How to calculate your pension in 2020

For citizens of pre-retirement age, the pressing issue is the size of their future pension. Information about this is not reported to the Pension Fund in advance, only after submitting documents. If you know the calculation methodology, you can calculate the approximate amount without outside help using a pension calculator.

How is the old age pension calculated in 2020?

Most people who have reached retirement age started working in the Soviet Union. Since then, the methodology for calculating payments has been changed several times. The Soviet period, until 1992, was regulated by the Law “On State Pensions in the Russian Federation” dated November 20, 1990 N 340-1. The period from 1992 to 2020 was administered by Federal Law of December 17, 2001 N 173-FZ “On Labor Pensions in the Russian Federation”. Since 2020, the Federal Law “On Insurance Pensions” dated December 28, 2013 N 400-FZ has been applied.

Accordingly, the payment consists of the following parts:

Other periods mean completing military service, receiving unemployment benefits, and other periods that are included in the length of service.

Types of pensions

The pension system in the Russian Federation is based on insurance principles. It includes four types of pensions:

- Insurance. This is a monthly payment made upon reaching retirement age. There are the following types of insurance pension:

- by old age. Paid to citizens of retirement age if they have sufficient work experience and have accumulated the number of individual pension coefficients (points) sufficient to assign a pension;

- on disability. Appointed in case of loss of ability to work due to injuries and illnesses, regardless of length of service;

- for the loss of a breadwinner. Assigned to disabled dependents of a deceased pensioner if they are members of his family.

- For state pension provision. Paid to employees of federal government agencies, military personnel, law enforcement officers, and other government service employees.

Future recipients of state pensions

Divided into the following types:

- for long service. Assigned to employees of the mentioned bodies for the period of work in these structures;

- state old age pension.

- state disability pension. Appointed to military personnel and citizens equivalent to them in connection with illnesses and injuries;

- State survivor's pension. Assigned to disabled family members of deceased or deceased recipients of state pensions.

- Social pension. Appointed if the required age has been reached, but there is no minimum number of pension points and there is insufficient work experience. There are social pensions for old age, disability, and loss of a breadwinner.

- Funded pension. Composed of accumulated insurance premiums paid by employers and investment income.

Until 2014, mandatory contributions to the Pension Fund for persons born in 1967 were paid partly for the insurance part and partly for the funded part of the pension. Then all contributions began to be paid only for the insurance part.

Accumulated contributions are saved, and income from investment is included in the calculation of the pension. At the request of the policyholder, they can be transferred to non-state pension funds and management companies. In this case, the funded part is not included in the calculation and is paid by a non-state fund. The savings portion can only be increased through voluntary contributions paid from the policyholder’s income.

Cumulative part of old-age pension

5 0 1655

The appointment of an old-age pension is provided for by the provisions of the legislation in force in the country. The rules for its appointment are regulated by relevant regulatory documents and may change over time.

https://www.youtube.com/watch?v=buJLOt9LsP4

The introduction of points did not change the principle of pension calculation. As before, its size is determined from the available experience, salary, and insurance contributions. The good news: recently, every employee can easily and quickly receive a statement with information about their pension rights.

Pension legislation changes frequently in our country, almost every 10 years. As a result, many people have little idea of what the size of their pension depends on and what can be done to increase it. Therefore, let’s look at a specific example of what the payment is formed from and where you can find information about your rights.

For those who go on vacation in 2020 and the coming years, it is formed from three parts:

- pension capital earned before December 31, 2001;

- insurance premiums for the period from 2002 to 2014;

- pension points for each year of work from 2020.

The calculation formula is simple: the IPC (individual pension coefficient) is multiplied by the cost of 1 point per year, established on the day the payment is scheduled.

Last week I met with a friend who had just recently retired. My retirement age is also not far off, so I was interested in finding out what determines the size of the old-age pension and the procedure for calculating it.

After talking with a friend and learning a lot of new information from him, I decided to go to the Pension Fund in order to clarify a few points regarding the calculation of pensions. In this article I have collected as much useful information as possible, which, I hope, will help readers understand the features of calculating an old-age pension.

It is guaranteed:

- persons who retired at a certain age. Before 2020, it was 60 or 55 years depending on gender. Since 2019, the age has been gradually increasing: in the second half of the year, men aged 60.5 and women aged 55.5 retired;

- those who have earned a total work experience of at least 10 years;

- who have accumulated 16.2 pension points (IPC).

All of the above conditions give a citizen the right to receive an old-age insurance pension.

Reference! An insurance pension is often called a labor pension, and vice versa. However, these are different concepts: the second existed until 2020 and included insurance and savings (Federal Law No. 400 of December 28, 2013). It also included a basic part, guaranteed by the state.

The latest data on changes in the size of the insurance pension in Russia, which is paid in old age, indicate that in 2020 it will increase by approximately 1 thousand rubles. Nevertheless, the level of indexation, which in percentage terms will be equal for everyone, will be individual in monetary terms for recipients.

This is what will affect the final size of the monthly payment to pensioners.

According to Law No. 400-FZ, the old-age insurance pension is paid every month and consists of three main parts:

- Basic. The fixed payment (FP) is assigned to everyone without exception in the amount determined by law.

- Insurance. The amount depends on the number of pension points (PB) earned by a person during his working life.

- Cumulative. Assigned if the employee individually and/or the employer made contributions to finance a funded pension.

According to the law, every person can form a funded pension (CP). For this purpose, deductions are made from wages to state and non-state pension funds. The size of the expected monthly payments directly depends on the amount of savings. In addition, citizens who have accumulated savings in the compulsory pension insurance system have the right to apply for payment of a funded pension:

- those born in 1967 and later;

- for men born 1953-1966 and women born 1957-1966, for whom the employer made contributions in 2002-2004;

- participants in the state co-financing program;

- women who sent maternity capital or part of it to form a funded pension.

