Calculation of pensions for those born in 1963 - calculation procedure, formula, points and IPC

This payment is formed on the basis of contributions (DC) made by employers for the entire period of the citizen’s labor activity. Pensions for those born before 1967 will be calculated using this formula:

- Determining the amount of capital before 2001. The calculation of pensions for those born in 1963 begins with determining the total amount of accumulated funds during work under the USSR and after its collapse at the time of the first reform.

- Calculation of the amount of pension savings from 2002 to 2004.

- Calculation of the number of pension points from 2020

- Summation of the total number of accumulated points. Calculation of the pension amount in accordance with the current cost of the IPC.

How to calculate an old-age pension for a man

The old-age insurance pension in 2020 is assigned to men who have reached the age of 60 years, and women who have reached the age of 55 years, with at least seven years of insurance experience and an individual pension coefficient of at least 9 (Article 8, Parts 1 - 3 Article 35 of the Law of December 28, 2013 N 400-FZ).

The duration of the insurance period required to assign an old-age insurance pension in 2020 is seven years, followed by an annual increase by a year until reaching 15 years in 2024 (Parts 1 - 2 of Article 35 of Law No. 400-FZ). Also in 2020, an old-age insurance pension is assigned if there is an individual pension coefficient of at least 9, followed by an annual increase of 2.4 until reaching 30 (Part 3 of Article 35 of Law No. 400-FZ).

Retirement age in Ukraine: what time do people retire in 2020?

The issue of calculation, payment and age for registration of pensions is of interest to every resident of the country.

Will it be increased? How many men and women will be able to live to retirement age in Ukraine? After all, a pension is often the only income of an ordinary Ukrainian in old age.

A person can no longer work as before, so he is looking forward to the moment when he can receive his earned pension.

Draft laws and changes on retirement age in Ukraine

According to the latest data, a bill has been proposed in Ukraine that would change the retirement age for women. The authors of the bill, registered in the Verkhovna Rada by Servants of the People, believe that in 2011 women were treated unfairly.

More precisely, the time of retirement should not depend on the date of birth. If the proposed bill is approved, women will become pensioners much earlier - at 55 years old.

However, there is an important limitation: this will only become possible if there is no job, that is, it will be prohibited to work and receive a pension at the same time at 55 years of age.

As for the male population, in Ukraine by 2028, approximately half of 60-year-old men will be able to retire on time. The rest, due to lack of experience, will work until they are 63 or 65 years old.

The Ministry of Social Policy indicated that in 2028 only 55% of men will have the required years of experience. Those who remain will have to work until they are 63 and 65 years old.

The number of pensioners who will not receive pensions will increase annually.

Raising the retirement age

International creditors may demand that Ukraine raise the retirement age to 65 years. This is due to the growing “hole” in the Pension Fund budget, which could not be closed by the pension reform.

In order to carry out the indexation of pensions provided for by law, in 2019 the Pension Fund deficit was increased to UAH 157 billion (last year to UAH 139 billion).

Last December, when it became finally clear what the Pension Fund deficit would be, World Bank officials said that Ukraine could not avoid revising the pension reform and raising the retirement age to 65 years.

What is the length of service?

Ukrainians were taught to distinguish between the concepts of “work experience” and “insurance period”. For the first, you need to work, and for the second, make all the calculations into the pension fund.

After the start of the implementation of the pension reform, the population had many questions about how these retirement standards now look in practice.

There are four categories of length of service on which retirement depends:

- Preferential experience . This length of service is counted for those who worked at enterprises full time and faced harmful and dangerous working conditions. Enterprises that have such production costs are listed in lists approved by resolutions of the Cabinet of Ministers of Ukraine.

- Insurance experience . This type of experience is a certain period of time during which a person was subject to compulsory state pension insurance and for which monthly contributions were paid in an amount not less than the minimum insurance premium (Article 24 of the Law of Ukraine “On Compulsory State Pension Insurance”).

