general information

The Alpine Republic received another title to its treasury. The Swiss pension system was included in the top 10 best pension systems in the world according to the latest Melbourne Mercer Global Pension Index-2017 study.

The Confederation took 8th place when a total of 30 countries among developed countries took part in the ranking.

All pension systems were assessed according to criteria such as proportionality, completeness and sustainability of development.

In addition to government guarantees, experts also assessed the role of private insurance.

At the top, but not like before

The Alpine Republic received another title to its treasury. The Swiss pension system was included in the top 10 best pension systems in the world according to the Melbourne Mercer Global Pension Index-2017 study.

The Confederation took 8th place. In total, 30 developed countries took part in the rating. All pension systems were assessed according to criteria such as proportionality, completeness and sustainability of development. In addition to government guarantees, experts also assessed the role of private insurance.

Due to the downward trend, Switzerland's current position cannot be called winning. In 2020, the Alpine Republic was in 6th place. In 2020 – in 4th place. What is the reason for this trend?

According to the study's authors, the growing life expectancy of the Swiss, combined with a constant retirement age, is leading to an increase in pension payments. This factor negatively affects the sustainable development of the Swiss pension system.

Features of the Swiss pension system

In 1972, a referendum was held in Switzerland, as a result of which it was decided to introduce a three-tier pension system, which is currently in force. Its basis is Säulen, which translated means “supports”, “columns”.

- First column "AHV".

This is the main component of the pension system, which is represented by mandatory state basic insurance. According to the law “On Old Age and Survivor Insurance”, its fund is formed jointly by the state and the insured residents.

The amount of payments at this level is determined depending on the length of service and average annual income in the course of work. The Swiss contribute from 1175 to 2350 francs to this fund monthly.

The main task of this level of the pension system is to provide a living wage to a citizen with:

- retirement due to age;

- loss of a breadwinner;

- loss of ability to work;

- the need for additional social support.

The maximum possible payments under this program can be received if two conditions are met:

- have a work experience of 45 years for men and 44 years for women;

- have an average annual income of at least 84,600 francs, which in Switzerland can only be obtained in highly paid jobs.

Meeting these conditions is problematic. Of the total number of Swiss pensioners, 28% of men and 15% of women receive the maximum in the first column.

The state pension paid under the AHV is considered by the Swiss to be insufficient to ensure a decent standard of living, so they take part in other pension programs.

- Second column "BVG".

BVG is a column representing the funded part of pensions. All able-bodied residents with an income of more than 21,150 francs/year can participate in this program. All issues related to its functioning are regulated in the Law “On Professional Insurance”. The purpose of the column is to ensure the usual quality of life after retirement.

The fund for this level of the pension system is formed individually according to labor insurance programs from contributions from the employer and employee. Contributions under this regime are required to be paid by hired workers. Self-employed people make payments on a voluntary basis.

Column payments depend on coefficients set annually by the Swiss government. In 2020, the conversion rate was 6.8% of the total amount of funds accumulated in the column account. There is a tendency towards its gradual reduction to a rate of 6%.

You can calculate how much a funded pension is in Switzerland using the formula:

Where:

P – pension per month, francs;

0.06 – annual conversion factor, fraction of units.

12 is the number of months in a year.

There are a number of situations where a pensioner can receive the full amount accumulated under the BVG:

- buying a property;

- organization of private business;

- mortgage loan repayment;

- immigration to another country;

- disability.

- Third column “Individual pension savings”

Participation in programs at this level is voluntary. In Switzerland, private investment funds have been created that offer investors various savings programs. The main task of the column is to create additional financial opportunities for the pensioner, allowing him to lead his usual “pre-retirement” lifestyle.

Individual pension insurance is divided into two levels:

- 3a – target pension fund, formed from tax payments on the income of individuals; especially relevant for self-employed people who are not required to make payments in the second column;

- 3b – free private pension funds, the capital of which is formed by investing payments made by participants.

Pension income from individual savings programs can be significant and depends only on the size of the contribution and the features of its investment.

The market for products offered for this column includes banks, insurance corporations and small private companies. Responsibility for the security of deposits lies entirely with their administrations, and not with the state.

Swiss pension system

The Swiss pension system is classified as multi-tier, which allows citizens, if they wish, to increase the amount of payments received after retirement.