Old age security is divided into two main types:

- Insurance. Its size depends on the number of accumulated pension points and the fixed payment. It affects the amount and percentage of indexation, which is calculated based on the inflation rate for the previous year, but can be large, as, for example, in 2019.

- Social. Accrued if the minimum number of pension points has not been accumulated. Men can apply for her appointment at 65 years old, and women at 60 years old. The payment amount is set by law each year. In 2020 it is equal to 5,180.24 rubles. Every year on April 1, the Government reviews the amount of social pensions. The increase coefficient depends on the percentage increase in the pensioner’s cost of living.

Minimum requirements for retirement in 2020

As a result of the pension reform carried out in 2020, the age for receiving a pension was raised to 60 years for women and 65 for men. The increase is smooth, with a transition period.

2020 falls into a transition period. According to the new rules, in the first half of the year, women who have reached the age of 50.5 years will be able to apply for a pension, men - 60.5 years. In the second half of the year, according to the approved age increase schedule, no one will be able to retire.

In addition to age, a prerequisite for receiving payments is at least 11 years of work experience and 18.6 pension points.

If there is no required length of service or the required number of IPCs, a social pension is assigned. The retirement age for social pension is 65 for women and 70 for men.

Who is entitled to early retirement?

The list of persons having this right is quite wide. It depends on many factors, the duration of work, profession, number of children. These are workers in dangerous and difficult jobs, train drivers, bus drivers carrying passengers, and others. In total there are more than 30 categories of citizens defined in Article 30 of Law No. 400 Federal Law.

From January 1, 2020, new benefits were introduced:

- a mother raising 3 children will be able to receive a pension not three years earlier than the period prescribed by law, and a mother raising 4 children - four years earlier. For a mother of five children, the previous period is 50 years;

- Women who have worked 37 years and men 42 years can become pensioners 2 years earlier, but upon reaching 55 and 60 years of age;

- employees laid off due to staff reduction are entitled to a pension two years before reaching retirement age. To receive a pension in this case, registration at the employment center is necessary, since such a right is granted to unemployed citizens.

The methodology for assigning pensions may seem complicated and cumbersome. This is due to repeated changes in legislation caused by different living conditions and activities of people in different periods. In fact, knowing the input data, many of which can be obtained in your personal account on the Pension Fund website, it is not so difficult to calculate the approximate amount of your pension yourself. To make the task easier, you can use the pension calculator available on the same website.

How profitable is it to buy points?

Many citizens remain unclear: is buying points really profitable? The answer to this question may depend on many factors and each case must be calculated individually.

For example, citizen Petrov was planning to retire in 2020; he has reached retirement age . But when applying to the Pension Fund, instead of 11 years of experience and 18.6 points, he has 10 years of experience and 17.5 points.

If he had continued to work in 2020, he could have gained the necessary length of service and points before retirement. This would be the best option for a citizen: he would accumulate the necessary points without additional investments: the employer would pay insurance premiums for him. But let’s assume that due to health reasons, citizen Petrov no longer has the opportunity to find a job.

In this case, he has several options:

- Wait 5 years and become eligible for a social pension.

- Enter into a voluntary legal relationship with the Pension Fund and buy points yourself.

Thus, in order to assign a pension, three basic conditions must be met:

- A person reaches retirement age.

- Having experience.

- Availability of pension points.

But taking into account the fact that the requirements for minimum length of service and pension points are regularly increasing, for some people the length of service or points is not enough to grant a pension. In this case, they have an alternative - to wait for the social pension to be assigned or to buy a pension on their own.

Expert opinion

Kurtov Mikhail Sergeevich

Practitioner lawyer with 15 years of experience. Specializes in civil and family law. Author of dozens of articles on legal topics.

In the latter case, they need to submit an application to the Pension Fund with the desire to register as a voluntary payer of contributions to compulsory pension insurance. When transferring contributions, it is necessary to take into account the threshold minimum and maximum values.

This is important to know: Validity period of a medical certificate for drivers

What is social pension and who is entitled to it?

A social pension is a government cash payment that is due to a person because of his social status.

There are several types of social pensions:

- Old age pension

is paid to people who have reached a certain age. From 2020, the retirement age is 63 for women and 65 for men. Moreover, not only citizens of the Russian Federation, but also non-residents and small peoples of the North, for example, Eskimos, Chukchi or Kereks, have the right to receive a pension. - Survivor's pension

. In this situation, minor children under 18 years of age or university students under 23 years of age who have lost one or both parents, or if the parents are unknown, are entitled to social benefits. - A disability pension

is paid to disabled citizens or individuals with limited abilities due to health conditions.

Accordingly, if a person belongs to one of the above social groups: elderly people, orphans or disabled people, then he must receive his social pension.

Search for a mortgage

We remind you that in 2020 the fixed payment amount is 5,686 rubles. 25 kopecks, and the cost of a pension point is 93 rubles. In addition to the three parameters indicated in the formula, the size of future payments will be affected by:

- Experience (labor or insurance);

- Retirement age;

- Years of military service, caring for a child or disabled person (if any).

Expert opinion

Kurtov Mikhail Sergeevich

Practitioner lawyer with 15 years of experience. Specializes in civil and family law. Author of dozens of articles on legal topics.

Let’s assume that a Russian woman was born in the late 1960s, spent a year and a half on maternity leave with her child, has no dependents and earns 70 thousand rubles.

per month. If she is ready to work for a total of 35 years before retirement, her pension will be 30 thousand.

This is important to know: Zemstvo teacher: content of the program

rubles And if a citizen applies for payments immediately upon reaching retirement age, she will receive 10 thousand.

rubles less.

We can conclude that to increase points, Russians need:

- Have impressive experience;

- Get of. earnings;

- Apply for your pension as late as possible.