- Special experience . Special length of service looks like the total duration of a certain work activity in the relevant types of work, which gives the right to early assignment of a labor pension.

- General (work) experience . This is the experience that applies in most cases. It is calculated according to the entries in the work book. Work experience may include such concepts as general, preferential and special work experience. In the Law of Ukraine “On Pensions”, the concept of total work experience is mainly used to distinguish it from the length of service that gives the right to pension benefits.

It is known that work experience that was earned before January 2004 is automatically equal to the insurance period. It is also worth noting that after the introduction of the insurance period on January 1, 2004, it no longer mattered how long a person actually worked. Now it is taken into account during what period and how much the employer paid for the employee to the Pension Fund.

It is also known that from January 1, 2020, citizens have the opportunity to retire at the age of 60, 63 or 65. This age depends on the number of years of accumulated insurance experience in work.

Relevant!

Retirement age in Ukraine

The law, which introduces pension reform in Ukraine and changes the retirement age, will be introduced in stages.

Changes that await Ukrainians:

| Year | Retirement age | Insurance experience |

| 2018 | 58,5 | 25 |

| 2019 | 59 | 26 |

| 2020 | 59,5 | 27 |

| 2021 | 60 | 28 |

| 2022 | 60,5 | 29 |

| 2023 | 61 | 30 |

| 2024 | 61,5 | 31 |

| 2025 | 62 | 32 |

| 2026 | 62,5 | 33 |

| 2027 | 63 | 34 |

Retirement age in Ukraine for women, table

| Date of Birth | Age | Retirement period |

| First half of 1962 | 55,5 | Until the end of December 2020 |

| Second half of 1962 | 56 | Until the end of 2020 |

| First half of 1963 | 56,5 | Until the end of 2020 |

| Second half of 1963 | 57 | Until the end of 2020 |

| First half of 1964 | 57,5 | Until the end of 2021 |

| Second half of 1964 and earlier | 58 | Until the end of 2022 |

Starting from 2028, the insurance period must be at least 35 years.

Retirement age in Ukraine for men

For reference:

- a loan at 0% can be obtained for up to 10 days

- more than 650 companies provide microcredit services in Ukraine, and most of them provide loans to pensioners

- The concept of an urgent loan means filling out an application online and receiving a response within 4-15 minutes

| Date of Birth | Age | Retirement period |

| First half 1957 | 60,5 | Until the end of 2017 |

| Second half of 1957 | 61 | Until the end of 2018 |

| First half of 1958 | 61,5 | Until the end of 2019 |

| Second half of 1958 | 62 | Until December 31, 2020 |

| First half 1959 | 62,5 | Until December 31, 2021 |

| Second half of 1959 and younger | 63 | Until December 31, 2022 |

The size of the old-age pension from January 2020 is 1669.20 UAH, this is the minimum amount that a pensioner can receive. For those who worked and managed to earn experience, 1% will be added for each year.

All Ukrainians who have reached 63 years of age and have earned the established insurance period can count on 40% of the minimum wage, but not less than 1,497 UAH. When the minimum wage is increased, this amount will automatically increase.

Old age pension, or how will changes affect pensions?

So at what age do people retire in Ukraine?

According to Part 1 of Art. 26 of the Law of Ukraine “On Compulsory State Pension Insurance” dated 07/09/2003 No. 1058-IV provides, in particular, that from January 1, 2020, persons have the right to receive an old-age pension upon reaching the age of 60 years and with no insurance experience less than 26 years old.

Source: https://deltabank-online.com.ua/pensionnyj-vozrast-v-ukraine/

Examples and formulas for calculating an old-age pension in 2020 for a woman born in 1962

- Average salary - let it be 20 thousand rubles for the entire length of service; This, we note, is still a simplification.

- Work experience - 13 partial years, including 5 months of 2020 (thus, until 2020 - 10 full years, counting from January 1, 2005). If you don’t have enough work experience, what to do?

- Experience until 2020 – 10 years.

