more about this directly on the Moscow Mayor’s website.

What is included in the social package

The full social package includes several points of guaranteed security:

- medications prescribed by a doctor,

- sanatorium treatment if there are medical indications,

- travel on suburban railway transport, as well as on intercity transport to the place of treatment and back.

List of possible medications

The state annually allocates billions of rubles to provide free medicines to all groups of the population in need. The attending physician should tell you what medications are prescribed for a particular disease. The following table shows the main categories of medications issued to beneficiaries on prescription.

| Group of drugs. | Titles. |

| Ophthalmological. | Pilocarpine, Timolol. |

| Against asthma. | Salbutamol, Aminophylline, Ambroxol, Formoterol. |

| Antihistamines. | Cetirizine, Loratadine. |

| Medicines for the kidneys. | Tamsulosin, Finasteride, Cyclosporine. |

| Antihyperglycemic agents. | Insulins (Protafan, Levemir, Biosulin, Rinosulin, Novorapid and others), as well as tablets Metformin, Glucagon and several other names. |

| Hormonal. | Prednisolone, Betamethasone, Thiamazole, Bromocriptine. |

| Analgesic. | Morphine, Narcotine, Codeine, Ketoprofen. |

| Antiepileptic. | Phenobarbital, Topiramate, Hydrochloroquine. |

| Anti-infective. | Cephalexin, Doxycycline, Clarithromycin, Tiloron. |

| Heartfelt. | Verapamil, Atenolol, Digoxin, Nitroglycerin. |

The list presented is far from complete. There are a lot of medicines that the state purchases for citizens in need. In addition, this list is constantly being updated. You can find out which medication is provided free of charge for a particular disease at the clinic or on the website of the Ministry of Health.

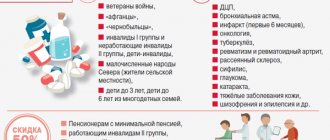

Benefits for pensioners

Pensioners receive benefits from the state and a corresponding social package if they belong to categories of citizens, the list of which is considered at the legislative level. That is, these are disabled people, blockade survivors, and so on.

What taxes do pensioners not pay in 2020 in the Krasnodar region

The decision to provide this compensation is made by the territorial body of the Pension Fund of the Russian Federation in the presence of special coupons for directions to receive from the transport organization with which the corresponding agreement has been concluded, travel documents that provide travel for pensioners to the place of rest and back.

More than 15 years of experience in finance. Date: October 27 Reading time 6 min. Krasnodar pensioners can count on benefits provided by the federal government to pay for housing and communal services and taxes, additional medical services, improved working conditions and free travel to the place of treatment. But they are also entitled to regional preferences for transport tax, etc. As soon as a Russian has reached a certain age and retired, he receives from the state not only a pension, but also additional privileges.

Social package provided by the employer

When looking for a job, most job seekers are interested in what benefits the employer is willing to provide to its employees.

Just a few years ago, payment for vacation and sick leave was considered the optimal amount of guaranteed social security. In fact, according to the Labor Code, such payments do not depend on the wishes of the employer, but must be mandatory.

Fortunately, recently some employers have significantly increased the scope of benefits that are guaranteed to employees.

The social package of an employee today includes not only guarantees of comfortable and effective work activity, but also a full-fledged sanatorium-resort vacation.

What may be included in the social package of a modern employer:

- free medicines in case of registration of sick leave,

- food and travel around the city at the expense of the employer,

- payment for places in preschool institutions,

- taking PC courses at the expense of the employer,

- payment for mobile communications.

Some managers have gone further and provide benefits not only to their employees, but also to members of their families, for example, they allocate money for trips to a summer camp or sanatorium.

To motivate the effective performance of an employee, company directors also use individual types of benefits, for example, experienced workers are provided with benefits for obtaining a loan, year-end bonuses, etc.

Be sure to read it! Unemployment benefit in 2020: amount and procedure for registration

For people with disabilities and disabilities, a social package can provide regular treatment.

For large enterprises, the presence of non-standard preferential conditions is a symbol of reliability and solidity, as well as an indicator of competent internal policy. According to statistics, just over sixty percent of Russian citizens consider their working conditions to be satisfactory, and the applicant’s priorities are determined by how diverse the social package is when applying for a job.

Benefits for pensioners in the Krasnodar Territory in 2020

- Military personnel who have reached retirement age. A prerequisite is length of service. It must be at least twenty years. If the length of service is mixed, then twenty-five years, twelve and a half of which are necessarily devoted to military service.

