What are “pension savings”?

Pension savings are funds located in the individual account of a citizen insured in the state or non-state pension fund of the Russian Federation, accumulated by him during his working life. Includes (Article 3 of the Law “On Funded Pension”):

- Contributions to the funded part by the employer for compulsory pension insurance (OPI).

- Additional contributions paid by citizens under the State Co-financing Program, as well as the amounts of contributions transferred by the state.

- Maternity capital or part of it, aimed at the funded part of the labor (insurance) pension.

Savings can be formed in a state or non-state pension fund at the discretion of the insured person. A citizen also has the right to transfer his savings to other funds, but not more than once every five years .

A citizen has the right to designate legal successors to receive the unspent part of savings after his death by submitting an application to the fund in which the funded pension is formed.

Who creates pension savings?

Who can have a funded pension today?

Pension savings today are available directly to citizens who:

- were born before 1967;

- are subject to compulsory pension insurance (that is, they officially worked after 2001, or are still working);

- men born between 1953 and 1966, as well as women born between 1957 and 1944, for whom, from 2002 to 2004, employers made insurance contributions to the state treasury for the funded segment of the pension.

In addition, persons who are:

- participants in the system of co-financing of state pensions;

- mothers who used maternity capital as a source of funds to form a pension.

Who is entitled to a lump sum payment of the funded part of the pension?

As my personal experience of communicating with our citizens shows, absolutely all future and already entering into their rights pensioners want to receive their savings in the form of a lump sum payment. And that's reasonable. Let’s assume you have a pension capital of 250 thousand rubles. and when you retire, you would like to see this amount in full in your bank account, rather than receive it in parts over 240 months (that is, 12 years). Since, annually, a deposit in the bank will bring you from 20 to 25 thousand rubles. - this is about 1800 rubles. per month, excluding the principal amount. And payments of savings in the form of a monthly increase in the insurance pension will amount to only 1041.67 rubles. And it is worth remembering that as soon as you have acquired the right to a funded pension (retirement age, early pension), it is no longer invested, that is, it does not bring you additional income from the management company (PFR/NPF), but is paid to you.

My calculation clearly shows the motivation of our citizens to receive pension savings at a time, and not urgently or monthly.

But still, let’s figure out who has the right to a one-time payment of a funded pension:

- First of all, these are citizens (retirement age M-60 years, F-55 years, as well as those who took early retirement) born in 1967 and younger (1968,1969...). And also a man born 1953-1966. and women born 1957–1966 who officially worked between 2002 and 2004.

- In this case, savings can be received in a one-time full amount only if their amount does not exceed 5% of the amount of the insurance pension that is accrued to the person (the owner of the savings) taking into account the fixed payment.

- Also, the right to a one-time payment of pension savings is available to citizens who have reached retirement age (M-60, F-55 years) and are already receiving pension payments for disability or loss of a breadwinner, but due to certain circumstances have not earned the right to an insurance pension ( due to lack of minimum insurance period or number of pension points). In order for this category of citizens to have the right to a lump sum payment, it is necessary to have savings. And for this, let me remind you once again, you must have officially worked in the period from 2002 to 2014. and meet the age criteria.

- Citizens born in a later year (1966, 1965...) may also have the right to a one-time payment if they independently formed their pension savings through participation in the state program for co-financing pension savings. Participants in this program made contributions from their income (from 2,000 to 12,000 rubles/year), which the state doubled. If other conditions are met, they can also be obtained once.

Urgent pension payment - what is it?

There is no clear definition of this concept in the legislation, but Art. 5 of the law “On the procedure for financing payments from pension savings” reveals what is meant by this type of security.

Based on this norm, the following characteristics can be distinguished:

- carried out in cash;

- is periodic (paid monthly);

- relies on those who have reached the previously established retirement age (60 years for men and 55 for women) and have the minimum required insurance period and individual coefficient;

- is formed from additional contributions within the framework of compulsory insurance.

Important! Thus, a fixed-term pension is a monthly periodic payment that is due to a citizen upon reaching the age of 60 and 55 years for men and women, respectively, if they form a funded part, within the framework of which they or their employers transferred additional insurance contributions in excess of the mandatory ones.

Existing types of payments

At the present time, Russian citizens can simultaneously use insurance pension provision along with a funded pension.

In a situation where a person has paid contributions to form a pension, during registration he can use one of several types of payments:

- Indefinite, which can be implemented until the end of a person’s life.