- The average salary over these 10 years is 20,000 rubles.

- The wage fund for this time is 2,400,000 rubles.

- We receive our “pension capital” - 384,000 (the amount we would have transferred to the Pension Fund over these 10 years - 16% of 2.4 million).

- Now we get the amount of the insurance part of the pension - 1684.21 rubles. (384000 / 228);

- We convert the pension capital into points (64.1 here is a constant):

On the conditions for granting pensions to women born in 1963

Often citizens who contact the Pension Fund Branch for the Vladimir Region are interested in what conditions exist for assigning a pension. For example, they ask: “I was born in February 1963, I am going to retire in 2020, since I will be 55 years old. I just don’t understand how much experience I should have - 9 years or 15?”

Taking into account the transitional provisions of Article 35 of the Federal Law of December 28, 2013. No. 400-FZ, the duration of the insurance period required to assign an old-age insurance pension in 2020 is 6 years. Starting from January 1, 2020, the duration of the insurance period increases annually by 1 year.

How to correctly calculate your pension in 2020

- social - appointed regardless of length of service;

- insurance - the recipients are pensioners who have managed to accumulate the required number of points;

- funded is the least common type of pension payment.

- 1.8 – during compulsory military service;

- 1.8 – while caring for the first child until he reaches one and a half years old;

- 3.6 – during the period of raising a second child upon reaching a similar age;

- 5.6 – when caring for children 3 and 4 upon reaching one and a half years of age.

LABOR CONSULTANT

- First of all, it is necessary to find out the amount of interest that is deducted from wages into the insurance pension. There are two options - 10% and 16%.

- Then the annual salary is determined. Then you need to calculate using the formula:

When calculating pensions, it is now mandatory to take into account not only all sorts of coefficients responsible for length of service, allowances for disability, as well as for large families, but also attention is paid to length of service that corresponds to official employment. This applies to women who were born in 1962 and plan to retire in 2020.

Pension calculator

These results of calculating the insurance pension are purely conditional and should not be perceived by you as the real amount of your future pension. To make the results easier to understand, all calculations are performed under constant conditions of 2020. For calculation purposes, it is assumed that the entire period of formation of your future pension rights took place in 2020 and you were “assigned” an insurance pension in 2020, taking into account the life plans you personally indicated, and also on the condition that you will “receive” all the years of your working life the salary you specified.

The actual amount of the insurance pension is calculated by the Pension Fund of the Russian Federation when applying for its appointment, taking into account all the generated pension rights and benefits provided for by pension legislation on the date of assignment of the pension. For example, for disabled people of group I, citizens who have reached the age of 80, citizens who worked or lived in the Far North and equivalent areas, citizens who have worked for at least 30 calendar years in agriculture, who do not carry out work and (or) other working activity and living in rural areas, the insurance pension will be assigned in an increased amount due to the increased size of the fixed payment.

This is interesting: Can Priestovs Arrest a Transfer Before Receipt?

The procedure for calculating the old-age pension in 2020

After 2020, the funded part of the pension was allocated as a separate type, and citizens had the opportunity to form it or not. When forming the funded part, insurance contributions go to both parts of the pension:

- later retirement (delaying retirement for more than 10 years doubles the bonus coefficient, however, given the average life expectancy of citizens in our country, this increase seems dubious);

- having work experience in the Far North;

- presence of disability and age over 80 years;

- presence of disabled dependents.

My year of birth is 1963, which years should I choose to calculate my pension?

Woman, born in 1963, upon retirement, taking into account the amount of wages received during work, the amount of insurance contributions (16% of wages) and the presence of life circumstances (for each year of leave to care for the 1st child - 1.8 points, for the 2nd child - 3.6 points, for the 3rd child - 5.4 points, for the 4th child - 5.4 points; for each year of caring for disabled people of group I, disabled children, persons older 80 years old – 1.8 points) must score at least 13.8 points. If there are not enough points, the woman is DENIED to receive a pension.