- Labor veterans. Citizens receive this status if they have worked for a sufficient amount of time, namely twenty and twenty-five years for women and men, respectively; state awards are also required. The age limit for such a pensioner is thirty-five years, for a pensioner - forty years.

- Other persons. Civil servants, WWII veterans, disabled people, people who do not have sufficient income to meet basic needs, and so on.

Benefits for pensioners in the Krasnodar Territory in 2020 are a measure of support for certain categories of citizens in the field of taxation and social security. Pensioners belong to that part of the population that not only claims some benefits, but also receives regular accruals. Benefits for pensioners in the Krasnodar Territory as of 2020 are divided into two groups: federal and regional.

How to refuse a social package: procedure

A beneficiary can waive the social package either completely or partially. To do this, you must contact the pension fund department before October 1 of the current year with an application.

When a pension is assigned, the social package is automatically provided in kind, and if the pensioner wishes to receive its cash equivalent next year, the application must be submitted strictly before October 1 of the current year. If a citizen has already submitted a similar application earlier, a repeated application to the Pension Fund will be required only if his decision changes.

For certain categories of citizens of the Russian Federation, various social packages are provided, which include the right to additional monthly financial support. It will be included in the social package for disabled people of the Second World War due to injuries received during hostilities, as well as for minor prisoners of German camps. The right to receive such additional payment is granted regardless of place of residence. The benefit amount is one thousand seventy-five rubles.

Another type of DEMO in the amount of five hundred rubles can be received by categories of citizens who participated in the Second World War and who suffered in concentration camps.

To receive additional benefits, you need to contact the territorial authorities for the payment of pensions.

A citizen can receive benefits only on one basis, which implies the highest amount of payment.

Every citizen of the Russian Federation, even if he is not a pensioner, can receive additional benefits based on his application to the regional Pension Fund. For Russians living abroad, payments are also provided through the Pension Fund of the Russian Federation.

Submit an application to waive the social package

Compensation for medicines to pensioners and other benefits in monetary terms can be provided only upon a written application from the pension recipient. The decision of a pensioner or disabled person to replace in-kind assistance with cash, expressed in the application, will be valid until a new application is submitted to the Pension Fund.

If you are late in submitting your application, that is, you do not apply before October 1, you will only be able to receive monetary compensation after a year. For example, if the application was submitted on October 16, 2020, then the cash equivalent will be paid only from January 1, 2019.

The application must be submitted to the territorial branch of the Pension Fund where the pensioner’s personal file is located. Personal appeal to the Pension Fund or through an authorized representative is allowed. You can submit documents through the MFC or send them by mail. In some regions of the country, you can even submit your application through the State Services portal or in the pensioner’s personal account on the Pension Fund website.

Procedure for refusing NSO

Disabled people themselves, as well as their relatives, are often interested in how to correctly formalize the refusal of medications due to disability, until what month the procedure must be completed. Everything must be done before October 1 of the current year. There is no need to renew anything annually, compensation can be used indefinitely, documentation only needs to be submitted once. A new package of documents will only be required if a person makes his decision and again wants to receive benefits instead of monetary compensation due to changed circumstances.

How to receive a cash payment

It takes 10 working days to make a decision on assigning the monetary equivalent of social assistance. The period is counted from the moment of registration of the application. Pension Fund specialists are given another 5 days to inform the applicant about the decision.

Cash compensation for medicines to pensioners is made simultaneously with pension payments and in the same way as the pension is paid. If a person is kept in a social institution, then compensation can be transferred to the account of this institution.

The amount of monetary compensation for a social package for a disabled person

The cost of services included in the social package in 2020 is 1086 rubles 64 kopecks. Of these: medicines in the amount of 837 rubles, sanatorium treatment in the amount of 129 rubles 47 kopecks and travel in the amount of 120 rubles 19 kopecks.

This does not mean that you will only be given medicines worth 837 rubles, no. If you vitally need expensive drugs, they will provide you with them. This means that if you basically don’t need medications, you can receive 837 rubles into your account every month. The same applies to other services. Travel by train to the place of treatment will cost 3-10 thousand, but if you don’t need to go anywhere, you can receive 120 rubles and kopecks every month.