The Pension Fund also reminds that pension points can be purchased. This opportunity applies to those who want to retire earlier or earn more, those working abroad, as well as the self-employed - entrepreneurs, specialists in private practice, translators, farmers and tutors.

To receive an old-age pension, citizens must:

- reach retirement age.

- have 15 or more years of work experience;

- have at least 30 pension points.

The amount of pension points can be greatly increased by applying for a pension significantly later than retirement age. Each year of overtime increases pension points by corresponding factors. The fixed payment will also increase.

If you claim your pension at age 65 instead of 60, your fixed benefit will be 36% higher and your pension points will be 45% higher. If at 70, then the growth will be 2.11 and 2.32 times.

Law on increasing social pensions in 2020

A social pension is a regular payment that accrues to people who, for certain reasons, cannot confirm their work experience, or it is not enough to calculate insurance payments due to age. The “social” pension begins to be paid 5 years later than the insurance one and depends on the subsistence level established at the regional or federal levels.

The age for receiving social pension will be gradually increased as a result of the pension reform that started last year. In addition to the elderly, this type of payment is also received by disabled people, children who have lost their breadwinner, as well as minors whose both parents are unknown.

Who is entitled to an increase and who will be left without additional payments to social pensions

Social pensions will be indexed for non-working pensioners, disabled people, as well as minor citizens who have lost their breadwinner or those whose both parents are unknown. In addition, on August 1, social payments for persons on state support will also be indexed. The bonuses will also affect the pensions of World War II veterans and members of their families.

The increase will affect more than 3.8 million citizens, 2.1 million of whom are pensioners with insufficient work experience or no work experience at all. Despite such large numbers, the group of the population receiving social pensions is the smallest of all the others.

21.7 billion rubles were allocated for indexation, which, according to the Government, will not affect the country’s economy in any way, even taking into account the current crisis.

Pension indexation formula

From January 1, 2020, pensions will increase only for non-working pensioners: without labor and civil contracts, individual entrepreneur status and voluntary contributions.

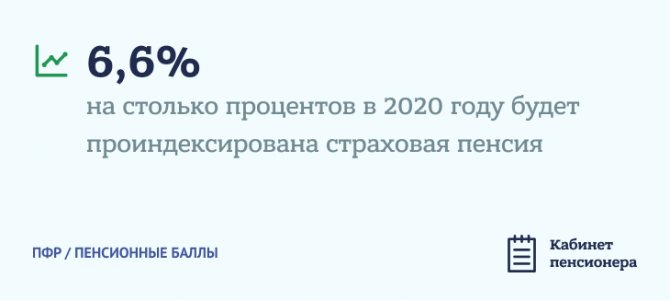

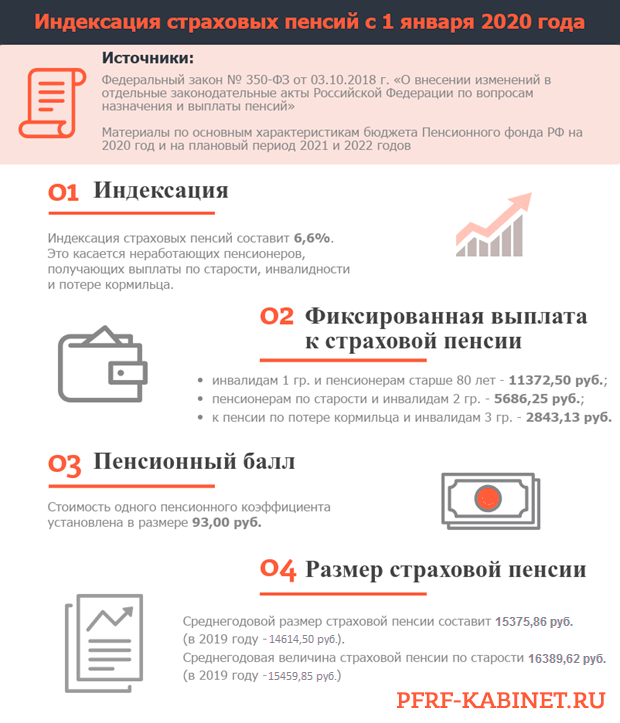

Pension indexation will be 6.6%.

It should be counted like this.

If the old-age pension is greater than the minimum subsistence level of a pensioner in the region:

Pension in 2020 + 6.6%

If the pension is less than the subsistence minimum:

Old age pension + 6.6% + Last year's supplement to minimum

Working pensioners will not receive an increase from January 1. But there is a trick that will help you legally receive additional payment.

What kind of indexing are we talking about?

Every year the state tries to somehow increase pensions. The amounts that pensioners received last year are increased by a certain percentage. This increase is called indexation. Previously, it was small, but after raising the retirement age, the average pension in Russia was promised to be increased by 1000 RUR. For this, from January 1, 2020, payments to pensioners were indexed by 7.05%. This is almost twice as much as in previous years.

By what percentage will pensions be increased in 2020 from January 1?

From January 1, 2020, pensions will be indexed by 6.6% . The indexation system has changed: if previously they grew by the inflation rate, now they will increase by a fixed amount, which is correspondingly higher than last year’s pension supplements.

Be sure to read it! Personnel provision agreement - 2020: what is outstaffing and outsourcing

Find out how much your pension will increase from January 1, 2020.

Infographics: how pensions will change from January 1, 2020

For example, in 2020, pension payments increased by 7.05% , and the inflation rate was 4.3%. In 2020, the inflation rate is expected to increase by 0.5%, and the pension will decrease compared to the previous year. The average amount of payments to pensioners is 14.8 thousand rubles. 6.6% of this amount is an increase of almost one thousand rubles. But these are calculations in accordance with the average pension; many citizens have individual pensions, so the size of the increase may be different. From January 1, 2020, indexation of social pensions is also expected. Without taking into account length of service, the pension will be increased for disabled people, war veterans, and their widowed mothers by 3.9 percent.