The pension insurance system has 3 levels:

- The regime established at the state level includes payments for old age, loss of a breadwinner or disability. It is a mandatory state program, the amount of payments for which is tied to length of service and average annual income during employment.

- An additional level is required for working pensioners. This program is represented by the funded part of the pension, in which all able-bodied citizens whose annual income exceeds 21,150 francs participate.

- Individual. This level of the pension system is completely voluntary and is represented by various private investment funds. Products designed for pensioners are offered by both large insurance companies, banks, and small organizations.

The state bears full responsibility only for providing pensioners with the first level, so that an elderly person is not left without a means of subsistence. In order for the pension amount to suit older people, they themselves must make a choice in which levels of the system to join.

First pension level

The corresponding pension system consists of 3 levels. The first level is the mandatory state system of “Old Age and Survivor Insurance” AHV. The pension in Switzerland under this system is calculated based on length of service and average annual income. At the moment, the minimum pension is 1,175 francs, the maximum is 2,350 francs per month. However, getting the maximum pension is not so easy.

This requires a continuous work experience of 45 years for men and 44 years for women. In addition, the average income should be at least 84,600 francs per year - a decent amount even for Swiss salaries. In Switzerland, 28% of working-age men and 13% of women receive the maximum pension. If we are talking about a pension for a married couple, then it is a maximum of 3,525 francs per month, subject to the same conditions regarding length of service and income. Contributions to the pension fund in the amount of 5.125% of wages are paid equally by the employer and employee.

Second pension level

This support has been in effect since 1985 - compulsory insurance of a person for the period of working activity, and is a funded (BVG) part of the pension. The goal is that the benefit amount should be at least 60% of the salary. Transfer 7-18% of income to savings banks chosen by the employer.

Interesting information from BBQcash: When changing jobs, a person transfers his savings independently.

All citizens are required to pay contributions if:

- over 17 years old;

- annual income is more than 21.3 thousand francs.

Self-employed people, people earning less than the required amount, individual entrepreneurs are not required to pay, only if they wish. For them there is the following - 3 support.

Important from BBQcash: a citizen in old age receives 6.8% from his savings.

This level is added to the previous one, significantly increasing the benefit amount. A person can receive all the savings in full if:

- buys a home;

- creates a business;

- pays off the mortgage;

- moves for permanent residence abroad;

- receives disability benefits.

Be sure to read it! Alimony from a military personnel pension: is it collected in 2020?

In 2020, there were changes related to the savings of spouses - after a divorce, they are divided in half.

Third pension level

Voluntary level or self-insurance - the principle of operation is similar to other countries. There are two types:

- Target - formed from tax deductions. Contributions can reduce the current base - by a maximum of 34.1 thousand francs for individual entrepreneurs, for others - 6.8.

- Free - voluntary payments to private funds, banks or insurance companies.

No tax is paid on interest received.

Useful information from BBQcash: transition to official work for the self-employed - it is possible to transfer savings to the previous level.

You can use your savings after reaching a certain age. There are many investment products offered with favorable conditions. Responsibility for funds lies with the foundations, not the state. They are known throughout the world for their reliability. The amount paid depends on the amount of savings.

First pension level

The corresponding pension system consists of 3 levels. The first level is the mandatory state system of “Old Age and Survivor Insurance” AHV. The pension in Switzerland under this system is calculated based on length of service and average annual income. At the moment, the minimum pension is 1,175 francs, the maximum is 2,350 francs per month. However, getting the maximum pension is not so easy. This requires a continuous work experience of 45 years for men and 44 years for women. In addition, the average income should be at least 84,600 francs per year - a decent amount even for Swiss salaries. In Switzerland, 28% of working-age men and 13% of women receive the maximum pension. If we are talking about a pension for a married couple, then it is a maximum of 3,525 francs per month, subject to the same conditions regarding length of service and income. Contributions to the pension fund in the amount of 5.125% of wages are paid equally by the employer and employee.

Retirement age in Switzerland

The retirement age in Switzerland today is 64 years for women and 65 years for men. By 2020, it is planned to equalize this age to 65 years for everyone. Retirement is possible before reaching this age, but not earlier than 62 for women and 63 for men. In this case, the pension amount will, of course, be smaller. The economic industry association Economiesuisse and the Swiss Employers' Association have proposed a stepwise increase in the retirement age to 67 years. But this idea has not yet found a response either in the parliament or in the Swiss government.