- Urgent, when paying money for a certain period.

- Lump sum, in which the payment of the amount is made one time.

For the insured person, the Pension Fund of the Russian Federation establishes a payment format, which will depend on the amount of funds that are in the individual account of any person.

If the amount is less than 5%, in this situation the Pension Fund has the authority to order payment of all the money at once. In addition, this type of issue is available in the event of a certain type of insurance event, which may include loss of a breadwinner, disability, etc.

Who is entitled to payments?

The payment can be made by the owner of pension savings in whose personal account the savings funds are placed.

And in the event of his death, his heirs (legal successors) can receive such a right.

According to the law, the following can receive money:

- heirs related to the first (spouses, parents, children),

- or second stage (brothers, sisters, grandparents, grandchildren).

In addition to the legal heirs, the persons specified in the special will have the right to claim. The citizen who owns the account writes such a statement and leaves it with the Pension Fund.

After his death, this organization is obliged to notify the persons specified in the will that they can receive the money due to them under the will.

If we are talking about maternity capital, all issues related to payments will be regulated in accordance with Article 256 of the Federal Law. Guardians or adoptive parents (with the permission of the guardianship authorities) or children upon reaching adulthood will be able to receive the funds.

Features and nuances

A striking feature of the registration of the funded part of the pension is that only citizens born in 1967 can apply for it. and subsequent years.

Their work must begin before January 1, 2014, and the decision on choosing a funded pension must be made before December 31, 2015.

Please note that it is almost always impossible to receive your pension savings before retirement.

The opportunity to receive a funded portion appears simultaneously with the right to an insurance pension.

However there is an exception:

early payment is possible in situations where a citizen has been assigned an early retirement pension. In addition, a feature of a funded pension is that it is inherited.

The recipients in this case will be the persons indicated by the deceased citizen in the will. If the will does not indicate the names of the heirs, they will be determined in accordance with the law.

Watch a video on this topic: Thus, the funded part of the pension

This is a great way to increase your savings. And since its registration is not a difficult task, almost any pensioner can invest their savings to increase capital.

When applying to the Pension Fund with a request to receive a lump sum payment formed from the funded part of the pension, a citizen must submit a personal application.

Let's look at what the application form looks like, and also determine how to fill it out correctly so that there are no problems when accepting documents.

Features of savings payments

The legal basis for disposing of additional funds of future pensioners is regulated by Law No. 360-FZ. As one of the directions for disposing of these funds, the opportunity is provided for subjects to apply for an urgent payment.

The assignment of an urgent pension payment from pension savings is characterized by the following features:

- the grounds for receiving it arise simultaneously with the application for a pension;

- fixed-term pension payment is established for a period specified by the subject himself, but not less than 10 years;

- the calculation of the specified payment can be carried out only on the basis of savings contributions not related to compulsory pension insurance.

Note!

When applying for a pension, citizens have the right to independently decide how the accumulated contributions will be disposed of. The volume of pension savings may be greater if you apply for the actual assignment of a pension after the legal acquisition of pension rights. In addition to the urgent payment, it is possible to establish an additional payment to the monthly pension payment.

How are savings formed?

When citizens apply, Pension Fund officials check the status of an individual personal account. The possibility of managing funds from a personal account for urgent payment arises if it takes into account the following types of additional contributions:

- voluntary transfers made by the citizen himself as part of the co-financing program;

- funds that were transferred to the personal account from the state as part of co-financing the funded part of the pension;

- additional transfers at the expense of the employer for whom the citizen worked;

- investment income received in the process of managing funds;

- part of maternity capital funds aimed at increasing the savings part of a woman’s personal account.

The size of the urgent payment of pension savings will directly depend on the state of the personal account. The more transfers were made before contacting the Pension Fund, the higher the monthly payment to the recipient will be.

How does the amount of savings in a personal account increase?

Topping up an individual account can be done as follows:

- by transferring additional contributions at the expense of the citizen himself or the management of his enterprise. In 2014–2019 employers' insurance contributions for their employees were allocated in full (all 22% of the wage fund) exclusively for the formation of insurance pensions;

- co-financing of revenues from federal budget funds (this opportunity is currently suspended, since the co-financing program has ceased to operate);

- income received from financial management from a personal account.

Receiving investment income deserves special attention. Citizens have the right to independently choose the procedure for managing their savings finances, including by transferring funds to non-state pension funds or management companies.