The amount of payments towards the insurance pension will increase to almost 5,690 rubles from 2020.

Since the fixed part is indexed from January 1, the sizes of these allowances will also be changed. This applies to:

- Allowances for dependents. For each disabled family member, the pensioner will now receive 1,895.42 rubles.

- Bonuses for northern experience. For work in the Far North they will pay an additional 2843.13 rubles, and in areas equivalent to the KS, 1895.42 rubles.

- Additional payments for rural experience - 1421.56 rubles.

How is a pension calculated for those born in 1966 in 2024?

One of the most frequently asked questions is how to calculate your pension yourself in 2020? This process has a large number of different nuances and features. Especially when it comes to citizens before a certain year of birth.

It is important to remember that when making calculations, points for all calendar years must be taken into account. At the same time, the coefficient indicator valid at a specific point in time of calculation is applied.

When will women born in 1965 retire: new retirement table by year of birth

- In 2020 (second half of the year), men and women who: were born in the first half of 1959 and 1964, respectively, will be able to retire;

- have at least 10 years of experience and 16.2 points accumulated.

- those born in the second half of 1959 and 1964, respectively;

- that is, if you were born in the first half of 1965, you will be able to retire in the second half of 2021,

- and if you were born in the second half of 1965, you will be able to retire as an old-age pension in the first half of 2022.

Calculation of pensions for women born in 1964 - formula, points, IPC and calculator

- Fixed payment. The size is determined by law and reviewed annually.

- Individual. The amount depends on the number of accumulated pension points and the cost of the IPC, the amount of which is established by law.

The procedure for calculating pensions is the same for everyone. Pension payments are assigned from the date of application for accrual, but not before the right to receive them arises.

To do this, women born in 1964 need to contact the Pension Fund, the Multifunctional Center, through the State Services portal or directly to the employer, providing:

This video is unavailable

With good sound. Retirement age for women in the Republic of Kazakhstan since 2020. Age table. https://drive.google.com/file/d/1WK0b. Additional service for calculating compensation for pension savings, up to the level of inflation. Mail: [email protected]

ruSkype: s7131471PhonePayment for services is made by replenishing the phone balance +7 777 713 14 71.

Bilyalov Sergey Seitkazyevichs January 1, 2020 - upon reaching 58.5 years of age; January-June 1960 January-July February-August March-September April-October May-November June-December

from January 1, 2020 - upon reaching 59 years of age; July-December 1960 from July to December

from January 1, 2022 - upon reaching 60.5 years of age; January-June 1962 January-July February-August March-September April-October May-November June-December from January 1, 2023 - upon reaching 61 years of age; July-December 1962 from July to December

Calculation of pensions for those born in 1962

Pension points are conventional units adopted in the new system as the basis for calculating payments. They are intended to include data on how many years and with what earnings a citizen has been working.

How is future payment calculated? Insurance pension capital , which underlies the amount of the benefit, is formed from contributions made by the employer of the future pensioner. The amounts are calculated based on his official salary before taxes or other deductions are deducted from it. The amount of transfers made into pension contributions is 55 years .

: How to beat up the bailiffs

New pension law from 2020 - retirement table by year of birth

In fairness, it should be noted that the retirement dates will not be increased for citizens entitled to early retirement “due to harmfulness” (lists 1 and 2), as well as for victims of radiation and man-made disasters, flight test personnel and recipients of early pensions for health reasons and for “social reasons” (certain categories of disabled people, mothers of large families who raised 5 or more children, etc.).

For example, a health worker received the basis in question in 2020, so he will be able to start receiving funds no earlier than 2020. If such a reason arises in 2020, then no earlier than 2022. If in 2021, no earlier than 2024.

The procedure for calculating the old-age pension in 2020

- later retirement (delaying retirement for more than 10 years doubles the bonus coefficient, however, given the average life expectancy of citizens in our country, this increase seems dubious);

- having work experience in the Far North;

- presence of disability and age over 80 years;

- presence of disabled dependents.

Errors in determining the amount of the pension due are not uncommon. Therefore, if a citizen doubts that his pension is calculated correctly, he can submit a corresponding application to the Pension Fund. After five days, Pension Fund employees must check the calculation for errors and, if found, correct them.

Source: https://law-property.ru/pravo-sotsialnogo-obespecheniya/kak-nachislyaetsya-pensiya-1966-goda-rozhdeniya-v-2024-godu

How will the pension be indexed?

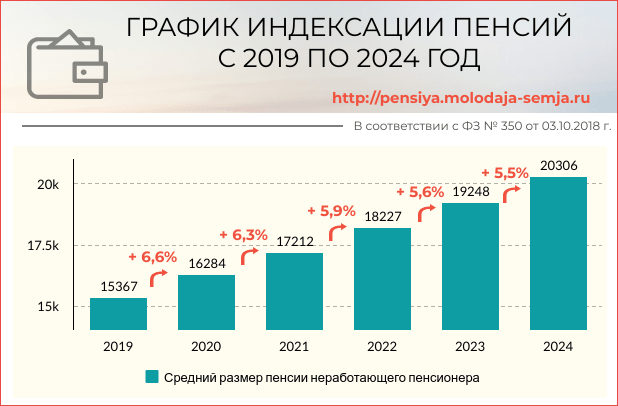

Insurance pension indexation scheme for 2019-2024. set so that as a result of all planned increases, the average payment increases to 20 thousand rubles. The procedure approved by law is presented in the form of infographics:

Infographics: indexation of pensions until 2024

As usual, the increase will be carried out by changing the value of the pension point and fixed payment from which the pension is calculated. The formula for calculating the insurance pension (SP) is as follows:

SP = Sipk × ∑IPK + FVsp

Where:

- Sipk - the cost of one pension coefficient established by law on the date of calculation;

- ∑IPK - the sum of pension coefficients formed on the citizen’s personal account;

- FVsp - a fixed payment (the basic part of the insurance pension), established by law on the date of calculation.

