NPF "Khanty-Mansiysk" - personal account

| Profitability: | 4,04 % |

| Assets: | 31678982.10064 thousand rubles. |

| Reliability: | A+ |

| Official site: | www.hmnpf.ru |

| Personal Area: | Login to your personal account |

| Telephone: | 8 |

Today, the spread of joint stock companies is becoming very popular, which provide the opportunity to invest your personal funds or savings to receive additional profit on top of your basic pension. Today we will look at the example of a non-state pension fund of the city of Khanty-Mansiysk.

It is worth noting right away the fact that it was created exclusively for people of retirement age and with the aim of providing them with additional income. The fund was created in 1995 and to this day is one of the most reliable on the market. In 2020, according to official data, it ranked high in issuing pension benefits among senior citizens.

KHMNPF - twice “reliable MMM”

According to Oleg Kiselev, chairman of the board of trustees of the NPF Renaissance Life and Pensions, in this case the court’s decision was due to the weakness of the plaintiff’s arguments. And now, it would seem, a new leadership has arrived... Well, then you know for yourself - about how and what the new broom sweeps. In our previous publication, we wrote about the FSFM’s negative assessment of the Fund’s development trends, based on an analysis of its pension savings and reserves. And we ended our study with the words “it will happen again.” An interested reader has the opportunity to either reproach us for exaggerating and excessive pessimism, or be convinced that we are right. After all, the management of KhMNPF reports “significant successes”: the first fund in the Urals Federal District, one of the top ten in the country as a whole, a leader in accumulated profitability over eight years, etc. Here, again, we must give credit to the new leaders of the KhMNPF for their ability to manipulate numbers and people. Previously, they would have simply been embarrassed to average indicators to the level of the Urals Federal District. In the mid-2000s, the Khanty-Mansiysk non-state was in the first positions in Russia as a whole. But this is not where the cynicism of the new leadership lies. He is trying to use average data for 8 or more years in profitability indicators, i.e. include the period of work of the previous leadership, which was declared “ineffective” by the newcomers. I remember that Lenya Golubkov in the MMM advertisement also drew very convincing graphics - boots, a fur coat, an excavator! But let’s not argue with Lenya, and let’s turn to the opinion of experts.

The current president of the KhM NPF is written and spoken of as a super-class specialist, despite his relative youth. Why - a graduate of the Financial Academy under the Government of the Russian Federation, studied abroad several times and both times in London - received an MBA degree from the London Business School, and then another diploma with “distinction” from the London School of Economics and Political Science! By the way, it should be noted that Lenya Golubkov also went abroad to gain experience, but even in the MMM advertisement he did it with his hard-earned money, but Alexey Okhlopkov’s education is paid for by the Foundation’s clients, because the payment for his education abroad is the same is provided for by his employment contract, and these trips are paid for as business trips of the president - consider that from the same funds of the investors. And with such and such qualifications of Alexey Anatolyevich - such “effective”, let’s say delicately, management of the pension fund of Khanty-Mansiysk. What is the cost of just the decision to liquidate the Foundation’s branch in Moscow? It is known that the presence of a company in the capital is equivalent, in terms of the possibility of increasing the number of clients, to a presence in at least 30 regions of Russia. What kind of concern for cost reduction could have dictated this “strategic decision”? Even a non-specialist understands that a pension fund is a clearly defined “client business,” as they say. In this business, reputation and customer trust in the operator are the basis! And the current leadership of the KhM NPF was essentially killing the Fund’s reputation. We believe that this was the main reason for the sharp outflow of clients in 2010.

This is interesting: How to Find out Housing and Utilities Debts by Vdres Ekb

Official website of NPF "Khanty-Mansiysk"

The above pension fund has its own official website, which provides all the detailed information. In this article we will briefly talk about this site and what type of information can be found on it.

There are two types of insurance - compulsory and voluntary. Unlike the first, the second is optional and often this type of insurance is offered by non-governmental organizations. It is worth noting that the profit from voluntary insurance is significantly higher than from compulsory insurance. In order to become a participant, you should prepare a list of all required documents and write an application to join the fund.

Now let's look at the most important points in the fund section - profitability and reliability rating.

Profitability

Profitability – the percentage of income of investors is 4.04%. This guarantees you decent earnings and constant additional income from your investments.

Reliability rating

Reliability rating - this rating shows the level of reliability and stability of the profit growth of your deposits. Before investing in any fund, you should carefully read its rating. The Khanty-Mansiysk pension fund has a rating of A+, which implies a very reliable and high level of profitability.