Important! The state guarantees that even if the investment is unsuccessful, the funds in the personal account will not decrease, but their increase will occur only if the investment returns.

Conditions for receiving a funded pension

You can receive the funded part of your pension if three conditions are met:

- Reaching the previous retirement age: for women – 55 years, for men – 60 years. Raising the retirement age did not affect the rules for receiving a funded pension.

- Having a minimum length of experience: in 2020 – 10 years, in 2020 – 11 years.

- Availability of the required number of pension coefficients: in 2019 – 16.2, in 2020 – 18.6. The number of points depends on the salary level. For example, with a monthly salary of 10 thousand rubles, only 1 point is awarded per year.

Features of formation of urgent payment

If the above funds are available in an individual account, a citizen has the right to create security for them at his choice:

- Together with other money paid to the citizen in the form of the funded part of the insurance pension.

- In the form of an independent benefit (actually an urgent payment).

These types of security differ in the period by which the total amount is divided. In the first case, the period of receiving it is divided into a survival period, which is established by the state; in the second, it is determined by the citizen independently. At the same time, however, the period for receiving this type of security, indicated in the application of an individual, cannot be less than 120 months, i.e. 10 years.

Every year, the amount of this security, provided monthly, is subject to revision (only upward), since during this time additional contributions and income may be received, as well as additional income from investing the unpaid portion of the money.

NPF

NPF "Bolshoi" appeared in 1995, and over the years of its active activity it has accumulated a significant client base - over 440 thousand people.

According to the Central Bank, the company received a high level of profitability over the past year - 9.77%, thus overtaking a number of the country's largest funds. More detailed information about the organization’s work in the pension market will be presented further.

Official website of NPF "Bolshoy"

The company has its own website located at https://www.bigpension.ru. On the main page you can see a small menu with important sections, a button to enter your personal account, a site search engine, a news feed and a functional calculator familiar to non-state funds.

The fund itself is a union of employers in our country, since over 450 companies from various segments of the economy began to cooperate with it, providing their employees with a decent pension.

Any citizen of our country can become a client of the company, since Bolshoi offers not only corporate products, but also individual pension programs. To do this, you need to contact any branch and conclude an OPS agreement. You need to have your passport and SNILS with you.

Basic important information is contained on the site pages. If any question still arises, you should try to contact the employees of a specific branch of the fund or call the hotline number indicated in the upper right corner of the official page on the Internet. Competent specialists will try to help every client.

Bolshoi Pension Fund Program

NPF implements two main types of programs - for companies (corporate option) and for individuals (individual option). The first type involves 3 packages of pension solutions:

- base;

- standard;

- extended.

Basic allows companies to save budget and attract other sources of pension financing in the person of the employees themselves and the state. The standard package is more suitable for medium-sized companies - it combines both mandatory pension insurance and an individual pension plan.

An expanded version of the pension solution involves significant intervention by the employing company itself in the formation of an employee’s pension, which creates good prospects for solving corporate problems.

Private programs will give clients the opportunity to decide for themselves exactly how contributions will be made and what their size will be. A flexible approach will allow everyone's interests to be taken into account. On the website you can see several packages of plans - personal, family and investment.

Having decided on your own preferences, you can conclude an appropriate agreement. More detailed information about the nuances of this process can be found on the official website of the fund.

reliability NPF "Bolshoi"

In February of this year, the rating agency RAEX (Expert RA) left the fund's high level of reliability (AA indicator) unchanged. The rating forecast is stable, which indicates the reliability of the company and the prospects for cooperation with it.

The indicator has a positive effect on Bolshoi's significant reserves of its own funds.

At the end of last year, available funds exceeded the minimum threshold by 117%, although a couple of months earlier the excess was only 47%.

In addition, the high level of service both online and offline, as well as the steady growth in profitability, directly affected the fund's rating.

Fund return

For the period from 2005 to 2012, NPF “Bolshoi” reached 94.95% in terms of total return. The lack of profit in 2008 was due to the crisis, but the very next year the fund showed a record 28.3%. In general, if we calculate the average annual increase in savings, we can talk about 11.86% per annum.

This figure is direct evidence of a well-executed investment policy. Funds received in the form of monthly contributions are invested in bonds of serious companies and deposits with high interest rates. As noted above, the company has recently been able to overtake many competitors, showing a significant increase in profitability.