Compensation for expenses incurred

If a disabled person purchases some medicines with his own money, if they are entitled to them, but were not available in the pharmacy, he has the right to receive compensation for them (according to Order of the Ministry of Health No. 57 of January 31, 2011).

To do this, you need to visit the Pension Fund, having in hand:

- passport,

- medical policy,

- individual rehabilitation program,

- preferential prescription,

- receipts indicating the name of the medicine, its price, date of purchase, name of the pharmacy chain.

People with disabilities often wait for several years to receive the necessary technical means provided for by their rehabilitation program. If a beneficiary can purchase the product he needs himself, he has the right to compensation from the state.

It is worth considering two important nuances:

- Compensation is due only for the rehabilitation aid that is provided for in the rehabilitation program.

- The state pays only the compensation amount that is prescribed in the Law and established for a specific subject of the Russian Federation. So if a beneficiary has purchased some super modern and very expensive thing (for example, an automatic wheelchair), you should not expect that the state will fully reimburse its cost. They will pay as much as the cheapest regular wheelchair costs without any bells and whistles.

You can find out more about prices and compensation on the FSS website.

Changes in the amount of compensation for medicines for disabled people

Medicines are constantly becoming more expensive, which is why compensation for them to disabled people is regularly increasing. Indexation occurs annually, and the material expression of the NSO increases from February 1.

How to get money back for medicines

Before making a decision to refuse to receive preferential medications, you should carefully weigh the pros and cons. The benefit in kind is subject to restoration only after a year.

Be sure to read it! Repairs in the entrance of an apartment building: whose responsibility is it - the management company or the residents?

It is important to clarify how to return money for medicines to pensioners. There is also a procedure for obtaining a tax deduction for medical expenses. The concept of medical services includes not only therapeutic measures, but also the purchase of pharmaceutical drugs. The main condition for receiving a deduction is completing a course of treatment.

You can receive a deduction (partial reimbursement of expenses) after the end of the year in which medical services were provided. The maximum amount of expenses for which a refund of 13% of expenses is made is 120,000 rubles per year. Based on the maximum amount, the deduction will be 15,600 rubles.

The procedure for obtaining a deduction for medical services is the same as for refunds on other taxes:

- an application is submitted to the tax authority;

- a 3-NDFL declaration is drawn up;

- Documents confirming treatment costs are attached.

However, tax deductions are only available to those individuals who pay personal income tax. If a pensioner does not work, does not receive dividends, or has no other income that is subject to personal income tax, then he is not entitled to deductions.

Measures to support pensioners in the Krasnodar region in 2020

Error 1. Sum up transport tax benefits when owning several technical equipment. The pensioner must choose one of them to receive the benefit - exemption from the mandatory fee in the amount approved by the regional regulatory act, depending on the engine power and age of the person applying to the institution.

To receive a deduction, you need to contact the INFS at your place of residence with a completed declaration, attached documentation for the apartment, and an application for a deduction in the amount of 13% of the amount spent, but not more than 300 thousand rubles. in case of spending from own funds, 390 thousand rubles. - when buying with a mortgage.

Is it worth abandoning the state? privileges

Many disabled people sign up to waive the disability benefits package, preferring to receive money monthly. It is reserved for those categories of people who need to receive expensive medications, use public transport to travel to various examinations, and undergo treatment in a sanatorium. If your health has deteriorated and a more serious disability group has been assigned after the MSEC, it will be possible to return benefits.

Is it worth giving up free medicines in favor of compensation?

In some cases, it is better for a person not to replace the benefits provided by the state with monetary compensation. This applies to disabled people who need expensive medications and regular sanatorium treatment. Each region creates its own list of medical and health institutions to which beneficiaries can apply for a voucher. But the institution must be specialized in the human disease. An adult can be treated for 18 days, a child – 21 days (no less). For diseases related to mental health, brain, and spinal cord, the period of sanatorium care is increased to 42 days (minimum).

You should carefully compare all the facts and think about whether it is worth refusing this category of services if the patient requires an annual stay in a sanatorium. The amount of compensation is not so high, for a year it will be a little more than 2,000 rubles, and it is impossible to purchase a voucher on your own without a significant additional payment. If there is no need to visit a sanatorium, you can refuse this benefit. The same applies to medications. If you refuse medications due to disability, you should think about the fact that some expensive drugs simply cannot be purchased with monetary compensation. And others cannot be obtained in pharmacies.