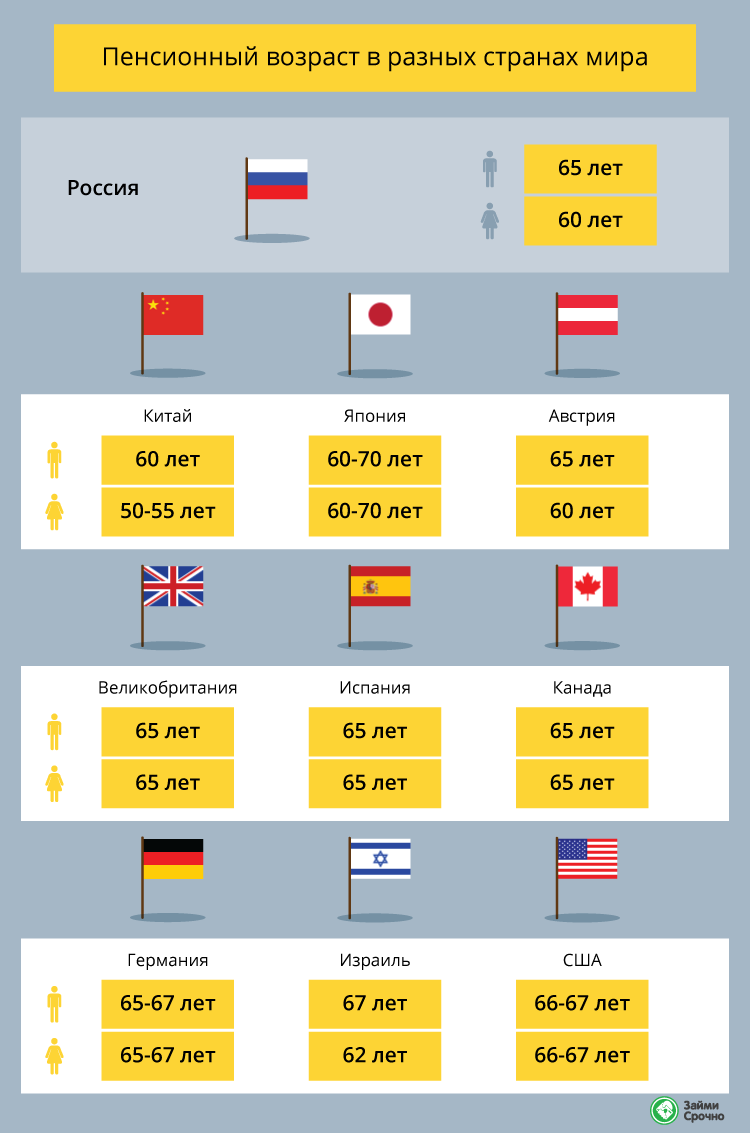

Situation by country

At what age do residents of different countries of the world begin to receive pensions? In general, as the analysis shows, many developed countries begin to make payments to citizens only after their age limit exceeds 60-65 years. In other words, the level to which Russia is just moving has long been the norm in the developed countries of the world.

At the same time, of course, each country has its own characteristics. For example, in Switzerland, by 2020 they want to make women and men equal by sending them to retirement at the age of 65. Before this, the weaker sex could count on benefits from the age of 64. At the same time, citizens have the opportunity to go on a well-deserved rest from the age of 58, however, in this case, the amount of payment will be less than that of those who began to receive benefits within the prescribed period.

A similar situation is observed in Japan. Citizens of the Land of the Rising Sun can retire from the age of 60, but only those who postponed their application for a pension until the age of 65 will receive good money. But, apparently, this provision will be rewritten in the coming years. The country is experiencing a serious demographic problem, so it is possible that the retirement age will exceed the level of 70 years.

In the UK you can currently receive pension payments after age 65, but this could increase to age 68 in the next 30 years. At least there are such plans. Whether they will be implemented or not, no one knows. Everything depends on various factors, including those related to the politics and economic development of the country.