NPF Khanty-Mansiysk - Non-state pension fund

Everyone who is employed in budget-type organizations now has the opportunity to become recipients of an additional pension in old age by transferring a certain amount every thirty days. Moreover, their employers deposit the same amount into the account of the profitable Khanty-Mansiysk Fund.

The new trend of the present century - providing yourself with an additional pension - is now gaining rapid momentum. The majority of working citizens of the Russian Federation, worried about their future, strive to find the most reliable investment options that would pay off in their old age.

How to join?

If you are interested in the presented pension fund and you decide to become a member, then in order to do this, you must complete several simple tasks:

- Contact one of the available fund sales offices, provide all the necessary documents and leave an application.

- Use the official website, where you can also download the required documents and fill out an application.

- Register on the website, go to your personal account and fill out an application to join the fund there.

Non-state pension fund Khanty-Mansiysk, reviews in Yekaterinburg

There are no reviews for today. If you have something to tell about “Khanty-Mansiysky”, then please leave your opinion below, even if your review is negative. We do not remove negative reviews without reason. We stand for honesty and integrity in business! Learn more about review moderation. No registration required!

I got into an accident involving 3 cars, completely by accident. I had to deal with insurance companies before, but this time the insurance company refused to pay the due money. I contacted Sverdlovsk Legal Assistance Center LLC and the company’s lawyers helped me file a claim. I was paid within a week, thank you!

10 Jun 2020 lawurist7 134

Share this post

- Related Posts

- Instructions for Filling out 3 Personal Income Tax for 2020 When Selling an Apartment

- Can a Labor Veteran Refuse Free Prosthetics and Take Money?

- Indexation of Pensions in 2020 for Non-Working Pensioners

- What are the benefits for young families in Omsk?

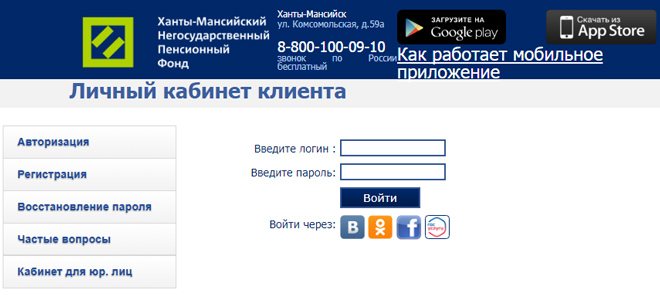

Personal Area

Like any other site, there is a personal account. It provides information about you and the transactions and payments performed since registering on the site. This is very convenient, since you always have the opportunity to find this or that information regarding transactions and the savings part.

Possibilities

A large selection of services is offered. To do this, you need to register and start using the available services. Check your savings balance, investment amounts, frequency of contributions and more.

How to find out your savings?

To find out what the amount of accumulated investments and savings is, you simply need to log into your personal account by typing your login and password, and go to the desired tab, where all the necessary information is presented. You can use your personal account and log into it whenever you want and constantly check and monitor ongoing transfers and contributions.

Login to Personal Pension Account

1. General Provisions

1.1. The National Non-State Pension Fund (hereinafter referred to as the Fund) offers the Internet User to use the Fund’s website www.nnpf.ru (hereinafter referred to as the Site) and the site’s services under the conditions set out in this User Agreement. 1.2. The User Agreement is mandatory for all users of the Site and Site services. 1.3. The User Agreement comes into force from the moment the User expresses consent to all its terms, without any reservations or exceptions, and is valid for the entire time of using the site’s services. 1.4. If the User disagrees with any of the terms of the User Agreement, the User does not have the right to use the services of the Site. 1.5. The Foundation reserves the right to make changes and additions to the User Agreement at any time. 1.6. The Foundation is not obliged to notify Users in advance of changes and additions to the User Agreement and/or obtain the consent of Users. 1.7. Changes and additions to the User Agreement come into force from the moment they are posted on the Foundation’s website, unless otherwise provided by the User Agreement. 1.8. If the User does not agree with the changes and additions made to the User Agreement, the User is obliged to stop using the services of the Site. 1.9. The posting of reference materials and information, document forms and samples of their completion on the website is carried out in order to increase the level of pension literacy of the User and does not constitute an offer.

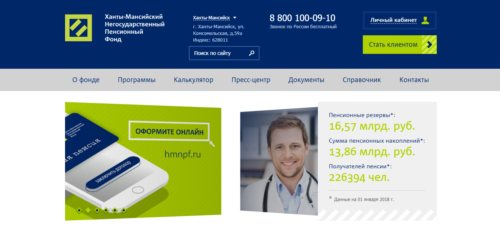

Website of NPF Khanty-Mansiysk

The resource is located at the following address: www.hmnpf.ru. The official website provides information about the history of the fund's development; there is a pension calculator that allows you to calculate the size of your future pension and the approximate amount of monthly contributions.