Funded pension and how to get it

To arrange payment of the funded part of the pension, you must submit a corresponding application to the NPF. A package of required documents should be prepared in advance. The nature of the payment itself may be:

- one-time;

- urgent;

- indefinite.

The pension fund has the right to consider the submitted application within one month if we are talking about payment of the entire amount of pension savings at once.

Term payments are made monthly for a minimum of 10 years. Perpetual payments depend on the state's decision regarding the maximum life expectancy. Such applications are processed faster - within 10 working days.

In general, the procedure for assigning payments for a funded pension is not particularly difficult, and upon reaching retirement age it is easy to implement.

How to fill out an application for payment at NPF “Bolshoi”

The application is regulated by law, so the document must contain certain information. Firstly, this is the name of the fund itself, which provides pensions. Secondly, personal data, starting from full name and ending with address. Thirdly, SNILS and telephone number for communication are indicated.

The fund employee enters the corresponding figures in the column with the account number. Finally, the document must indicate what the method of receipt will be and whether there are already assigned pensions. The application is supported by a date and signature and is left for consideration by the fund.

Bolshoi Fund head office telephone number

The head office is located at: Moscow, st. Miklouho-Maklaya, 36a. The number there is the following - 937-65-31. If necessary, you can send a fax to (495) 937-65-32.

The non-state pension fund "Bolshoi" is one of the reliable companies periodically assessed by the rating agency "Expert RA". The volume of assets allows the organization to occupy 15th position and hold 11th place in terms of the total number of insured persons and the volume of pension insurance obligations.

Being a supporter of a conservative investment policy, the company was able to achieve good results, balancing between the safety of citizens' invested funds and protection against inflation. The question of whether it makes sense to trust your future pension to the fund in question is something everyone decides for themselves. But it’s still worth considering the above.

Source: https://pfrf-kabinet.ru/lk/bolshoj.html

How and where to exercise the right to receive SPV?

Registration of SPV is carried out at the branch of the Pension Fund where the applicant has a savings account. The procedure is carried out in several stages:

- preparation of the required set of documentation;

- submitting documents for consideration to the Pension Fund or Non-State Pension Fund;

- receiving a receipt stating that all documentation has been submitted for reconciliation;

- review and analysis of submitted information within 10 calendar days;

- receipt by the applicant of a decision on payment or refusal to provide it;

- fulfilling the requirements of PF representatives to finalize documents if an incomplete set of documents was submitted;

- payment of funds during the time period specified in the application.

The start date for processing payments is the day the package of documents is submitted to the Pension Fund. If the documents were sent by mail, the filing date is considered to be the day indicated on the stamp. If a person has not issued a self-employed person, then the money due by law will be paid to the pensioner along with standard pension payments.

What documents are required?

To obtain the right for a citizen to receive pension payments of the type in question, the following documents should be sent to the pension fund:

- Application for urgent payment from the funded part of the pension.

- Passport of the recipient of the payments in question.

- Registration code of a citizen receiving pension payments with the tax authorities.

- A certificate of the salary of the subject in question about receiving a pension.

- The recipient's work record book with notes on his work experience.

Other documents requested by the pension fund in each individual case.

Amount of immediate payment of funded pension

Pension savings located in the personal account of each insured citizen are formed from several parts. At the same time, a citizen who forms pension savings when the right to a labor (insurance) pension arises can:

- receive pension savings in the form of an urgent payment (except for compulsory pension insurance contributions);

- or as part of a funded pension, which is paid monthly based on the expected period of pension payment.

According to the legislative norms reflected in Article 5 of the law “On the procedure for financial payments from pension savings”, the amount of the urgent payment is determined on the date of its appointment . Depends on the period determined by the insured person, which is indicated in the application for the assignment of this accrual and the amount of accumulated funds in the citizen’s current account.

What funds are used to generate the urgent payment?

The formation of a fixed-term pension occurs only through contributions that the citizen has made additionally to the funded part of the pension. These include:

- voluntary contributions transferred under the State Co-financing of Pensions Program and accruals received from the state within the framework of this Program (the citizen’s contribution is doubled, but within amounts from 2 to 12 thousand rubles per year);

- additional contributions from employers (contributions paid to a funded pension in addition to contributions to compulsory pension insurance);

- maternity capital funds;

- income from investing the above funds (through a management company or non-state pension fund).