Accordingly, when the cost of the coefficient and the fixed payment is indexed by a percentage established by law, the amount of pension provision also increases by the same percentage.

It should be noted that the increase applies only to non-working pensioners receiving some type of insurance pension (for disability, old age or loss of a survivor). For working citizens, the cost of the coefficient and the fixed part is not indexed throughout the entire period while they are employed. They will still be eligible for promotion only after dismissal and recalculation taking into account promotions missed over the years of work.

Pension indexation schedule by year until 2024

The pension indexation scheme until 2024 has been approved in such a way that the increase in the average payment amount is 1,000 rubles per year. To ensure such an increase, the following changes were made in the increase schedule:

- Increases during the established period will be carried out annually from January 1 . Before this, indexation was carried out not from the beginning of the financial year, but only from February 1.

- The percentage by which the pension will be increased annually exceeds inflation. Prior to these changes, increases were made strictly in line with actual inflation (inflation is projected to be approximately 4% per year).

The indexation percentages provided for by law until 2024 are presented in the table:

| Year | Indexation, in % | Average pension after increase, in rubles. | Amount of increase, in rubles. |

| 2019 | 7,05 | 15367 | on average, approximately 1 thousand rubles. |

| 2020 | 6,6 | 16284 | |

| 2021 | 6,3 | 17212 | |

| 2022 | 5,9 | 18227 | |

| 2023 | 5,6 | 19248 | |

| 2024 | 5,5 | 20306 |

It should be clarified that the amount of the increase is determined relative to the average size of the insurance pension and will be calculated individually for each citizen.

- If a citizen’s pension provision is less than the Russian average, then the amount of additional payment from annual indexations will be less than 1 thousand rubles.

- If the pension is higher than average, then the increase will exceed a thousand rubles.

To calculate how the size of the payment will increase as a result of indexation, you need to multiply it by the percentage established for the corresponding year.

The cost of a pension point by year until 2024

Annual indexation of the price of one pension coefficient in the period 2019-2024. will be carried out in accordance with Part 7 of Art. 10 of Law No. 350-FZ of October 3, 2018. This provision of the law contains the exact values of the pension point that will be used when calculating the pension - they are presented below in the table:

| Year | Cost of the pension coefficient, in rubles. |

| 2019 | 87,24 |

| 2020 | 93,00 |

| 2021 | 98,86 |

| 2022 | 104,69 |

| 2023 | 110,55 |

| 2024 | 116,63 |

It should be noted that the change in the value of the coefficient applies only to unemployed pensioners. For working citizens, the value of the point is “frozen” at the value that was established by law on the date of assignment of pension payments .

However, after the dismissal of a pensioner, the pension is recalculated taking into account the current point value established by law on the date of such recalculation. If the pensioner gets a job again, the cost of one IPC will be “frozen” and will not be indexed until he resigns.

Fixed payment towards pension for the period 2019-2024.

The size of the fixed payment to the old-age insurance pension, which will be established in 2019-2024, is legislated in Part 8 of Art. 10 of Law No. 350-FZ. For other types of insurance coverage, the value of the PV is determined as follows:

- the fixed part of the disability pension of group 1 is 200% of the old-age pension;

- for disability group 2 - 100% of the old-age payment;

- for group 3 disability and loss of a breadwinner - 50% of the EF in old age.

From 2020 to 2024, the amount of the fixed payment will be set in accordance with the data in the table:

| Year | Amount of fixed payment to the corresponding type of pension provision, in rubles. | ||

| for disability group 1 | for old age, for disability 2 groups | for disability group 3, for loss of a breadwinner | |

| 2019 | 10668,38 | 5334,19 | 2667,10 |

| 2020 | 11372,50 | 5686,25 | 2843,13 |

| 2021 | 12088,96 | 6044,48 | 3022,24 |

| 2022 | 12802,20 | 6401,10 | 3200,55 |

| 2023 | 13519,12 | 6759,56 | 3379,78 |

| 2024 | 14262,68 | 7131,34 | 3565,67 |

The PV values given in the tables are valid only for non-working pensioners. For citizens who continue to work, the fixed part is not indexed and remains unchanged from the date of their pension provision.

For some categories of pensioners, the law provides for the right to an additional increase in the fixed part. According to Article 17 of Law No. 400-FZ of December 28, 2013, an increase in the PV is based on:

- if the pensioner has dependents;

- for accumulated experience in the northern regions;

- for accumulated experience in agriculture;

- upon reaching 80 years of age and so on.

If a pensioner lives in the northern regions of Russia, then the amount of the fixed payment increases by the regional coefficient established at the place of residence. For example, in Chukotka, PV doubles.

What are fixed payments to an insurance pension?

Previously, the size of the pension was influenced by two factors - length of service and salary. Nowadays, length of service is simply used as a barrier that must be overcome in order to become eligible for a pension. Once you have overcome this barrier, experience ceases to matter. But the salary continues to play its role to the end in the play called “Whether you work or don’t work, the pension is the same.”

Duration and especially continuity of service as factors for increasing the size of pensions are a thing of the past. Today, length of service is only a condition for assigning a pension, but its size is entirely dependent on the amount of wages. The Zen channel “I HAVE THE RIGHT” understood addictions.

With an average salary you cannot earn a large pension

SSP = FV x PC1 IPTot. x RVPB x PC2 SNP, where:

- SSP – the amount of the insurance pension.

- FV – fixed payment. Its size is reviewed annually on January 1. The base value in 2020 is RUB 5,334.19. For some categories of applicants the figure is different. So, for example, for disabled people of group I or people over 80 years old, the PV doubles (10,668.38 rubles). If the applicant has one parent who has died and receives a survivor's pension, the PV will be only half of the base value (RUB 2,667.10).