The resource is also equipped with a directory that helps raise the level of pension literacy of the population; the main page presents programs implemented by the organization. A plus is the fact that the organization has a mobile application available for Android and iOS platforms.

Features of cooperation with NPF "Khanty-Mansiysk"

NPF Khanty-Mansiysk has a huge number of depositors, the number of which even exceeds 200 thousand people. Reviews about NPF Khanty-Mansiysk are only enthusiastic and positive, so this organization attracts the attention of a huge number of people who are looking for a fund to invest their pension savings.

In 2012, NPF Khanty-Mansiysk was considered one of the largest funds in the Russian Federation, and the profitability even exceeded 27%. At the same time, the organization offers its investors the opportunity to use a unique co-financing program, with the help of which their future pension will significantly increase. Under this program, the depositor and the state deposit a certain amount of money into the account of the insured person, and the duration of these deposits can be very different, and the amount of money deposited varies depending on the chosen program. Typically, these contributions are paid in a manner that is convenient for the investor, so they can be paid monthly, quarterly or annually.

Reliability rating of NPF Khanty-Mansiysk

In 2009, the RA expert gave the fund an A++ level, which corresponds to the highest degree of reliability. Organizational changes in 2012 led to the fact that the NPF did not provide information for the rating and the current rating was suspended.

The following year the company was rated at A, followed by an upgrade to A+, which remained until 2020.

According to the new assessment methodology, the company received a level of ruA- (not downgraded!), which indicates a high level of reliability and a stable forecast.

NPF Khanty-Mansiysk - Non-State Pension Fund - reviews

At the end of 2011, the fund ranks first in the Ural Federal District in terms of its main indicators, as well as 5th place in the Russian Federation in terms of the size of pension reserves (16,198,651 thousand rubles) and 7th in terms of the size of its own property (22 476,231 thousand rubles). 221,207 people, more than 170 thousand people, participate in the fund's programs. receive a lifetime pension. According to the Expert RA rating agency, the fund has been assigned the highest reliability rating - A++.

At the end of 2012, the NPF consolidated its position among the largest funds, took first place in the Ural region and second in Russia in terms of accumulated return for the last 3 years, which is 26.9%.

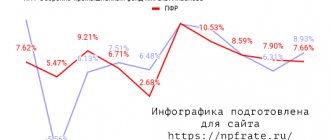

Profitability of the Khanty-Mansiysk fund

A big jump in the income indicator was made in 2009, then it amounted to 23.29%. In the same year, the Pension Fund's income stopped at 9.52%. In the next couple of years, a decline was noticeable, and until 2020, the Pension Fund of Russia was ahead of the Khanty-Mansiysk NPF in this indicator.

That year, the return was 15.84% and exceeded the 1.34% performance of the state fund. Data for the last two years have not yet been provided, but the website says that the amount of pension savings has almost reached 14 billion rubles, and pension reserves amount to 16.57 billion rubles.

City life

O is part of the trust management business of the Gazprombank group. Earlier in a TV interview, the president of the Khanty-Mansiysk NPF, Alexey Okhlopkov, noted that the fund intends to change management companies and has already withdrawn assets from the previous ones. “The task is to come to a completely understandable and transparent mechanism for investing and assessing the value of assets so that the government and our investors can at any time, simply by visiting our website, see the structure of the portfolio and understand how much it is worth. We plan that in the first quarter of 2011 we will complete this work and reach a transparent state,” noted Alexey Okhlopkov.

This is interesting: Length of Service for Teachers in Russia 2020

there was no mistake because there was no financial consideration on your part. I just thought that such moments need to be approached financially logically. many still believe that even our stock market is a pyramid like MMM.

Procedure for registration and termination of an agreement with the fund

You can conclude an agreement at any nearest office of the company. You can first fill out an application for the transfer of funds from the Pension Fund of the Russian Federation or another non-state fund directly on the website.

The procedure involves several steps - entering contact information, clarifying the address, providing the system with personal data, confirming information. Important! You can conclude an agreement in the office only if you have a SNILS number and a passport.

The conditions for termination of the contract are specified in the document itself. The client has the right to terminate the contract at his own discretion, for which a written application is submitted to the fund.

The paper must indicate how the fund will use the available funds - transfer it to another NPF (or Pension Fund), transfer it to an account. In the latter case, part of the annual income will be lost, and you will also have to pay 13% tax on the income received.