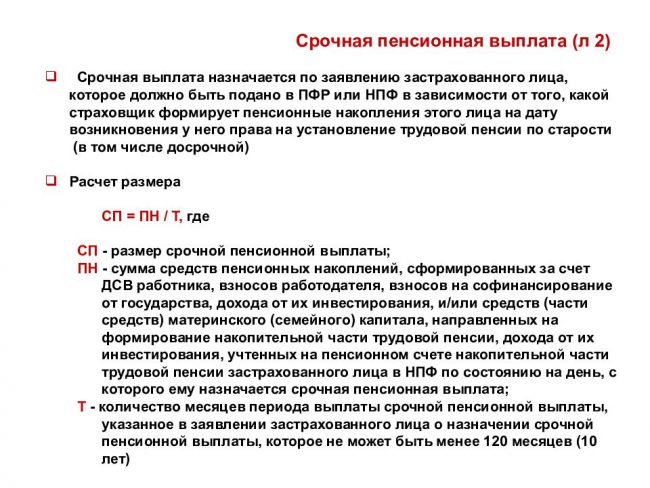

Formula for determining size

The amount of urgent payment is determined depending on the payment period , the decision of which is determined by the citizen himself, and is calculated using the following formula:

SP = PN / T,

Where:

- SP - the amount of the fixed-term pension;

- PN - the total amount of savings formed from additional insurance contributions for a funded pension;

- T - the number of months indicated at the request of the insured person in the application for a fixed-term pension, which cannot be less than 120 months.

Adjustment of immediate pension payment

According to Article 12 of Law No. 360-FZ of November 30, 2011, the amount of the urgent payment must be adjusted as a result of investing savings funds for citizens who have been assigned a pension, annually from the first of August of the year following the year of receipt of income.

The size of the adjustment depends on the amount of savings taken into account to determine the amount of savings and calculate the amount of the urgent payment when it was assigned or the previous adjustment. The results of investing funds also play a significant role.

The amount of adjustment is calculated using the formula:

SV = SVk + PNk / T,

Where:

- SV - urgent payment;

- СВк - the amount of urgent payment established as of July 31 of the year in which the adjustment is made;

- Pnk - the amount of savings funds that are formed from additional contributions taken into account as of July 1 of the year from which the corresponding adjustment is made;

- T - the number of months of the accrual period that the insured person indicated in the application, reduced by the number of months that have passed from the date of its appointment as of July 31 of the year in which the corresponding adjustment is made.

If there is no investment income, no adjustment is made until the following year.

Lump sum payment upon retirement

At the beginning of our article, I noted that the issue of a lump sum payment of pension savings is relevant now and this will continue for some time, but not for long. This is due to several reasons. At the current time, the majority of citizens who retire are citizens of a later generation who did not fall under the reform of the pension system of the Russian Federation, and if they are included in the age criterion, then in any case their amount of pension savings is often small and does not exceed 5 percent threshold. This allows them to receive the amount of pension savings in a lump sum. It is also worth noting that the official earnings of this category of citizens in the “zeros” (if any at all during this period) were relatively small. The amounts that were paid to them previously and on the basis of which deductions were made to the Pension Fund/NPF are insignificant for the current period of time.

However, over time, younger generations will begin to retire, who have been participating in the program for a longer period and have a higher official income. This will reduce the frequency of lump sum payment of funded pensions, which will be replaced by immediate and monthly payments.

However, lump sum payments of pension savings will continue to be received in regions where wages are low (below the national average) and unscrupulous (gray, black) employers.

IMPORTANT! A lump sum payment is made no more than once every five years.

This is also an important and fundamental question. Quite often I am asked: I retired, received a lump sum payment, will I be able to receive it in another five years? At the same time, the person no longer works officially, but enjoys life to the fullest on a high pension payment. So, you can receive a lump sum pension payment only if the pensioner continues to work. Let’s say, having retired due to length of service (and in our country a number of professions have a legal right to this), a person received a payment, continued to work, and after 5 years can receive this payment again if all the requirements are met. And if you do not work and no contributions are made towards you, then where can the savings that you want to receive come from?..

And that’s all for today... I hope the article will be useful to you and help you find answers to your questions...

Goodbye!

PS “A person can live a long time on the money he waits for.” William Faulkner

Only pensioners can apply for the funded part of their pension (women over 55 years old, men over 60 years old).

The statement is for them the main legal “bridge” that will lead to material well-being.