- IPKobshch. – the total number of points accumulated by a citizen on an individual personal account (IPA) for the entire period of official employment and non-insurance periods.

- RVPB is the ruble expression of one pension point. The value is set annually on January 1 and is the same for all recipients of insurance pensions. From 2020, 1 PB is equal to 87.24 rubles.

- NPP is the funded part of the pension. It is determined if the future pensioner participated in its formation.

- PC1 and PC2 are increasing coefficients. They apply if the pension was assigned at the personal request of the citizen later than the time established by law. When entering a well-deserved retirement, in accordance with the law, the value is applied equal to 1.

Pension points are used to calculate all types of insurance pensions (age, survivor, disability). They directly affect the final payment amount. The greater their number, the higher the pension size will be.

Anyone can independently increase their own income in old age by forming a funded pension in the pre-retirement period. The employer can do this for him. The money is placed in a state or non-state pension fund at the discretion of the investor. The final amount of payments is affected by the amount of funds accumulated in the personal account.

5 0 1655

Table of contents

SC = IPKS × SPB × PC, where

- SP – estimated amount of the insurance part;

- IPKS is the number of PB earned by a citizen, plus non-working periods.

- TsPB – price 1 PB. The size is determined annually by Government decree;

- PC – adjustment factor for each full year of delayed retirement.

Whose pensions will increase from January 1, 2020

From January 1, 2020, labor pensions for non-working pensioners will be indexed. Non-working pensioners are those who are not insured in the compulsory pension insurance system. That is, no one pays mandatory contributions for such a pensioner: neither the employer, nor he himself.

Examples of pension indexation in different situations

| There is indexing | No indexing |

| Pensioner without work and living only on pension | The pensioner receives a pension, but continues to work under an employment contract |

| The pensioner was still working in September, quit in November, and will return to work in February | The pensioner has civil contracts with individual entrepreneurs or legal entities |

| A pensioner officially rents out an apartment or sells vegetables from his garden | A pensioner works part-time as an individual entrepreneur using a simplified tax code or a patent. |

| A pensioner earns money as a tutor and takes advantage of tax holidays | A pensioner has simplified individual entrepreneur status, but he earns nothing |

| The pensioner registered as self-employed and earns 100 thousand rubles a month from apartment renovations | The pensioner has registered as self-employed, but pays voluntary contributions for himself |

Here are two contrasting examples.

If a physics teacher has retired but continues to work at the school, he receives both a pension and a salary. The employer pays insurance premiums for him every month - 22% of the salary. A physics teacher is considered a working pensioner, so his pension will not change from January 1. His payments will be increased slightly from August 1, but according to different rules.

If the same physics teacher retired and left school to earn money by tutoring at home, he is not required to pay fees or even personal income tax. That is, he does not transfer anything to the budget at all, receives a pension and income from teaching students. But from the point of view of pension legislation, such a teacher is not working. From January 1, the state will index his pension.

This looks unfair from the point of view of payments: those who pay contributions and still replenish the Pension Fund budget will not receive an increase. And those who no longer pay anything will receive it through indexation. In this way, the state is trying to support pensioners who do not have additional sources of income other than pensions.

Who is eligible to purchase

Citizens who:

- They work outside the Russian Federation (hence, no contributions are made to the Pension Fund for them) and would like to form a pension in Russia.

- Citizens who permanently or temporarily reside on Russian territory and are not subject to the requirement for compulsory pension insurance. These are, for example, the self-employed.

- An individual paying contributions to the Pension Fund for another person for whom the employer does not pay.

This is important to know: How to compensate for damage if neighbors flooded the apartment

What will be the indexation of pensions in 2020?

From January 1, 2020, old-age pensions for non-working pensioners will increase by 6.6%. This amount of indexation was provided for a year ago, when the retirement age was raised.

The old-age pension is calculated according to the following formula:

Fixed part + Number of points × Point value

The increase consists of two parts:

- Fixed part. This is the amount that is awarded to absolutely all pensioners, regardless of the number of their pension points. In 2019, the fixed part is 5334.19 R, and in 2020 - 5686.25 R, that is, 6.6% more.

- Pension points. During work, individual pension coefficients accumulate in each person’s personal account. Their number is affected by the amount of contributions: the more contributions, the more points. In 2020 you can get a maximum of 9.13. A certain number of points are accumulated towards retirement, and for each point the state pays a certain amount. In 2020, one point costs 87.24 R, and in 2020 it will cost 93 R - also 6.6% more.

The amount of old-age pensions in 2019-2024

Pension indexation from 2020 to 2025 will gradually decrease to the inflation level of the previous year. Accordingly, non-working pensioners will receive a pension indexed in this amount from January 1 of the following years:

| Year | % indexing | Pension amount |

| 2020 | 6.6% | 14,986 rubles 25 kopecks |

| 2021 | 6.3% | 15,930 rubles 48 kopecks |

| 2022 | 5.9% | 16,870 rubles 10 kopecks |

| 2023 | 5.6% | 17,814 rubles 56 kopecks |

| 2024 | 5.5% | 18,794 rubles 34 kopecks |

Old-age insurance pensions will increase by 33.7% over six years. It was 14,058.19 rubles in 2019, it will become 18,794.34 rubles in 2024.

There will be no indexation of pensions for pensioners who are still working professionally. They will be able to receive indexed payments after leaving work. Recalculation of payments will be made from the next month after termination of employment.

Be sure to read it! Personal account, State services Ryazan: official website, login, registration

Calculation of pensions for those born before 1966

The payment associated with a citizen reaching old age and calculated in accordance with current legislation is called a pension.

Not only people who have the necessary length of service and have reached the established age, but also some categories of beneficiaries have the right to receive this monetary allowance. For example, a pension is assigned for disability or loss of a breadwinner. In our state, pensions are calculated in different ways.