Personal account of NPF Khanty-Mansiysk – registration and login

Registration in the service is available to every client of the fund. The official website provides a special form. In addition, since 2016, it has become possible to log into your personal account through social networks. The corresponding icon is now next to the login button.

Your personal account makes it possible to monitor your account status, top it up using a card from any bank, send scans of documents to the fund, follow news and receive timely advice online.

The Central Bank did not allow the Khanty-Mansiysk Non-State Pension Fund into the savings guarantee system

The regulator did not like the massive investments in housing construction

Photo: RIA URA.Ru

The Central Bank did not allow the Khanty-Mansiysk Pension Fund, whose shareholder is the government of the Khanty-Mansi Autonomous Okrug, into the guarantee system. Vedomosti was informed about this by two counterparties of the fund and confirmed by a person close to the regulator. The reason is investments in real estate, which the Khanty-Mansiysk Non-State Pension Fund was interested in even before the last crisis and suffered losses in 2009, says one of the fund’s counterparties.

Khanty-Mansiysk Non-State Pension Fund is in the top 25. The fund implements district pension programs for additional pension provision “Two pensions for state employees” and “Ugra Pension Standard” and is the largest investor in regional housing construction. The fund's board of trustees is headed by Governor Natalya Komarova. The fund began preparing for entry into the guarantee system in advance - it was incorporated last summer and submitted an application to the Central Bank.

“The Central Bank’s inspection of the fund took two months, but based on its results a negative decision was made,” Vedomosti quotes the counterparty of the Khanty-Mansiysk Non-State Pension Fund and a pension consultant, who knows this from a Central Bank employee. According to them, inspectors from the Central Bank did not like how the fund placed funds from private and corporate pensions (pension reserves) - most of it was invested in shares of closed real estate mutual funds, the book value of which was inflated by about 4 billion rubles.

“Several months ago, the fund applied to the Central Bank with the aim of joining the guarantee system, the Central Bank has not yet made a decision on accepting the fund,” admits Elena Shumakova, a representative of the governor of the Khanty-Mansiysk Autonomous Okrug. According to her, the regulator “expressed concern about a significant share of pension reserves invested in housing construction in the Autonomous Okrug,” but at the same time “expressed complete satisfaction with the quality of the assets in which pension savings were invested.”

In 2007, the Khanty-Mansiysk Non-State Pension Fund was the first in the pension market to begin large-scale investments in housing construction in the cities of the region - hundreds of thousands of square meters of housing, “entire blocks” of housing were launched, the fund manager recalls. These projects were financed from pension reserves - the regulator allows them to be invested much more liberally than savings. Investments were structured mainly through closed-end real estate mutual funds. During the 2008 crisis, a number of construction projects came to a standstill, the management of the fund announced that there was a 5 billion ruble hole in its property, and began to sue its management companies.

Customer reviews of NPF Khanty-Mansiysk

In general, clients speak positively about the fund's activities. The professionalism of the staff, ease of use of the site, and the availability of a mobile application are noted. Regional attachment turns out to be a disadvantage for some; for local citizens, it only benefits them.

Among the reviews there are those that talk about the fund’s low profitability. This picture is not excluded by the organization itself, since its activities are tied to the economic situation in the country, therefore, profitability may change.

For 23 years now, JSC NPF Khanty-Mansiysk has been successfully operating in the field of pension provision. The reliability is evidenced by the numbers - the number of pension recipients in the fund, according to information from the official website, has already exceeded 220 thousand people.

Addresses and telephones

The central office of the fund is located in the city of Khanty-Mansiysk at the address: st.

Komsomolskaya, 59a. The company has 5 branches (in the cities of Nizhnevartovsk, Tyumen, Surgut, Nefteyugansk, Chelyabinsk) and 10 representative offices. The location of a specific unit can be found on the company’s website or by calling the hotline 8-800-100-09-10 (the call is free in Russia). The organization’s employees will answer questions about the fund’s activities and help resolve the problem.

Online registration

This is the easiest way to register from anywhere in the world. The main thing is to have access to the Internet.

- Go to “Personal Account”. If you are not yet registered in your “Personal Account”, go through this procedure.

- Go to the section “Recipients of additional pension”.

- Click "Add Client" and enter your details.

- The next re-registration date is indicated next to your account. If there is less than a month left until the date, the “Re-registration” button will be active

- Click “Re-registration” and fill out the fields that appear.

- If the “Application successfully submitted” window appears, it means that the procedure was completed successfully.

- When your application is processed (this can happen within 1-7 days), you will see the next registration date in the “Recipients of an additional pension” - “Accounts” section next to your account.

- The “Re-registration” button will be active again one month before the next registration date.