Well-being is made up of transfers from employers of future retirees, which accrue 22% of the employee’s monthly earnings.

The share of the funded part of the pension from employer contributions is 6%.

It is worth noting that the following can also count on a funded pension:

- persons who allocated material assets of maternity capital to form savings.

- Participants in co-financing pension payments.

How to write?

How to write an application for a funded pension?

Application forms for the funded part of a pension are distinguished by a clear, specific design style.

To fully convey all the information, you will need to write the following data:

Otherwise, the application will be rejected and you will have to start the entire application process all over again.

What is submitted with the document?

A package of documents is submitted along with the application for the funded part of the pension. It includes:

- passport;

- a document confirming the conclusion or dissolution of a marriage;

- certificate of compulsory pension insurance;

- citizen’s details for transferring payments (usually bank account number).

IMPORTANT!

If the application was submitted by an authorized representative, then along with all the necessary papers you must also provide a document confirming the authority of the representative.

Where and when to submit?

How to apply for the funded part of a pension to the Pension Fund?

The collected package of documentation and the written application are transferred either to the management company or to the non-state fund in which the citizen’s savings were formed. You can submit papers in person, by postal order or through the MFC.

The application is usually submitted personally by the citizen or his authorized representative. It is worth noting that you can submit an application no earlier than 30 days in advance.

until retirement.

If the application is submitted after reaching the legal age, the funded part of the pension is calculated from the date of its submission.

Receipt procedure

The procedure for assigning and receiving such benefits consists of several steps:

- Drawing up and sending an application by the insured person.

- The fund's decision to assign such a benefit.

- Delivery of this type of security to the recipient.

The application is submitted to the territorial body of the Pension Fund if the funds of the funded part are placed there. In the case of transfer of money under the management of a non-state PF, a similar application is submitted at the location of the representative office of the relevant fund.

After a positive decision is made, delivery of the cash security must be organized by the Pension Fund or Non-State Pension Fund in which the citizen has contributions. The delivery rules, as well as in more detail the specifics of establishing this type of security, are determined by the law “On Funded Pension” (Article 9).

Delivery options for urgent pension payments

Urgent payments are delivered to the citizen simultaneously with the insurance pension . The pensioner has the right to choose which transfer method seems most acceptable to him. So, the following options exist:

- transfer of money through a banking organization, which will transfer material support to the pensioner’s personal account, immediately with an insurance monthly pension;

- money can also be handed over to a citizen personally by courier, provided that they are sent by mail or transferred by some other organization.

If a citizen transferred pension savings to a non-state Pension Fund, who is responsible for their payment?

Provided that the funded pension will be formed in a non-state pension fund, and not in the Pension Fund of the Russian Federation , this organization will issue urgent pension payments. In this case, you will have to go there to create and receive an urgent pension payment.

If your funds were accumulated in a non-state pension fund, this organization will subsequently pay them out

In this case, all rules regarding succession remain in force, and you will be able to receive the money left to you by a deceased relative at any time, if you had the appropriate permission.

Non-state pension fund Bolshoy - application for payment

NPF "Bolshoi" has been operating since 1995, working in the format of a closed joint stock company. During this time, about 450 large organizations became clients of the fund. The main areas of activity are non-state pension provision and compulsory pension insurance.

The Bolshoi Pension Fund offers effective solutions for all categories of clients. The organization provides services without the participation of intermediaries, consistently ensuring their high quality.

Official website of NPF "Bolshoi"

The official website of NPF "Bolshoi" https://bigpension.ru/ provides information for corporate clients and individuals. Here you can find out:

- indicators of profitability and reliability;

- conditions for increasing pensions;

- pension plans;

- corporate programs;

- NPF news.

The official website of the Bolshoy pension fund contains samples of standard documents and answers to the most pressing questions. Potential clients can learn how to transfer their savings to the fund, earn more money and control the amount in the account.

The resource also offers such a useful service as a pension calculator. By indicating your gender, age, level of earnings and other parameters, everyone has the opportunity to calculate the approximate amount of pension payments. At the same time, there is a very clear comparison with the Pension Fund’s indicators.

The site also has a personal account, the use of which requires registration indicating SNILS, card number or telephone number.

Fund reliability

The activities of NPF "Bolshoi" are highly assessed by the RA "Expert" in terms of reliability. The fund had a maximum rating of “A++” for several years, with a stable outlook. In 2020, the “AA” rating was confirmed.