Table of retirement ages in different countries of the world

| A country | Retirement age for men, years | Retirement age for women, years |

| Austria | 65 | 60 |

| Belgium | 65 | 65 |

| Great Britain | 65 | 65 |

| Germany | 65-67 | 65-67 |

| Israel | 67 | 62 |

| Spain | 65 | 65 |

| Canada | 65 | 65 |

| China | 60 | 50-55 |

| USA | 66-67 | 66-67 |

| Japan | 60-70 | 60-70 |

Pension amount in Switzerland

The amount of the benefit is the sum of payments for all three pillars, which can reach 60-80% of the last earnings. Sometimes it reaches 6,000 francs per month, which is enough to ensure a comfortable life. This amount is most likely the exception rather than the rule—more often people receive less benefits.

Minimum pension in Switzerland

The minimum size is guaranteed by the first column. From 2020, payments of no less than 1185 and no more than 2370 francs per month. In 2020 they were slightly lower (10 and 20). 45 years of experience - 1200 benefits. For spouses, another calculation - 150% of the arithmetic average of their pensions, but not more than 3.5 thousand francs. These are small amounts by Swiss standards.

Average pension in Switzerland

The average amount in 2020 is 4 thousand francs, which is equal to the minimum wage. This is quite a small amount.

Pension in Switzerland in rubles - from 77 to 260 thousand and above.

Important from BBQcash: when prices and average salaries change, benefits are indexed.

There is no special widow's pension or inheritance of spousal benefits. Can apply for survivor's benefits if living in Switzerland.

The financial well-being of the elderly ensures:

- developed economy;

- state attention to social issues;

- reasonable pension system.

Retirement allows citizens to be happy by changing their lives. They travel and spend more time doing their favorite hobbies.

What will we get from raising the bar?

Many citizens often compare the level of pensions in Russia and in developed countries of the world. Indeed, from this point of view, there is a serious disproportion in the amount of payments. If in Russia today the average pension is 14 thousand rubles, then in developed European countries the size of the pension benefit in terms of Russian currency can reach 100-120 thousand rubles.

Raising the age will slightly reduce this imbalance, although there is no talk of a complete reduction in the difference. According to officials' forecasts, in the next 5 years Russians will be able to receive a pension of 20 thousand rubles. Read about what type of pension is available to individual entrepreneurs in our material “Pension for individual entrepreneurs. What affects the size?

This jump will occur due to a reduction in the burden on the pension system. If potential pensioners, instead of retiring, now continue to work for the good of the country, then more funds will flow into the budget and less will be spent. Due to this, funds will begin to appear to increase payments to existing pensioners.

Capital repayment

In certain cases, BVG pension capital in Switzerland can be paid out in full at once. This is possible in the case of purchasing real estate, to pay off a mortgage loan, in case of starting your own business, when leaving Switzerland for permanent residence abroad, as well as when receiving a disability pension. At the same time, the main task of the second level of pension, together with the first, is to provide income for those who have retired at least at the level of 60% of their previous salary.

Pensioners receive 250,000 rubles

It is not for nothing that Switzerland was included in the top ten countries with the best pension provision. The retirement age is the same - for women it is 62 years old, for men - 65. Life expectancy in Switzerland is approximately 82 years, but in our country people live on average ten years less.

To provide such pensions, the Swiss authorities deduct 5.12% from salaries, the same amount is paid by the employer's company. In addition, private pension funds withdraw 6.8%. Residents of this country can voluntarily contribute certain amounts to the pension fund; salaries allow it. The pension is at least 60% of the monthly salary, this is the minimum.

It is not customary for the Swiss to ask about the size of their salary; it is too personal a question. But some are frank. It turns out that the average salary is about 360,000 rubles, even the simplest job pays at least 80,000 rubles. True, renting housing here is expensive - from 63,000 rubles, and then only by agreement.

Benefits for pensioners

The average level of pension provided is so high that the question of providing benefits for anything automatically disappears. Benefits for pensioners in Switzerland are not provided even for transport or utility bills. All expenses regarding travel, flights, medicine, etc. are subject to 100% payment for both the working class and pensioners.

In conclusion, I would like to note once again that by creating a multi-level pension formation system, Switzerland has chosen the very right path. Citizens of retirement age and other socially protected segments of the country's population always have decent support, both from a financial and health point of view.

Dictatorship of the elderly?