After the last reform, the calculation of pensions changed, instead of amounts in rubles they switched to conventional units (pension points). The previous calculation remained only for people born before 1966.

In this review we will tell you how pensions are calculated for those born before 1967.

Calculation of old age pension

Receiving an old-age pension is possible for citizens who have reached a certain age. It does not matter whether they continue their work activity or not.

Back in the first third of the twentieth century, a law was proclaimed on the payment of pensions to citizens who had reached old age, and since then, no major changes have been made to it.

Only the calculation methods have been revised, including the calculation of pensions for those born before 1967.

To receive a pension, you must not only reach a certain age, but also have a certain amount of work experience behind you. Women must work for at least twenty years, and men five years more. The Pension Fund of the Russian Federation is responsible for the payment of pension accruals. The amount of payments varies throughout the country and depends on:

- from the region;

- work experience;

- age of the pensioner;

- special conditions (combatant, award winner, etc.);

- professions;

- wages.

In addition, the total amount of the pension is influenced by various coefficients taken into account when calculating.

Calculation of pensions for those born before 1967

In addition to the nuances mentioned above, the size of the pension is influenced by three parts from which it is composed:

The pension fund does not automatically begin paying pensions to citizens when they reach the required age. Each person must take care of this in advance. PF specialists advise starting to apply for a pension approximately six months before reaching retirement age; only in this case can you start receiving payments on time.

When applying for a pension, you should collect all documents confirming your work experience, especially those that took place in the former Soviet republics. After all, the Pension Fund does not have a single database that includes the length of service of all citizens before the collapse of the USSR. It is very important to confirm your entire work experience, because it affects the size of your pension.

Thus, to calculate the pension of citizens born before 1967, the following are used:

- Cumulative payments transferred from the beginning of 2002 to the end of 2004. Therefore, an important point in these accruals was the “white salary”. The higher the official salary, the more deductions were made.

- Basic part. After indexation in 2011, the size of the basic part is 2963 rubles 7 kopecks.

- Insurance part. It is calculated based on continuous length of service until January 1, 2002; all other years of work are called excess length of service. They are required to calculate the experience coefficient.

Formulas for calculating pensions

The formula for calculating the pension: P = BC + MF + LF, where P is the pension, BC is the basic part, LF is the accumulative part, and SF is the insurance part.

Since the basic part is the same for everyone, and everyone has their own funded part, the question arises of how to calculate the insurance part.

There is also a special formula for this: SP = PC/T, where PC is the pension capital, and T is the expected period of pension payment, it is calculated in months (this indicator is in the tables compiled by the Pension Fund, you can view it on the Internet).

Pension capital is calculated from the sum of conditional pension capital (CPC) and pension capital (PC1) formed after 2002; data on it can be ordered from the Pension Fund. The CPC is calculated as follows: (RP-warhead)/T.

RP is an estimated pension, its value is equal to SKxZR/ZPxSZP:

- SC is the length of service coefficient, its value is 0.55 (for men who have worked for 25 years, and for women - 20 years). For each year worked in excess of this norm, 0.01 is added to the coefficient, but the maximum size of the insurance premium cannot exceed 0.75);

- ZR/ZP is the ratio of a citizen’s salary to the average salary in the country. Moreover, the pensioner’s salary is taken for the period from 2000 to 2001 or the average for five other years. the ratio should not exceed 1.2;

- The SWP is calculated by the Pension Fund based on the amount of 1,671 rubles.

Having learned the necessary components that concern you personally, you can estimate the size of your future pension in advance.

The most difficult thing will be to calculate the insurance part, but given the data provided, anyone can handle it.

The main thing is to ask the Pension Fund for the amount of pension capital and find on the Internet a table of the expected age of payments. After this, it will be quite simple to calculate the pension for those born before 1967.

Reviews and comments on the article “How pensions are calculated for those born before 1967”:

Subscribe to news

A letter to confirm your subscription has been sent to the e-mail you specified.

How to calculate an increase if the pension is less than the subsistence minimum

An old-age pension may be less than the regional subsistence minimum for a pensioner. For example, a man worked unofficially all his life and accumulated only minimal experience and points. By the age of 60, he was awarded a pension of 8,500 R. And the cost of living in the region is 10 thousand rubles.

Such pensioners are paid an additional amount that is not enough to reach the subsistence level in the region. Despite the fact that the earned pension is 8,500 R, the man will receive 10 thousand: the budget will add 1,500 R to him.

In April 2020, a special law was adopted regarding the indexation of such pensions. Now the accrued pension itself is indexed - for example, 8,500 RUR. It will be increased by 6.6%. This increase will be paid in addition to the additional payment up to the subsistence level, although previously the increase was included in this additional payment and did not affect the size of the pension at all.

The same pensioner will receive a pension from January 1, 2020, which will be calculated using the following formula:

8500 R + 1500 R + 8500 R × 6.6% = 10,561 R

When the pension is less than the subsistence minimum, indexation does not concern the full amount of the payment, but only the actually accrued old-age pension, taking into account length of service and points. Therefore, for some pensioners, their full pension, taking into account additional payments, will increase not by 6.6%, but, for example, by 5%.

How much will migrants receive?

As reported by the Ministry of Labor of the Russian Federation, Russia will pay pensions to labor migrants from the countries of the Eurasian Economic Union (EAEU), which, in addition to the Russian Federation, includes Armenia, Belarus, Kazakhstan and Kyrgyzstan. It is planned that the agreement will be ratified by the end of 2019. As a result, the country where the migrant worked and made contributions to the Pension Fund will pay him a pension even when the migrant returns home. That is, a pension assigned by one of the EAEU member states will be “exported” when moving to another country of the economic union. In 2020–2021 additional expenses of the Russian Pension Fund for pension payments under the new agreement will amount to a total of 166 million rubles. They will grow over the years.

Question answer

Will paying pensions to migrants be a burden on the budget?