If the three conditions considered are met (age, length of service and points), then the right to a pension arises and you can proceed to its calculation.

So, a woman’s entire experience is divided into stages. The Soviet period of work was the most difficult to account for. At this time, there were no automated information systems; all data was documented.

Calculation of pensions for those born in 1962

It is possible to apply for a pension only if all three points are met. What if there is no length of service or coefficients ? Continue to work and increase your pension capital to achieve the required values. For non-working persons who do not have the opportunity to formulate a future payment, the state has organized a special social old-age pension . Its registration is possible 5 years after reaching the age for retirement and does not depend on the citizen’s labor merits.

Attention! If you have any questions, you can consult with a lawyer on social issues for free by phone: +7 in Moscow, St. Petersburg, +7 throughout Russia. Calls are accepted 24 hours a day. Call and solve your problem right now. It's fast and convenient!

Calculation of pensions for those born before 1967

In addition to the insurance, each pensioner is guaranteed a basic part, which is indexed annually, like the insurance. In January 2020, its size was 4558 rubles 93 kopecks. Adding up the basic and insurance parts, we get the amount of the full pension: 8328.44+4558.93= 12887.37 rubles.

Certificates about his earnings Semenov S.S. did not provide it, so the amount of his salary for 2000-2001 was taken (for this period, the Pension Fund database contains information about all insured persons, i.e. those who worked officially at that time). The average monthly salary for this period for Semenov S.S. was 1530 rubles. The salary coefficient, showing the ratio of his earnings to the average salary in the Russian Federation in 2000-2001, is equal to 1530/1671 = 0.92.

When will men born in 1959 retire: new retirement table

It should be noted that the original bill providing for a change in the working period of citizens contained a more stringent version of the reform - an increase of 1 year every year (without the right of early registration 6 months earlier in 2020 and 2020), as well as an increase in the retirement period for women for 8 years (i.e. from 55 to 63 years) . But during the consideration of the project in the State Duma, an amendment was adopted softening the proposed parameters (it was proposed by President V. Putin).

When will men born in 1959 retire? The new table of retirement by year of birth under the new law will help determine in which year a citizen will be able to apply for an old-age pension starting from January 1, 2020.

Innovations in pension legislation come into force in Russia

MOSCOW, January 1 - RIA Novosti . The main package of laws on changes to pension legislation comes into force in Russia.

In October, Russian President Vladimir Putin signed the law “On Amendments to Certain Legislative Acts of the Russian Federation on the Appointment and Payment of Pensions.” The law was adopted by the State Duma on September 27 and approved by the Federation Council on October 3.

The Pension Fund of Russia (PFR) clarified that the adopted document is aimed at ensuring sustainable growth of insurance pensions and a high level of indexation, which provides for a gradual increase in the age at which an old-age insurance pension will be assigned.

As Prime Minister Dmitry Medvedev noted, the Russian authorities chose the “lesser of evils” when deciding on these changes.

Basic Law

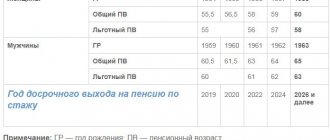

The law provides, starting in 2020, for a gradual increase in the retirement age by five years - to 65 for men and 60 for women. As Deputy Prime Minister Tatyana Golikova explained, men born in 1959 (first half of the year) will retire in the first half of 2020, while those born in the second half of 1959 will retire in the second half of 2020.

According to the Deputy Prime Minister, Russians born in the first half of 1960 will receive pensions in the first half of 2021, and those born in the second half of the year - in the second half of 2022. Men born in 1961 will retire in 2024, at age 63.

Citizens born in 1962 - at 64 years old, in 2026, and men born in 1963 - in 2028, that is, at 65 years old.

In turn, women born in the first half of 1964 will retire in the first half of 2020, and those born in the second half of the year - in the second half of 2020.

For women born in 1965, pensions will also be assigned depending on the half of the year they were born - the first half of 2021, and the second half of 2022.