Accordingly, when calculating a pension under the second pillar, factors such as the general level of inflation and the demographic situation should also be taken into account. This means that in Switzerland, for the first time, it would become possible to cut already paid pensions in the event that everything is bad on the stock exchange, and inflation suddenly starts to go through the roof (while it is minimal in Switzerland), and there is “something wrong” with the demographics.

Show more

Discussion of pension and tax reform has begun in Switzerland

This content was published on February 20, 2020 February 20, 2019 The next referendum in Switzerland will be held on May 19 and a new draft pension and tax reform will be submitted to it.

“The idea behind the principle of “flexible pensions” is very simple - it only means that Switzerland would lose the unique opportunity to once and for all promise and maintain the once promised level of pension provision, because there is now a statutory obligation to maintain pensions once and for all. always at a set level and forms the main mechanism for the redistribution of funds at the expense of younger generations in favor of generations of pre- and retirement age. This injustice has now reached an appalling scale; it is no longer possible to sit idly by,” says J. Bachmann.

And everything would be fine, but in Switzerland young people now show an alarmingly low level of interest in politics . In other words, she does not go to vote, unlike older generations, who are very active politically and always “crush” the few young people who come to the polling stations with their mass. And it may happen that young people, again staying at home, will simply give their future into the hands of old people, who will not fail to fail a reform that is unfavorable for them personally. Josef Bachmann, meanwhile, is trying to remain optimistic. He is confident that the initiative will have a chance of success, especially if pensioners, who in Switzerland “still have a sound mind and a generous heart,” are convinced of its feasibility.

Show more

Swiss experience of direct democracy and the European project

This content was published on September 02, 2020 September 02, 2020 Switzerland is by no means the only country where people can directly resolve issues of relations with the European Union.

Show more

How do pensioners live in Switzerland?

If we look at the statistical data, we can note that a fifth of the population of this country is at retirement age. Accordingly, the persons reached 64 and 65 years of age. Due to the fact that the population growth rate is small and the number of able-bodied people has decreased, a crisis has occurred in the pension system. A high level of quality of life and medical services provided; by the age of 65, citizens are in good physical shape.

The country experienced a surge in birth rates in the 1960s, which will lead to an increase in the number of elderly people by 2030. Currently, the allocated funds are not enough to meet the needs of pensioners. To meet the requirements of this category of citizens, the state needs to build about 100 houses intended for the elderly.

The situation can also be improved by increasing the number of services provided at home. The level of medicine in Switzerland is at a high level, psychologists work with these individuals, it is possible to attend clubs and group classes. For example, these are walking, traveling in groups, etc.

Be sure to read it! What is the retirement age in Australia for men and women in 2020?

This group of citizens has the opportunity to use discounts on the purchase of plane tickets, which affects active recreation. Vegetable gardening and horticulture are considered only as a hobby.

How much do Swiss pensioners earn?

In theory, if a citizen takes advantage of the opportunities listed by the three elements of the pension system, he will be able to receive pension payments in the amount of about 6 thousand francs. This value is set for a monthly period. However, this example is an exception. This is due to the fact that the majority of Swiss residents have a lower level of income.

On average, residents of this country receive about 3.5 - 4 thousand francs per month.

Diversification of risks!

“For foreign countries, the Swiss pension system with its three pillars has always served and continues to serve as a role model,” says Thomas Gächter , professor at the Department of Labor and Social Security Law at the University of Zurich. “The model itself was conceived simply perfectly, the only problem is that it was never possible to complete this building.”

www.swissinfo.ch

Firstly, the state currently invests too little in the so-called “first pillar” (AHV), and therefore no one in Switzerland can live on this pension alone for a long time. “The second pillar is built on the principle of investing in various market instruments and receiving interest on the invested capital, but now there is a situation of extremely low returns in the international financial markets, and in a situation of modest interest on the invested capital, the payment of the once promised pension turns into an almost impossible task. Gaps are emerging in the pension financing system.”

What is Umwandlungssatz (conversion factor)?

The recalculation coefficient is an indicator on the basis of which the accumulated pension capital is recalculated into the annual amount intended for payment through the “second pillar” into the income of the pensioner - the owner of this capital.

This takes into account factors such as statistical life expectancy (survival period) and the probable, expected level of return on pension capital invested in available investment instruments.