“Just don’t use the word “migrants.” We are talking about all the people who come to our country, work honestly, and officially pay all taxes and insurance premiums. These could be artists, athletes, doctors, builders, janitors, etc., says Chairman of the Federation Council Committee on Social Policy Valery Ryazansky . – We have been moving towards such a civilized approach to pension provision for a long time. There were so many stories when millions of people moved back and forth after the collapse of the USSR and could not prove their old Soviet experience in the republics. There were so many tears and tragedies... Then bilateral agreements were concluded with the CIS countries, and people began to be counted as having “republican” experience. And now, one might say, a “pension code” is being prepared for the EAEU countries. If a person worked legally and paid contributions, he has every right in old age to receive a pension from Russia for this period, taking into account the contributions made.”

The cost of a pension point in 2020

The size of the pension point in 2020 will be 93 rubles . In 2020, the pension point is less than the future - 87.24 rubles. This information was taken after the official publication of the “Main Characteristics of the Budget of the Pension Fund of the Russian Federation.”

Accordingly, the pension point will be the following amount in subsequent years:

- 2021 – 98.86 rubles;

- 2022 – 104.69 rubles;

- 2023 – 110.55 rubles;

- 2024 – 116.63 rubles.

This information was approved in accordance with Federal Law No. 350-FZ.

Why do retirees quit for a raise?

Indexation of pensions concerns only non-working pensioners for whom no one pays contributions. Moreover, the indexation system is designed in such a way that when a working pensioner resigns, his pension is indexed taking into account all the interest that has accumulated. This does not mean that he will be paid all the increases in rubles: his next pension will be increased by all the percentages that were not taken into account earlier due to work.

Then the pensioner can get a job again. But the increase will not be taken away from him. That is, you can quit at the end of December, wait for indexation and get a job again with contributions deducted. Or close the individual entrepreneur and register again after three months. Then it will be possible to legally obtain indexation for all years, including the 6.6% due in 2020. No one can take away a raise after getting a job: this is the rule of law.

Benefits for pensioners

For this reason, some pensioners specifically terminate their employment contracts and then sign them again. Because since the state has come up with a strange scheme to save money on indexation, it makes sense to take the maximum from it using legal methods.

If you decide to do this, discuss it with your employer to avoid losing your job. It may turn out that the director will only be happy with the application from the pensioner and will use this situation to hire a younger employee.

When will pension payments double?

This summer, Russian pensioners will receive significant increases in their pensions. According to the Pension Fund of Russia, from the beginning of July the number of pensioners receiving benefits will increase. The emergence of new benefits is inevitable. Pension funds will be recalculated for working pensioners.

Below is a list of the main changes related to the pension system. The list of innovations was analyzed by experts.

New benefits

Russian pensioners can expect two planned benefits. There will be an increase in pensions for people who have turned 75 years old. Currently, such a privilege is enjoyed by persons in their eighties. The corresponding amendment has already been approved by the government of the Russian Federation and will soon be considered by the State Duma.

Another privilege concerns pensioners who have outstanding loan payments. People of retirement age with an income of less than double the minimum wage (unemployed, disabled, loss of a breadwinner) will receive the right to a deferment on existing early loans.

Analyst Anna Bolshova approves of the future emergence of new benefits for people of retirement age. In her opinion, the budget has the means for this. And it doesn’t matter at all what was the reason for the proposed decision: the widespread problem with the coronavirus, or the approaching constitutional vote.

Fact! On the topic of loans, pensioners most often take this step because of relatives. And the solution related to debt installment will help support pensioners and their family members.”

Additional payments

From the beginning of August, funded pension payments will increase. Those who participate in the savings system do not have to fill out any applications - the recalculation will occur automatically.

FACT! The increase will affect 80,000 pensioners, whose average funded pension amount is about one thousand rubles per month.

Payments to participants in the program for co-financing pension savings will increase by almost eight percent. The payment amount will be 1,705 rubles per month.

IMPORTANT! Those citizens who have reached retirement age according to the previous indicators are eligible to apply for the presented types of bonuses: 60 years old for men, 55 years old for women. Previously, such a payment could only be received if you had the right to early retirement.

Legislative basis for increasing pension payments to working pensioners

Not long ago, a new bill was introduced into the State Duma (participants: head of the State Duma committee Yaroslav Nilov, Senator Sergei Leonov and others), which provides for the return of indexation to all employed pensioners.

For this category of persons, indexation was suspended four years ago. The bill contains a proposal to resume indexation and establish one pension coefficient in the amount of 93 rubles (last year the pension coefficient was 87.24 rubles).

According to the creators of the bill, such measures will help pensioners who work unofficially. We remind you: there are about ten million pensioners in the country with official employment. 184 billion rubles will be needed to increase pensions in 2020.

However, experts doubt that such a measure will be adopted. Against the backdrop of the coronavirus pandemic, there is a serious economic impact, and the government will not make additional payments.

According to the head of GA Alpari, officials know that pensions in the Russian Federation are quite small, and therefore pensioners who do not have significant health problems are forced to work.

“If the Russian state is a social state, then working pensioners also need to increase the bonus. The amount of money subject to the previously indicated planned indexation is definitely feasible for the state budget. It is also worth considering that people of retirement age are at risk. During layoffs, in fact, it is pensioners who lose their jobs, and no legislative rules can save them, since employers will always find a way to get out.”

Changes in the payment of pension funds, according to amendments to the Constitution, will affect the following citizens:

- Pensioners who have completed their working career.

- Pensioners working after retirement.

- Pensioners-guardians of minor children.

- Pensioners who have reached the age of 75.

- Pensioners participating in a state program providing for a project for co-financing pension savings.

Putin’s decree on doubling pensions suggests such nuances. He said in his statement about regular indexation of pensions. Now Putin has proposed introducing measures to support older citizens. The article lists its main provisions, describes the advantages and prospects for senior citizens.