It must be remembered that the monetization of benefits does not apply to the accompanying person. That is, if a disabled person requires the constant presence of a stranger who helps him move, accompanies him to the place of treatment, he has the right to a number of benefits, such as free or discounted travel with his ward. When monetizing, all benefits of the accompanying person are not compensated.

Some people are not interested in the monetization of the social package, but in the question of whether it is possible to refuse disability. For example, if a child has been diagnosed with schizophrenia (psychiatry), but upon reaching the age of 18, no manifestations of the disease have appeared for a long time, and because of the diagnosis, the young person’s path to universities and a good job is closed. In this case, you can write a statement to VTEK. If it is proven that his state of health allows him to exist normally in society, the disability will be removed. Accordingly, the social package is also liquidated.

The social package is an important help for citizens in need. It is especially relevant for those who need expensive medications, regular spa treatment, and provision of technical equipment. But there are beneficiaries for whom it is more profitable to receive at least small cash payments in exchange for guaranteed benefits. Before refusing a disability benefit, you need to think it over carefully and analyze your health status in order to make the right decision.

What federal and regional benefits are available to pensioners in 2020?

- For example, if you had the right as a pensioner and as a labor veteran to a 50% discount when paying for housing and communal services, you could not apply for a 100% discount.

- To begin with, it should be made clear that the state takes care of large families, since they significantly improve the demographic situation in the country.

- In this regard, they are entitled to some benefits that are not available to other families.

- The size and direction of the benefit is determined at the federal level.

- But, besides them, local governments also have the right to create additional bonuses for large families, depending on the demographic situation in a particular region.

- It is very noteworthy that local authorities do not have the right to cancel federal benefits, but can only add some others to them.

- A large family is considered to be that unit of society where three or more children are raised, none of whom have yet reached the age of 18.

- Moreover, the children can be either their own or adopted.

- Separately, it should be noted that there are some cases when a family in which one or more children have crossed the 18-year-old threshold has the status of a large family.

- So, for example, if a family, in addition to the status of having many children, is also considered low-income, and one or more children have reached the age of majority, but are studying full-time at a vocational school or university, this status will not be taken away from the family, up to the age of 23 child's age.

- But at the same time, the child must live in the same living space with his parents.

- Thus, the government believes that a child studying full-time cannot yet support himself.

- We should not forget that a large family also has the right to receive low-income status.

They will return money for real estate no more than 2 million rubles. There is a loophole: you can get more if the apartment or house is purchased with a mortgage. Then, in addition to the deduction for the living space itself, it is possible to claim a benefit for the interest paid on the mortgage loan. But only up to 3 million rubles.

The most popular questions and answers regarding waiver of benefits

Question : I am a victim of the Chernobyl accident and have a disability. I receive a pension and have been disabled for several years now. From a friend of a Chernobyl survivor I learned that he is paid two EDVs at once . Is it possible? On the Pension Fund of Russia website it is written that if there are two grounds, one is selected.

Answer : The information presented on the official portal of the Pension Fund is correct. But it contains no exceptions to the basic rule. In your case, this exception comes from Federal Law No. 1244-1 , which talks about the social protection of victims of radioactive emissions. According to it, you, as a Chernobyl survivor, have the right to a monthly payment even if there is another reason for receiving it (in your case, it is a disability).

We recommend that you contact the Pension Fund for clarification of the lack of a second payment. You may need to present documents confirming your status as a Chernobyl survivor.

According to the law, EDV is paid from the moment the right to it arises. That is, you have the right to demand payments from the Pension Fund for all missed deadlines.

Answers to frequently asked questions

Question No. 1: A citizen of the Russian Federation (lives in the Oryol region), applied for an early retirement pension. Is he entitled to receive a single social travel card?

In the Oryol region, this issue is resolved in relation to the norms of the regional government Decree No. 365 of October 18, 2010 (current edition of 2020). According to this legal act, the ESPB was introduced in the region from the beginning of May 2015. At that time, its cost was 350 rubles.

Today (this also applies to 2020), a social travel pass is issued to a preferential category of citizens, which is noted in this Resolution. All beneficiaries receive social support from the Oryol region. These also include people who receive their pension early. Therefore, they are also entitled to ESPB.

Question No. 2: Is it possible for a beneficiary to receive cash compensation in exchange for the ESPB?

No, regional legislation does not provide for such a possibility. The social travel card reduces the actual cost of travel several times. This is its main purpose. Paying a reduced fare does not justify itself in itself.