For example, having accumulated 100 thousand francs, a pensioner can receive an annual pension of 6,800 francs, which is 560 francs per month (35 thousand rubles, or 15 thousand hryvnia), while the conversion coefficient should be 6.8%. It is impossible to live on this amount alone in Switzerland.

End of insertion

All these problems are exacerbated by unfavorable demographic trends, especially in the area of first pillar financing. Now a large generation is retiring, born after 1945 from soldiers who survived the war and looked into the future with particular optimism. As for the Swiss themselves, their peculiarity is the desire to retire sooner rather than later . Associated with an extremely high “ survival period ,” all these aspects together begin to form a very explosive combination. “The bomb is ticking, time has passed,” says Professor Hechter.

However, it is ticking not only in Switzerland, but also in almost all developed countries of the “first world” . To paraphrase the famous statement of Orson Welles, “the end of the world will happen in Switzerland, only three days later.” The key to this confidence can be precisely a “system of three pillars”, which very skillfully “puts eggs in different baskets”, in other words, diversifies risks, relying on financial sources of different nature. “In other countries this bomb will explode first,” says Professor Gächter, but Switzerland will also be affected by this problem, albeit later, if only because the pensions paid here are currently “overly generous.” That is, how is it?

About the Swiss pension insurance system

The country's pension system is divided into levels:

- The regime established at the state level includes payments for old age, loss of a breadwinner or disability. As soon as a citizen turns 20 years old, the state insures him, and from that time on he is obliged to pay insurance premiums from his income. This level applies to all people reaching retirement age who live and work in the country’s economy and is intended to provide a minimum subsistence level.

- An additional level is required for working pensioners. The working population of retirement age, receiving a pension, continues to contribute money to the Pension Fund. The main goal of the 2nd regime is to ensure a decent standard of living, close to that of working age.

- Individual. Includes personalized diagrams. They are available to working citizens, but are not required for everyone. People who intend to significantly increase the size of their pension benefits in the future open a special bank account and transfer money to it. The account is blocked until reaching retirement age. If the client expresses a desire, the bank can invest these investments in bonds or stocks. In any case, this money does not lie dead weight, and by the time you reach retirement age, the amount can be impressive. The government encourages people to make such savings and therefore provides special tax benefits for them.

The state bears full responsibility only for providing pensioners with the first level, so that an elderly person is not left without a means of subsistence. In order for the pension amount to suit older people, they themselves must make a choice in which levels of the system to join.

The state does not provide any benefits for pensioners, but the size of their pension is so high that they are able to pay for their own medical care, travel expenses, and flights.

Retired Swiss people can afford to live for their own pleasure: travel, make large purchases, in general, do not deny themselves anything. Citizens of the country ensure themselves a calm and prosperous old age throughout their working lives.

Early retirement

In Switzerland, early retirement is currently particularly popular, before reaching retirement age; this option often suits both older people and employers, but can lead to significant financial problems in the future.

Employers, by inviting employees to voluntarily retire early, naturally save significant money. Most people of pre-retirement age feel extremely uncomfortable working their last years, as they may be asked to resign at any time.

There is growing concern about the financial state of the pension system. In Switzerland, a woman can retire at 64, and a man at 65. If desired, an employee can retire 2-3 years early, in which case he receives a social package and is freed from the need to pay contributions to the pension fund, as well as the employer. As a result, less and less funds are flowing into the pension insurance system, which becomes especially threatening, given the current situation with the aging of society.

Ways to solve the problem

The Swiss government is seriously concerned about this problem and is addressing the issue of increasing the employment of older employees so that they continue to pay due contributions to the pension insurance fund. Trade union representatives offer support for employees nearing retirement age, protection from dismissal and assistance in finding work, but their demands are difficult to fulfill in the current situation. According to statistics, the share of employment in Switzerland among people aged 50 to 64 is 71.7%; more than half of the unemployed over 50 have been looking for a new job for more than a year, and their number continues to grow. Trade unions propose to increase the number of retraining and advanced training courses for people over 50 years of age. True, while only an indicative list of necessary measures has been outlined, implementation has not begun.

Employers do not particularly support these initiatives, because this increases the financial burden on enterprises. The Chairman of the Swiss Association of Employers, Valentin Vogt, considers the above measures impracticable, since excessive government intervention will only lead to the fact that enterprises will stop hiring employees of pre-retirement age altogether.