The organization operates within the framework of the law and has the appropriate license. The activities of the fund are controlled by the state and expert structures; there are systems of internal and public control.

Profitability indicators

The Bolshoi Pension Fund accumulates 28.2 billion rubles in the form of savings; the fund’s clients are more than half a million people. Of these, 50 thousand consistently receive pension payments. The organization does not have long-term loans.

As of the first quarter of 2020, the yield was 10.82%, a year earlier it was 2.68%. According to the official website of the NPF Bolshoi pension fund, in 2013 it entered the top 13 best structures of this kind in the Russian Federation with a yield of 13.9%.

The investment structure consists of:

- bank deposits;

- bonds and shares of companies and enterprises of the country;

- government securities;

- investments in mutual funds;

- investments in real estate.

The fund has maintained stable returns since 2012. In 2008 it was equal to 0%, in 2011 – 2.82%, but these were times of crisis when the level of other non-state pension funds was no better or even worse.

Helpful information! The new law on insurance and funded types of pensions has been in force in the Russian Federation since 2013. The funded part is provided to citizens who have SNILS.

Receiving the funded part of the pension

The formation of a funded pension share occurs voluntarily from additional income and investment income. This part is calculated from the amount in the personal account that exceeds the standard amount of insurance payments.

A Russian’s pension provision is divided into two parts: 16% is transferred to an insurance pension, 6% is distributed individually. It is from this 6% that the cumulative share can be formed.

Good to know! The funded part of the pension can be used by persons born after 1967.

However, citizens born before this period can also take advantage of the opportunity to create pension reserves. To do this, you need to top up your personal account by 2-12 thousand rubles throughout the year.

Helpful information! Maternity capital can be considered as a funded share of a pension; its amount increases during the investment period.

Thus, citizens without work experience can increase the amount of cash benefits they will receive after retirement. In other cases, they are entitled to only the minimum basic payment.

All payments are divided into three categories:

- One-time payment – receiving all accumulated money at once.

- Urgent – monthly payments over a specified period of time in a fixed amount. The payment period must be at least 10 years.

- Payments to heirs after the death of the account owner apply to untouched funds from the savings share without taking into account indexation, which the pensioner did not have time to use.

Receiving the funded part of the pension is possible from the moment the labor pension is paid or the right to it is obtained.

One-time payment of pension savings accounted for in a special part

In this case, the following procedure for making such payments is established by law:

- A citizen submits to the pension fund an application drawn up in the form regarding the procedure for paying a special part of the pension fund’s savings.

- The application is supported by special documents that prove the citizen’s right to receive such payments.

- The volume of one-time payment of funds that are subject to accounting in a special part is strictly established.

- The procedure for carrying out the procedure for payments of this type is established.

- The option of issuing a similar amount of funds to him is negotiated with the recipient.

- Funds are issued to the recipient personally in cash within a specially agreed time frame.

Such payments are allowed to be received exclusively by citizens who, by law, have proven their own right to the opportunity to receive savings from a special part.

How are payments adjusted?

An increase in the amount of the funded part or its change is made on two grounds:

- Amounts that have not yet been taken into account for the previous year are taken into account annually (this recalculation occurs on August 1);

- the payment is adjusted based on the results of the investment (funds transferred to the payment reserve are taken into account).

To make the adjustment, you need to add the amount of funds in the account as of July 31 with the funds received as a result of investment (state co-financing, for example). And then divide by the number of months of the payment period specified by the pensioner himself (taking into account payments that have already expired from the date of assignment!).

The billing period begins on August 1 and ends on July 31 of the next calendar year. That is, the adjustment is made annually on August 1 (according to Federal Law number 360) taking into account investment income received in the past year. These changes in calculations are made without the participation of pensioners (insured persons). Recalculations are carried out exclusively by employees of the Pension Fund. And the annual adjustment coefficient is determined by the government and fixed by special regulations.

If there are no positive results from the investment or losses are recorded, the adjustment is not made until August of the following year.

Possibility to receive payments towards pension savings upon application

The law, issued in 2011, for the first time in the history of our country, or more precisely, its pension system, made it possible for people to use the funds that had been accumulated in their name as subsequent financial support of a pension nature, not only in the form of monthly transfers to their account. Now they can also be received as a lump sum payment . Of course, only if there are legal grounds for doing so.