Women born in 1966 will retire at age 58, in 2024, and women born in 1967, at age 59, in 2026. Those born in 1968 will receive a pension at age 60, in 2028.

As part of the changes to the legislation, benefits are also provided for workers of certain specialties (medics, teachers, artists), residents of the Far North and rural areas, women with three or more children, as well as citizens with over 42 years of experience (men) and 37 years (women). ).

The funded pension will be paid, as at the current retirement age, from 55 years for women and from 60 for men. At the same time, both one-time payments are provided for those whose funded pension amounts to 5% or less of the entire pension, as well as urgent payments. In addition, the right to continue to assign a funded pension at the appropriate age is secured.

For those who were supposed to retire in 2019–2020, a special benefit is provided - retirement six months earlier than the new retirement age: a citizen who is supposed to retire in January 2020 will be able to do this already in July 2020.

Penalty for dismissal of a pre-retirement employee

The second law in the package amends the Criminal Code to provide for fines for unjustified refusal to hire or for dismissal of persons of pre-retirement age.

Thus, for refusal to hire or dismissal of a person of pre-retirement age, a fine of up to 200 thousand rubles or in the amount of the income of the convicted person for a period of up to 18 months, or compulsory work for a period of up to 360 hours will be imposed.

In addition, the employer is obliged to annually provide employees of pre-retirement age with two days of free medical examination while maintaining their wages.

Also, from January 1, 2020, the maximum amount of unemployment benefits will increase from 4.9 thousand rubles to 11.280 thousand rubles - the period of such payment is set at one year.

The Pension Fund of Russia, together with the regions, will actively work to explain all innovations in legislation; in particular, the fund and the Federation of Independent Trade Unions of Russia (FNPR) signed an agreement on cooperation in this area during an extended meeting of the Pension Fund of Russia board in December.

Another innovation will affect funds confiscated from corrupt officials: now they will be transferred to the Pension Fund budget.

Indexation and growth of pensions

From January 1, 2020, insurance pensions of non-working pensioners will be indexed by 7.05%, which is higher than the forecast inflation rate for 2020.

As the Pension Fund of the Russian Federation said, the exact size of the future pension is individual for everyone, as it is calculated from its current value.

For example, for a pension of 6 thousand rubles as of December 31, 2018, the increase will be 423 rubles, for pensioners receiving 10 thousand rubles - 705 rubles.

The size of the fixed payment after indexation will be 5334.2 rubles per month, the cost of the pension point will be 87.24 rubles. As a result of indexation, the old-age insurance pension will increase on average in Russia by one thousand rubles, and its average annual amount will be 15.4 thousand rubles.

According to Deputy Prime Minister for Social Affairs Tatyana Golikova, 30 million 778 thousand citizens - non-working old-age pensioners - will receive an additional pension supplement in 2020. As the Pension Fund of the Russian Federation said, the insurance pension of non-working pensioners will continue to grow: by 2024, the average monthly old-age insurance pension of non-working pensioners will be 20 thousand rubles.

Pension certificate “in digital”

Also, from January 1, 2020, the Russian Pension Fund is launching a pilot project to introduce a digital social card - an analogue of a pension certificate, which can be accessed through the PFR mobile application.

The press service of the Pension Fund of the Russian Federation reported that thanks to this card, socially responsible businesses, without access to the system of interdepartmental electronic interaction (SMEV), will be able to identify a person as a pensioner. This card will perform similar functions for citizens of pre-retirement age.

The digital social card will be implemented through the Pension Fund of Russia mobile application; through it it will be possible to obtain information about the status of a citizen and the social benefits entitled to him in the form of a unique QR code.

Source: https://ria.ru/20190101/1548961551.html

How to Calculate Old Age Pension for a Man Born in 1963

The estimated size of the labor pension for a woman with a total work experience of at least 20 years depends on the length of service coefficient (SC), the woman’s average monthly earnings (AZ), the average monthly salary in the Russian Federation for the same period (ZP) and the average monthly salary in the Russian Federation for third quarter of 2001 for calculating and increasing the size of pensions approved by the Government of the Russian Federation (SZP = 1671 rubles).