At the same time, projects are being organized in various regions of the country to develop the abilities and competencies of employees over 50. For example, in the canton of Schaffhausen, master classes are held in which older workers exchange experiences and support each other. More than 500 people have already taken part, and the results are clear: many find new jobs.

Swiss pension for foreigners

Foreigners living in Switzerland can receive a pension if they have dual citizenship. The second country must belong to the European Union or have a pension agreement.

Russian citizens cannot receive a pension here or take into account their work experience in this country, because... there is no signed agreement. You can apply for Russian benefits if you have paid contributions to the Pension Fund. The registration is handled by the department working with the population living abroad. Payments are transferred in rubles to an account opened in a selected financial institution in Russia. Every year you need to confirm that you are not dead.

How do foreigners receive a pension?

To receive a basic level of old-age benefits in Switzerland, you must not only have dual citizenship, but also be a citizen of the European Union, or a country that has a social security agreement with Switzerland. There are no other options for pension payments for foreigners.

Can citizens of the Russian Federation receive a pension?

If a citizen, before immigrating to Switzerland, paid pension contributions on the territory of the Russian Federation for several years, he is probably interested in the possibility of receiving appropriate payments, even while abroad.

A similar feature is provided for by Russian legislation, however, several features should be taken into account:

- payments are made only in domestic currency;

- Receipt of funds is possible only to an account in one of the financial organizations of the Russian Federation at the client’s choice;

- Every year the pensioner must confirm the fact that he is alive.

To apply for a pension and clarify the conditions, a citizen will need to contact the Russian Pension Fund, the Department for Providing for Persons Living Abroad. Confirmation of being alive is carried out by visiting the Russian consulate in Switzerland. In this case, you will need to present a citizen's passport.

Which countries are lowering the bar?

However, one should not think that all the countries around Russia are doing nothing but raising the bar for retirement.

There are also counter examples. Just the other day, interesting news came from Italy. The country's president signed documents that allow older Italians to retire from age 62. Let us recall that until recently, citizens of this country could count on pension provision only after they turned 66-67 years old. Thus, the retirement age has dropped by several years.

The age in this country has been actively raised since 2011 in order to solve accumulated financial problems. But the new order did not meet with understanding among citizens. The authorities were forced to retreat.

According to experts, lowering the level will cost the state treasury dearly. This year we will have to additionally plan for expenses of about 4 billion euros, and next year another 8 billion euros. However, such a measure may also have a positive side. The fact is that lowering the age limit will allow older citizens to retire faster and free up jobs for younger workers. Thus, adjustments to the target may have a positive impact on the unemployment rate.

In addition to age, Italy will also introduce a basic income for citizens who are below the poverty line. According to local experts, about 5 million citizens today fall under this definition. They will have the opportunity to claim payments of up to 780 euros per month.

Returning to the retirement age level, Italy is not the only country that is lowering the bar. For example, Poland is taking similar actions. Here the bar was lowered to 65 years for the stronger sex. Women will be able to receive payments after 60 years. Before this reduction reform, the country's authorities intended to raise the bar to 67 years for all citizens.

In France, age changes with enviable regularity. For example, in the 80s the bar was lowered from 65 years to 60. About 10 years ago the bar was raised to 62 years, after which it was lowered again to 60 years.

Summing up

In conclusion, I would like to note once again that by creating a multi-level pension formation system, Switzerland has chosen the very right path. Citizens of retirement age and other socially protected segments of the country's population always have decent support, both from a financial and health point of view.

Sources

- https://1migration.ru/switzerland/v-chem-osobennost-pensionnoj-sistemy.html

- https://business-swiss.ch/e-konomika-shvejtsarii/pensionnaya-sistema-shvejtsarii/

- https://my-swiss.ru/culture/pensiya-v-shvejcarii.html

- https://bbqcash.com/aid-and-benefits/retirement-in-switzerland

- https://pensiya-lgoty.ru/pensionnaya-sistema-v-shvejcarii/

- https://pfrp.ru/faq/pensiya-v-shvejtsarii.html

- https://opensii.info/pensionnyy-vozrast/v-shveycarii/

- https://SwitzerlandLife.ru/pensiya-v-shvejcarii/

[collapse]