Calculating an old-age pension in 2020 for a woman born in 1963 is quite complicated. The article provides instructions for calculating pensions with a specific example. Because you shouldn’t rely entirely on the Russian Pension Fund and treat your pension without due attention. Today, no one except the citizens themselves are interested in determining the size of their pension as profitably as possible.

Calculate your pension online using a calculator

An elderly person can count on a certain amount guaranteed by the state. Its size depends not only on the category of the recipient. Regions independently determine the amount that pensioners will receive. Fixed payments are subject to mandatory indexation. To do this, you need to take into account the economic indicators of the country. Without fixed payments, it is impossible to determine the amount of survivor benefits. Every year on February 1, pensions are indexed in accordance with Article 16 of Federal Law No. 400.

Interesting to read: Mat Capital Will There Be Payments in 2020?

Many users experience difficulties when trying to determine the effectiveness of funds invested in non-state pension funds. To obtain information about the status of savings, you can contact the Pension Fund. You can check the amount of pension contributions directly on the organization’s website. To do this, you must indicate your SNILS number.

How to calculate a pension in 2020 for a woman born in 1963

Victoria's length of service coefficient is 0.55, she worked for exactly 20 years. If I worked longer, then 0.01 would be added for each year. Estimated pension amount: RP = SK x ZR/ZP x SZP = 0.55 x 1.2 x 1671 = 1102.86 rubles. The amount of the estimated pension capital (PC) as of 01/01/2002 = (1102.86 - 450) x 228 = 148,852.08 rubles, after indexation: 835,774.66 rubles, taking into account valorization: 1,002,929.59 rubles.

The conditions for retirement in 2020 for a woman born in 1963 are as follows: age 55 years, work experience - 9 years, individual pension coefficient - 13.8. An example of calculating a pension: Victoria began her working career on January 1, 1982, in 2020 she turned 55 years old and is going to retire.

How is a pension calculated, example of calculation

- The salary of a future retiree. The higher this indicator, the greater the monthly benefit will be.

- Duration of work activity. The longer a pensioner worked, the more pension points he receives.

- The age at which a pensioner stops working. The legislator sets the lower limits of the age allowing retirement: for women - 55 years old, for men - 60. If, for example, a man continues to work until he is 65 years old, then this fact will be taken into account when calculating the pension and will affect the growth of benefits.

- subsidy established by the state - 4,982.9 rubles ;

- price value of 1 point – 81.49 rubles ;

- The maximum allowable salary before tax, subject to insurance contributions, is 85,083 rubles per month .

10 Jun 2020 lawurist7 517

Share this post

- Related Posts

- Law On Medical Care of Pensioners of the Ministry of Internal Affairs in Departmental Educational Institutions. Now You Need Certificates Looking for the Pension Department

- Can Bailiffs Take A Car If There Are Debts?

- Benefits of Mordovia 2020 for Pensioners Veterans of Labor Allowances of 1934

- Benefits for labor veterans 2020 on long-distance trains

Pension for persons born before 1967

For example, for an employee in 1985-1990. the salary was 160 rubles, and the national average in the same period was 200 rubles. Then 160/200 = 0.8. If the employee had a salary of 260 rubles, then 260/2001 = 1.3, i.e. a limit value of 1.2 is used for it. Next, multiply the resulting number by the salary coefficient. Then they multiply by 1671 (the amount is established by law) and subtract 450 - this is the basic part of the pension at the beginning of 2002.

If a citizen was born before 1967 (i.e. 1966 inclusive), the calculation of his pension is carried out according to special rules. Its size depends only on length of service and average salary. Pension points have been taken into account since 2002, when they were introduced. Step-by-step instructions with calculation examples can be found in the article.

For what years is salary taken to calculate the pension? Calculation rules

The calculation of old-age pensions is an important and relevant topic for elderly citizens of the Russian Federation, since for many people this type of receiving funds is sometimes the only source of livelihood.

This year, a topic that has affected the entire population of Russia remains on the agenda - the reform of pension payments, which was adopted by the Government and affected the retirement dates of citizens who were not able to take advantage of all the advantages of the times before the reform.

Questions about the formation of future pension payments are also important.

For what years is salary taken to calculate the pension?

Some policies may change next year. There have been statements in the media that the methods of calculating payments will also change, namely, the base that is taken into account to ensure pension payments will change. All this may mean that the order in which periods are taken into account may completely change.

The existing accrual system and possible changes

Old-age pension payments were previously made based on the old-style system, where the initial information was based on the size of a citizen’s salary.

The calculation method itself plays an important role here. Now, when pension payments are calculated, they use a formula where they take the initial information SP = IPK+SIPC+FV.

In simple terms, the insurance pension consists of the following parts:

- IPC is the number of pension points that a citizen received, including through the calculation of average wages;

- SIPC is the price for one of the pension points for the period of calculations;

- PV is a fixed payment also for the accrual period, since due to indexing it changes every year.

The insurance pension is calculated taking into account the number of pension points, their value, as well as a fixed payment

In a situation where a citizen received a good salary, such information in the formula does not always lead to a large amount that the government is willing to pay to a person who has worked most of his life and expects to receive good amounts in retirement. This year the elements of the formula will not change.

Important ! Only their quantitative values will undergo changes.

The procedure for calculating insurance pension payments

The pension payment consists of two elements - the insurance component and the main one. If a citizen contributed funds to a savings fund, then the savings component will also be included in the calculation.

The main or basic components are a fixed payment, the amount of which is subject to changes in a positive direction if indexation has been carried out, but it is assigned by the legislative bodies (last year + funds for the percentage of inflation each year).

When calculating the total payment, the insurance component, basic, and also cumulative - if available, is taken into account

The components of the insurance pension are calculated individually. It consists of the following parts.

ComponentNotes

| Work experience that has accumulated during the citizen’s labor activity | This only covers the period up to 2002. |

| average salary | The period that is calculated based on this indicator causes controversy and concern among citizens, since this moment may become a factor that will determine everything regarding pension payments. That is why it is allowed to choose the period where wages were the highest. |

| A special coefficient that comes out when calculating the average salary and indicators for the state | All information comes from the Federal State Statistics Service. Based on this, citizens often have questions about the years that go into calculating this indicator. |

Pension points when calculating an old-age pension are calculated according to the salary, which is also related to contributions to the Pension Fund of the Russian Federation. If the salary was on the same level as the subsistence minimum, the citizen is given two points.

If the size was two subsistence levels in the region, three points are given. There is no point in putting any special effort into this, since the maximum possible number of points that can be obtained in 2020 is 9.13.

The cost of a pension point increased and reached 87.24 rubles.

In 2020, you can earn a maximum of 9.13 pension points

It is impossible to make a forecast about how much the indicators will increase this year, and even experienced specialists will not do this. This is due to the fact that indexation indicators are determined once. Based on the new reform, the accrual requirements will increase in stages. This applies to old age pension payments.

Important ! The length of service at the lowest level is gradually changing, and by 2025 it will be 15 years, and the number of points needed for retirement in 2025 will be 30.

Last year, a citizen needed a minimum of 13.8 points, and had to have at least nine years of experience. This year, 10 years of experience and 16.2 points are required.

In 2020, a minimum of 10 years of service will be required to retire

The rules for calculating length of service have also changed, for example, regarding the period of study at a higher educational institution.

To receive an insurance pension, you need a certificate of income for 2000-2001 or 1998-2002. It turns out that this may be the answer to the question of which periods are taken into account.

Accrual years

Source: https://posobie-expert.com/za-kakie-gody-beretsya-zarplata-dlya-nachisleniya-pensii/